AUROPHARMA

Equity Metrics

January 13, 2026

Aurobindo Pharma Limited

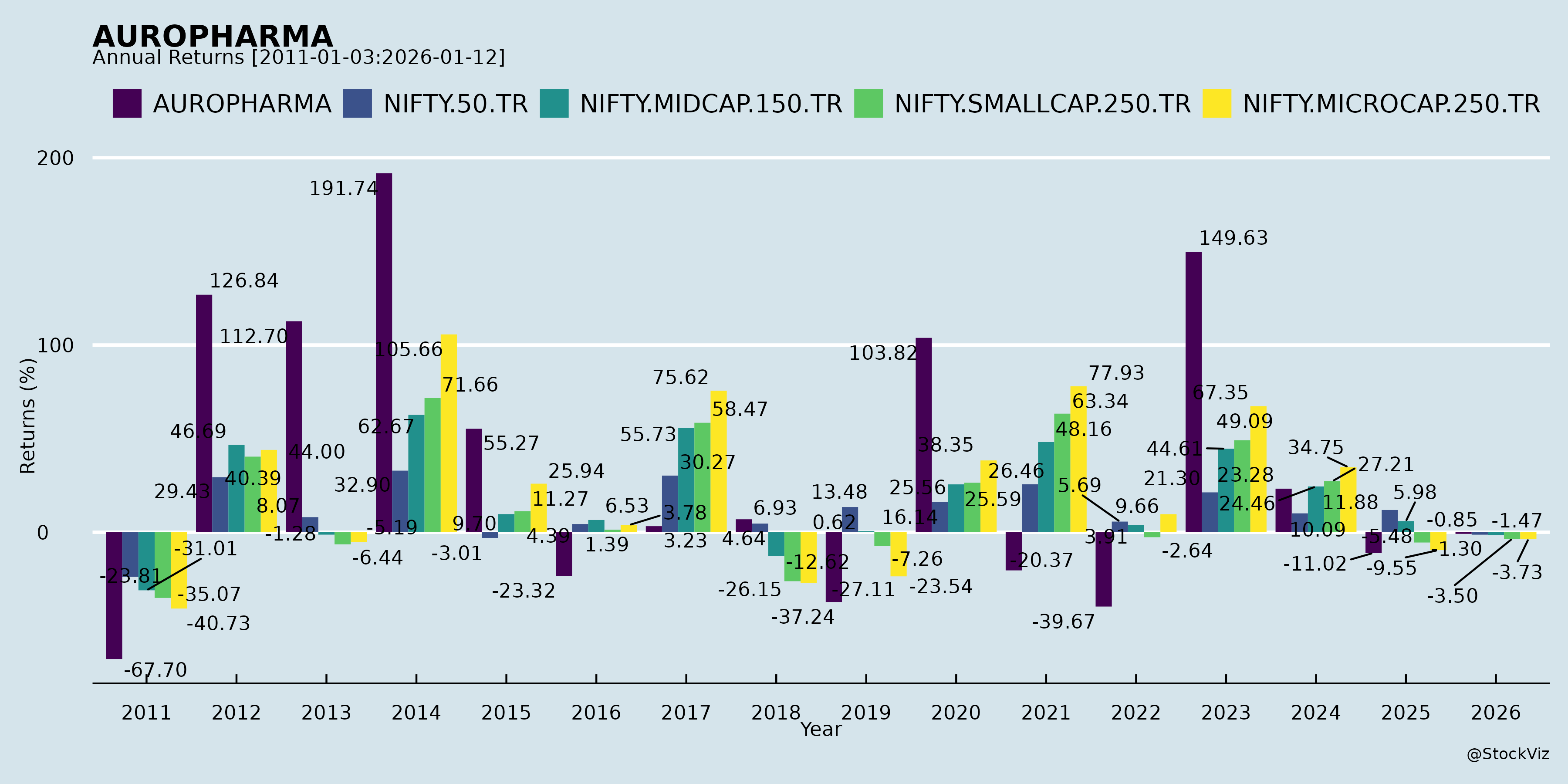

Annual Returns

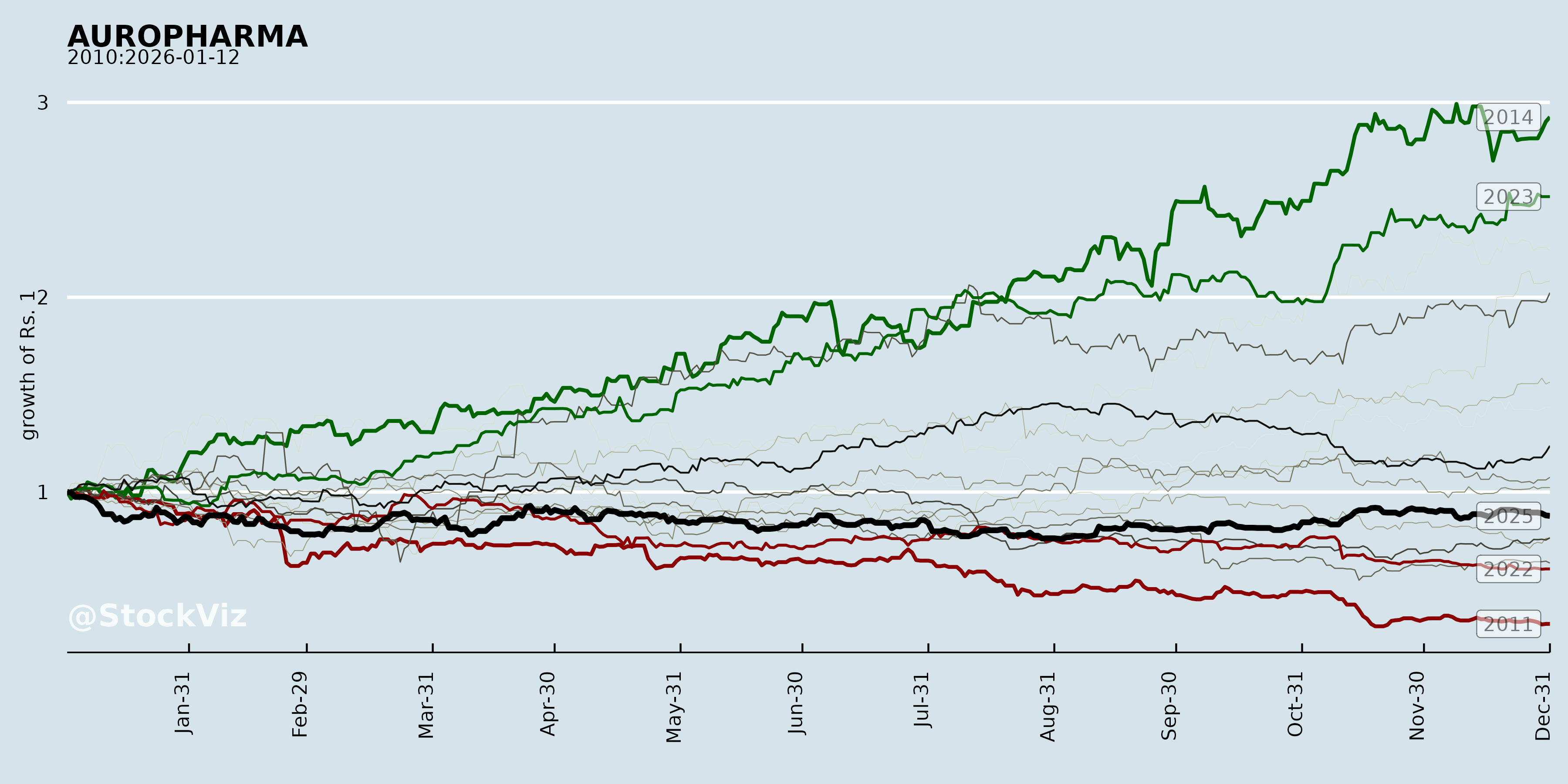

Cumulative Returns and Drawdowns

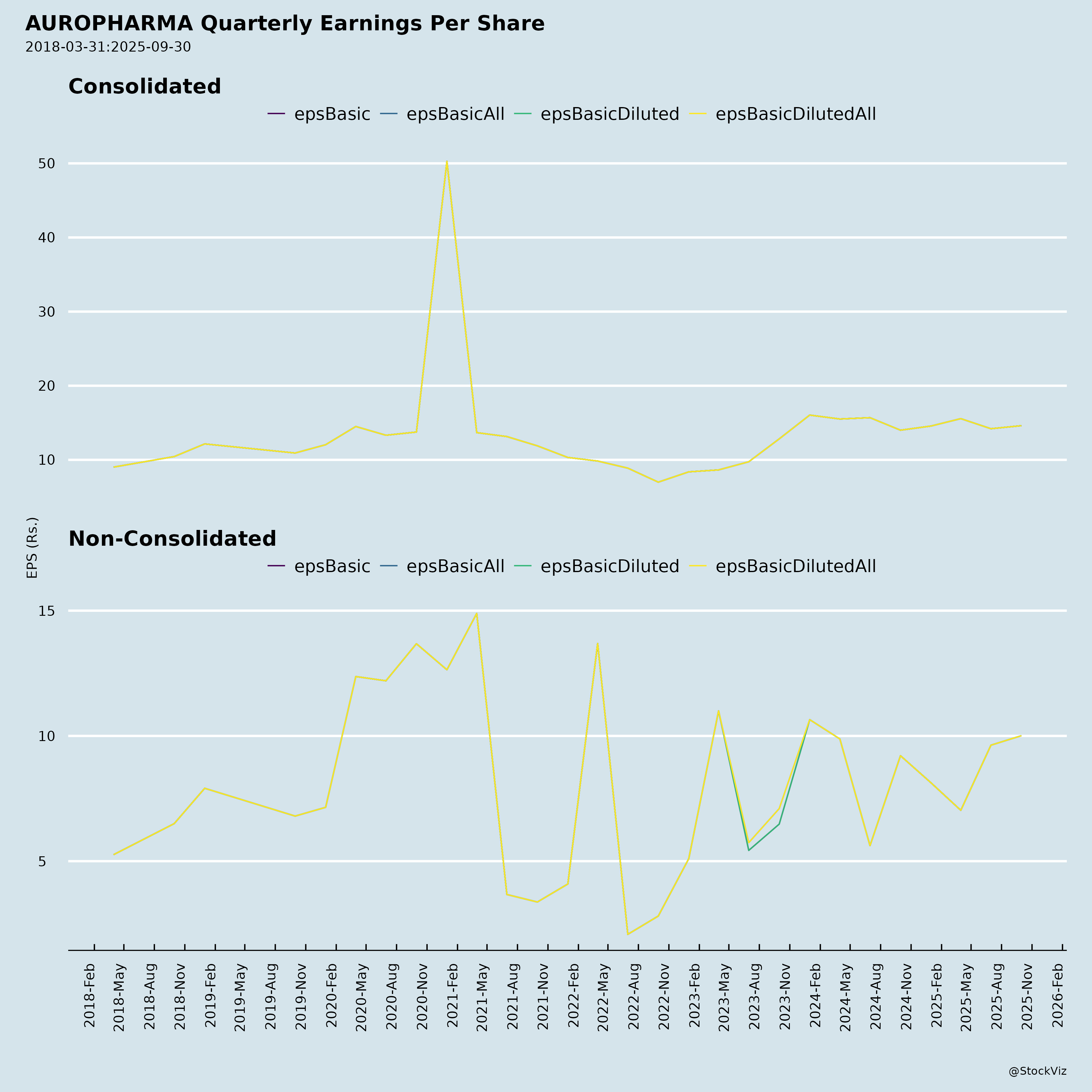

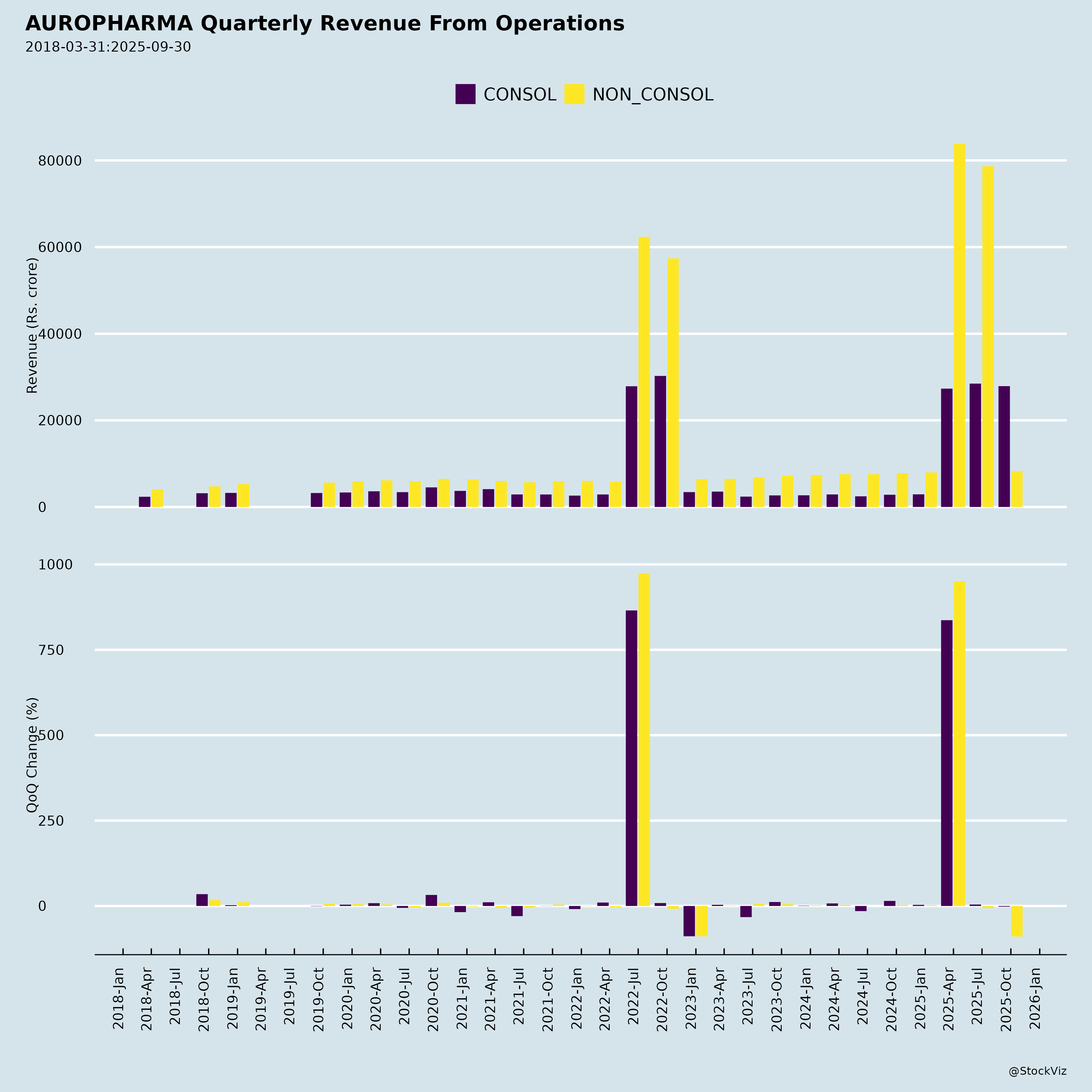

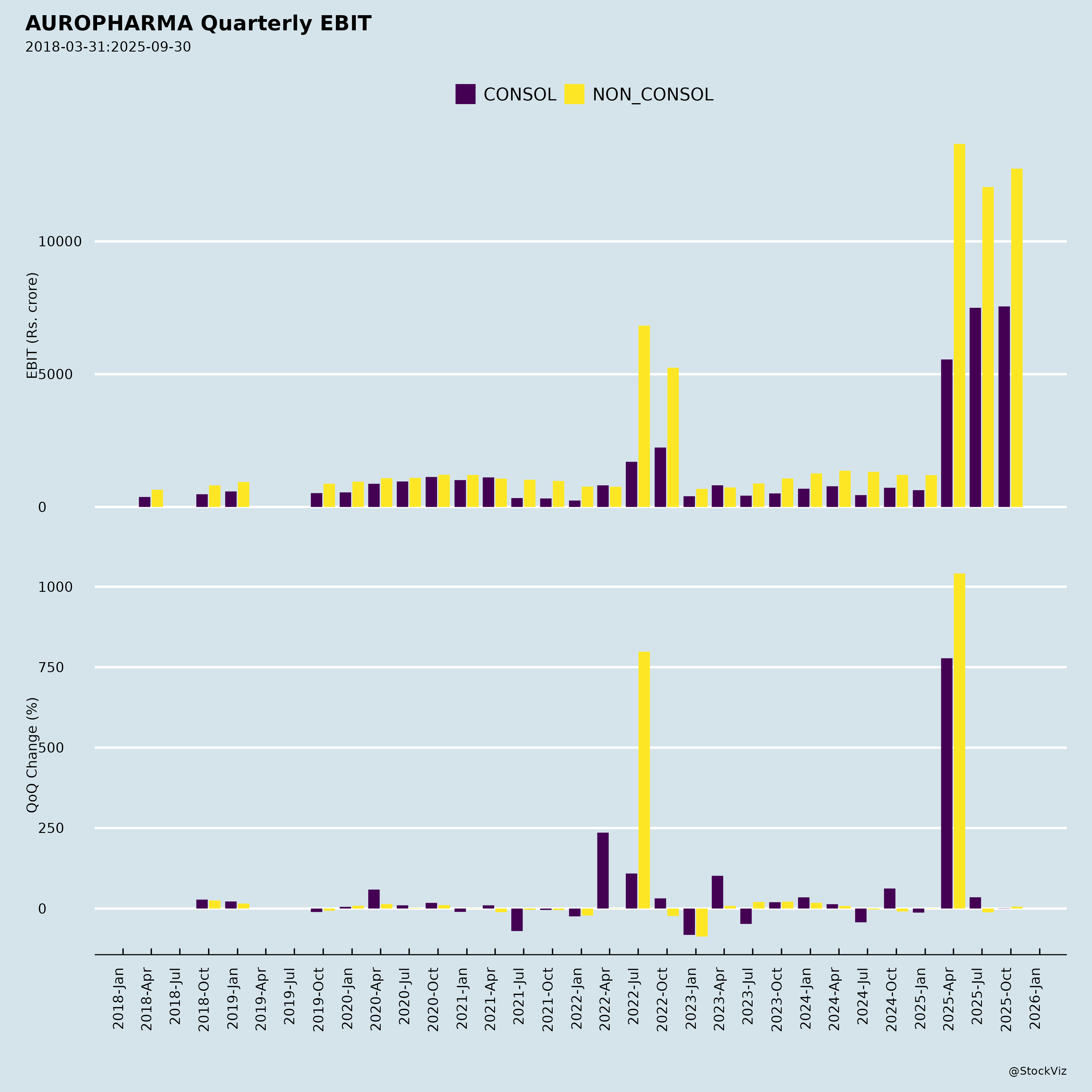

Fundamentals

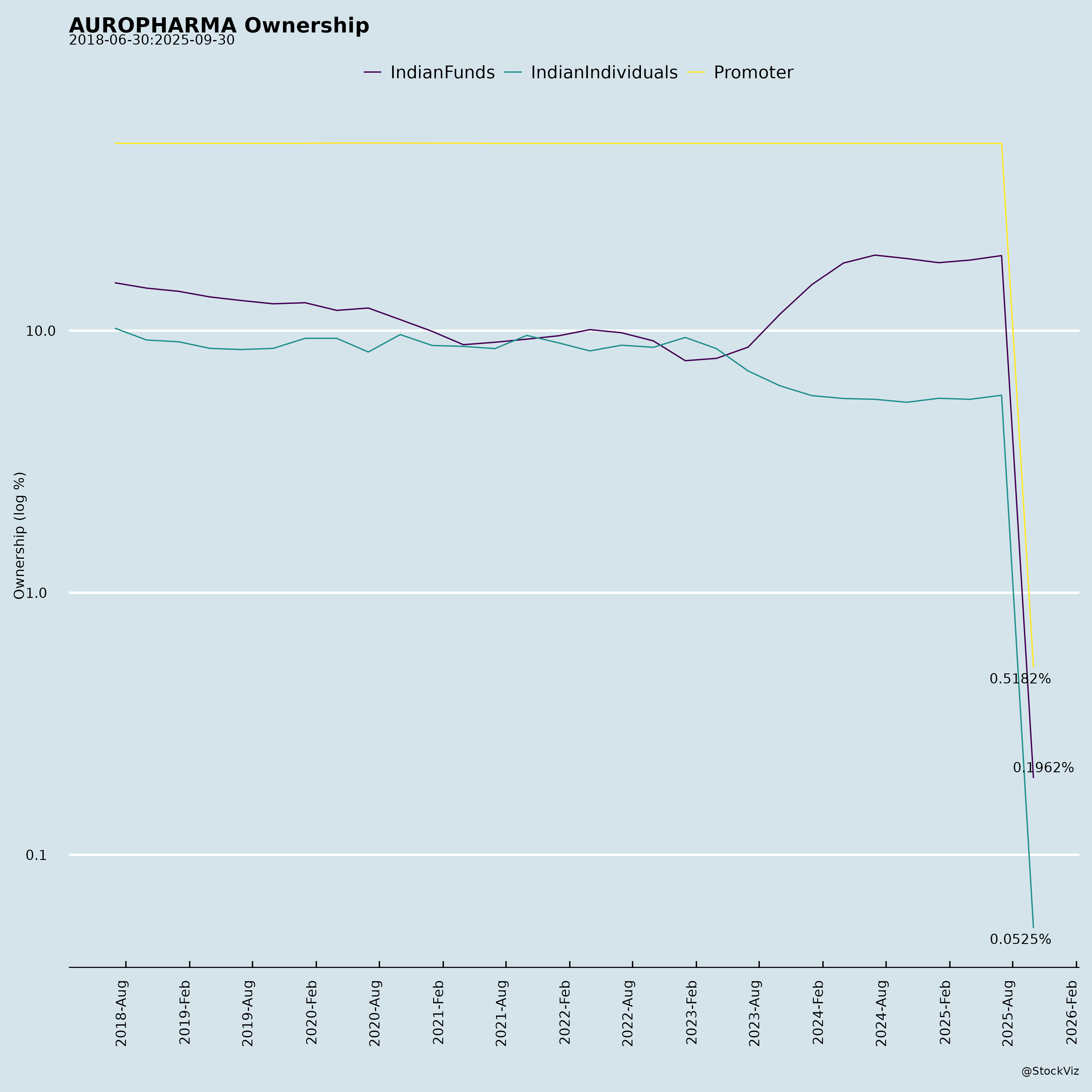

Ownership

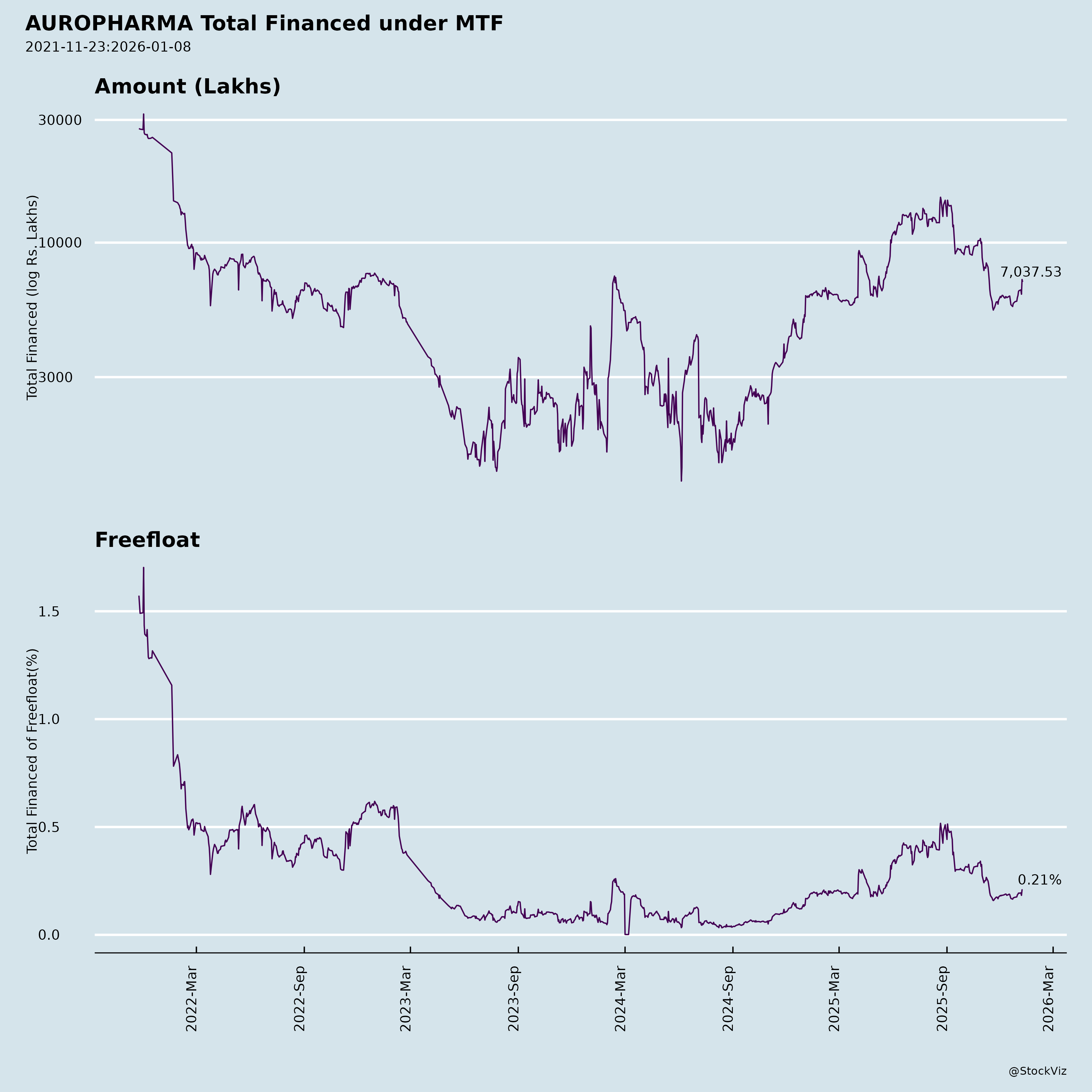

Margined

AI Summary

asof: 2025-12-03

Aurobindo Pharma Limited (AUROPHARMA) Analysis

Based on Q2FY26 Earnings, Announcements, and Financials (as of Sep 30, 2025)

Tailwinds (Positive Momentum)

- Robust Revenue Growth: Q2FY26 revenue at ₹8,286 Cr (+6.3% YoY), driven by formulations (10.3% YoY to ₹7,325 Cr). Key markets shining: Europe (+17.8% YoY to ₹2,480 Cr/EUR 243 Mn), Growth Markets (+8.7% YoY to ₹882 Cr/USD 101 Mn), ARV (+68.7% YoY to ₹325 Cr/USD 37 Mn), US stable (+3.1% YoY to ₹3,638 Cr/USD 417 Mn, 43.9% of total).

- Profitability Stability: EBITDA ₹1,678 Cr (+7.1% YoY, 20.3% margin); Net Profit ₹848 Cr (+3.8% YoY). Gross margins expanded 90 bps YoY to 59.7%.

- Pipeline Strength: 13 US ANDA filings, 7 approvals, 6 launches in Q2. Cumulative: 876 ANDAs (711 final approvals), addressing $193 Bn US market. Global filings: 5,782 formulations, 4,369 APIs.

- Biosimilars Momentum: EU/UK approvals (e.g., trastuzumab, bevacizumab); Phase 3 successes (BP16 Prolia biosimilar ready for filing); 3+ immunology/oncology filings by FY27.

- Balance Sheet Health: Net cash USD 170 Mn; Free cash flow USD 57 Mn (pre-dividend/buyback). R&D spend ₹414 Cr (5% of sales) supports specialty shift.

- Operational Efficiency: Capex USD 106 Mn focused on capabilities/new markets; domestic formulations up (₹81 Cr in Q2).

Headwinds (Challenges)

- API Segment Weakness: -16.9% YoY to ₹961 Cr (11.6% of revenue); Beta-lactam (-20.1%), Non-Beta-lactam (-8.3%) hit by market conditions.

- US Softness: Ex-gRevlimid growth +6% QoQ but overall flat YoY due to transient product sales dip; Puerto Rico excluded.

- Regulatory Scrutiny: US FDA inspection at Eugia Unit II (Nov 3-14, 2025) yielded 9 procedural observations (response planned; no operational impact stated).

- Margin Pressures: Overheads +8.2% YoY; Forex gains down; Higher depreciation (+12.3% YoY).

- Working Capital Strain: Inventory build-up; Standalone cash flow from ops strong but consolidated shows capex intensity.

Growth Prospects

- US Generics Leadership: 876 ANDAs target high-value therapies (CVS $52 Bn, Anti-Diabetic $42 Bn). Post-2028 pipeline + launches to drive 2-6% QoQ growth.

- Biosimilars Ramp-Up: Portfolio (pegfilgrastim, filgrastim, etc.) with SKU expansions, new indications; Capacity build for filling/bulk; CuraTeQ Malta for self-testing. Target: Immunology/oncology dominance by FY27.

- Geographic Expansion: Europe/Growth Markets double-digit growth; New subsidiaries (e.g., Malaysia, Chile, Malta) for market access.

- Strategic Focus: R&D/capex on specialties; Partnerships for commercialization; ARV revival. FY26 guidance intact (steady execution per MD).

- Medium-Term: H1FY26 revenue ₹16,154 Cr (+5-6% YoY implied); EPS ₹28.81 (standalone). Potential Lannett acquisition (pending regulatory nod).

Key Risks

| Risk Category | Details | Mitigants |

|---|---|---|

| Regulatory | FDA observations (9 procedural at Eugia); Approval delays (134 under review). | Procedural nature; Strong track record (711 approvals). |

| Competition/Margins | Generic pricing pressure; API decline from market oversupply. | Biosimilars/specialty shift; Stable gross margins (59.7%). |

| Forex/Debt | USD/INR volatility (87.29 avg); Gross debt ₹7,484 Cr but net cash positive. | Hedged forex; Low finance cost (4.7% annualized). |

| Operational | Capex heavy (H1 ₹13.6 Bn); Inventory up 6% QoQ. | Free cash flow gen; 31 FDA-approved facilities. |

| Execution | Biosimilar commercialization delays; Geopolitical/supply chain (e.g., new entities). | Diversified 150+ countries; JV/share of profit stable. |

| M&A | Lannett deal regulatory risks. | No FY26 financial impact disclosed. |

Overall Summary: Aurobindo demonstrates resilient growth (6%+ revenue, stable margins) amid API headwinds, fueled by formulations/biosimilars tailwinds. Growth prospects strong in US/Europe/specialties, with net cash buffer. Risks tilted regulatory/competitive but manageable via pipeline depth. Stock poised for steady upside if FDA issues resolve smoothly; monitor Q3 for biosimilar milestones. Recommendation: Positive hold/buy on dips, target FY26 EPS ~₹60+.

Copyright © 2023 SAS Data Analytics Pvt. Ltd. All rights reserved.