AUBANK

Equity Metrics

January 13, 2026

AU Small Finance Bank Limited

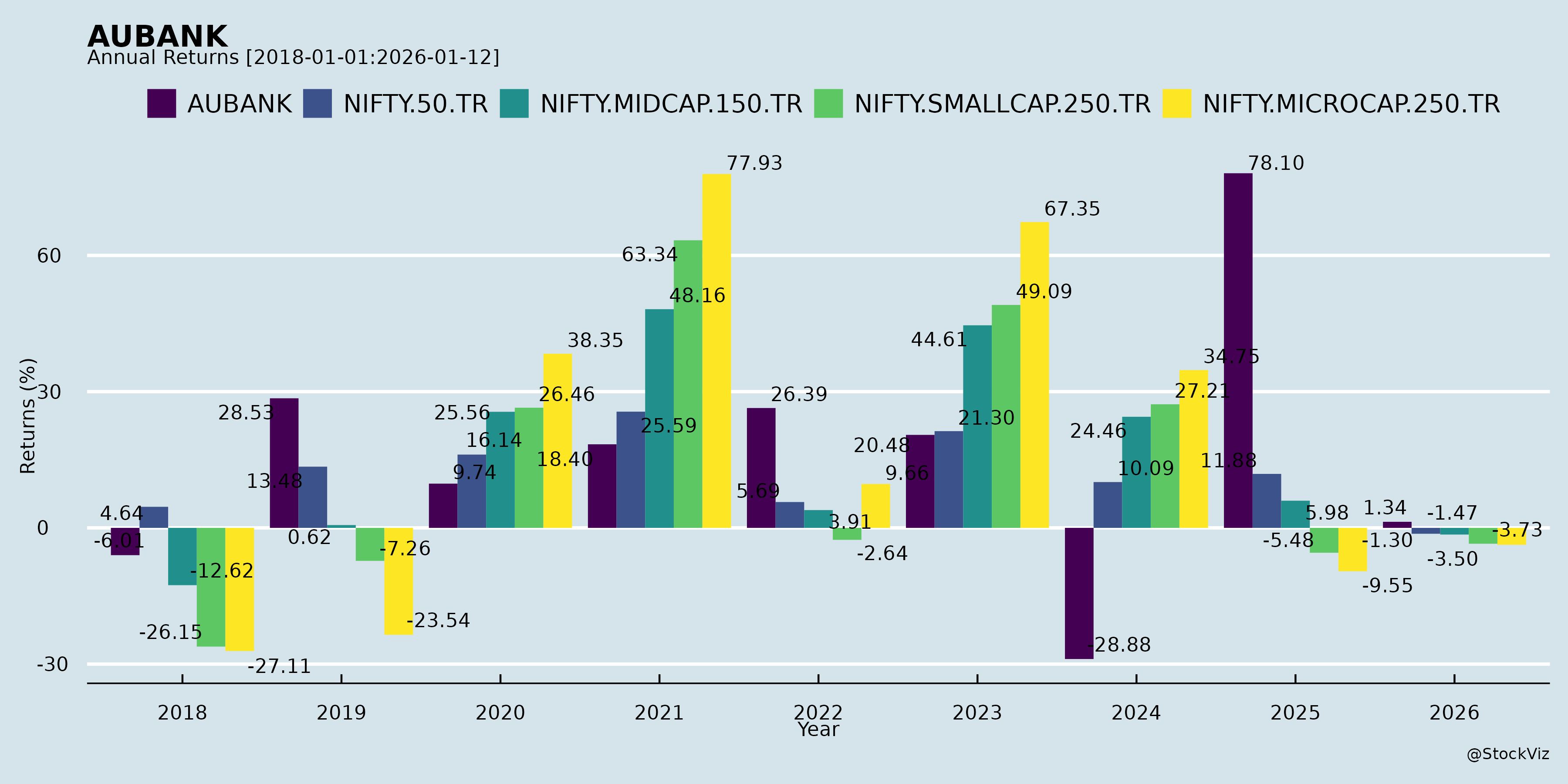

Annual Returns

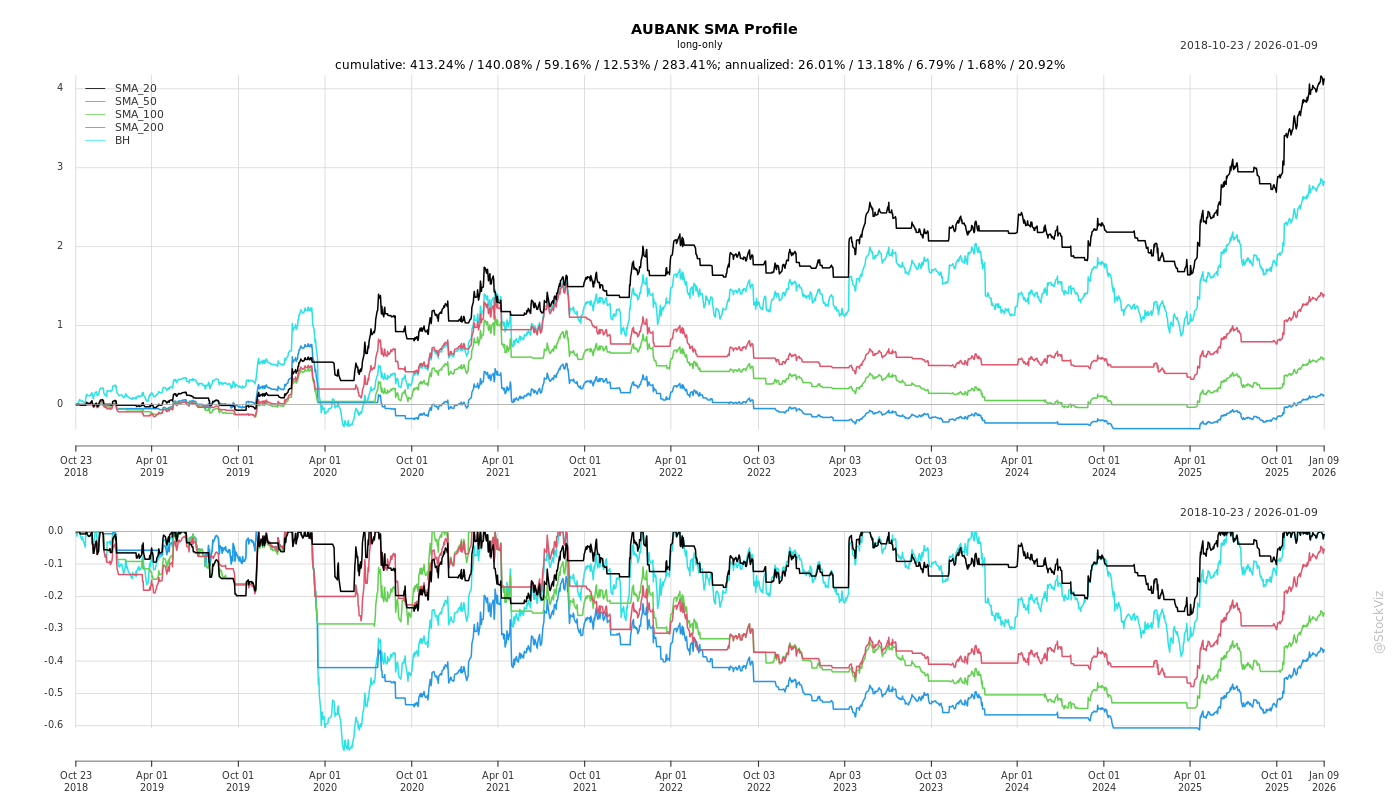

Cumulative Returns and Drawdowns

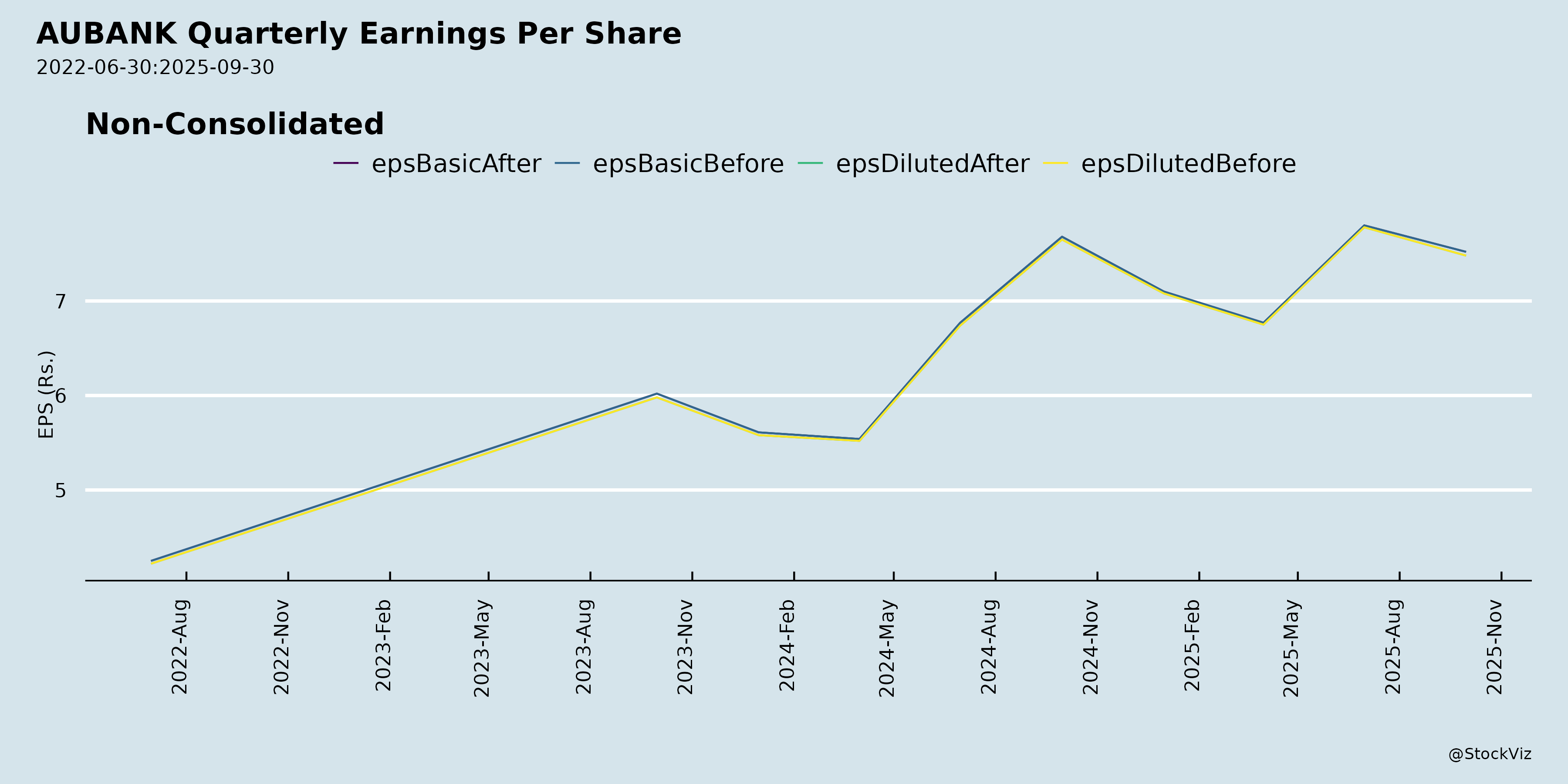

Fundamentals

Ownership

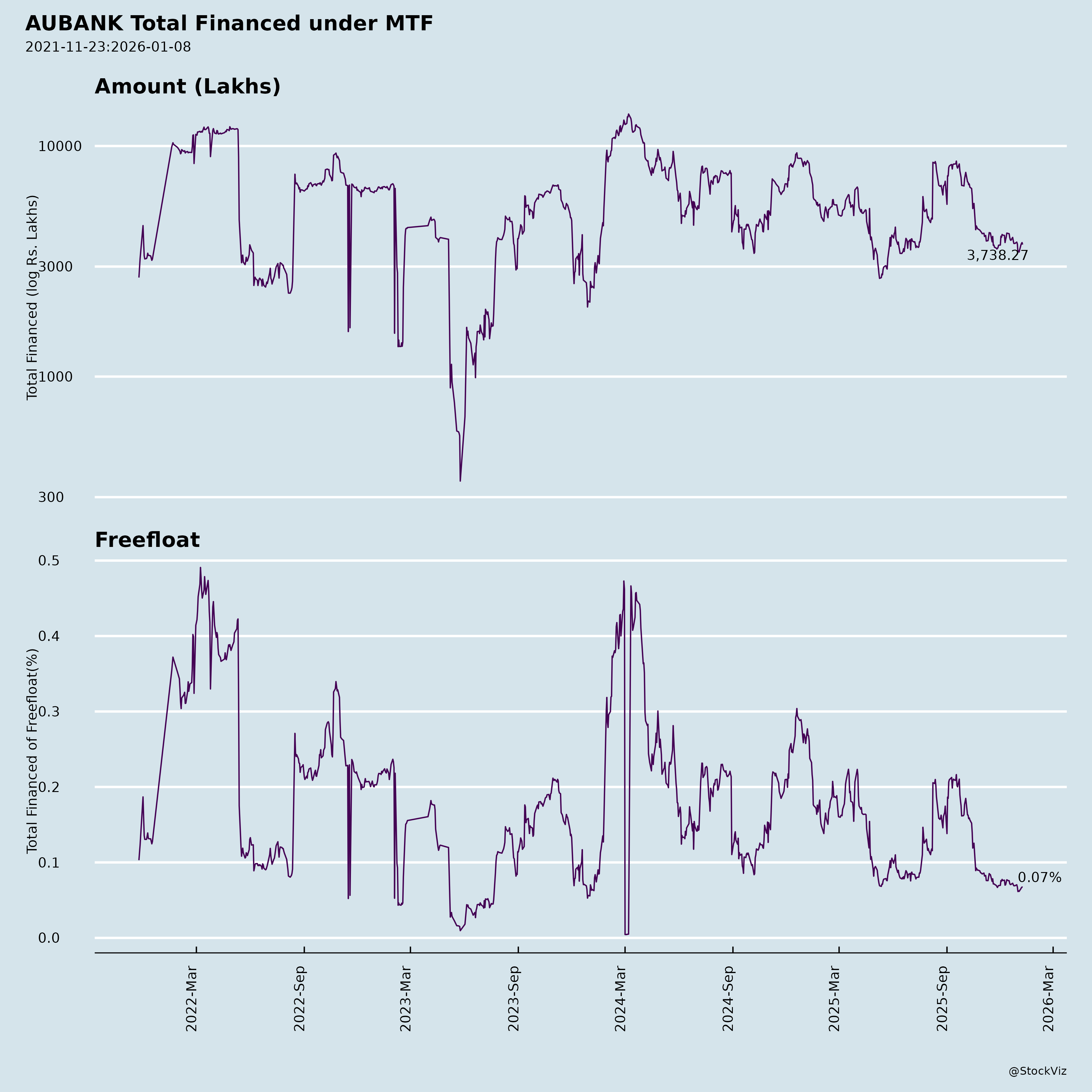

Margined

AI Summary

asof: 2025-11-27

Analysis of AU Small Finance Bank Ltd. (AUBANK)

AU Small Finance Bank (AU SFB) reported resilient Q2/H1 FY26 results amid macro headwinds, with strong deposit mobilization, NIM stabilization, and strategic milestones like in-principle RBI approval for Universal Bank transition. Below is a structured summary of headwinds, tailwinds, growth prospects, and key risks, derived from the Q2 FY26 earnings presentation, press release, board updates, and disclosures.

Headwinds (Challenges Pressuring Performance)

- Unsecured Loan Stress: De-growth of 23% YoY in MFI/credit cards/personal loans (now ~8% of portfolio); elevated slippages (₹908 Cr in Q2, down 12% QoQ but high CE issues in MFI at 98.95%). Credit costs at 0.64% for H1 (vs. 0.50% YoY), with GNPA at 2.41% (up from 1.98% YoY).

- Yield Compression: GA yield down 19 bps QoQ to 13.9% due to repo repricing and mix shift; NIM at 5.5% (flat YoY but improved 5 bps QoQ).

- Macro/Operating Pressures: Global volatility, domestic demand deferral (rains/floods/GST cuts), high opex growth (11% YoY to ₹1,647 Cr), and sequential PAT dip (3% QoQ to ₹561 Cr).

- Liquidity/Deposit Costs: CD ratio at 87% (81% ex-refinance); CoF down 25 bps QoQ but remains elevated at 6.83%.

Tailwinds (Supportive Factors)

- Robust Liability Franchise: Deposits +21% YoY to ₹1.33 Lac Cr (2x system growth); CASA stable at 29.4%; stable deposits (79% of total). Non-callable bulk TDs +50% YoY.

- Secured Loan Momentum: Ex-unsecured GLP +22% YoY; retail secured assets (67% mix) at 14.4% yield, strong vintage performance.

- Profitability Resilience: PPoP +21% YoY to ₹2,522 Cr (H1); RoA/RoE at 1.4%/12.9% (H1); core other income +11% YoY.

- Regulatory/Governance Boost: RBI in-principle nod for Universal Bank (first since 2014); new Independent Directors (e.g., Mr. N S Venkatesh for treasury/risk, Mr. Satyajit Dwivedi for rural finance); strong ratings (AA+/Stable FD).

- Macro Tailwinds: RBI repo cuts/CRR reduction, proposed RWA cuts/DICGC reforms, govt capex/GST relief.

Growth Prospects (High-Potential Opportunities)

- Universal Bank Transition: Enhanced brand/deposits (target granular CASA/seniors/NRIs); lower PSL/ticket limits; higher refinance/govt banking access (18-month promoter restructuring via NOFHC).

- Distribution & Product Scale: 2,626 touchpoints (+121 in Q2); FY26 plan: +100-120 branches, deepen wheels/gold/mortgages (20% growth target), commercial banking (renewables/MSMEs), cross-sell (insurance/wealth/cards/payments).

- Unsecured Recovery: MFI CE improving; cards normalizing by FY26-end; potential resumption post-calibration.

- Digital/Tech Edge: AU0101 app (65% penetration, 15.4L MAUs); partnerships (Zaggle cards, SBI Life); AD-I/Fx growth.

- Scale with Sustainability: 30 years legacy; 120L+ customers; H1 PAT +6% YoY; target H2 earnings via margin/credit cost improvement. Post-merger synergies (Fincare) for south India dominance.

Key Risks (Critical Vulnerabilities)

| Risk Category | Details | Mitigation |

|---|---|---|

| Asset Quality | High unsecured slippages (MFI SMA 2.9%, cards peak); potential ECL impact. | CGFMU cover (69% MFI), collections infra, portfolio calibration. |

| Interest Rate/Liquidity | Yield-CoF spreads narrowing; LCR 119% but refinance-dependent CD ratio. | Deposit re-pricing (SA rates cut), granular focus (79% stable deposits). |

| Regulatory/Execution | Universal transition (NOFHC compliance); RBI approvals for MD/CEO pay/re-appointment. | Strong governance (new IDs), proven track record. |

| Macro/Competition | Rural slowdown, unsecured competition; global trade risks. | Diversified book (67% secured retail), pan-India expansion. |

| Concentration/Leadership | Promoter-led (22.8% holding); keyman risk (MD & CEO re-appointment). | Succession planning, board strengthening. |

Overall Outlook: AU SFB is poised for accelerated growth (deposits/loans outpacing system) via Universal Bank pivot and execution, but must navigate unsecured cleanup and macro volatility. FY26 guidance implies H2 pickup; stock could re-rate on transition success (trading at ~1.5x FY26E BVPS). Monitor Q3 asset quality for confirmation.

Copyright © 2023 SAS Data Analytics Pvt. Ltd. All rights reserved.