ANGELONE

Equity Metrics

January 13, 2026

Angel One Limited

Annual Returns

Cumulative Returns and Drawdowns

Fundamentals

Ownership

Margined

AI Summary

asof: 2025-12-03

Angel One Limited (ANGELONE) Analysis: Headwinds, Tailwinds, Growth Prospects, and Key Risks

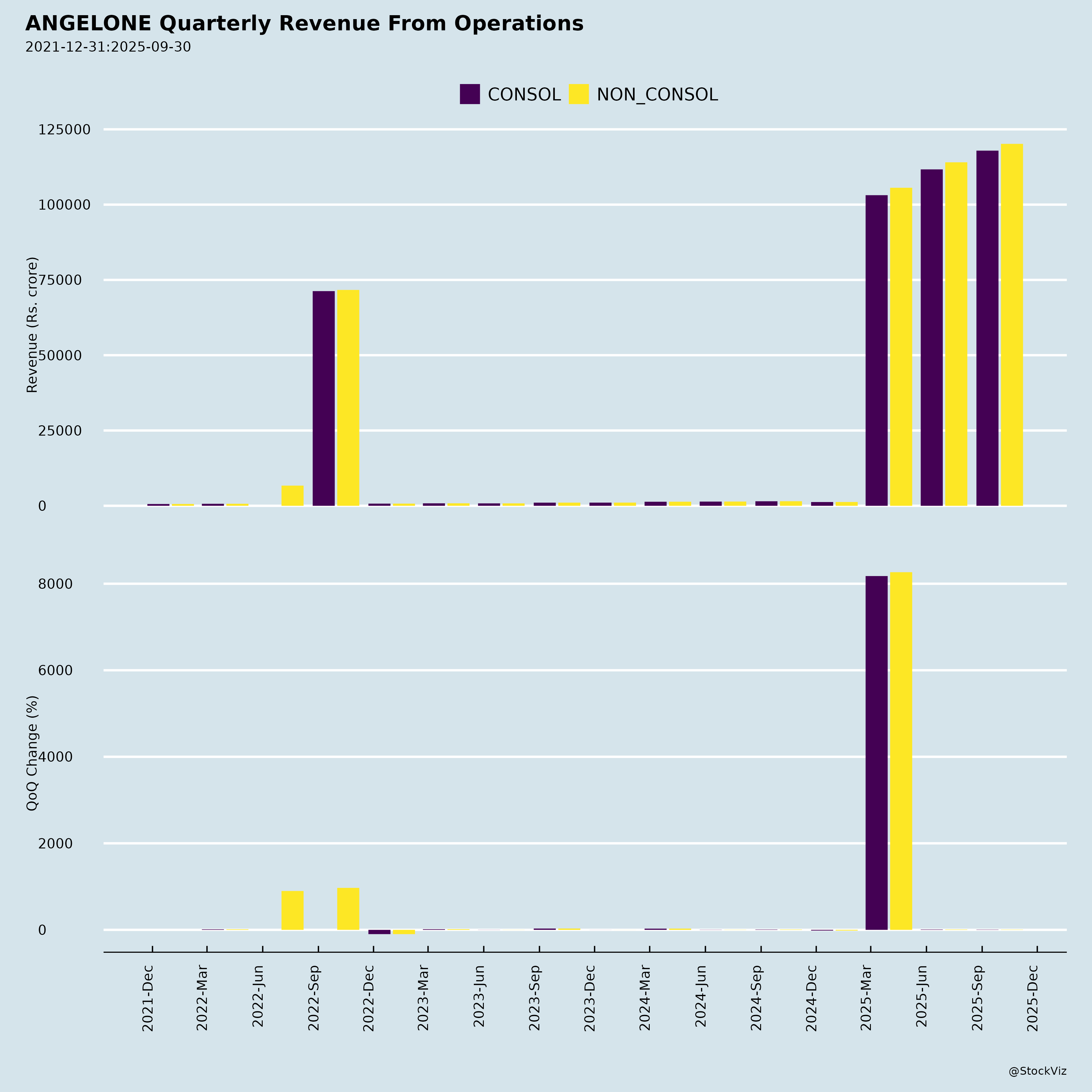

Angel One, a leading Indian fintech broker, continues to demonstrate resilience through client acquisition, product diversification, and tech-led engagement. Q2 FY26 (ended Sep 2025) showed QoQ recovery in revenues (+5.6% to ₹9,410 Mn) and PAT (+85% to ₹2,117 Mn), driven by funding book growth and emerging businesses. However, YoY pressures from market softness persist. Below is a structured summary based on the provided disclosures, financials, investor presentation, and updates.

Tailwinds (Positive Drivers)

- Robust Client Momentum: Client base hit 34.1 Mn (+4.9% QoQ, +24% YoY); gross additions 1.7 Mn QoQ. Nov’25 update: 35.08 Mn clients (+21.9% YoY). Strong Tier 2/3 penetration (90% of additions).

- Market Share Gains: Retail equity turnover share at 20.5% (+71 bps QoQ); F&O at 21.7%. Commodity share 52.5-65.1%. NSE active clients 6.9 Mn (15.2% share).

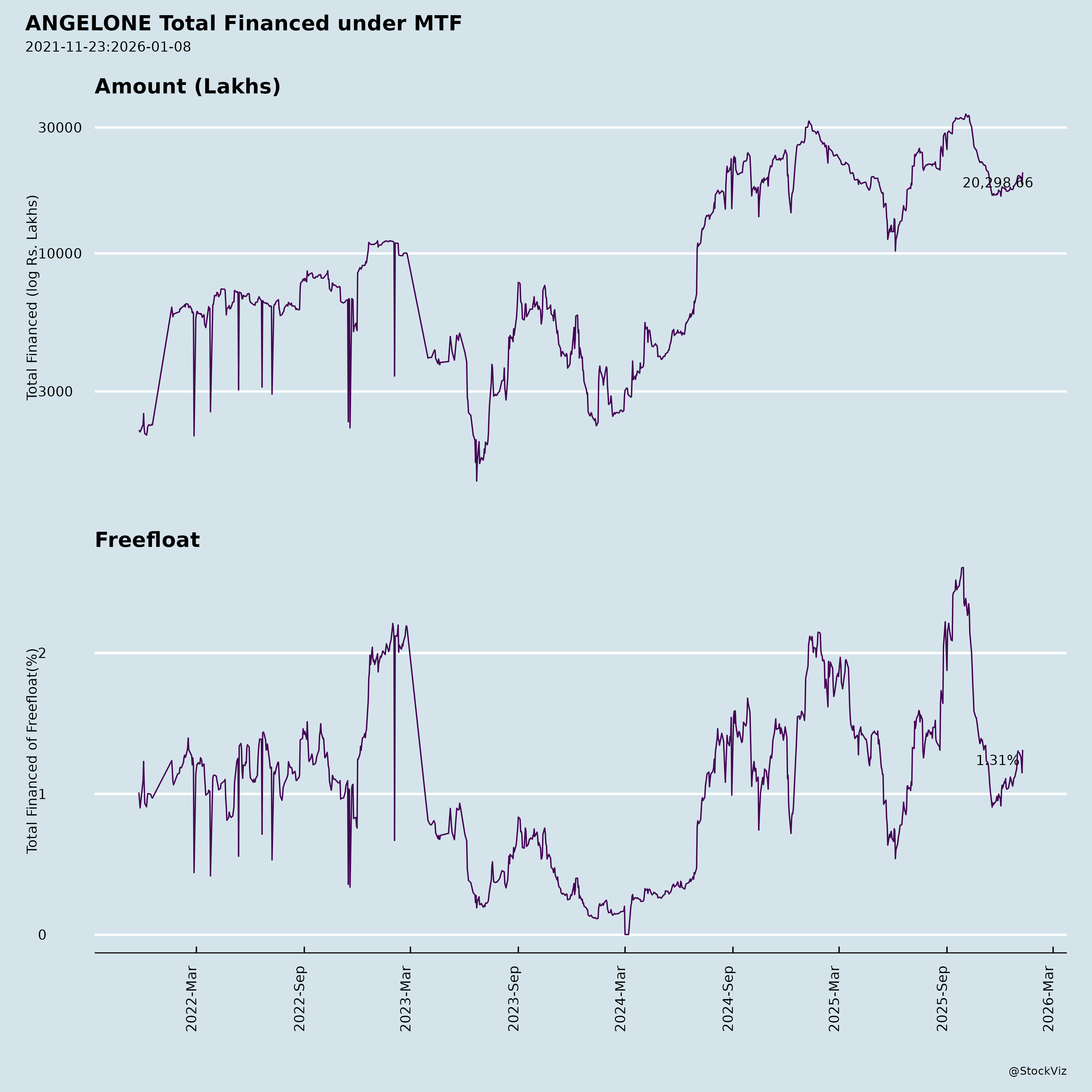

- Funding & Transaction Growth: Avg. client funding book ₹53 Bn (all-time high, +2.7% MoM in Nov); orders 360 Mn (+5% QoQ). ADTO resilient at ₹1.4 Tn (premium basis, +31.8% QoQ).

- Diversified Revenue Streams: Emerging businesses shining – Unique SIPs 2.4 Mn (+23.8% QoQ); credit disbursals ₹4.6 Bn (+97% QoQ, cumulative ₹13.9 Bn); Wealth AUM ₹61.4 Bn (+21.3% QoQ, 1,250+ clients); AMC AUM ₹4 Bn (+16.8% QoQ, 138k folios, 7 schemes).

- Tech & AI Edge: AI chatbot “Ask Angel” live; omnichannel platform; ISO 27001 certified. Supports LTV via personalization and ecosystem lock-in.

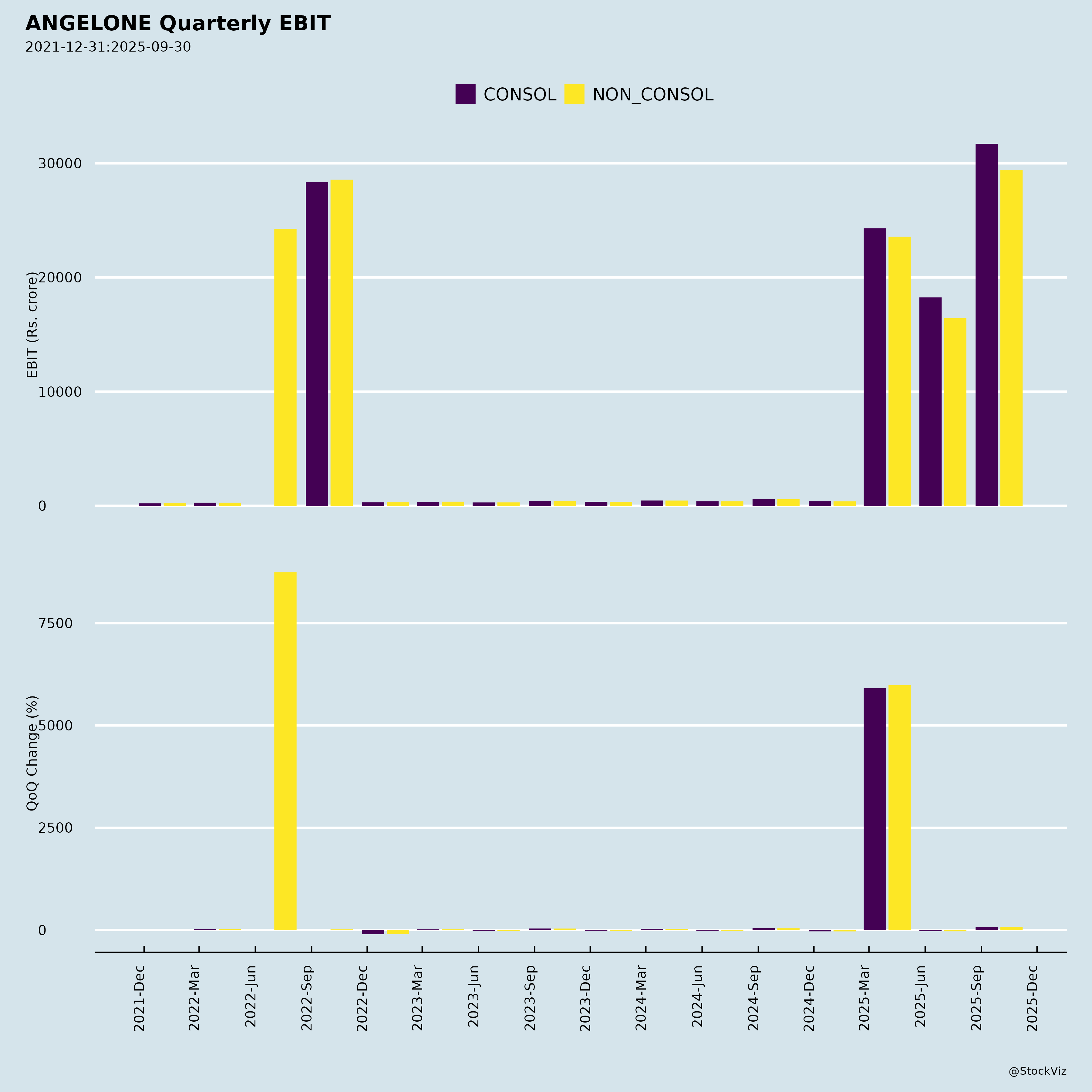

- Financial Resilience: Normalised EBDAT margin stable at 34.5%; healthy cohorts with consistent net income (payback 7-10 months). Cash reserves strong (₹109 Bn bank balances).

Headwinds (Challenges)

- Market Volatility Impact: QoQ/YoY declines in ADTO (-9.8% MoM Nov), orders (-12.3% MoM), and gross revenues (-21% YoY). Cash ADTO down -7.5% QoQ.

- YoY Revenue Pressure: Total gross revenues -14% YoY (ex-ancillary); PAT -50% YoY due to softer volumes and higher opex (branding/IPL spends ₹1,117 Mn in H1 FY26).

- Margin Compression: Reported EBDAT margin dipped to 34.5% (from 49.9% YoY); cost-to-income rose to 68.8% amid employee costs and IPL.

- Client Acquisition Slowdown: Gross additions -11.1% MoM (Nov); competition in discount broking.

- Regulatory Scrutiny: SEBI fine ₹3 Lakh (Nov 2025) for AP terminal non-compliances (unauthorised users, supervision lapses). Minor financial impact but highlights compliance risks.

Growth Prospects (Medium-Term Opportunities)

- Annuity & Diversification: Shift to fee-based (MF SIPs, wealth, AMC) and annuity (insurance JV with 26% stake in Angel One LivWell Life Insurance; GIFT City branch). Target: Broader ecosystem (credit, FDs, insurance) for LTV uplift.

- India’s Fintech Boom: Demat accounts exploding (younger, regional cohorts); passive AUM growth; underpenetrated insurance (~5% life premiums). Angel’s 16.5% share in incremental demats positions it well.

- Scale Projections (from Presentation): Client base to 1.9 Mn by FY28; ADTO ₹0.6 Tn; funding book ₹38.9 Bn. Multi-product platform (AI-led) to drive retention.

- Strategic Moves: Life insurance JV (₹1.04 Bn investment); AMC expansion; Ionic Wealth tech (AI agent, AA integration).

- Healthy Fundamentals: Recurring revenues; low NPA in funding; maturing cohorts (stable income post-24 months).

Key Risks

| Risk Category | Description | Mitigation |

|---|---|---|

| Regulatory/Compliance | SEBI thematic inspections (e.g., AP terminals); potential for higher fines/slaps. PIT/UPSI risks in analyst meets. | Strong governance; disclosures compliant. |

| Market/Cyclical | Broking (55%+ revenue) tied to volatility; F&O curbs possible. | Diversification (annuities ~20-30% potential); funding book secured by demats. |

| Credit/Operational | Funding book expansion (₹59.5 Bn); NPAs (negligible now but scaling risk). | AI/ML models; low exposure per client (₹0.1-0.5 Mn for 84%). |

| Competition | Zerodha, Groww in discount space; HNI shift to full-service. | AI personalization; Super App ecosystem. |

| Execution | New ventures (insurance JV, GIFT City) need approvals; dilution from ESOPs (25 Mn+ units). | Experienced team; JV with LivWell. |

| Macro | Rate hikes, economic slowdown impacting volumes/funding. | Resilient model (orders up in 75% of >5% index corrections). |

Overall Outlook: Positive with cautious optimism. Tailwinds from diversification and tech outweigh headwinds; FY26 growth pegged at 20-30% in clients/revenues (per presentation). Target ₹2,000-2,500 (20-30x FY26 EPS est. ₹75-85) on 25-30% ROE trajectory. Monitor regulatory developments and Q3 volumes.

Copyright © 2023 SAS Data Analytics Pvt. Ltd. All rights reserved.