Stockbroking & Allied

Industry Metrics

January 13, 2026

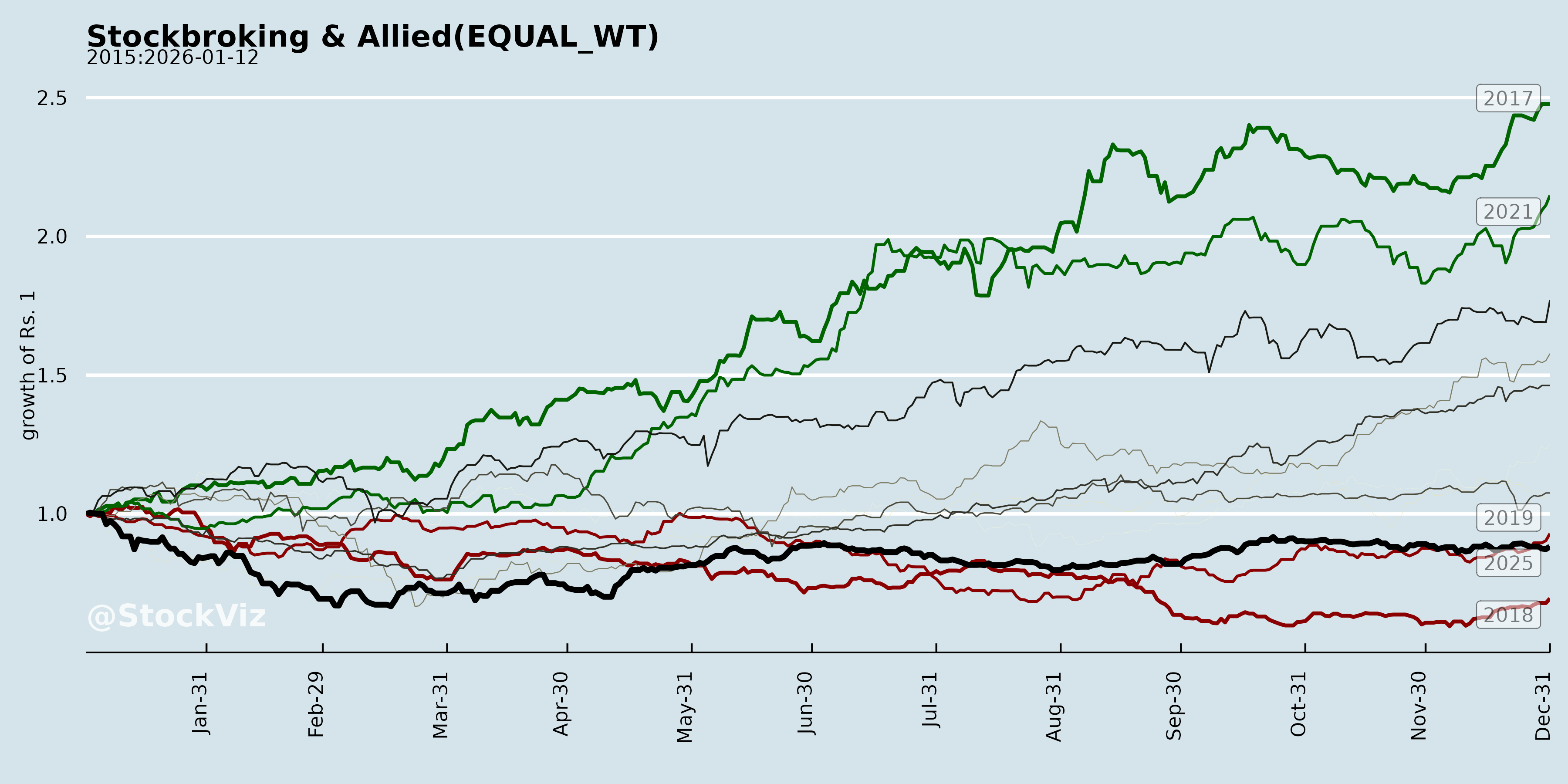

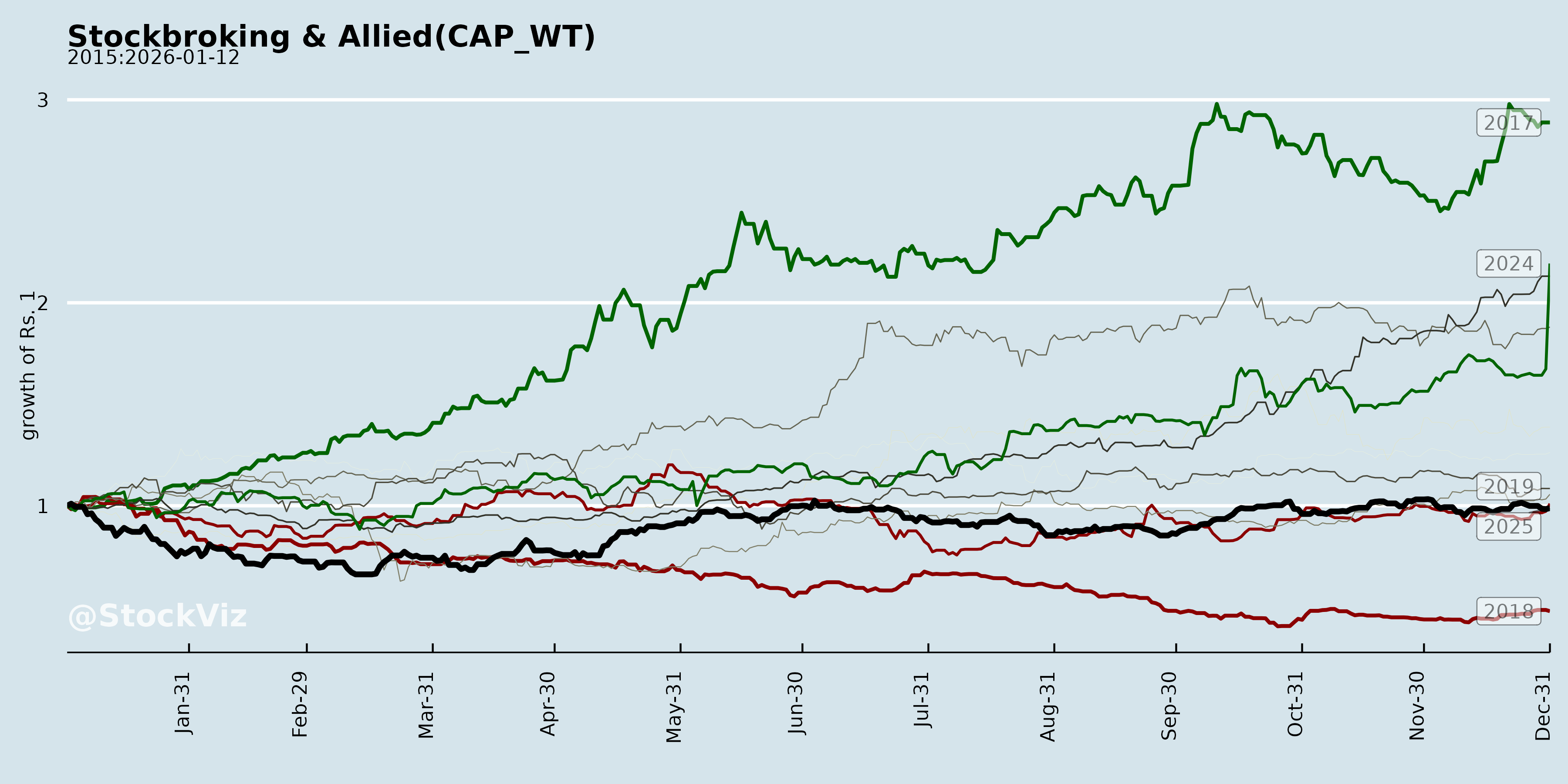

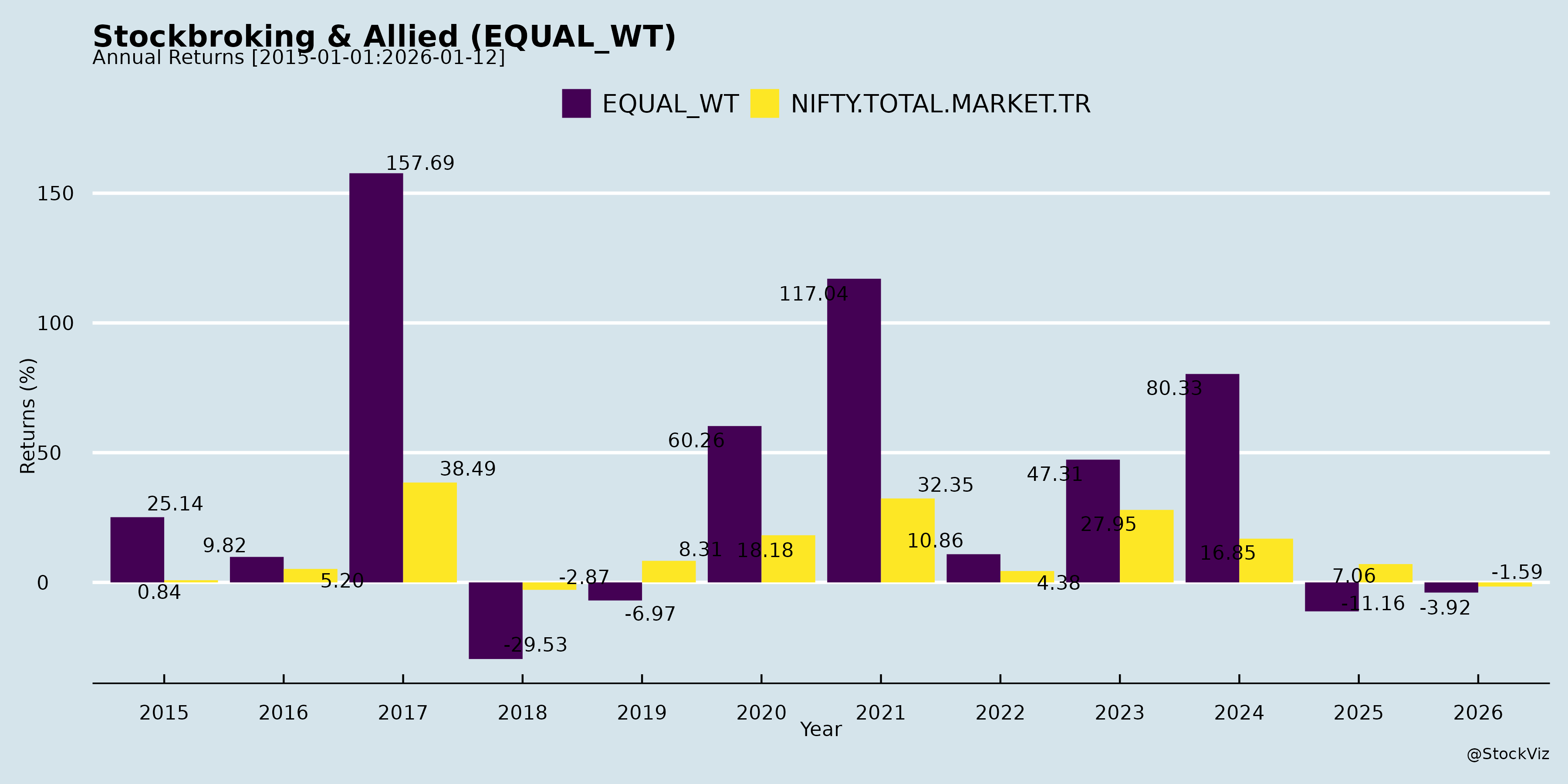

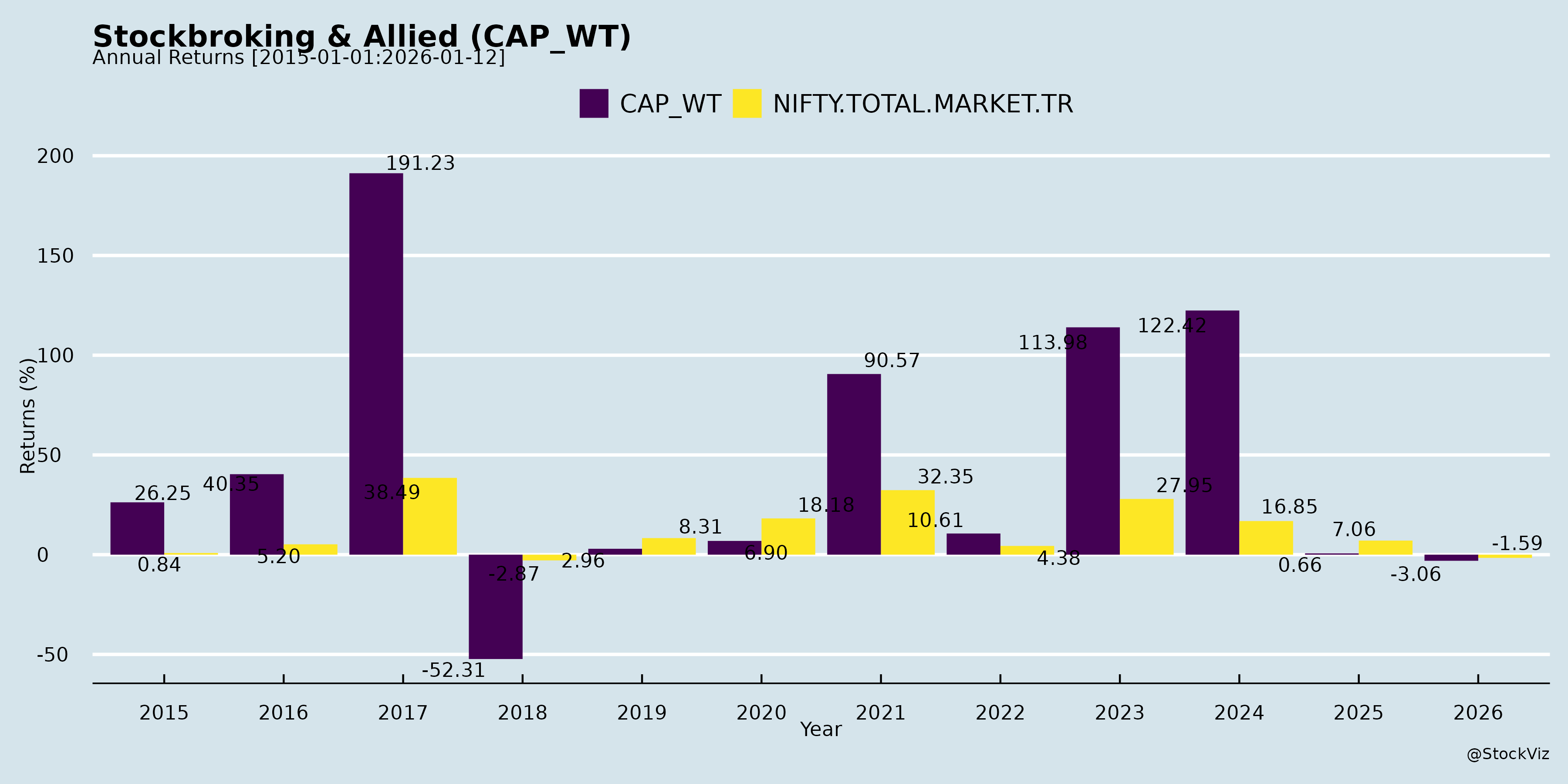

Annual Returns

Cumulative Returns and Drawdowns

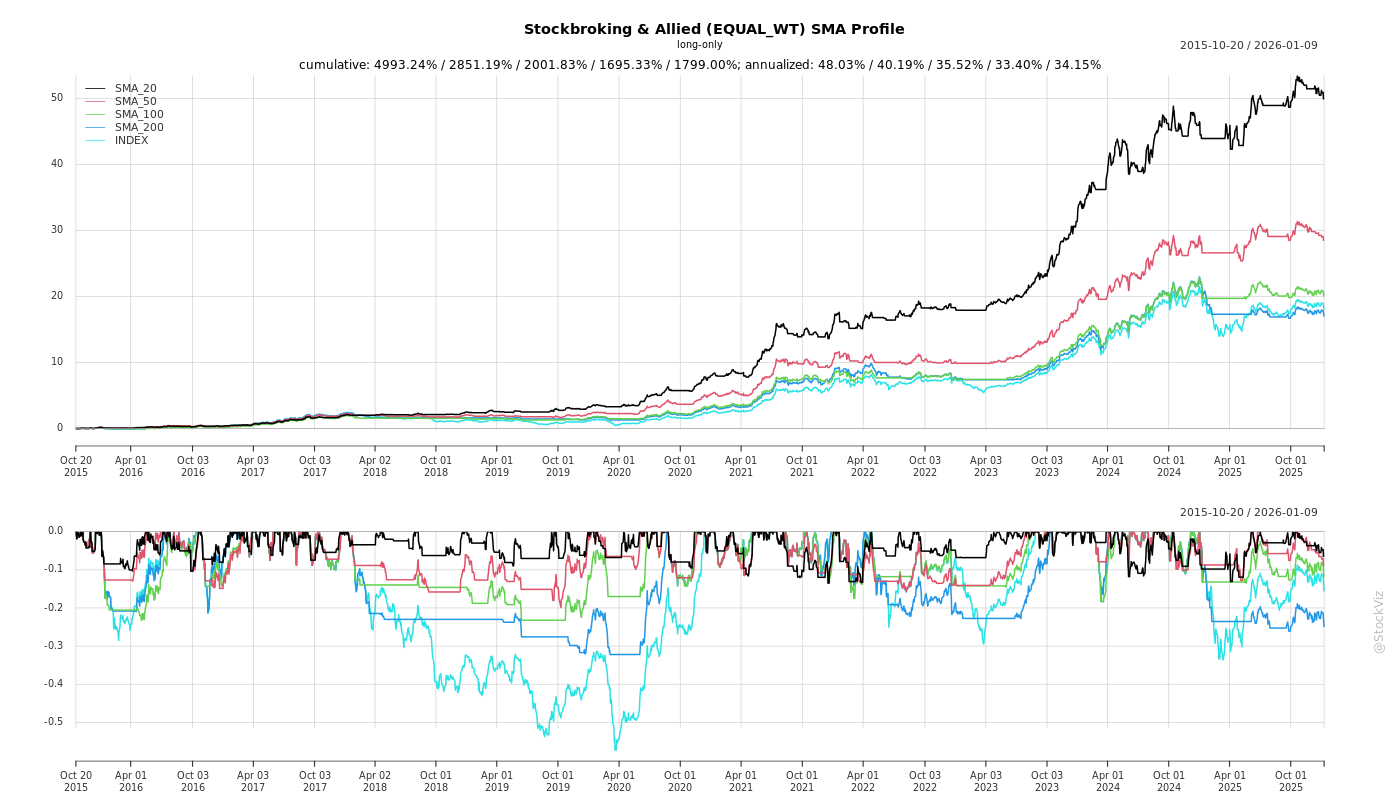

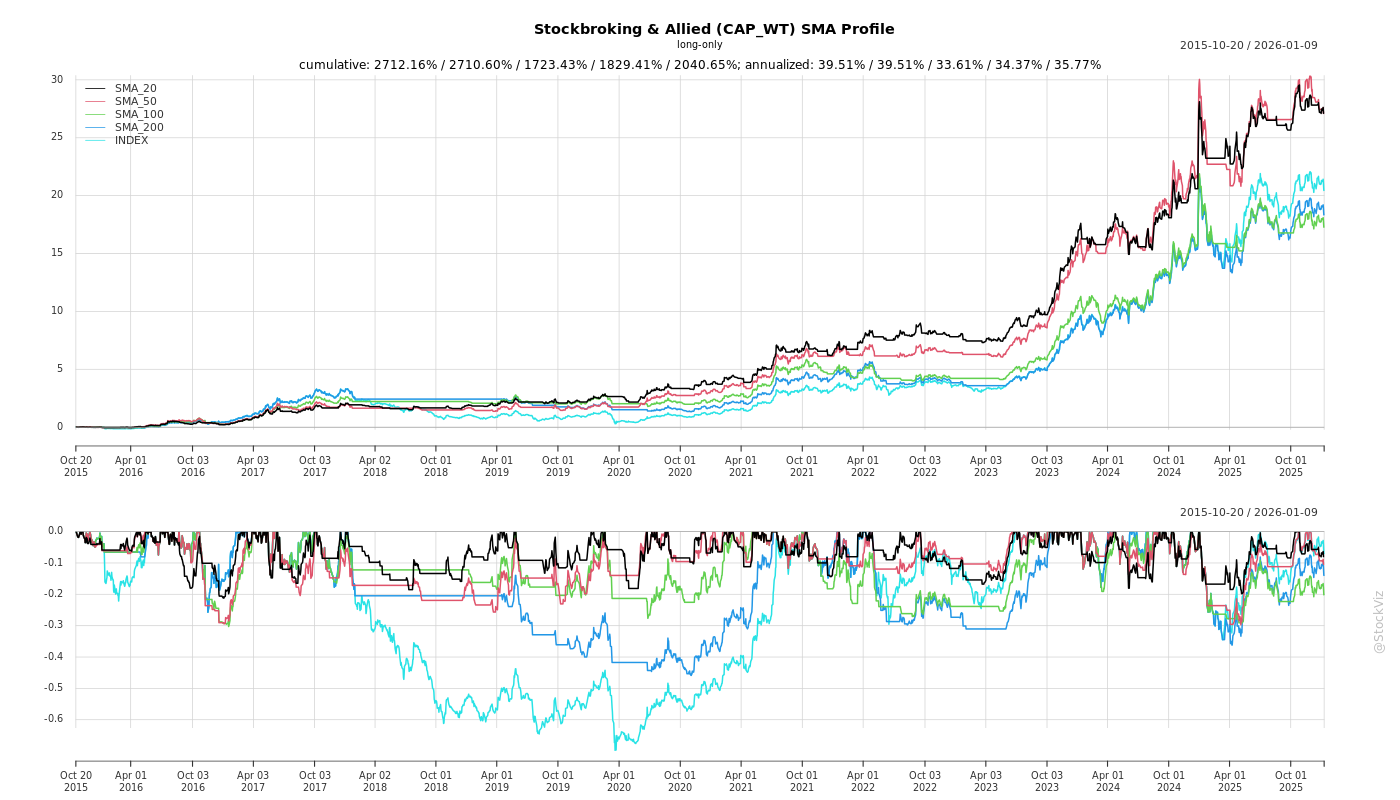

SMA Scenarios

Current Distance from SMA

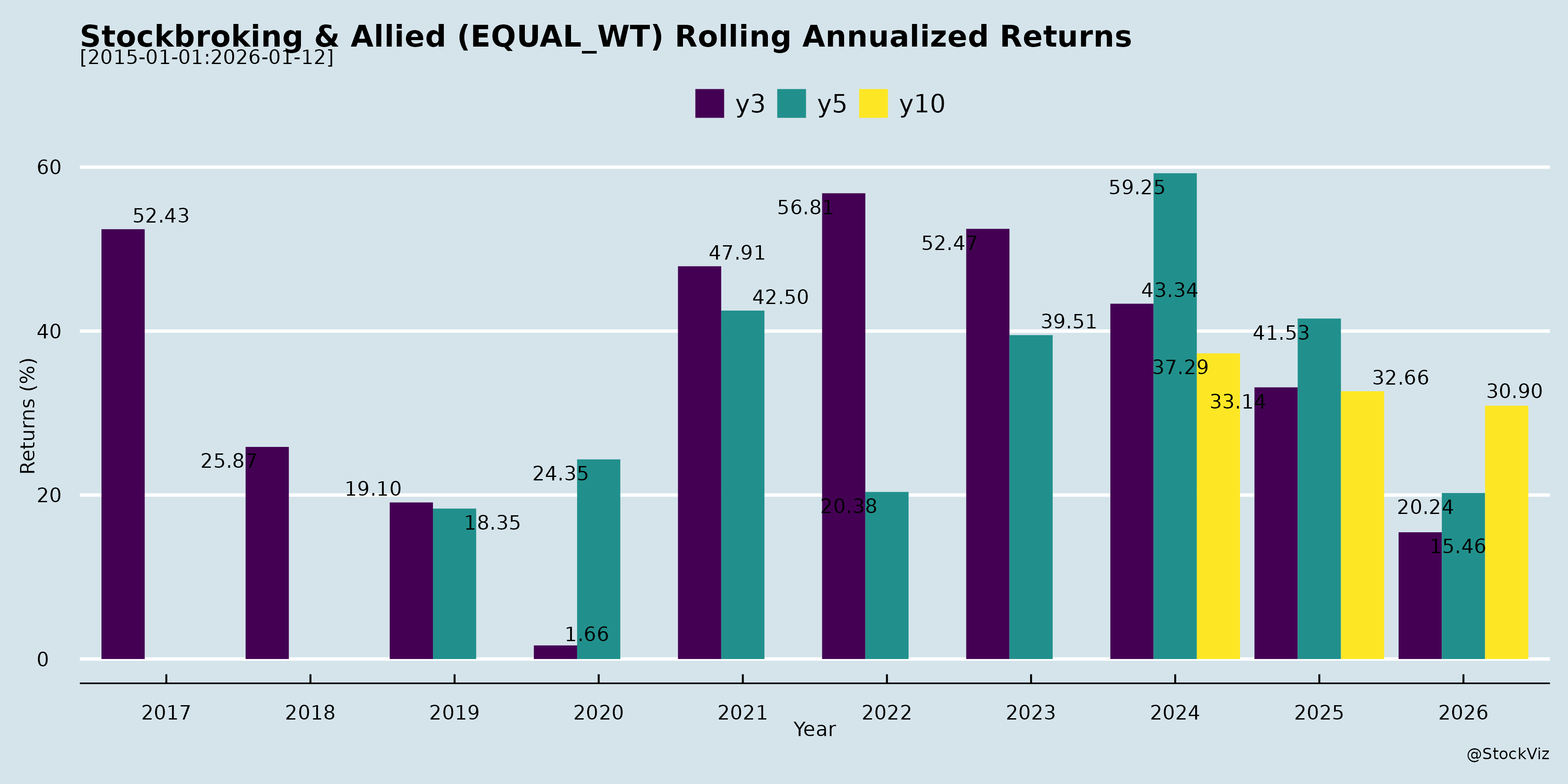

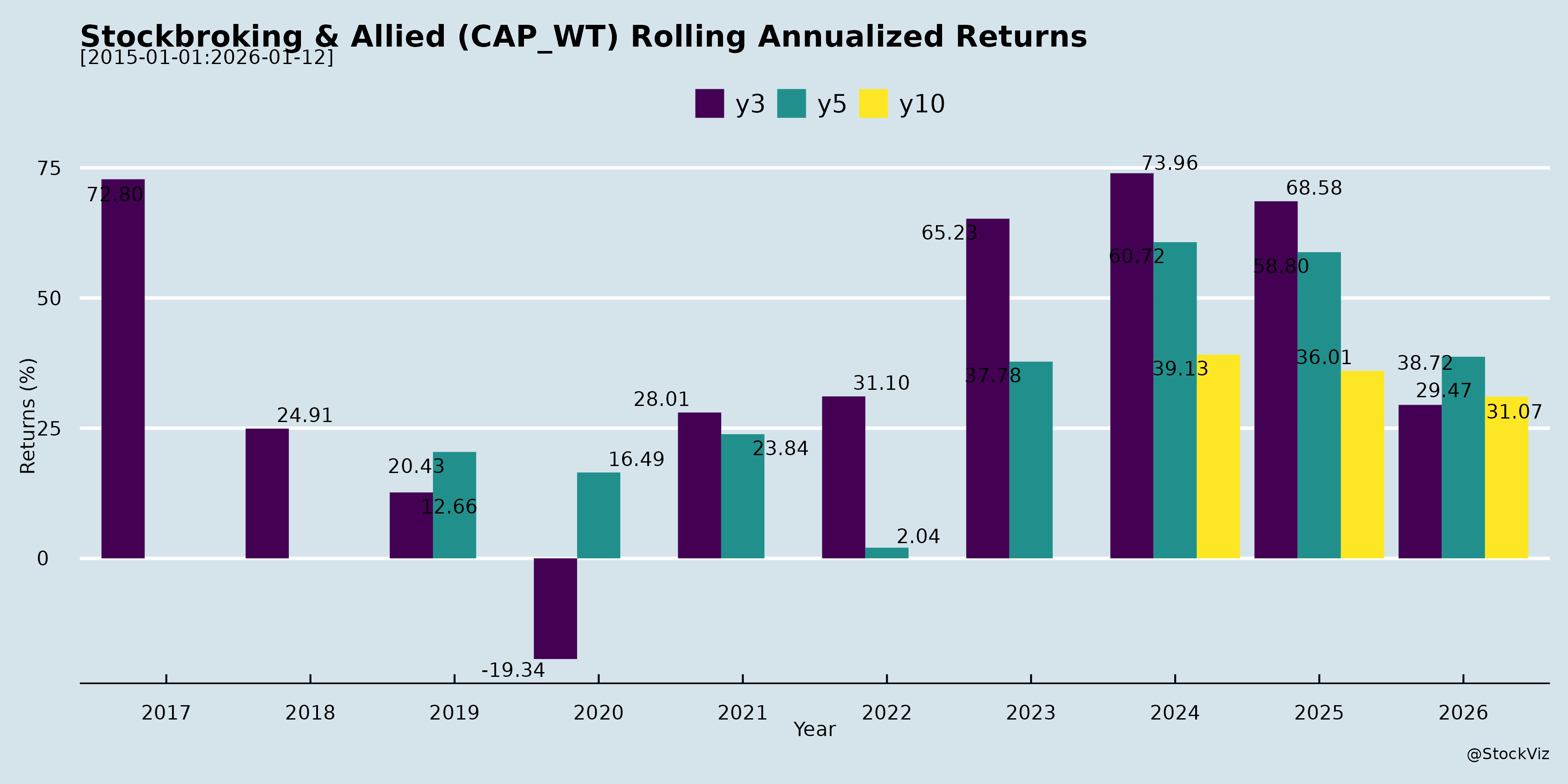

Rolling Returns

Market Cap

EBIT (% of Industry Total)

Revenue (% of Industry Total)

AI Summaries

Analyst

asof: 2025-11-29

Analysis of Indian Stockbroking & Allied Sector (Based on Q2/H1 FY26 Earnings Transcripts)

The provided documents include earnings conference call transcripts and regulatory filings from key players in the Indian stockbroking and allied sectors (e.g., Groww, Motilal Oswal, Nuvama, Angel One, IIFL Capital, Anand Rathi, Share India, Geojit, SMC Global, 5paisa, etc.). These reveal a sector undergoing regulatory recalibration and consolidation, with short-term volume pressures offset by diversification into high-margin areas like wealth management, lending (MTF/NBFC), insurance, and tech-driven products. Overall, FY26 is shaping up as a “transition year” with moderated growth (revenues down 3-25% YoY for many), but long-term prospects remain robust due to rising retail participation and financialization.

Headwinds (Key Challenges)

- Regulatory Tightening (Primary Drag): SEBI’s F&O reforms (e.g., fewer weekly expiries, higher margins, true-to-label norms) led to 15-40% YoY decline in cash/F&O ADTO industry-wide. Impacts: Brokerage revenues down 20-37% YoY (e.g., Groww, Motilal Oswal, 5paisa). Consultation papers propose brokerage caps (e.g., 2-12bps), algo curbs, and product suitability filters, risking further 1-6% PAT hits.

- Volume Moderation & Volatility: Cash ADTO down 6-17% QoQ; FII outflows ($10B+), geopolitical tensions, and tariffs subdued sentiment. Active clients ~25% of demat accounts (207M total); churn in low-quality F&O users.

- Margin Compression: CAC up (e.g., Groww), funding costs rising for MTF/NBFC. Employee costs +5-28% YoY (hiring for sales/IT); yields down (MF: 42-45bps).

- Competition Intensity: Discount brokers aggressive on MTF pricing (e.g., 7.99%), prop trading shifts, and client poaching. Market share erosion in cash (e.g., Motilal Oswal at 7.1%).

Tailwinds (Supportive Factors)

- Retail Resilience: Demat accounts surging; SIP AUM/flow market share gains (e.g., Motilal Oswal at 4.8%). Shift from F&O speculation to investments (delivery up).

- Diversification Momentum: Non-broking revenues rising (30-58% mix): | Segment | Key Highlights | |———|—————| | MTF/Lending | Books doubling (e.g., Groww INR1,085Cr, Nuvama +40%); yields 14-15%. | Wealth/FP Distribution | AUM +14-46% (e.g., Motilal Oswal INR1.87Tn PWM); insurance premiums +10-343%. | Insurance Broking | Premiums +10-21% YoY; low-margin but scalable.

- Digital/Tech Edge: App upgrades, AI personalization, algos (e.g., 5paisa Scalper, uTrade Algos); online turnover 67%.

- Geographic Expansion: Tier-2/3 focus (71% clients for Anand Rathi); international (Dubai/Singapore for Nuvama).

Growth Prospects

- Short-Term (FY26 H2): Volumes stabilizing (Oct uptick); MTF/wealth to drive 20-25% revenue CAGR (e.g., Share India INR1,000Cr MTF by 2027). Insurance/NBFC steady (13-15% credit growth).

- Medium-Term (2-3 Years):

- Wealth boom (PMS/AIF/Alternates; e.g., Motilal Oswal IBEF V at INR8,350Cr).

- Tech/Fintech (Project Drone, algos, AI; NPS-like platforms).

- Lending scale-up (secured focus; e.g., Nuvama +25% CAGR).

- Market share gains in niches (e.g., commodities, SIPs at 4.8-8.2%).

- Long-Term (5+ Years): Financialization (USD126Tn savings by 2047); equitization tailwinds. Targets: 50:50 broking/non-broking mix (Anand Rathi); ARR >60% (Motilal Oswal).

| Company Examples | FY26/H1 Targets/Growth |

|---|---|

| Groww | MTF double-digit share; wealth integration. |

| Motilal Oswal | AMC/PWM PAT share up; Housing AUM 2x. |

| Nuvama | Flows INR25-26K Cr; ARR >50%. |

| Share India | MTF INR1,000Cr by 2027; PMS launch. |

Key Risks

| Risk Category | Details | Mitigation |

|---|---|---|

| Regulatory | F&O curbs (weekly expiry removal?), algo/brokerage caps (1-6% PAT hit). | Diversification; compliance tech. |

| Market/Volume | FII outflows, volatility; dormant clients (25% active). | MTF/wealth focus; quality acquisition. |

| Competition | Pricing wars (MTF/zero brokerage); discount broker dominance. | Tech differentiation; niches (algos, NRI). |

| Credit/Operational | NBFC NPAs up (3.6% GNPA); CAC volatility. | Secured lending; ECL provisioning. |

| Execution | RM hiring (50-400 adds); tech integration delays. | In-house tech; vintage RM focus. |

| Macro | Rate cuts slow; global slowdown. | Insurance/MF stability. |

Summary

The sector faces near-term headwinds from regulatory F&O curbs (volumes -15-40% YoY) and competition, leading to moderated FY26 growth (revenues -3-25% YoY, PAT margins 4-12%). However, tailwinds from diversification (MTF/wealth/insurance up 20-74%) and retail SIP resilience provide stability. Growth prospects are strong in H2 FY26+ (20-25% CAGR via lending/wealth/tech), targeting 50:50 broking/non-broking mixes and financialization megatrends. Key risks center on further regulation and execution, but diversified models (e.g., Motilal Oswal ARR 61%) position leaders for outperformance. Overall, cautiously optimistic: FY26 transitional (PAT flat/slight decline), FY27+ rebound (15-30% growth) as markets stabilize. Investors should monitor regulatory updates and MTF/wealth traction.

General

asof: 2025-11-29

Analysis of Indian Stockbroking & Allied Sector

The Indian stockbroking and allied services sector (encompassing broking, investment banking/ECM, wealth/asset management, merchant banking, PMS/AIFs, and research) is experiencing robust momentum driven by buoyant capital markets, retail participation, and institutional flows. Insights from the provided filings (e.g., Groww/Billionbrains, Motilal Oswal, Angel One, Systematix, DAM Capital) and investor presentations highlight a mix of expansion activities, strong Q2/H1 FY26 financials, and sector tailwinds. Below is a structured analysis of headwinds, tailwinds, growth prospects, and key risks.

Headwinds (Challenges)

- Regulatory Compliance Burden: Frequent SEBI LODR Regulation 30 disclosures (e.g., IEPF transfers by Indo Thai, subsidiary investments by Groww/Nuvama/Geojit) indicate heightened scrutiny on related-party transactions, unclaimed dividends/shares, and approvals. Delays in regulatory nods (e.g., Angel One’s insurance JV) add operational friction.

- Market Cycle Dependency: Broking revenues (e.g., Systematix’s equities segment) are tied to trading volumes; any volatility (implied in DAM Capital’s moderated RoE due to cash buildup) could pressure fee-based income.

- Project Cancellations & Strategic Shifts: Share India rescinded a drone project subsidiary, signaling evolving priorities amid competitive pressures.

- Cost Pressures: Employee costs rising (DAM Capital: 46% QoQ in Q2 FY26 due to variable pay), alongside finance costs from borrowings (Geojit/Groww infusions).

- Competition & Margin Squeeze: High player density (e.g., Motilal Oswal’s NCD fundraising for expansion) in broking/wealth could erode market share.

Tailwinds (Supportive Factors)

- Buoyant Capital Markets: ECM activity surged—DAM Capital executed 12 deals (INR 13,600 Cr, 18% IPO share); Systematix raised INR 2,513 Cr across IPOs/QIPs. Q2 FY26 IPOs/QIPs hit record highs (DAM data: 59 issuances).

- Strong Financial Performance: Systematix: Revenue +52% YoY (INR 55.7 Cr); DAM: +69% (INR 107 Cr), PAT +141%. High RoEs (DAM: 36.5% annualized H1 FY26).

- Retail & Institutional Flows: Equity turnover CAGR 18.8% (DAM); PMS/AIF AUM growth supports wealth (Systematix: INR 9,000 Cr AUM, 32% 5-yr PMS CAGR).

- ESG & Expansion Momentum: Positive ratings (360 ONE: 78.2; IIFL: 79) aid credibility; new subsidiaries/ventures (Nuvama trusteeship, Angel One insurance JV, Groww rights issue).

- Tech & Leadership Boost: Systematix’s new wealth CEOs; integrated platforms enhance client acquisition.

Growth Prospects

- ECM & IPO Pipeline: 21+ IPOs mandated (DAM: 13 left-lead); Systematix: INR 5,300 Cr pipeline. FY25 funds raised 2.2x FY24; 186 DRHPs filed.

- Diversification into Allied Services: Wealth/PMS/AIFs scaling (Systematix: New SME fund 92% committed; DAM: Institutional broking with 296 clients). Insurance/MF forays (Angel One, Nuvama).

- Subsidiary Capital Infusions: Groww (INR 1,045 Mn), Geojit (INR 185 Cr), signaling broking/wealth expansion.

- Institutional Demand: FII/DII AUM growth (DAM: 277 active clients); research coverage expanding (DAM: 210 stocks/24 sectors).

- Sector Tailwinds: Domestic flows resilient (net INR 24k Cr H1 FY26); equity T/O at INR 1.06L Cr (Aug ’25). Potential for 20-30% CAGR in revenues amid IPO/QIP revival.

Key Risks

- Market Downturns: Volatility could slash broking/ECM volumes (e.g., DAM’s H1 FY26 RoE dip from cash hoard).

- Regulatory/Approval Delays: Pending SEBI nods for IPOs/JVs; IEPF compliance risks shareholder trust.

- Execution & Competition Risks: Pipeline conversion uncertain (e.g., Share India’s cancellation); top-10 client concentration (DAM: 45%).

- Capital Intensity: Infusions (e.g., Groww/Geojit) strain balance sheets if markets slow; debt (Motilal Oswal NCDs).

- Operational/Geopolitical: Cyber/tech risks in broking; global flows sensitive to US Fed/China slowdowns.

Summary

The sector is strongly positioned for growth (20-30% revenue CAGR potential) amid IPO frenzy, institutionalization, and diversification into wealth/AIFs/insurance. Tailwinds from market buoyancy and domestic flows outweigh headwinds like regulations/costs, with firms like DAM Capital (69% YoY growth) and Systematix (52% YoY) exemplifying resilience. Key monitorables: Pipeline execution (50+ IPOs/QIPs) and RoE sustainability. Overall Outlook: Bullish, but cyclical—position for volatility via diversification. Investors should favor execution-strong players with robust pipelines and low debt.

Investor

asof: 2025-11-29

Analysis of Indian Stockbroking & Allied Sector (Based on Q2/H1 FY26 Earnings Transcripts)

The transcripts from 12 companies (Groww, Motilal Oswal, Nuvama, Angel One, IIFL Capital, Anand Rathi, Share India, Geojit, DAM Capital, SMC Global, 5paisa, etc.) highlight a sector under transition amid regulatory tightening and market volatility. While broking faces near-term pressure, diversification into wealth, lending, and insurance offers resilience. Below is a structured summary:

Headwinds (Challenges)

- Regulatory Pressures: SEBI’s F&O reforms (e.g., reduced weekly expiries, higher margins, “true to label” norms) led to 13-40% QoQ/YOY decline in cash/F&O ADTO/volumes across firms. Consultation papers on brokerage caps (12bps to 2bps) and algo trading could impact 1-6% of revenues/PAT. True to label and product suitability frameworks add compliance costs.

- Volume Decline & Dormancy: Industry ADTO down 13-21% QoQ; active clients ~25% of demat accounts (e.g., 46M active vs. 207M demat). Client churn/dormancy rose due to volatility/FII outflows ($10B+ in H1FY26).

- Margin Compression: Aggressive MTF pricing (e.g., 7.99%) and unsecured lending scrutiny eroded yields (e.g., 7% credit costs). Employee costs up 3-28% (hiring for sales/IT/wealth), CAC variability (e.g., 15-20% QoQ swings).

- Market Volatility: FII outflows offset by DII ($20B inflows), but subdued sentiment hit broking (37% YOY drop in some firms).

Tailwinds (Positives)

- Domestic Resilience: Strong SIP/MF inflows (e.g., 4.8-8.2% market share gains); MF AUM up 46% YOY in some cases. Insurance premiums up 10-21% YOY (life/health/motor).

- Diversification Success: Non-broking revenue (wealth, insurance, MTF) now 27-58% of mix (up from 12-33% in FY21). Insurance broking grew 17-343% QoQ; MTF books up 26-41% (e.g., to INR1L Cr industry-wide).

- Digital/Tech Edge: App upgrades, AI (e.g., portfolio advisory, scalpers), algos (uTrade), SEO drove 20% QoQ client adds in some firms. Online turnover ~67%.

- Institutional Strength: Robust IPO/QIP pipelines (27-39 deals, 10.6% share); ECM revenue up 65% YOY in leaders.

Growth Prospects

- Wealth & Distribution: Target 50:50 broking/non-broking mix by FY27; MF AUM to INR9.5K Cr; PMS/AIF launches (e.g., Q4FY26). Insurance via POSP/MISPs; ARR assets doubling (e.g., INR50K Cr crossed).

- Lending Expansion: MTF to INR1K-1.5K Cr by FY27 (secured mix up); LAS/NBFC growth (25% CAGR); lower-cost FCCBs for funding.

- Tech & Expansion: Project Drone (WealthTech), AI algos, new branches (Tier 2/3 cities); algo trading post-SEBI norms. Target top-3/5 positioning via power-user focus.

- Institutional: 10.6% IPO share; ECM/IB deals (INR49K Cr H1FY26); PE/credit funds.

- Overall: 20-25% PAT growth rebound in H2FY26; RoE 22-48%; ARR 61% of revenues.

Key Risks

- Regulatory Uncertainty: Weekly expiries, brokerage caps, algo norms, F&O curbs (1-2% PAT hit); unsecured lending scrutiny (7% credit costs).

- Competition & Margins: Discount brokers erode yields; CAC volatility; top-10 client concentration (25-44% in IE).

- Market/Volume Risks: FII outflows, volatility; dormant clients (25% active ratio).

- Operational: Employee costs (up 27%), credit losses (GNPA 1.4-3.6%), tech integration (e.g., Fisdom).

- Execution: MTF scaling (competition), wealth ramp-up (RM productivity), treasury volatility.

Summary Outlook: Short-term pain from regulations/volumes (PAT down 15-54% YOY), but tailwinds from diversification (wealth/insurance/MTF) and domestic flows position the sector for 20%+ recovery in H2FY26. Leaders with tech/wealth focus (e.g., Groww, Motilal) eye 50:50 broking/non-broking mix by FY27. Risks center on regulation/competition; prospects hinge on volume stabilization and execution. Sector RoE remains strong (22-55%), but volatility persists.

Meeting

asof: 2025-12-01

Summary Analysis: Indian Stockbroking & Allied Sectors (Based on Q2FY26 Financials & Disclosures)

The provided documents cover Q2FY26 (ended Sep 2025) unaudited results, board outcomes, postal ballots, and notices from 12 listed broking/allied firms (e.g., Groww, Angel One, Motilal Oswal, IIFL Capital, Anand Rathi, DAM Capital). Key sector traits: Dominance of brokerage fees (50-70% revenue), margin funding/interest income (20-40%), diversification into wealth mgmt/insurance. Aggregate revenue growth ~15-20% YoY (e.g., Groww ₹10,708 Cr H1FY26, Angel One ₹23,423 Cr H1FY26), but patchy profits due to costs. Sector AUM/client base expanding amid retail boom.

Tailwinds (Positive Drivers)

- Retail Investor Surge & Digital Adoption: High trading volumes (e.g., Angel One fees ₹15,946 Cr H1FY26). Tech platforms (Groww, Angel One) drive low-cost onboarding; ESOP grants (e.g., Groww 33.9M shares) retain talent.

- Diversification Success: Shift to high-margin areas—wealth mgmt (Motilal Oswal AUM ₹10K Cr), asset mgmt (360 ONE ESOP approvals), insurance JVs (Angel One). Nuvama/Groww acquisitions boost goodwill (Groww ₹13K Cr).

- Capital Infusion & Listings: Fresh capital via IPOs (Groww post-IPO results, Anand Rathi ₹745 Cr IPO utilized), FCCBs (Share India USD50M proposal), stock splits (Nuvama 1:5).

- Regulatory Tailwinds: GIFT City expansions (Groww, Angel One); relaxed ESOP norms aid retention.

Headwinds (Challenges)

- Cost Pressures: Employee expenses 25-35% revenue (Groww ₹1,238 Cr Q2FY26); finance costs rising (Angel One ₹1,761 Cr H1FY26). IPL sponsorships/marketing inflate opex (Angel One ₹1,117 Cr H1FY26).

- Revenue Volatility: Fees down YoY in some (Groww 10% dip Q2); MTM losses (IIFL ₹2,467 Cr Q2). Q2 profit dips (Groww ₹4,713 Cr vs. prior highs).

- Regulatory Scrutiny: IT searches (IIFL/holding cos); true party risks in broking. Margin caps/volatility curbs funding income.

- Competition: Discount brokers erode margins; 13-15 subs per firm (Groww) signals consolidation pressure.

Growth Prospects (High Potential)

- AUM/Client Expansion: 20-30% YoY brokerage growth; wealth/AMC push (Motilal Oswal passive funds, Nuvama sub-division for liquidity). Post-IPO scaling (Groww equity ₹11,985 Cr).

- New Ventures: Insurance (Angel One JV), GIFT City branches; intl (Groww IFSC sub). ESOPs signal 15-20% headcount growth.

- Fundraises: Equity/debt raises (Groww ₹17K Cr H1FY26); FCCBs for capex/working capital.

- Projections: Sector FY26 revenue ~₹1.5-2L Cr (20% CAGR); 15-25% PAT growth if markets sustain (Nifty highs).

Key Risks (Moderate-High)

- Market/Cyclical: Volatility hits volumes (e.g., Groww revenue flat Q2); equity dependence (90% revenue).

- Regulatory/Compliance: SEBI curbs (fees/margins); IT probes (IIFL impact undetermined); FEMA/FDI changes for FCCBs.

- Credit/Operational: Margin lending risks (Groww loans ₹29K Cr); cyber/fraud (tech-heavy ops).

- Execution: High capex (tech/acquisitions); talent churn (ESOP-heavy).

- Liquidity: Cash burn in ops (Angel One -₹11.8K Cr CFO H1FY26); debt rise (Groww D/E 0.76x).

Overall Outlook: Bullish medium-term (tailwind-dominant) with 20%+ growth if markets hold; monitor regs/volatility. Diversified players (Groww, Angel One) resilient vs. pure brokers. Sector ROE ~20-30%; risks hedged via non-broking (wealth/insurance ~20-30% mix).

Press Release

asof: 2025-11-29

Summary Analysis: Indian Stockbroking & Allied Sector (Based on Provided Documents)

The provided documents from key players (e.g., Motilal Oswal, Angel One, 360 ONE WAM, IIFL Capital, Anand Rathi, Share India, Geojit, DAM Capital, 5paisa, etc.) highlight a mixed but resilient sector in H1FY26. Pure broking faces volume pressures, but diversification into annuity streams (wealth/asset mgmt, IB, NBFC) drives stability. Overall, Q2FY26 shows robust client/AUM growth amid market volatility, with investment banking booming on IPO revival.

Tailwinds (Positive Drivers)

- Client & AUM Expansion: Strong acquisition (Angel One: +1.7Mn clients to 34Mn; Anand Rathi: +7% active clients; Share India: 46K broking clients). AUM surges (MOFSL: ₹1.77L Cr AM, ₹1.87L Cr PWM; Anand Rathi: ₹7.7K Cr; Angel One: ₹61Bn wealth AUM).

- Annuity Revenue Growth: Shift to recurring income (MOFSL: 46% YoY PAT in AM; Angel One: SIPs +24% QoQ; IIFL: Distribution AUM +24% QoQ to ₹44K Cr).

- MTF & Funding Books: Robust traction (Angel One: ₹53Bn; Anand Rathi: +26% QoQ to ₹1K Cr; Indo Thai funding for MTF expansion).

- Investment Banking Boom: Record IPO/QIP activity (DAM Capital: 9 IPOs, ₹13.7K Cr raised; IIFL: 14 deals; Share India: 3 listings, 7 DRHPs).

- Strategic Moves: Partnerships/acquisitions (360 ONE-UBS deal for ₹26K Cr AUM); regulatory nods (Monarch IFSCA FME license for GIFT City funds); funding at premiums (Indo Thai: ₹118 Cr at ₹650 Cr valuation).

- Tech & Leadership: AI enhancements (Angel One, 5paisa); key hires (Systematix wealth MDs; 5paisa AI expert director).

Headwinds (Challenges)

- Revenue Declines: YoY drops due to lower volumes/regulations (IIFL: -8%; Geojit: -21%; 5paisa: -23%; Share India: -21%; Angel One PAT +85% QoQ but flat YoY context).

- Trading Volume Pressure: FII selling, volatility (5paisa: ADTO decline); cash/F&O softness (Angel One: Cash -2% QoQ).

- Regulatory Impact: True to form changes hit retail broking (IIFL explicit mention); higher costs for MTF amid shortages (Indo Thai).

- Margin Squeeze: OpEx up (5paisa: +4% QoQ); IPL spends drag (Angel One adjusted metrics).

Growth Prospects

- Diversification Beyond Broking: Annuities to dominate (MOFSL: 31% PAT CAGR decade; 360 ONE: UHNI focus ₹5.8L Cr AUA). Wealth/NBFC/AMC scaling (Angel One: Credit +97% QoQ; Share India NBFC ₹253 Cr book).

- Retail Penetration: Demat boom (Angel One: 16.5% share; Indo Thai: 175Mn accounts potential). Algo/MTF/tech platforms (Share India, Anand Rathi).

- IB & Alternatives: IPO pipeline (DAM: 21 mandates); AIF/ETF/GIFT City (Monarch: ₹900 Cr AIF; Systematix AIF suite).

- Global/Tech Edge: UBS collab (360 ONE); AI/robo-advisory (5paisa, Angel One); 20-30% client CAGR sustainable.

- Projections: Sector ROE ~20%+ (MOFSL); net worth 10x growth potential via internal accruals/buybacks.

Key Risks

- Market/Volume Dependency: Volatility/FII outflows crush broking revenues (Geojit/5paisa YoY PAT -59%).

- Regulatory Shifts: Margin rules, true-to-form could cap MTF/broking (IIFL, Indo Thai fund shortages).

- Competition: Discount brokers erode shares; client churn in volatile markets.

- Execution Risks: Deal pipelines (DAM/IB) vulnerable to approvals/delays; integration in acquisitions (360 ONE-UBS).

- Leverage/Capital: MTF growth raises funding costs; no external raises but buybacks strain (MOFSL).

- Macro: FII selling, elections, global slowdowns impact IPOs/volumes.

Overall Outlook: Positive with moderation. Tailwinds from diversification/tech outweigh headwinds; expect 15-25% sector revenue CAGR if markets stabilize. Leaders (MOFSL, Angel One, DAM) outperform via annuities/IB. Monitor Q3 volumes/SEBI rules.

Copyright © 2023 SAS Data Analytics Pvt. Ltd. All rights reserved.