AIAENG

Equity Metrics

January 13, 2026

AIA Engineering Limited

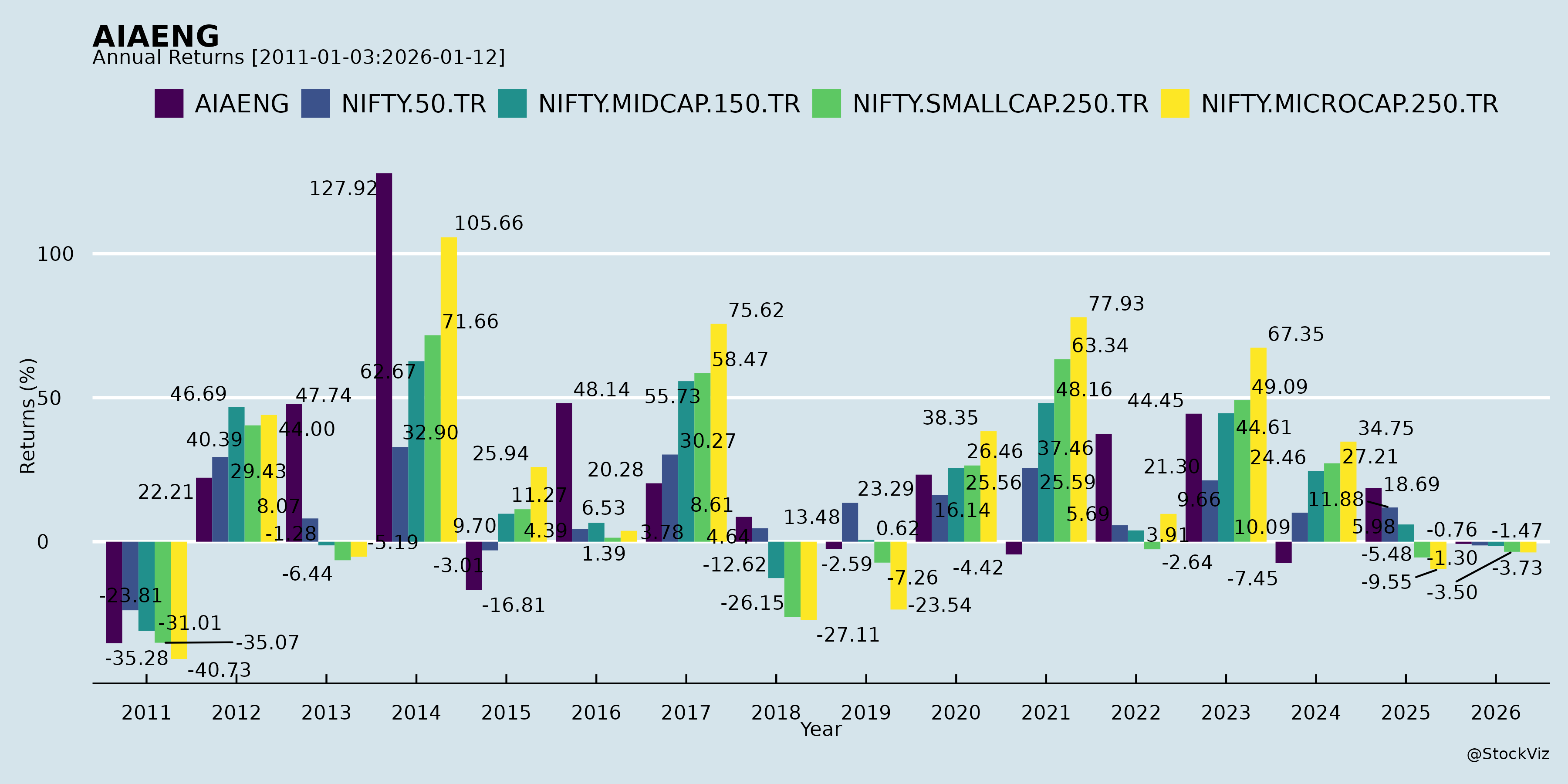

Annual Returns

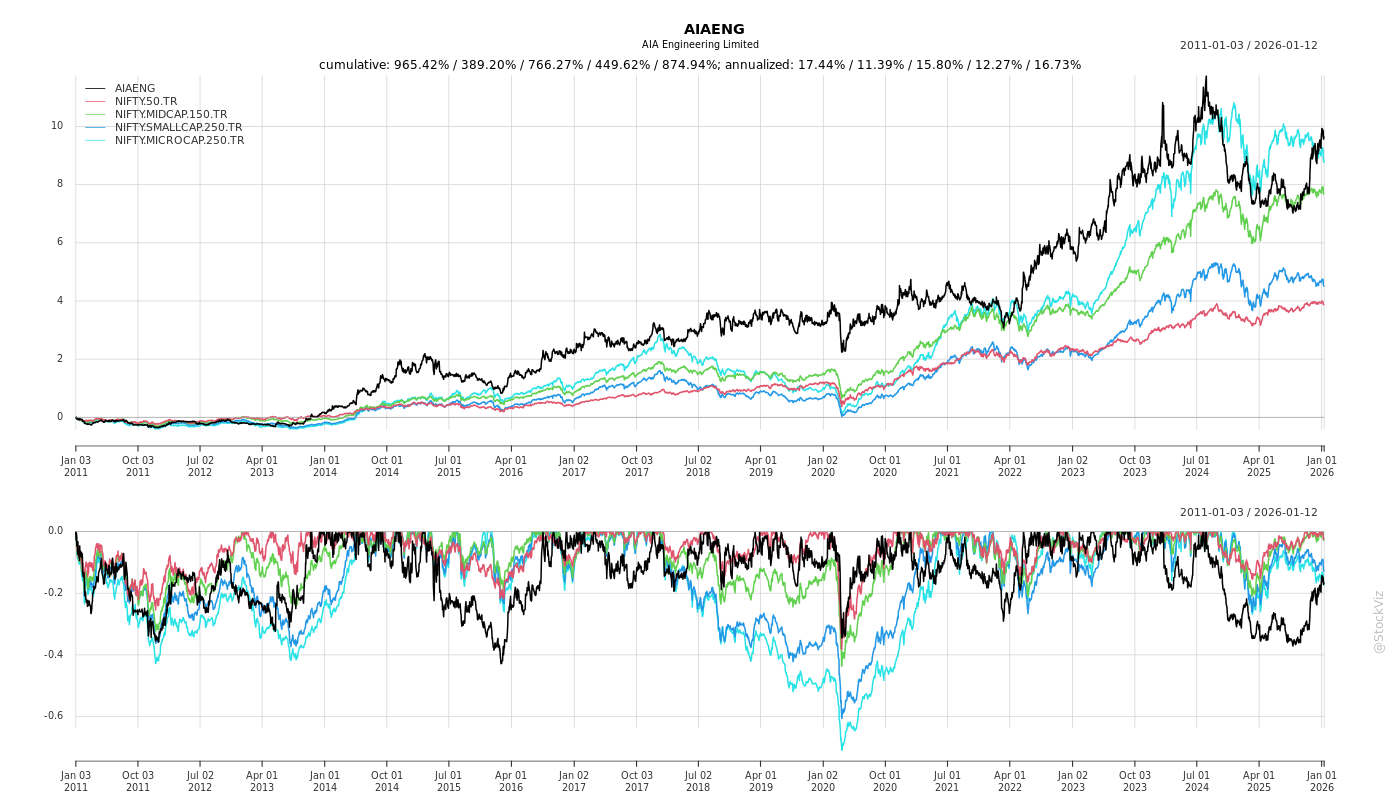

Cumulative Returns and Drawdowns

Fundamentals

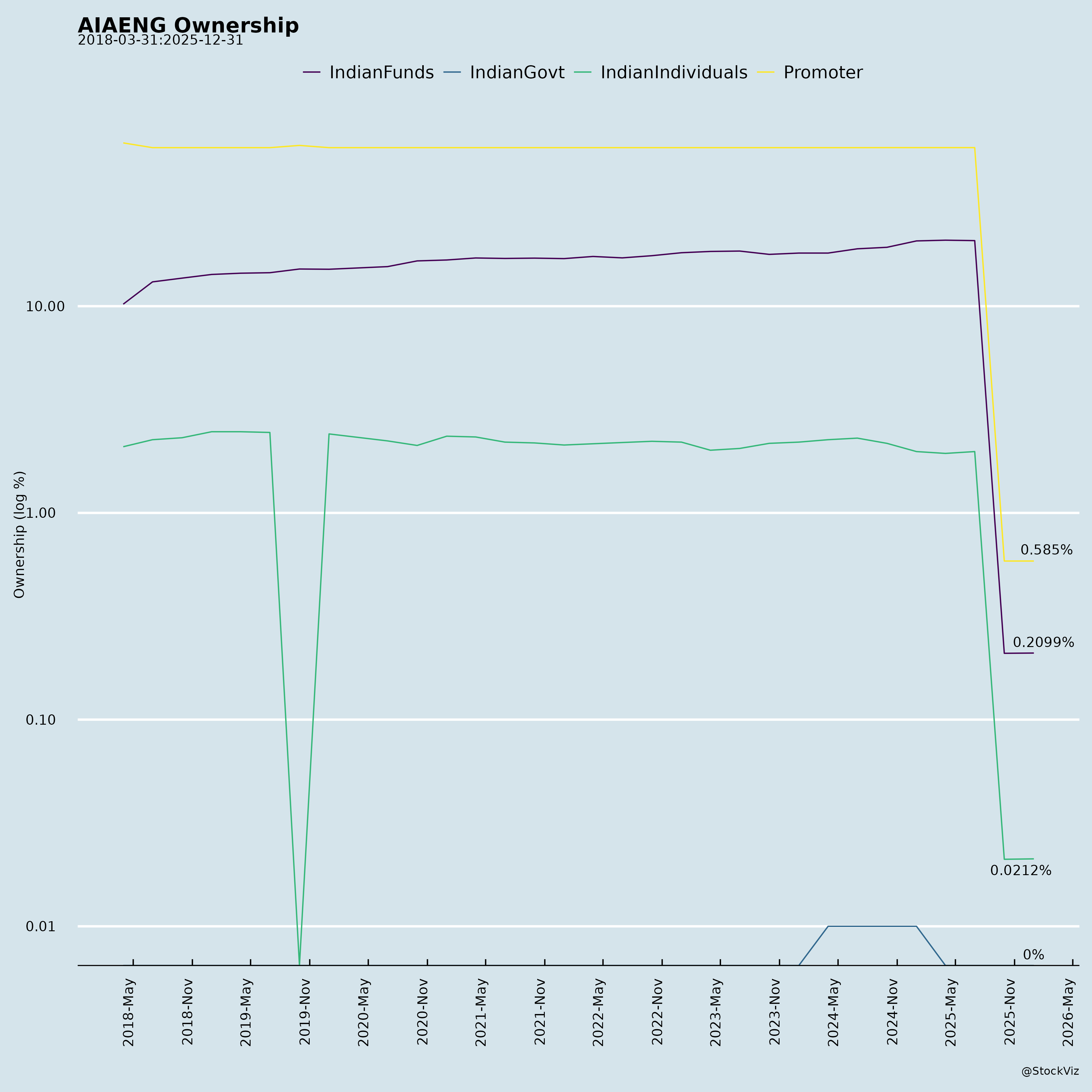

Ownership

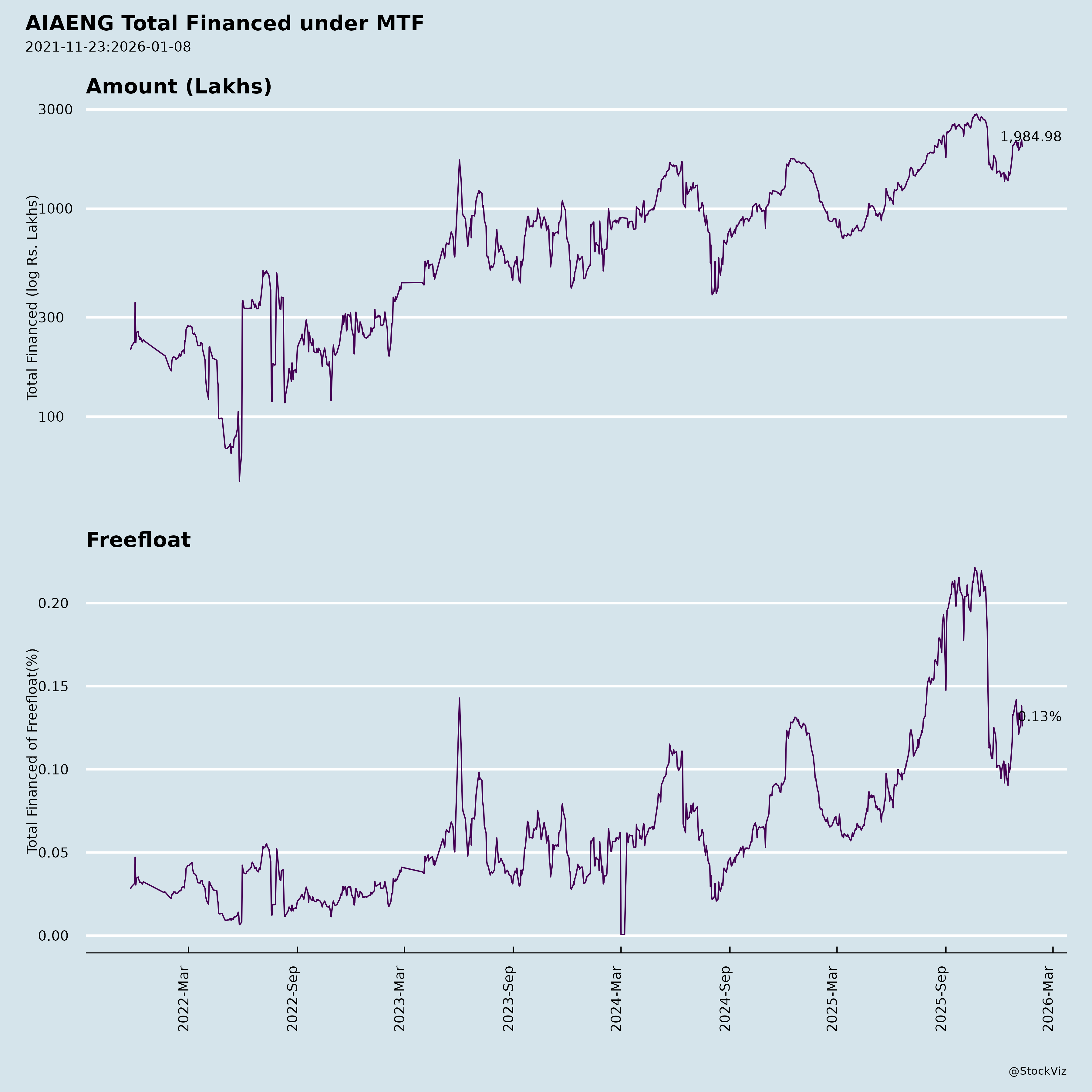

Margined

AI Summary

asof: 2025-12-03

AIA Engineering Limited (AIAENG) Analysis

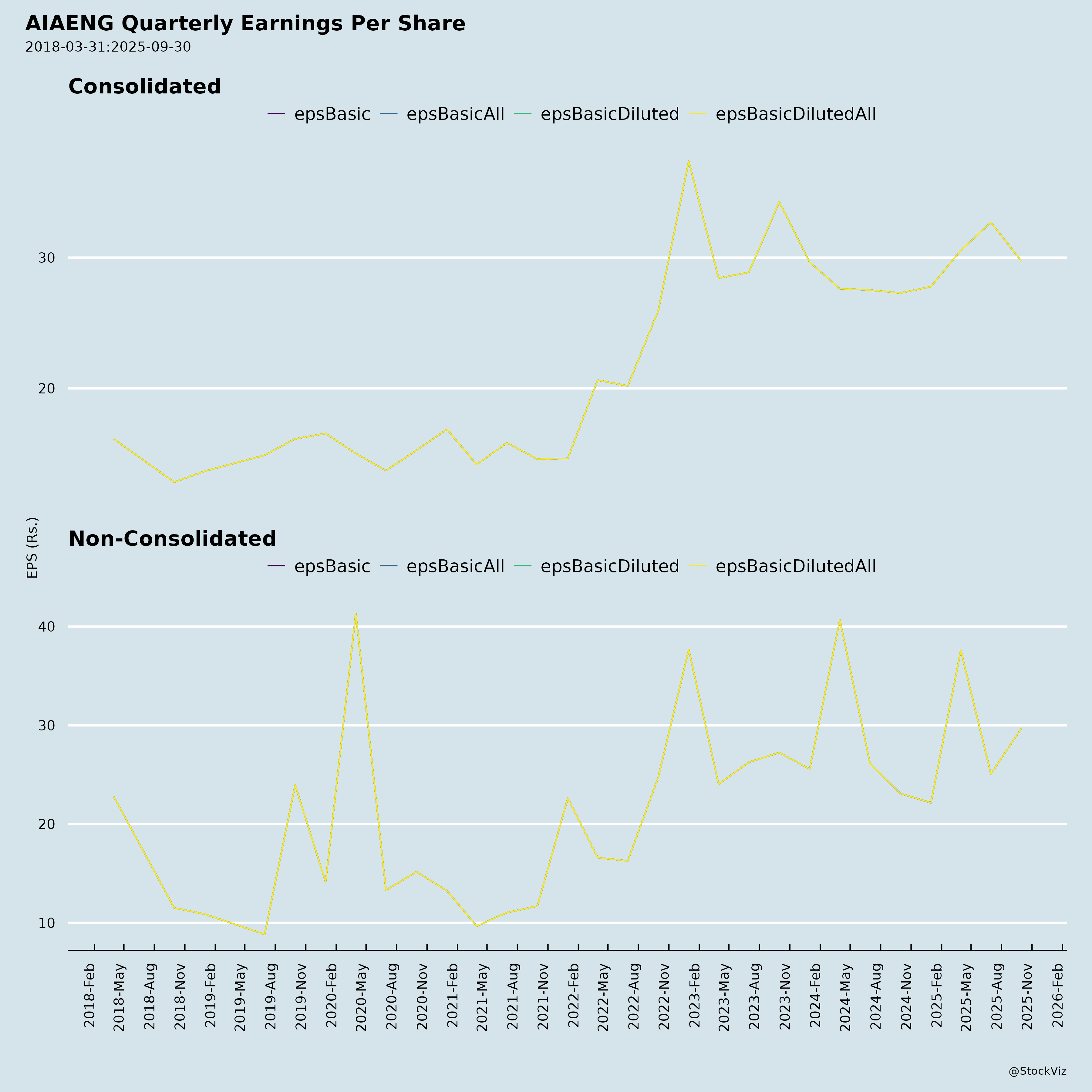

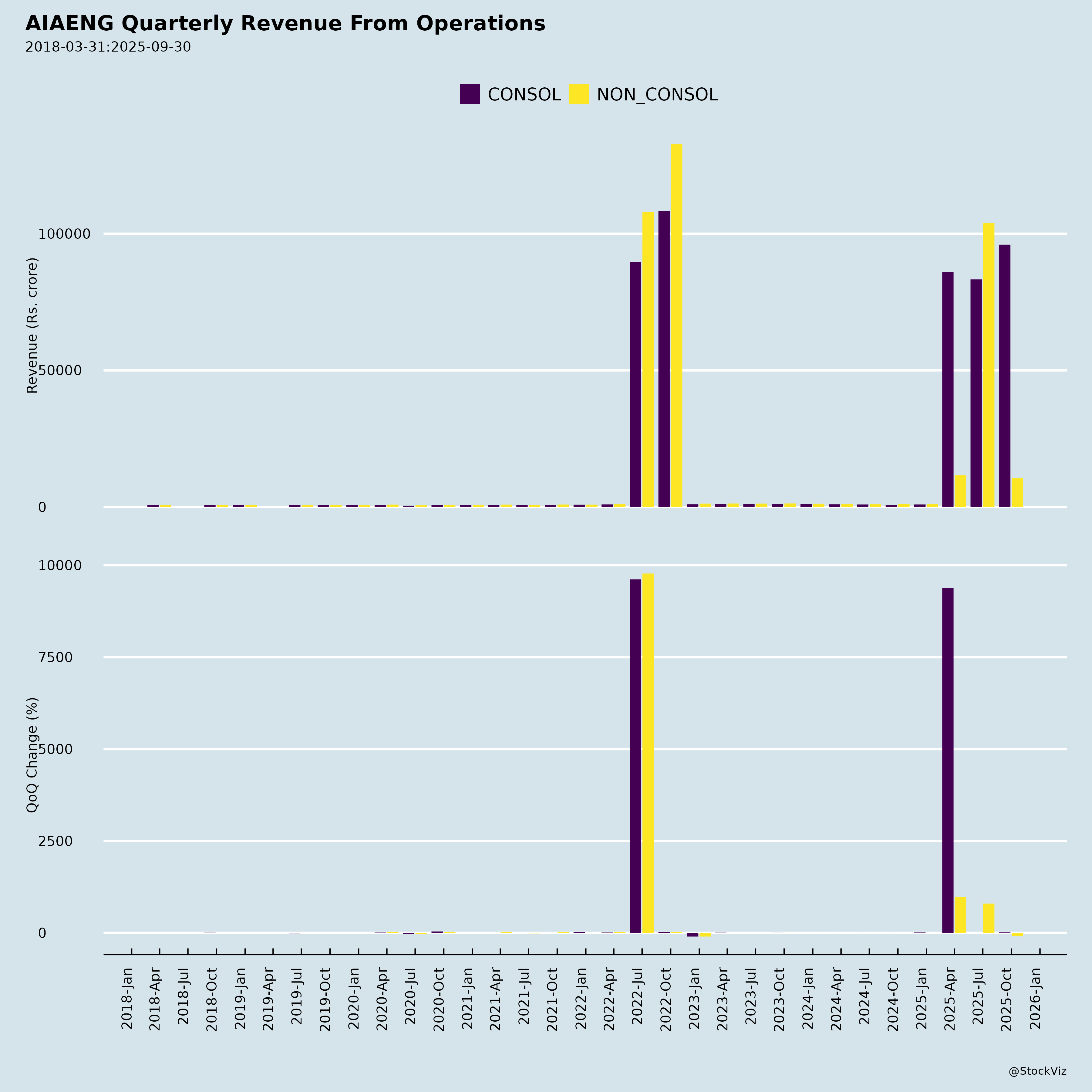

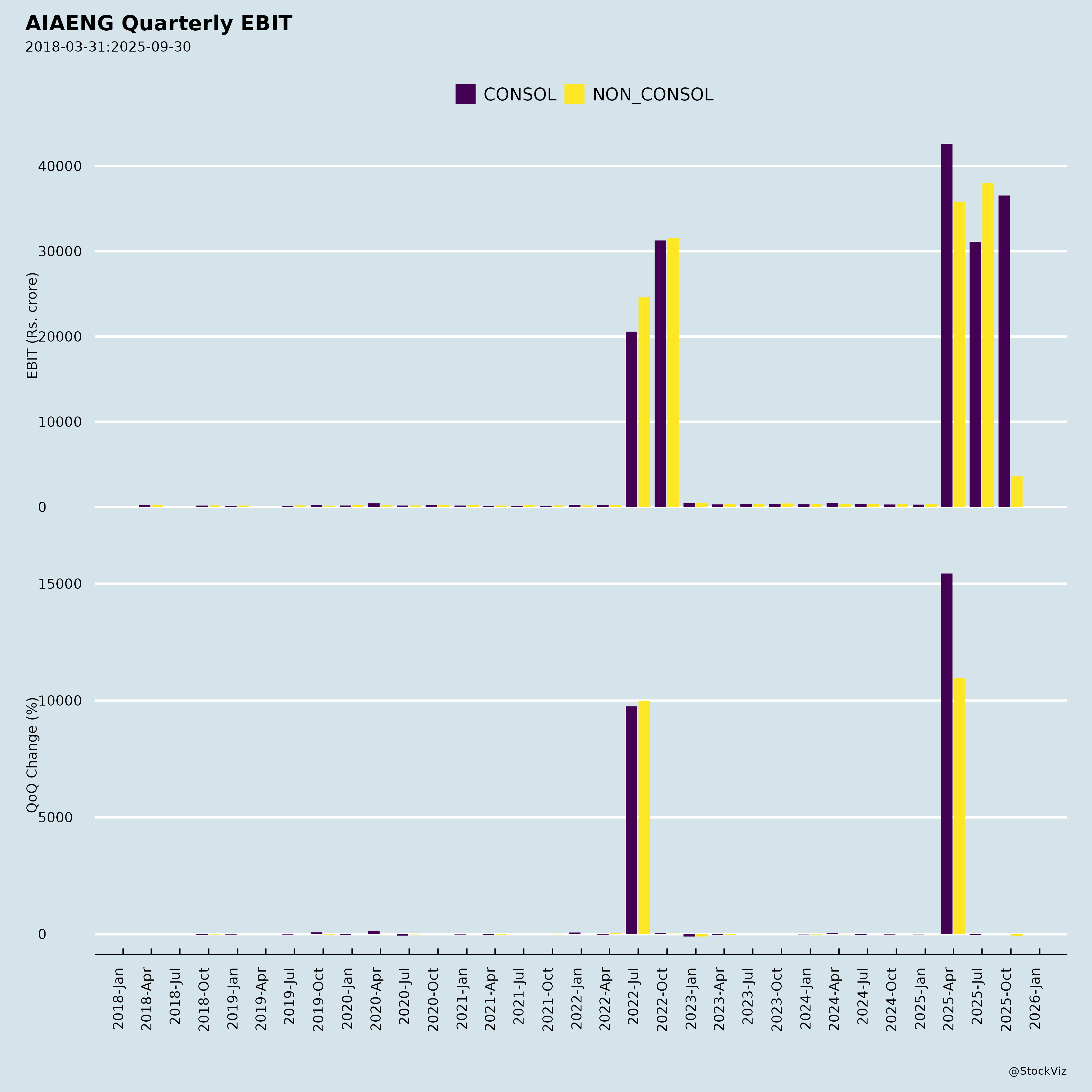

FY’26 H1 Overview: Consolidated revenue ₹2,087 Cr (+1% YoY), volumes 123k tons (+2.5% YoY), EBITDA margins ~28% (elevated due to favorable mix/FX; guided 20-24% sustainable), PAT ₹583 Cr (+13% YoY). Strong balance sheet (cash/investments ~₹5,000+ Cr), utilization 55-60% on 460k ton capacity. Chile order (USD 33 Mn, ~15k tons/year) is key milestone.

Headwinds

- Flat/Stagnant Volumes: Mining segment degrew 2.5% YoY in H1; customer inventory destocking (20-30k tons potential drag).

- Trade Barriers: US ADD/CVD (6.91% + 3.16%) effective Jun’25; customers absorbing but some slowdown/negotiations.

- Margin Pressure Ahead: Shift to lower-margin grinding media (₹100-110/kg vs. liners ₹300-350/kg) as volumes ramp; current 28%+ EBITDA unsustainable.

- Competitive Intensity: Forged media players (e.g., Molycop acquisition by Indian player); Chinese hi-chrome commoditized.

- Operational: Subsidiary Welcast closure (non-material); Nagpur unit shutdown.

Tailwinds

- Breakthrough Orders: Chile copper mine (first hi-chrome adoption; low penetration in S. America); Q4FY26 offtake starts (~3-4k tons).

- Solution Differentiation: Liner + hi-chrome packages boost customer throughput/power savings (vs. pure forged); trials successful in 10-12 mines (incl. India, Africa).

- Favorable Mix/FX: Q2 EBITDA ₹395 Cr aided by FX gains (₹33 Cr), export incentives (₹18 Cr), treasury (₹64 Cr).

- Strong Finances: Net cash position, low debt, annual CAPEX ₹150-180 Cr (debottlenecking, renewables, Ghana/China plants).

- Non-Mining Growth: +10% YoY in H1 (cement/thermal).

Growth Prospects

- Volume Ramp: +30k tons incremental FY27 (min); pipeline >200k tons (50+ mines, 8-10 advanced trials concluding Dec-Feb’26). Hi-chrome market: 1.5-2 Mn tons opportunity (gold/copper/iron; current 25-30% penetration).

- Geographic/Market Expansion: S. America (Chile/Peru/Brazil: 700-800k tons forged); Africa (Ghana/Nigeria); aim sustained YoY growth post-FY26.

- Capacity/Margins: Utilization to 70-80%; EBITDA 24-25% long-term if mix holds.

- Catalysts: 2-3 more large wins expected Q3-Q4FY26; renewable energy CAPEX for cost savings.

Key Risks

| Risk Category | Details | Mitigation |

|---|---|---|

| Execution | Long sales cycles (1-2+ years); trial conversions uncertain (conservative miners). | 10+ successful trials; Chile as reference. |

| Trade/Regulatory | ADD probes (US, potential others); tariffs erode realizations. | Solution packaging reduces dumping risk; sell to willing customers. |

| Macro/Commodity | Ferrochrome/scrap volatility (50-70% RM cost); mining slowdown. | Full pass-through; inventory buffers. |

| Competition | Molycop/Tega scale-up in hi-chrome/liners. | Unique design engineering + throughput guarantees. |

| Financial/Other | FX volatility; subsidiary drags (e.g., Welcast). | ₹4-5k Cr cash hoard; non-material impact. |

Overall Outlook: Steady H1 sets stage for FY27 re-rating via volume inflection (15-20%+ CAGR potential). Chile validates strategy; focus on conversions key. Risks skewed to execution/trade, but robust fundamentals support premium valuation. Buy on dips for long-term compounding.

Copyright © 2023 SAS Data Analytics Pvt. Ltd. All rights reserved.