Castings & Forgings

Industry Metrics

January 13, 2026

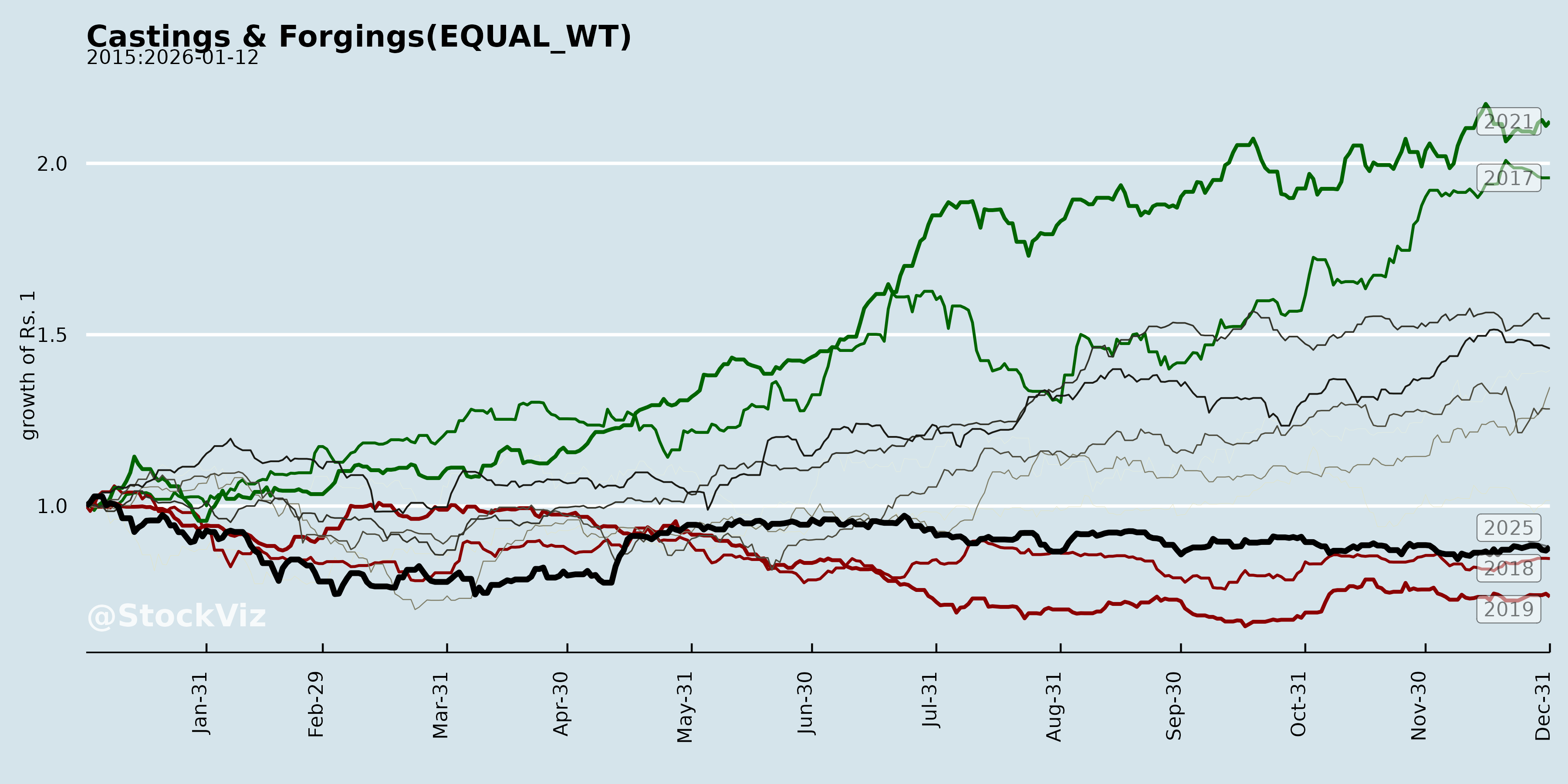

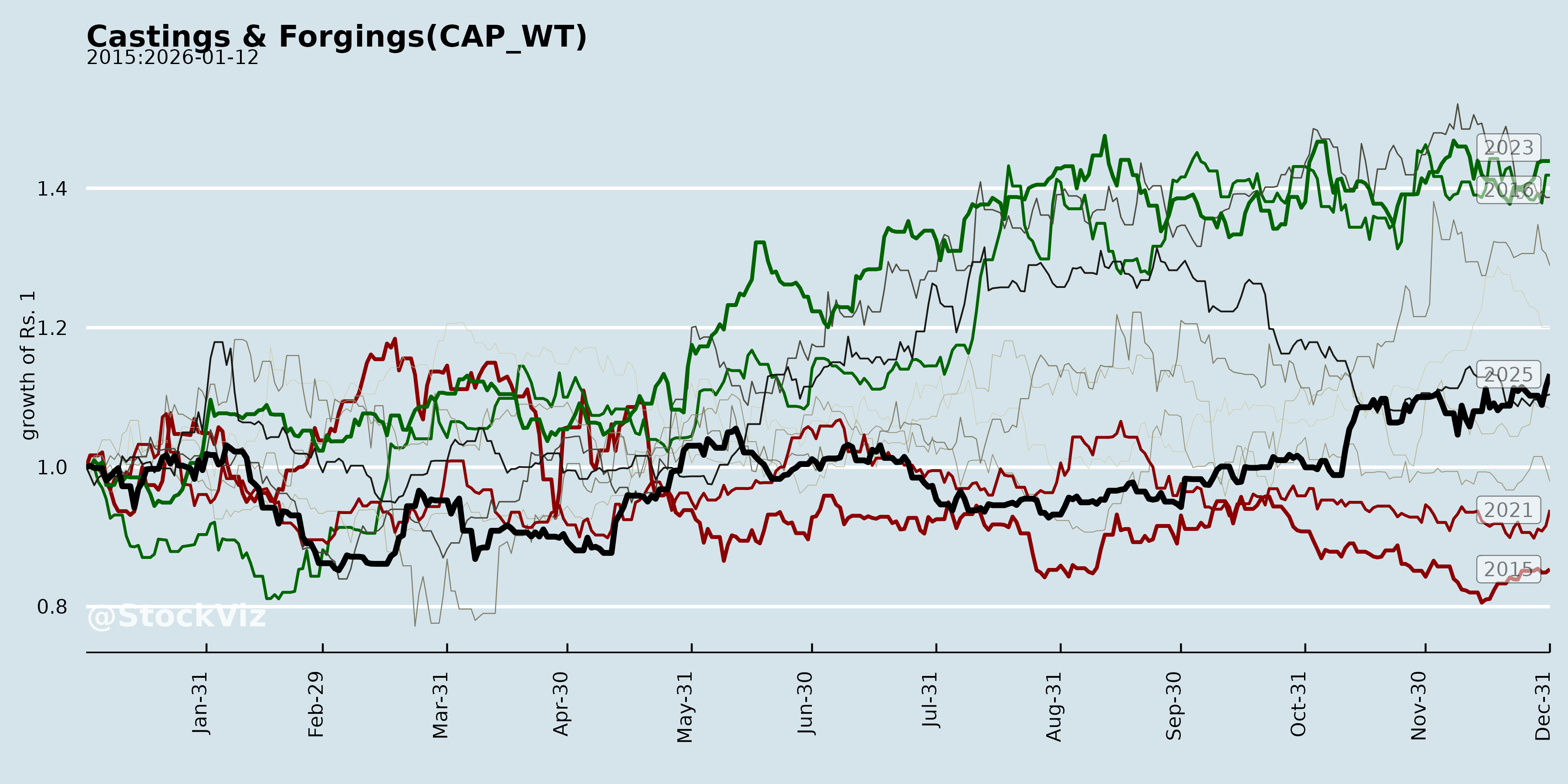

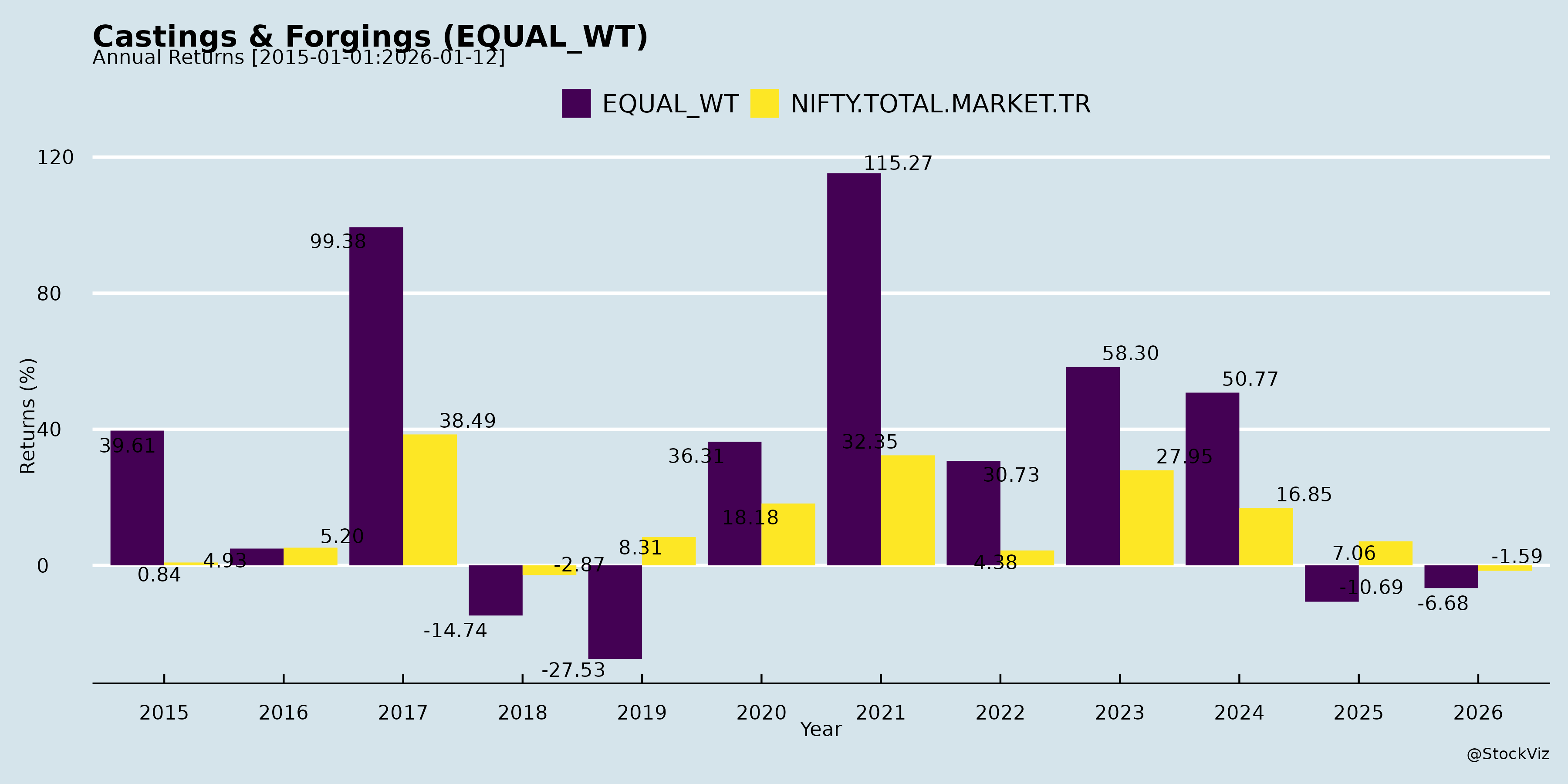

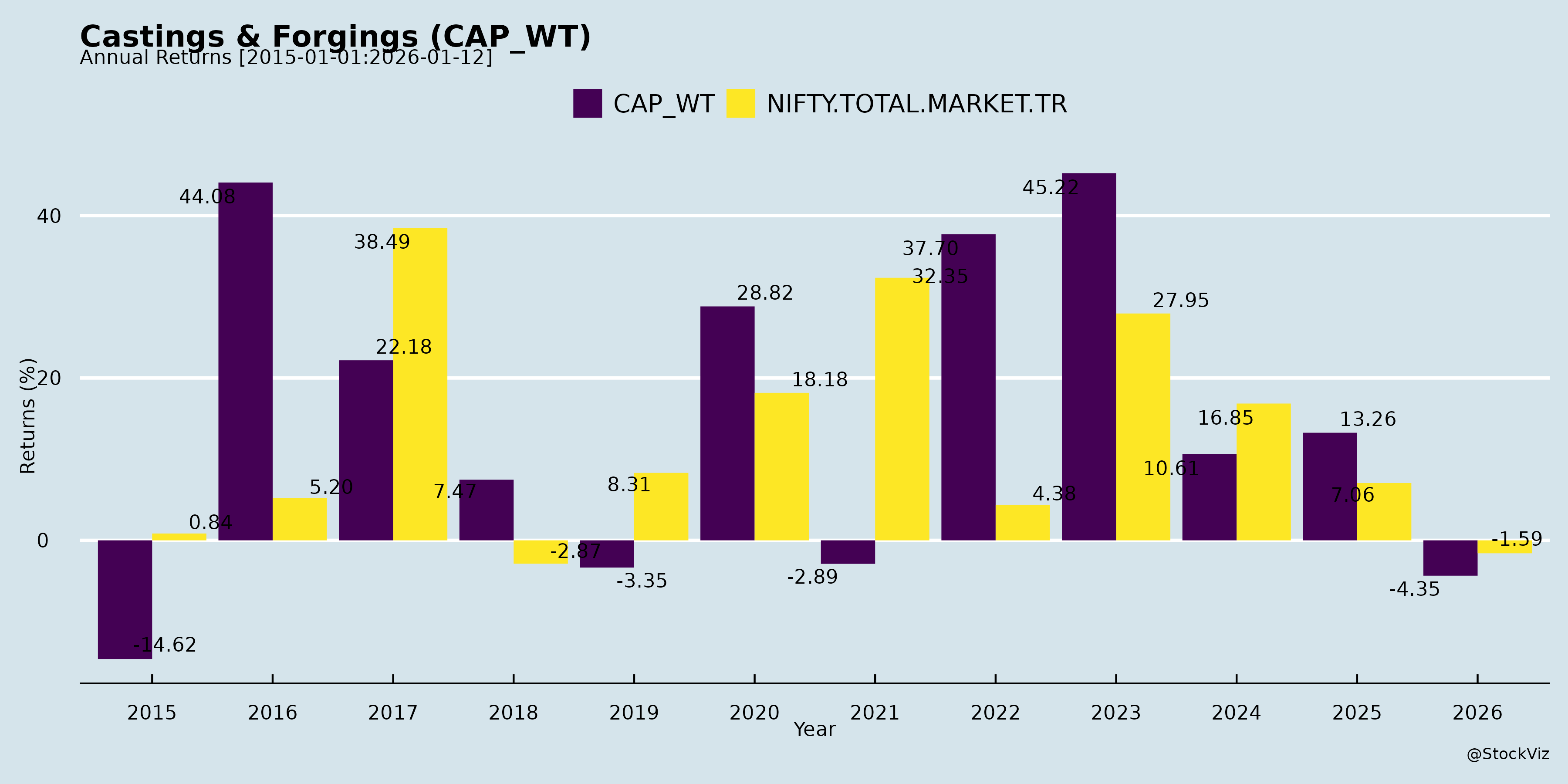

Annual Returns

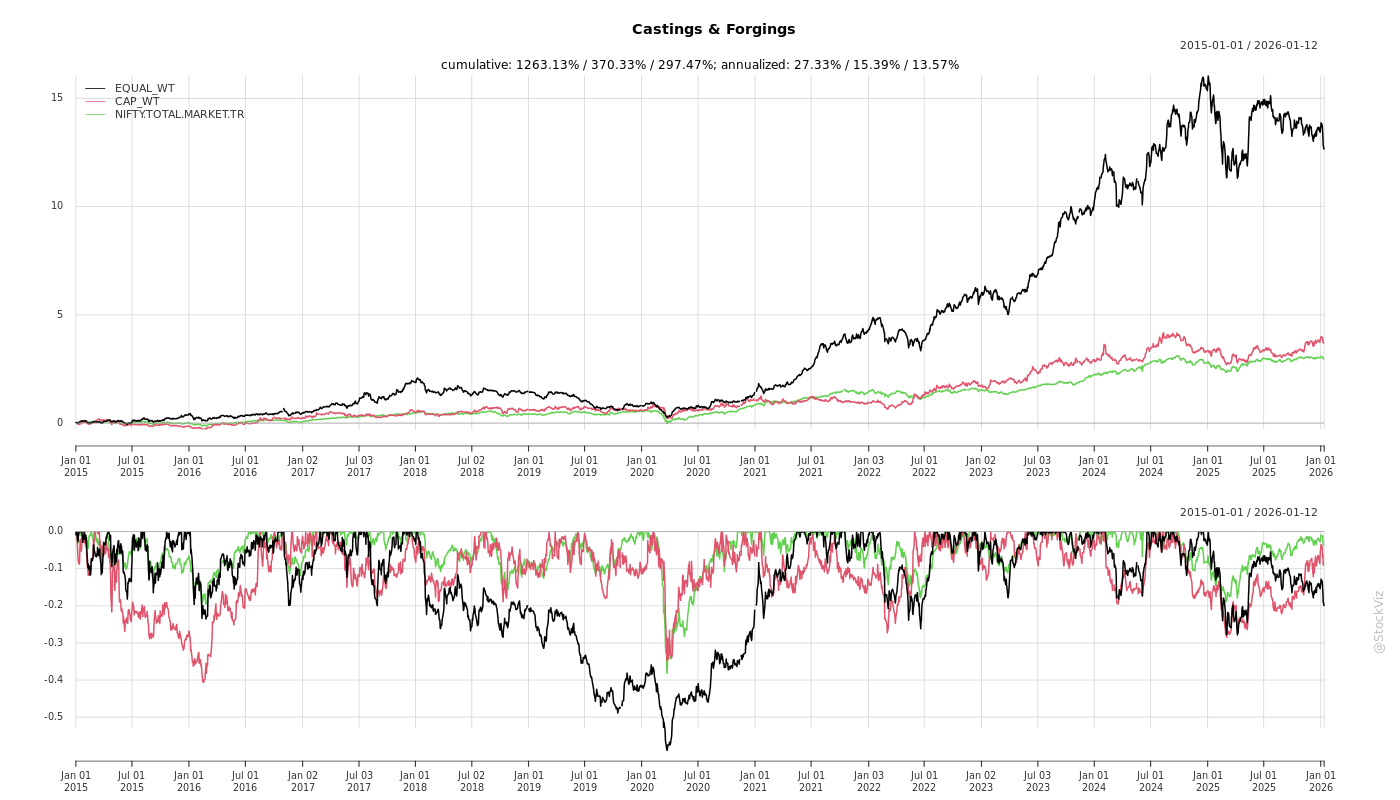

Cumulative Returns and Drawdowns

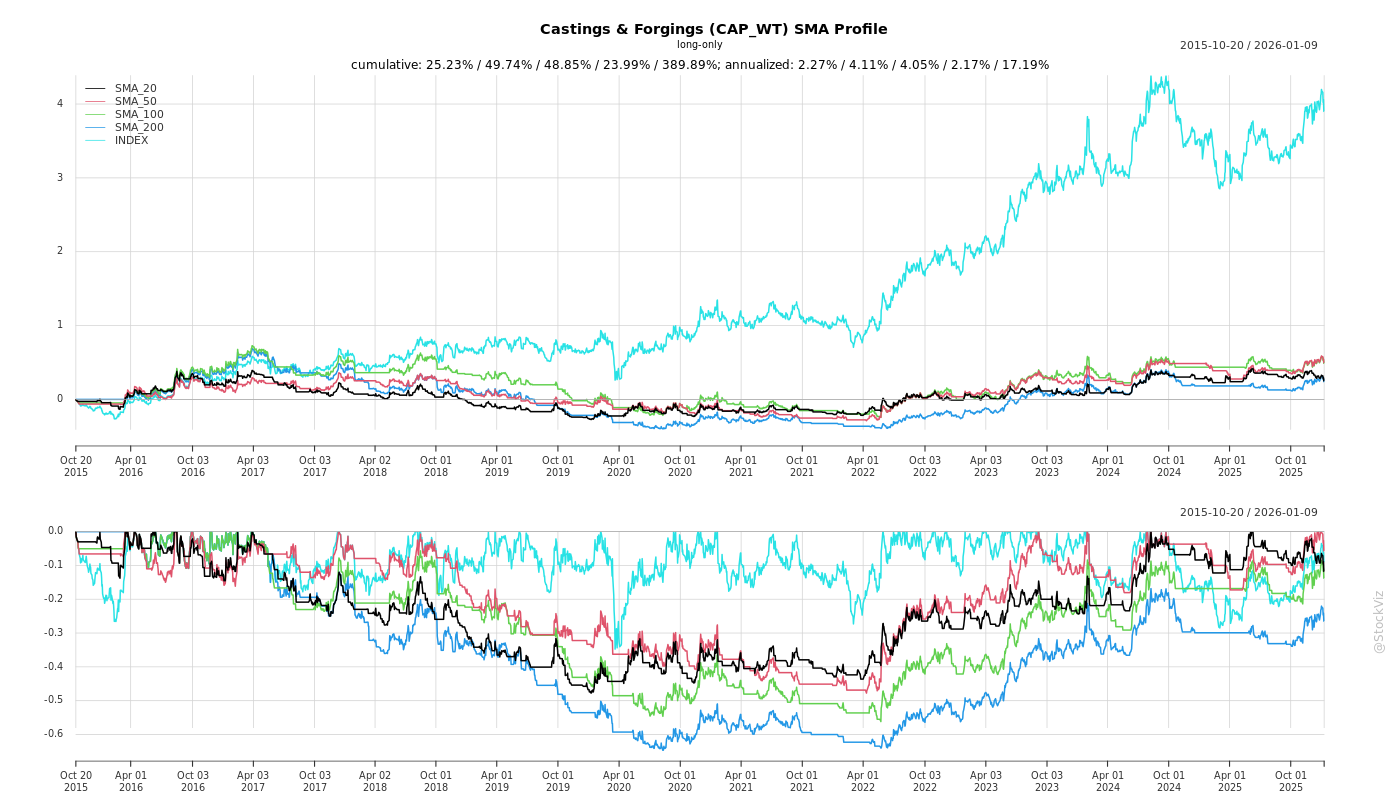

SMA Scenarios

Current Distance from SMA

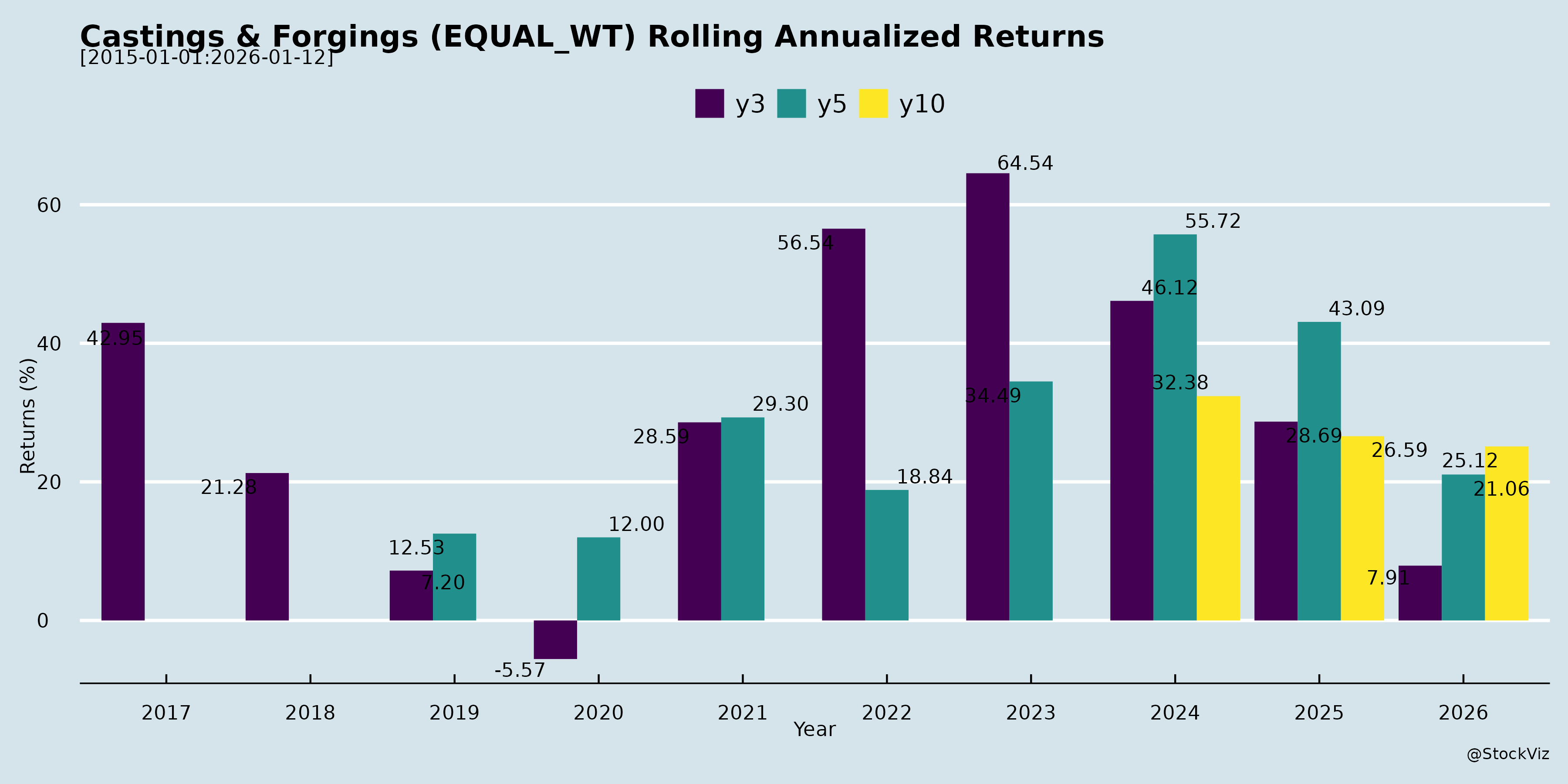

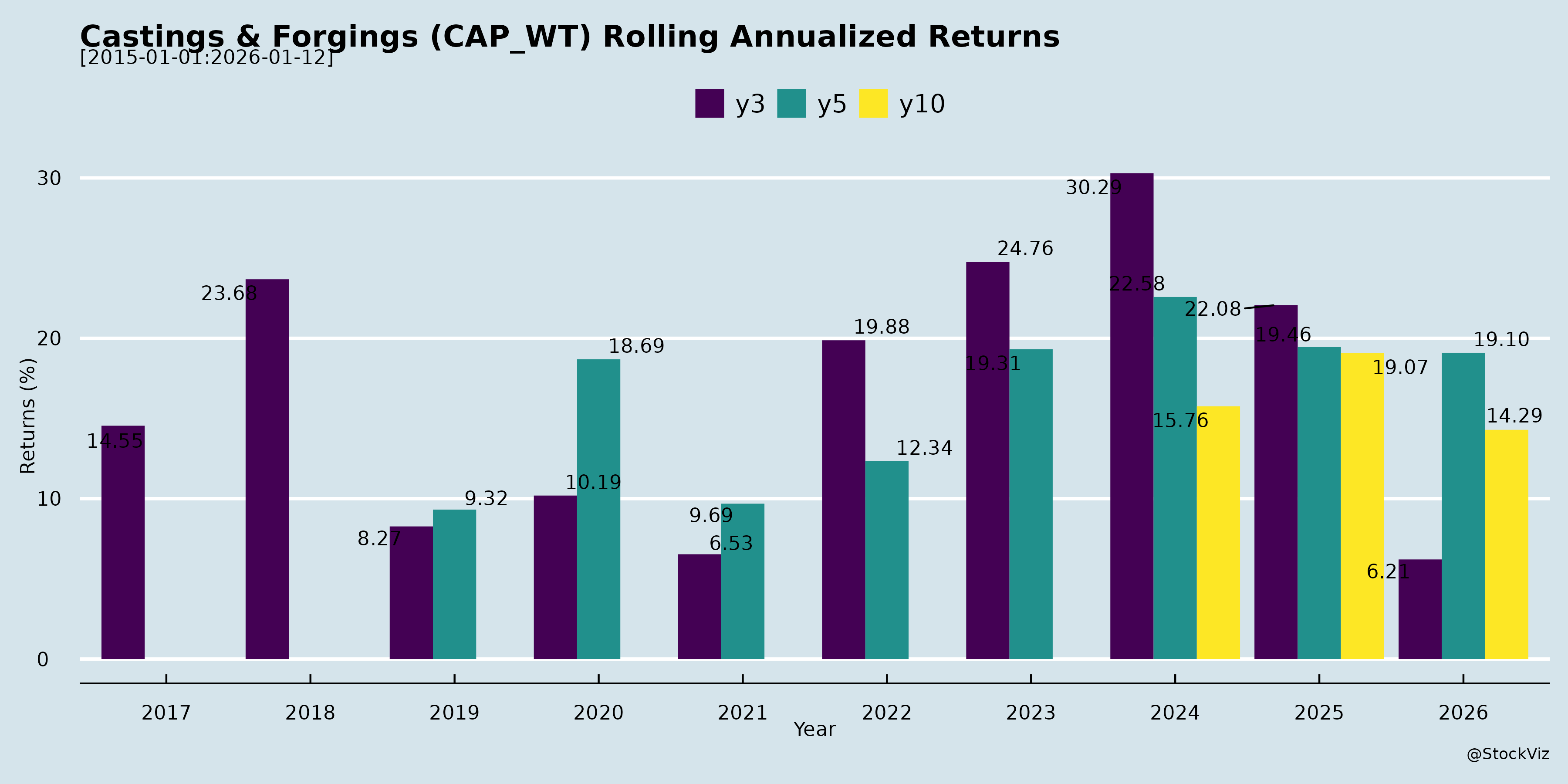

Rolling Returns

Market Cap

EBIT (% of Industry Total)

Revenue (% of Industry Total)

AI Summaries

Analyst

asof: 2025-11-29

Analysis of Indian Castings & Forgings Sector

Based on the provided documents (earnings transcripts from AIA Engineering, Happy Forgings, Kalyani Forge; investor meets/factory visits from Balu Forge, Steelcast, Nelcast, Synergy Green; and related announcements), here’s a structured analysis of the Indian Castings & Forgings sector. The sector shows resilience amid global headwinds, driven by domestic strength, value-added shifts (e.g., hi-chrome grinding media, machined forgings), and capex-led expansions. Key players like AIA (mining-focused castings), Happy Forgings (auto/industrial forgings), and others highlight a mix of mining, auto (CV/PV/farm/off-highway), and industrial applications.

Headwinds

- US Tariffs & Export Slowdown: Persistent 25-50% tariffs on steel/aluminum products (sectoral, not reciprocal) have led to destocking, order delays, and 35-40% volume drops in US-exposed segments (10-20% of revenues for Happy Forgings/Kalyani). Affects CV, farm, gensets, off-highway; full Q3 impact expected.

- Global Demand Weakness: Subdued exports to Europe/North America/Brazil (e.g., 45% dip in Happy’s farm deemed exports; UK customer volumes halved). Inventory corrections (20-30k tons potential in mining per AIA peers).

- Raw Material Volatility: Steel/ferrochrome softness aids margins short-term but lags in pass-through (1-2 quarters); power/fuel costs rising with renewables transition (AIA).

- Trade Barriers: Anti-dumping probes, pricing pressures in grinding media (AIA); legacy low-volume exports being pruned (Kalyani).

- Operational: Employee costs up amid recruitment (Kalyani); timing variances in non-mining (AIA volumes flat YoY).

Tailwinds

- Strong Domestic Momentum: CV/infra (steel/cement), tractors (+4-7% FY26), PV ramp-up (festive demand); GST incentives boosting uptake (Happy Forgings).

- Margin Resilience: EBITDA 24-31% sustained (AIA 28-29%, Happy 30.7%); product mix shift to high-value machined parts (88% in Happy), liners/castings (higher realizations Rs.300-350/kg).

- Capex & Efficiency: INR 650 Cr (Happy), Rs.180 Cr (AIA), recon/productivity programs (Kalyani); utilizations 55-60% with 70-80% targets. Clean audits, ERP/compliance tools boosting IFC scores.

- Cash Generation: Near-100% OCF conversion (Happy); treasuries/export incentives (AIA Rs.116 Cr other income).

- Diversification: Non-auto industrials (13-50% mix target), wind/data centers/mining (Happy/AIA).

Growth Prospects

- Volume/Market Share Gains: AIA targets 30k tons+ YoY from FY27 (hi-chrome conversions; Chile 15k tons/year, 10-12 mine trials → 200-250k ton pipeline). Happy: INR 350 Cr secured orders (non-auto, wind/farm/heavy).

- Segment Expansion: | Segment | Key Drivers | Potential | |———|————-|———–| | Mining (AIA) | Hi-chrome penetration (25-30% → 60-70%); South America breakthrough (700-800k tons forge market). | 5-15k tons FY26; sustained YoY growth. | | Auto (CV/Farm/PV) | Domestic infra/tractors; Europe/Brazil ramps (heavy axles, SUVs). | 15-20% CAGR; PV to 8-10% mix (Happy). | | Industrials/Off-Highway | Wind/gensets/data centers/mining; near-net tech. | 50% revenue mix (Happy); INR 80 Cr new orders H1 FY26. |

- Exports: Europe transmissions SOP (Kalyani); non-US ramps (15-20% domestic vs. 80-85% export in new capex).

- Inorganic/Strategic: Acquisitions eyed (Happy: 6-8 months; strategic fit). Order pipelines: 200 Cr (Kalyani), 116 Cr wins FY25.

- Overall: 15-20% CAGR revival (Happy); 250-300k ton utilizations (AIA).

Key Risks

- Tariff Escalation/Delay: Prolonged 50% duties could shift supply chains (e.g., China alternatives); 10-15% revenue exposure (Kalyani).

- Demand Normalization Failure: Prolonged destocking (US/Europe farm/CV); no quick revival (CNH/AGCO commentary).

- RM/Cost Pressures: Ferrochrome/scrap spikes; FX hedges losses (Happy).

- Execution/Competition: Capex delays (1.5-3 yrs lead); hi-chrome trials conversion (AIA: 2+ yrs); forged rivals (Molycop/Tega).

- Customer/Geopolitical: Concentration (large mines/OEMs); Brazil/Canada softness; Chinese commodity hi-chrome.

- Compliance/Scale: Audit/ERP transitions; working capital strain on growth.

Summary

The sector faces short-term headwinds from US tariffs (export drag 10-20% revenues) and global destocking, capping H1 FY26 growth (flat YoY for some), but tailwinds like domestic auto/infra demand, superior margins (25-30% EBITDA), and capex (INR 650+ Cr across peers) provide buffers. Growth prospects are robust (15-20% CAGR FY27+), led by mining hi-chrome conversions (AIA 30k+ tons), auto ramps (PV/heavy tractors), and industrials (wind/mining), with South America/Europe diversification. Key risks center on tariff clarity (Q3-Q4 watch), RM volatility, and execution, but strong balance sheets (D/E <0.1x, INR 300+ Cr cash) and governance upgrades position the sector for sustained expansion. Investor sentiment positive (multiple meets/visits), with H2 FY26 eyed for inflection.

Financial

asof: 2025-12-03

Analysis of Indian Castings & Forgings Sector (Based on Q3 FY25 Financial Results)

The provided documents contain unaudited Q3 FY25 (quarter ended Dec 31, 2024) and 9M FY25 financial results from key players: AIA Engineering (global leader in high-chrome mill internals), Happy Forgings, Balu Forge Industries, Steelcast, Nelcast, Synergy Green Industries, Tirupati Forge, and Hilton Metal Forging. These represent a mix of large-cap (AIA), mid/small-cap forgings/castings firms focused on auto, mining, infra, and exports.

The sector shows mixed performance: revenue contraction in leaders (e.g., AIA down 13% YoY Q3 standalone) amid global headwinds, but pockets of growth (e.g., Balu Forge +55% YoY Q3). Margins resilient (AIA ~23% PAT margin), but profits down YoY due to costs. Fundraising for expansions signals optimism.

Below is a structured summary of headwinds, tailwinds, growth prospects, and key risks.

Headwinds (Challenges Pressuring Performance)

- Revenue Declines/Soft Demand:

- AIA (sector bellwether): Q3 revenue down 13% YoY (₹90.8bn vs ₹104.4bn standalone); 9M down 17%. Consolidated similar. Attributed to mining slowdown.

- Steelcast: 9M revenue down 18% (₹25.5bn vs ₹31.1bn).

- Tirupati Forge: Q3 down 19% (₹2.6bn).

- Hilton: Q3 flat but PAT down 78% YoY (₹45L vs ₹211L).

- Implies cyclical demand weakness in mining/auto/infra exports.

- Cost Pressures:

- Raw material/power/fuel up (e.g., AIA Q3 materials ₹41.8bn, power ₹7.5bn; Happy Forgings similar).

- Finance costs elevated (AIA down due to debt paydown, but others up 20-50% YoY).

- Inventory fluctuations hurt profits (negative changes in AIA, Balu).

- Trade Barriers:

- AIA: US preliminary anti-dumping (4.3%) & countervailing duties (3.36%) on grinding media from India (final Apr/May 2025). Impacts exports (US key market).

Tailwinds (Positive Supports)

- Resilient Margins & Profits:

- AIA: Q3 PAT ₹20.7bn (23% margin); 9M ₹67bn. EBITDA strong despite revenue dip.

- Balu Forge: Explosive growth; Q3 revenue +55% (₹16bn), 9M +60% (₹44bn); PAT +113% Q3.

- Happy Forgings: Steady Q3 revenue ₹35bn, PAT ₹6.5bn (18% margin); IPO proceeds utilized for capex/debt reduction.

- Steelcast: Q3 PAT up 10% (₹19.2bn); dividend ₹1.8/share declared.

- Operational Efficiency:

- AIA buyback completed (₹500cr, 1.06% shares @ ₹5k); low debt (finance costs <1% of revenue).

- Synergy Green: Q3 revenue +10% (₹9.7bn).

- Fundraising Success:

- Right/preferential issues (Synergy ₹46cr utilized for capex; Tirupati allotments post-results).

Growth Prospects

- Capacity Expansions:

- Multiple firms raising funds: Synergy (foundry/fettling/machine shop/solar); Tirupati (preferential warrants/equity for capex); Happy (IPO proceeds for machinery).

- AIA: New UAE step-down sub; VMPS JV stake increase (mining products).

- Export-Led Demand:

- AIA’s global subs (US, UAE, China, etc.); 9M consolidated revenue ₹313bn (down but scale ₹485bn FY24).

- Balu: Strong subs growth (foreign sub revenue ₹9.5bn Q3).

- Sector tailwinds: Mining/infra boom (AIA’s mill internals); auto EV shift (forgings for components).

- Margin Expansion Potential:

- AIA: 30%+ EBITDA; scale from expansions.

- Projected FY25 recovery: Infra capex (₹11tn budget), mining (global demand).

- Projections: Sector CAGR 10-15% to FY27 (auto/mining/infra); AIA/Balu leaders could hit 15-20% revenue growth post-headwinds.

Key Risks

| Risk Category | Description | Impacted Companies | Mitigation |

|---|---|---|---|

| Trade/Geopolitical | US duties (AIA: 7.66% combined prelim.); China/EU tariffs possible. | AIA, Balu, Hilton (exports 50-70%) | Diversify markets (AIA’s 14 subs); localization. |

| Input Cost Volatility | Steel/power/fuel up 10-20% YoY (evident in P&Ls). | All (materials 40-50% costs) | Hedging; efficiency (AIA low finance costs). |

| Demand Cyclicality | Mining/auto slowdown; global recession. | AIA, Steelcast (revenue dips) | Diversification (auto/infra); order book strength. |

| Forex/Debt | Rupee volatility; high finance costs (Happy ₹215L Q3). | Tirupati, Synergy | Low debt (AIA); IPO proceeds for repayment. |

| Execution | Capex delays (fundraises ongoing); subs integration. | Synergy, Tirupati | Monitoring agencies (e.g., Happy ICRA). |

| Regulatory | SEBI compliance (e.g., Nelcast clarification on consols). | All | Unmodified audit reports. |

Overall Outlook: Cautious Optimism. Headwinds from trade/demand softening cap near-term growth (sector revenue flat/down 10-15% YoY avg.), but tailwinds from expansions/margins support 10%+ FY25 recovery. Leaders like AIA/Balu resilient; watch US duties finalization. Risks tilted external (trade/costs); internal execution key. Recommended: Monitor Q4 for export rebound.

General

asof: 2025-11-29

Summary Analysis: Indian Castings & Forgings Sector (Based on Provided Announcements)

The documents highlight announcements from key players like Balu Forge Industries (strongest performer), AIA Engineering, Happy Forgings, Steelcast, Nelcast, Synergy Green Industries, Tirupati Forge, Kalyani Forge, and Hilton Metal Forging. Collectively, they reflect a positive sector outlook driven by capacity expansions, defence/aerospace diversification, robust financials, and investor interest. Balu Forge’s Q2/H1 FY26 earnings dominate, showcasing high growth. However, minor compliance/governance slips and capex intensity pose challenges. Below is a structured analysis of headwinds, tailwinds, growth prospects, and key risks.

Tailwinds (Supportive Factors)

- Strong Financial Momentum: Balu Forge reported 33.8% YoY revenue growth in H1 FY26 (₹5,327 Mn), EBITDA margins ~29%, PAT up 51.3%, with net debt/equity at 0.02x and ROCE/ROE >25%. Steelcast ranked #91 in Fortune India 100 Emerging Companies (20%+ CAGR in net income, ROCE >15%).

- Capacity & Tech Upgrades: Balu Forge expanding forging to 150,000 MTPA and machining to 80,000 MTPA via Hattargi facility (25T hammer, 8,000T press). Integrated facilities reduce outsourcing; Industry 4.0 adoption boosts efficiency.

- Sector Tailwinds: Push into defence (360k empty shells p.a. line commercializing; 180+ product approvals), aerospace, railways, and renewables. ESG focus (AIA’s CRISIL score 54/100; Balu’s net-zero by 2040 commitments).

- Capital Access & Investor Interest: Tirupati Forge’s NSE in-principle approval for ₹26.4 Cr preferential issue (1.47 Cr shares + 1.18 Cr warrants). Nelcast’s analyst plant visits signal institutional engagement.

- Healthy Balance Sheets: Low leverage (Balu: net cash ₹603 Mn FY25), strong CFO (₹404 Mn H1 FY26), enabling acquisitions/tech imports under MOOWR scheme (duty-free).

Headwinds (Challenges)

- Cost Pressures: Raw material costs up 31.7-37.8% YoY (Balu Forge), squeezing margins slightly (EBITDA dipped to 27.6% in Q2 FY26 from 29.3%).

- Compliance & Governance Hiccups: Happy Forgings’ unclaimed dividends campaign (IEPF transfer risk); Synergy Green ESOP grant error (22,080 vs. 22,980); Kalyani Forge record date clarification post-BSE query.

- Operational Scaling: High CWIP (48% of assets in Balu H1 FY26, down from 74% FY25) indicates capex delays; working capital days stable but inventory/receivables up.

- Shareholder Engagement: Mandatory demat push and IEPF reminders (Happy Forgings) highlight legacy physical share issues.

Growth Prospects

- Revenue Acceleration: Balu Forge guides 40-45% FY26 growth via Hattargi ramp-up, defence commercialization, and 25+ global OEMs. Total sector potential from defence self-reliance (Atmanirbhar Bharat), railways/oil-gas demand.

- Diversification: Shift to high-margin segments (defence/aerospace: artillery shells, turbine blades); non-auto > auto in Balu pipeline. Export focus (80 countries).

- Sustainability Edge: ESG investments (water recycling, renewables) attract global clients; real-time ESG dashboards (Balu).

- M&A & Funding: Acquisitions of high-end equipment (e.g., from Mercedes/Thyssenkrupp); preferential issues (Tirupati) fund expansions.

- Order Book Strength: Balu: Diversified across agriculture, defence, oil-gas; long-term contracts ensure visibility.

Key Risks

- Execution/Capex Risk: Delays in Hattargi commissioning or CWIP capitalization could inflate debt (Balu borrowing up to ₹640 Mn); asset turnover may normalize post-capitalization.

- Cyclical/Market Risks: Dependence on auto/industrial (60%+ revenue in Balu); raw material volatility, global slowdowns (e.g., auto OEMs).

- Regulatory/Compliance: SEBI LODR scrutiny (e.g., allottee trading locks in Tirupati issue); IEPF transfers erode shareholder value.

- Concentration Risks: Few facilities/customers; defence approvals hinge on indigenization timelines.

- External: Forex/geopolitical (UAE ops in Balu); no losses in 4 years (Steelcast criteria), but margin compression if input costs rise.

Overall Sector Outlook: Bullish with strong tailwinds from defence/industrial capex. Balu Forge exemplifies 30-40% growth potential; peers like Steelcast/Nelcast show momentum. Monitor Q3 FY26 earnings for expansion execution. Risks are manageable with low debt, but cost control key. Recommendation: Positive; focus on defence-exposed names.

Investor

asof: 2025-11-29

Summary Analysis: Indian Castings & Forgings Sector

Based on Q2/H1 FY26 Earnings Calls/Announcements from AIA Engineering, Happy Forgings, Kalyani Forge, and others (Steelcast, Nelcast, Balu Forge, Synergy Green). The sector shows resilience amid global headwinds, driven by strong domestic demand, margin expansion via value-added products, and capex-led growth. Companies report steady tonnage/revenue (e.g., AIA ~63k tons/Q2), high EBITDA margins (25-31%), and cash-rich balance sheets, but exports face tariff pressures.

Headwinds (Challenges)

- US Tariffs & Export Slowdown: Sectoral duties (25-50% on steel/aluminum) led to 35-40% volume drop in US-exposed business (10-20% of revenues for Happy, Kalyani). Customer destocking in CV, farm, off-highway; Europe/Brazil softness adds pressure. Exports ~18-40% of sales, with dips in Q2/H1.

- Global Demand Weakness: Subdued US/Europe tractor/CV markets (e.g., Happy: 45% farm export dip; AIA: flat mining volumes). Inventory corrections (20-30k tons potential) delay recovery.

- RM Volatility & Costs: Steel/ferrochrome softness aids margins short-term but lags in pass-through; power/fuel upticks noted.

- Trade Barriers: Anti-dumping probes (AIA history); forged media competition (Molycop/Tega).

- Y-o-Y Flatness: H1 revenues flat/4-5% up (e.g., Happy +4%, Kalyani flat), with employee costs up amid turnover dips.

Tailwinds (Positives)

- Robust Domestic Growth: Infrastructure/GST cuts boost CV/farm (Happy: 10% domestic volume up); industrials strong (wind/power/oil-gas).

- Margin Expansion: EBITDA 24-31% (AIA 28%, Happy 31%); product mix shift to machined/hi-chrome liners (60% gross margins). Forex/export incentives aid (AIA: ₹116cr other income).

- Cash Generation: Near-100% OCF conversion; liquidity ₹300-4,600cr (low D/E <0.1). Strong ROCE/ROE (14-18%).

- Order Wins & Solutions: AIA’s Chile breakthrough (15k tons/year hi-chrome); Happy/Kalyani new MNC/EU programs (₹80-350cr secured).

- Governance/Tech Upgrades: Clean audits, ERP/compliance tools (Kalyani); Vriddhi savings (₹17cr).

Growth Prospects

- Volume/Capacity Ramp: AIA targets +30k tons FY27 (total 3-4L tons capacity at 55-60% util.); Happy/Kalyani: 15-20% CAGR via ₹650cr capex (wind/heavy axles/PV). Utilization to 70-80%.

- Diversification: Shift to industrials/PV/off-highway (50% mix target); mining solutions (hi-chrome packages, 60-70% penetration upside). Exports to South America/Europe (AIA: 700-800k tons copper belt potential).

- New Verticals: Wind/data centers/defense/mining (Happy: PV to 8-10%); inorganics (Happy evaluating).

- H2/FY26 Outlook: Domestic traction + tariff relief could revive exports; new SOPs (e.g., EU transmission). Sector CAGR 15-20% medium-term via China+1, infra push.

- Pipeline: ₹200-350cr new orders; 50+ mine trials (AIA); 116cr wins (Kalyani).

Key Risks

| Risk Category | Details | Mitigation |

|---|---|---|

| Geopolitical/Trade | Tariff hikes/delays; ADD probes; US election uncertainty. | Diversify exports (Chile/EU); solution-based pricing (AIA). |

| Demand | Prolonged global auto/mining slowdown; destocking. | Domestic focus (50%+ mix); industrials ramp. |

| Execution | Capex delays (₹150-650cr); validation cycles (6-18 months). | Phased rollout; 58% Capex progress. |

| Costs | RM/currency volatility; employee hikes. | Pass-through clauses; hedging. |

| Competition | Chinese/forged players (Molycop); low penetration in LATAM. | Tech edge (hi-chrome liners); patents. |

| Others | Compliance lapses; over-reliance on mining/auto (38-62% revenues). | ERP/IFC upgrades; board strengthening. |

Overall Outlook: Sector poised for 10-15% FY26 growth (domestic-led), accelerating to 20%+ FY27 via capex/exports recovery. High margins/cash provide buffer; monitor US tariffs (Q3 impact likely). Bullish on mining/industrials; cautious on exports near-term.

Meeting

asof: 2025-12-02

Indian Castings & Forgings Sector Analysis (Based on Q2/H1 FY26 Results)

The sector demonstrates resilient revenue growth (avg. 10-25% YoY across sampled companies like AIA Engineering, Balu Forge, Happy Forgings, Nelcast, Synergy Green, Tirupati Forge), driven by capacity expansions and export demand. However, profitability pressures persist due to capex ramp-up. Key insights from filings:

Headwinds (Challenges)

- Margin Compression: EBITDA margins dipped 1-5% QoQ (e.g., Tirupati, Synergy, Nelcast) from higher depreciation/finance costs (defense/solar capex), elevated employee expenses (hiring for new units), and raw material/power inflation.

- Trade Barriers: US anti-dumping/countervailing duties (3-7% on grinding media/flanges; AIA, Balu Forge) impacted exports (50-60% revenue for many).

- Working Capital Strain: Inventory build-up (5-15% rise), overdue receivables (Balu: ₹13 Cr export dues), forex losses.

- Operational Hiccups: Unit closures (AIA Nagpur, Happy subsidiary), policy changes limiting solar utilization (Synergy).

Tailwinds (Positives)

- Revenue Momentum: Strong topline (e.g., AIA +18% H1, Balu +89% Q2, Happy stable), buoyed by auto/infra exports and higher US tariffs boosting pricing.

- Capex Execution: Defense/solar ramps (Tirupati: 1.2L shell bodies/yr; Synergy ESOP for talent); ring rolling/press lines scaling (Ganga, Tirupati).

- Policy Support: Indigenization (defense budgets up 13% CAGR), Make in India aiding domestic orders.

- Balance Sheet Strength: Cash-rich (AIA ₹465 Cr investments), buybacks/dividends (AIA ₹500 Cr), low debt in leaders.

Growth Prospects

- Defense Pivot: Explosive potential (Tirupati Q1FY27 ops; market CAGR 13% to $1.4B by 2032); indigenization favors automated lines.

- Sector Tailwinds: Forgings CAGR 6-9% (auto 60% share, infra/oil&gas); India as global hub (export share 55% for sampled firms).

- Capex Payoff: Full solar/defense utilization by FY27 (cost savings 10-20%); expansions to 100% capacity (H1FY27).

- Projections: Revenue +20-30% FY26; EBITDA margins recover to 15-20% post-capex.

Key Risks

| Risk Category | Description | Mitigation |

|---|---|---|

| Execution | Delays in defense trials/capex (Q4FY26 target); solar policy flux. | Phased rollout, govt. contracts. |

| Geopolitical/Trade | US duties escalation; forex volatility (10-15% export reliance). | Diversification (EU/Africa/Asia). |

| Financial | Debt rise (Synergy B/S strain); ECL provisions (overdues). | Strong cash flows (AIA ₹36 Cr ops CF). |

| Operational | Raw material/power hikes; skilled labor shortages. | Backward integration, hiring. |

| Regulatory | Ind AS compliance, approvals for warrants/shares. | Timely filings, monitoring agencies. |

Overall Outlook: Bullish long-term (defense/infra-led); near-term volatility from capex/debt. Leaders (AIA, Balu) resilient; midcaps (Tirupati, Synergy) high-beta growth plays. Monitor US duties/FY27 defense ramp.

Press Release

asof: 2025-11-29

Indian Castings & Forgings Sector Analysis

Based on Q2/H1 FY26 results and updates from Happy Forgings (HAPPYFORGE), Balu Forge (BALUFORGE), Nelcast (NELCAST), Tirupati Forge (TIRUPATIFL), and Hilton Metal Forging (HILTON).

Tailwinds (Positive Drivers)

- Robust Domestic Demand: Healthy growth in Commercial Vehicles (CV: 37% share at Happy), Farm Equipment (34%), Passenger Vehicles (PV: up to 5%), and Industrials (13%). Volumes up 4.5-5.2% YoY (Happy), steady tractor/M&HCV sales (Nelcast).

- Margin Expansion: Highest-ever gross margins (~60%) and EBITDA margins (29-31%) at Happy due to softening steel prices and stable realizations (Rs. 248/kg in H1FY26). EBITDA/kg up to Rs. 12.5 at Nelcast. Balu maintained 27-29% EBITDA margins amid 34% revenue growth.

- Strong Financials & Cash Flows: Near-100% OCF conversion (Happy), liquidity at ₹315 Cr, low debt. Balu PAT up 51% YoY in H1.

- Sustainability & Efficiency: Tirupati’s 4.8 MW solar plant to save ₹25-50 Mn annually, reducing energy costs.

- Government Support: Railways push for 40,000+ LHB/Vande Bharat coach conversions, 17,500 new coaches by 2029 (Hilton approval as first private MSME supplier).

Headwinds (Challenges)

- Weak Exports: Muted demand (16% share at Happy) due to end-market weakness, de-stocking, tariff uncertainties, and US slowdown/additional tariffs (Nelcast exports down; Q2 revenue flat/declining).

- Uneven Segment/Geography Growth: Minor dips in Off-Highway (10%) and exports; overall revenue growth modest (4% at Happy, flat at Nelcast) vs. high growth at Balu (34%).

- Margin Pressure in Spots: EBITDA margins dipped QoQ at Balu (31% to 27.6%); Nelcast at 7-8.4% (below peers).

Growth Prospects

- High Double-Digit Revenue/EBITDA Growth: Balu at 34% YoY; Happy adjusted PAT +10%; Nelcast PAT +23% adjusted. Volumes to drive via capex (Happy ₹650 Cr program; Balu Hattargi greenfield to 150K MTPA forging).

- Defence & Railways Ramp-Up: Balu defence shells (360K/year capacity) commercializing; Hilton enters Vande Bharat/LHB wheels (8,000+ trains potential).

- Product Diversification: High-value machined products (88% at Happy), new export castings (Nelcast FY27 sales), precision components across auto/defence/rail (Balu).

- Capacity & Tech Upgrades: Balu to 80K MTPA machining; integrated forging/machining; Nelcast high-margin products for utilization boost. Long-term: Broader OEM partnerships.

Key Risks

- Export/Trade Disruptions: Tariff headwinds, US/EU slowdowns could persist, impacting 16-35% export revenues.

- Raw Material Volatility: Steel price softening aided margins, but reversal could squeeze (realizations stable but down 0.4-0.6% YoY).

- Execution Delays: Capex overruns in expansions (Balu/Tirupati greenfields); capacity utilization tied to demand recovery.

- Macro/Geo Risks: Uneven global recovery, customer de-stocking; sector dependence on cyclical auto/CV/rail.

- Competition & Margins: Intense rivalry in defence/rail; margin contraction if input costs rise or volumes miss.

Overall Outlook: Sector resilient with domestic strength and policy tailwinds offsetting export weakness. Leaders like Balu/Happy show 20-50% growth potential via defence/rail/capex; laggards like Nelcast eye recovery via new products. FY26 growth: 10-30% revenue for top players, margins 25-30% sustainable. Monitor US tariffs and steel prices.

Copyright © 2023 SAS Data Analytics Pvt. Ltd. All rights reserved.