AGRITECH

Equity Metrics

January 13, 2026

Agri-Tech (India) Limited

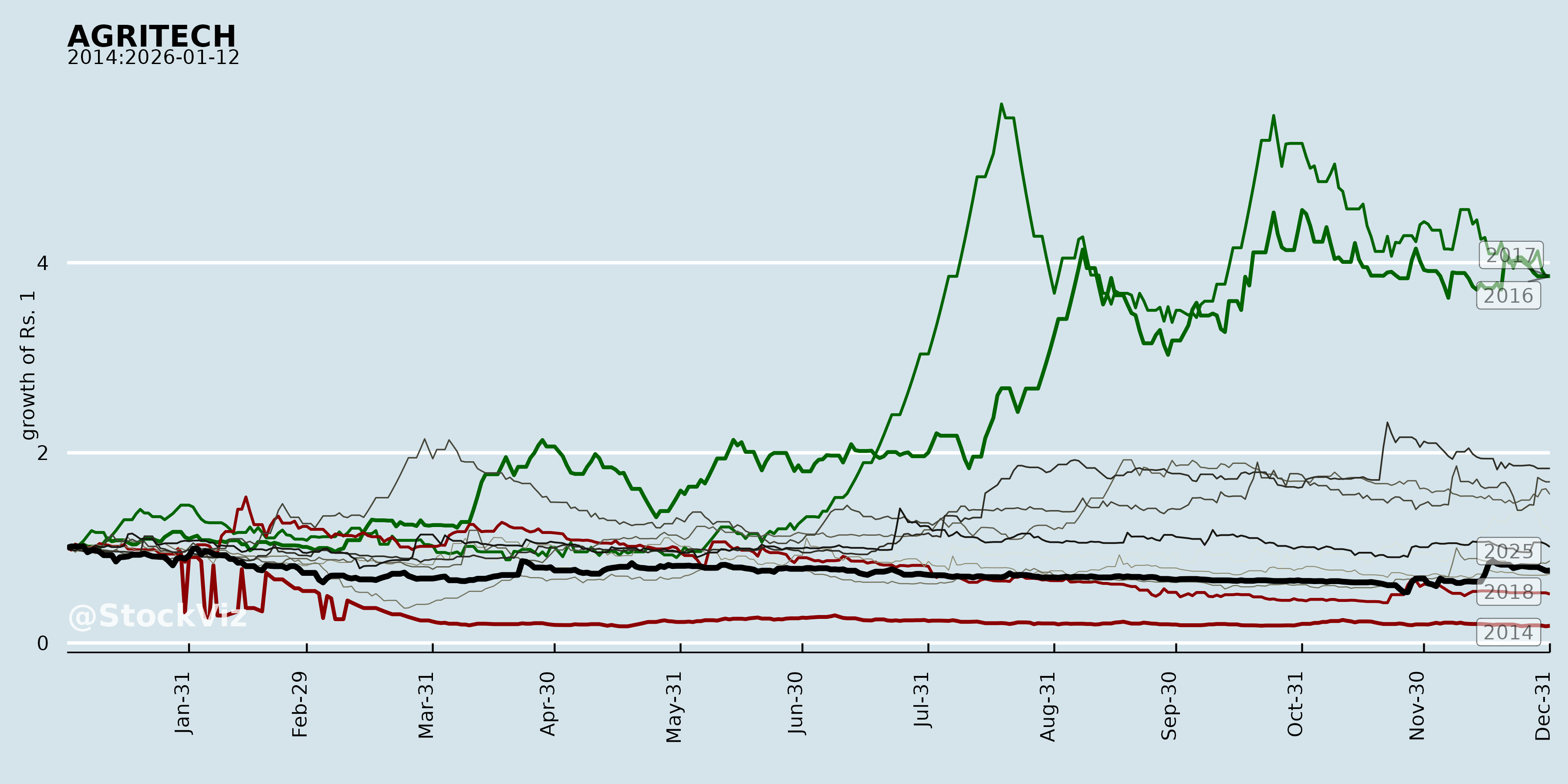

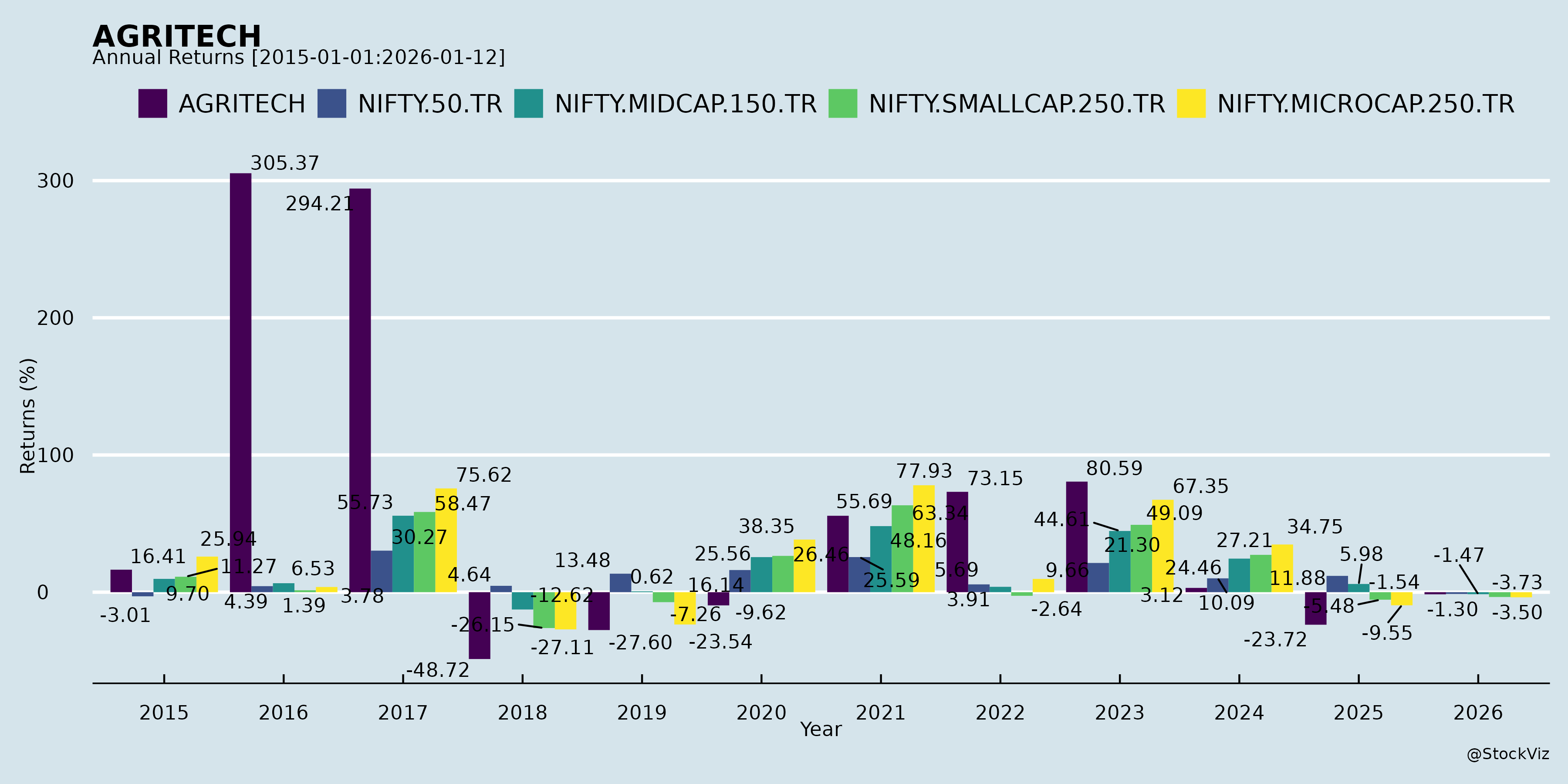

Annual Returns

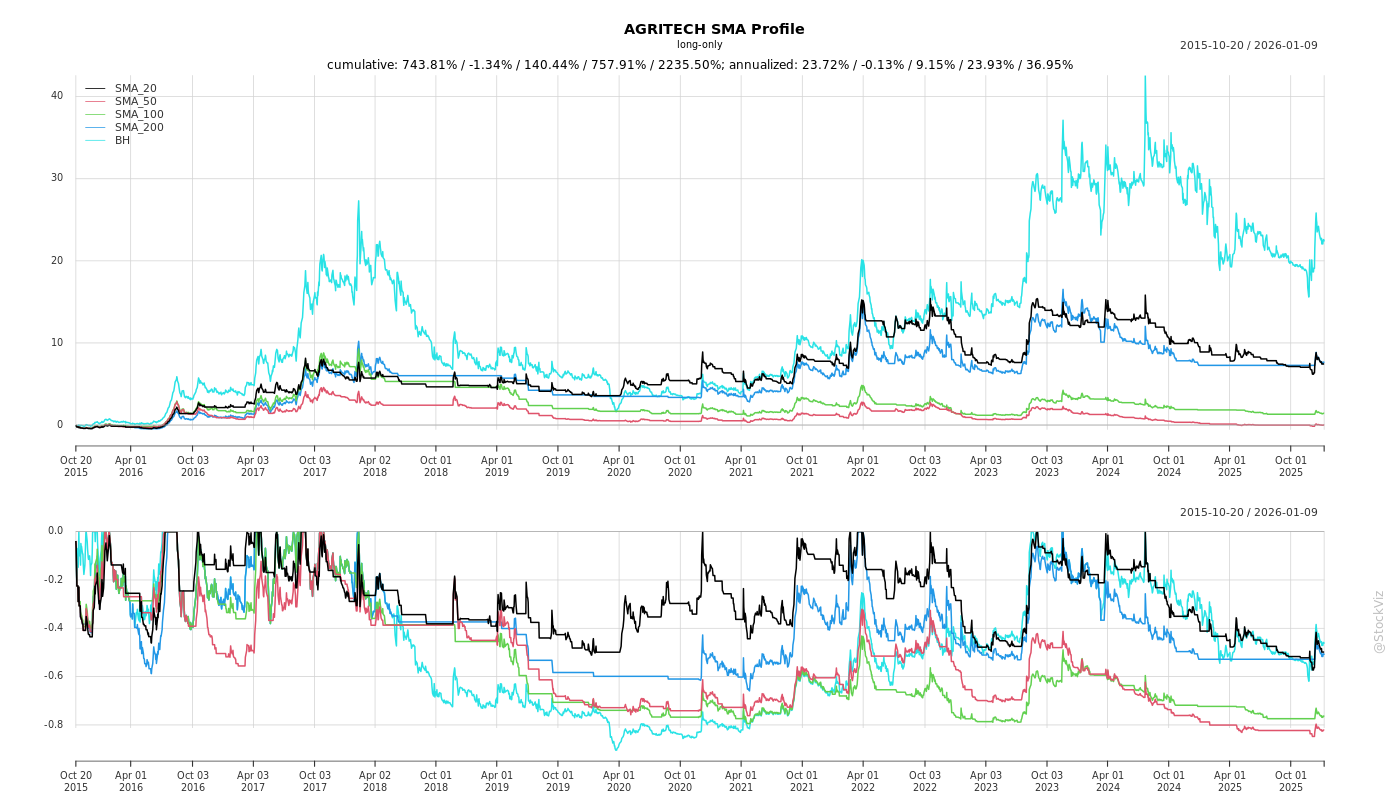

Cumulative Returns and Drawdowns

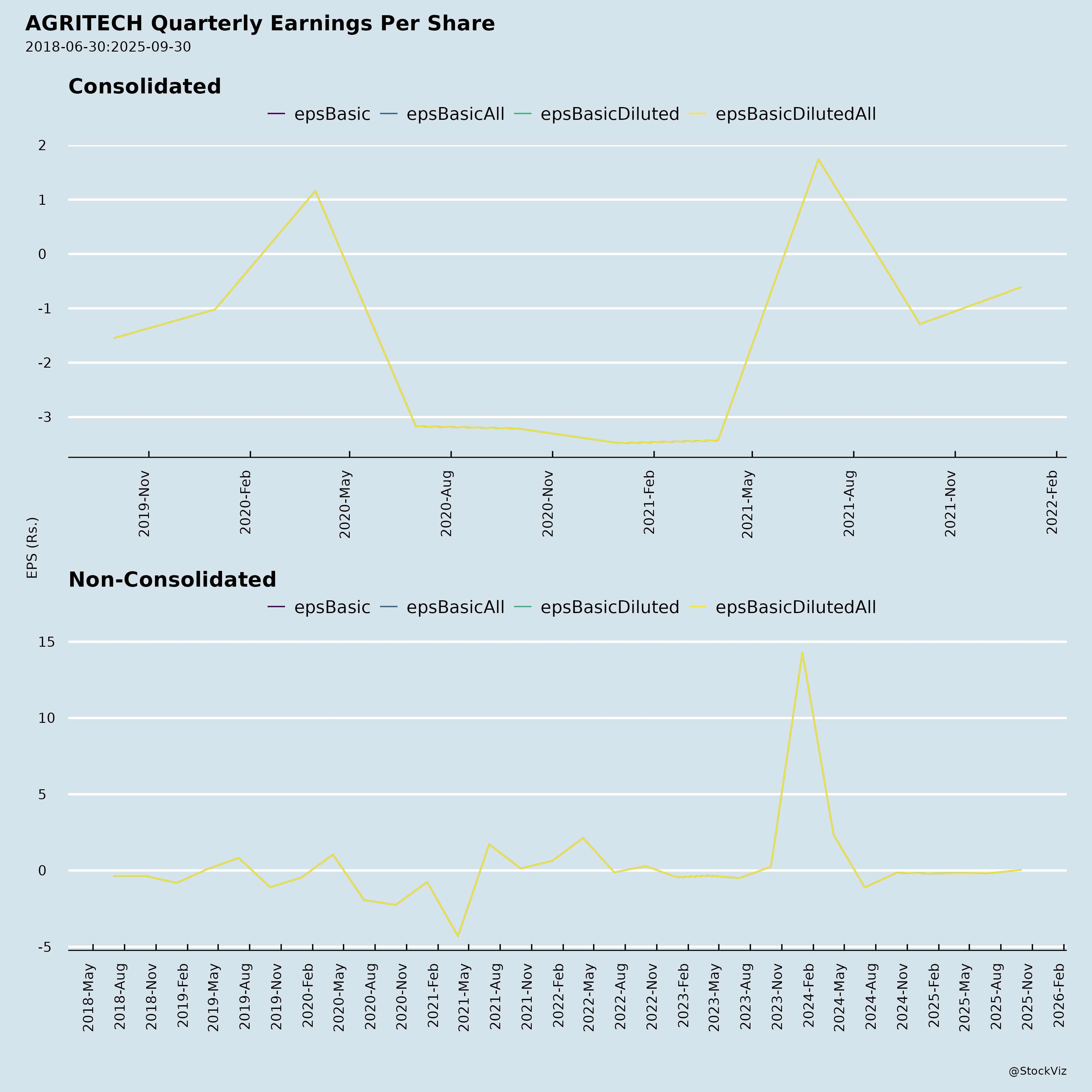

Fundamentals

Ownership

Margined

AI Summary

asof: 2025-11-27

Agri-Tech (India) Limited (AGRITECH) Analysis

Company Overview: Agri-Tech (India) Ltd. (BSE: 537292, NSE: AGRITECH) is engaged in a single segment—horticulture crops. FY26 H1 results (ended 30 Sep 2025) show modest revenue growth but persistent operational losses, propped up by one-off asset sales. Balance sheet dominated by ₹8,893 lakhs in loans & advances (88% of current assets), with auditor qualifications on recoverability and compliance. Recent AGM (19 Sep 2025) highlighted governance tensions, with public shareholders rejecting independent director re-appointments.

Tailwinds (Positive Factors)

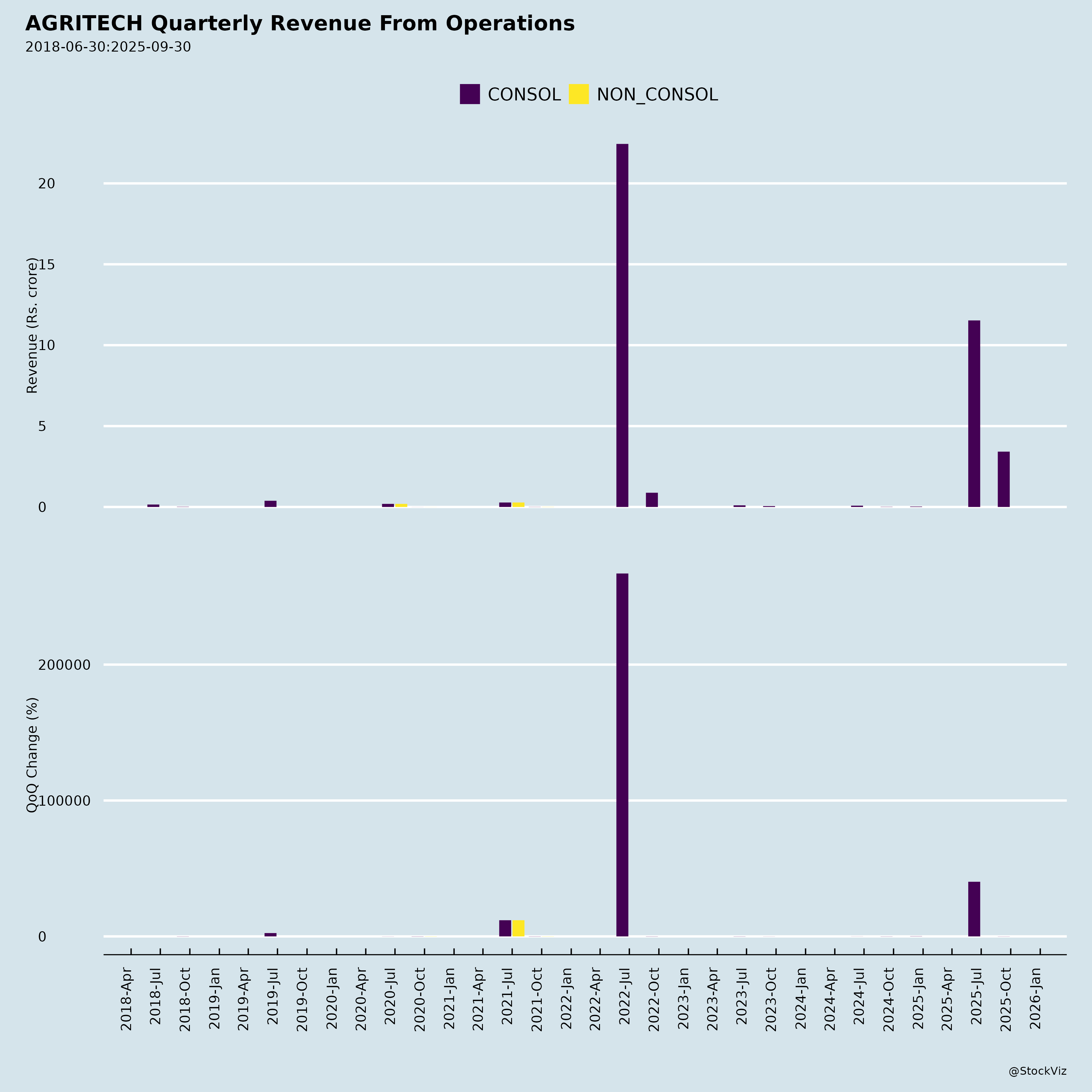

- Revenue Momentum: H1 FY26 revenue up 61% YoY to ₹14.95 lakhs (Q2: ₹3.42 lakhs). Indicates slight operational pickup in core horticulture business.

- Loss Reduction: H1 net loss narrowed to ₹7.96 lakhs (vs. ₹74.34 lakhs YoY), aided by lower production expenses and one-off “Other Income” (₹18.95 lakhs in Q2 from asset sales).

- Asset Monetization: Sale of land (₹93.79 lakhs in H1) generated positive investing cash flow (+₹84.46 lakhs), supporting liquidity amid negative operations.

- Legal Recovery Potential: Filed NCLT claim for ₹2,505 lakhs interest on loan to TechIndia Nirman Ltd., which could materially boost income if realized.

- No Investor Complaints: Clean record on grievances.

Headwinds (Negative Factors)

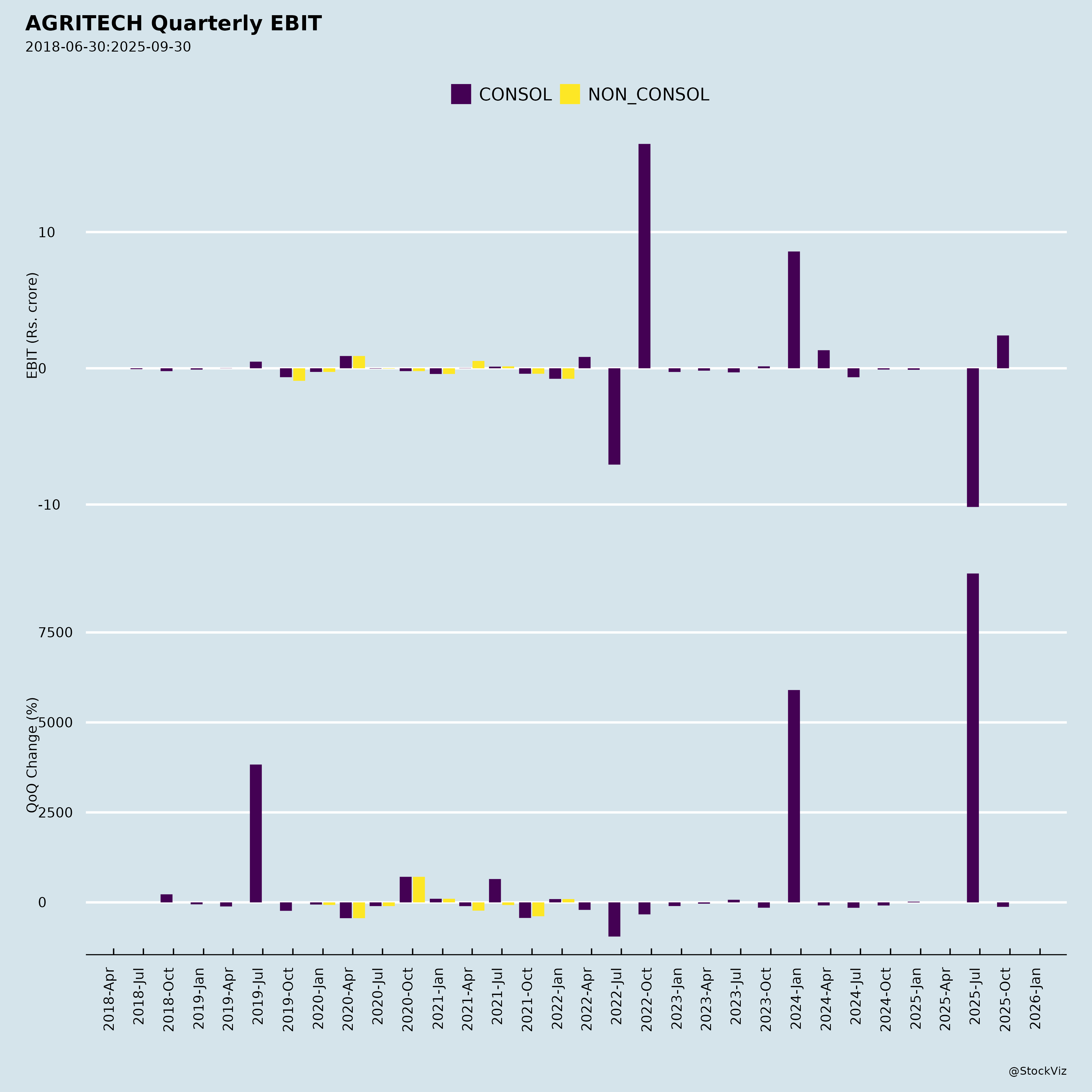

- Persistent Operational Weakness: High expenses (H1 total: ₹41.86 lakhs), driven by “Other Expenditure” surge (₹27.83 lakhs, up from ₹16 lakhs YoY). Negative operating profit (-₹25.91 lakhs H1).

- Liquidity Strain: Cash & equivalents fell to ₹4.21 lakhs (from ₹22.08 lakhs FY25-end); H1 operating cash flow -₹102.33 lakhs due to liability reductions.

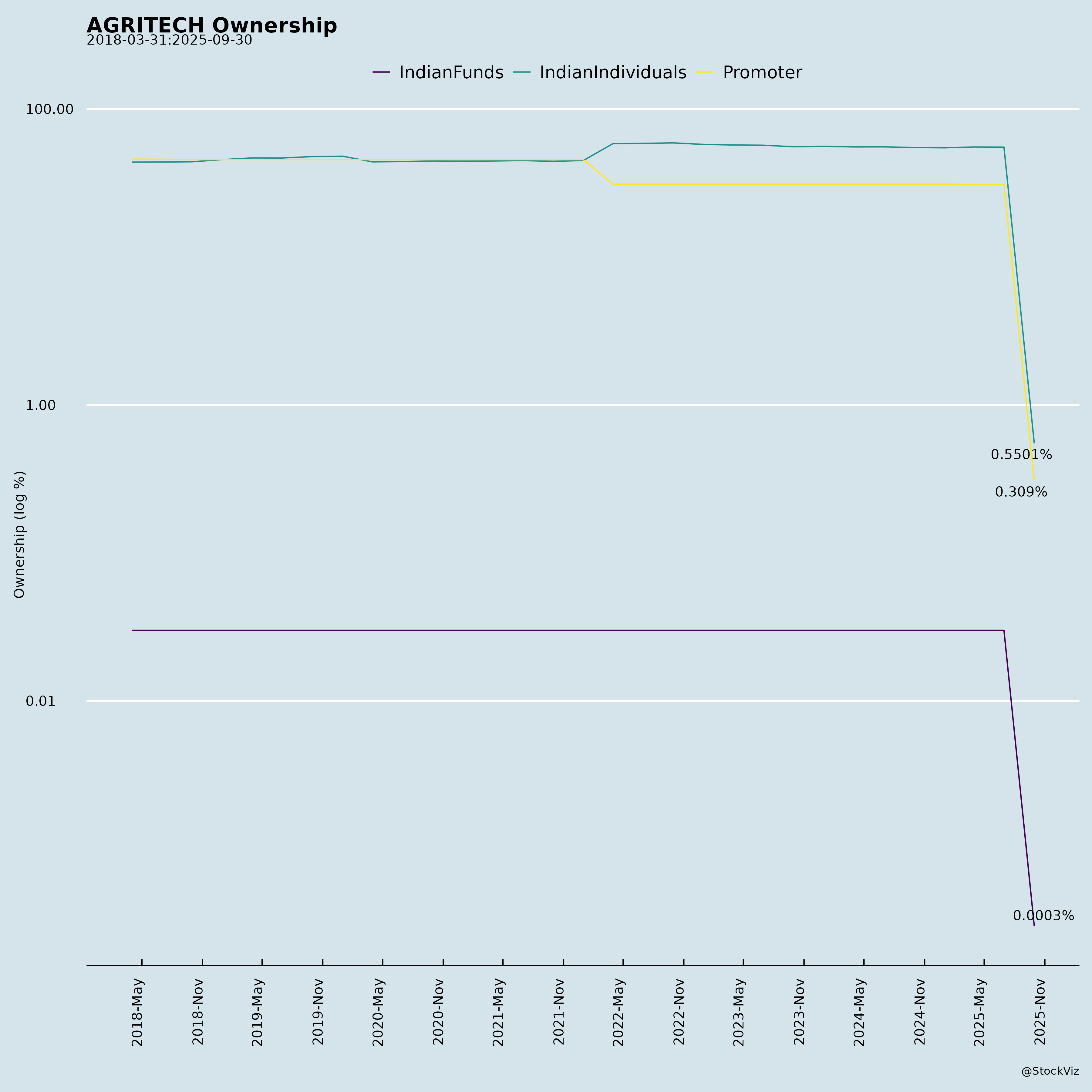

- Shareholder Dissent: Public non-institutions (38.5% shareholding) voted ~99.8% against ordinary resolutions and fully against special resolutions at AGM, signaling distrust (e.g., IDs re-appointment failed at 61.55% favor vs. required 75% for special res).

- Low Revenue Base: Tiny scale (annualized H1 revenue ~₹30 lakhs), with inconsistent quarterly performance (Q1: ₹11.53 lakhs → Q2: ₹3.42 lakhs).

Growth Prospects

- Moderate: Agri-tech/horticulture tailwinds in India (govt. push via schemes like PMKSY), but company’s execution poor. Potential from loan interest recovery (₹2,505 lakhs claim + ₹226 lakhs uncharged interest) could transform balance sheet (equity ₹10,006 lakhs). Asset sales provide bridge funding for ops revival.

- Upside Scenarios: NCLT success + cost control could yield profitability; diversification beyond single segment unmentioned but needed.

- Base Case: Stagnant/low-single-digit revenue growth; losses persist without recovery. Long-term prospects hinge on resolving legacy loans (88% current assets at risk).

Key Risks

| Risk Category | Description | Severity |

|---|---|---|

| Financial/Recoverability | ₹8,893 lakhs loans & advances (to parties like TechIndia Nirman) at high risk; interest not accrued (₹2,505 + ₹226 lakhs). Auditor flags uncertainty/non-compliance (Sec 186). | High (Could wipe out equity) |

| Liquidity | Negative op cash flows; cash burn; no borrowings. Reliant on asset sales. | High |

| Governance/Regulatory | Auditor qualified review; AGM failures on IDs re-appointment (public revolt); potential SEBI scrutiny on related-party loans. Promoter votes (61.5%) overridden by public activism. | High |

| Operational | Loss-making core biz (horticulture); high opex volatility; no diversification. | Medium |

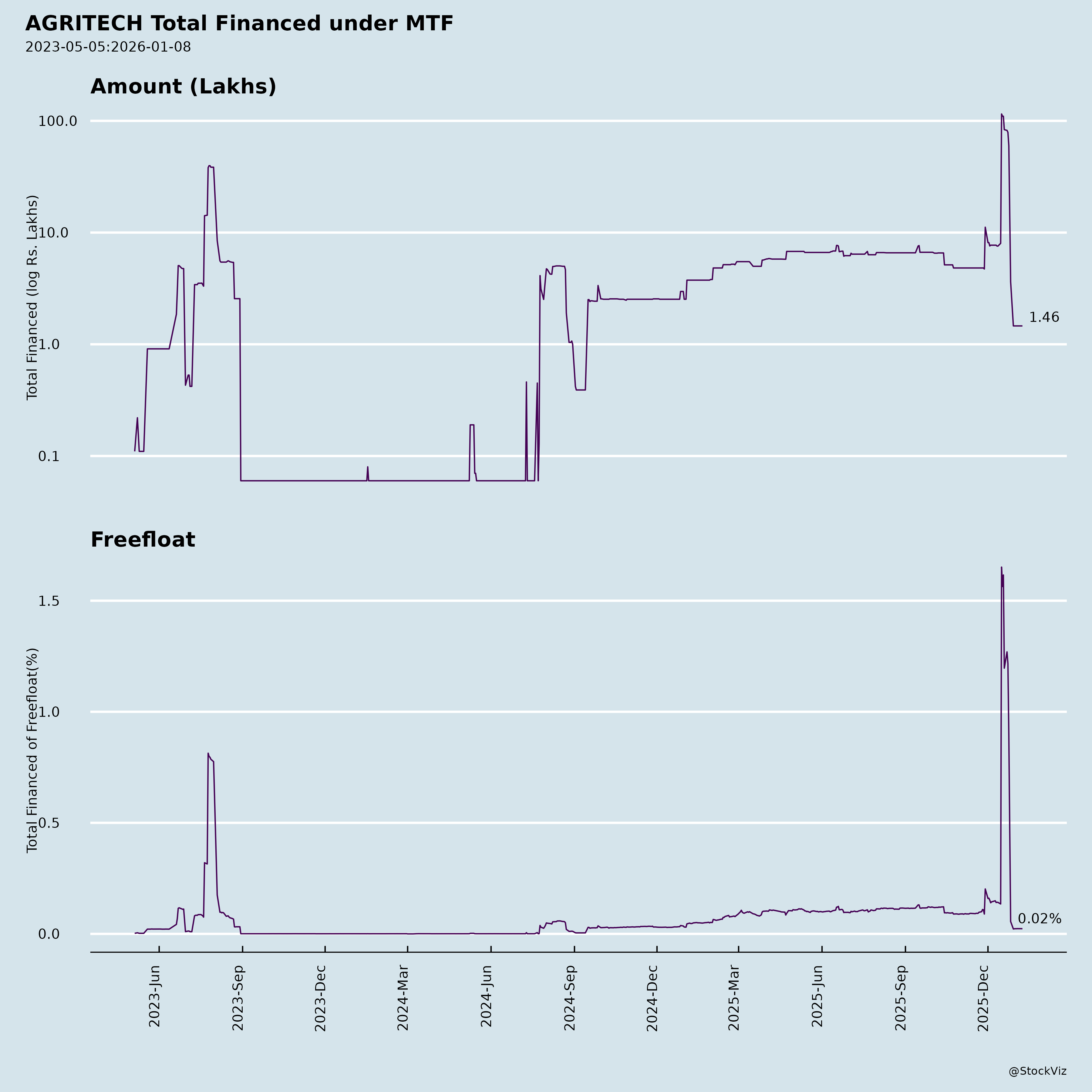

| Market/Shareholder | Thin trading/liquidity; 38.5% public float highly dissatisfied (99.8% against key votes). Risk of further activism/delisting pressure. | Medium-High |

Overall Summary: CAUTIONARY HOLD/SELL. Tailwinds from revenue uptick and potential recoveries are overshadowed by headwinds like liquidity crunch, legacy bad debts, and governance red flags (AGM dissent, auditor qualifiers). Growth prospects limited to legal windfalls; operational turnaround unlikely without mgmt. change. Key monitor: NCLT outcome and Q3 results. Market cap likely depressed; high-risk for investors. (Analysis based solely on provided docs; no external data used.)

Copyright © 2023 SAS Data Analytics Pvt. Ltd. All rights reserved.