AFCONS

Equity Metrics

January 13, 2026

Afcons Infrastructure Limited

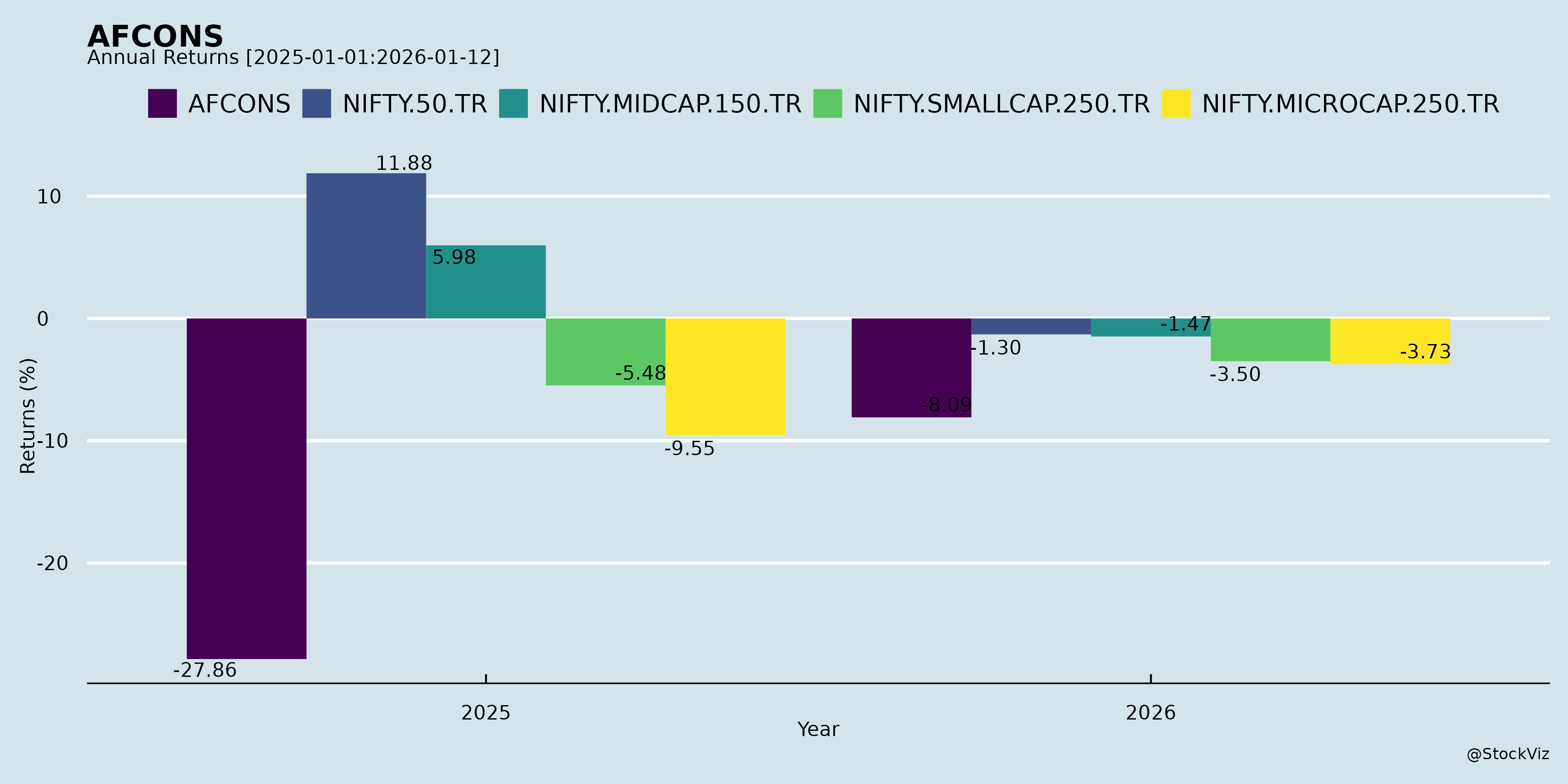

Annual Returns

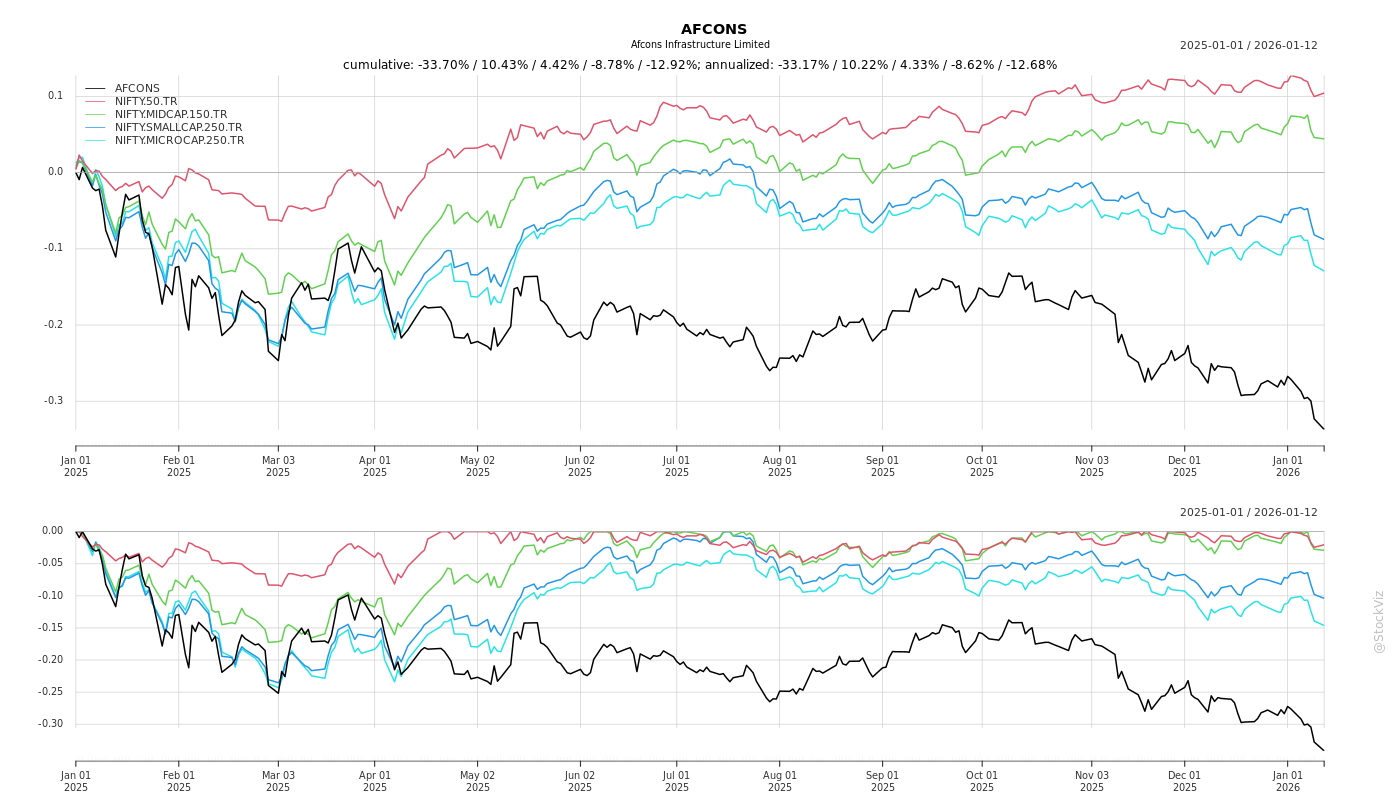

Cumulative Returns and Drawdowns

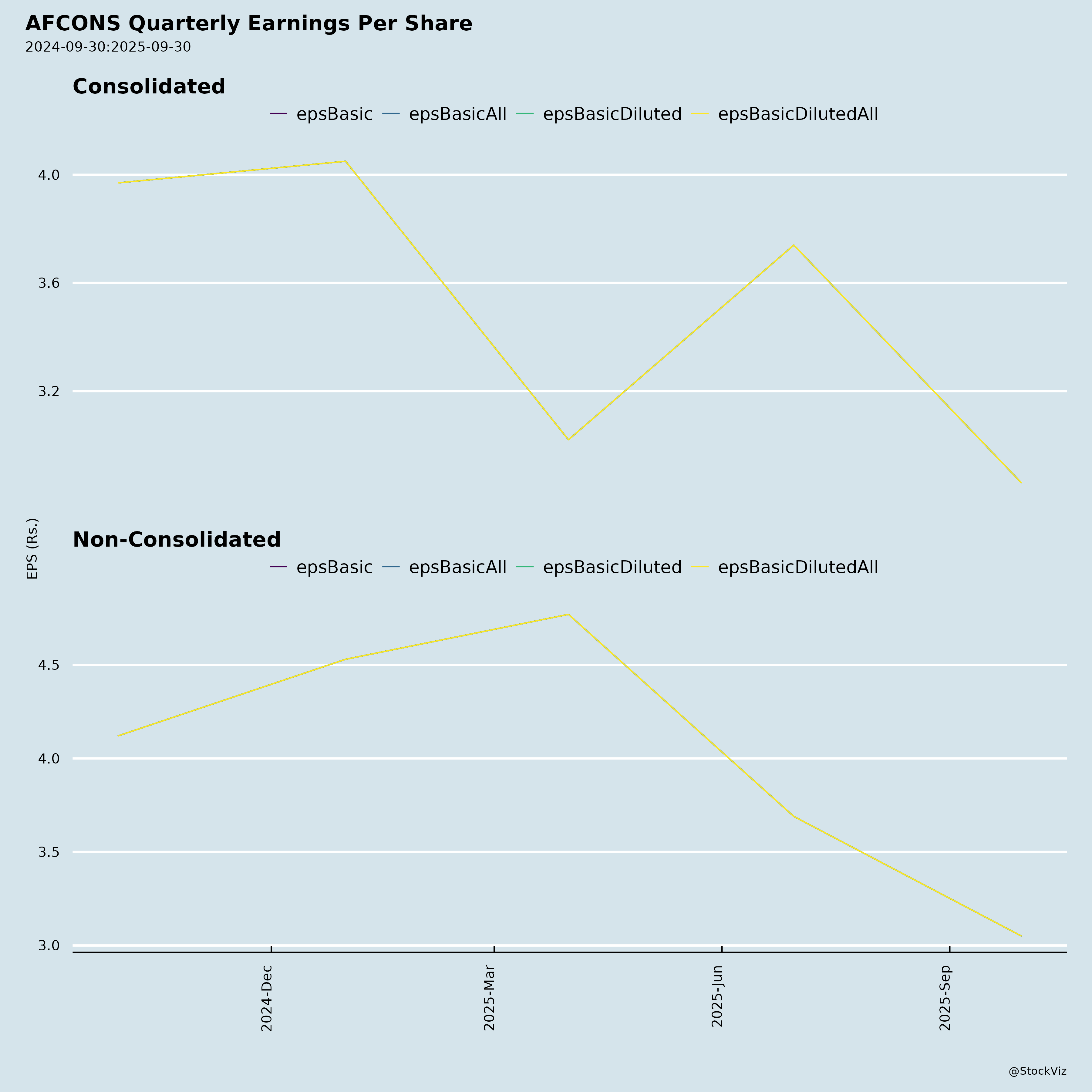

Fundamentals

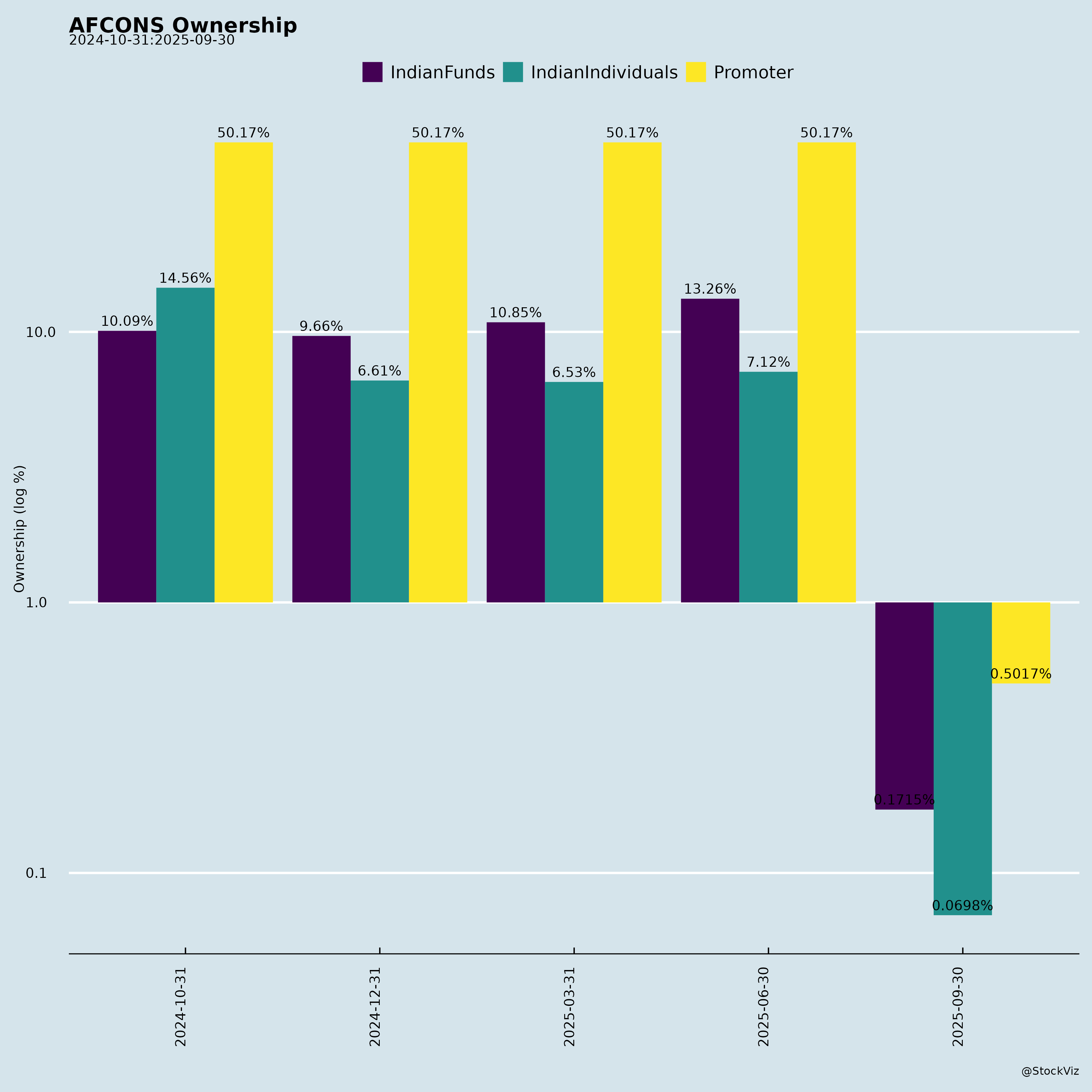

Ownership

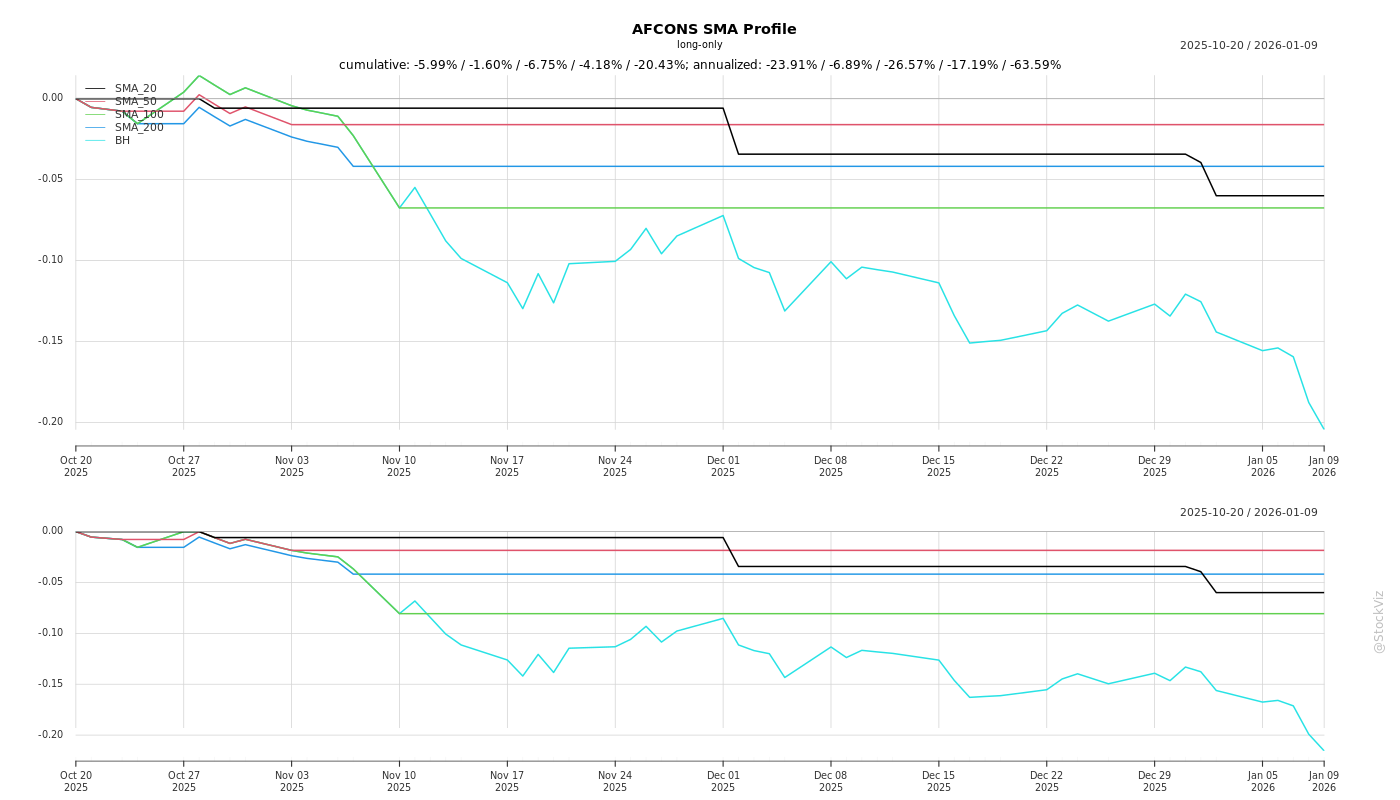

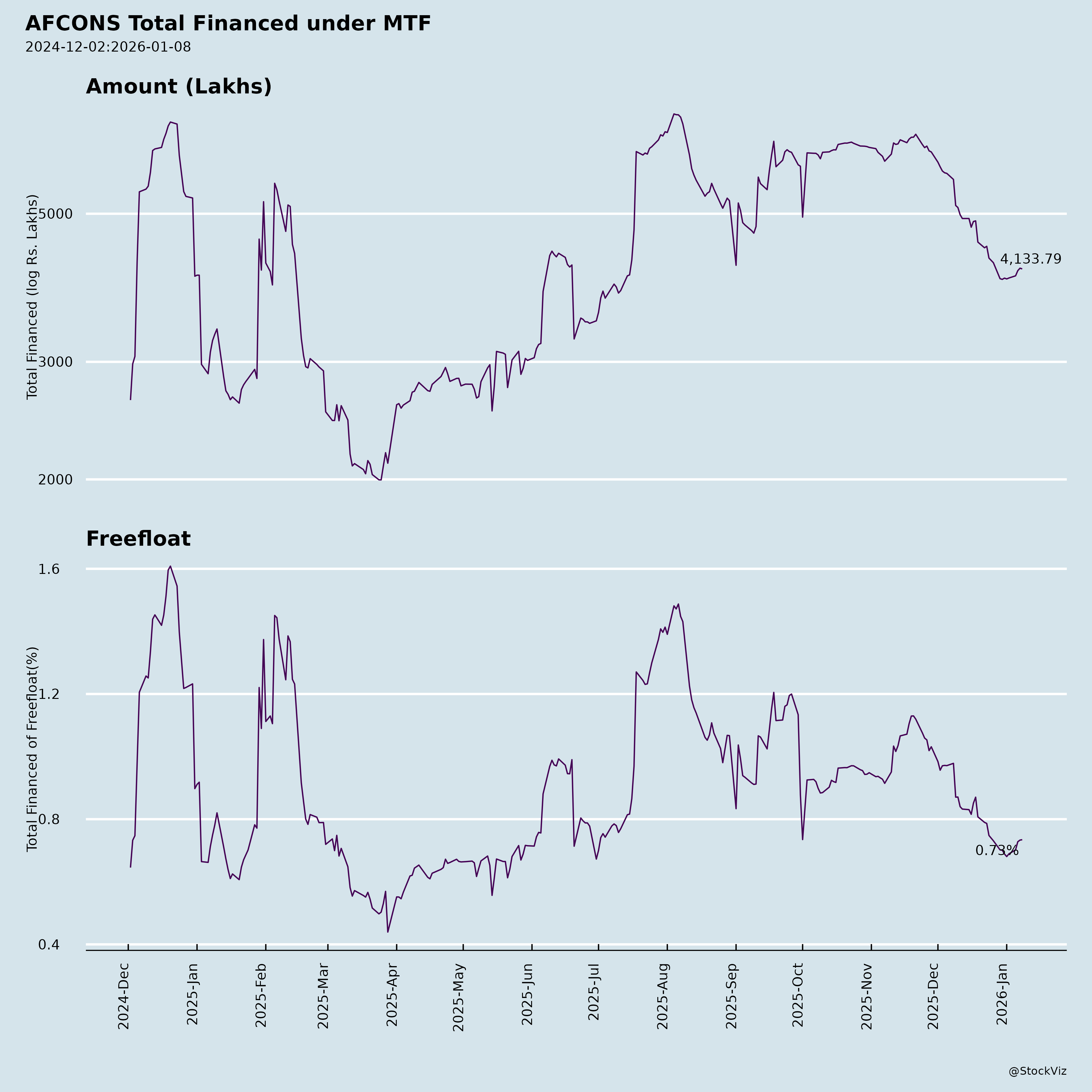

Margined

AI Summary

asof: 2025-12-08

Afcons Infrastructure Limited – Investment Analysis Summary

(Based on FY26 Q2 & H1 Results, Corporate Filings, Governance & Operations as of December 2025)

1. Overview

Afcons Infrastructure Limited (NSE: AFCONS | BSE: 544280) is a flagship engineering and construction company under the Shapoorji Pallonji (SP) Group, specializing in EPC (Engineering, Procurement, and Construction) projects across complex infrastructure sectors—both domestically and internationally.

Key highlights: - Listed on BSE & NSE in 2024. - FY26 H1 Order inflow: ₹1,268 Cr; order book: ₹32,681 Cr (as of Sep ’25) - Ranked among Top 140 global contractors (ENR), with leadership in Bridges (12th), Marine & Ports (14th), and Transportation (45th). - Crisil upgraded to AA- (Stable) & A1+ (Short Term). - Focus on extreme engineering, sustainability, and digital transformation.

2. Tailwinds (Growth Drivers)

A. Strong Order Book & Book-to-Bill Ratio

- Order book: ₹32,681 Cr (Sep ’25) — highest-ever reported pending order book (~₹369 billion).

- Book-to-bill ratio (H1 FY26): 2.5x, indicating robust pipeline relative to revenue.

- H1 FY26 order inflow: ₹1,268 Cr, including large marine EPC orders (e.g., ₹884 Cr in November alone).

- Diversified mix:

- 54% Urban Infrastructure (Metro, Elevated Corridors)

- 22% Hydro & Underground

- 13% Marine

- 89% Domestic, 11% Overseas

Indicates stable near-term revenue visibility and confidence in execution capacity.

B. Strategic Market Leadership in High-Complexity Segments

Afcons is a technology-driven infrastructure specialist in challenging civil works: - Tunnels: World’s 1st undersea rail tunnel (7km) in MAHSR (Mumbai-Ahmedabad High-Speed Rail). - Marine Port Works: One of the largest Indian contractors in ports (e.g., Nagoya Port in Oman, Nigeria, Mauritania). - Bridges: Built Chenab Bridge, world’s tallest railway arch bridge (J&K). - Underground Metro: Pioneered India’s 1st underwater metro tunnel (Kolkata Metro).

Complex projects offer higher margins, lower competition, and strong moat.

C. Geographic Expansion & International Footprint

- Presence in 30+ countries across Africa, Middle East, Asia, CIS.

- Recent high-value overseas projects:

- Greater Male Connectivity Project (Maldives) – largest infra project in Maldives.

- Tanzania Water Supply Project

- Projects in Liberia (ArcelorMittal), Gabon, Ethiopia.

- International projects contribute ~11% of order book but offer higher strategic value and diversification.

Growing international recognition supports long-term growth and reduces domestic cyclical exposure.

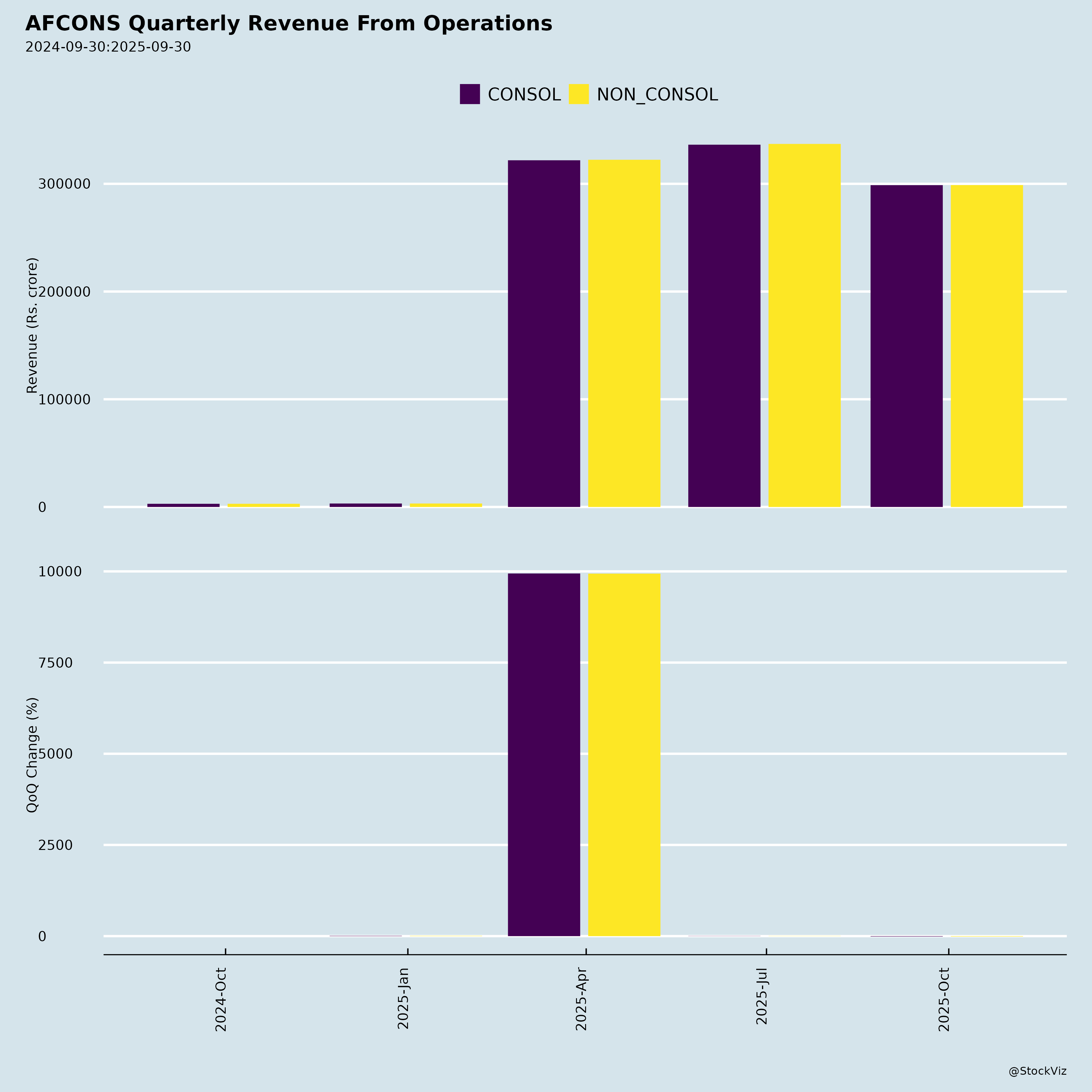

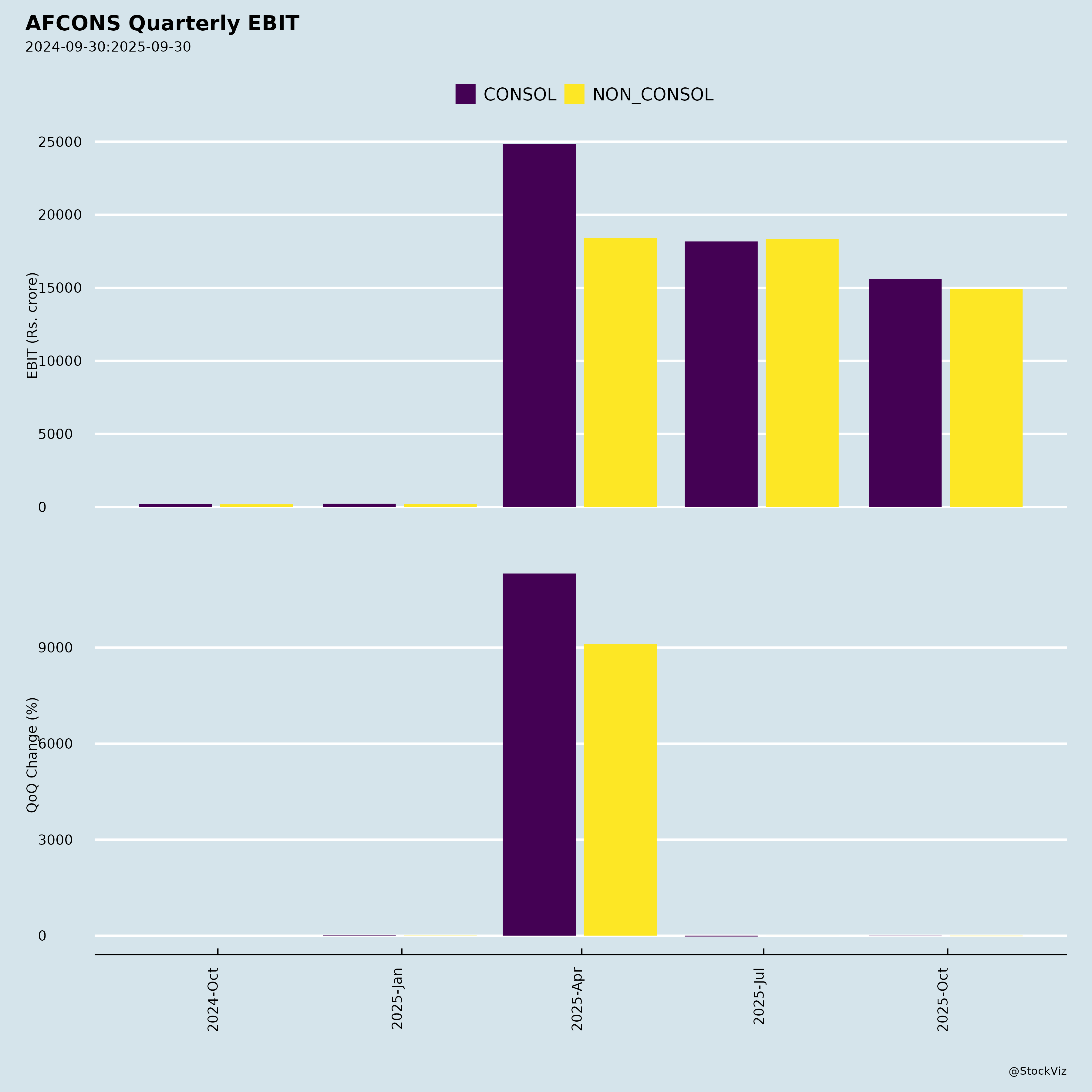

D. Robust Financial Health & Leverage Management

- Net Debt/Equity (H1 FY26): 0.5x – conservative balance sheet.

- ROCE (H1 FY26): 14.6% (annualized) → healthy capital efficiency.

- ROE (H1 FY26): 9.1% – shows improvement in returns.

- EBITDA Margin (H1 FY26): 13.0%, though slightly down QoQ (from 13.8% in Q1 FY25 to 12.9% in Q2 FY26).

- Cash Equivalents (Sep ’25): ₹375 Cr → sufficient liquidity despite negative cash flow from operations in H1.

Strong capital structure allows room for bidding on large projects without distress.

E. Strategic Equipment Base Enhancing Execution Edge

- Owns one of India’s largest in-house fleets:

- 17 Tunnel Boring Machines (TBMs) + 3 pending

- 14 Marine Barges, 8 Jack-ups, 145 Cranes

- Equipment valued at ₹4,294 Cr (Sep ’25).

- In-house workshops in Delhi & Nagpur for maintenance & innovation.

Reduces subcontractor dependence, ensures project continuity, and improves cost control.

F. ESG & Sustainability Focus

- Environmental:

- 19.5% water recycled

- 24% reduction in energy intensity (FY24–25)

- 51% of FY25 revenue from “green” projects (e.g., metro, irrigation, waste management)

- Social:

- ₹2.84 Cr CSR spend (FY25), impacting 14,637 beneficiaries

- Livelihood, water access, and education initiatives

- Awards: ‘Green Commercial Project’ (Delhi Metro), multiple safety & innovation awards.

Aligns with global ESG trends, enhances brand value, and attracts institutional investors.

3. Headwinds & Execution Challenges

A. Marginal Decline in Margins (Q2 FY26)

- Q2 FY26 EBITDA margin dropped to 12.9% (from 13.8% in Q2 FY25).

- PAT margin at 3.4%, down from 4.4% YoY.

- Contributing factors:

- Higher input costs (steel, cement, fuel)

- Project execution delays (working capital pressure)

- One-time cost pressures in marine and tunneling projects

Suggests margin pressure despite strong order inflow; requires focus on cost optimization.

B. Negative Cash Flow from Operations (H1 FY26)

- Cash flow from operations: ₹-488 Cr (vs. ₹-669 Cr net cash outflow).

- Driven by:

- Increase in working capital (₹-1,441 Cr)

- Rise in trade receivables and contract assets

- Timing of milestone billing and client payments

While common in EPC, prolonged negative FCFF could strain liquidity. Monitoring is key.

C. Execution & Project Risks in Large/Overseas Projects

- Many mega-projects in challenging terrains (e.g., Chenab, Atal Tunnel, MAHSR).

- International exposure brings risks:

- Political instability (e.g., Yemen, West Africa)

- Foreign exchange volatility

- Delayed payments, contract disputes

Though Afcons has strong risk management framework, delays or arbitration can impact near-term PAT.

D. High Dependence on Government & PSU Clients

- 79% of clients: Government (including NHAI, DMRC, Metro Corporations)

- While stable, it implies:

- Payment delays and bureaucratic hurdles

- Sensitivity to government policy shifts and capex cycle

- Private sector exposure is low (12%)

Revenues tied to public infrastructure spending – vulnerable to budget slippage or delays.

4. Governance & Strategic Moves

Positive Developments

- Employee Stock Option Plan (ESOP) 2025 Approved for both parent and subsidiaries/associates:

- Enhances employee retention in high-skilled sector.

- Improves alignment with shareholder interests.

- Leadership continuity:

- Key promotions and revised remuneration for MD (Srinivasan Paramasivan) and Executive Chairman (Subramanian Krishnamurthy) through ESOPs.

- New Independent Director (Santosh Balachandran Nayar) added with strong financial background.

Strong board oversight, strategic governance focus, and talent development through Afcons Talent Academy.

Knowledge & Innovation Strength

- Only Indian infra firm to win MIKE Award 7 times in a row.

- Chief Knowledge Officer (CKO) role → institutionalizes learning.

- Project lifecycle focused training with ~360,000 man-hours/year.

- Innovation in tunneling, lean construction, and remote monitoring.

Reduces rework, improves safety and execution efficiency – a true differentiator.

5. Growth Prospects (Medium to Long Term)

| Segment | Growth Opportunity |

|---|---|

| Metro Rail & Urban Transit | Major participant in Delhi Metro Phase IV, Bengaluru Metro, CMRL, Nagpur Metro, Mumbai Trans Harbour. Urbanization + govt. push on metro expansion = long runway. |

| High-Speed Rail (MAHSR) | C2 Tunnel Package (undersea) – landmark project; sets stage for future HSR bids. |

| Rural Water & Irrigation | Multiple UP projects – government focus on water security presents opportunity. |

| Overseas Expansion | Africa & Middle East demand for ports, water, roads. Afcons well-positioned to win more mandates. |

| Private Sector EPC (Emerging) | Greenfield industrial corridors, logistics parks (e.g., PM Gati Shakti). New revenue stream. |

Outlook: Afcons is transitioning from a regional contractor to a global EPC leader with technological edge.

6. Key Risks

| Risk Type | Assessment |

|---|---|

| Margin Pressure | Moderate-High |

| Working Capital Strain | High |

| Execution Delays | Medium |

| Overseas Risk | Medium |

| Dependence on Top Executives | Medium |

| Litigation/Disputes | Low-Medium |

| Government Capex Cyclicality | High |

7. Conclusion: Investment Thesis

✅ Bull Case

- Afcons is leveraging its technical edge in complex EPC projects.

- Order book visibility, strong balance sheet, and leadership in key niches (tunnels, marine, bridges) support long-term growth.

- ESG focus and international presence open new markets and premium contracts.

- Governance improvements and ESOPs enhance stakeholder alignment.

⚠️ Caution Areas

- Margins under pressure; need for execution discipline.

- Cash flow management critical for sustainable growth.

- Market perception still that of a mid-cap constructor; valuation premiums require consistent PAT growth.

Final Summary Table

| Factor | Assessment |

|---|---|

| Financial Strength | Strong (0.5x Debt/Equity, ROCE 14.6%) |

| Growth Visibility | High (₹32,681 Cr order book, 2.5x B/B ratio) |

| Margin Trajectory | Stable to Improving (monitor Q3/Q4 recovery) |

| Cash Flow Health | Under Pressure (working capital build-up) |

| Competitive Edge | Exceptional in tunneling, marine, extreme engineering |

| Governance | Strong board, strategic ESOPs, knowledge-led culture |

| Risk Profile | Medium (government dependency, execution complexity) |

| Growth Outlook | Positive over 3–5 years |

Recommendation: Favorable for Long-Term Buy (Hold for Growth)

Afcons is a high-potential infrastructure play with differentiated capabilities in technologically demanding projects. Investors should monitor margin recovery, cash flow management, and execution cadence over the next few quarters. The stock offers asymmetric upside if it successfully monetizes its order book efficiently and scales international operations.

Ideal Investor Profile: Long-term focused, ESG-conscious, accepts moderate cyclicality in infrastructure returns.

Contact for Further Info:

Naresh Sharma – Corporate Communications

Email: naresh.sharma@afcons.com

Investor Relations: Drisha Poddar – investor.relations@afcons.com

Website: www.afcons.com

Copyright © 2023 SAS Data Analytics Pvt. Ltd. All rights reserved.