5PAISA

Equity Metrics

January 13, 2026

5Paisa Capital Limited

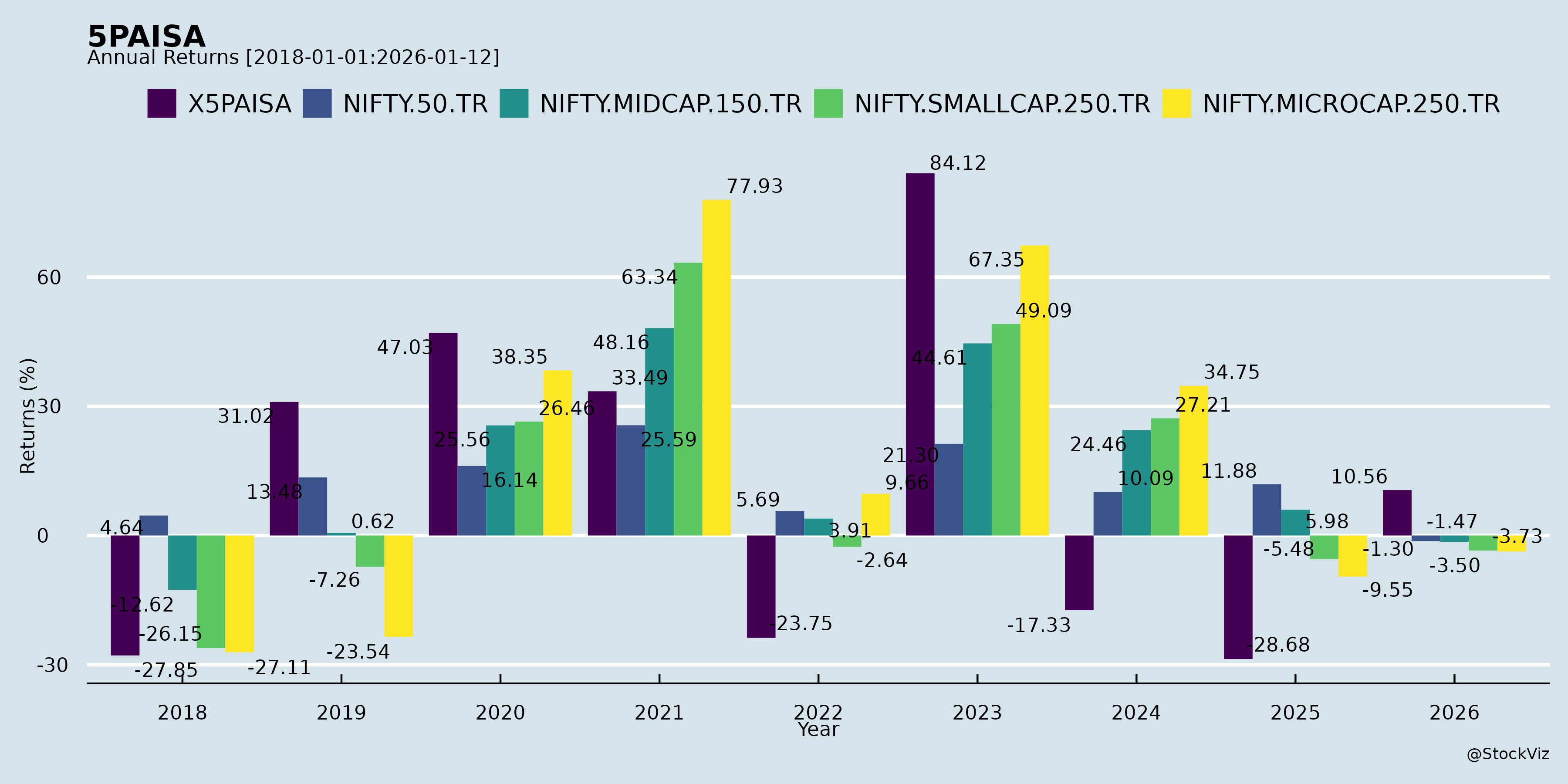

Annual Returns

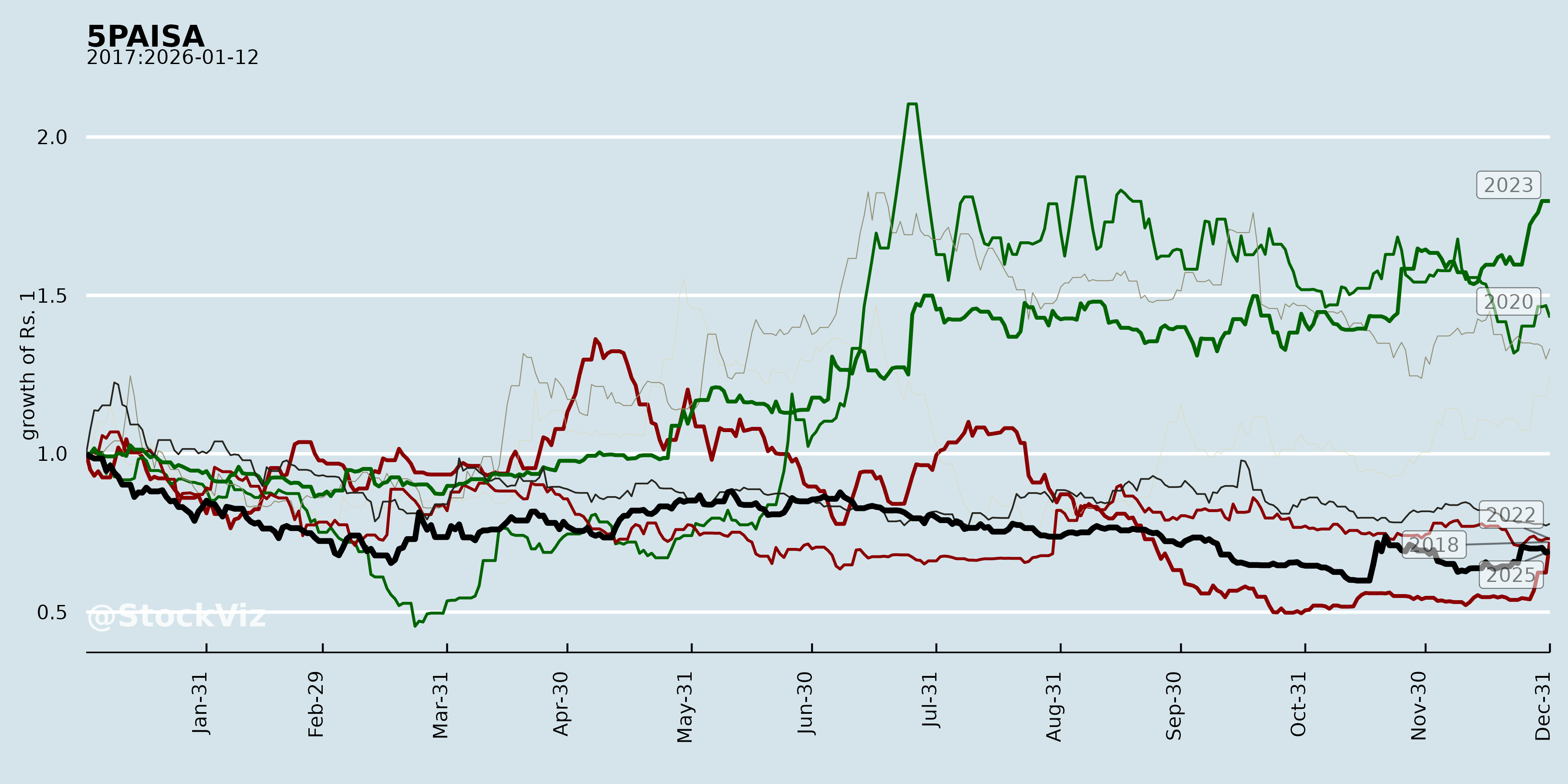

Cumulative Returns and Drawdowns

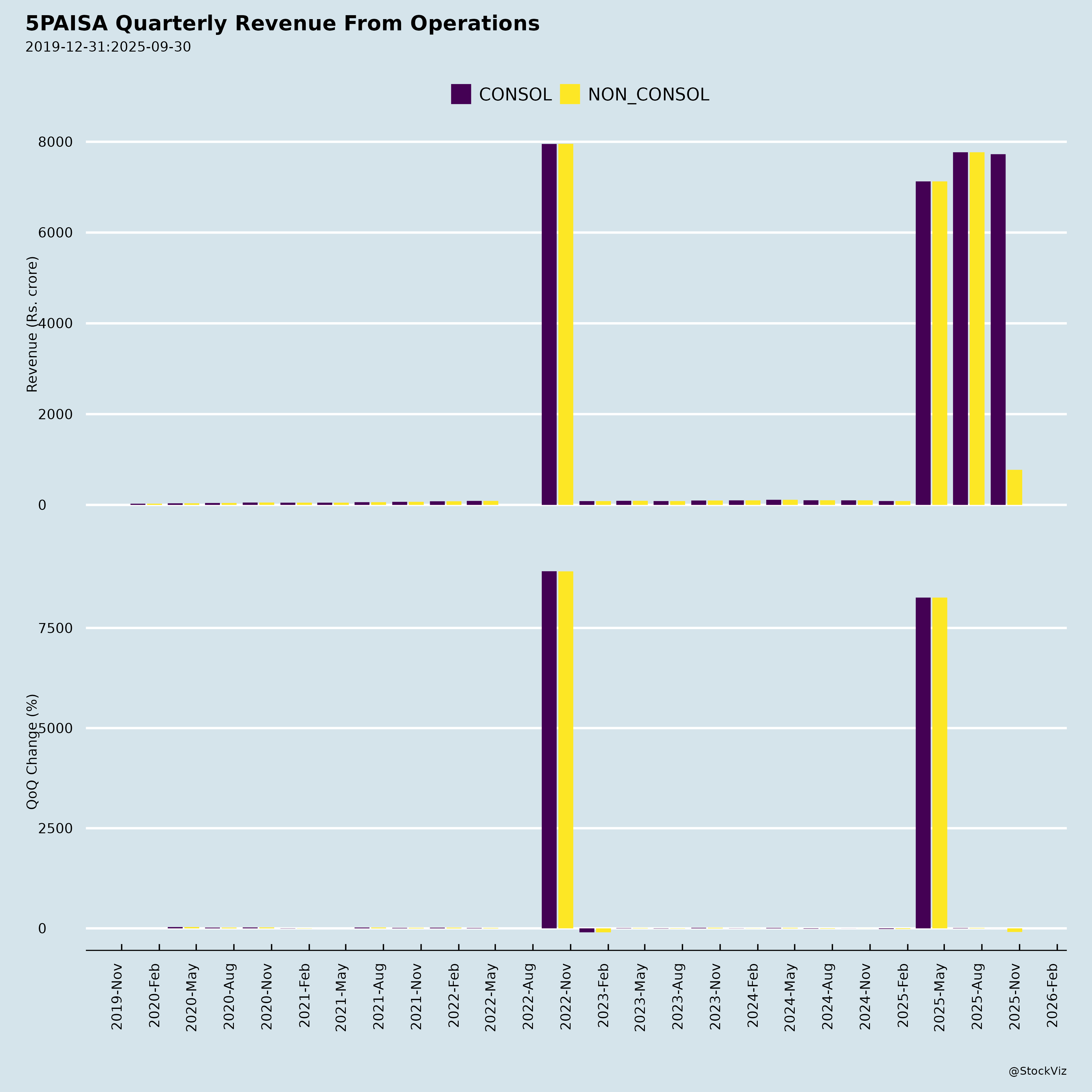

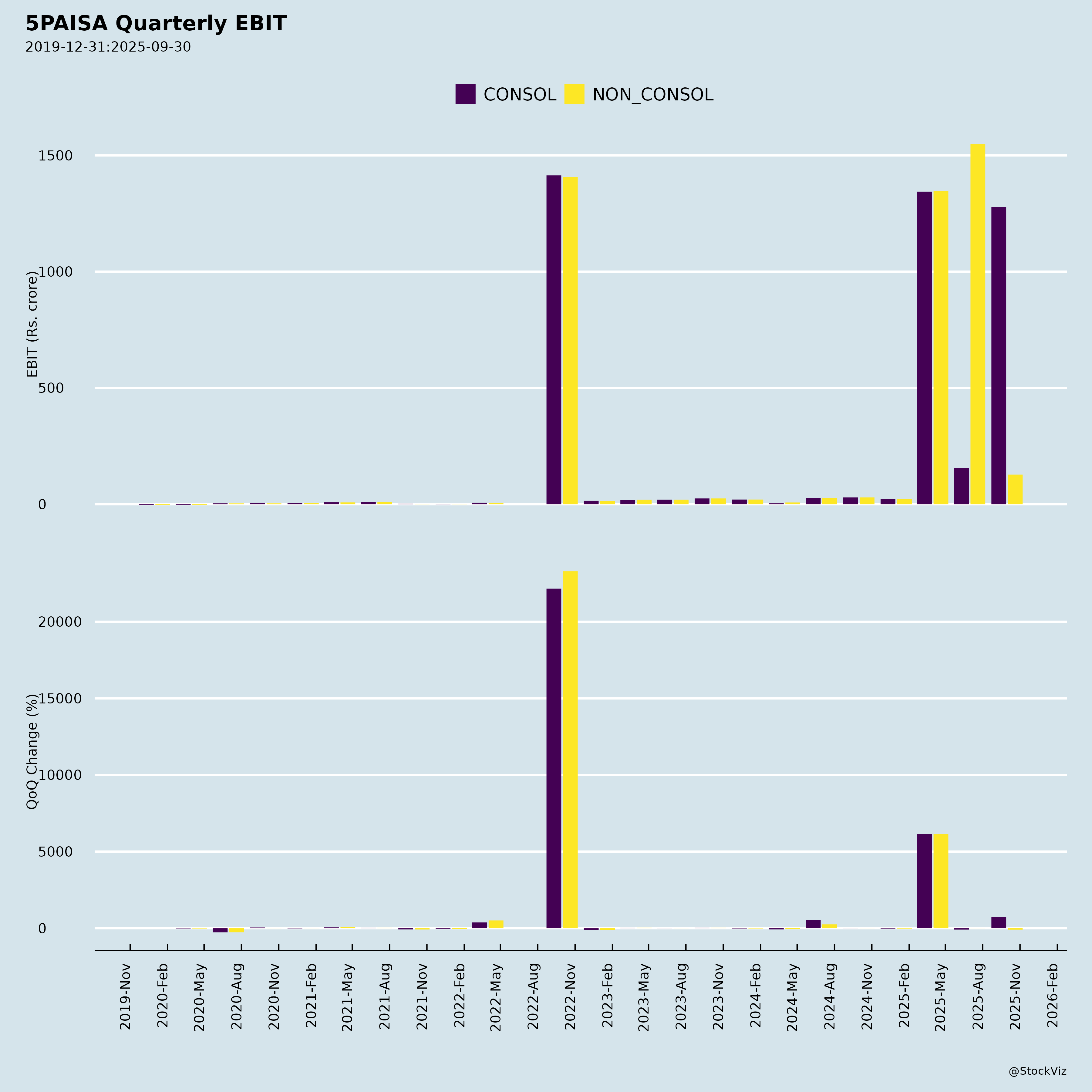

Fundamentals

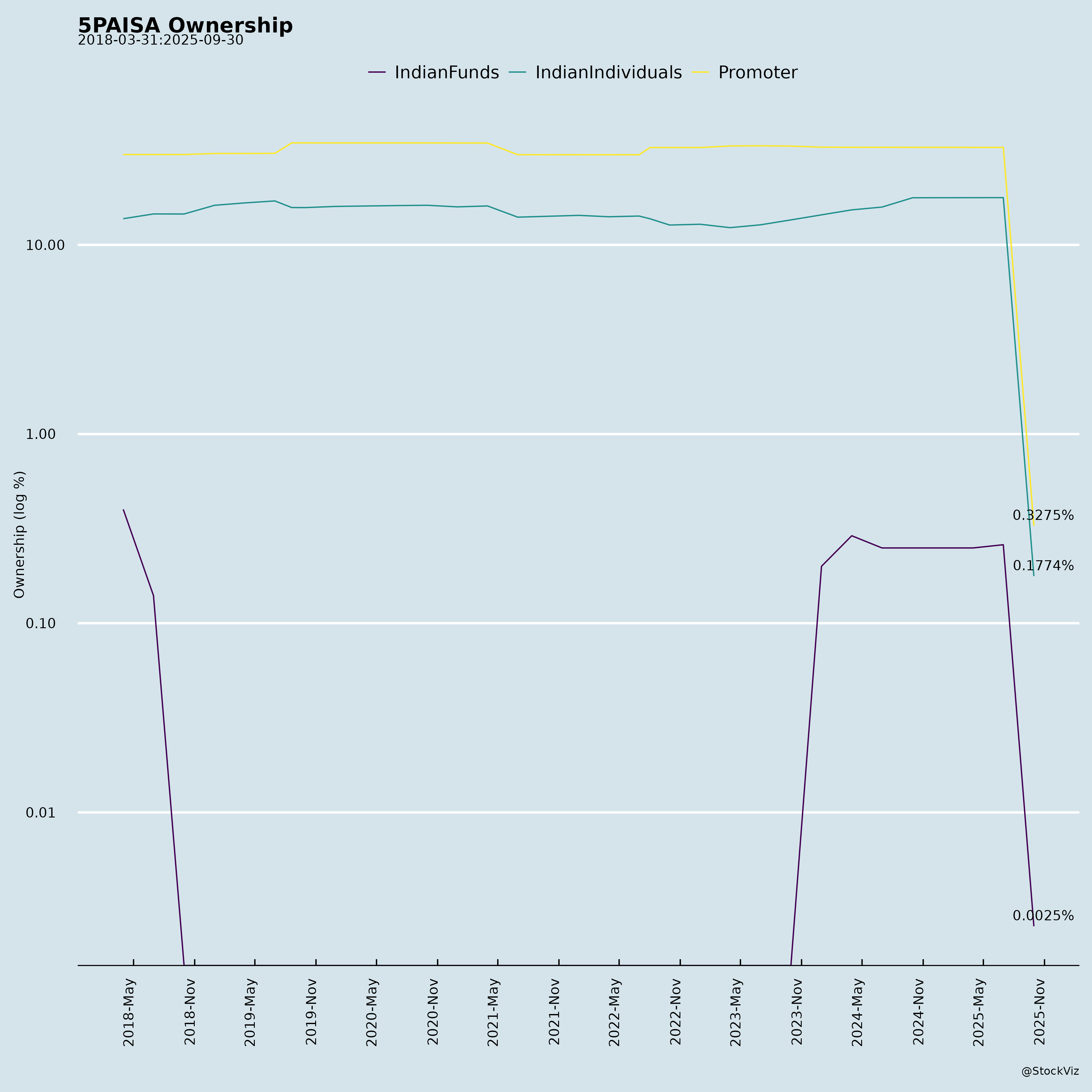

Ownership

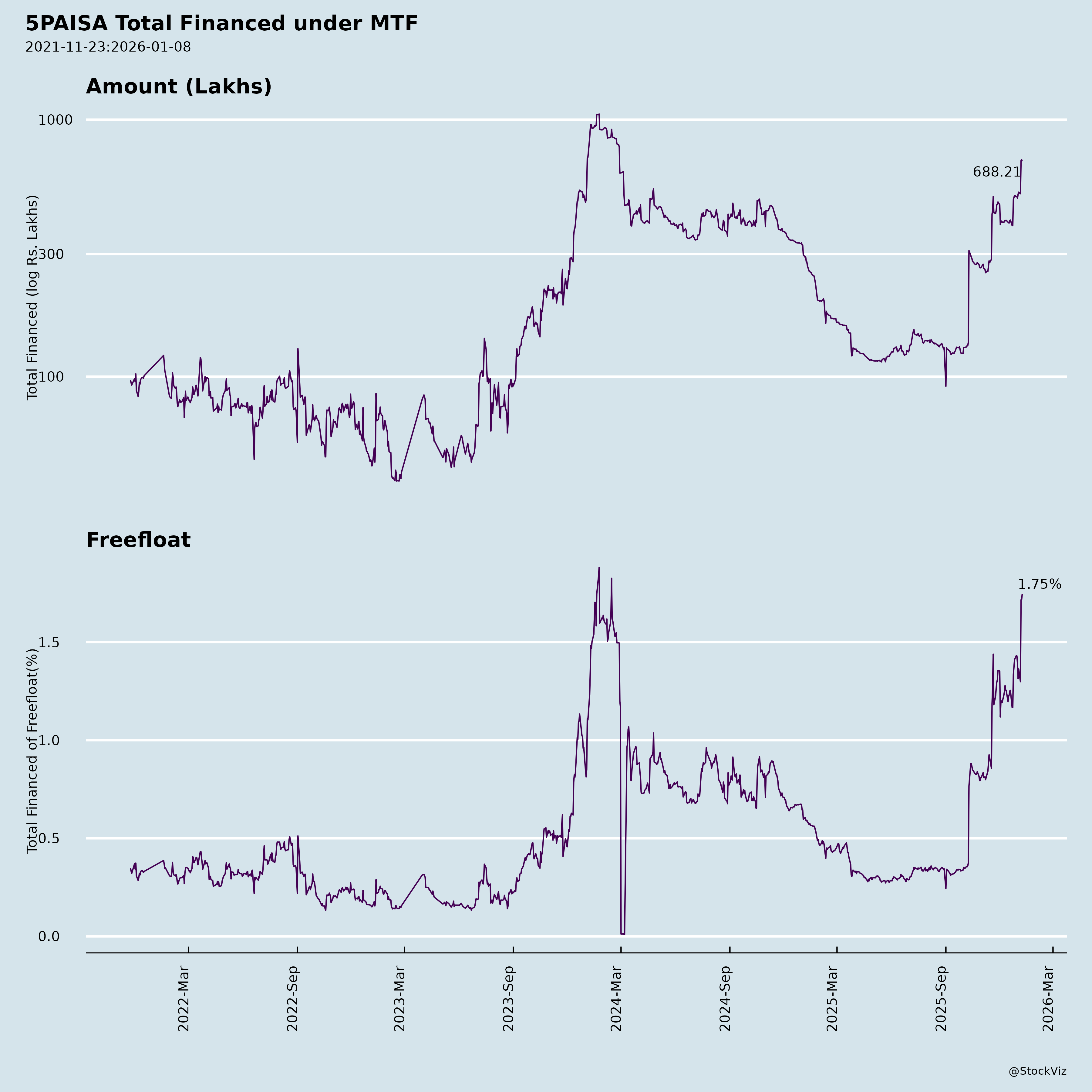

Margined

AI Summary

asof: 2025-11-27

Analysis of 5paisa Capital Limited (5PAISA) – Headwinds, Tailwinds, Growth Prospects, and Key Risks

Overview: 5paisa Capital Ltd., a discount brokerage focused on tech-driven DIY trading/investing, reported Q2 FY26 (Sep 2025) consolidated revenue of ₹77.3 Cr (down 1% QoQ, 23% YoY) and PAT of ₹9.5 Cr (down 18% QoQ, 57% YoY). Customer base hit 50.1 lakh (+95k QoQ), ADTO rose 18% QoQ to ₹2.68 Tn, amid volatile markets (industry cash ADTO -16.7% QoQ, F&O -13.6%). MTF book grew 17% QoQ to ₹364 Cr avg. Net worth: ₹626 Cr. Key filings highlight regulatory penalties, product launches, and board changes.

Headwinds (Challenges Pressuring Performance)

- Market Volatility & Volume Decline: FII outflows ($10B+), geopolitical tensions led to industry ADTO drop; company’s brokerage income fell 2% QoQ/-27% YoY. Revenue flat QoQ despite efforts.

- Client Dormancy/Churn: Industry active clients ~25% of 207 Mn demat accounts; 5paisa’s active base stable but orders down ~10 lakh QoQ due to volatility/no quick gains.

- Regulatory Scrutiny: ₹3L SEBI penalty (jointly with ex-directors) for OBPP non-compliances; IT search (Jan 2025) with notice under Sec 158BC (impact undetermined); SEBI show-cause on expired RA license.

- Rising Costs: Expenses up 4% QoQ (marketing, finance costs from MTF); repo rate cut hit other income (-₹2-2.5 Cr).

- Hyper-Competition: Cluttered space (Zerodha, Groww, Angel, Dhan 20x larger); pricing wars limit differentiation.

Tailwinds (Supportive Factors)

- Efficient Acquisition: +20% QoQ new clients (95k); CAC down 15% (₹700-715), FYR up 25% (₹1k-1.2k), 7-8 month payback (best-in-class). DIY: 89.2%.

- MTF Momentum: Income +22% QoQ; avg book +17% to ₹364 Cr; expansions (1,200+ scrips, “Pay Later”, 0.026% rates).

- Product/Tech Edge: Launches (Scalper web platform, ETF dashboard, Strategy Analyzer, Alpha Scan, UPI); app 4.2 stars (22.7 Mn installs), CSAT 94%, FTR above industry.

- Diversification: MF AUM +4.7% QoQ (₹1,647 Cr); strong net worth (50%+ of client funds).

- Governance Boost: New AI-expert Independent Director (Zor Gorelov); committee reconstitutions.

Growth Prospects

- Customer Scale/Monetization: 5 Mn+ base; focus on power users (F&O, algos, MTF); ARPU ~₹8-9k (broking + other); H2 FY26 expected better (execution + market recovery).

- Industry Tailwinds: Demat accounts +14.6 Mn H1 FY26; retail/DII ownership rising (20.2% market); F&O ADTO 82% 5-yr CAGR; MTF industry >₹1L Cr.

- Tech/AI Leverage: APIs, algo marketplace, Xstream AI; 33% workforce in tech; Flutter migration, cloud infra.

- Wallet Share Expansion: MF/ETFs/SIPs, global access; FYR decay modeled but LTV focus.

- Outlook: No formal guidance; execution on awareness/product to capture share in ₹3.8 Tn peak ADTO era.

Key Risks

| Risk Category | Details | Potential Impact |

|---|---|---|

| Market/Volume | High beta to equity volumes/sentiment; FII flows, volatility. | Revenue/PAT volatility (e.g., Q2 PAT -57% YoY). |

| Regulatory | SEBI/IT probes, penalties (₹3L recent); RA license lapse; OBPP issues. | Fines, restrictions, undetermined tax liability. |

| Competition/Retention | Top players dominate; dormancy (frenzy entrants churn); ARPU decay (~40% Y2). | Market share erosion; CAC sustainability. |

| Operational | Tech downtime (minimal noted), cyber risks (ISO 27001 certified). | Customer loss in speed-critical trading. |

| Financial | Leverage (MTF/debt ₹29L Cr); rate sensitivity (repo cuts). | Margins squeeze (PAT 12%, cost-income 83%). |

| Execution | Acquisition quality, product roadmap delays; no forward guidance. | H2 miss if markets subdued. |

Overall Summary: 5paisa shows resilience (customer/ADTO growth, tech focus) amid headwinds (volumes, regs), positioning for tailwinds in retail boom. Growth hinges on execution in competitive space; risks tilted regulatory/market. PAT margins resilient (12-15%) but scale needed vs. peers. Positive: Efficient ops, MTF traction; outlook cautiously optimistic for FY26 H2. Investors monitor Q3 volumes, reg resolutions.

Copyright © 2023 SAS Data Analytics Pvt. Ltd. All rights reserved.