VISASTEEL

Equity Metrics

January 13, 2026

Visa Steel Limited

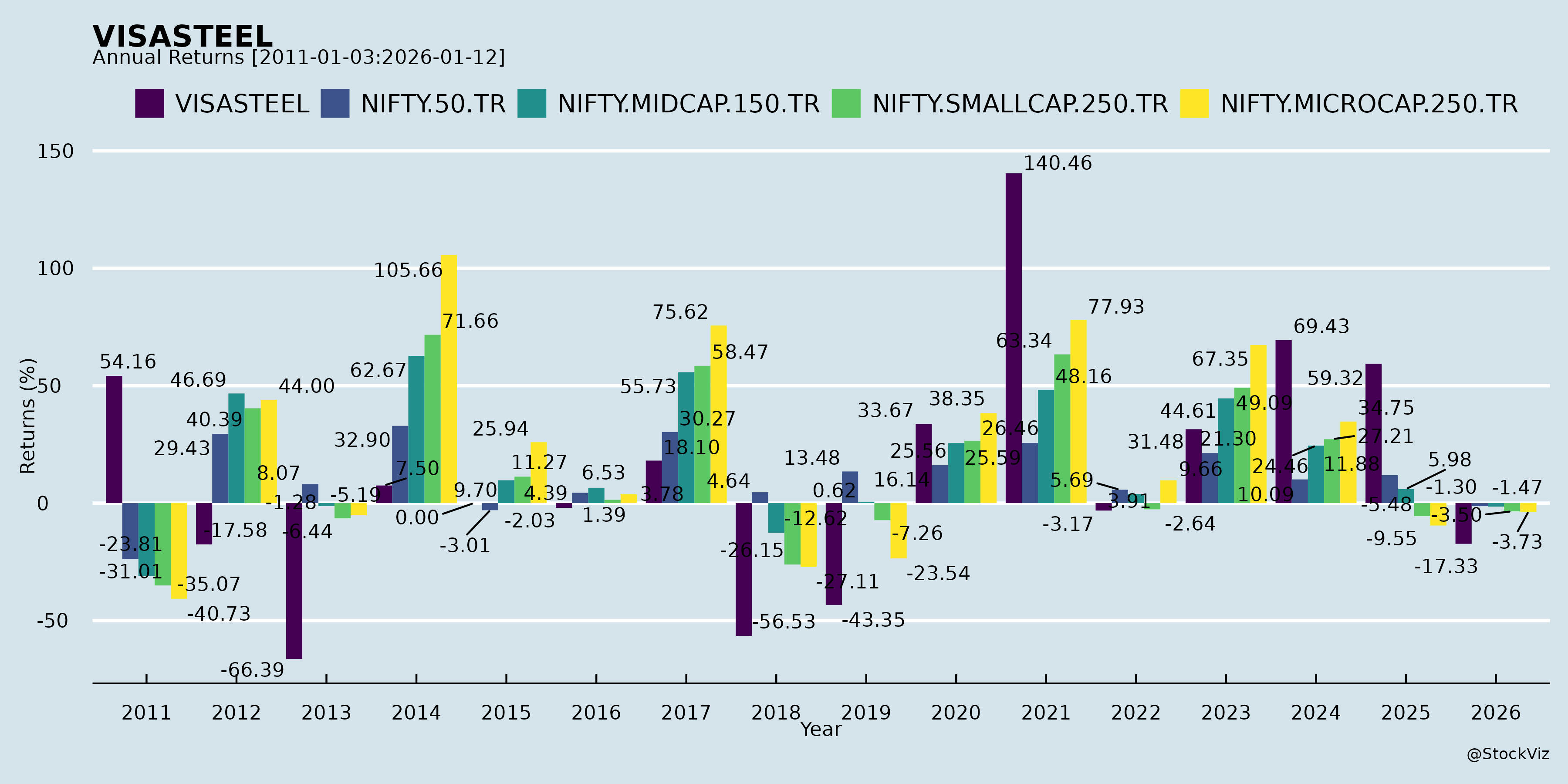

Annual Returns

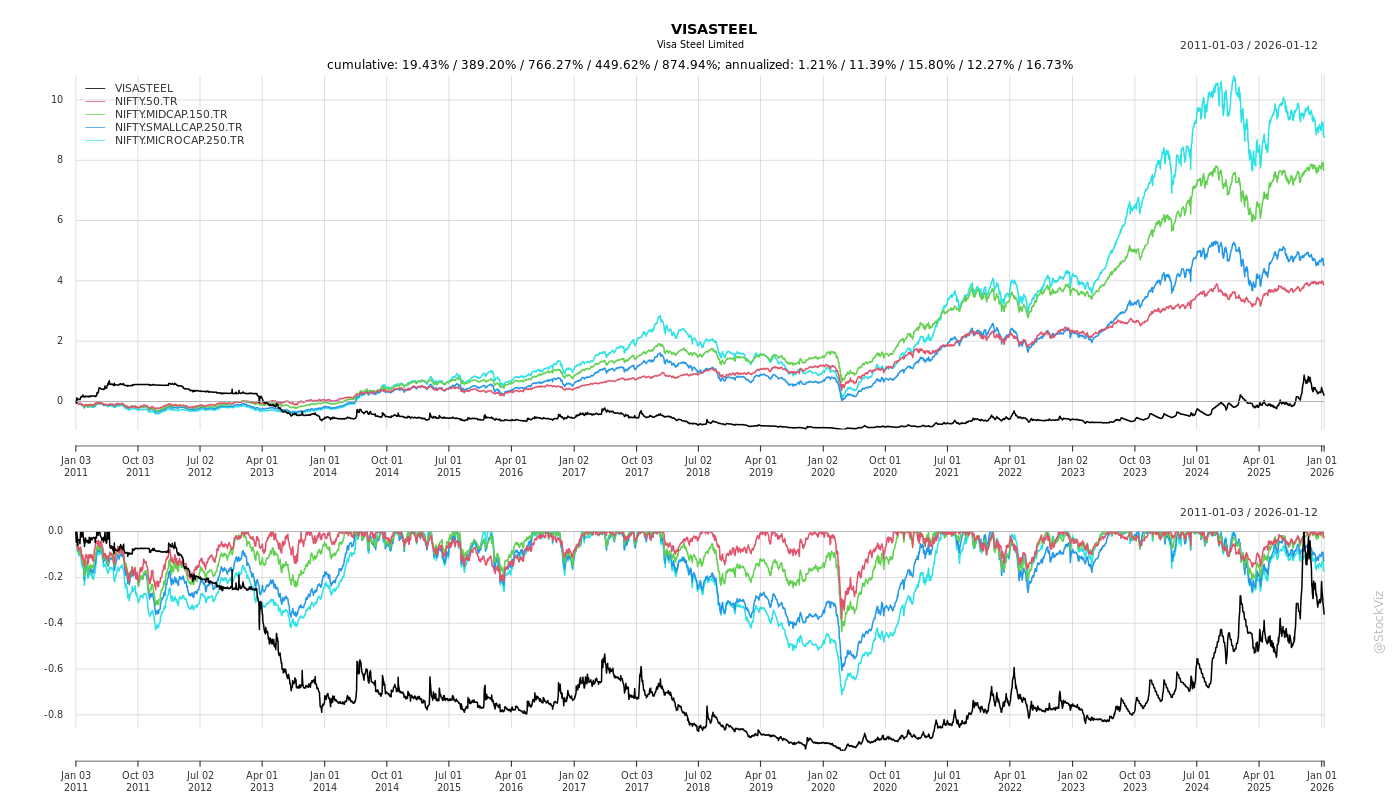

Cumulative Returns and Drawdowns

Fundamentals

Ownership

Margined

AI Summary

asof: 2025-11-27

Analysis of VISA Steel Ltd (VISASTEEL) – Headwinds, Tailwinds, Growth Prospects, and Key Risks

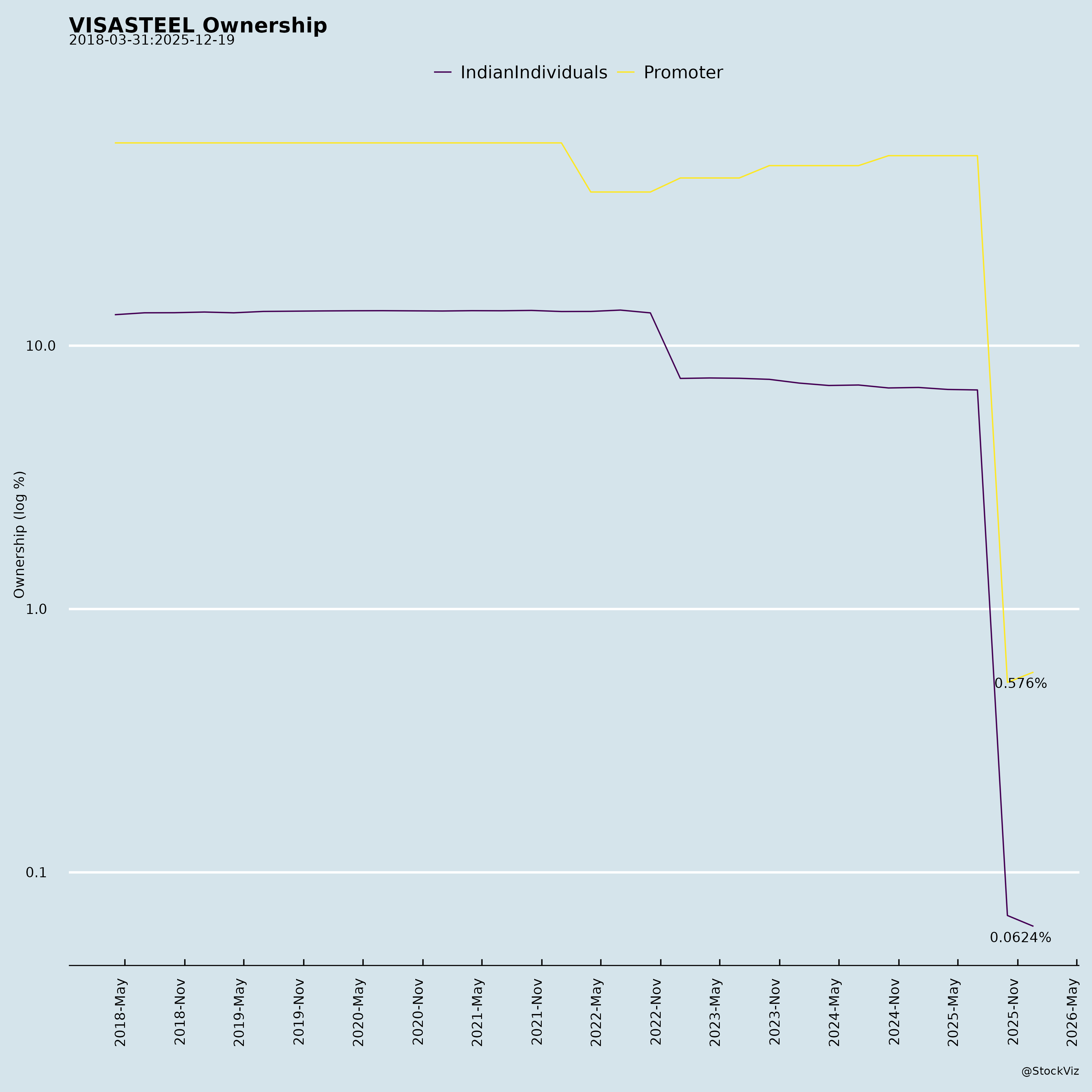

VISA Steel Ltd, a ferro alloys producer listed on BSE (532721) and NSE (VISASTEEL), faces significant financial distress but shows signs of promoter-led revival efforts as of late November 2025. The company allotted 5 crore convertible warrants (Rs. 200 Cr total, Rs. 50 Cr upfront) to promoter group entity VISA Industries Ltd on Nov 26, 2025, following shareholder approval. Q2/H1 FY26 results (ended Sep 30, 2025) reflect ongoing losses amid high debt, but operations have resumed post-regulatory clearance. Below is a structured summary:

Headwinds (Key Challenges)

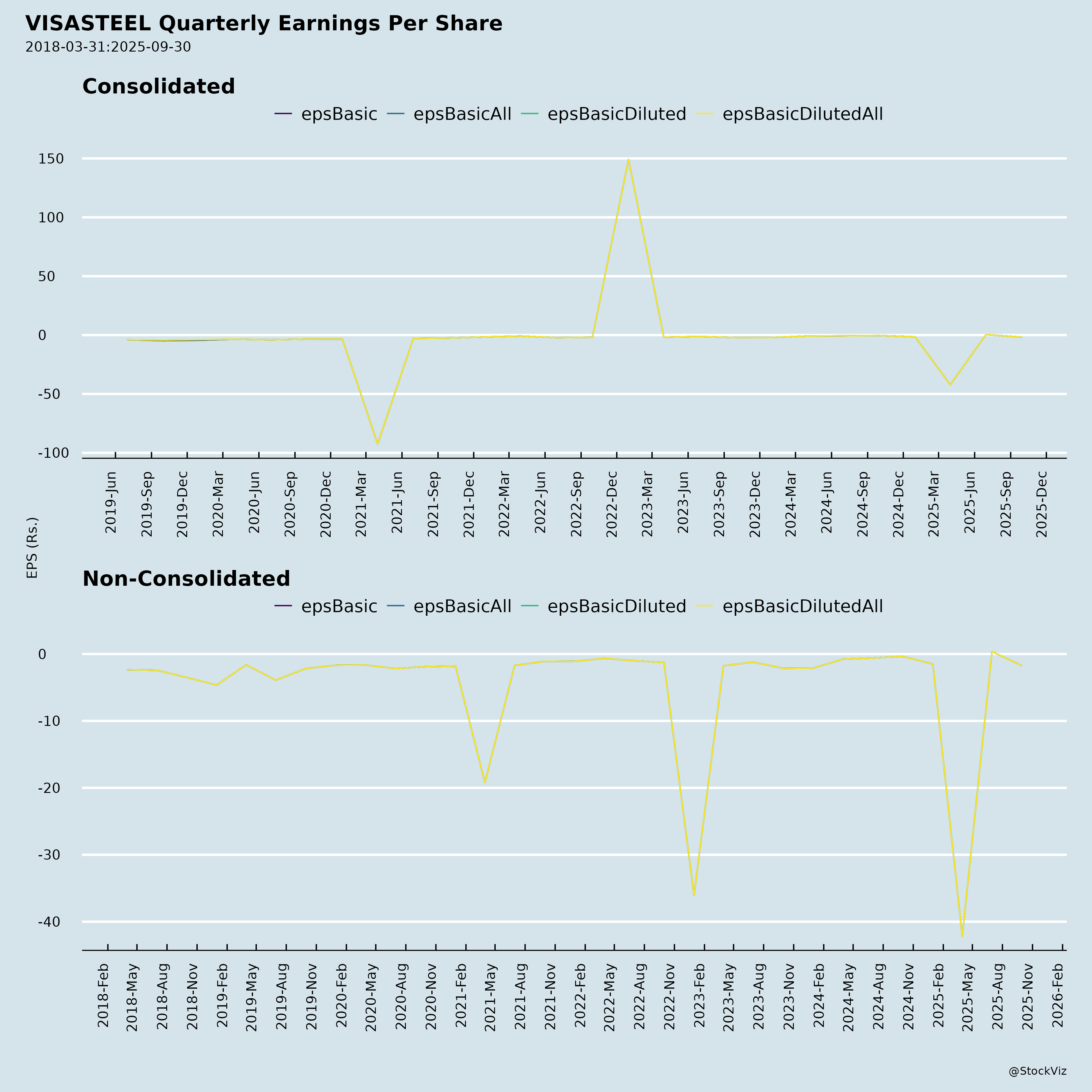

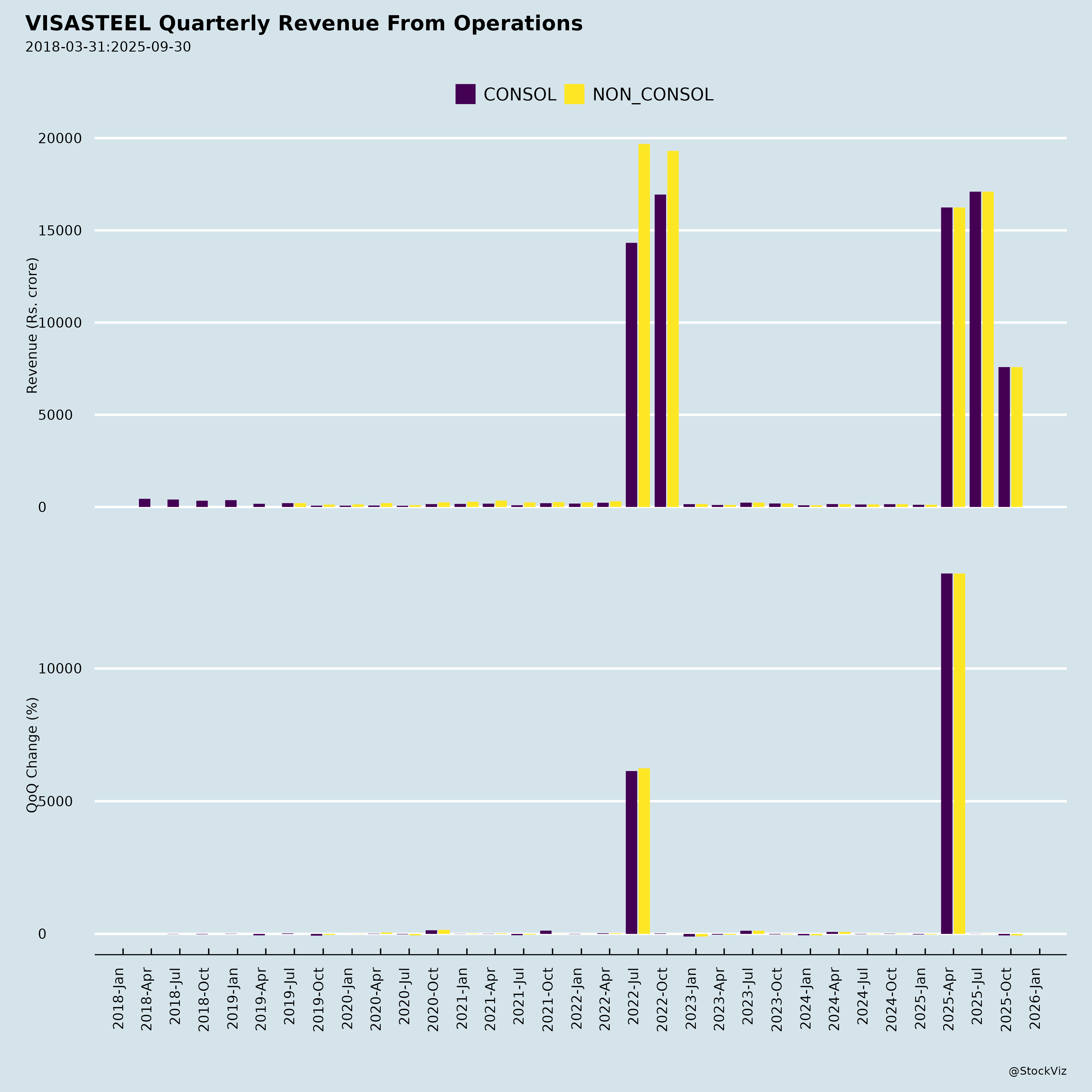

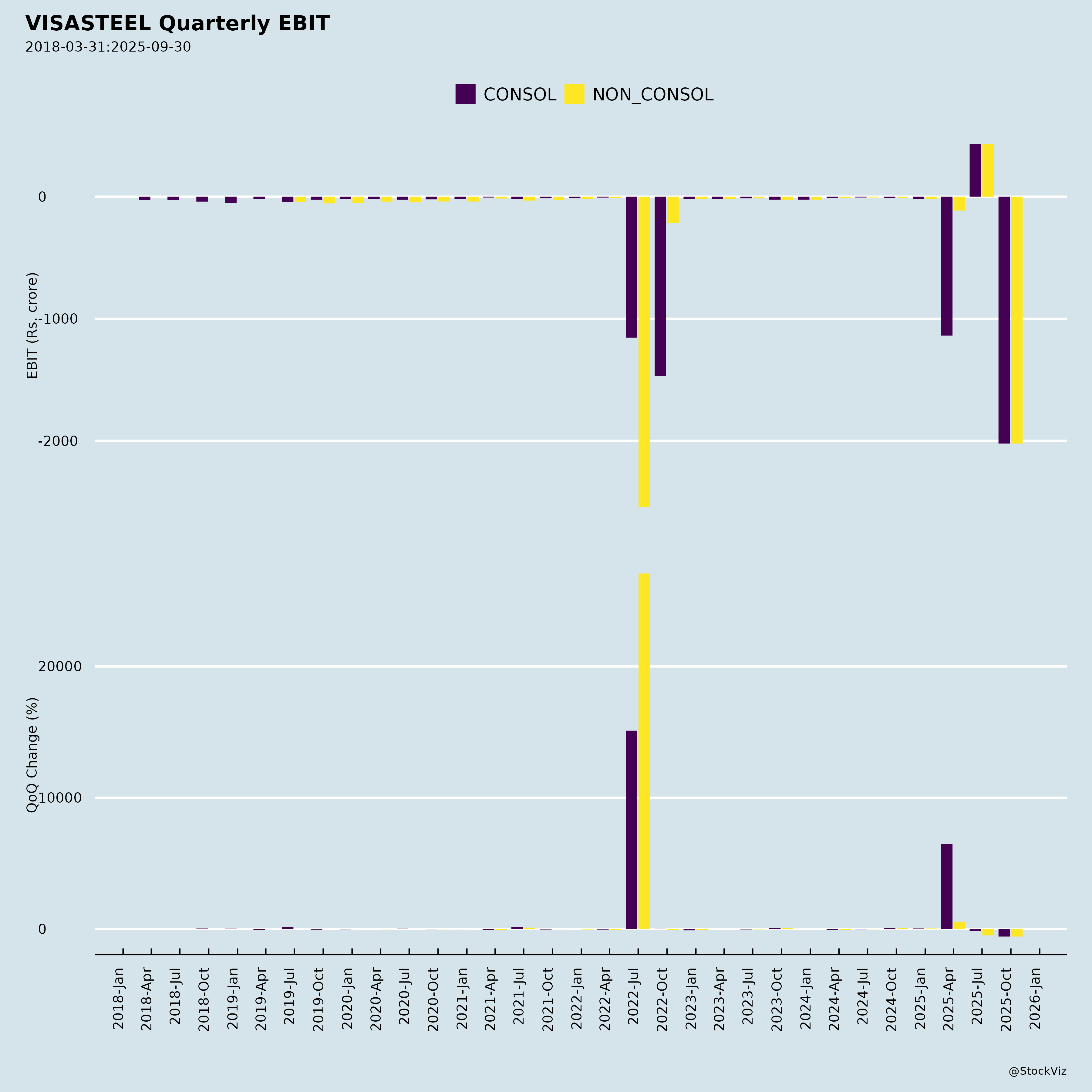

- Deep Financial Losses and Negative Net Worth: H1 FY26 standalone loss of Rs. 159 Cr (Q2: Rs. 202 Cr loss); other equity at -Rs. 14,926 Cr. Revenue declined sharply (Q2: Rs. 759 Cr vs. Rs. 1,709 Cr in Q1). Current liabilities (Rs. 18,695 Cr) far exceed current assets (Rs. 814 Cr).

- Massive Debt Burden: Borrowings ~Rs. 13,566 Cr (NPA since 2012). Auditors qualify reports for non-provision of interest (~Rs. 14,045 Cr accumulated, including Rs. 399 Cr for Q2), inflating reported profits/losses.

- Liquidity Crunch and Going Concern Doubt: Cash ~Rs. 1.6-2 Cr; operations historically limited by working capital shortages. Auditors highlight “material uncertainty” on going concern due to eroded net worth and debt overhang.

- Declining Operations: Revenue from ferro alloys under conversion arrangements (non-comparable); external factors like pollution controls halted production until Sep 2025.

Tailwinds (Positive Developments)

- Promoter Infusion and Debt Progress: Rs. 50 Cr upfront from warrants (potential Rs. 150 Cr more over 18 months); proceeds earmarked for debt repayment/general purposes. 96% debt assigned to ACRE; settlement discussions ongoing. NCLT withdrew CIRP (Sep 26, 2025), closing insolvency proceedings.

- Regulatory Clearance: Granted Consent to Operate (CTO) by Odisha SPCB (Sep 6, 2025), enabling operations resumption.

- Shareholder Backing: Special resolution for warrants passed overwhelmingly at EGM (Nov 2, 2025) with near-unanimous promoter/public support (total shares voted: ~9.07 Cr out of 11.58 Cr).

- Asset Base: PPE at Rs. 4,369 Cr (impaired but recoverable per mgmt.); single-segment ferro alloys focus aligns with steel cycle recovery.

Growth Prospects

- Debt Resolution Catalyst: Successful ACRE settlement could unlock working capital, normalize interest provisioning, and enable full operations. Funds from warrants (dilutive but supportive) target debt reduction, potentially improving liquidity and profitability.

- Operational Ramp-Up: Post-CTO resumption; H1 revenue Rs. 2,468 Cr shows baseline activity. Steel/ferro alloys demand (India’s infra push) could drive growth if capacity utilization rises from current low levels.

- Equity Expansion: Warrants convertible at Rs. 40 (premium to FY25 EPS of -Rs. 44.61); post-conversion, equity capital rises ~43% (to ~16.58 Cr shares), strengthening balance sheet for expansion.

- Short-Term Outlook: Mgmt. expects financial health improvement post-debt resolution; positive Q1 profit (Rs. 43 Cr) indicates potential quarterly variability/turnaround.

Key Risks

| Risk Category | Description | Potential Impact |

|---|---|---|

| Debt Restructuring Failure | ACRE settlement pending; no book adjustments yet. Failure could trigger fresh insolvency or higher interest claims (Rs. 14K+ Cr). | High – existential threat to going concern. |

| Dilution & Shareholder Value | 5 Cr warrants = ~43% dilution; issue price Rs. 40 vs. recent lows (stock trades at discount historically). | Medium – erodes EPS; promoter control strengthens (already dominant). |

| Accounting/Regulatory | Auditor qualifications on interest; past CIRP history. SPCB CTO could be revoked. | High – restatement risk; compliance costs. |

| Operational/Liquidity | Working capital shortages persist; forex/steel price volatility; low cash buffers. | High – hampers revenue growth. |

| Market/External | Ferro alloys cyclical; competition from imports; Odisha power/land issues. | Medium – sector headwinds. |

Overall Summary: VISA Steel is in a precarious turnaround phase – high risk, high reward. Tailwinds from promoter funding (Rs. 50 Cr in, more inbound) and debt progress provide breathing room, but headwinds dominate with negative equity, unprovisioned liabilities, and going concern flags. Growth hinges on ACRE deal closure and ops scaling; monitor Q3 results and warrant conversions. Investment Stance: Speculative/distressed play; suitable only for high-risk tolerance, with catalysts like debt waiver key. Current market cap likely low (vs. Rs. 11.58 Cr FV equity), implying undervaluation if revival succeeds.

Copyright © 2023 SAS Data Analytics Pvt. Ltd. All rights reserved.