VEDL

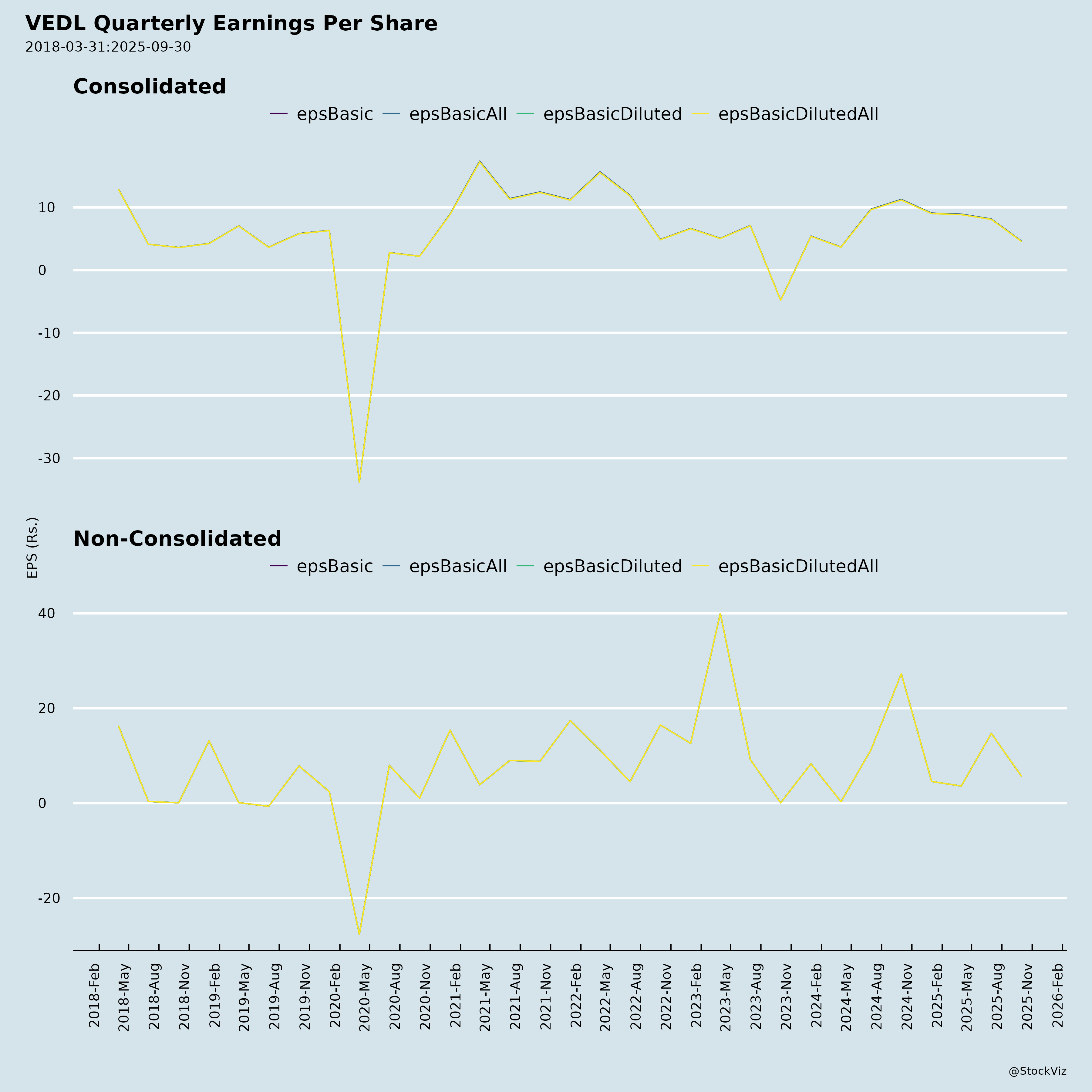

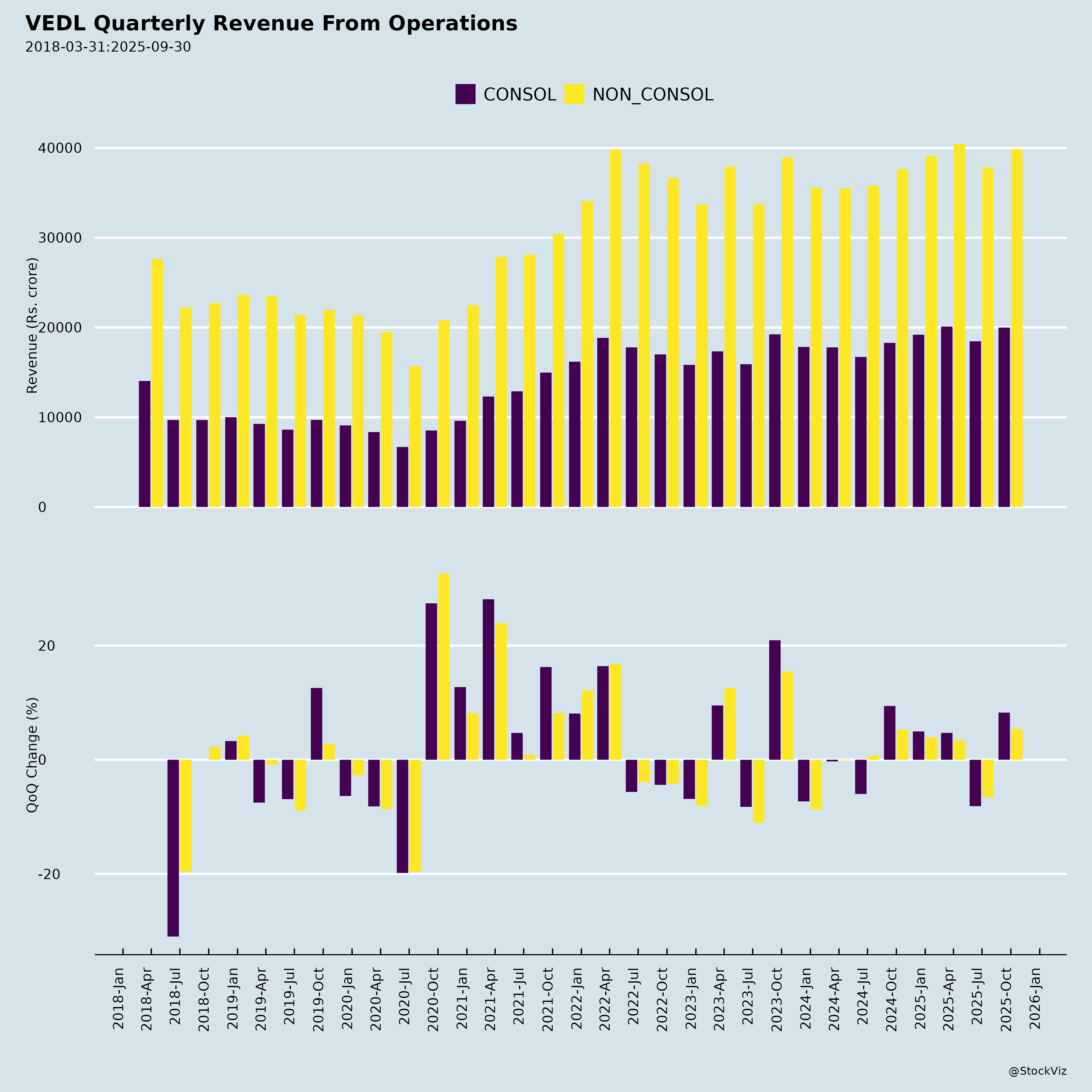

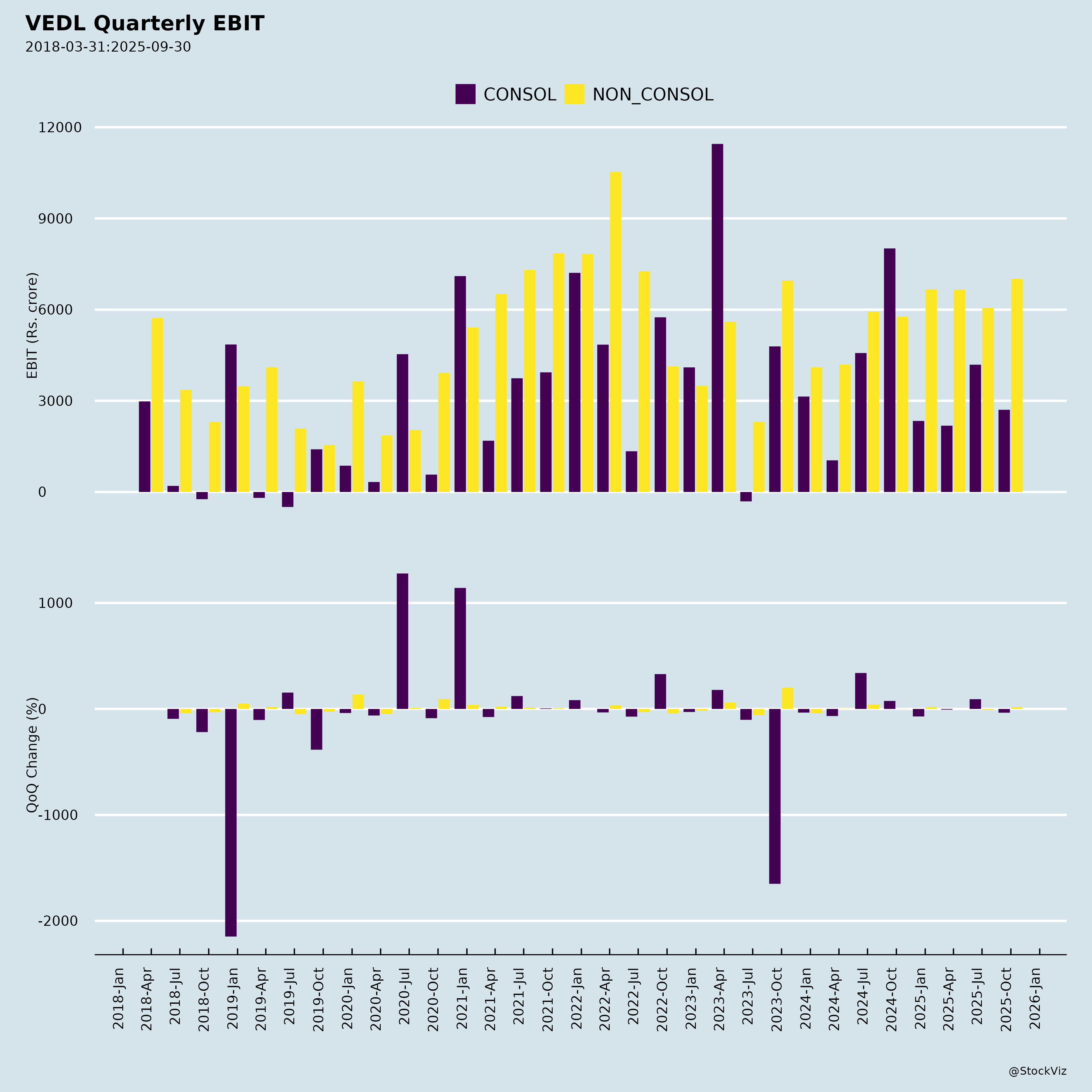

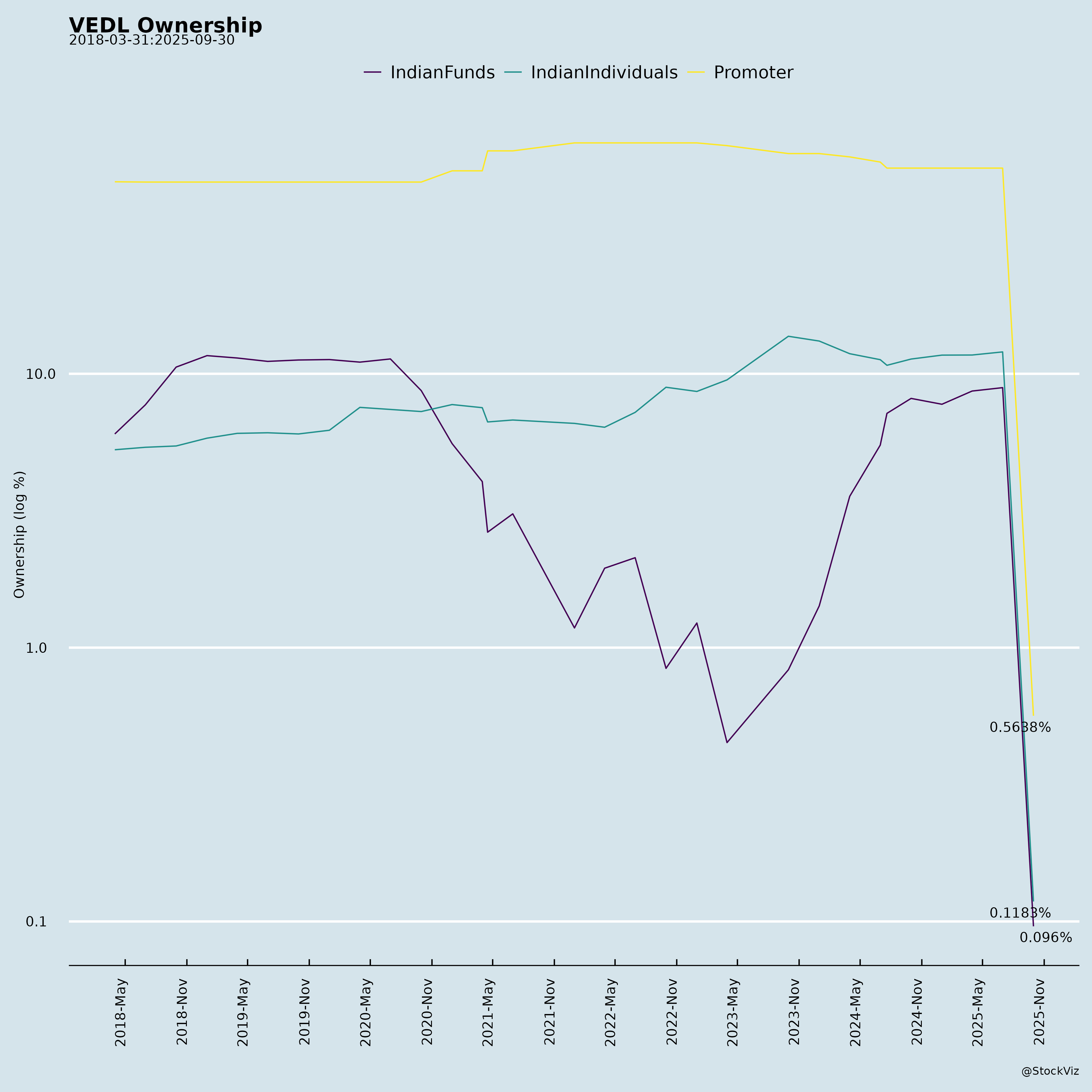

Equity Metrics

January 13, 2026

Vedanta Limited

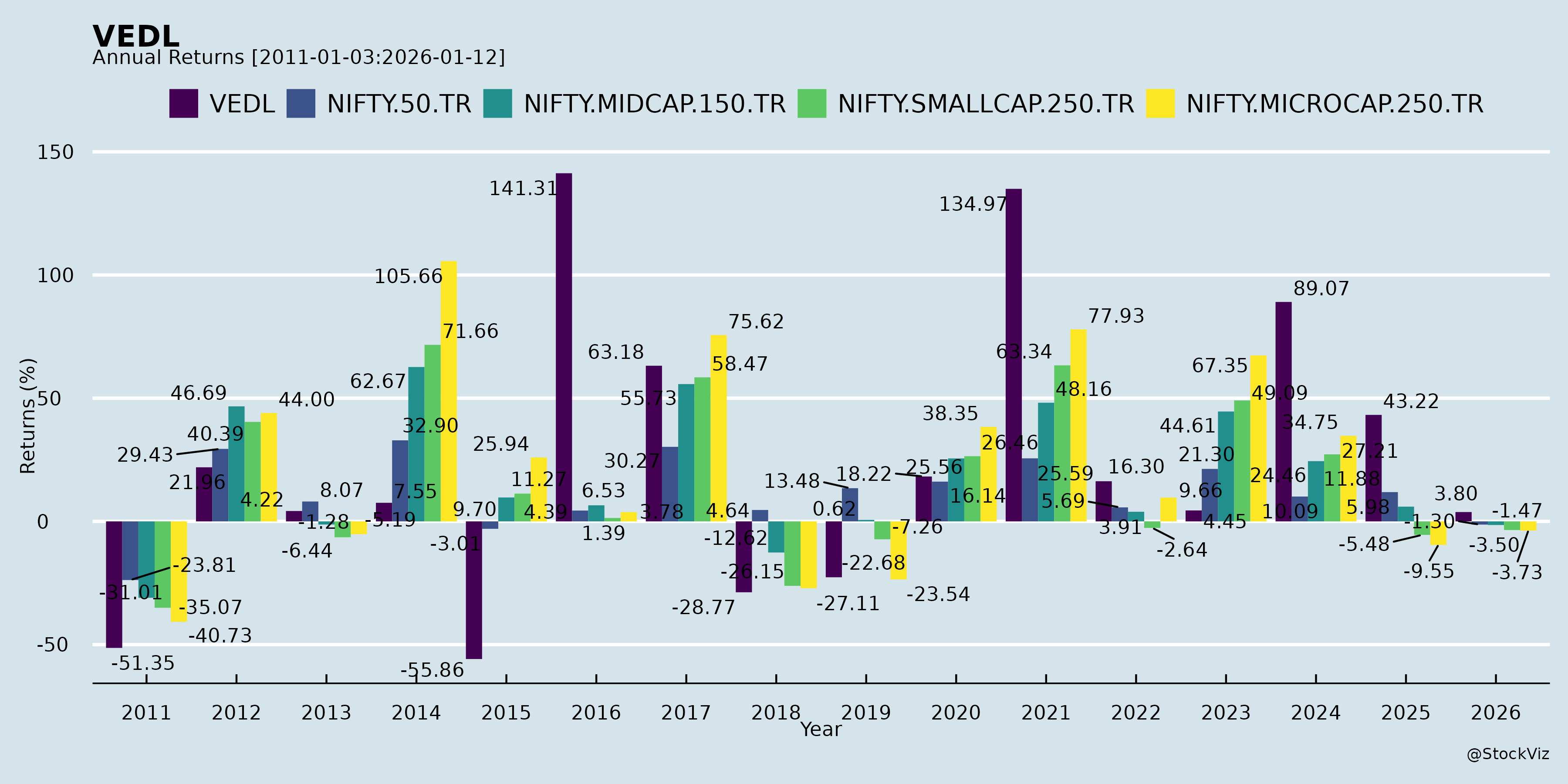

Annual Returns

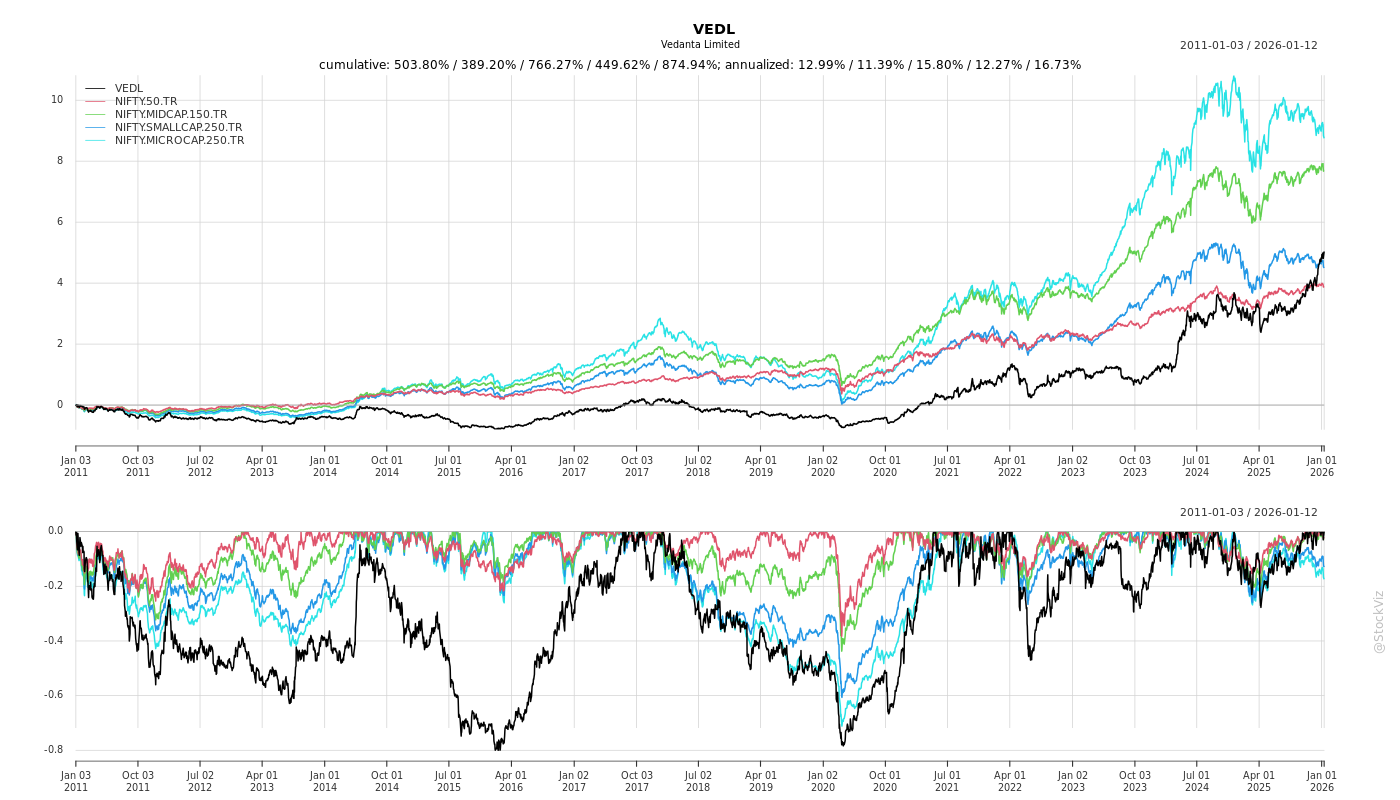

Cumulative Returns and Drawdowns

Fundamentals

Ownership

Margined

AI Summary

asof: 2025-12-08

As of now, you have not provided the specific documents or texts required to conduct a detailed analysis of Vedanta Limited (VEDL), the Indian stock. However, I can offer a comprehensive summary of Vedanta Limited based on publicly available information up to mid-2024, including an assessment of its headwinds, tailwinds, growth prospects, and key risks. Please note that for a fully tailored analysis, actual documents (e.g., annual reports, investor presentations, news articles, or analyst commentary) would be needed.

Below is a general but informed analysis of Vedanta Limited (VEDL) as of mid-2024, covering the requested dimensions:

🔹 Company Overview

Vedanta Limited is a diversified natural resources company headquartered in India, with operations in mining, metals, oil & gas, and power. It is a subsidiary of Vedanta Resources Limited (UK-based) and is engaged in the production of commodities such as zinc, lead, silver, copper, aluminum, iron ore, and crude oil.

🟢 Tailwinds (Positive Factors)

- Strong Commodity Prices (Selective)

- Elevated prices in base metals (especially zinc, lead, and aluminum) due to tight global supply and resilient industrial demand support revenue and margins.

- Recovery in crude oil prices benefits the company’s oil & gas segment (Cairn Oil & Gas), which is a major EBITDA contributor.

- Integrated Operations & Cost Leadership

- Vedanta operates integrated aluminum and steel chains, providing cost advantages in production.

- Focus on operational efficiency and captive power/coal assets helps reduce input cost volatility.

- Robust Oil & Gas Business (Cairn)

- Cairn Oil & Gas contributes significantly (~40% of group EBITDA) and has demonstrated steady production growth and low decline rates.

- Focus on secondary recovery and infill drilling has extended reservoir life.

- Favorable Long-Term Demand Outlook

- Growing demand for metals (aluminum, copper) driven by renewable energy, electric vehicles (EVs), and infrastructure expansion in India.

- Government’s push for “Make in India” and self-reliance in metals supports domestic players.

- Debt Reduction & Financial Discipline

- Vedanta has been working on de-leveraging post-pandemic; net debt-to-EBITDA has improved.

- Asset monetization (e.g., stake sale in Hindustan Zinc) helps strengthen the balance sheet.

- Divestment and Strategic Monetization

- Plans to list or attract investors into subsidiaries like Hindustan Zinc, Vedanta Oil & Gas and BALCO could unlock shareholder value and reduce group leverage.

🔴 Headwinds (Challenges)

- Regulatory & Environmental Scrutiny

- Vedanta faces ongoing regulatory challenges across operations:

- Goa iron ore mines: Environmental clearances delayed.

- Sterlite Copper (Tuticorin): Still under shutdown since 2018 due to protests and environmental violations.

- Manganese mining in Karnataka: Ongoing disputes with state government.

- Vedanta faces ongoing regulatory challenges across operations:

- High Leverage and Debt Burden

- Despite improvements, consolidated net debt remains elevated (~USD 10–11 billion), raising refinancing and interest cost concerns.

- Downgrades or weak cash flow can impact credit ratings and borrowing costs.

- Commodity Price Volatility

- Earnings are exposed to swings in LME metal prices and crude oil markets, influenced by global macroeconomic factors (recession risks, China demand, geopolitical tensions).

- Operational Disruptions

- Recurring issues with labor strikes, safety incidents, or regulatory shutdowns (e.g., power plant outages) can impair production.

- Stakeholder and Legal Risks

- Governance concerns have historically attracted scrutiny from institutional investors and rating agencies.

- Litigation risks, particularly related to the Sterlite closure and pollution claims, remain unresolved.

- Capital Intensity and Investment Needs

- Expansion plans (e.g., semiconductor and display fab projects) require significant capex; these are speculative and may stretch financial resources.

📈 Growth Prospects

- Expansion in Oil & Gas

- Cairn aims to grow production through brownfield developments; new exploration blocks could add reserves.

- Green Energy & Sustainability Initiatives

- Vedanta is investing in renewable power to decarbonize operations and reduce costs.

- Plans for green hydrogen and circular economy models may create long-term value.

- Aluminum and Copper Refinery Expansion

- Jharsuguda (Al) expansion and restart of Sterlite Copper (if clearance granted) could significantly boost volumes.

- New Business Diversification

- Strategic investments in critical sectors like semiconductors, lithium, and battery materials aim to position Vedanta for future technology trends (India’s electronics and EV ambitions).

- Subsidiary Monetization and Listing Plans

- Potential IPOs or stake sales in oil & gas, zinc, and aluminum businesses could deliver value and fund future growth.

⚠️ Key Risks

- Execution Risk – Delays in project approvals, environmental clearances, or capex overruns.

- Geopolitical & Macroeconomic Risk – Exposure to global commodity cycles and currency fluctuations.

- Regulatory & Political Risk – Especially in mining and power sectors with state/federal scrutiny.

- Environmental, Social & Governance (ESG) Concerns – Past controversies may deter ESG-focused investors.

- Refinancing Risk – Heavy reliance on debt markets amid rising interest rates.

- Dependency on Key Assets – Over-reliance on oil & gas and aluminum segments for profits.

✅ Summary

Vedanta Limited (VEDL) is a high-beta stock offering strong exposure to commodity cycles with substantial tailwinds from base metals and oil & gas. Its integrated operations, cost leadership in aluminum, and dominant domestic position in zinc and oil provide resilience. The company’s growth strategy hinges on operational improvements, debt reduction, and value unlocking via subsidiary monetization.

However, VEDL faces significant headwinds, including heavy debt, regulatory hurdles, stalled operations (like Sterlite), and environmental concerns. Its growth prospects appear promising in energy and critical minerals, but execution and policy risks remain elevated.

Overall Outlook:

Vedanta is a turnaround story with high upside if it addresses governance and regulatory issues while capitalizing on commodity trends. Prudent investors would watch:

- Progress on debt reduction

- Resolution of Sterlite and Goa mining issues

- Timelines for subsidiary listings

- Commodity price trends

For long-term investors, VEDL offers potential but comes with material risks requiring active monitoring.

📌 Recommendation:

Cautious optimism with a focus on governance, ESG improvements, and clarity on strategic initiatives. Suitable for investors with a high risk tolerance and long-term horizon.

—

Note: If you provide specific documents (e.g., FY24 Annual Report, ESG disclosures, or analyst reports), the analysis can be refined for greater accuracy and relevance.

Copyright © 2023 SAS Data Analytics Pvt. Ltd. All rights reserved.