TATASTEEL

Equity Metrics

January 13, 2026

Tata Steel Limited

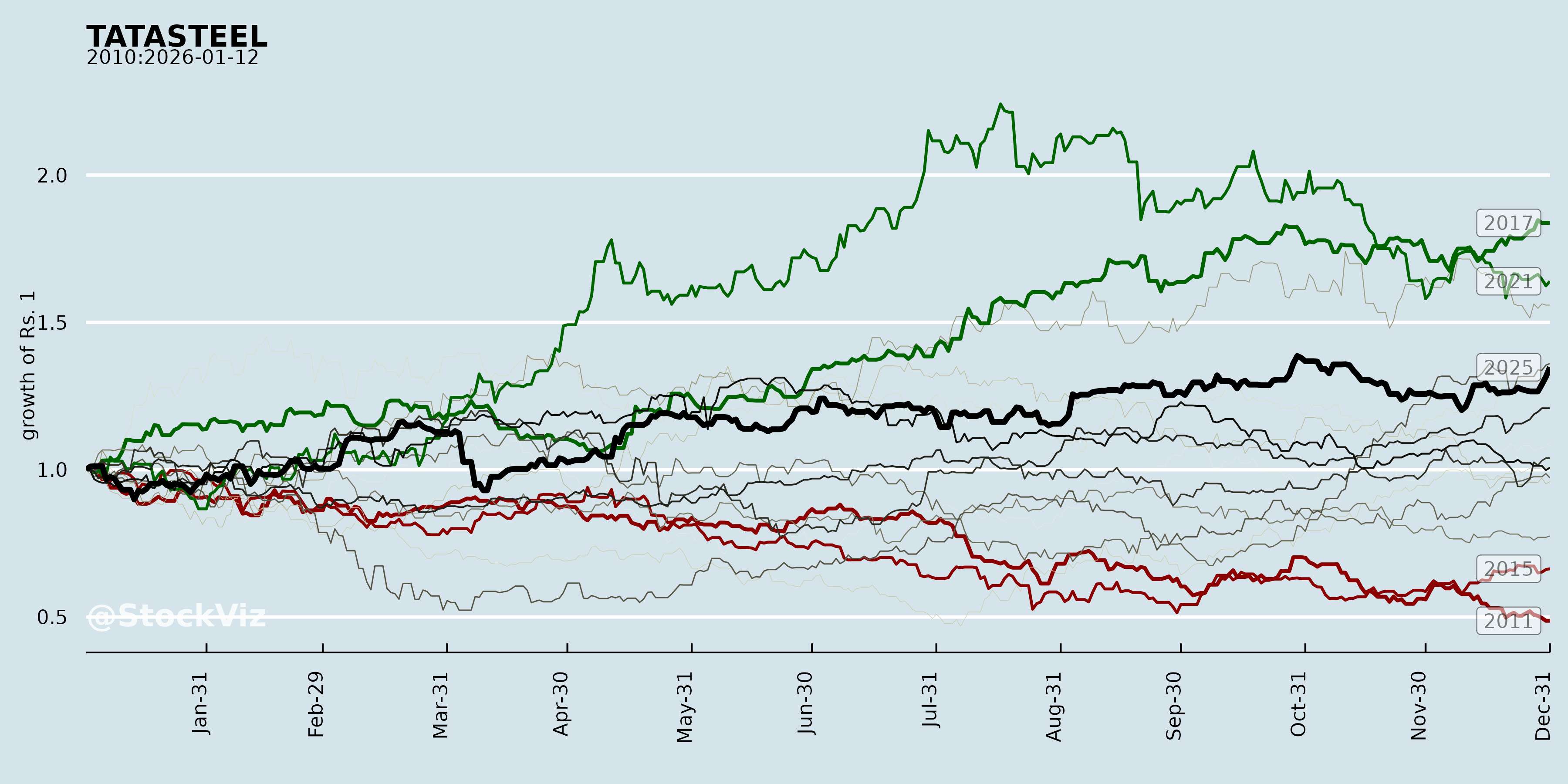

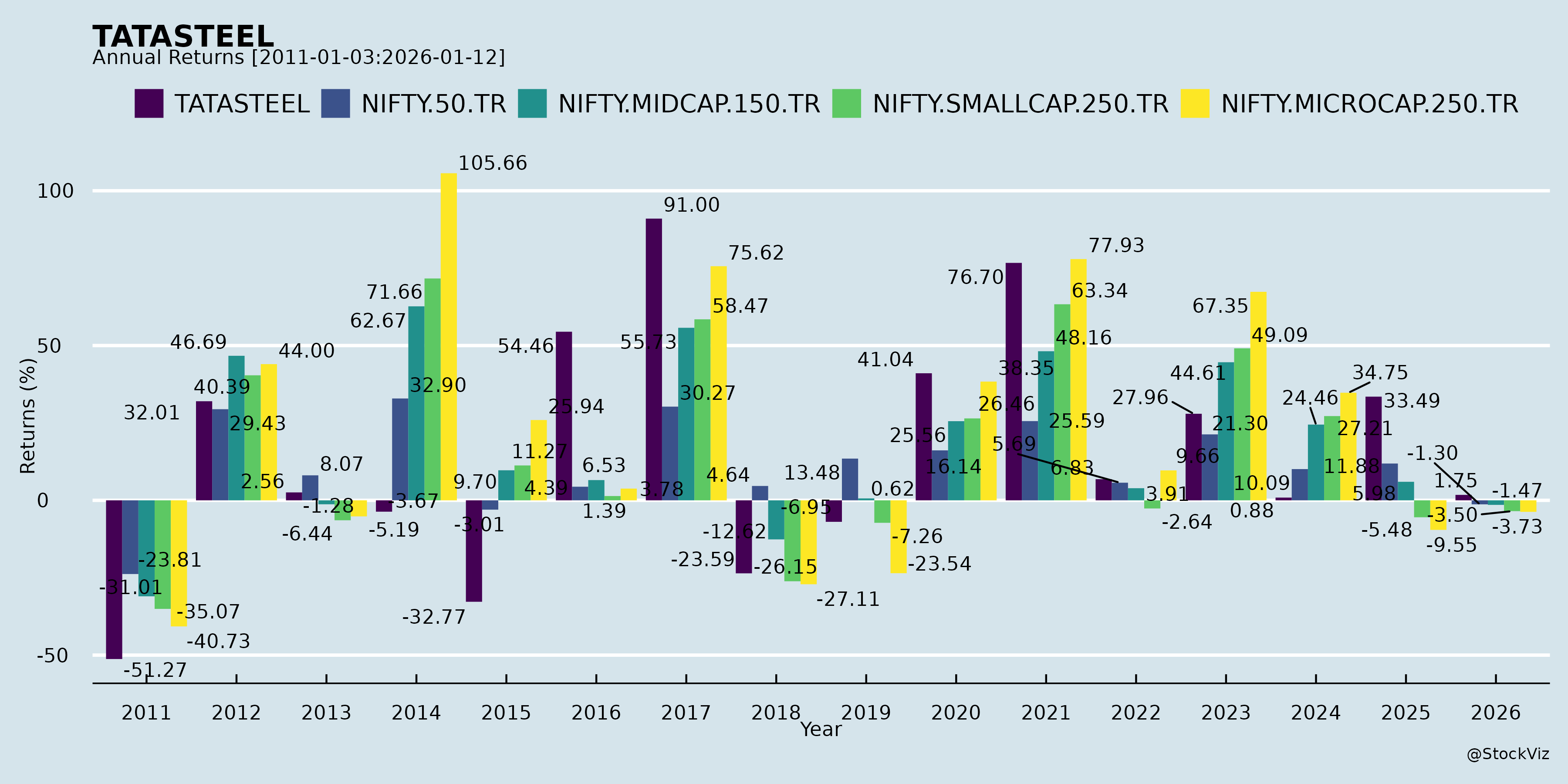

Annual Returns

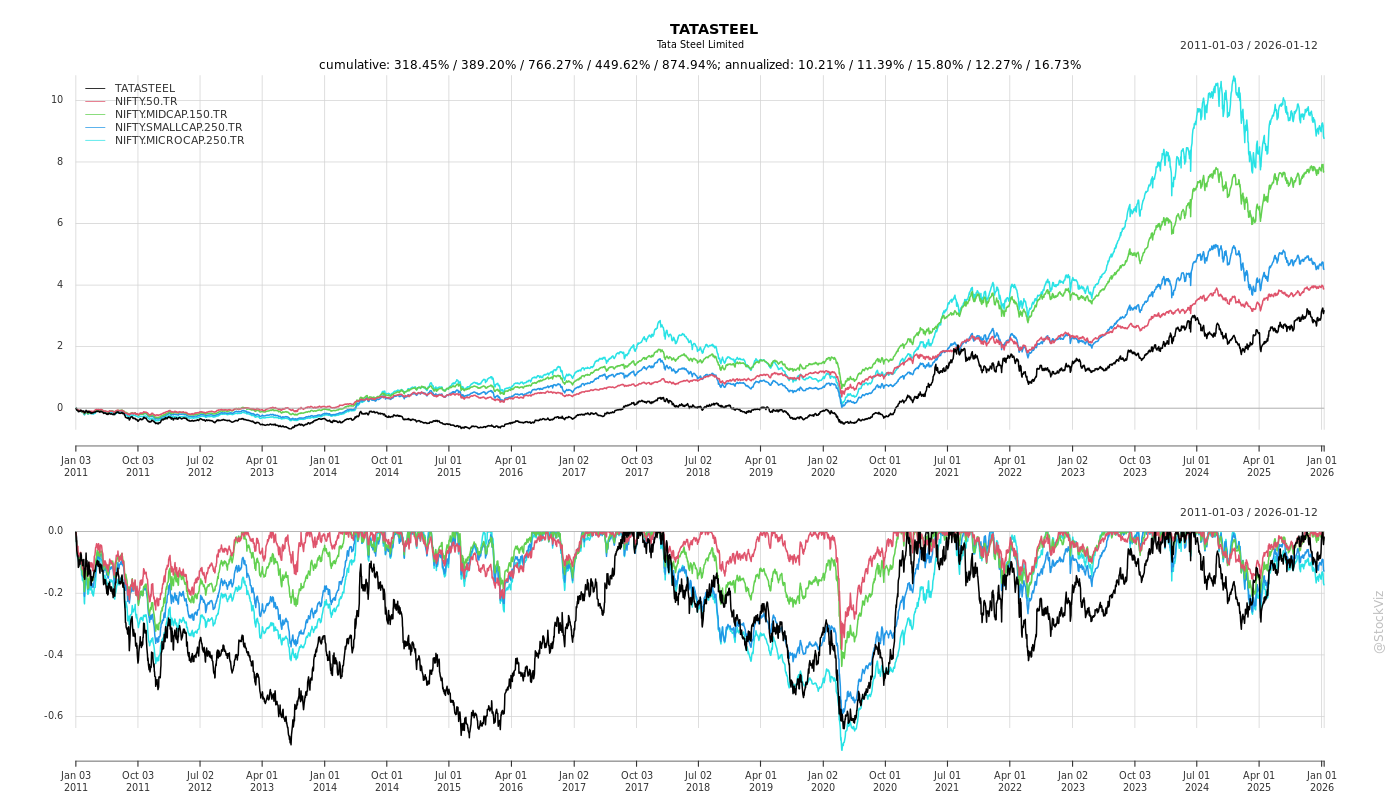

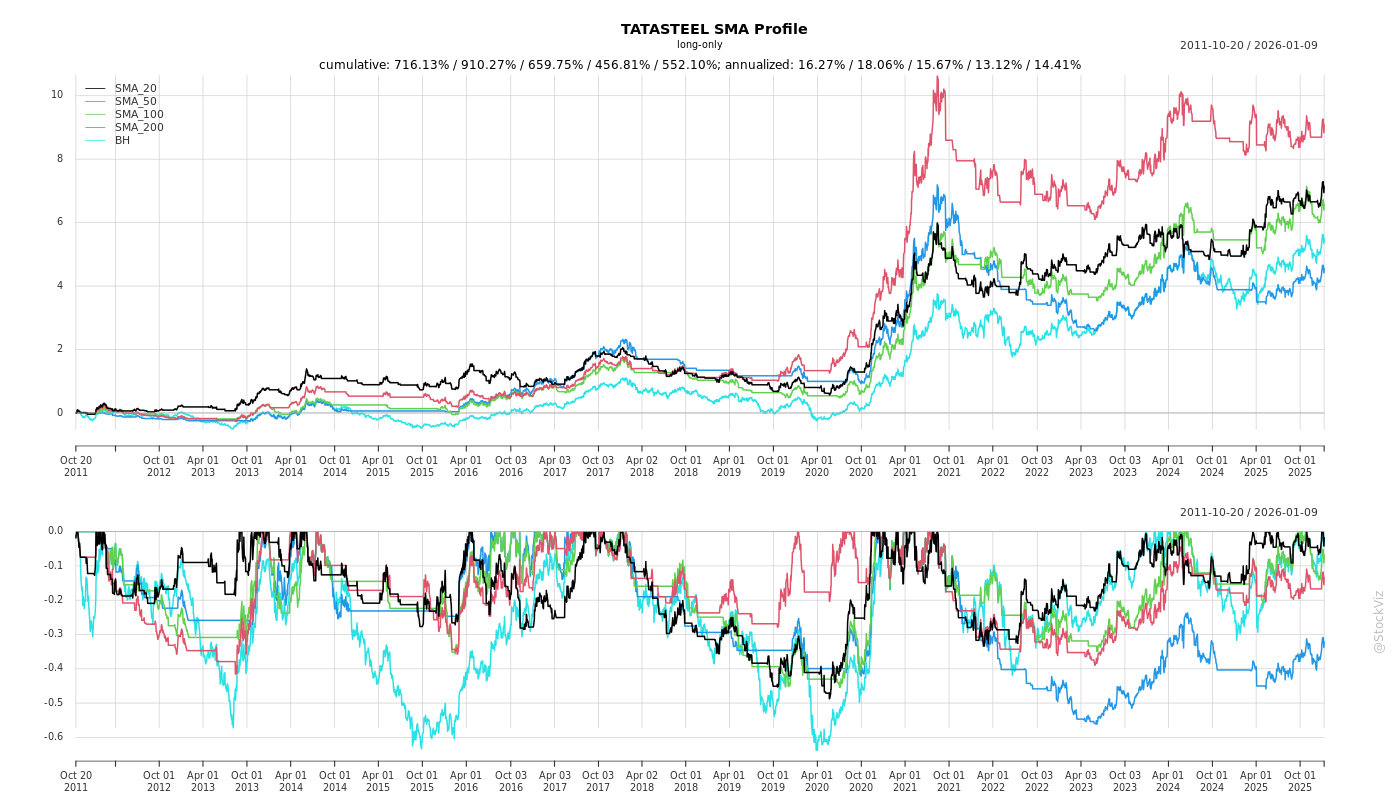

Cumulative Returns and Drawdowns

Fundamentals

Ownership

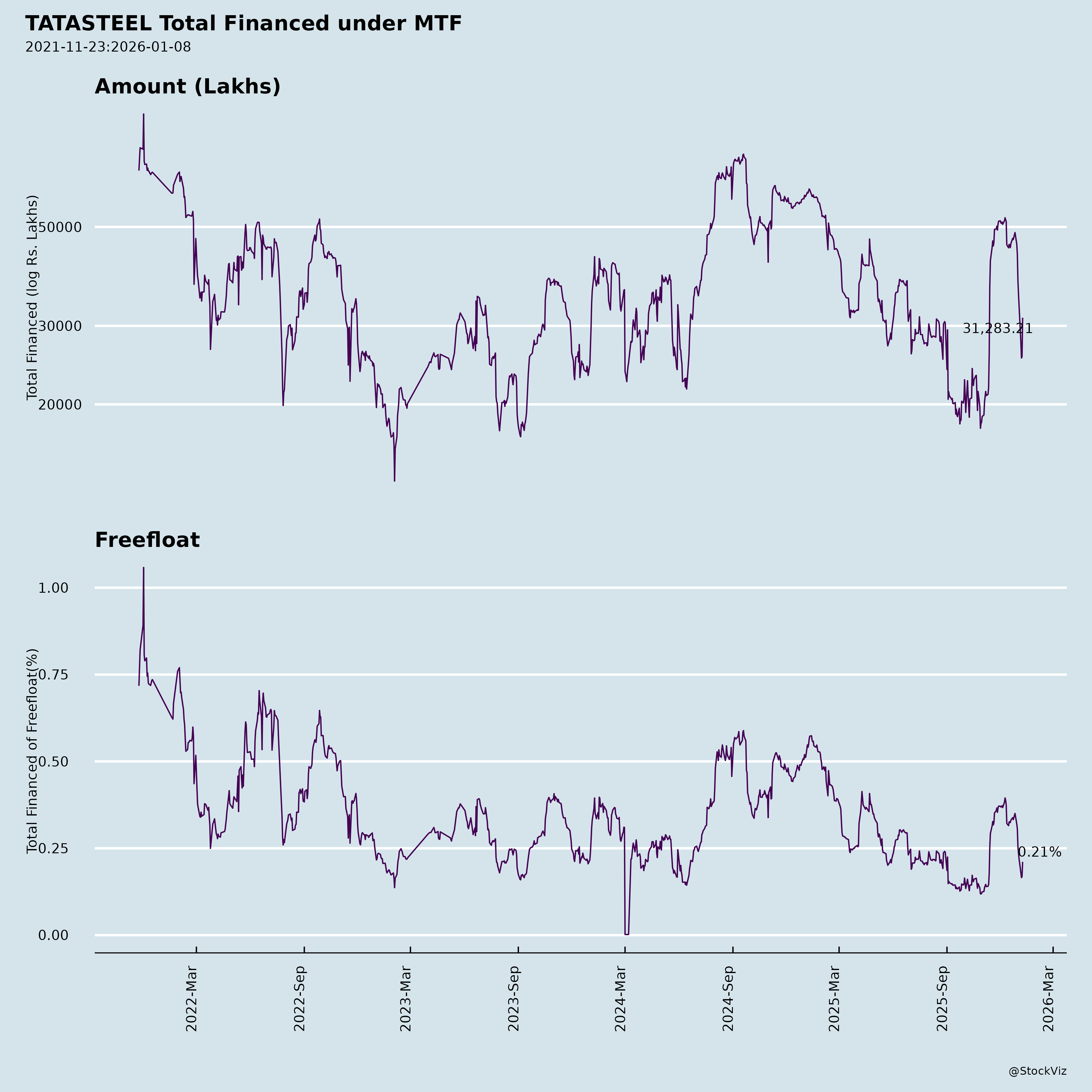

Margined

AI Summary

asof: 2025-12-04

Tata Steel (India) Headwinds, Tailwinds, Growth Prospects & Key Risks: Summary

Headwinds (Challenges)

- Global Market Volatility: Persistent tariffs, geopolitical tensions, and elevated Chinese steel exports (exceeding 100 MT) suppress international prices.

- UK/EU Policy Uncertainty:

- UK steel sector faces structural deficits due to import quotas exceeding demand and high production costs.

- EU’s Steel Plan 2.0 and CBAM implementation risk further distorting trade.

- UK steel sector faces structural deficits due to import quotas exceeding demand and high production costs.

- Netherlands Decarbonization Costs: High capex (up to €2 billion) and operational complexity for the IJmuiden decarbonisation project.

- Legacy Portfolio Issues:

- Ferrochrome unit divestment required to exit underground mining (Sukinda mine lease) and align with strategic focus.

- Sukinda mines necessitate costly underground operations, making the business unviable.

- Ferrochrome unit divestment required to exit underground mining (Sukinda mine lease) and align with strategic focus.

- UK/EU Execution Risks:

- UK’s slow policy response to quotas/imports; Netherlands’ JLofI depends on regulatory approvals.

Tailwinds (Opportunities)

- Cost Transformation Program:

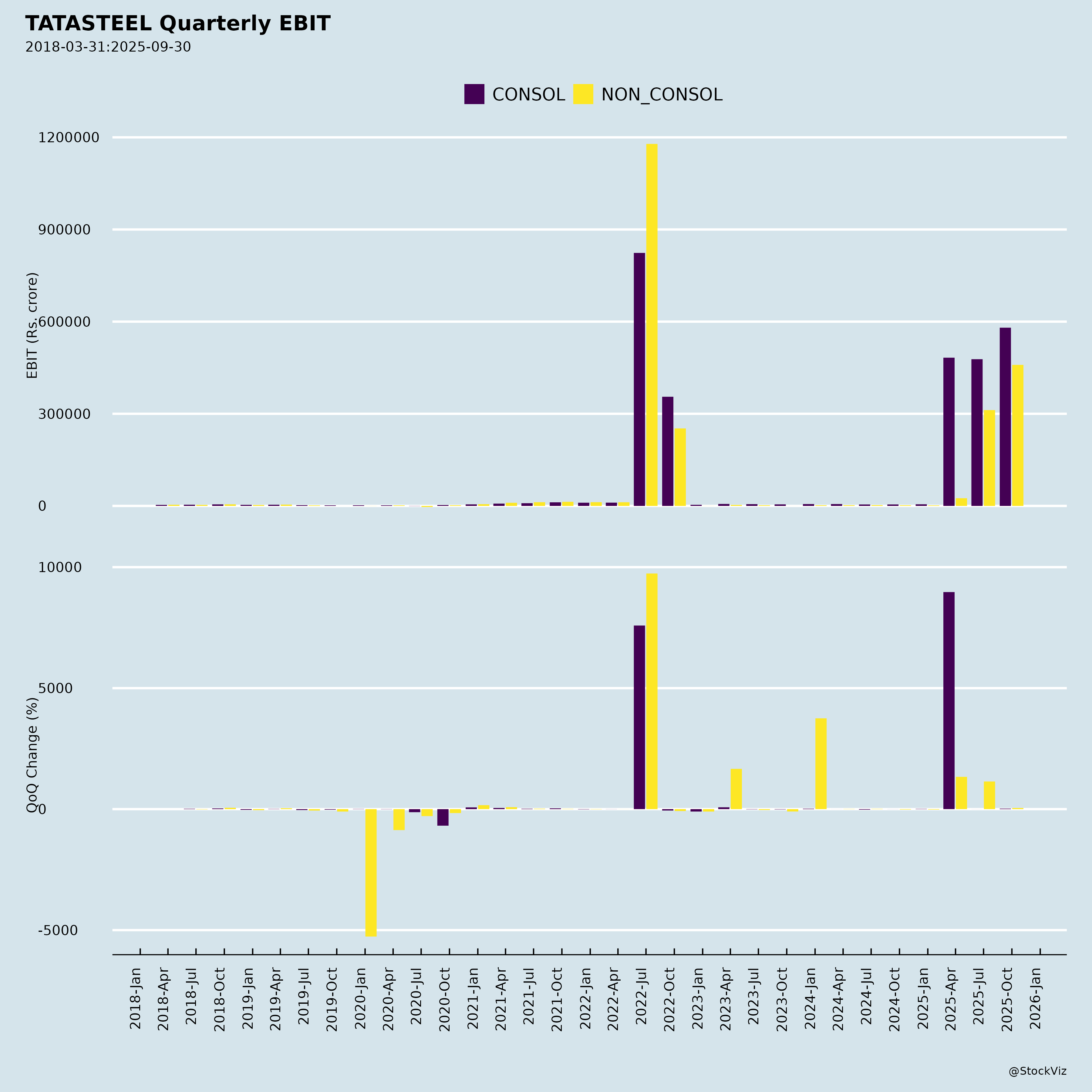

- Achieved ~Rs 5,450 crores in the first half FY26, improving EBITDA margins (280 bps QoQ).

- Leveraged leaner coal mixes, operational efficiency, and India-specific cost discipline.

- Achieved ~Rs 5,450 crores in the first half FY26, improving EBITDA margins (280 bps QoQ).

- India’s Growth Momentum:

- Crude steel production up 8% YoY (5.65 MT), with domestic deliveries surging 17% QoQ.

- India’s EBITDA margin (24%) is the highest among key markets, driven by domestic demand.

- Crude steel production up 8% YoY (5.65 MT), with domestic deliveries surging 17% QoQ.

- Downstream Portfolio Expansion:

- Acquisition of 50% stake in Tata BlueScope Steel (TBSPL) to strengthen coated steel offerings.

- Neelachal expansion and Ludhiana EAF project to scale long products.

- Acquisition of 50% stake in Tata BlueScope Steel (TBSPL) to strengthen coated steel offerings.

- Decarbonization Synergy:

- Netherlands’ JLofI with €2B policy support for integrated CO₂-reduction.

- UK grant funding for decarbonisation aligns with Tata Steel’s ESG goals.

- Netherlands’ JLofI with €2B policy support for integrated CO₂-reduction.

- Digital Transformation:

- E-commerce platforms (Aashiyana/DigECA) achieved ₹1,980 crores GMV (tripled YoY).

Growth Prospects

- India Dominance:

- Kalinganagar (8 MTPA) and Neelachal (6–10 MTPA) capacity ramp-up will drive ~3 MTPA additional volumes.

- Downstream portfolio (TBSPL + coated products) targets $2–3x revenue growth.

- Kalinganagar (8 MTPA) and Neelachal (6–10 MTPA) capacity ramp-up will drive ~3 MTPA additional volumes.

- International Diversification:

- Netherlands: €2B JLofI project for low-carbon production (target: 3 MTPA by 2030).

- UK: EAF expansion to reduce reliance on imports and improve profitability.

- Netherlands: €2B JLofI project for low-carbon production (target: 3 MTPA by 2030).

- Cost Leadership:

- €1.5B cost reduction target by 2025 through operational excellence and procurement optimization.

- €1.5B cost reduction target by 2025 through operational excellence and procurement optimization.

- Strategic Divestments:

- Ferrochrome plant sale (Rs 610 crore base consideration) reduces legacy liabilities and improves cash flow.

Key Risks

- Policy & Regulatory Uncertainty:

- EU/UK policies (steel quotas, CBAM, subsidies) could erode profitability or delay projects.

- Delays in NL’s JLofI approvals may derail decarbonisation capex.

- EU/UK policies (steel quotas, CBAM, subsidies) could erode profitability or delay projects.

- Execution & Timelines:

- Neelachal expansion and NL’s JLofI face execution risks (land acquisition, regulatory approvals).

- Kalinganagar’s relining and Neelachal timelines are contingent on environment clearances.

- Neelachal expansion and NL’s JLofI face execution risks (land acquisition, regulatory approvals).

- Market Sensitivity:

- Price volatility from China’s export surge and cyclical demand could pressure margins.

- UK/EU competition from low-cost producers may limit export potential.

- Price volatility from China’s export surge and cyclical demand could pressure margins.

- Currency & Interest Rates:

- INR depreciation and rising global interest rates increase financing costs and import expenses.

- INR depreciation and rising global interest rates increase financing costs and import expenses.

- ESG & Social Risks:

- Decarbonisation costs may strain margins if policy support is reduced.

- Community relations in India (e.g., Kalinganagar protests) could delay projects.

- Decarbonisation costs may strain margins if policy support is reduced.

Conclusion

Tata Steel is positioned for growth through India-focused volume expansion, downstream diversification, and strategic international projects. The cost transformation program and digital initiatives provide a competitive edge. However, success hinges on navigating policy headwinds in the EU and UK, executing complex projects on time, and managing execution risks. A balanced focus on operational excellence, stakeholder engagement, and proactive policy advocacy will be critical.

Copyright © 2023 SAS Data Analytics Pvt. Ltd. All rights reserved.