SHRIRAMFIN

Equity Metrics

January 13, 2026

Shriram Finance Limited

Non Banking Financial Company (NBFC)

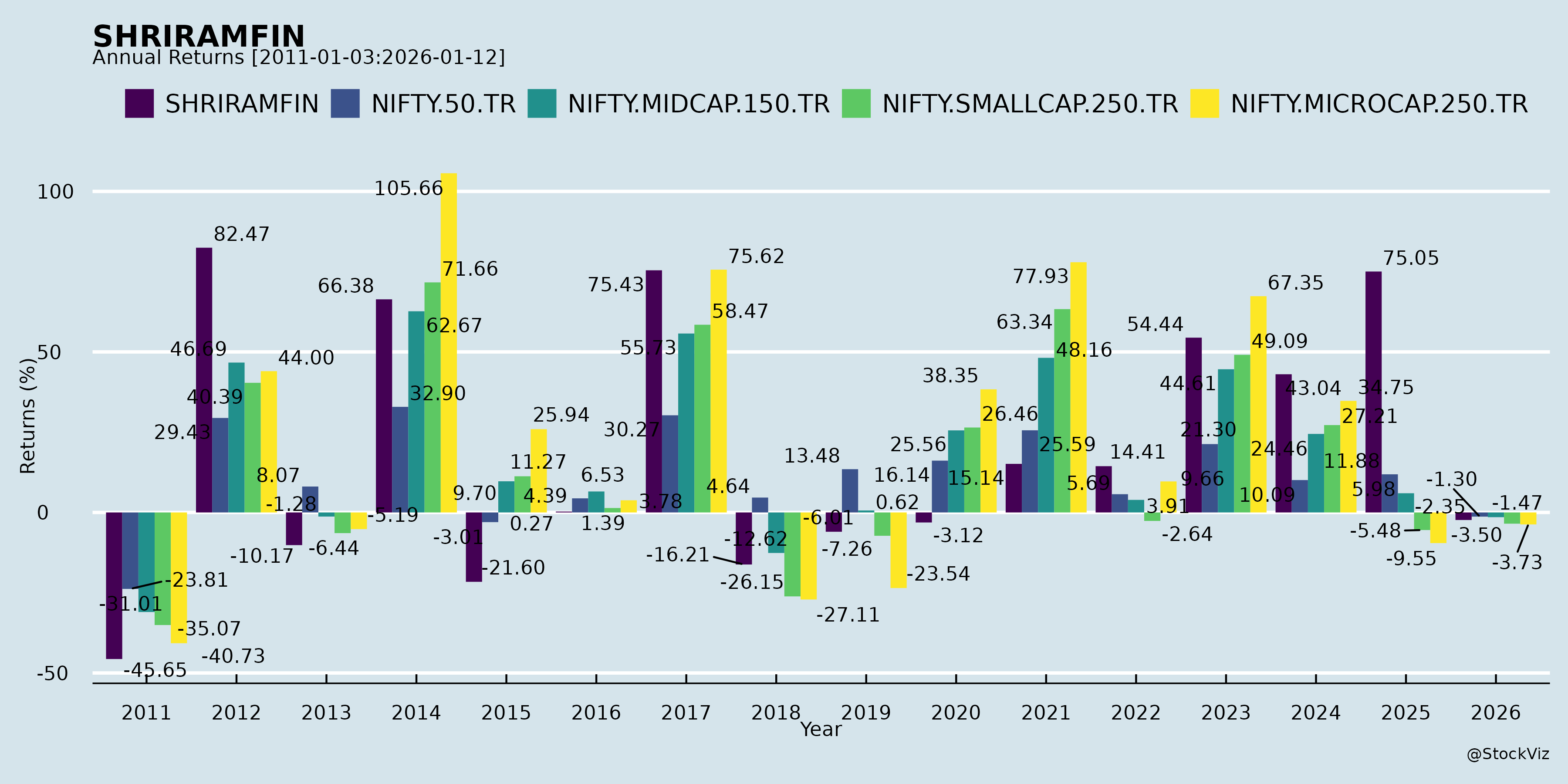

Annual Returns

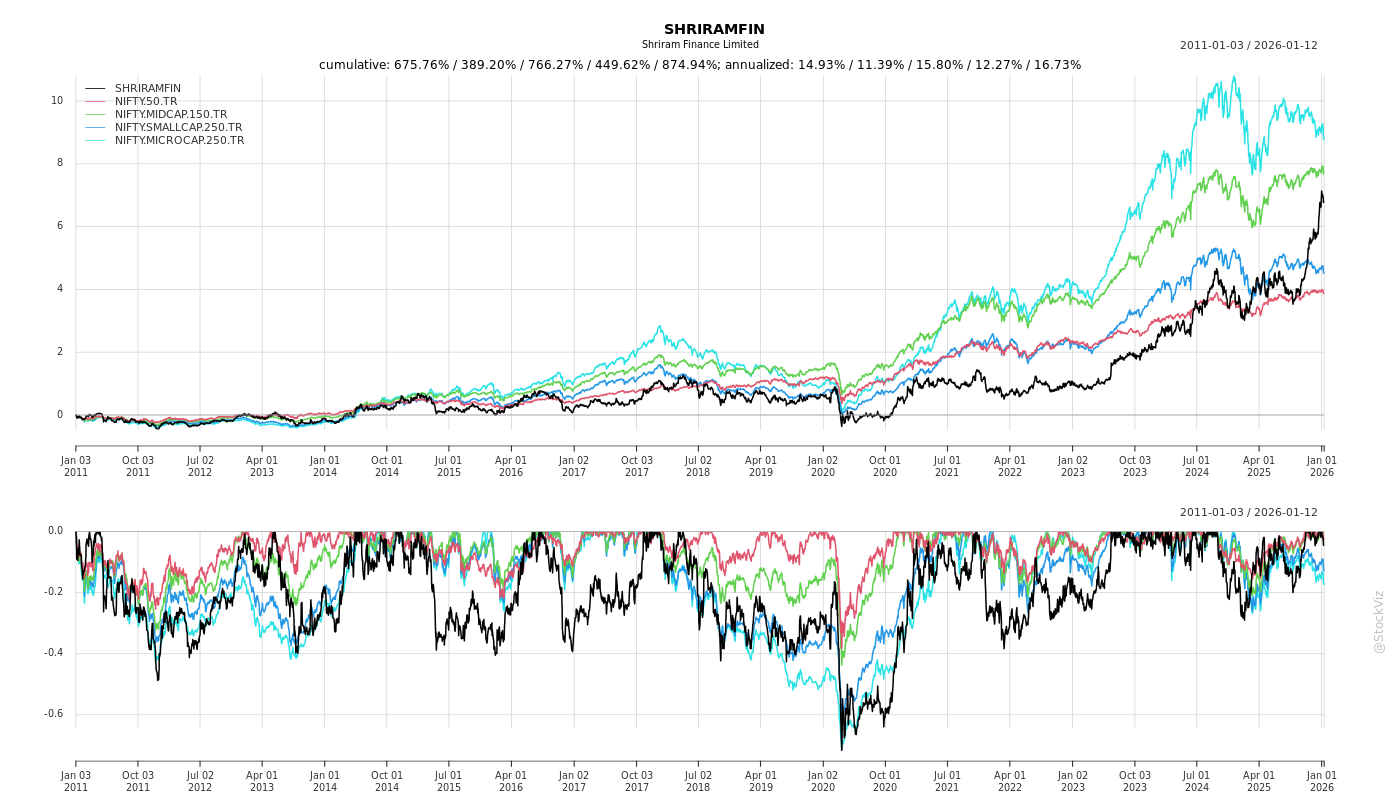

Cumulative Returns and Drawdowns

Fundamentals

Ownership

Margined

AI Summary

asof: 2025-12-08

Based on the provided results of the postal ballot and scrutinizer’s report for Shriram Finance Limited (SHRIRAMFIN) dated December 3, 2025, we can derive a comprehensive analysis of the company’s governance stability, strategic direction, growth prospects, key risks, and external headwinds/tailwinds.

While the document is governance and procedural in nature, it offers valuable insights into strategic leadership decisions, capital-raising capacity, shareholder sentiment, and organizational direction — all of which are critical for assessing the firm’s fundamentals and future trajectory.

🔍 1. Key Developments & Strategic Moves (Tailwinds)

✅ Re-appointment of Independent Director (Mr. Jugal Kishore Mohapatra)

- The independent director was re-appointed for a second term with 97.17% approval from shareholders.

- Tailwind: Reflects strong board stability and confidence in governance practices. Institutional investors endorse continuity, which strengthens ESG and governance credentials.

✅ Re-designation of Mr. Parag Sharma as Managing Director & CEO

- Mr. Parag Sharma’s elevation to MD & CEO was approved with 99.12% support, indicating high confidence in current leadership.

- The move consolidates executive leadership after prior roles as Joint MD & CFO.

- Tailwind: Strong leadership continuity with deep domain expertise in NBFC operations and RBI regulatory frameworks, crucial for maintaining strategic momentum.

✅ Appointment of Mr. Sunder Subramanian as Whole-Time Director

- Sunder Subramanian will serve as Joint Managing Director & CFO, effective December 5, 2025.

- Approved with 98.8% in favor, signaling strong backing for new senior management.

- Tailwind:

- Fresh infusion of leadership talent with structured remuneration policy aligned with performance.

- Performance-linked variable pay (up to 100% of fixed pay) incentivizes profitability and scale growth.

- SAR units and share-linked incentives enhance long-term alignment with shareholder value.

✅ Large Debt Issuance Capacity Renewed (₹35,000 Crores)

- Shareholders approved private placement of non-convertible debentures up to ₹35,000 crore over one year.

- Approvals came with 98.95% support — one of the highest mandates.

- Tailwind:

- Critical capital flexibility to fund loan book growth, refinance existing debt, and support business expansion.

- Ability to access diverse investor classes (FPIs, HNIs, institutions) enhances funding diversification.

📈 2. Growth Prospects

| Factor | Insight |

|---|---|

| Leadership Clarity | Clear succession and leadership structure post-2025 with Parag Sharma (MD&CEO) and Sunder Subramanian (Jt MD & CFO). Enables focused execution. |

| Funding Advantage | ₹35,000 crores issuance window provides fuel for asset growth, especially in retail lending (vehicle finance, SME loans — core Shriram businesses). |

| Rational Incentive Design | Executive pay tied to performance metrics (via variable pay and SARs) supports profitable growth, not just top-line expansion. |

| Shareholder Approval Rates | Very high approval (>96% on all resolutions) indicates low dissent and high trust, reducing corporate governance risks. |

| Digital Voting Adoption | 100% remote e-voting; 2,371 shareholders participated (from 2.77 lakh total). Shows improving engagement of large beneficial owners, though participation remains concentrated. |

🔹 Conclusion: Shriram is positioning itself for sustainable, capital-backed growth under stable leadership, leveraging strong market confidence.

⚠️ 3. Risks & Headwinds

2. Dependence on Private Debt Markets

- Reliance on private placements (rather than public bonds or equity) exposes the company to:

- Liquidity tightness in credit markets.

- Increased borrowing costs during economic stress.

- Regulatory scrutiny on NBFC funding under RBI’s Scale-Based Regulation (SBR).

- Headwind: Credit risk perception may rise during macroeconomic downturns.

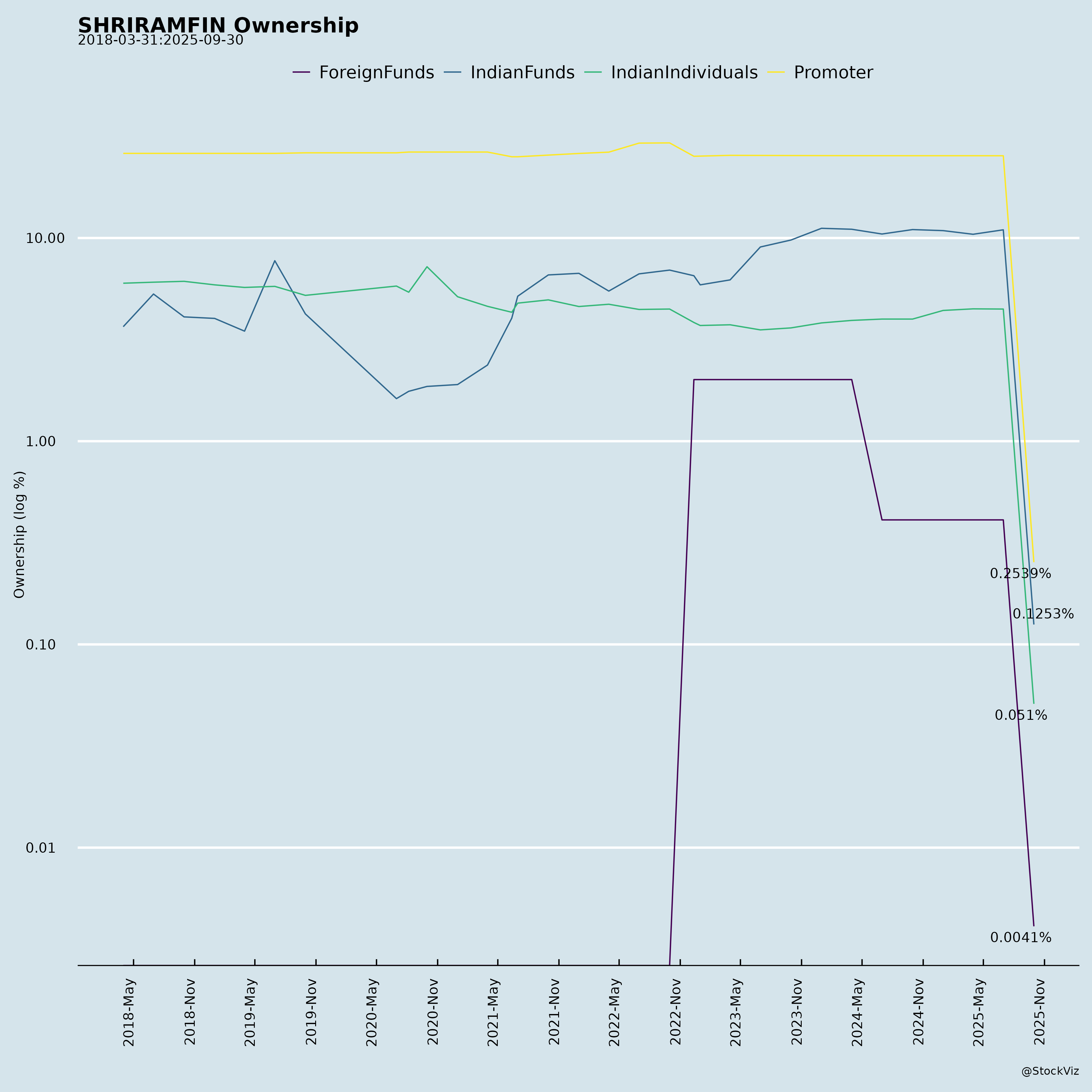

3. Concentration of Voting Power

- Promoters & promoter group hold ~25.4% stake (477.6 million shares out of 1.88 billion outstanding).

- They voted unanimously in favor on all key resolutions.

- While this ensures stability, it may limit governance checks if issues arise.

- Risk: Governance risk if promoter interests diverge from public shareholders.

4. Execution Risk in Leadership Transition

- Sunder Subramanian’s appointment involves significant remuneration and performance targets.

- Variable pay up to 100% of fixed pay (₹25 lakh/month max) creates high pressure.

- Risk: Failure to meet targets could impact morale or strategic agility.

🌐 4. Macro & Regulatory Tailwinds / Headwinds

| Factor | Implication |

|---|---|

| RBI Regulations – NBFC SBR | Compliant with Master Direction; helps Shriram scale responsibly. Access to large debt issuances reflects regulatory trust. ✅ |

| Strong Institutional Support | High voting participation from institutions (~88% of eligible shares voted): - Supports fundraising credibility. - Validates financial health. ✅ |

| Interest Rate Cycle (Late 2025) | Assuming rate cuts expected in FY26, this could: - Reduce borrowing costs (tailwind). - Pressure NIMs if lending rates drop faster (headwind). 🔁 |

| Economic Recovery Post-2025 | Green shoots in SME and vehicle financing segments (core to Shriram) boost credit demand. ✅ |

✅ Summary: SHIRIRAMFIN – Investment Thesis Snapshot

| Category | Assessment |

|---|---|

| Headwinds | - Very low retail shareholder participation (0.85%) - Heavy reliance on private debt capital markets - High performance pressure on new leadership |

| Tailwinds | - Strong shareholder mandate for leadership and funding - Clear executive succession and governance structure - Renewed ability to raise ₹35,000 crore in debt for growth - High institutional confidence and support |

| Growth Prospects | - Strong potential for loan book expansion (commercial vehicle, SME finance) - Improved capital flexibility supports market share gains - Leadership focus on performance-linked pay enhances ROE |

| Key Risks | - Concentration of voting power in promoter group - Execution risk in delivering on aggressive variable pay metrics - Macro sensitivity to credit demand and interest rates |

🏁 Final Verdict: Positive Outlook with Governance Vigilance

SHRIRAMFIN is well-positioned for growth in FY26 and beyond, backed by: - Leadership clarity, - Robust capital-raising powers, - High institutional trust, - And strong governance approvals.

However, long-term investors should monitor: - Retail shareholder engagement levels, - Cost of debt in next issuance rounds, - Asset quality trends, - And ability of new leadership to deliver on performance targets.

Despite risks, current developments signal strong momentum, governance prudence, and strategic readiness — making Shriram Finance a resilient play in the NBFC sector, particularly if macroeconomic conditions stabilize in India.

📌 Recommendation: Accumulate for long-term investors seeking exposure to a well-governed NBFC with clear growth financing and strong leadership alignment. Monitor quarterly asset quality and cost of funds.

Source: Postal Ballot Results and Scrutinizer Report – December 3, 2025. Company: Shriram Finance Limited (BSE: 511218 | NSE: SHRIRAMFIN)

Copyright © 2023 SAS Data Analytics Pvt. Ltd. All rights reserved.