ORIENTBELL

Equity Metrics

January 13, 2026

Orient Bell Limited

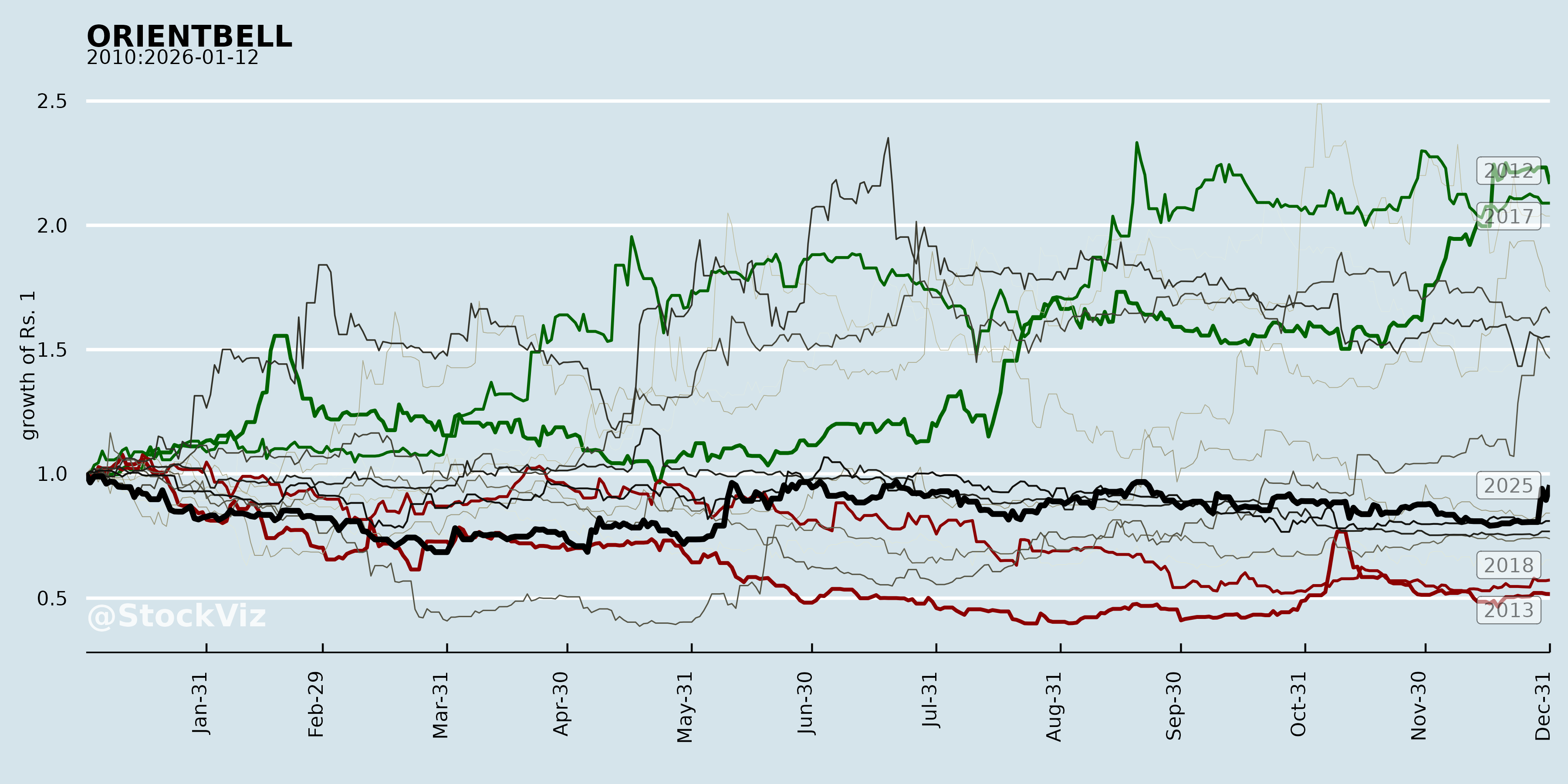

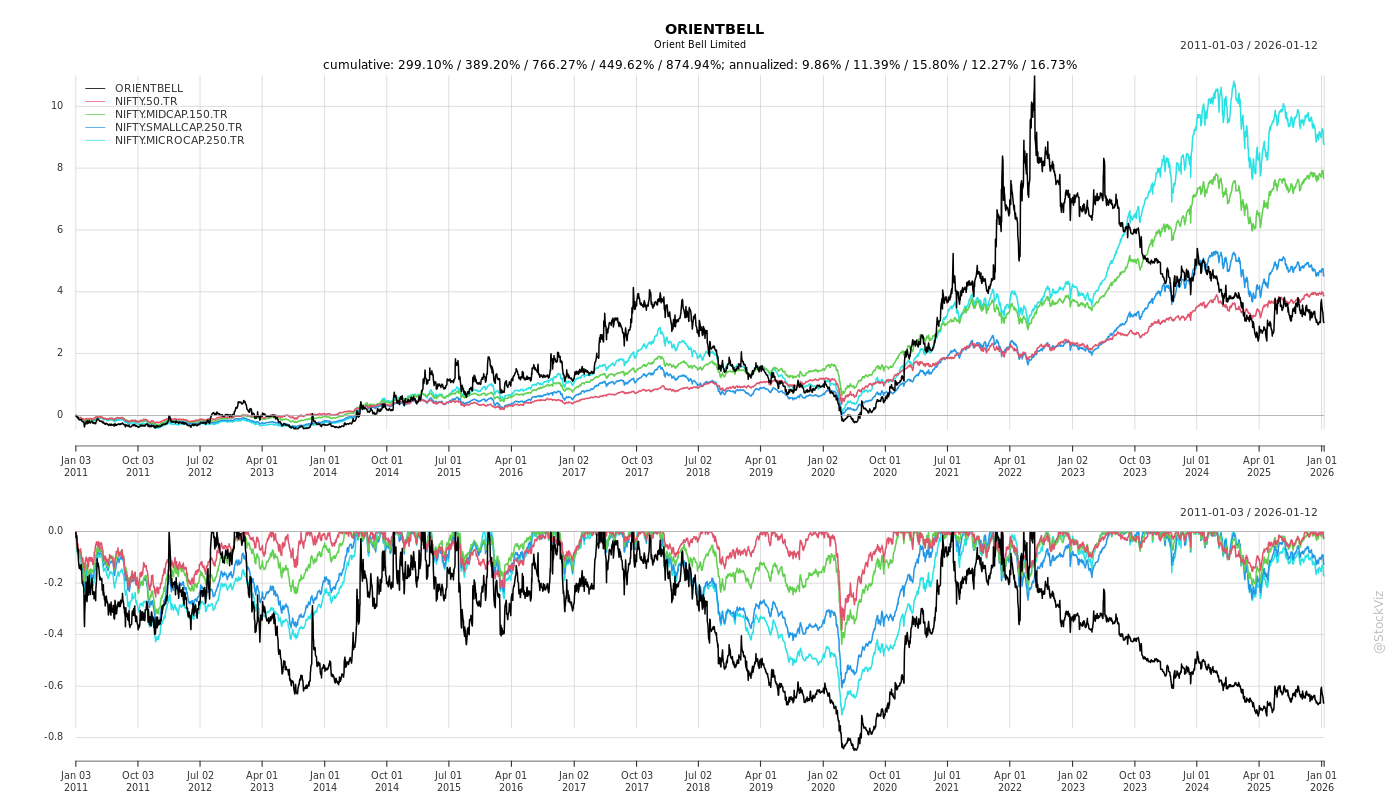

Annual Returns

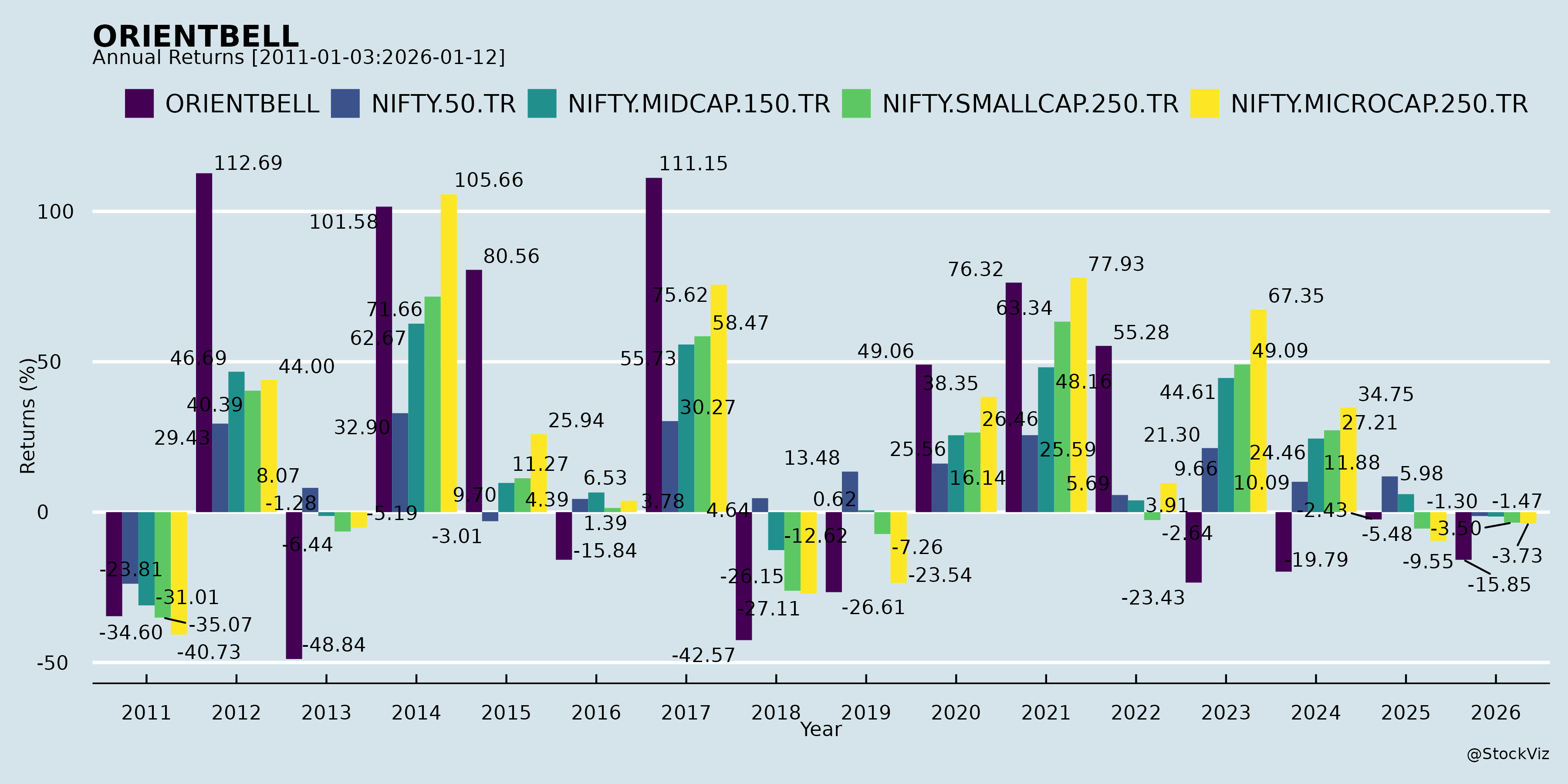

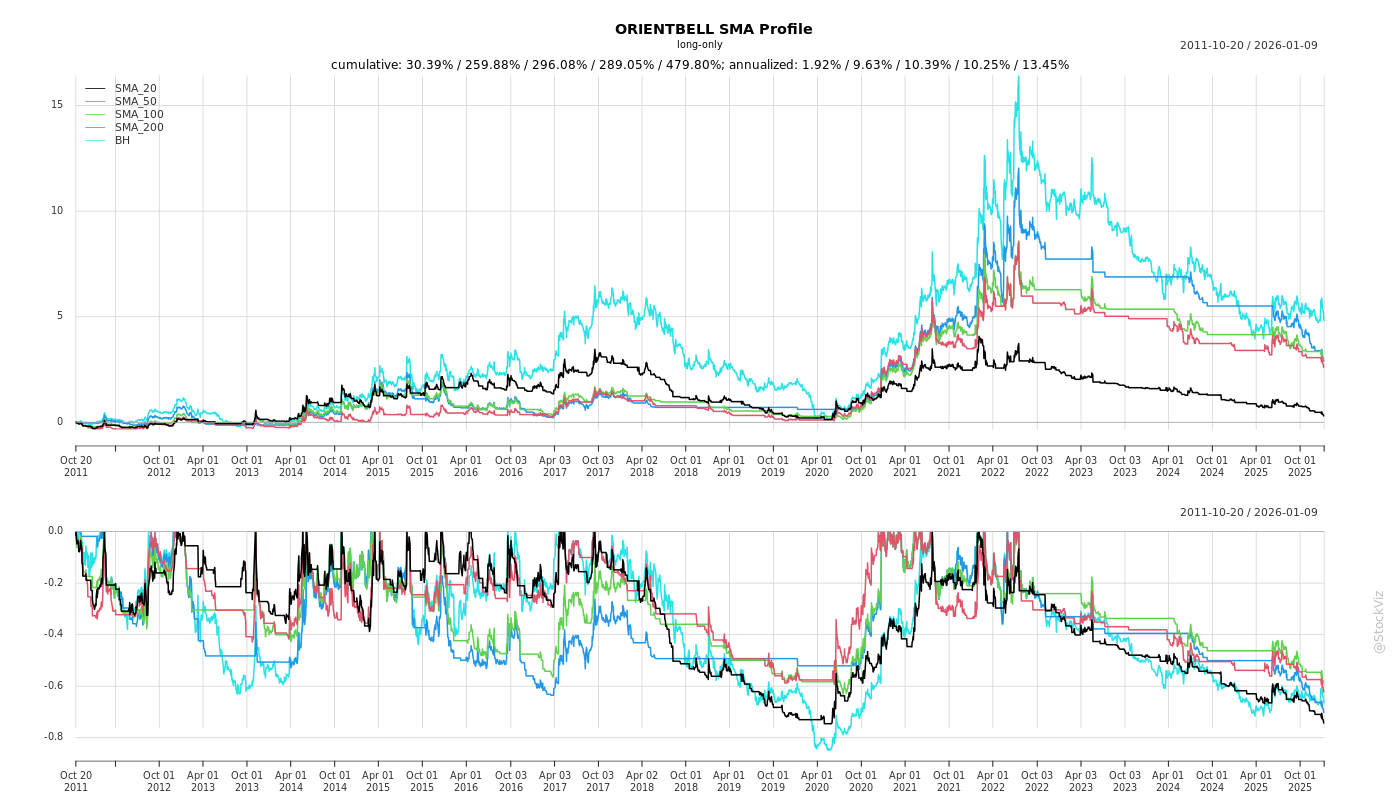

Cumulative Returns and Drawdowns

Fundamentals

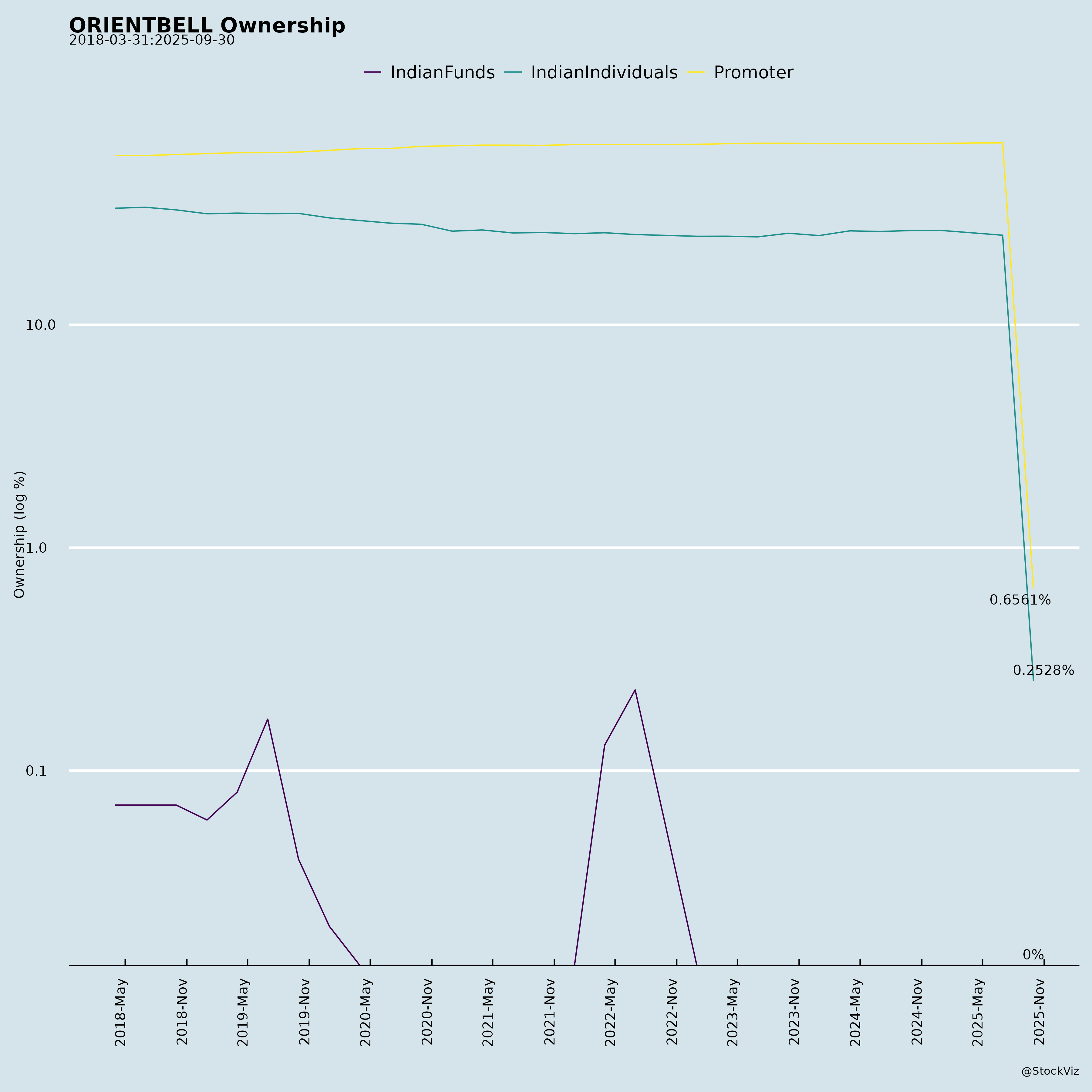

Ownership

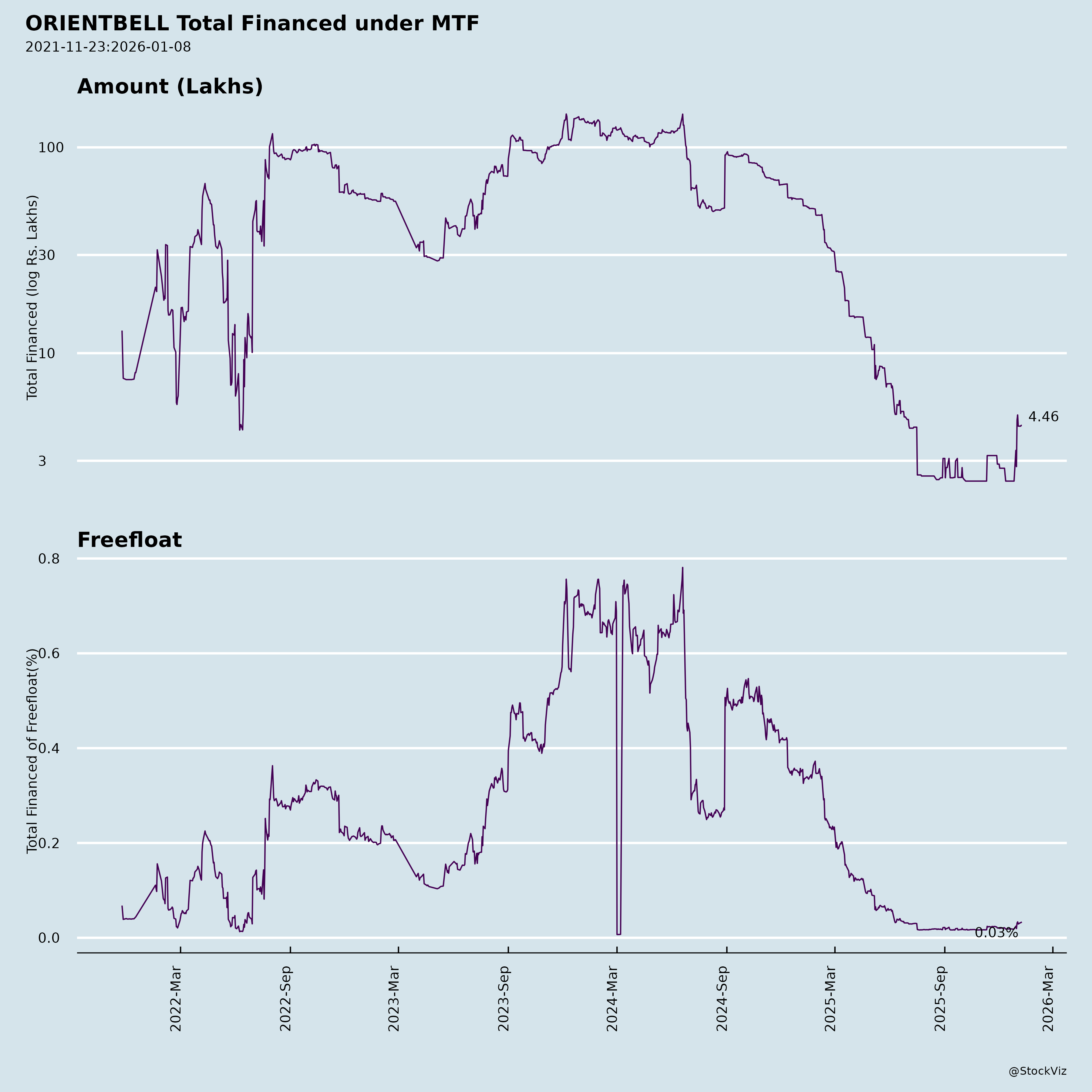

Margined

AI Summary

asof: 2025-11-27

Analysis of Orient Bell Limited (ORIENTBELL)

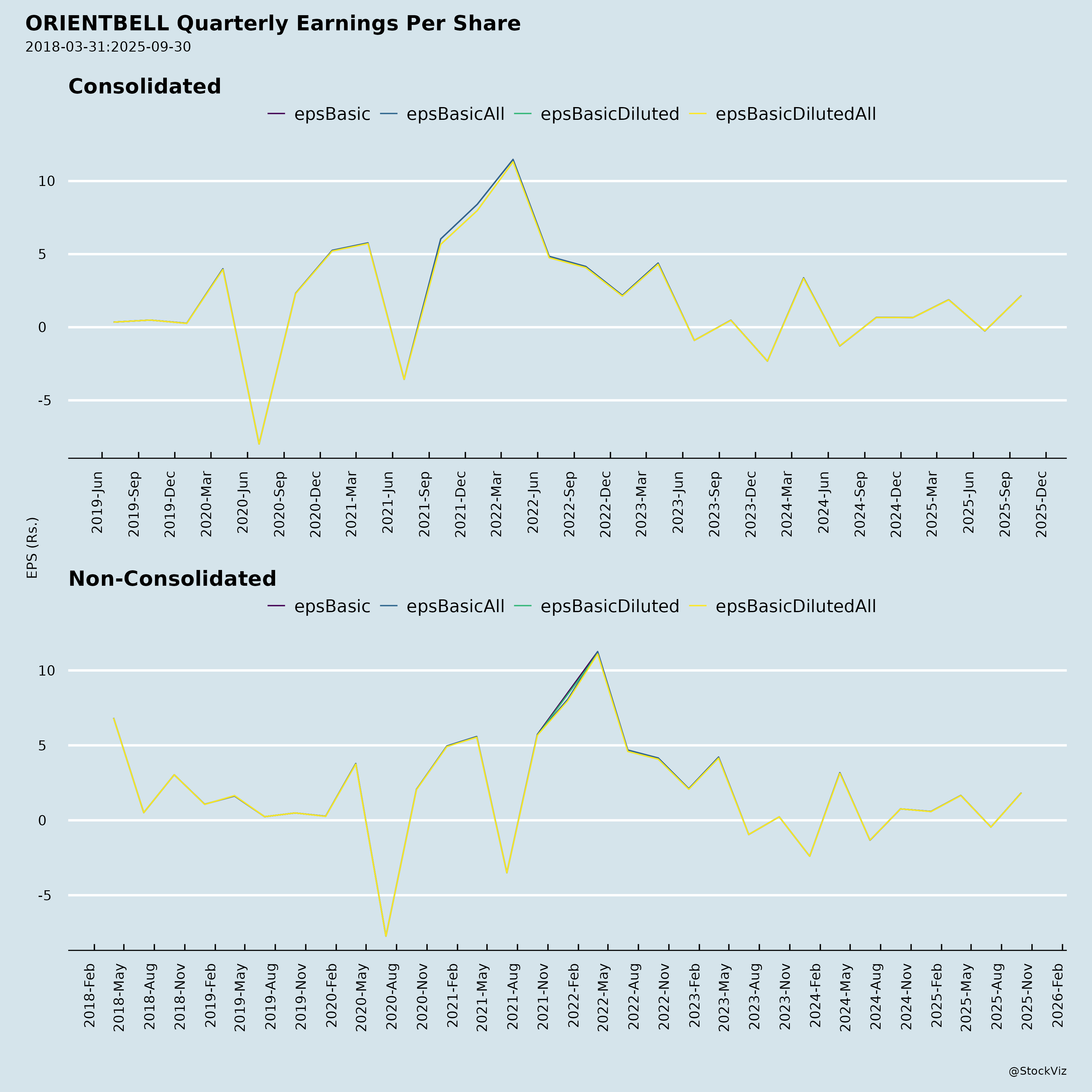

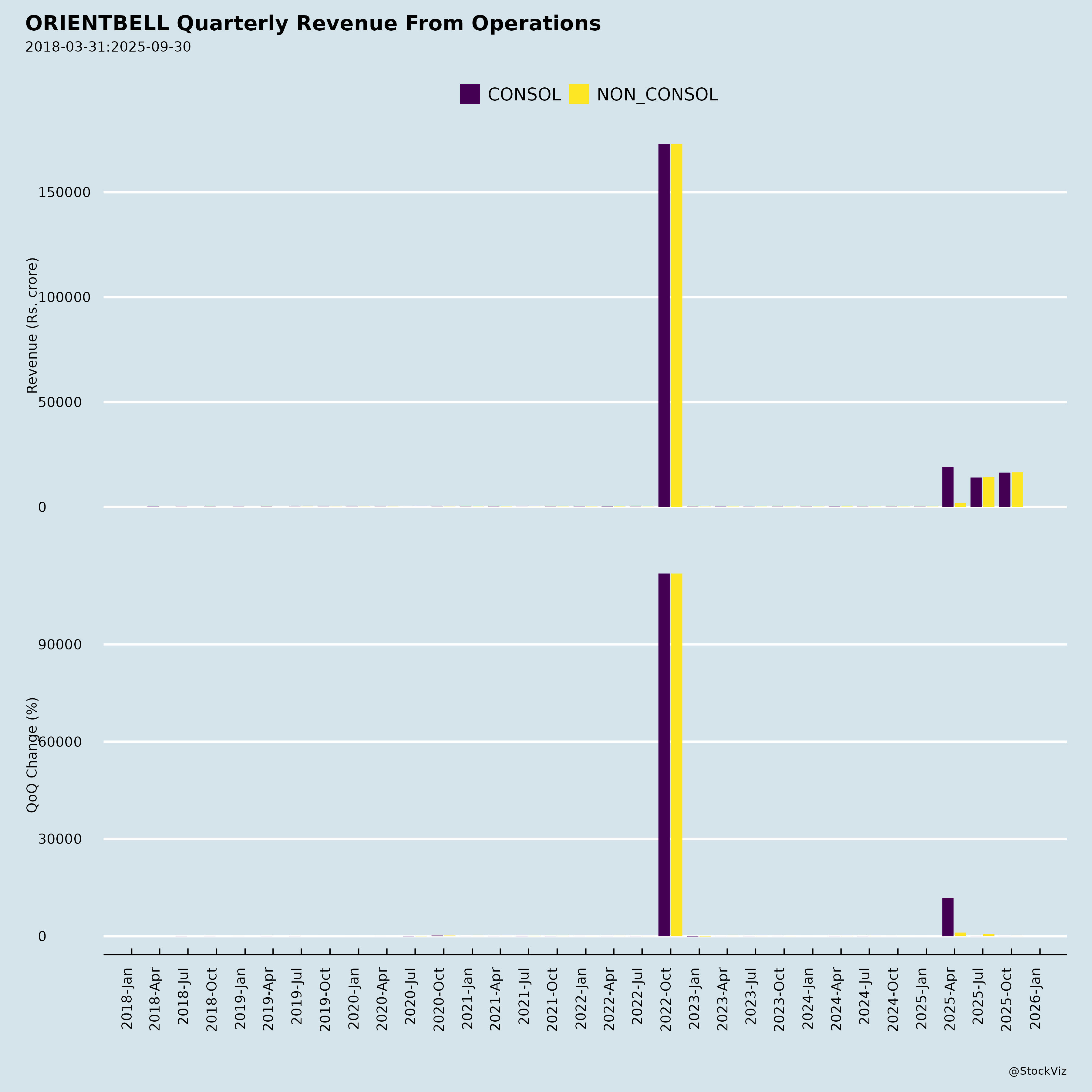

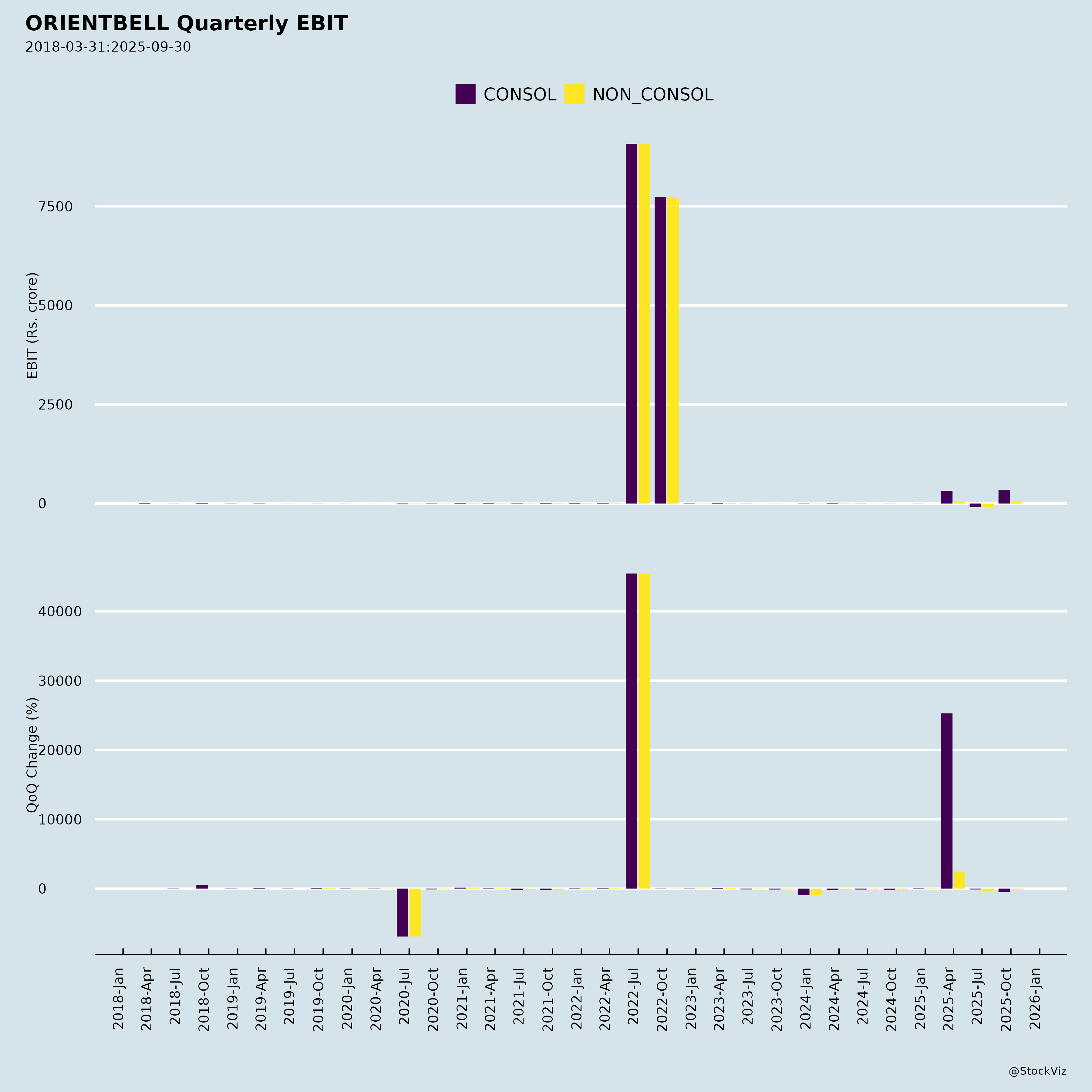

Orient Bell Ltd., a leading Indian ceramic/vitrified tiles manufacturer with 42.4 MSM capacity, reported Q2FY26 (ended Sep 30, 2025) results showing modest revenue growth (3% YoY to ₹165 Cr) but strong margin expansion (EBITDA up 23% to ₹9.8 Cr, GM 38.9%). H1FY26 revenue was flat (₹308 Cr), but EBITDA rose 19% to ₹15.4 Cr with PAT turning positive at ₹2.8 Cr. Key drivers include premium product mix shift and cost efficiencies, amid a healthy balance sheet (0.01x net D/E, 26-day cash conversion).

Tailwinds (Supportive Factors)

- Margin Expansion & Cost Discipline: Gross margins up 250 bps YoY to 38.9% (H1: +140 bps); COP down 3.7% YoY (like-for-like); EBITDA margins at 6% (Q2), driven by premium mix (GVT 41% of sales, vitrified 58%).

- Healthy Balance Sheet: Low net debt (₹3.6 Cr), efficient WC cycle (DSO/DIO/DPO optimized), and strong liquidity (₹33 Cr cash).

- Retail & Brand Momentum: 41% sales from 300+ OBTX boutiques; 3.8% sales invested in marketing (TV/digital); Instagram 100k followers; AI visualization tool for customer engagement.

- Operational Excellence: Zero accidents; strong capacity utilization; historical mix shift boosting realizations.

Headwinds (Challenges)

- Stagnant Topline: H1 revenue flat (-0.2% YoY); Q2 growth modest at 3%, signaling weak demand/volumes in a competitive tiles sector.

- Elevated Expenses: OpEx up 8% YoY in Q2 (to ₹54 Cr), pressuring profitability despite EBITDA gains.

- Macro Sensitivity: Tiles demand tied to real estate slowdown; historical revenue volatility (FY24-25 dip to ~₹670 Cr from FY23 peak).

- Inventory/Receivables Build: Inventories up to ₹76 Cr (vs ₹62 Cr Mar’25); trade receivables at ₹111 Cr.

Growth Prospects

- Product Mix & Capacity Leverage: GVT share up from 13% (FY20) to 41% (FY25); vitrified dominance; untapped 42 MSM capacity for volume ramp-up.

- Retail & Diversification: OBTX expansion; adhesives pilot in North India (Q2FY26 launch); digital tools/reels for B2C push.

- Margin Recovery Potential: Path to 7-9% EBITDA margins (historical peaks); sustained cost leadership.

- Industry Tailwinds: Ceramics recovery post-FY24 trough; 48-year legacy with 2000+ partners.

Key Risks

- Demand/Competition: Intense rivalry (e.g., Morbi players); real estate cyclicality could cap volumes.

- Input Cost Volatility: Energy/raw material fluctuations (mitigated so far but noted in COP).

- Execution Risks: New adhesives venture; scaling OBTX/digital amid marketing spend.

- Dilution/Market: Minor ESOP (5k options); low historical PAT margins (0.4% FY25); stock-specific sentiment post-flat H1.

- Regulatory/External: Analyst meets (no UPSI); forex/debt minor but macro (inflation, rates) relevant.

Overall Summary: Orient Bell shows resilience via margins/costs amid flat revenue, positioning for 10-15%+ growth if demand rebounds. Bull case: Premium mix + retail drives 5-7% revenue CAGR, 7%+ EBITDA margins. Bear case: Prolonged realty weakness caps at 2-3% growth. Attractive on low debt; monitor Q3 volumes. (Data from filings dated Oct-Nov 2025.)

Copyright © 2023 SAS Data Analytics Pvt. Ltd. All rights reserved.