OLAELEC

Equity Metrics

January 13, 2026

Ola Electric Mobility Limited

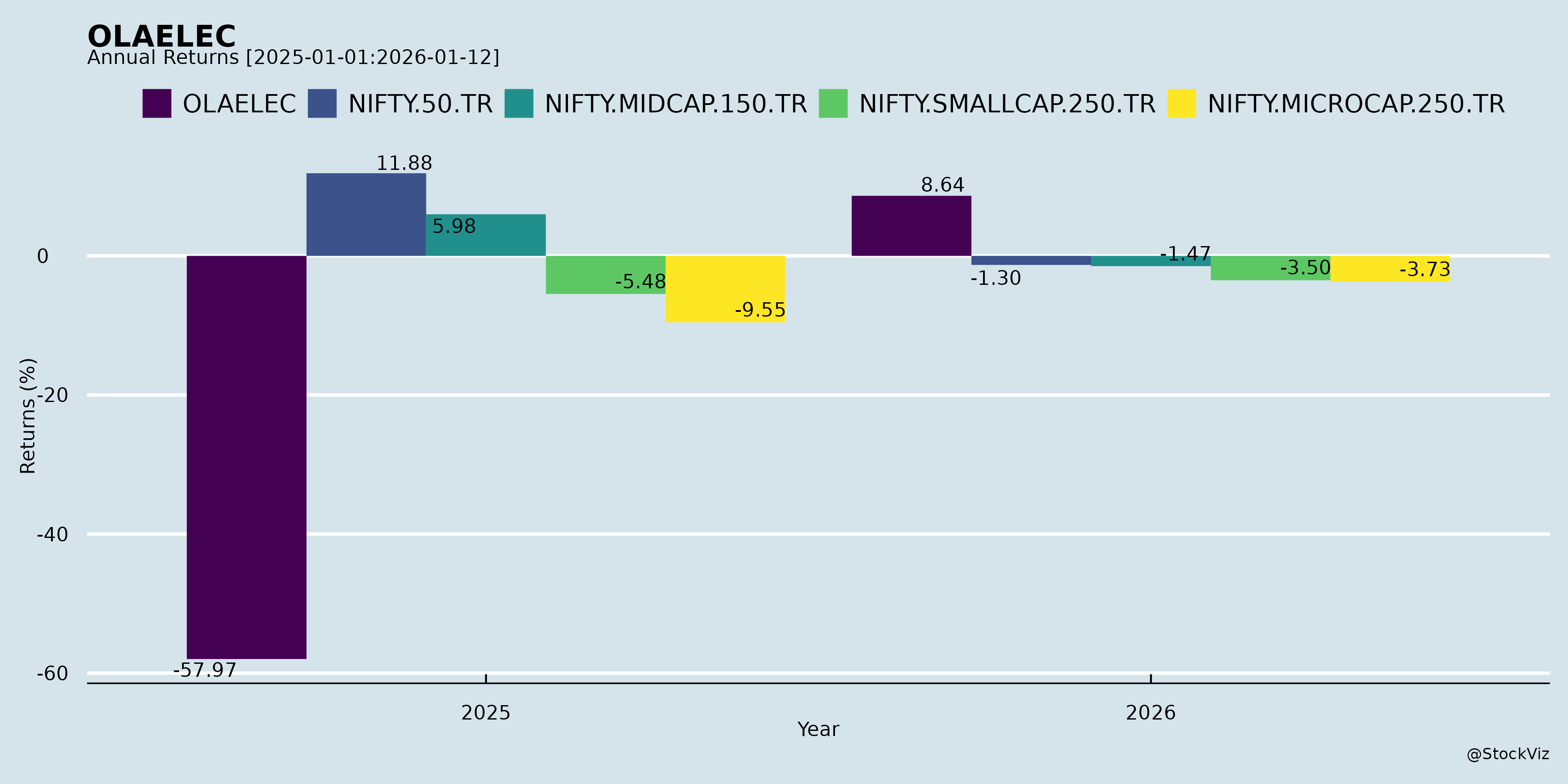

Annual Returns

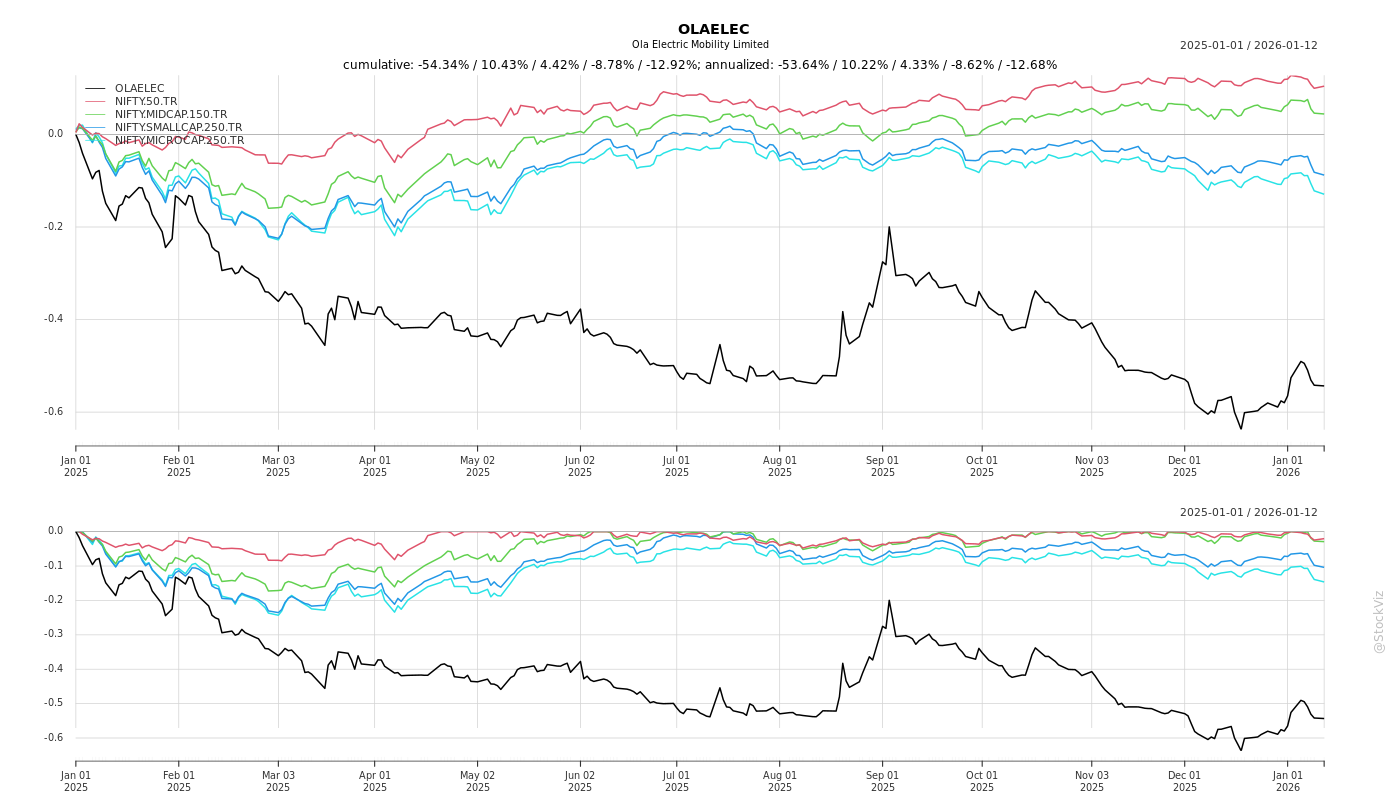

Cumulative Returns and Drawdowns

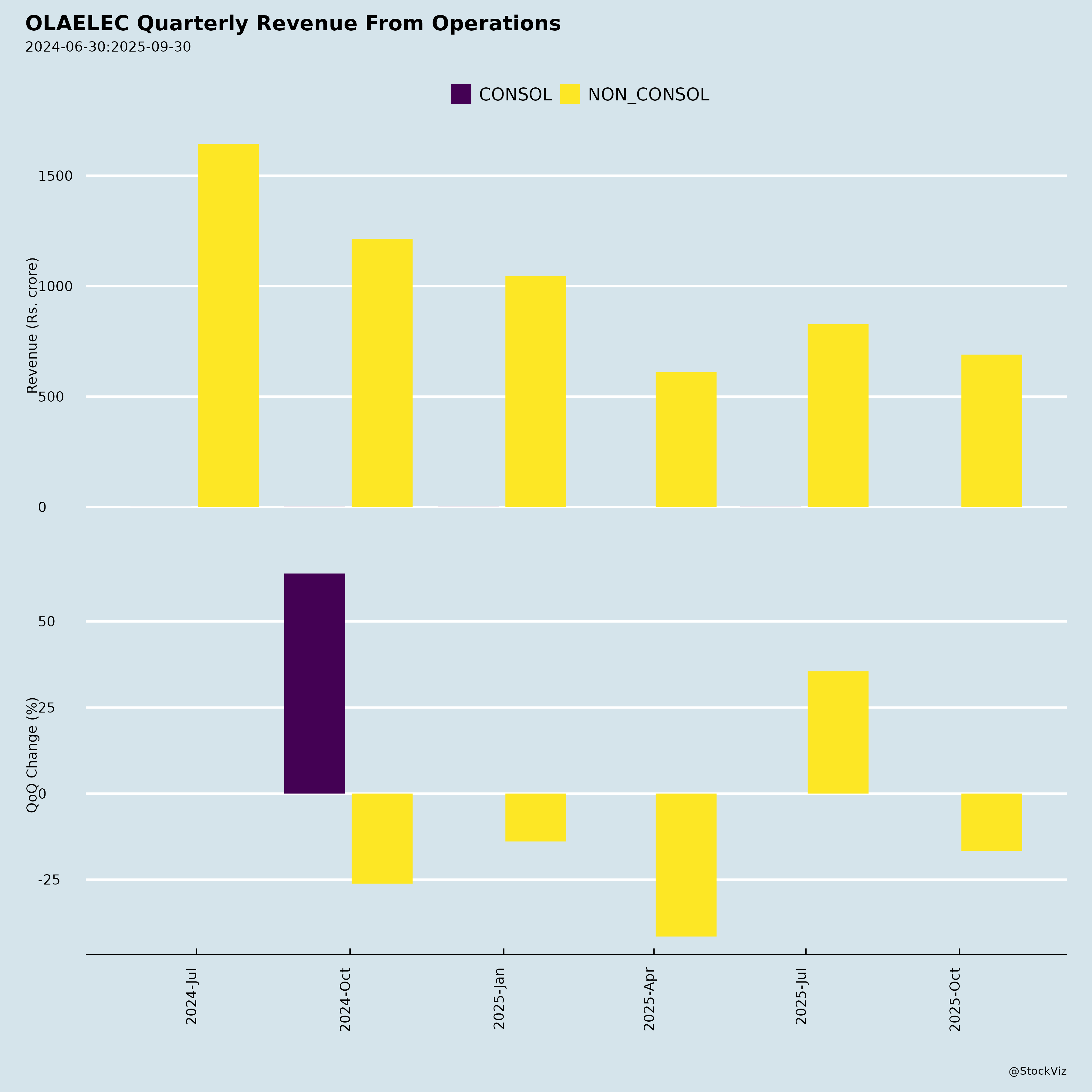

Fundamentals

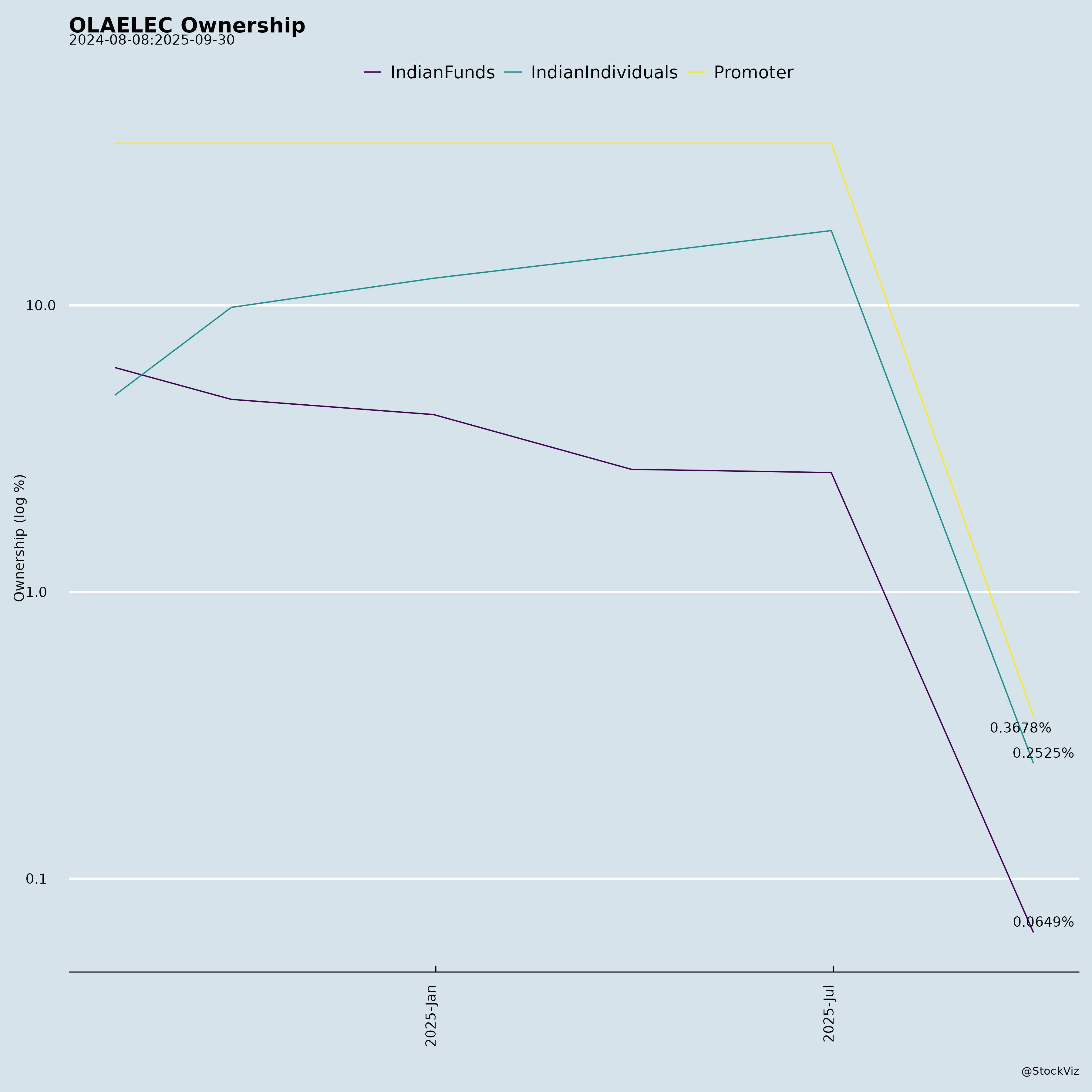

Ownership

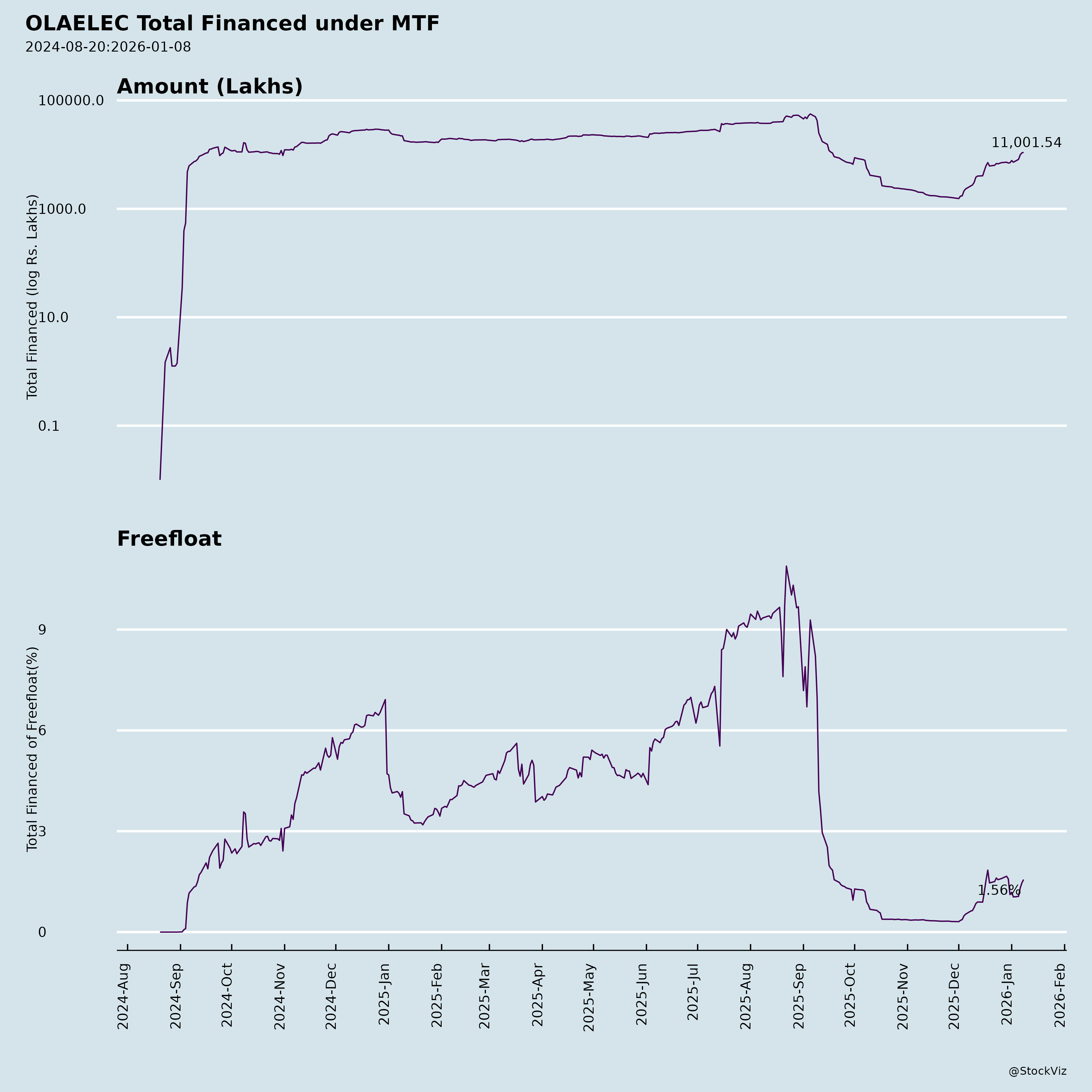

Margined

AI Summary

asof: 2025-12-03

Analysis of Ola Electric Mobility Limited (OLAELEC)

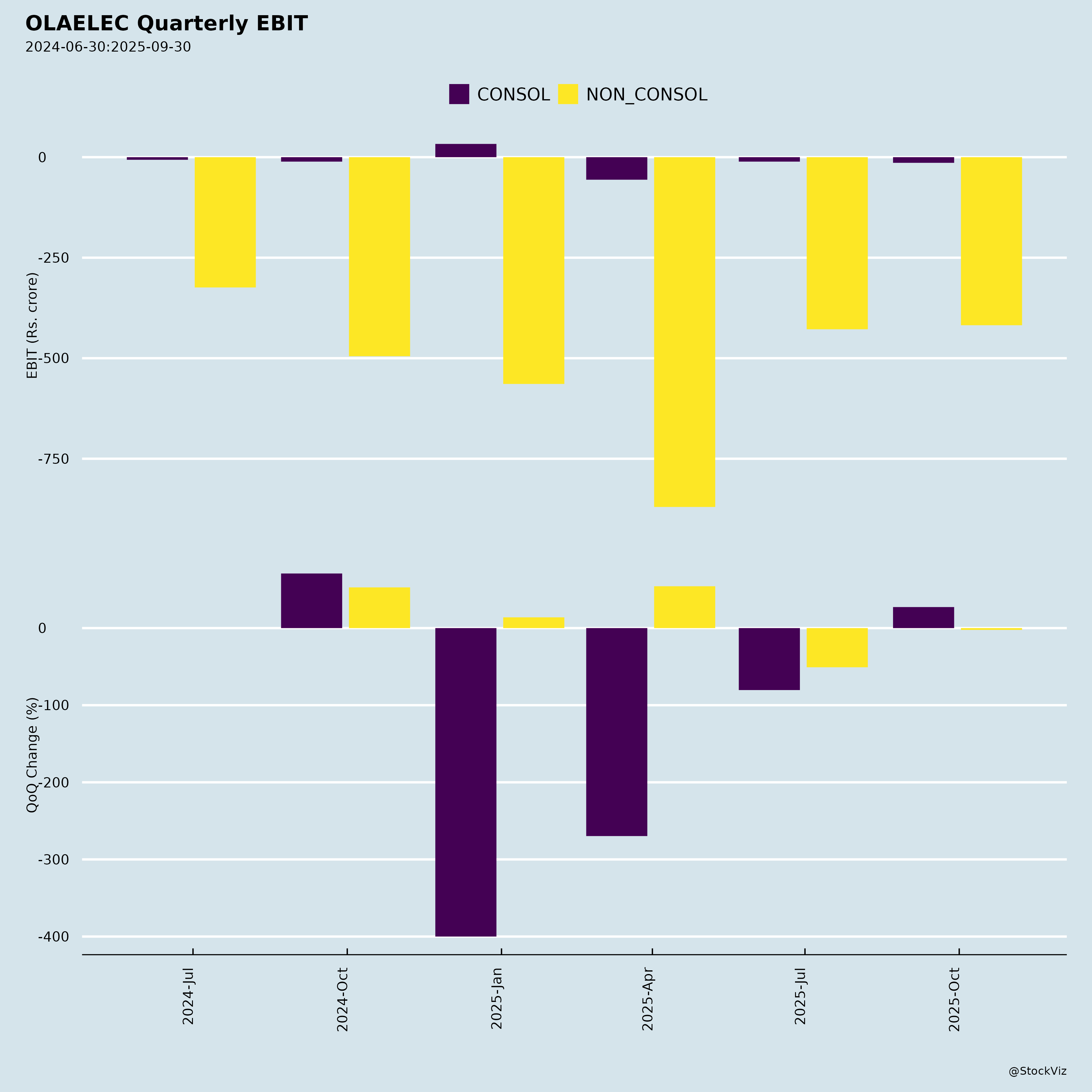

Ola Electric Mobility Limited (Ola Electric), India’s leading electric two-wheeler (E2W) manufacturer, is navigating a transitional phase focused on profitability amid a slowing EV market. The Q2 FY26 results (ended Sep 30, 2025) mark a milestone with the Auto segment achieving its first EBITDA positivity (0.3% margin), driven by 30.7% gross margins (up 510 bps QoQ) and 52% YoY opex reduction. However, deliveries fell 23% QoQ to 52,666 units, reflecting industry headwinds. Diversification into energy storage and services offers long-term levers. Below is a structured analysis based on the provided filings (KPI book, shareholders’ letter, financial results, announcements).

Tailwinds (Positive Momentum)

- Profitability Turnaround: Auto gross margins hit 30.7% (minimal PLI reliance at 2%), targeting 40% by FY26-end. Operating EBITDA improved to -₹47 Cr (-6.8% margin) from -₹339 Cr in Q3 FY25. Underlying Auto CFO turned positive at ₹15 Cr (adj. for festive inventory).

- Vertical Integration & Cost Discipline: Gigafactory at 2.5 GWh (ramping to 5.9 GWh by Mar26; 20 GWh by H2 FY27). In-house 4680 cells in vehicles (captive 2-3 GWh demand), ferrite motor (rare-earth free), and MoveOS upgrades. Opex to drop to ₹225 Cr (Auto) and ₹350-375 Cr (consol.) by Q1 FY27.

- Service & Parts Ecosystem (HyperService): Launched PAN-India in-app bookings; opens genuine parts (50%+ margins) to third-party garages. Parts revenue at 2.5% of sales (vs. industry 10-15%); unlocks high-margin recurring revenue.

- Diversification: Ola Shakti (residential BESS) targets ₹100 Cr Q4 FY26 / ₹1,000-1,200 Cr FY27 at 40-50% margins. Container BESS for grid-scale (51 GWh tenders CY25). PLI incentives from Q4 FY26.

- Fundraising & Liquidity: Postal ballot approved securities issuance (up to ₹1,500 Cr equity/convertibles + ₹1,700 Cr debt). ₹2,301 Cr unutilized IPO proceeds (as of Sep25).

Headwinds (Challenges)

- Volume Decline & Market Slowdown: Deliveries down 46% YoY (Q2 FY26: 52,666; H1 FY26: 120,858). Industry E2W flat YoY in festive season; ASP stable but competition via discounting erodes share. FY26 guidance cut to ~220k units (H2: 100k).

- Persistent Losses: Consolidated revenue down 43% YoY to ₹690 Cr; PAT -₹418 Cr (EBITDA margin -18.1%). Cell segment loss-making (-₹50 Cr opex). Negative CFO (-₹200 Cr) and FCF (-₹350 Cr).

- High Capex & Debt: Cell expansion (₹100-150 Cr H2 FY26) funded via SBI debt/PLI. Debt obligations rising (₹1,055 Cr FY31-35E). Inventory build-up impacted cash.

- Macro/Competitive Pressures: EV penetration stalled at ~7%; rivals prioritize share over margins.

Growth Prospects

- Short-Term (FY26): Consolidated revenue ₹3,000-3,200 Cr (focus profitability > volumes). Auto EBITDA ~5% by Q4; Cell stabilizes at 30% GM by early FY27. Roadster sales up 4x QoQ (15% of mix).

- Medium-Term (FY27+): Revenue mix shifts (Auto + Energy + Parts). Energy: Rooftop (6-8 GW installs FY26), grid-scale dominance (domestic vs. Chinese imports). Total capex discipline leads to Auto FCF positivity. Target: 40% Auto GM, broader compounding via integrated platform (cells → vehicles → grid).

- Strategic Enablers: Gen3 platform reliability; R&D (ADAS, AI Voice in 11 languages via MoveOS6); site visits (Dec05) to showcase Futurefactory/Gigafactory/BIC. D2C network (largest company-owned) aids service scale.

| Key Metrics Outlook | FY26E | FY27E Target |

|---|---|---|

| Deliveries (units) | ~220k | Not guided (profitable growth) |

| Auto GM | ~40% (Q4) | Structural 40%+ |

| Revenue | ₹3-3.2k Cr | Diversified (Energy/Parts add) |

| Cell Capacity | 5.9 GWh | 20 GWh |

| Opex (Consol.) | ~₹350-375 Cr/Q | Further efficiencies |

Key Risks

- Execution Risk: Gigafactory ramp (38k cells Q2; delays could hit margins). High capex amid cash burn (notes on going concern, mitigated by IPO/fundraise).

- Market/Competition: Prolonged slowdown; aggressive discounting erodes pricing power. EV adoption tied to infra/affordability.

- Regulatory/Legal: EPR/Battery Waste rules (unquantifiable costs). Ongoing CCPA/SEBI queries on grievances/bookings (mgmt: no material impact).

- Financial: Debt servicing (net interest rising); dilution from fundraising. Negative working capital swings.

- Operational: Warranty/service costs (HyperService mitigates); supply chain (cells transition).

- Macro: PLI delays, forex (rare-earth alternatives help).

Overall Summary: Ola Electric is pivoting successfully to profitability (Auto EBITDA inflection), leveraging vertical integration and diversification (Energy/Services) as tailwinds against volume headwinds in a maturing E2W market. Growth prospects are strong in FY27+ via high-margin adjacencies, but near-term risks center on execution and competition. Valuation should reflect transition (lower multiples on volumes, premium on margins/tech). Positive catalysts: Q3 results, Shakti ramp, fundraising. Recommendation: Hold/Buy on dips for long-term EV/energy play; monitor Dec site visit for sentiment boost. (Analysis as of Dec02, 2025 filings; stock dynamics may evolve.)

Copyright © 2023 SAS Data Analytics Pvt. Ltd. All rights reserved.