MUTHOOTFIN

Equity Metrics

January 13, 2026

Muthoot Finance Limited

Non Banking Financial Company (NBFC)

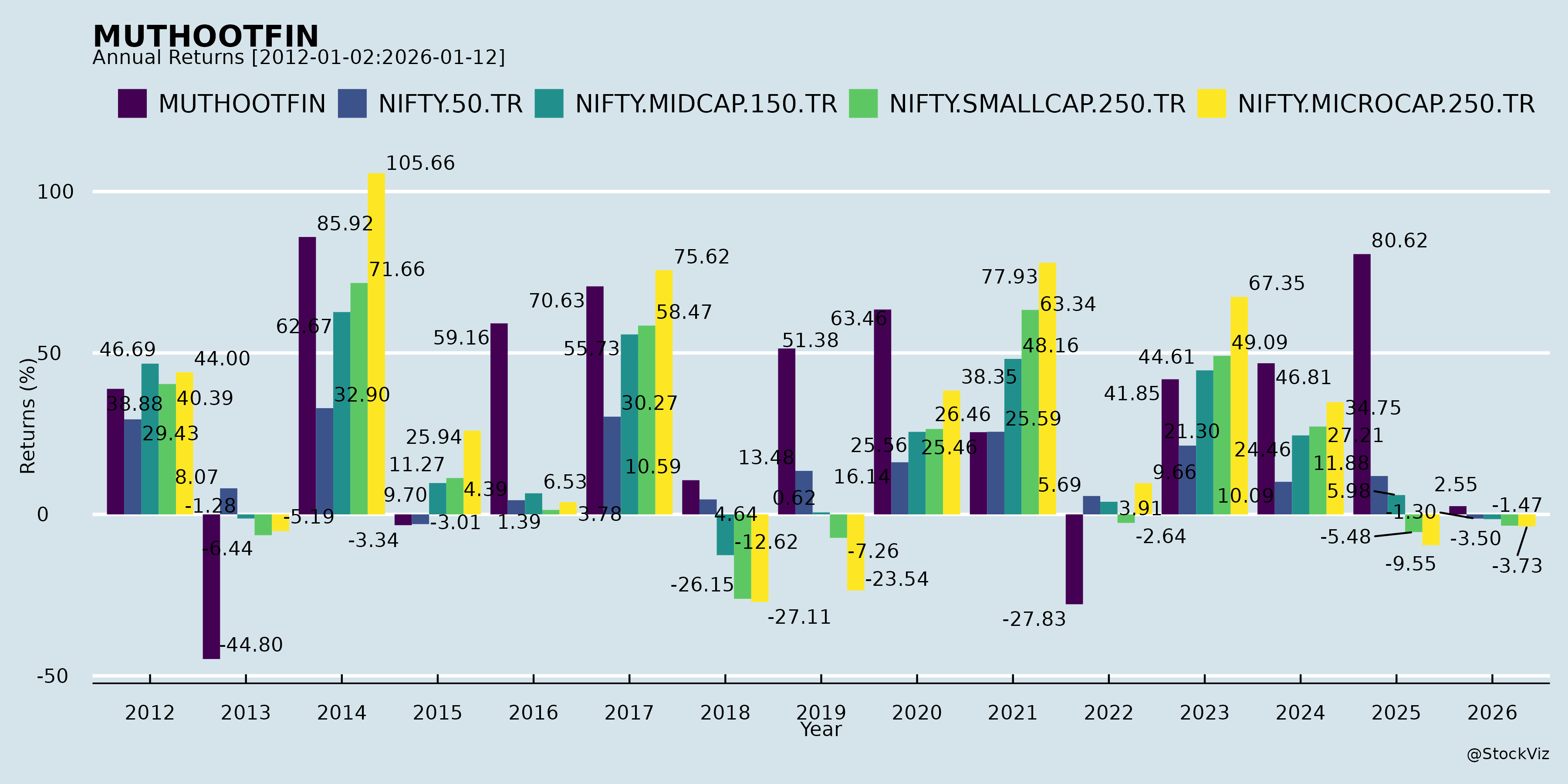

Annual Returns

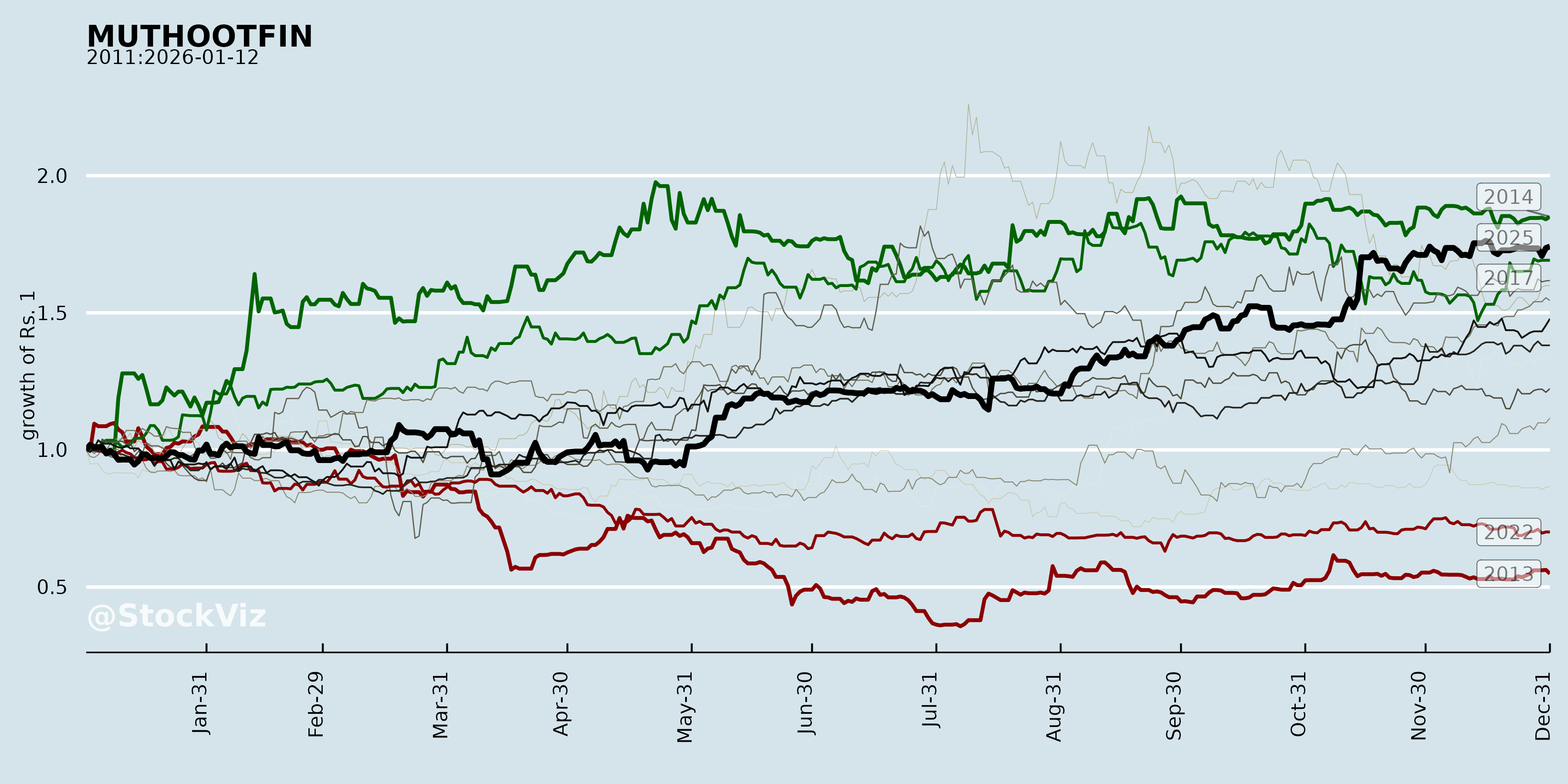

Cumulative Returns and Drawdowns

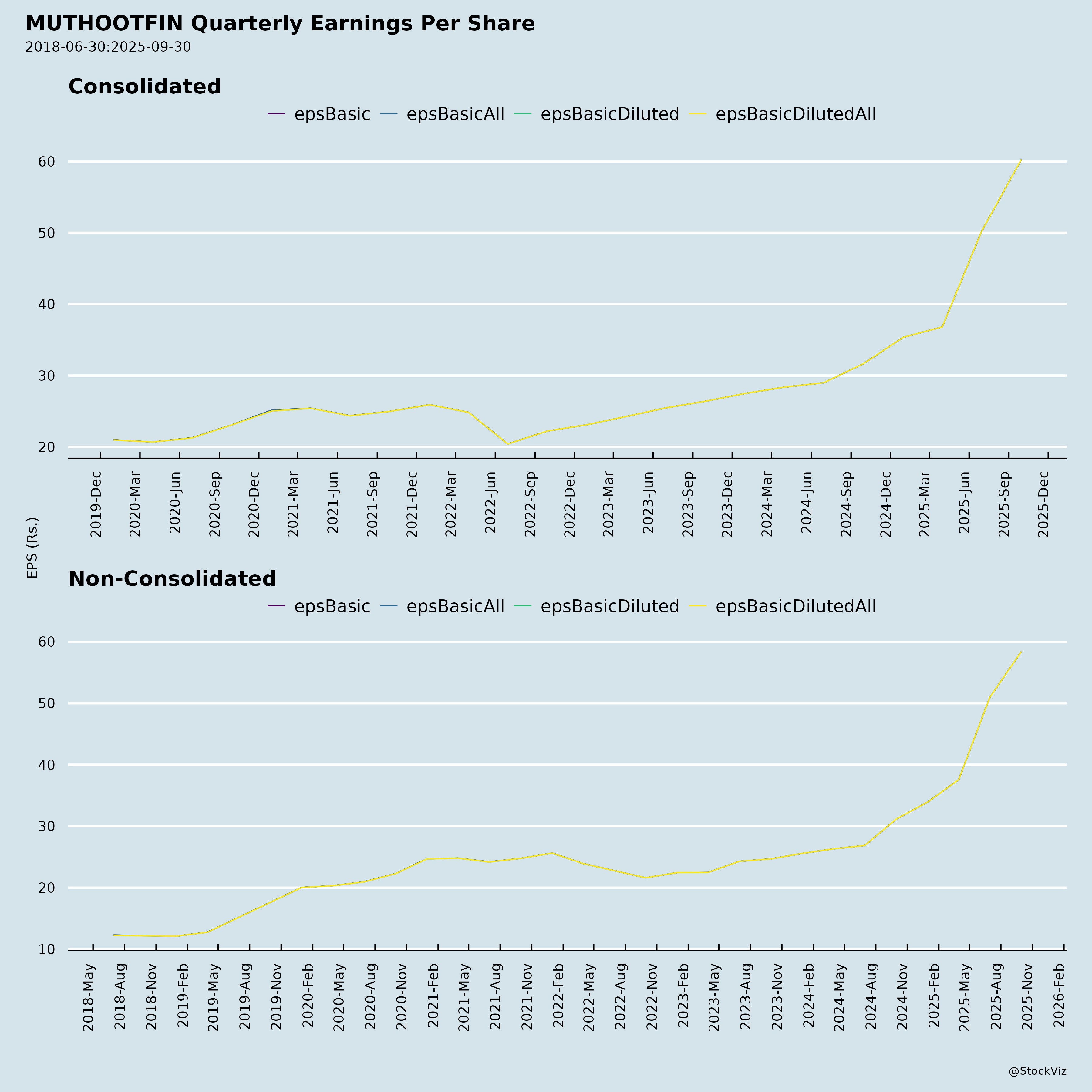

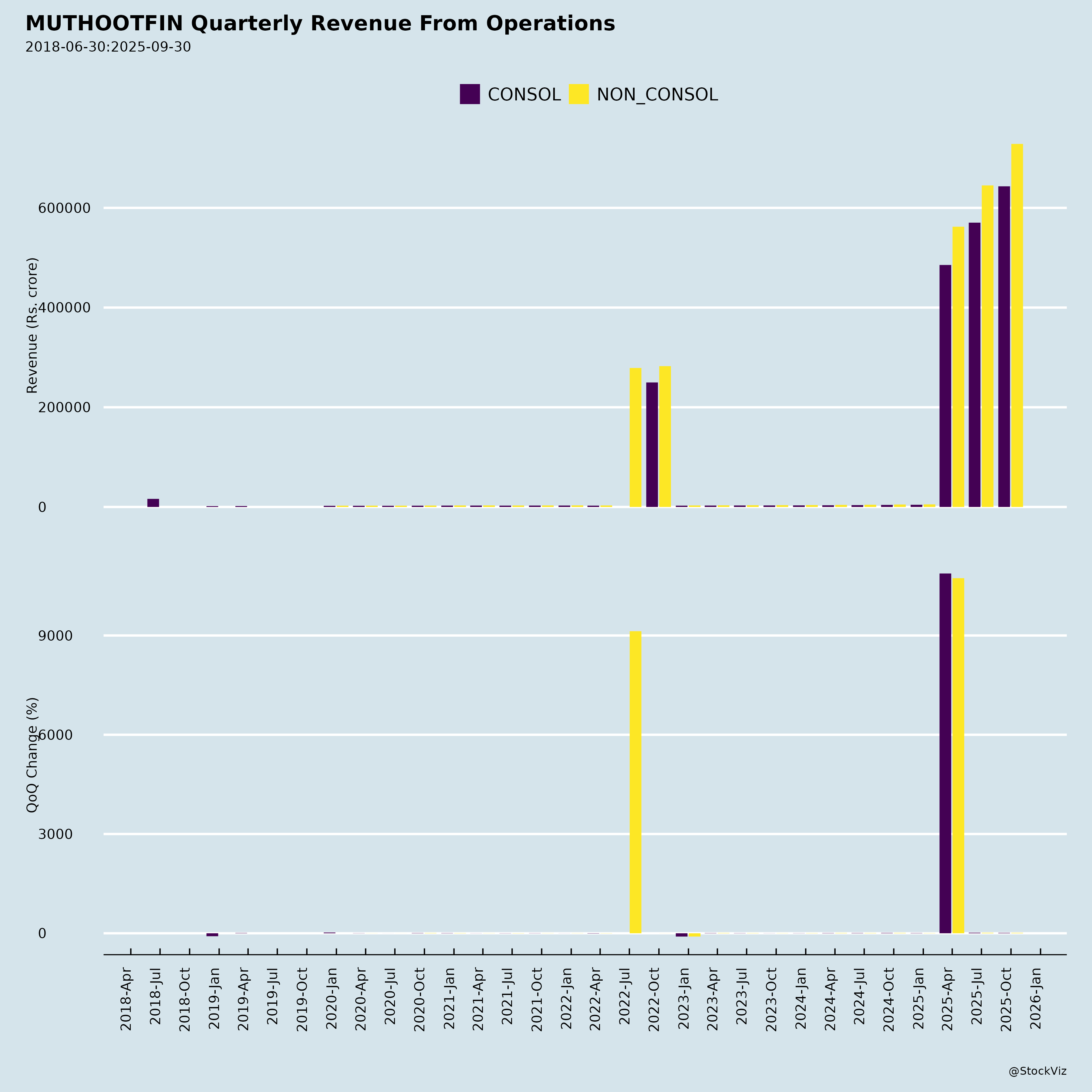

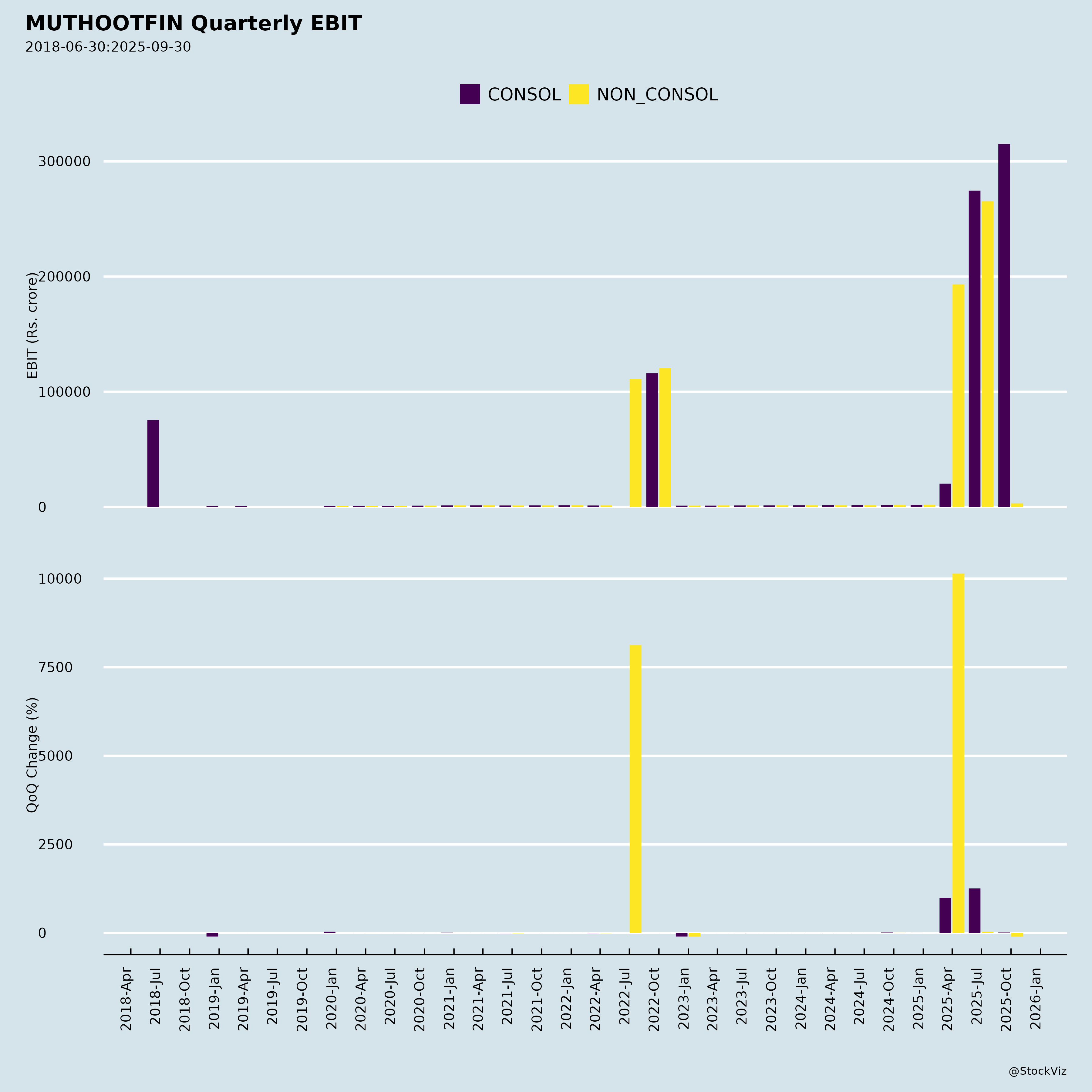

Fundamentals

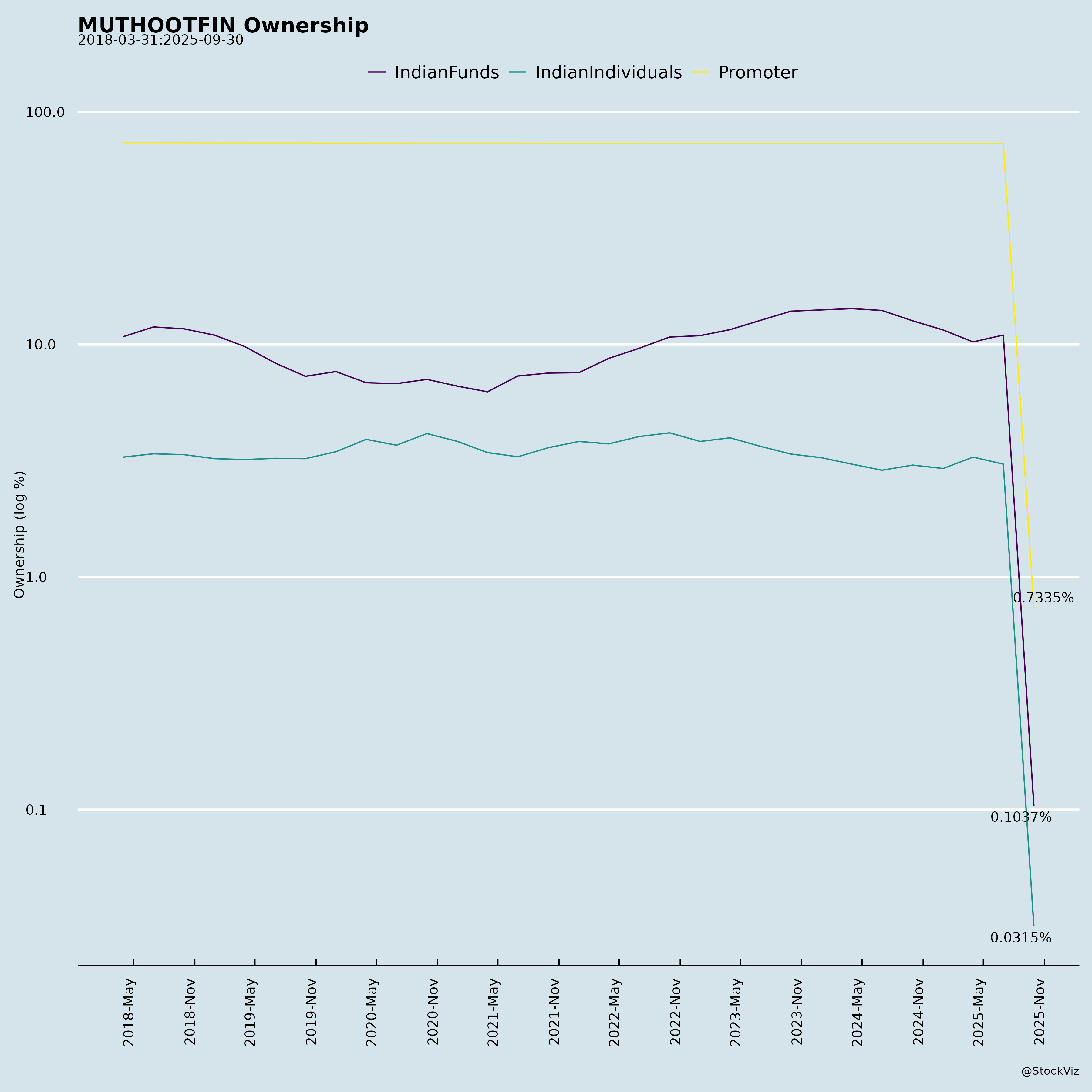

Ownership

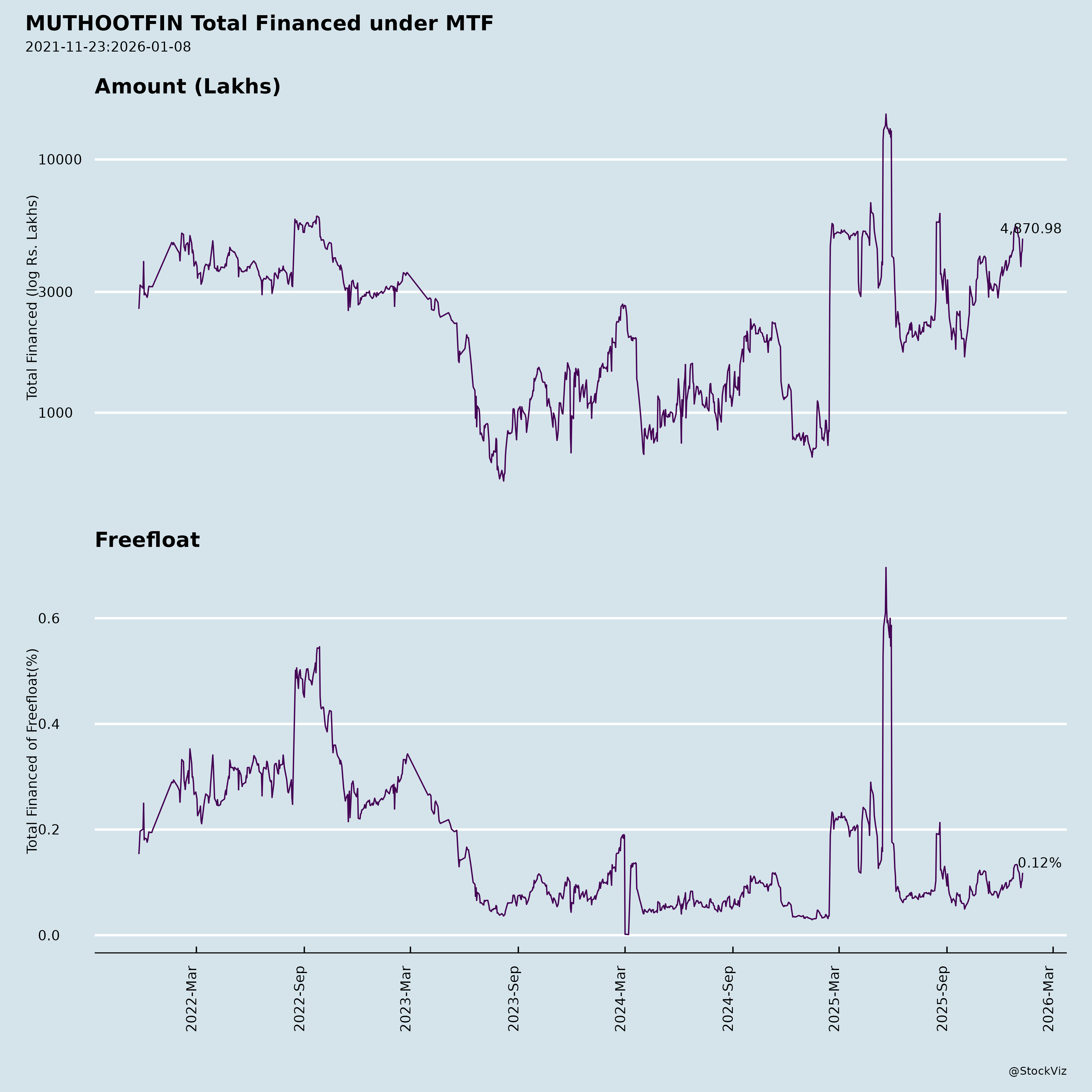

Margined

AI Summary

asof: 2025-12-08

Comprehensive Analysis of Muthoot Finance Limited (MUTHOOTFIN)

Based on Unaudited Financial Results for Q2 and H1 FY26 (September 30, 2025)

Executive Summary

Muthoot Finance Limited (MUTHOOTFIN) has demonstrated robust double-digit growth in both AUM and profitability in the first half of FY26, driven primarily by its core gold finance business and strategic expansion across subsidiaries. The company reported record-high standalone and consolidated loan assets under management (AUM), 74–88% YoY growth in net profits, and strong operational metrics. Favorable regulatory tailwinds, rising gold prices, digital transformation, and diversification efforts are aiding growth. However, increased credit costs, macroeconomic sensitivity to gold prices, and challenges in microfinance and subsidiary segments pose headwinds. Despite these, Muthoot’s trusted brand, branch expansion, and improved profitability ratios position it well for sustained growth.

Tailwinds – Growth Drivers

1. Strong Core Gold Loan Business

- Gold Loan AUM grew 45% YoY to ₹1,24,918 crores, with H1 FY26 disbursement to 8.9 lakh new customers (₹13,183 crores).

- Average loan ticket size up 32% YoY to ₹1.17 lakh, indicating improved customer profile.

- Gold pledged up to 209 tonnes (from 199 tonnes YoY), affirming rising trust and demand.

- Rising gold prices (~12–15% YoY) have enhanced value of collateral and loan eligibility, boosting customer demand.

2. Regulatory Support and Favorable Industry Landscape

- RBI’s tighter norms for unsecured loans (e.g., credit card, personal loans) are driving demand for secured loans like gold loans, where Muthoot is a market leader.

- RBI allowing 40% non-microfinance assets for NBFC-MFIs enabled Belstar Microfinance to diversify into gold loan branches (23 new branches in H1).

- Regulatory clarity supports expansion in housing finance (MHIL) and digital lending.

3. Expansion & Network Leverage

- Group branch network grew to 7,524 across India (6% YoY), driven by 133 new branches in H1.

- Muthoot Finance (standalone): 4,967 branches (up 2.3% YoY).

- Average Gold Loan AUM per branch: ₹25.15 crores – a 42% YoY increase, indicating higher operational efficiency and productivity.

4. Profitability & Operational Efficiency

- Standalone PAT: ₹4,391 crores (88% YoY growth).

- Return on Average Equity (ROAE): 29.14% (vs. 18.65% in H1 FY25) – strong capital efficiency.

- Return on Average Loan Assets: 7.30% (vs. 5.58%) – improved underwriting and yield management.

5. Subsidiary Growth & Diversification

- Muthoot Money (MML):

- Loan AUM: ₹6,393 crores (+182% YoY).

- Profit turnaround: from ₹5 cr loss to ₹106 cr profit.

- Muthoot Homefin (MHIL):

- Loan AUM: ₹3,247 crores (+33% YoY), equity infusion of ₹200 cr.

- Asia Asset Finance (Sri Lanka):

- AUM: LKR 3,868 crores (+48% YoY), PAT: LKR 40 cr (+33% YoY), 107 branches.

- Muthoot Insurance Brokers: Profit of ₹23 cr on ₹241 cr premium.

6. Strengthened Credit Profile

- Fitch upgraded Muthoot Finance’s long-term rating from BB to BB+ with Stable outlook.

- ICRA, CRISIL, and CARE maintain strong short-term and long-term ratings for both Muthoot and MHIL.

- Capital adequacy healthy (20.89% at standalone level).

7. Digital Transformation & Innovation

- Focus on faster, digital loan disbursal, improving customer experience and scalability, especially in remote areas.

8. Fundraising & Capital Strengthening

- Raised $600 million via USD-denominated bonds – strengthens international presence and reduces INR funding cost.

- Equity infusions in subsidiaries (₹200 cr in MHIL, ₹500 cr in MML) support growth and capital adequacy.

Headwinds & Challenges

1. Rising Credit Losses

- Credit losses in H1 FY26: ₹127.09 crores (vs. ₹28.84 crores in H1 FY25) – 341% YoY increase.

- % of credit losses to AUM rose to 0.10% from 0.03%

- Suggesitive trends:

- Gold prices may make loan-to-value breaches more frequent.

- Economic stress on lower-income borrowers during inflationary periods.

2. Microfinance Subsidiary (Belstar) Under Strain

- Belstar Microfinance reported a loss of ₹160 crores in H1 FY26 (vs. profit of ₹142 crores in H1 FY25).

- Loan AUM declined to ₹7,715 crores (from ₹9,625 crores).

- Stage III NPA: 4.58% (up from 3.51%).

- Industry-wide stress in RBI-regulated MFI segment, impacting sentiment despite strategic pivot.

3. International Currency Risk (Sri Lanka, USD Bonds)

- AAF’s performance measured in LKR, but Muthoot reports in INR – FX volatility impacts translation gains/losses.

- INR-LKR exchange rate at 0.2932, up from ~0.28 in H1 FY25 – adverse for INR translation of future profits.

4. Gold Price Volatility

- High gold prices boost collateral value, but also slow customer redemption, increasing inventory risk and storage costs.

- Sharp correction in gold prices could increase credit losses and trigger NPAs.

5. Concentration Risk in Gold Loans

- Gold loans represent ~90% of total AUM, making earnings highly sensitive to gold price cycles and rural economic health.

- While management plans to maintain non-gold AUM at 12–15%, current diversification remains limited.

6. Operational Costs Rising

- Expenses rising across subsidiaries, particularly in Belstar (↑expenses by 7.8%) and MML (↑134%), though revenues are growing faster.

7. Competition in Gold Finance

- Manappuram, Muthootti, Shriram – increasing competition, especially in tier 2/3 cities and digital lending platforms.

Growth Prospects & Strategic Initiatives

1. Upgraded FY26 Guidance

- Raised gold loan growth forecast to 30–35% (from 15%) due to strong H1 momentum and favorable tailwinds.

2. Expansion of Non-Gold Lending

- Muthoot plans to grow home loans (via MHIL), personal loans, and business loans.

- MHIL targeting LMI segments in 14+ states via hub-and-spoke model.

3. Leveraging Microfinance Diversification

- Belstar adding gold loan product lines to reduce reliance on unsecured microloans.

4. International Expansion

- Asia Asset Finance (Sri Lanka): 107 branches, 48% AUM growth – platform for further regional expansion.

- USD bond issuance supports global capital access.

5. Digital & Customer-Centric Innovation

- Accelerating tech investment for faster, seamless credit delivery.

- Acquiring 8.9 lakh new gold loan customers in H1 indicates high customer trust and scalability.

6. ESG & CSR Recognition

- CSR Times Award for NCD screening in tribal areas – enhances brand trust and social capital.

Key Risks Summary

| Risk Category | Risk Description |

|---|---|

| Gold Price Volatility | Sustained price rise may delay repayments; a sudden drop could trigger NPA spikes. |

| Credit Cost Escalation | Credit losses up 341% YoY – need for vigilant risk management. |

| Subsidiary Performance Volatility | Belstar’s significant loss and falling AUM pose drag on group results. |

| Regulatory Changes | Potential tightening of gold loan LTV norms or sectoral exposure caps. |

| FX and International Risk | Exposure to LKR and USD creates translation and interest rate risks. |

| Competition | Growing competition from peers and fintech lenders in digital gold loans. |

| Operational Scaling Risk | Rapid branch expansion may strain operational control and staffing. |

Conclusion & Outlook

✅ Bull Case

- Muthoot is executing its growth strategy effectively, with record AUM and profits, rising ROE, and improved branch productivity.

- Regulatory tailwinds, gold price support, and expansion in housing and international markets offer long-term upside.

- Asset quality remains strong at group level, and profitability is robust.

⚠️ Bear Case

- Rising credit losses and microfinance slump signal vulnerability in certain segments.

- Heavy reliance on gold loans and rural demand exposes company to commodity and demand cycle risks.

🔮 Overall Outlook: Strong Buy / Accumulate (for long-term investors)

- Target Growth Driver: Core gold business momentum with improving ROE.

- Holdings Strategy: Watch Belstar’s turnaround and credit cost trends closely.

- Valuation not provided, but earnings growth justifies premium if maintained.

Bottom Line:

Muthoot Finance is in a strong growth trajectory, led by its core gold loan business and supported by strategic diversification, digital transformation, and favorable regulation. While headwinds exist, the company’s leadership, capital strength, and brand trust position it to navigate challenges and deliver sustained value in FY26 and beyond.

Prepared based on Q2 & H1 FY26 unaudited results – November 13, 2025.

Source: Press release, performance highlights, and detailed financial breakdowns of Muthoot Finance Ltd & subsidiaries.

Copyright © 2023 SAS Data Analytics Pvt. Ltd. All rights reserved.