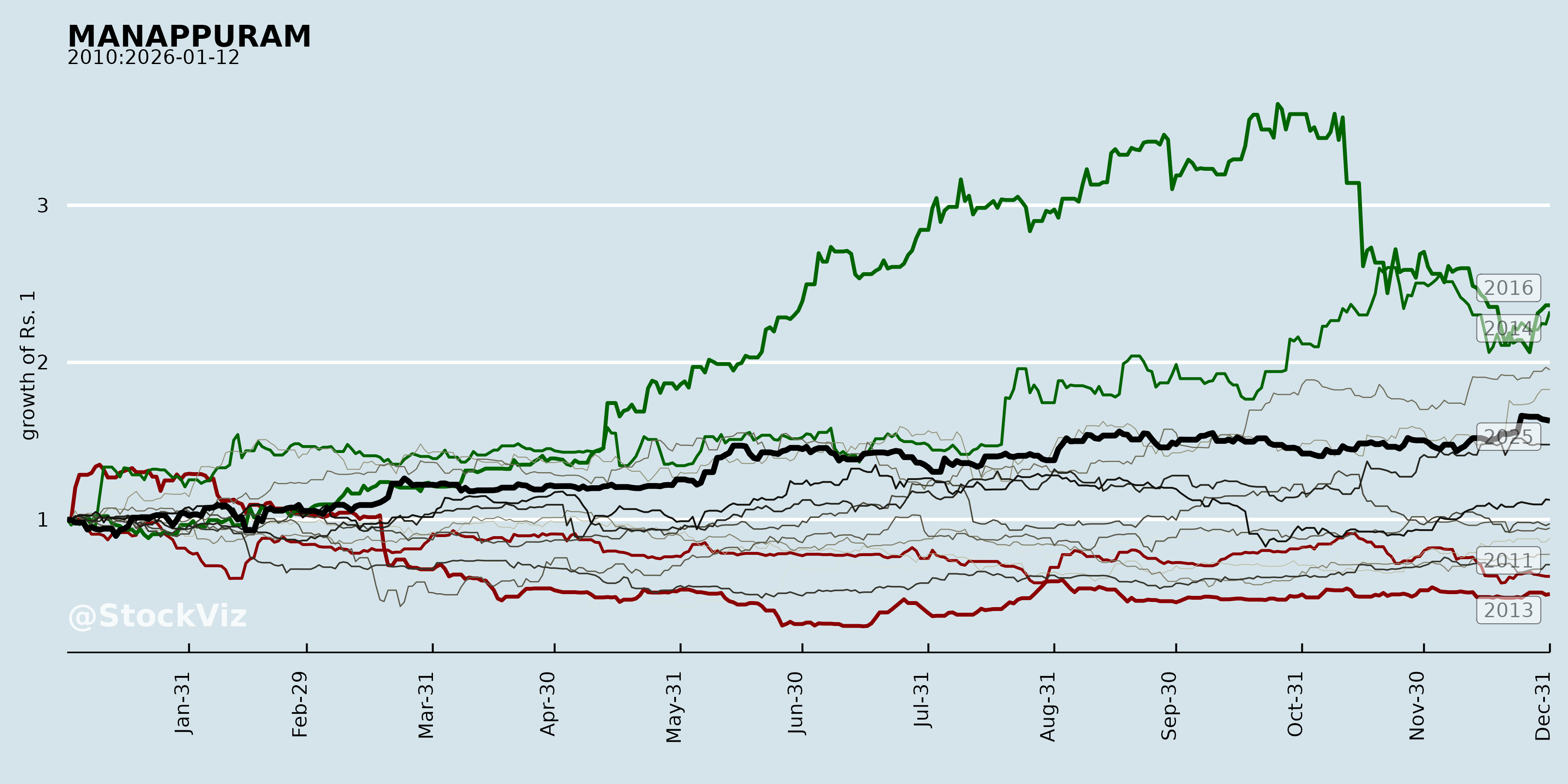

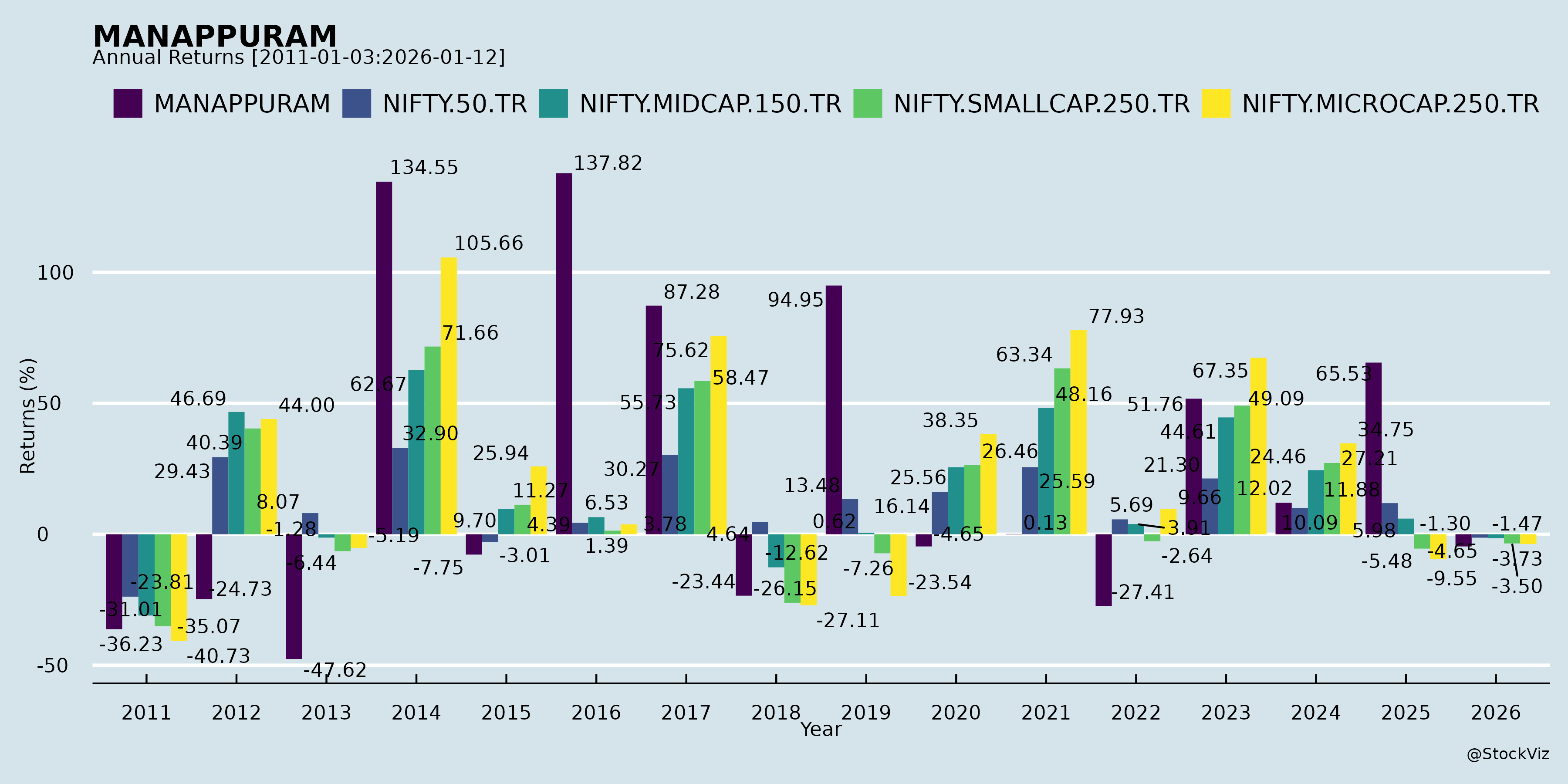

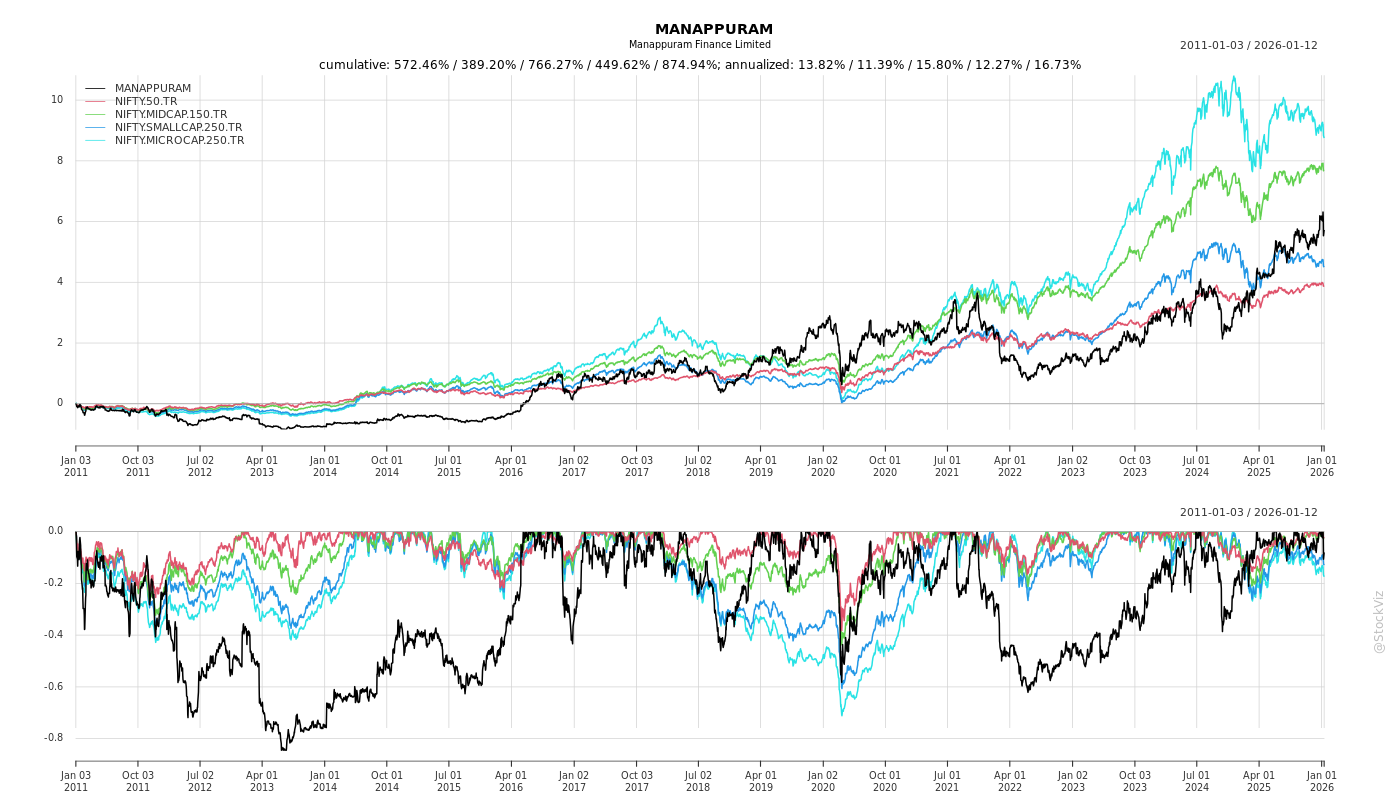

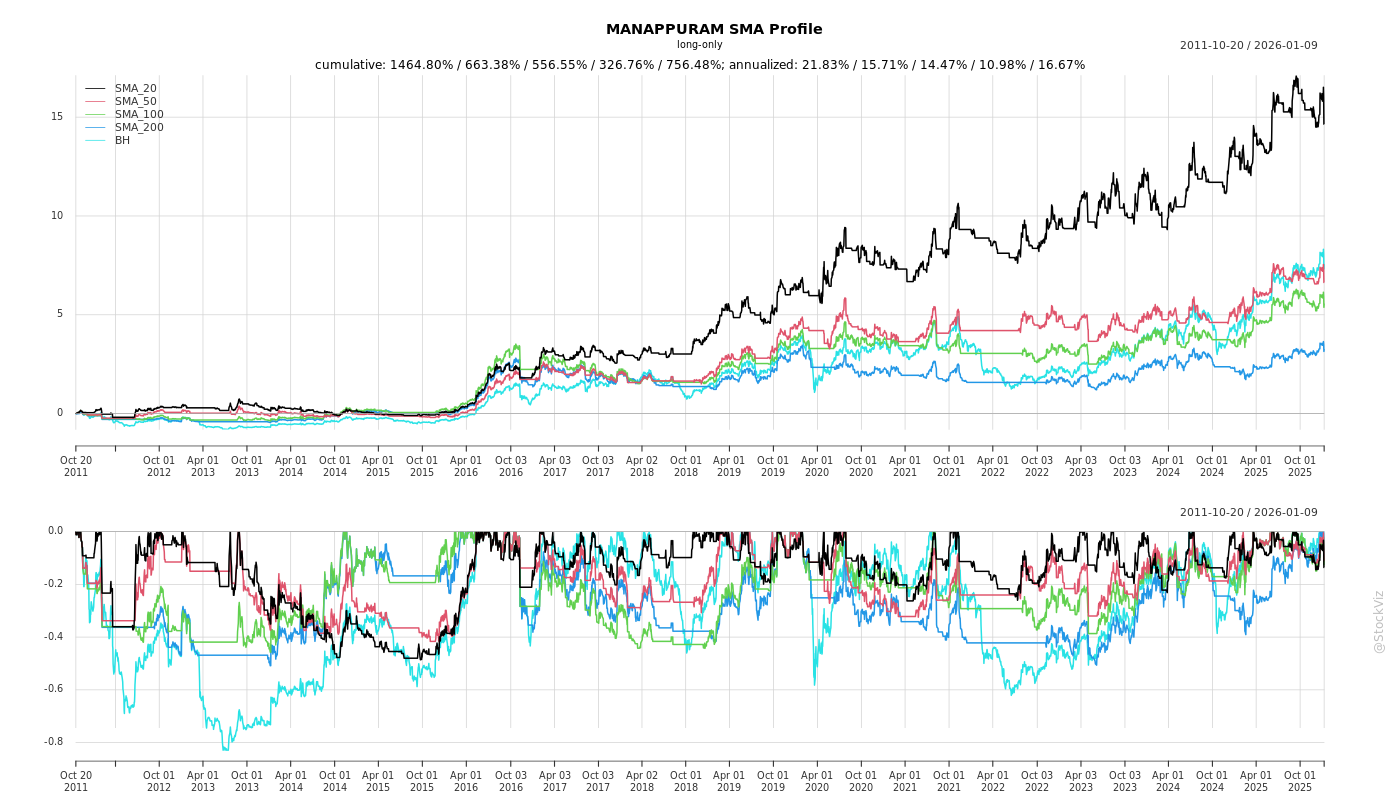

MANAPPURAM

Equity Metrics

January 13, 2026

Manappuram Finance Limited

Non Banking Financial Company (NBFC)

Annual Returns

Cumulative Returns and Drawdowns

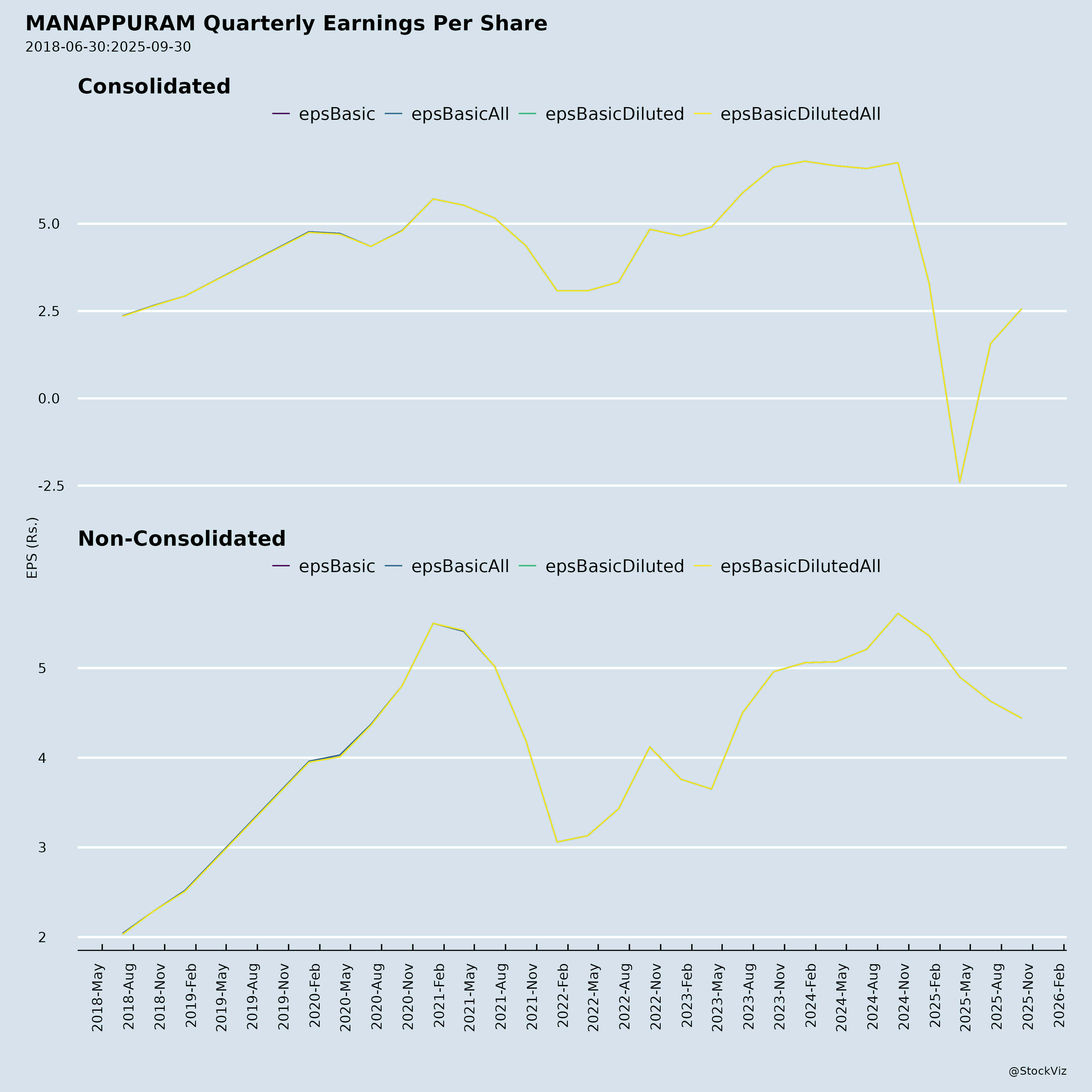

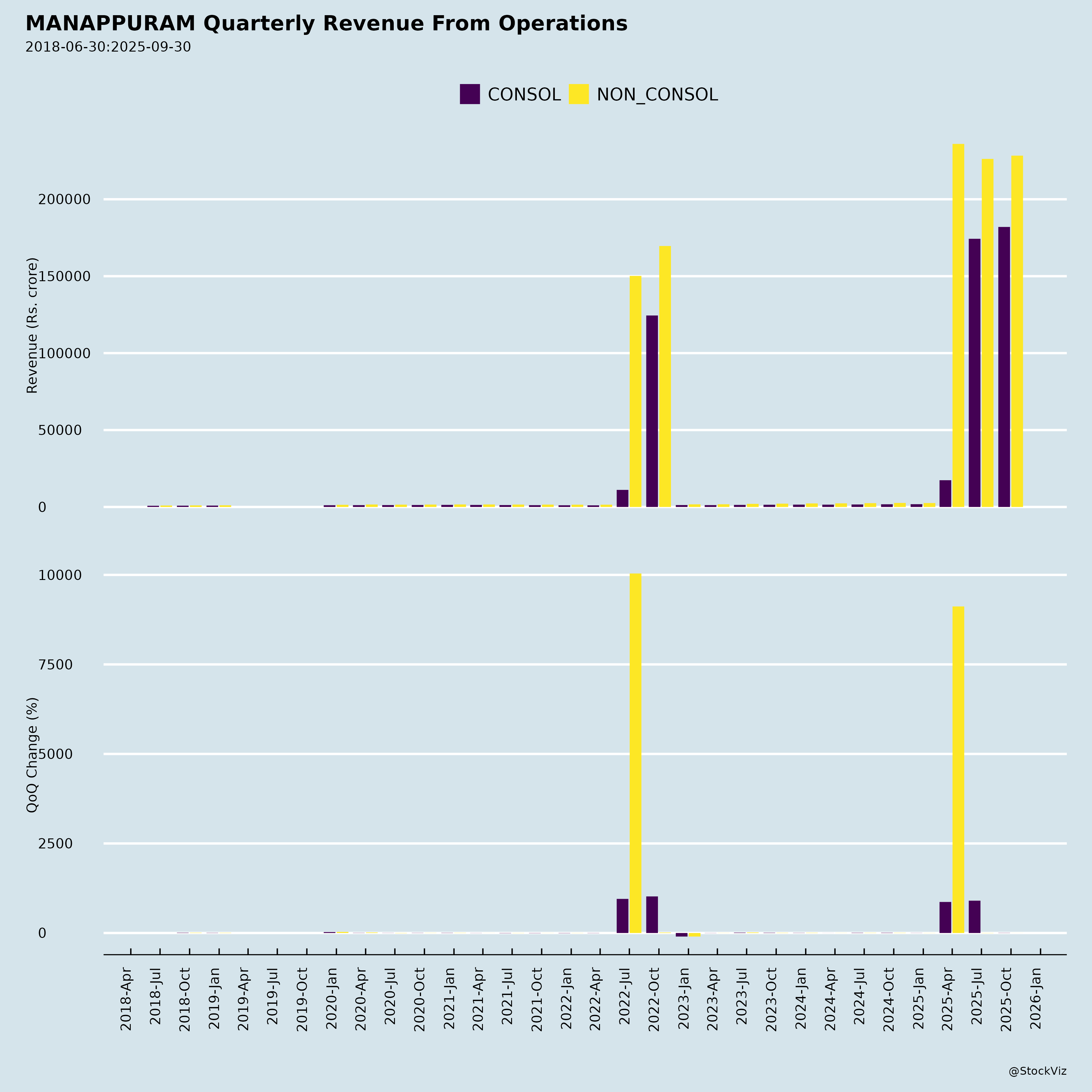

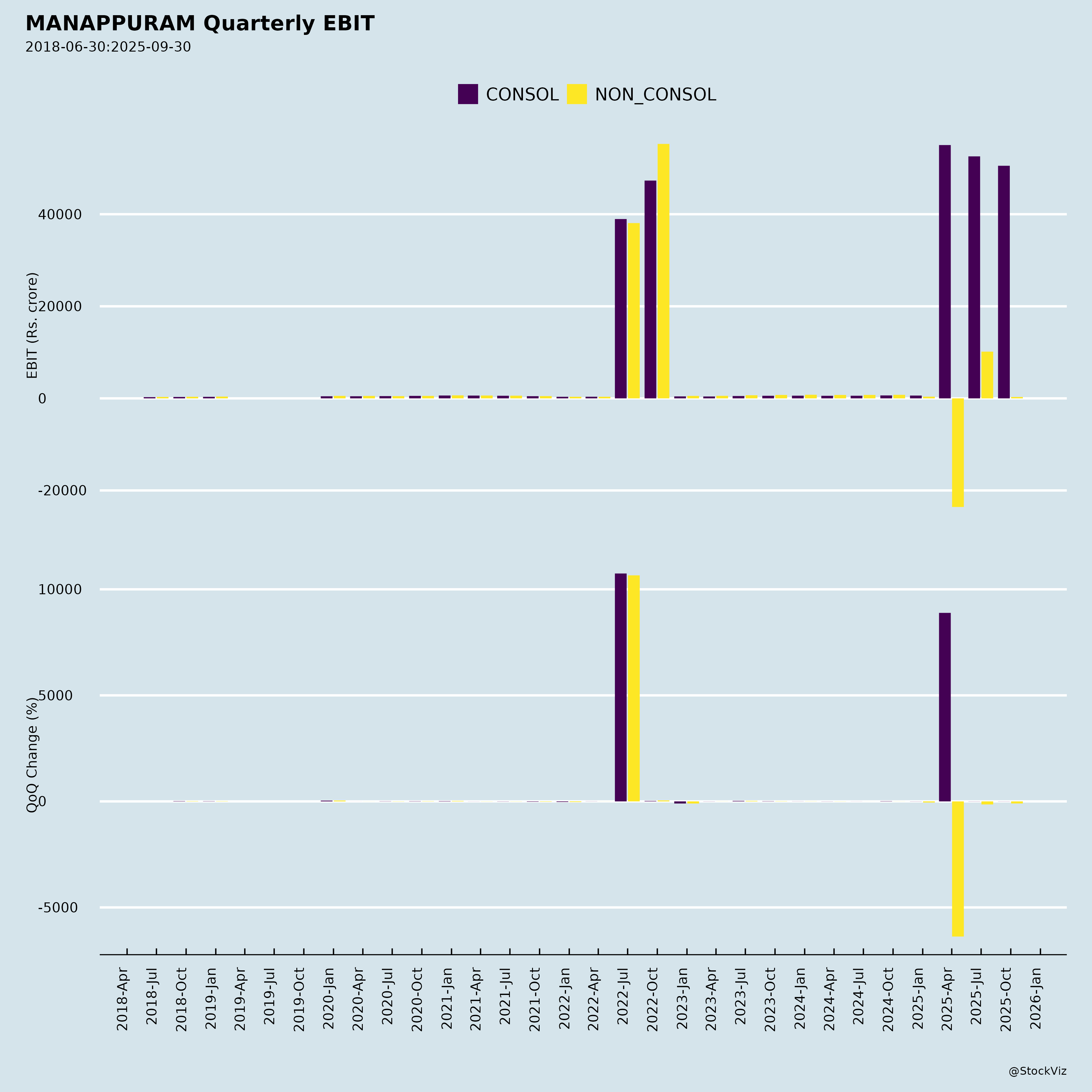

Fundamentals

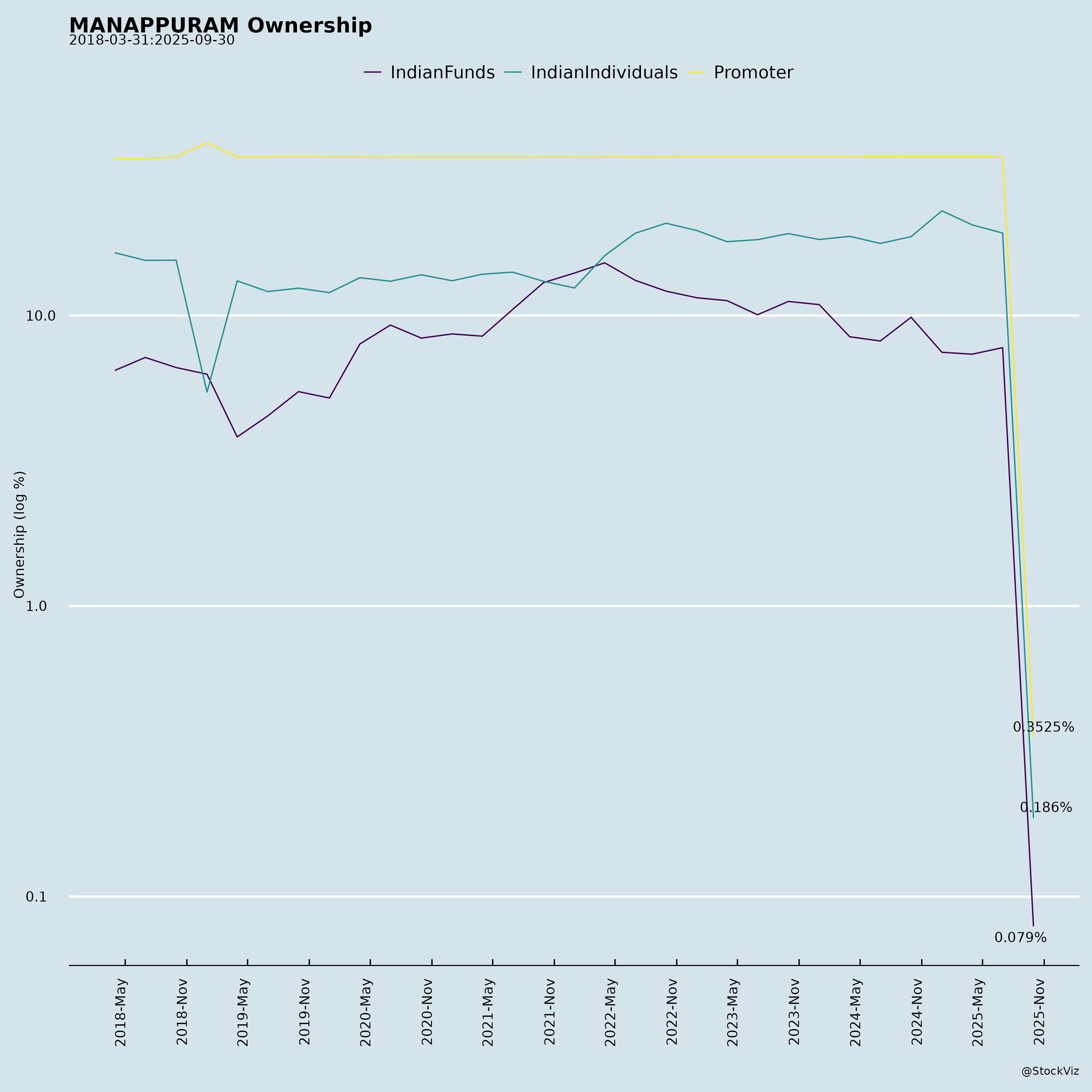

Ownership

Margined

AI Summary

asof: 2025-12-03

Analysis of Manappuram Finance Limited (MANAPPURAM)

Manappuram Finance Limited, India’s leading listed gold loan NBFC, reported consolidated H1 FY26 (ended Sep 30, 2025) results showing revenue decline (Rs 4,550 Cr vs Rs 5,149 Cr YoY) and sharp PAT drop (Rs 350 Cr vs Rs 1,129 Cr YoY), primarily due to Microfinance weakness. Standalone results were robust (PAT Rs 768 Cr). Gold loans remain the core strength (85%+ AUM), with total assets at Rs 51,657 Cr (+5% YoY). Declared 2nd interim dividend of Rs 0.50/share (25%). High CRAR (28%) and LCR (279%) indicate financial strength.

Tailwinds (Positive Drivers)

- Resilient Gold Loan Segment: Revenue Rs 3,896 Cr (+8% H1 YoY), assets Rs 44,323 Cr (+10% QoQ). Benefits from high gold prices, rural demand, and brand as “India’s first listed/highest credit-rated gold loan company”. Stage 3 loans low at 2.96% (net 2.56%).

- Strong Standalone Performance: PAT Rs 768 Cr (+YoY growth), assets Rs 44,238 Cr (+11% YoY), driven by lending efficiency and low impairment (Rs 192 Cr).

- Capital Infusion & Balance Sheet Strength: Infused Rs 500 Cr equity into stressed subsidiary Asirvad Microfinance. Net worth Rs 12,712 Cr, PCR 14%, full asset cover on NCDs.

- Dividend Policy & Shareholder Returns: Consistent payouts (Rs 1/share FY26 so far), signaling confidence.

- Regulatory Compliance: Timely disclosures (e.g., electronic dividend payments, security cover), positive auditor reports.

Headwinds (Challenges)

- Microfinance Drag: Revenue Rs 655 Cr (-58% YoY), segment loss Rs 652 Cr (vs profit Rs 236 Cr YoY). High impairment Rs 929 Cr consolidated (Microfinance ~Rs 417 Cr loss). Assets down to Rs 7,334 Cr (-16% YoY).

- Profitability Pressure: Consolidated PBT down 74% YoY to Rs 404 Cr; margins squeezed by higher finance costs (Rs 1,731 Cr, +stable YoY but elevated) and opex.

- Cash Flow Strain: Negative operating cash flow Rs (229) Cr (worse YoY), due to loan growth and working capital needs.

- YoY Declines: Total revenue -11%, driven by Microfinance slowdown amid borrower stress.

Growth Prospects

- Gold Loan Expansion: Potential 15-20% FY26 AUM growth (H1 +ve momentum), leveraging 600+ branches, digital platforms, and gold price tailwinds. Target: Sustain 20%+ market share.

- Microfinance Turnaround: Capital infusion aims to deleverage/strengthen Asirvad (now equity-funded). Rural recovery post-monsoon could aid; long-term 20% CAGR potential if NPAs stabilize.

- Diversification: Home finance (stable), insurance broking, and comptech subsidiaries growing. Total AUM target Rs 55,000+ Cr by FY26-end.

- Efficiency Gains: Standalone EPS Rs 9.07 (H1), ROE ~25% potential. High CRAR supports inorganic growth (e.g., acquisitions).

- Macro Support: Falling rates (if RBI cuts), gold imports easing, rural revival could boost FY26 PAT to Rs 2,000-2,200 Cr (consensus estimates).

Key Risks

- Asset Quality Deterioration: Microfinance NPAs high (implied >10% gross); any gold price crash (>20%) could spike gold loan defaults.

- Subsidiary Dependency: Asirvad (Microfinance) contributes ~15% revenue but major loss-maker; regulatory scrutiny on MFI lending rates/yields. | Risk | Mitigation | |——|————| | Liquidity/Interest Rates | LCR 279%, diversified borrowings (NCDs Rs 7,608 Cr), but rising rates could pressure NIM (down to ~9%). | | Regulatory | RBI norms on gold loans/MFIs; SEBI LODR compliance critical. | | Competition | Muthoot, IIFL in gold loans; capacity utilization key. | | Macro | Rural slowdown, gold volatility, election impacts. |

Overall Summary: Manappuram faces near-term headwinds from Microfinance stress (dragging group profits 70% YoY), but gold loans provide a strong buffer (stable 70%+ EBITDA contribution). Growth prospects hinge on MFI recovery and gold tailwinds, with FY26 AUM/PAT growth of 10-15%/20% feasible. Risks are tilted toward asset quality and subsidiaries (40% probability of prolonged MFI pain). Recommendation: Hold/Buy on dips (target Rs 220-240, CMP ~Rs 180-190 assumed); monitor Q3 MFI trends. Positive: High RoA (1.3%), dividend yield ~2.5%.

Copyright © 2023 SAS Data Analytics Pvt. Ltd. All rights reserved.