JUSTDIAL

Equity Metrics

January 13, 2026

Just Dial Limited

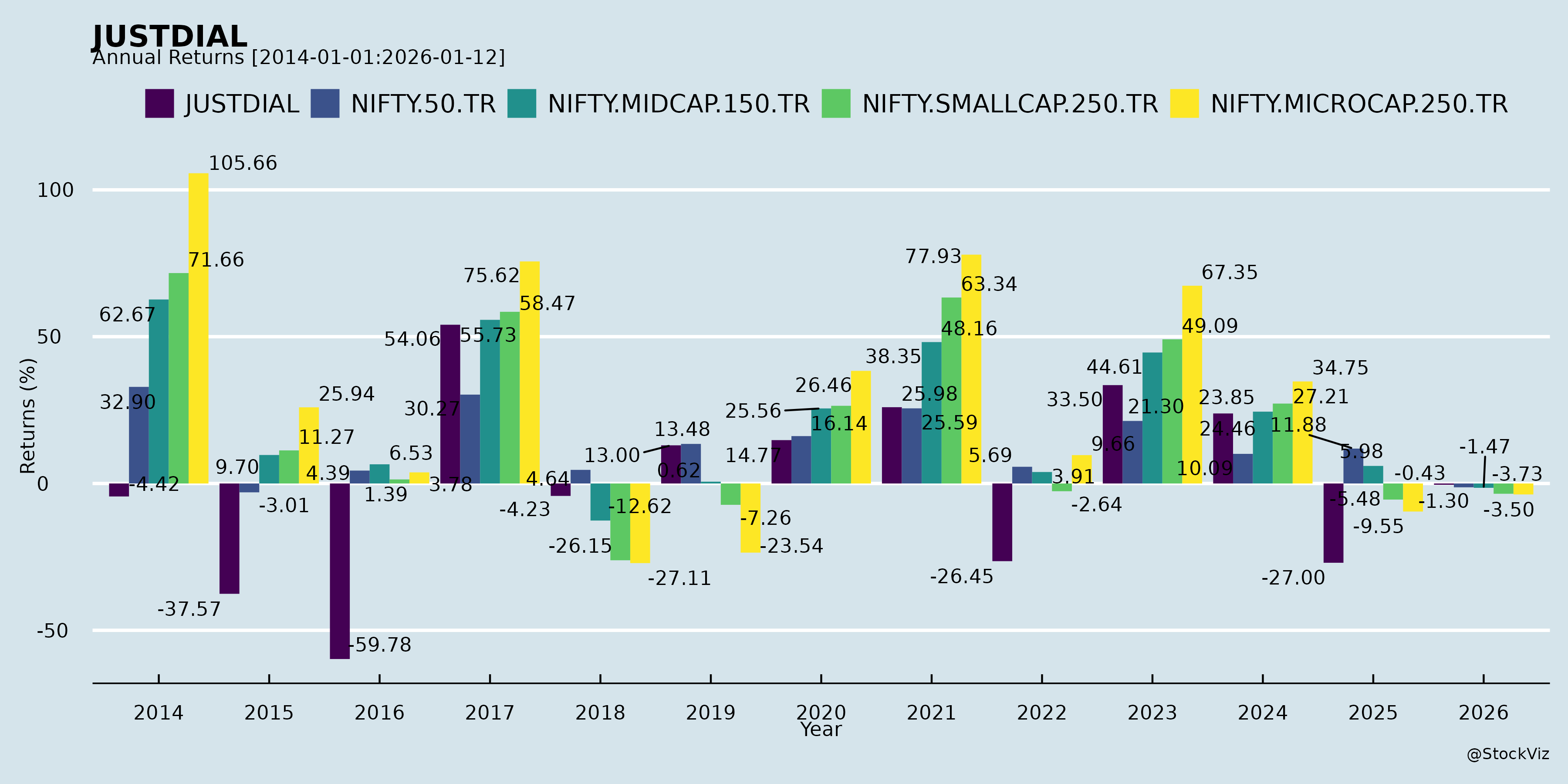

Annual Returns

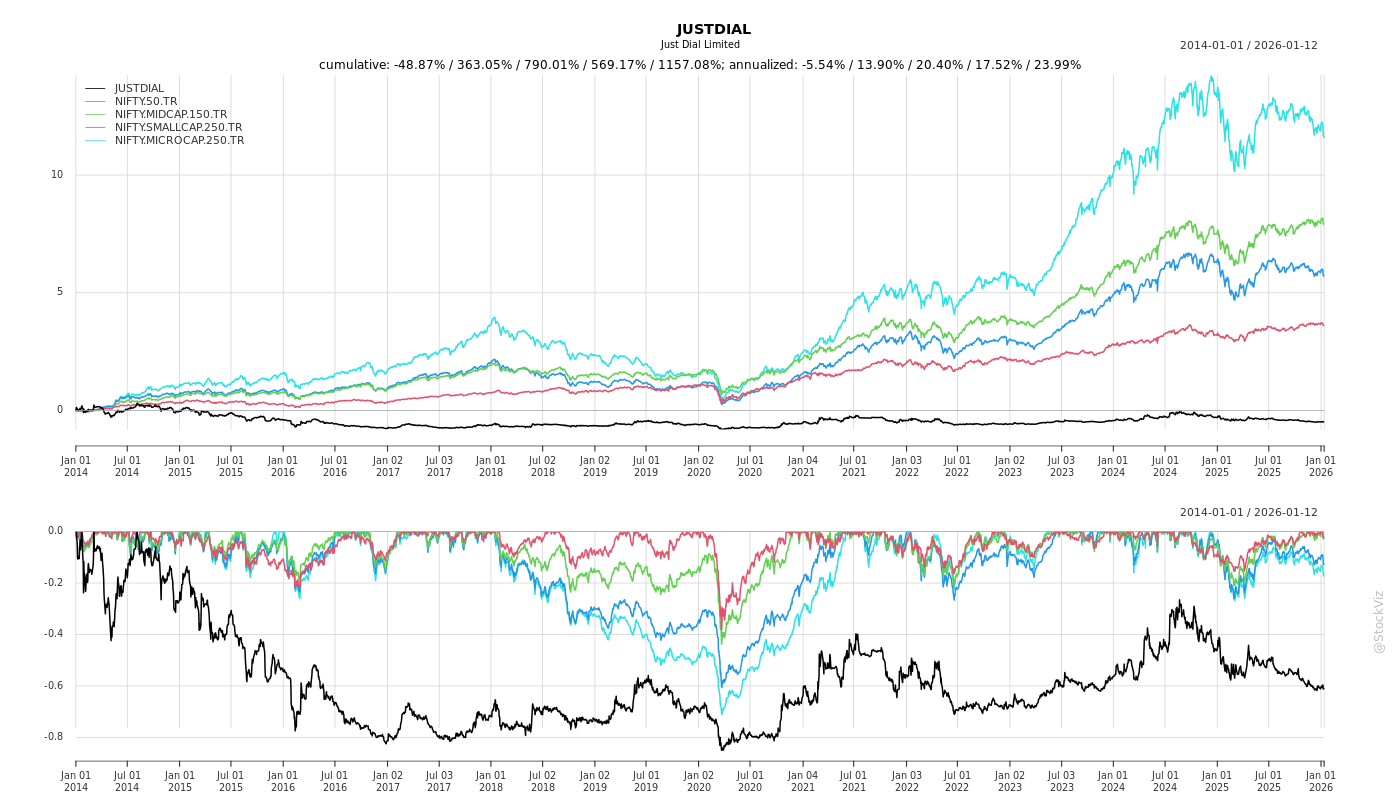

Cumulative Returns and Drawdowns

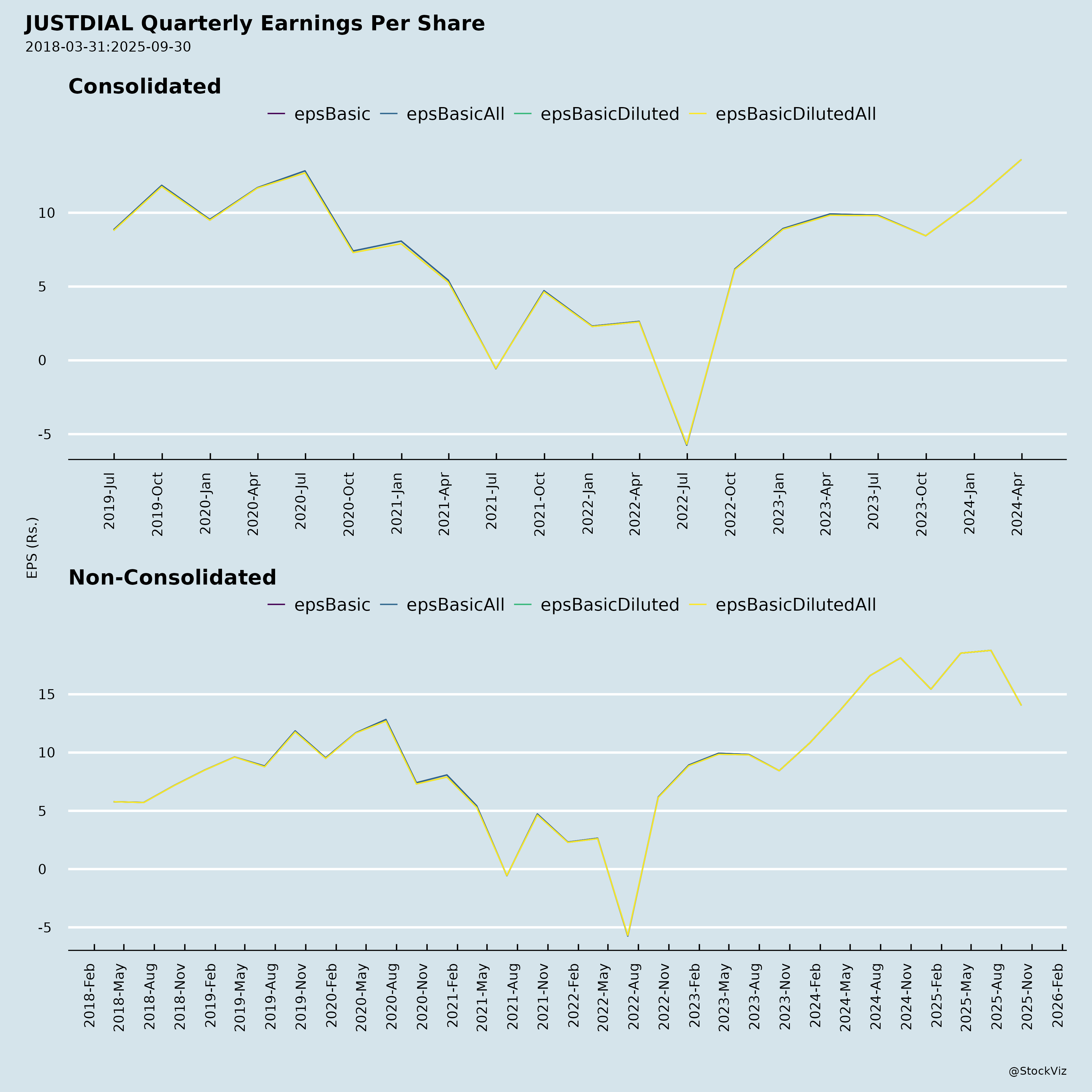

Fundamentals

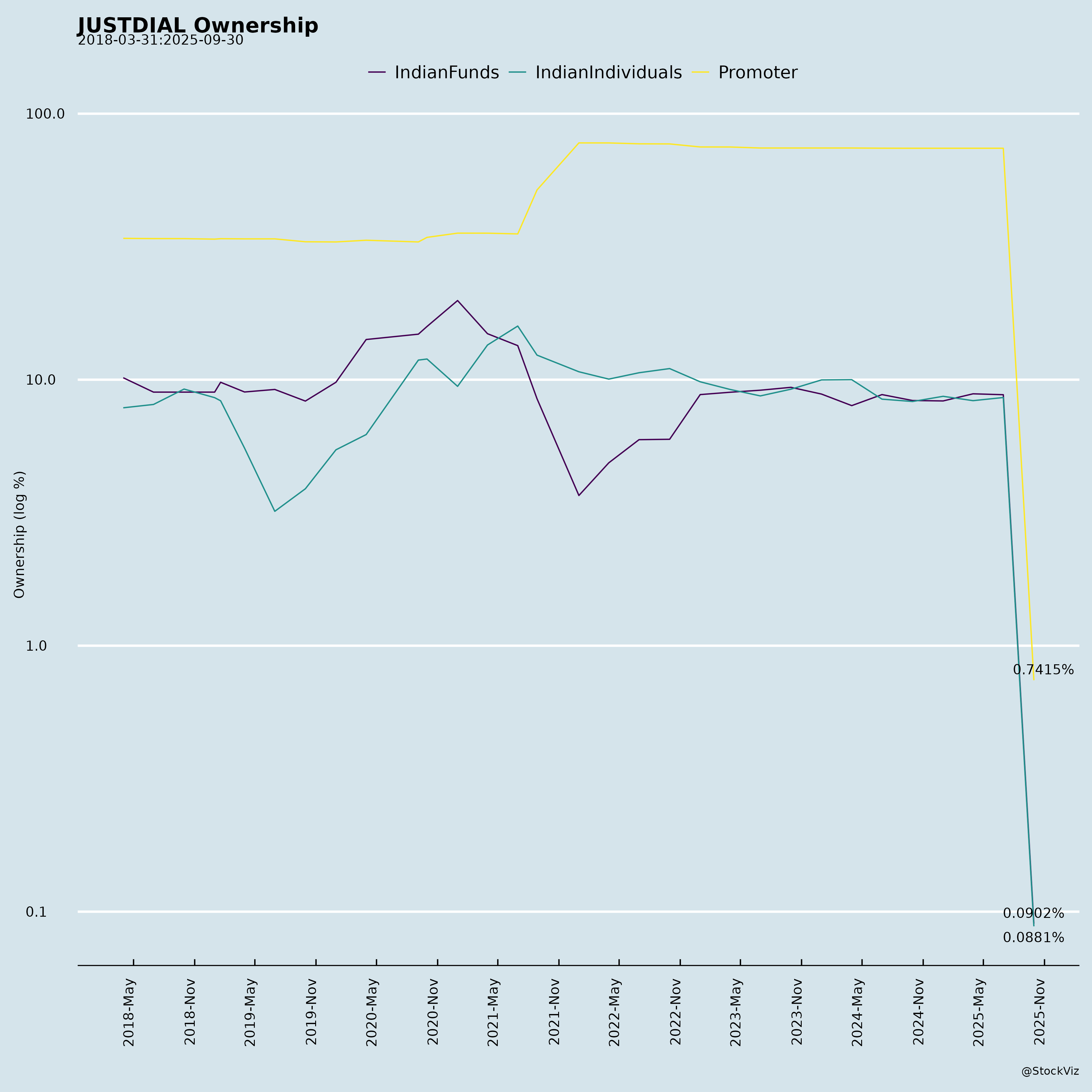

Ownership

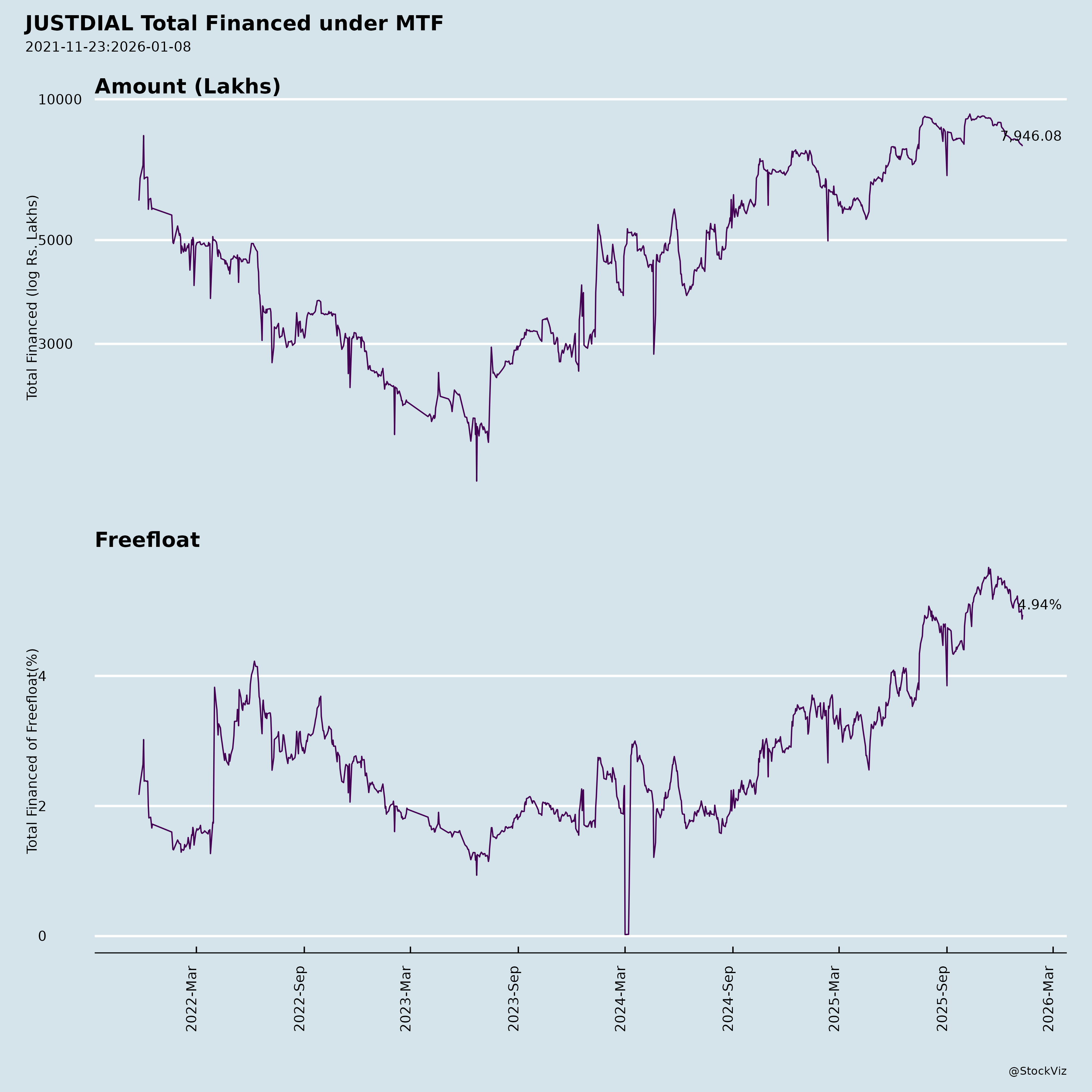

Margined

AI Summary

asof: 2025-11-27

Just Dial Limited (JUSTDIAL) Analysis: Headwinds, Tailwinds, Growth Prospects, and Key Risks

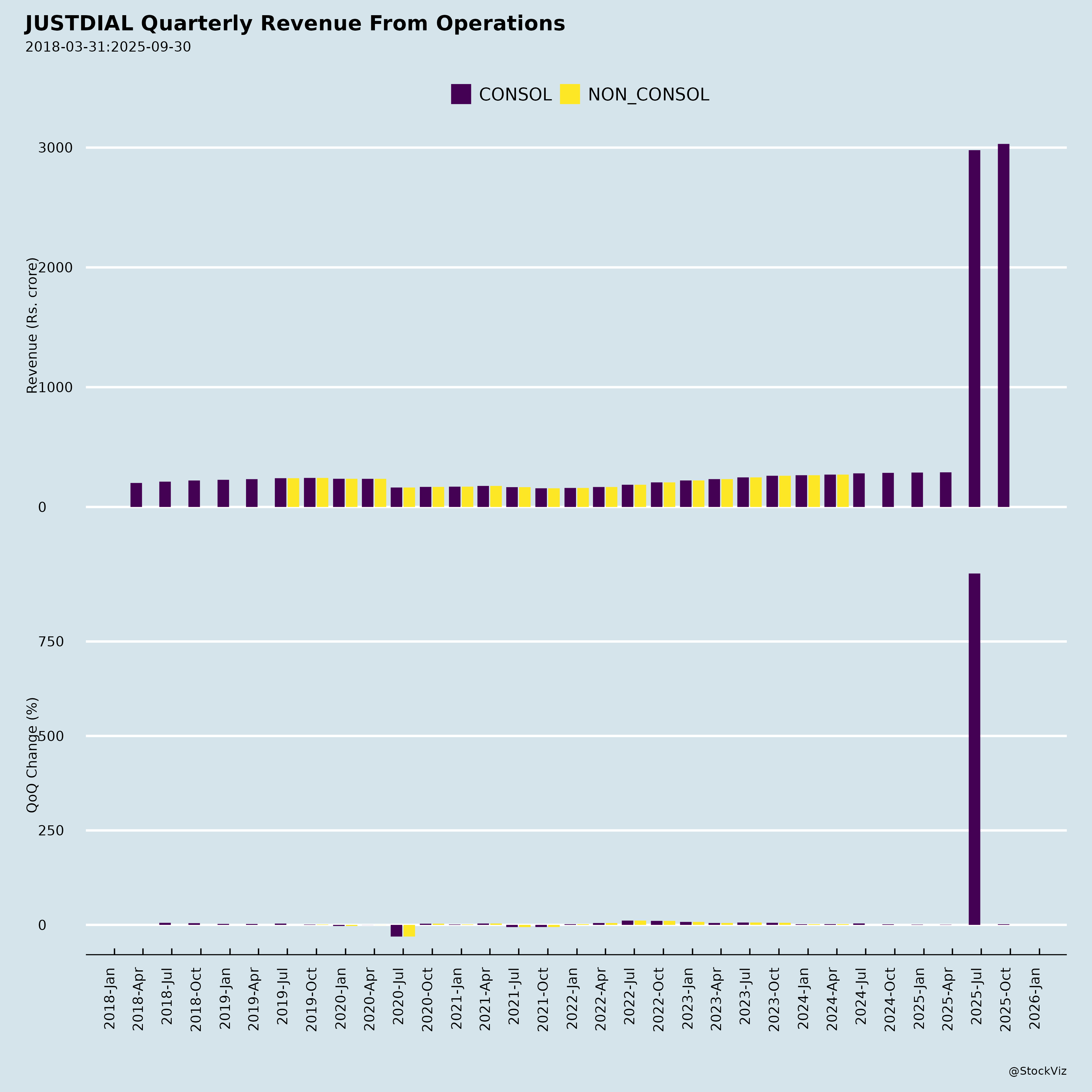

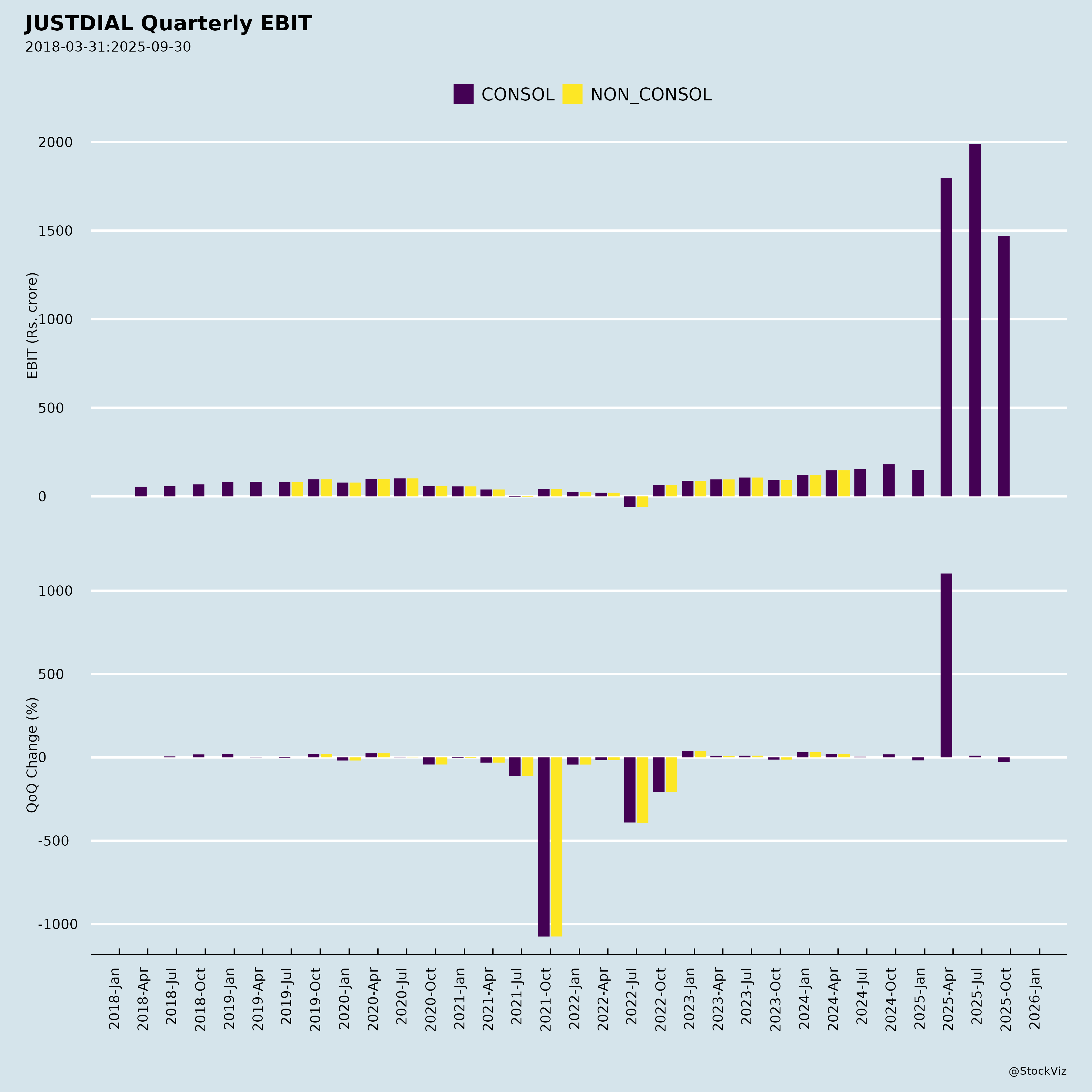

Just Dial operates as India’s leading local search engine, connecting SMEs with consumers via app/website/voice platforms. Q2 FY26 (Sep 2025) showed modest revenue growth (₹303 Cr, +6.4% YoY) amid flat traffic (197.7 Mn unique visitors), healthy margins (EBITDA 28.7%), and robust balance sheet (₹5,570 Cr cash/investments). Promoter stake ~74% (Reliance-backed). Below is a structured summary based on the provided documents.

Headwinds (Challenges Slowing Momentum)

- Stagnant Core Metrics: Traffic flat YoY (-0.2%), with declines in desktop (-16%) and voice (-3%); mobile growth (+2%) insufficient to offset.

- Modest Revenue Growth: +6.4% YoY operating revenue; paid campaigns grew only +4%, signaling SME ad spend caution amid economic slowdown.

- Profit Volatility: Net profit -23% YoY (₹119 Cr) due to sharp drop in other income (-36%, MTM treasury gains sensitive to bond yields).

- Cost Pressures: Employee expenses ~60% of revenue; total sales force steady at ~10K but total headcount down 3% YoY.

- Platform Shifts: Declining desktop/voice share (to 10%/3%); over-reliance on mobile (87%).

Tailwinds (Supportive Factors)

- Strong Financial Position: Zero debt, ₹5,570 Cr cash/investments (+13% YoY); deferred revenue ₹526 Cr (+2% YoY) ensures visibility.

- Profitable Model: EBITDA margin stable ~29%; prepaid campaigns provide cash flow stability.

- Content Moat: 51 Mn listings (+11% YoY), 239 Mn images (+16%), 155 Mn ratings (+3%); 36 Mn geocoded listings enhance UX.

- User Engagement: App downloads 41 Mn (+8% YoY), daily 8K; mobile traffic dominant.

- Reliance Backing: Promoter (RRVL) stake 64%, providing strategic synergies (e.g., retail/logistics integration).

Growth Prospects (High-Potential Opportunities)

- Digitalization of SMEs: 624K active paid campaigns (+4%); self-sign-up dashboard, JD Business tools for campaign management.

- Diversification Beyond Search: | Initiative | Description | Potential | |—|—|—| | JD Mart (B2B) | Product catalogs, quotes for 100s categories (e.g., CCTV, machinery); targets MSME shift online. | High; untapped B2B market. | | JD Pay/JD Omni | Payments, billing, websites for SMEs; cloud-hosted ERP-like dashboard. | Transaction fees; recurring revenue. | | JD Xperts | On-demand services (AC repair, pest control); 100 Mn+ Delhi enquiries/month. | Service commissions. | | JD Homes/Shopping/Travel/Logistics | Rentals, flights, bills, deliveries; integrates with search. | Monetize 198 Mn users via commissions. |

- Tech/AI Leverage: Voice search, maps, ratings; nationwide 250+ cities, 11K pincodes.

- Medium-Term: 6-10% revenue CAGR feasible via traffic recovery, new verticals; FY26 guidance implicit in trends.

Key Risks (High-Impact Threats)

| Risk | Description | Mitigation |

|---|---|---|

| Treasury Volatility | 50%+ profit from MTM gains; yield spikes caused Q2 drop. | Diversify income; high cash buffer. |

| Competition | Google Maps, Zomato/Swiggy, Reliance JioMart; local search commoditization. | Brand loyalty (1st mover), SME focus. |

| Macro/SME Slowdown | Ad budgets sensitive to economy; flat campaigns reflect caution. | Prepaid model, diversification. |

| Regulatory/Tax | GST changes, SEBI scrutiny on related-party (Reliance); ETR normalized to 19%. | Strong compliance (recent AGM approvals). |

| Execution | New verticals (JD Mart etc.) unproven; R&D spend needed for AI/mobile retention. | ₹5.5K Cr war chest; experienced leadership. |

| Cyber/Tech | Data breaches in 51 Mn listings; app dependency. | Advanced tech platform mentioned. |

Overall Outlook: Stable but transitioning from pure search to transactional ecosystem. FY26 growth ~6-8% likely, with upside from diversification (20-30% of revenue potential). Stock attractive on cash yield (~10% dividend possible), but monitor traffic/treasury. Risks tilted toward execution/competition; buy on dips for long-term MSME digital play.

Copyright © 2023 SAS Data Analytics Pvt. Ltd. All rights reserved.