INDIGO

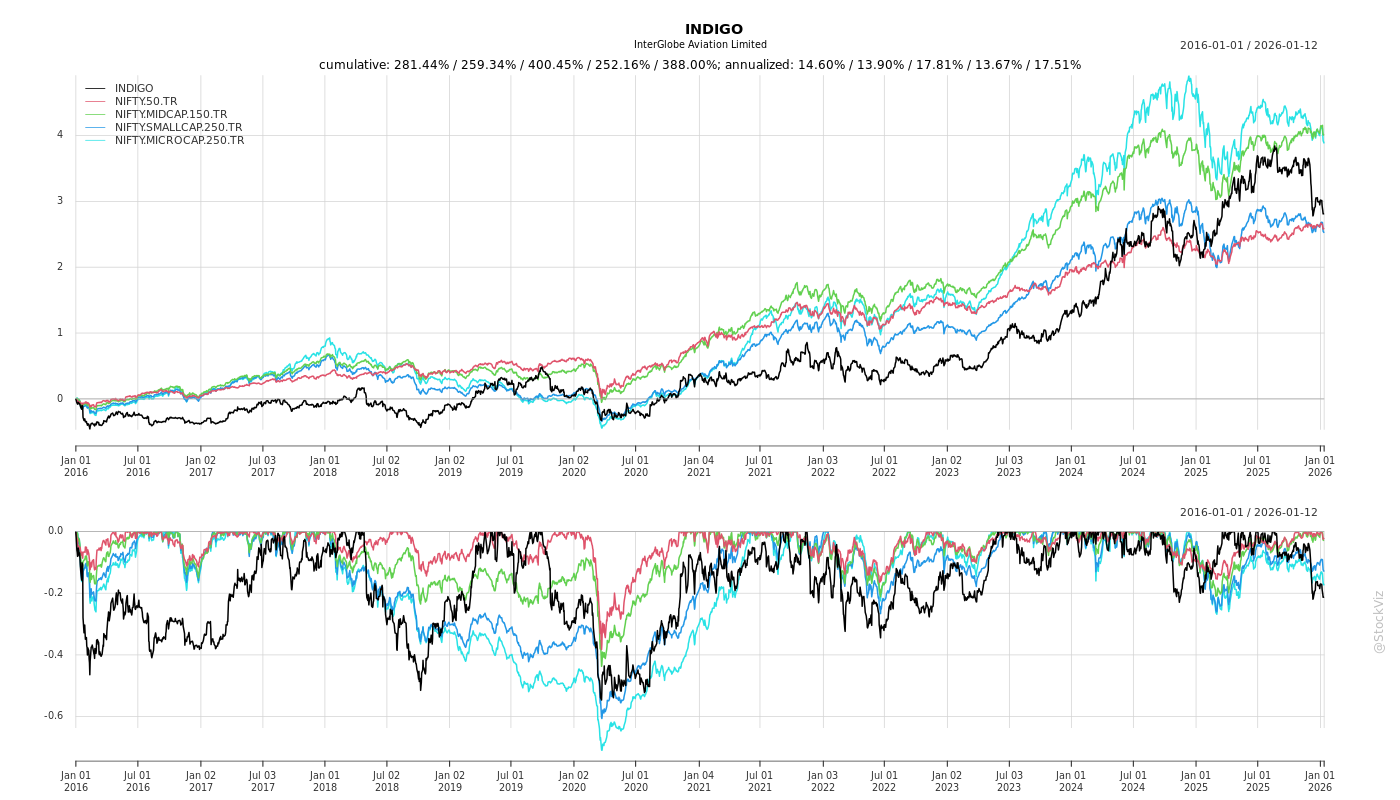

Equity Metrics

January 13, 2026

InterGlobe Aviation Limited

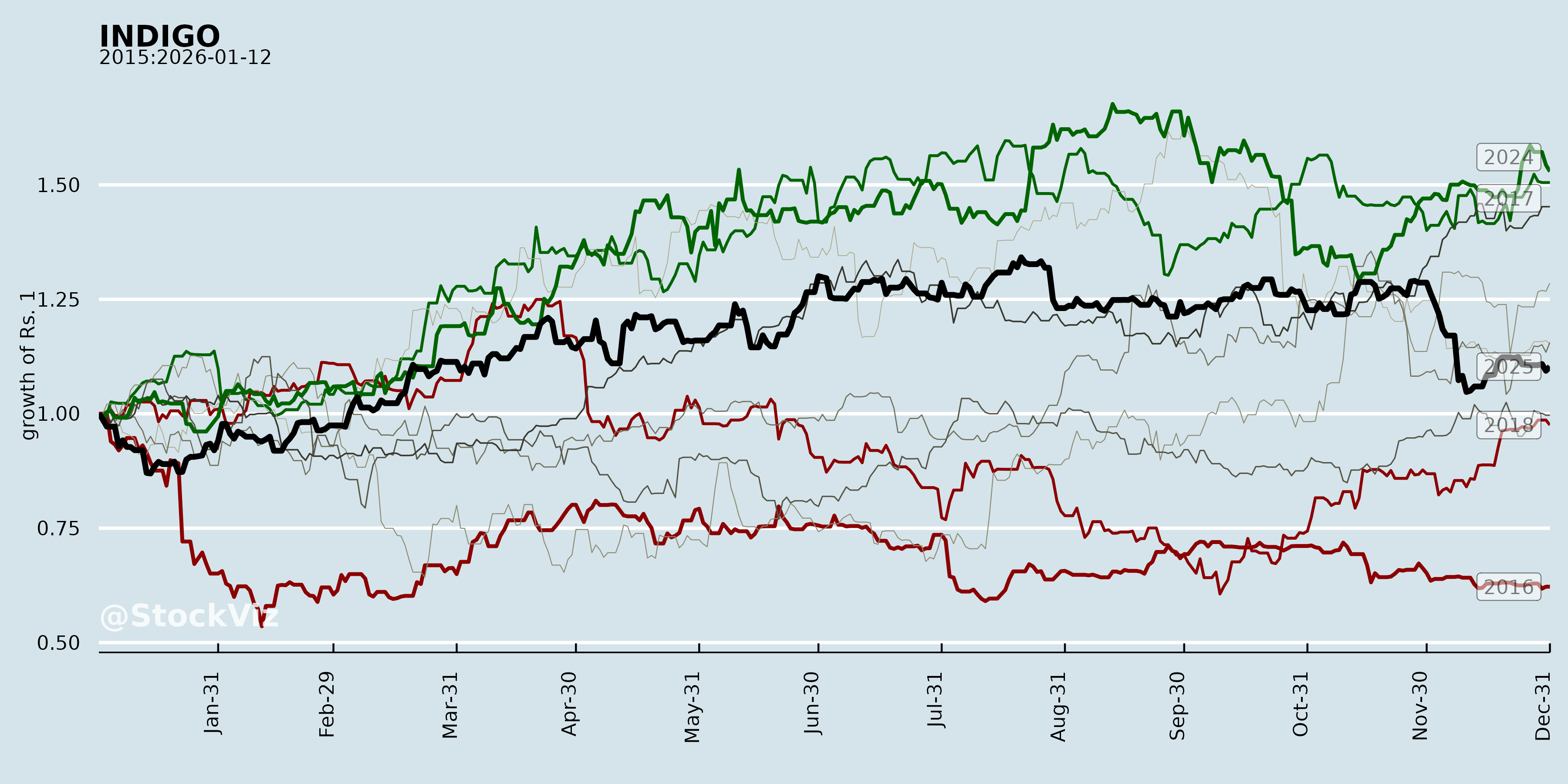

Annual Returns

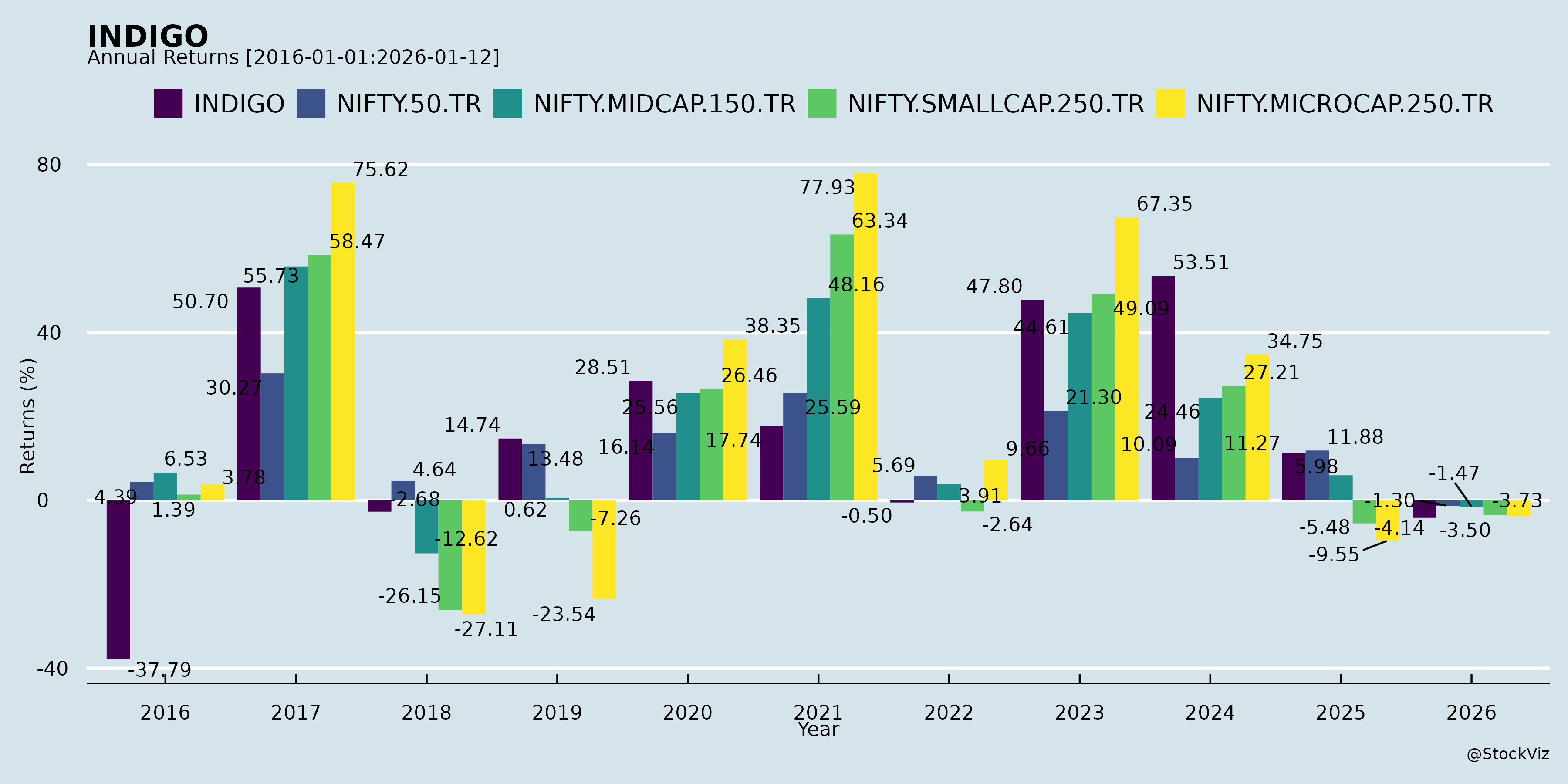

Cumulative Returns and Drawdowns

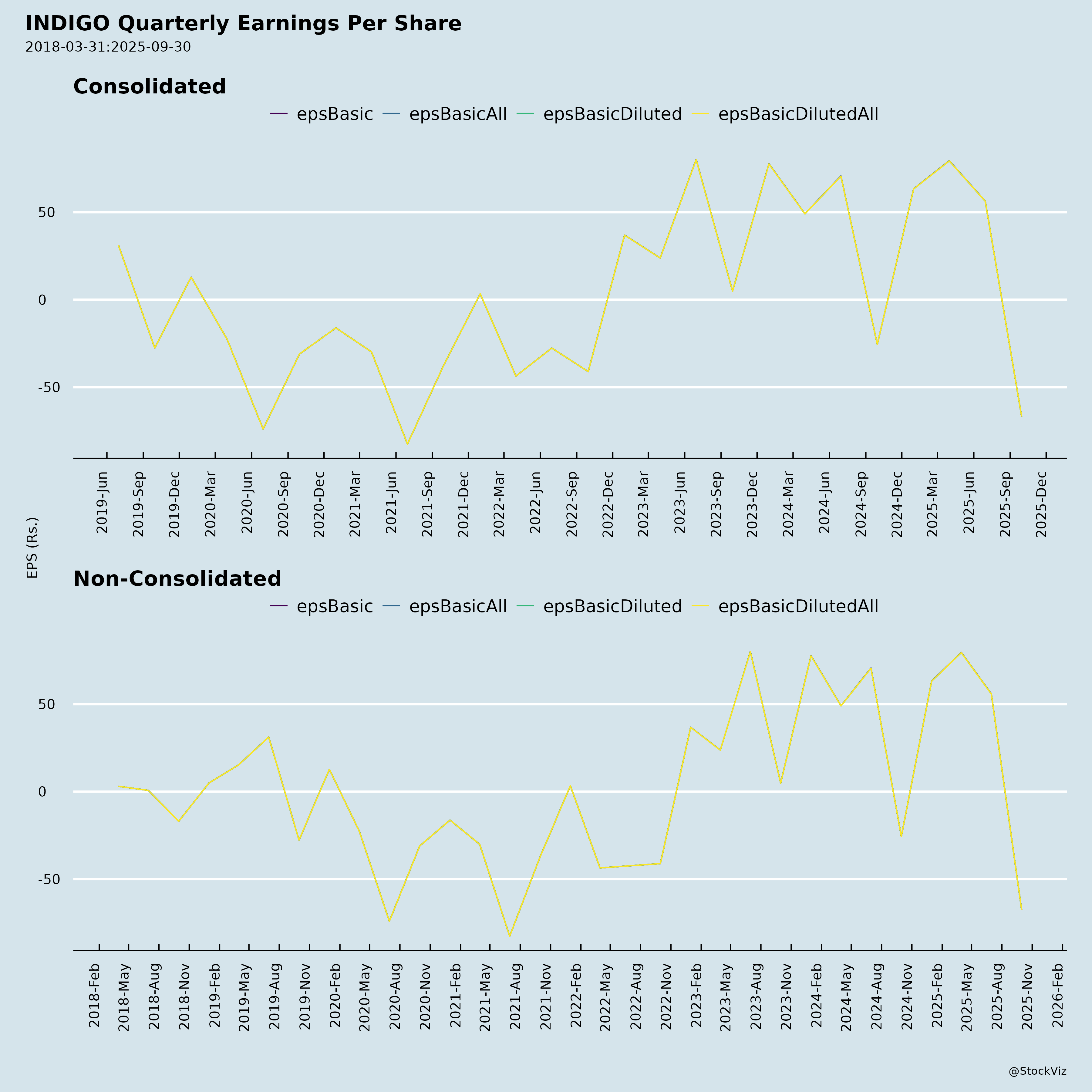

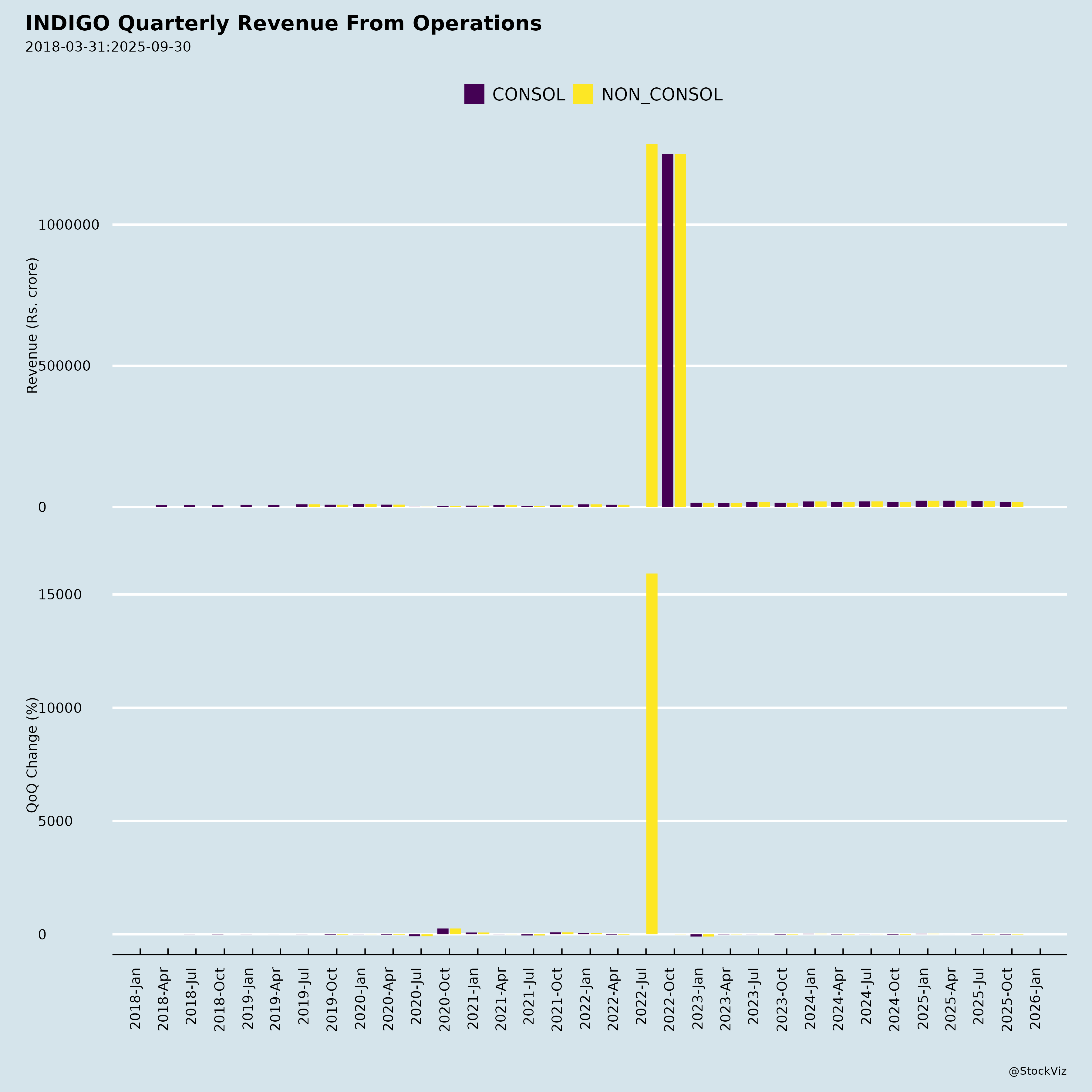

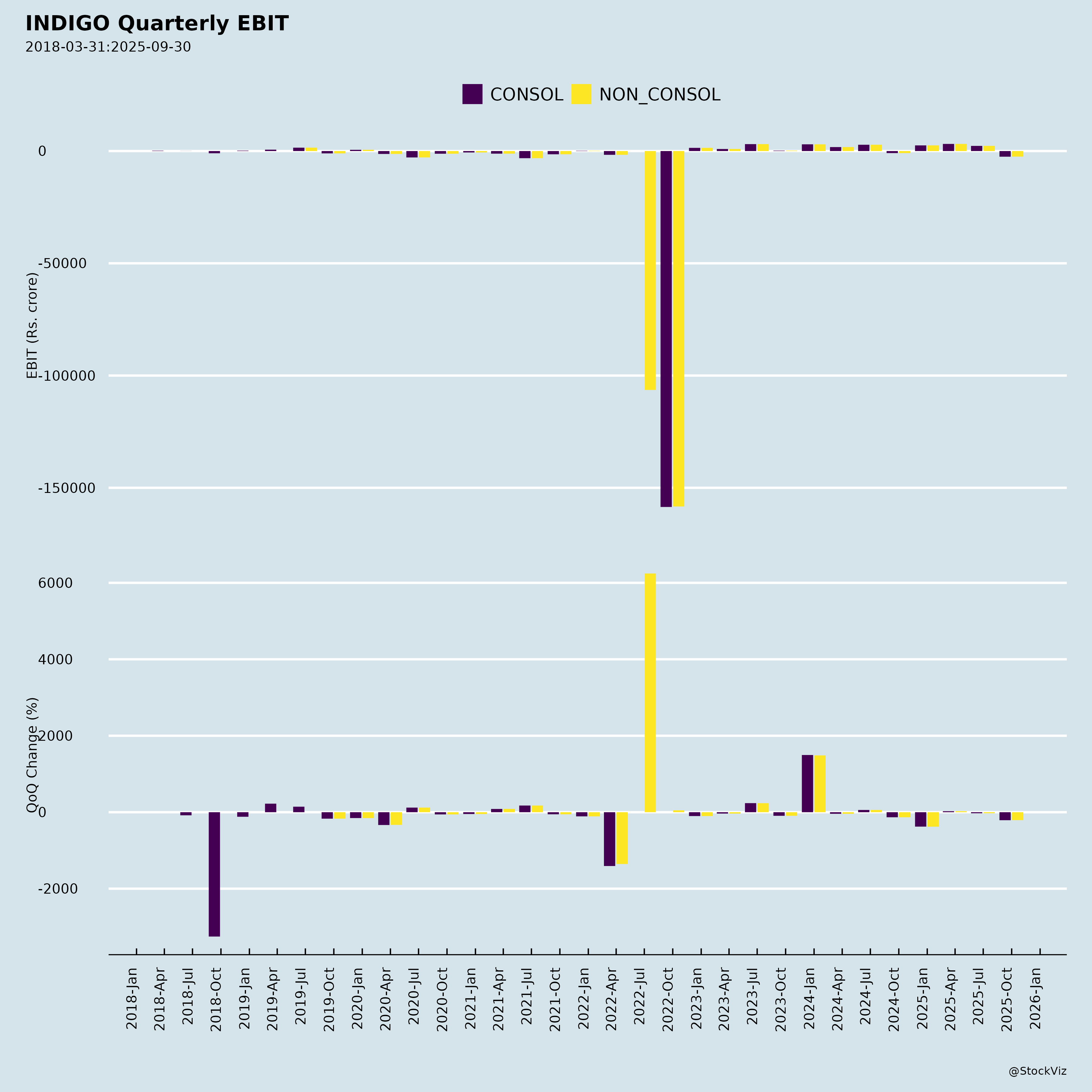

Fundamentals

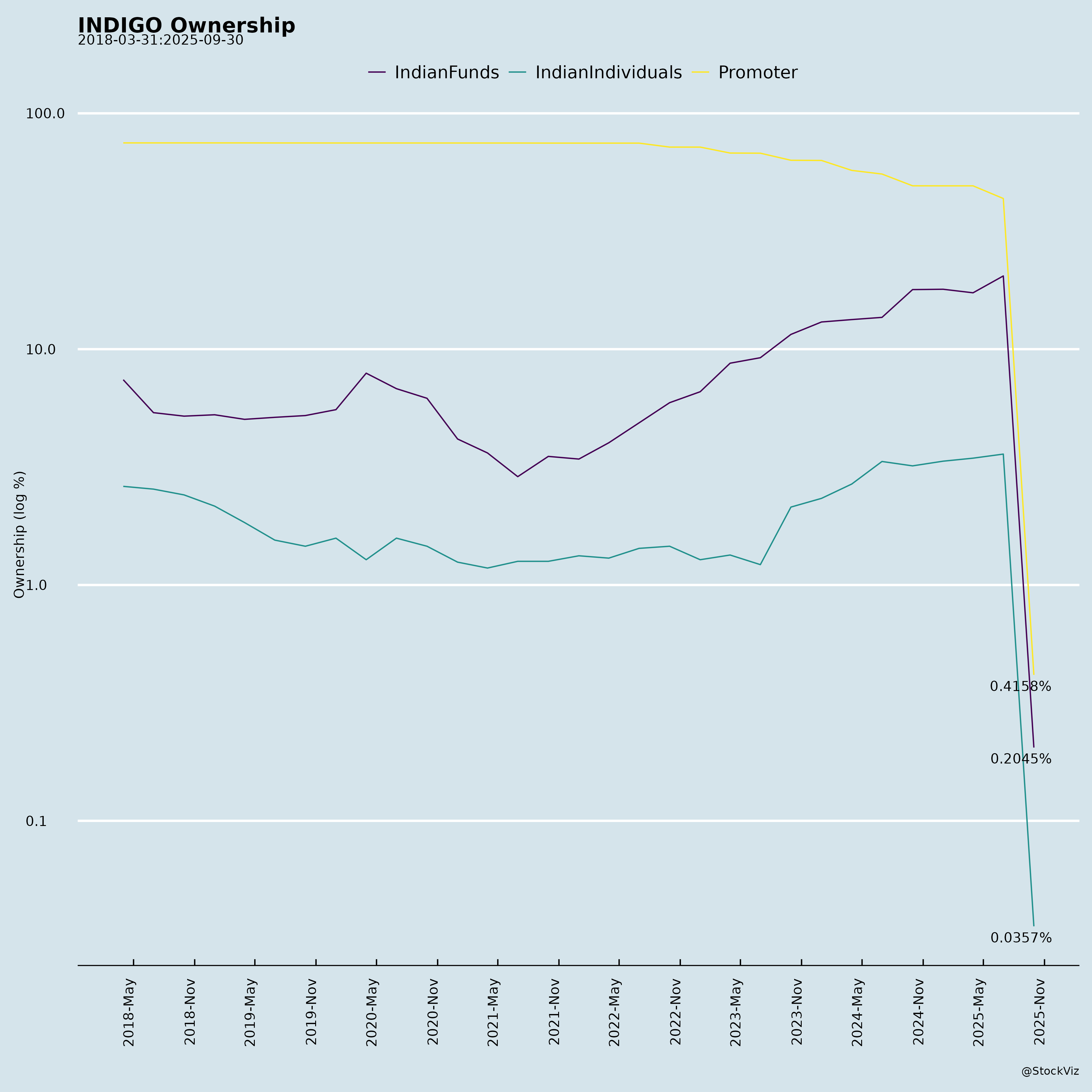

Ownership

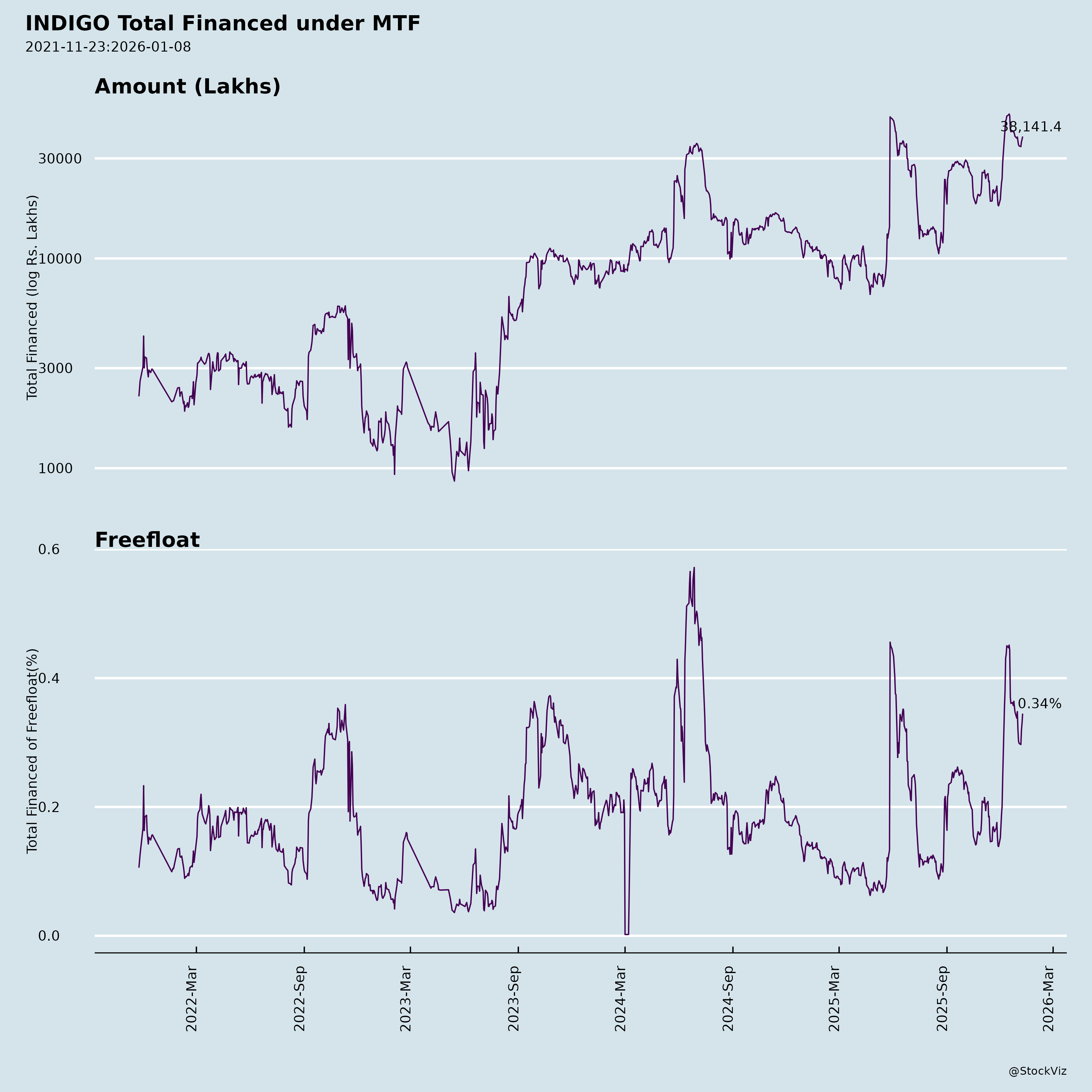

Margined

AI Summary

asof: 2025-11-29

IndiGo (InterGlobe Aviation Limited) Analysis

Company Overview: IndiGo is India’s largest airline by market share, operating a fleet of 417 aircraft (as of Sep 30, 2025). It serves 94 domestic and 41 international destinations, with strong operational metrics (99.89% technical dispatch reliability, 89.8% OTP). Q2 FY26 results show revenue growth amid challenges like forex volatility, with a strategic shift toward aircraft ownership via USD 820 mn investment in subsidiary IndiGo IFSC.

Tailwinds (Positive Factors)

- Revenue & Operational Momentum: Total income up 10.4% YoY to INR 196 bn (Q2 FY26); Revenue from operations +9.3%. Yield +3.2% to INR 4.69, RASK +2.3%. Capacity (ASK) +7.8%, passengers +3.6% to 28.8 mn.

- Cost Discipline (Ex-Fuel/Forex): CASK ex-fuel ex-forex up only 3.9% YoY to INR 3.01. Fuel CASK down 16.3% due to lower prices/hedging.

- Strong Balance Sheet: Total cash INR 535 bn (free cash INR 385 bn, up 58% YoY). EBITDAR ex-forex +42.5% to INR 38 bn (20.5% margin).

- Fleet & Network Expansion: Fleet net +1 (417 aircraft). USD 820 mn (INR 73 bn) investment in IndiGo IFSC for aircraft ownership, reducing lease reliance (historically operating lease heavy). Q3 FY26 ASK growth: high-teens; FY26 full-year: early teens.

- Operational Excellence: Market leader in OTP/customer satisfaction; awards (Skytrax Best in India/South Asia). Peak 2,244 daily flights.

- Strategic Initiatives: Analyst meets, board approvals signal investor confidence. New director (Amitabh Kant) adds governance expertise.

Headwinds (Challenges)

- Forex Impact: INR 29 bn forex loss (USD-denominated obligations amid INR depreciation to ~88.8/USD). Drove Q2 PAT loss to INR 26 bn (vs. INR 10 bn loss YoY); half-year PAT loss INR 4 bn.

- Cost Pressures: Total expenses +18.3% YoY (depreciation +26.5%, employee +10.6%, forex). CASK +10% to INR 5.16; aircraft rentals down 58% but offset by maintenance/repairs +19%.

- Seasonality & Losses: Seasonally weak Q2; reported EBITDAR margin down to 6% (ex-forex 20.5%). Half-year PBT loss INR 1.7 bn.

- Regulatory Penalty: INR 20 lakh DGCA fine (minor, no material impact) for procedural lapse on Udaipur SID.

Growth Prospects

- Market Tailwinds: India’s aviation boom (IndiGo: 400+ fleet, 2,200+ daily flights). International expansion (41 dest., partnerships for 86 more). FY26 capacity +early teens; Q3 high-teens ASK growth.

- Ownership Shift: IndiGo IFSC (turnover INR 290 Cr FY25) to acquire aviation assets, balancing lease-heavy fleet (333 operating leases). Potential for diversified financing.

- Ancillary/Yield Growth: Ancillaries +14.2%; load factor stable ~82.5%.

- Long-Term: 118 mn passengers FY25; fleet inductions (58 in 2024). Strategic capex (pre-delivery payments, maintenance) supports scale.

Key Risks

| Risk Category | Details | Potential Impact |

|---|---|---|

| Forex & Currency | High USD exposure (fuel, leases, debt). INR depreciation caused Q2 forex loss ~INR 29 bn. | Volatility erodes margins; unhedged future obligations. |

| Fuel Prices | 27% of costs; recent relief but geopolitical risks (e.g., Middle East). | CASK spikes; limited hedging buffer. |

| Regulatory/Legal | Ongoing tax disputes (INR 24 bn exposure on incentives; IGST INR 20.5 bn paid under protest). DGCA penalty signals compliance risks. Security clearances for directors. | Cash outflows, provisions; appeals pending in courts. |

| Debt & Liquidity | Total debt INR 748 bn (capitalized leases INR 497 bn). Dividend payout (INR 10/share) amid losses. | High leverage; refinancing risk in rising rates. |

| Operational/Competition | Supply chain (engines/parts), damp leases (8 aircraft), capacity cuts in weak seasons. Intense rivalry (Air India, Akasa). | Delays, cancellations; market share erosion. |

| Macro/Geopolitical | Economic slowdown, monsoon disruptions, intl. tensions affecting demand/yields. | Demand weakness; load factor decline. |

Summary: IndiGo demonstrates resilience with 10% revenue growth, operational strength, and proactive fleet ownership (USD 820 mn infusion), positioning for early-teens FY26 growth amid India’s aviation surge. Tailwinds from capacity/yield expansion outweigh Q2 forex-driven losses (ex-forex PAT positive). However, headwinds like currency volatility and rising costs pressure margins. Key risks center on forex/fuel (mitigate via hedging/ownership) and regulatory overhangs (tax/IGST disputes). Investment Outlook: Positive long-term (buy/hold for growth), but monitor INR/USD and Q3 execution. Ex-forex profitability signals underlying strength; target FY26 recovery.

Copyright © 2023 SAS Data Analytics Pvt. Ltd. All rights reserved.