EICHERMOT

Equity Metrics

January 13, 2026

Eicher Motors Limited

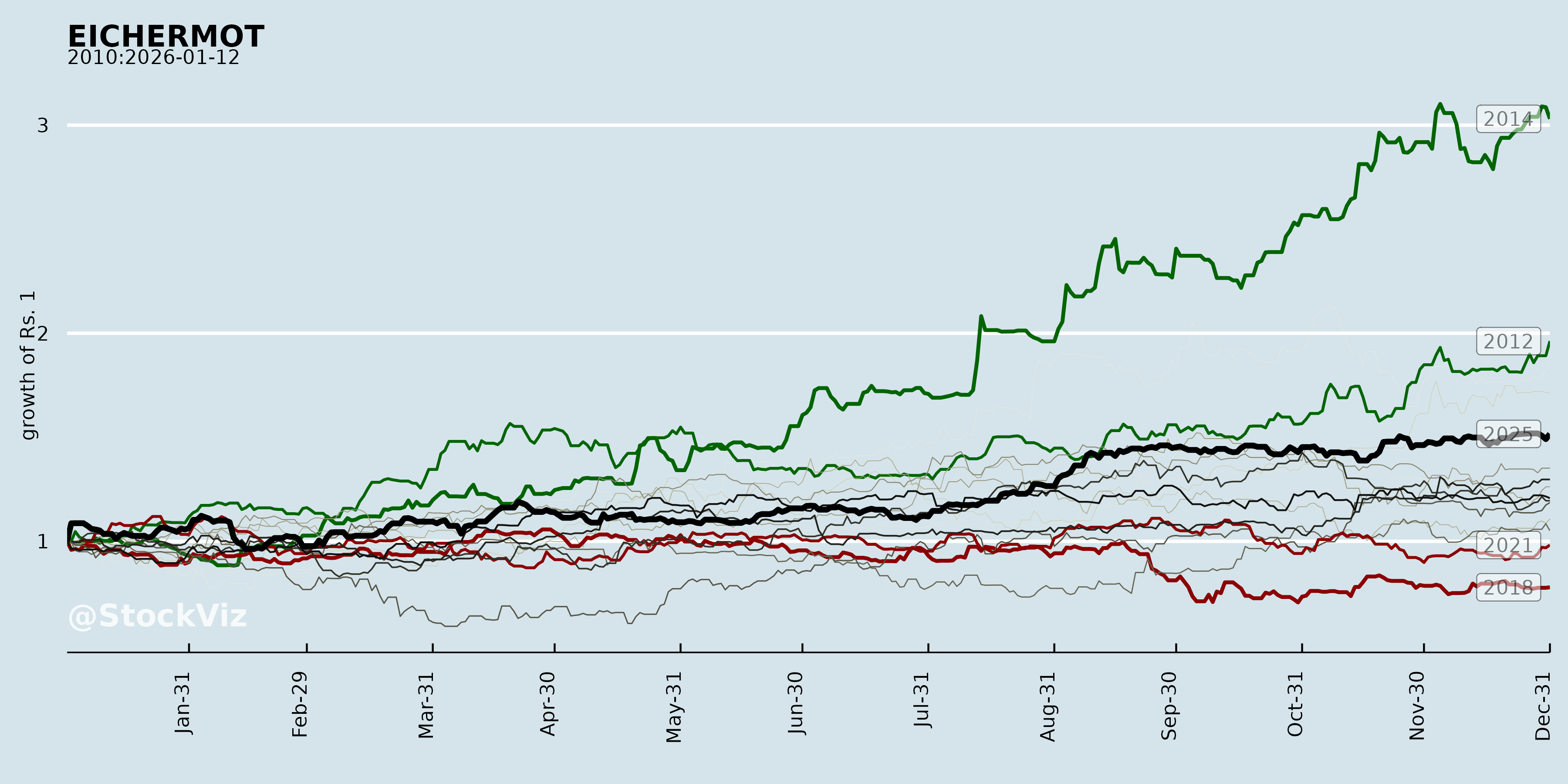

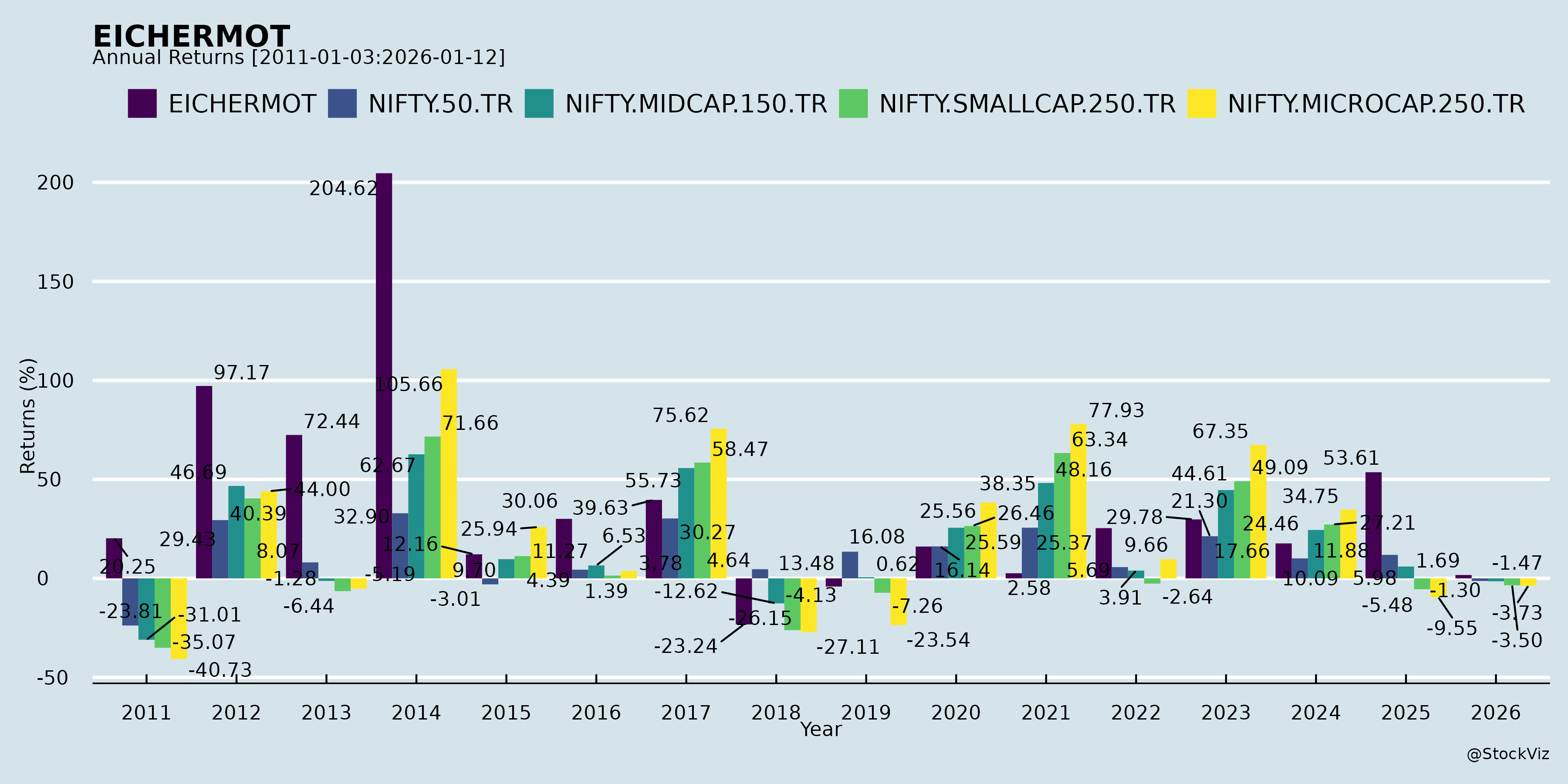

Annual Returns

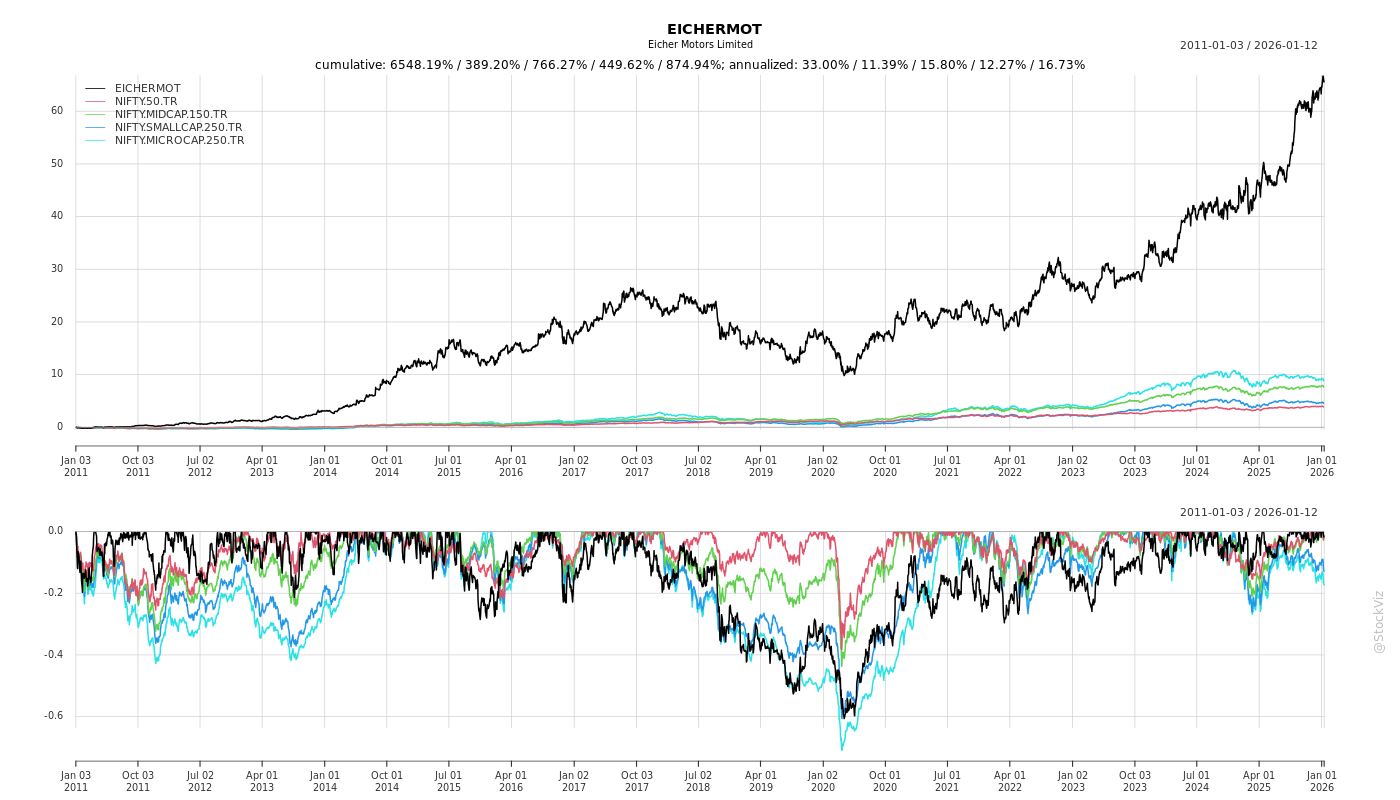

Cumulative Returns and Drawdowns

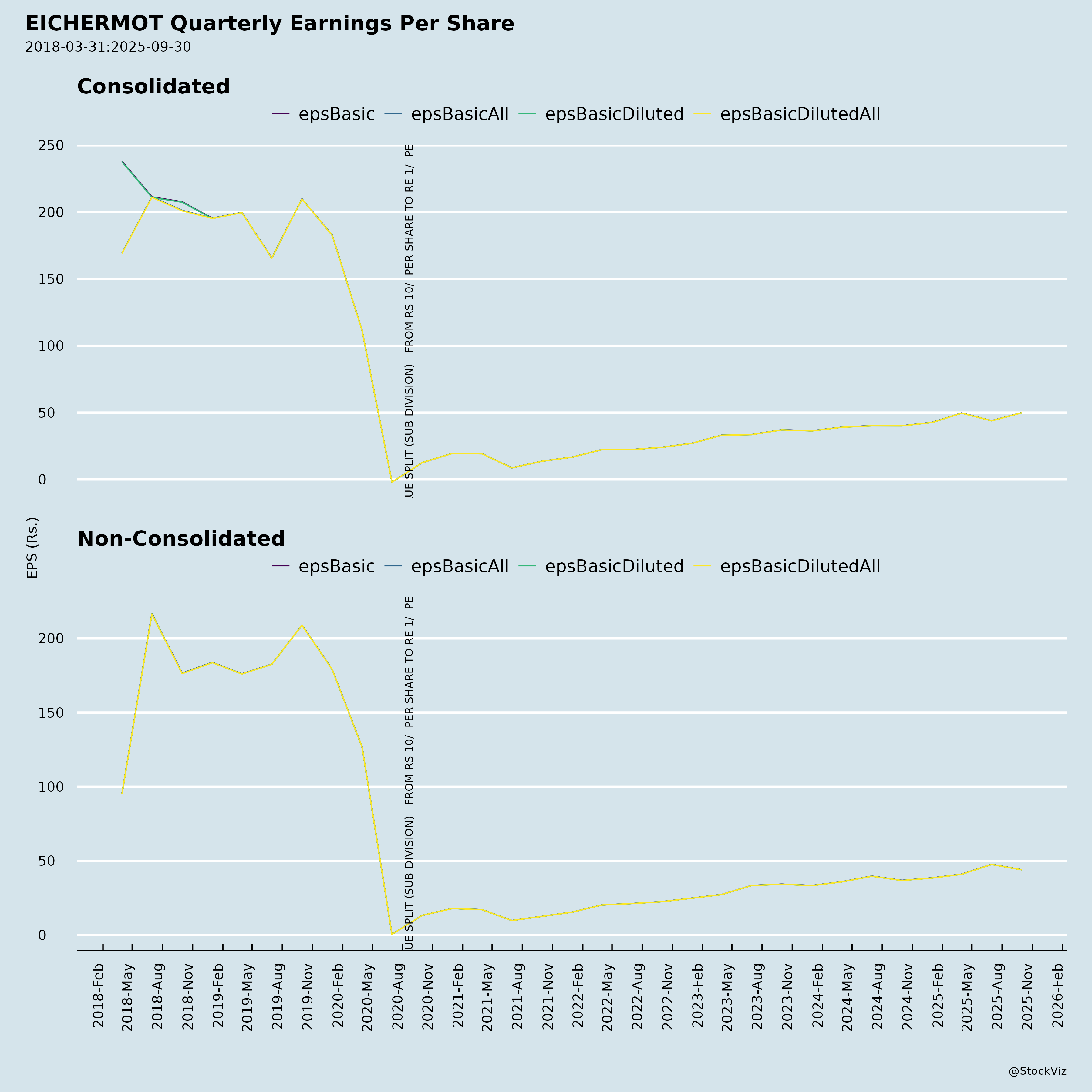

Fundamentals

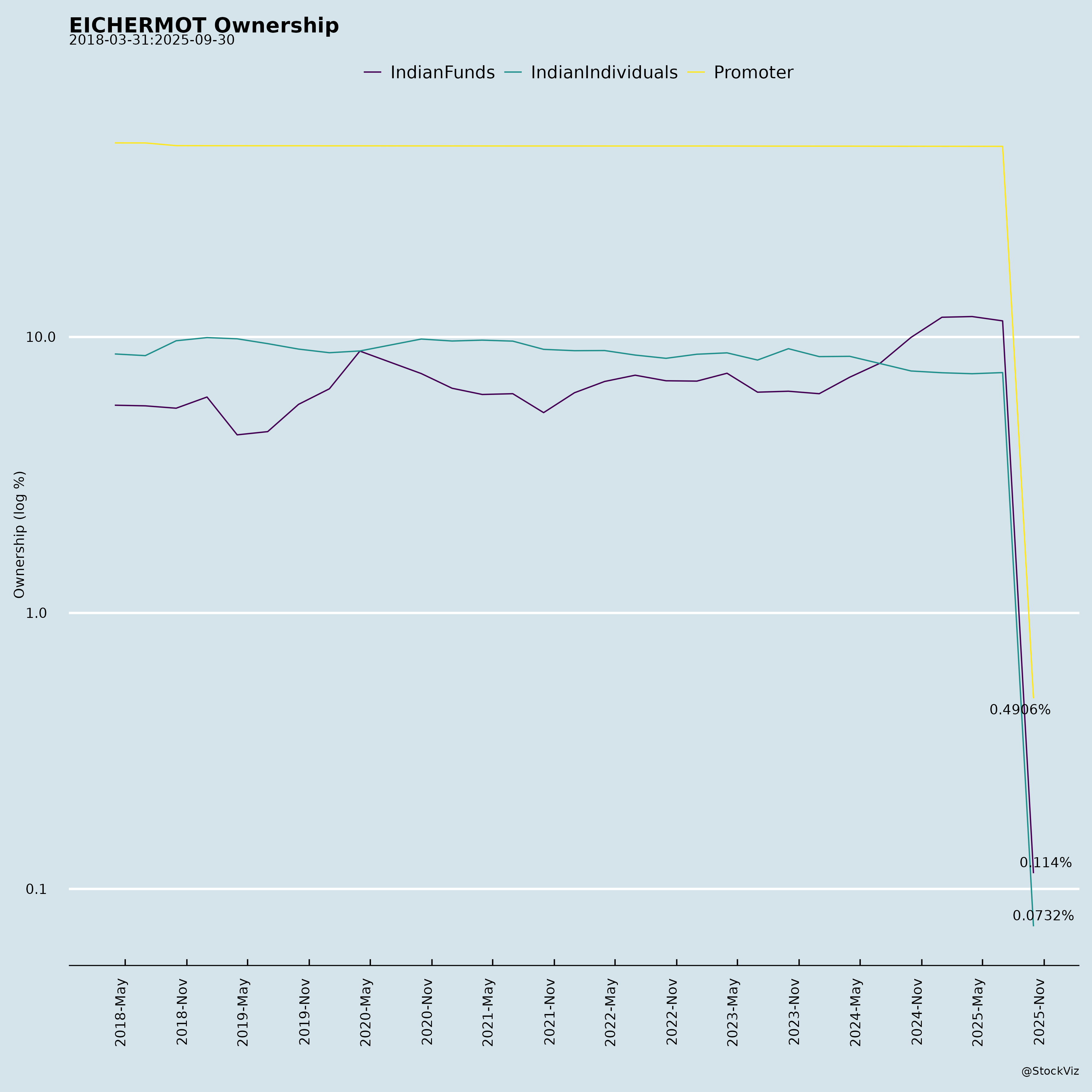

Ownership

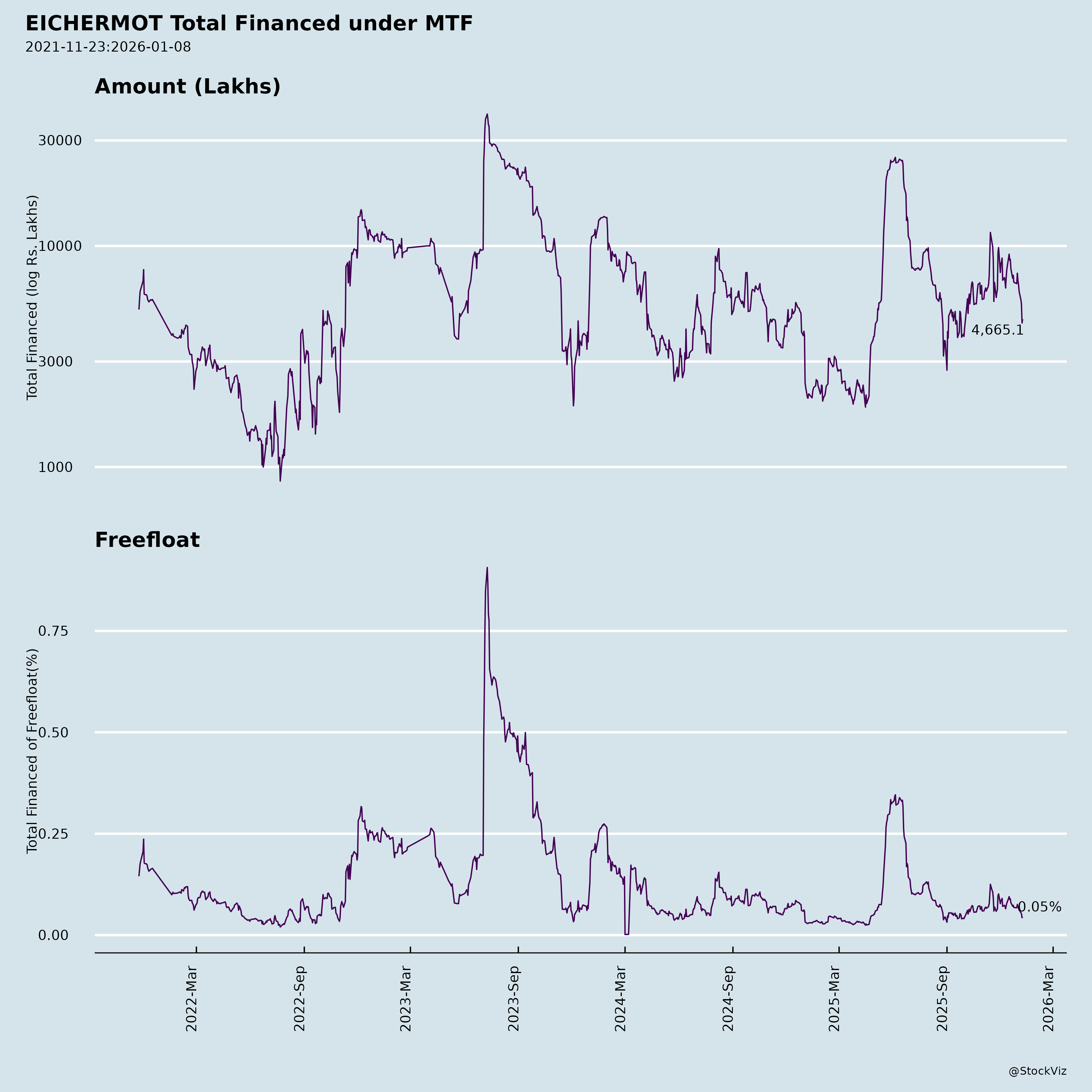

Margined

AI Summary

asof: 2025-12-08

EICHERMOT (Eicher Motors Limited) – Business & Stock Analysis

(Based on Q2 FY 2025-26 Press Release Dated November 13, 2025)

1. Tailwinds (Growth Catalysts & Positive Factors)

A. Stellar Financial & Operational Performance

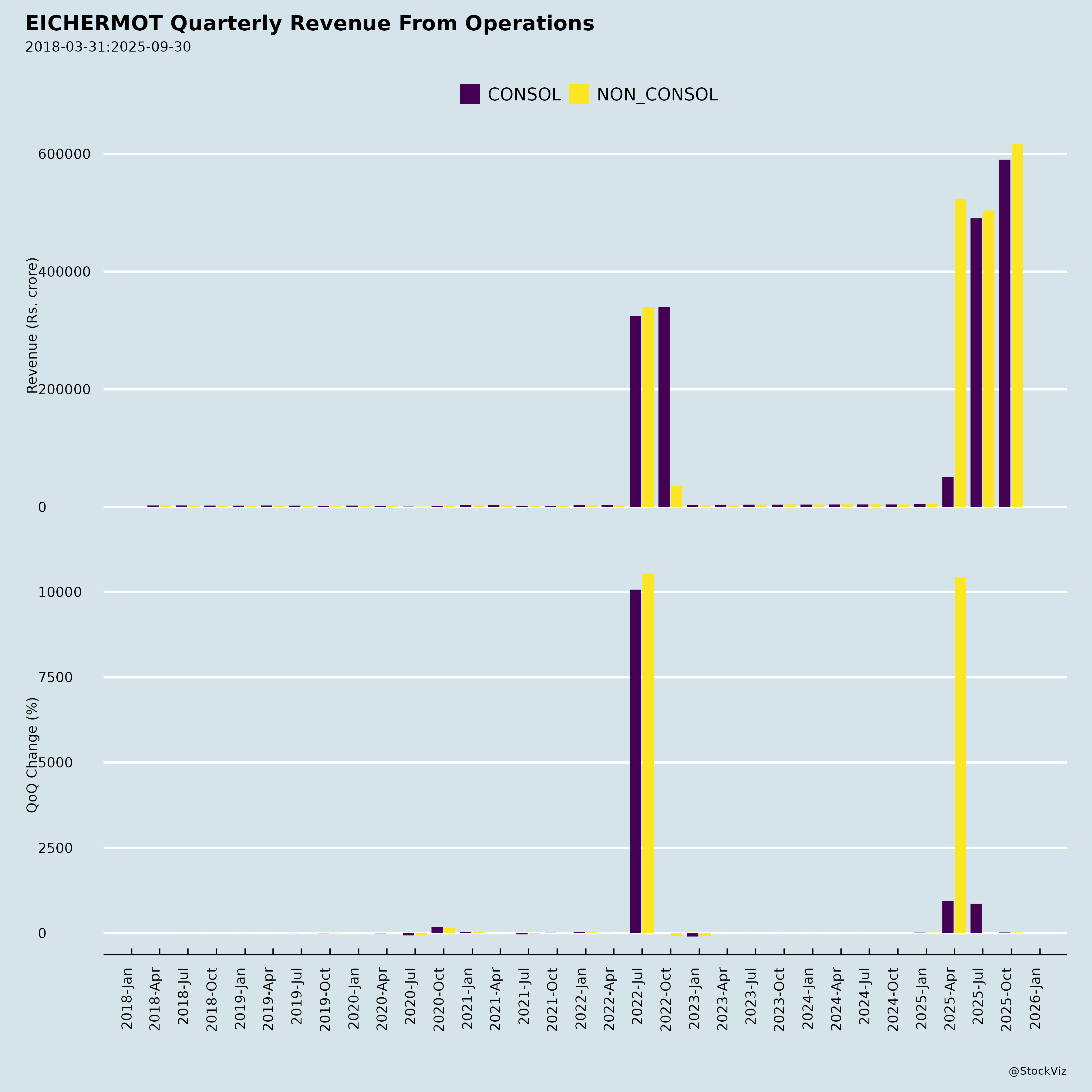

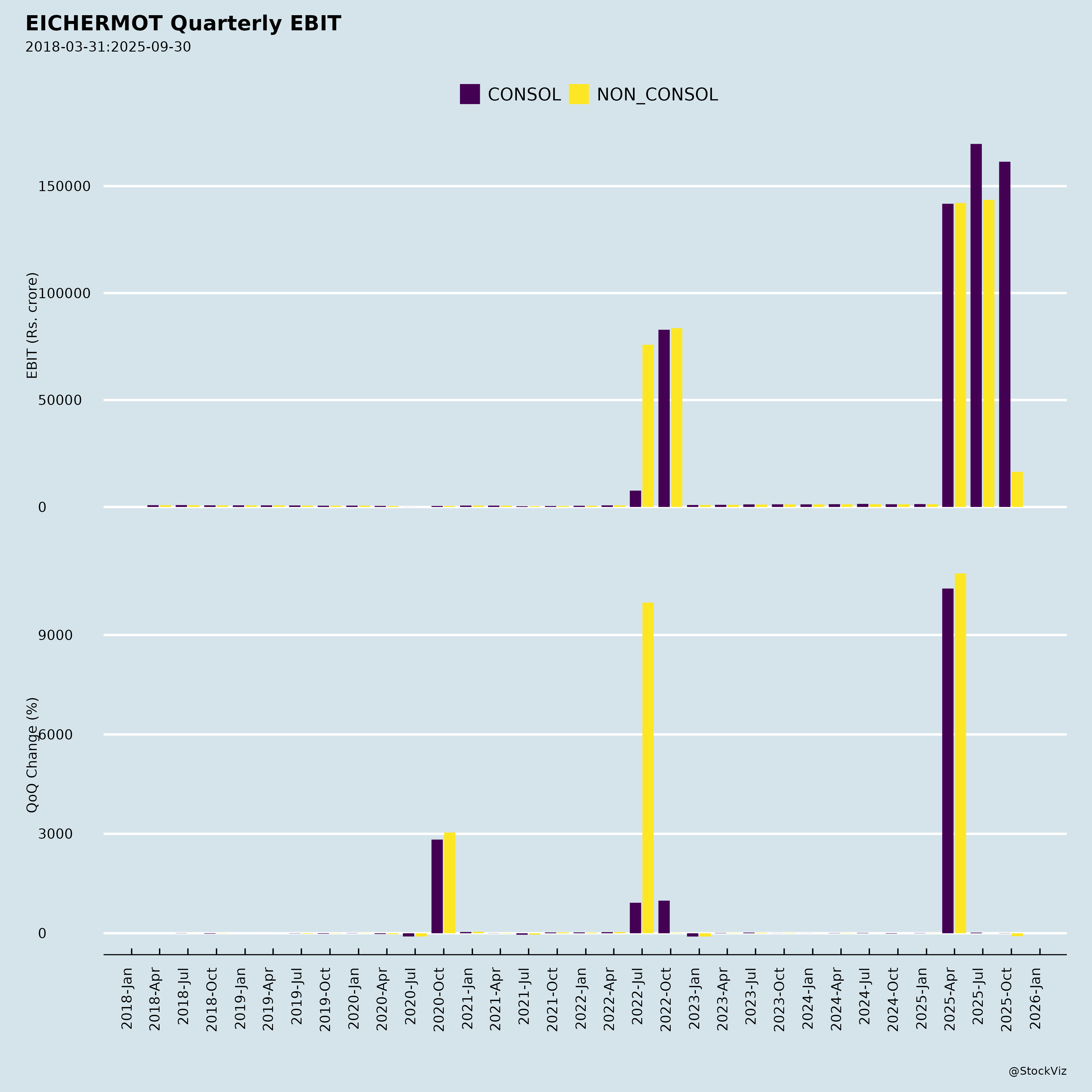

- Record quarterly performance: Revenue from operations up 45% YoY, EBITDA up 39%, and PAT up 25% YoY — signaling strong operating leverage and pricing power.

- Best-ever motorcycle sales: Royal Enfield sold 327,067 units (+45% YoY), the highest quarterly volume in its history.

- VECV on growth trajectory: Truck and bus deliveries grew 5.4% YoY to 21,901 units, with best-ever Q2 sales. Revenue up 10.3%, EBITDA up 8%, and PAT up 19.7% YoY — significant improvement in profitability.

B. Favorable Policy Environment

- GST rationalization has boosted accessibility and affordability of motorcycles below 350cc, directly benefiting Royal Enfield’s popular entry and mid-segment bikes (e.g., Bullet 350, Hunter 350).

- Increased consumer confidence and spending, especially during the festive season (2.49 lakh units sold) — reflects strong demand in rural and semi-urban markets.

C. Brand Strength & Product Innovation

- Product refreshes across key models (Meteor 350, Hunter 350, Guerrilla 450) with enhanced features and aesthetics are boosting appeal and personalization.

- Flying Flea S6 unveiling at EICMA and Electric Vehicle (EV) ambitions indicate innovation and preparedness for future mobility trends.

- Bullish outlook on mid-size motorcycle segment, where Royal Enfield continues to be a dominant, aspirational brand globally.

E. Successful Marketing & Community Building

- One Ride 2025 engaged 40,000+ riders across 60+ countries — strengthens global brand equity.

- Motoverse 2025 and #ArtOfMotorcycling season 5 deepen cultural engagement and loyalty, especially among younger riders.

- Events foster community, word-of-mouth marketing, and long-term brand stickiness.

F. Export Potential & Global Footprint

- Royal Enfield operates in 60+ countries with 850+ international dealerships.

- VECV is global hub for Volvo Group’s 5L & 8L engines — strategic importance in Volvo’s global supply chain.

- CKD (Completely Knocked Down) facilities in 6 countries support localized assembly and export competitiveness.

2. Headwinds (Challenges & Risks)

A. Margins Under Pressure (VECV vs. Royal Enfield)

- While Royal Enfield drives exceptional growth (45% revenue, 25% PAT), VECV revenue growth is modest (10.3%), and EBITDA margin improvement lags behind RENF, despite being more volume-driven.

- Profit generation remains skewed toward Royal Enfield — VECV’s reliance on cost absorption and pricing pressures in commercial vehicles could limit scalability.

B. Regulatory & Input Cost Volatility

- Truck market sensitive to fuel prices, BS-VI compliance, and freight regulations — any changes in emissions or road taxation may impact VECV margins.

- Steel, electronic components, and logistics costs remain inflationary risks for both vehicle segments.

C. Evolving Competitive Landscape

- Royal Enfield faces rising competition from:

- TVS (Apache, Raider), Bajaj (Dominar, Pulsar), Yamaha (R15), and KTM.

- Increasing penetration of electric two-wheelers from Ather, Ola, and TVS iQube which may challenge inner-city appeal.

- Need to continuously innovate and defend mid-size (350–650cc) dominance.

D. Dependency on Motorcycle Segment

- Despite strong contribution from VECV, 80%+ of EML’s profitability likely comes from Royal Enfield.

- Makes EML vulnerable to shifts in consumer preferences, rural recovery cycle, or slowdown in discretionary spending.

E. Execution Risk in New Product Launches

- Flying Flea (urban electric mobility) is unproven; success depends on battery tech, charging infrastructure, and consumer acceptance.

- Transition to electrification in commercial vehicles is still in early stages — VECV not yet showcasing EV trucks/buses at scale.

3. Growth Prospects

| Area | Potential |

|---|---|

| Royal Enfield Global Expansion | High — increasing presence in USA, Europe, and Southeast Asia with premium positioning. Continued growth in exports. |

| Electric Mobility (Flying Flea brand) | Medium to Long-Term — early mover in urban electric motorcycles could capture niche market. Requires significant investment. |

| VECV Market Share Gains | Strong — growing in heavy-duty segment and parts/support ecosystem. Potential for new EV/compressed gas trucks. |

| Aftermarket Revenue Growth | Steady — spare parts, accessories, service revenue rising (especially in VECV). Recurring income stream. |

| Premiumization & Product Mix | Positive — higher sales of 650cc twins, Super Meteor, etc. support margins. |

| Digital & Direct-to-Customer | Opportunity — enhance D2C channels, financing, and omnichannel experience. |

4. Key Risks Summary

| Risk Category | Details |

|---|---|

| 1. Cyclical Demand Risk | Slowdown in rural or urban consumer spending may impact motorcycle sales. Commercial vehicle demand linked to infrastructure and freight growth. |

| 2. Commodity & Cost Inflation | Rise in steel, rubber, electronics, and logistics costs may compress margins. |

| 3. Regulatory Changes | Stricter emission norms (BS-VI Phase 2), input taxation, or EV mandates could require significant R&D and capex. |

| 4. Electrification Disruption | Delayed EV adaptation could lead to market share loss, especially in commuter & urban segments. |

| 5. Execution Risk | Scaling global operations, launching new models (especially EVs), and managing dual-brand complex (Royal Enfield + VECV) adds complexity. |

| 6. Joint Venture Complexity | VECV is a JV with Volvo — strategic alignment and capital allocation decisions may not be fully controlled by EML. |

5. Overall Summary: EICHERMOT – Outlook & Investment Thesis

✅ Bullish Case (Strengths)

- Market leader in mid-size motorcycles with strong emotional brand equity.

- Best-ever financial performance driven by volume, operational efficiency, and festive demand.

- Solid growth in commercial vehicles (VECV) with market share gains and improved profitability.

- Positive policy tailwinds (GST rationalization) boosting demand.

- Strong brand community, innovation pipeline, and global presence.

⚠️ Bearish Concerns (Risks)

- High dependence on Royal Enfield for profits.

- Modest growth in VECV volumes despite revenue expansion.

- EV transition remains in early stages; execution risk in new categories.

- Commodity and macro risks could weigh on margins.

Verdict: POSITIVE – Strong Growth with Controlled Risks

Eicher Motors (EICHERMOT) is executing well across both its core businesses and is positioned favorably for sustained growth. Royal Enfield’s brand strength and global appeal, combined with VECV’s steady industrial growth, create a resilient dual-engine model. The company is benefiting from favorable demand dynamics, policy support, and operational excellence.

While risks related to commodities, competition, and EV transition exist, EML’s focus on heritage, innovation, and customer engagement provides a strong foundation for long-term value creation.

Recommendation for Investors & Analysts:

- Monitor: EV roadmap (Flying Flea scale-up), VECV’s heavy-duty share growth, and input cost trends.

- Valuation Note: Strong PAT growth supports premium valuation, but watch for margin sustainability.

- Long-term Buy: For investors seeking exposure to premium Indian manufacturing, brand-led growth, and global aspirations.

Sources: Q2 FY 2025-26 Press Release, Company Disclosures, Public Filings, Industry Trends.

Date of Analysis: November 14, 2025.

Copyright © 2023 SAS Data Analytics Pvt. Ltd. All rights reserved.