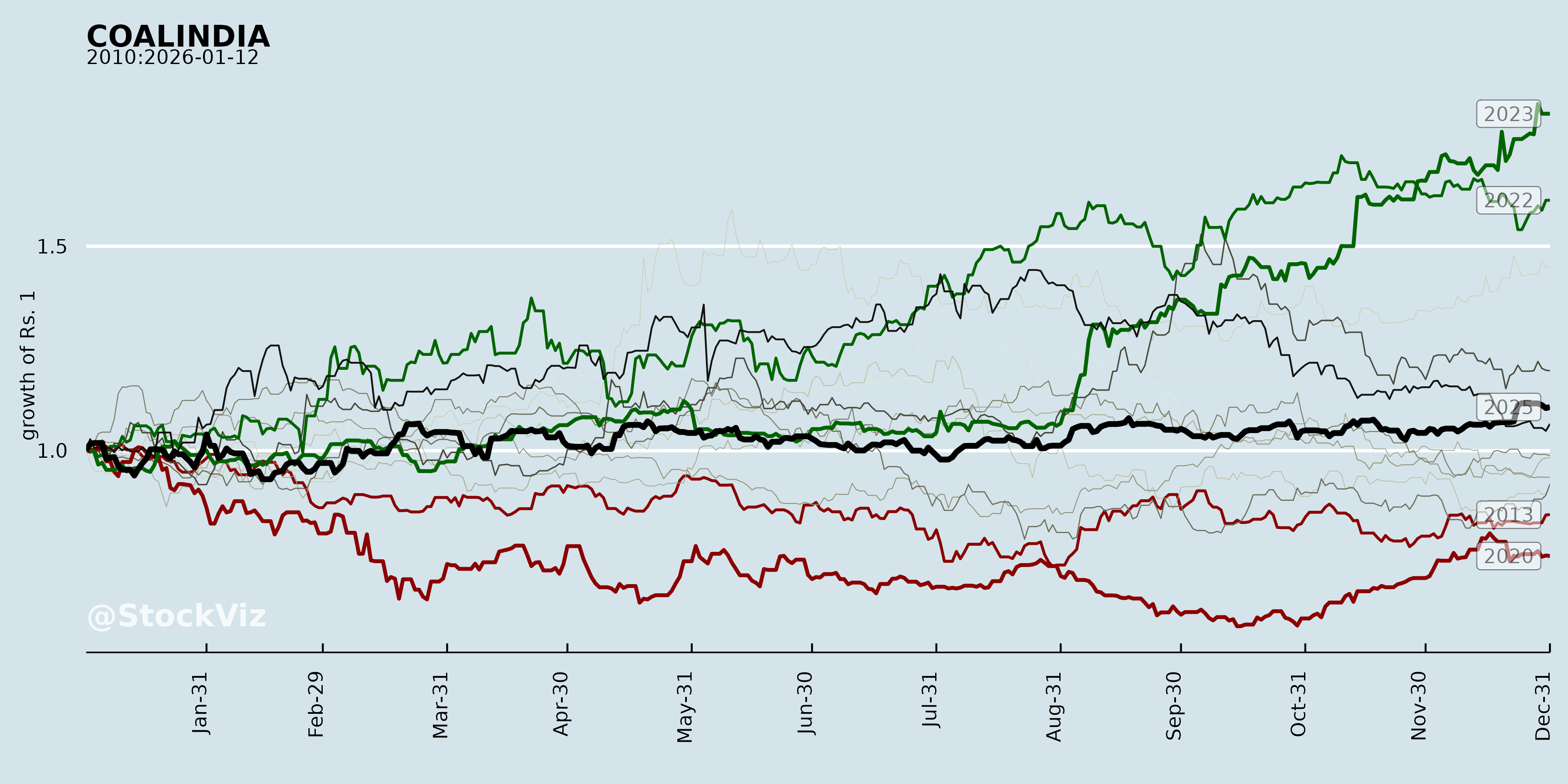

COALINDIA

Equity Metrics

January 13, 2026

Coal India Limited

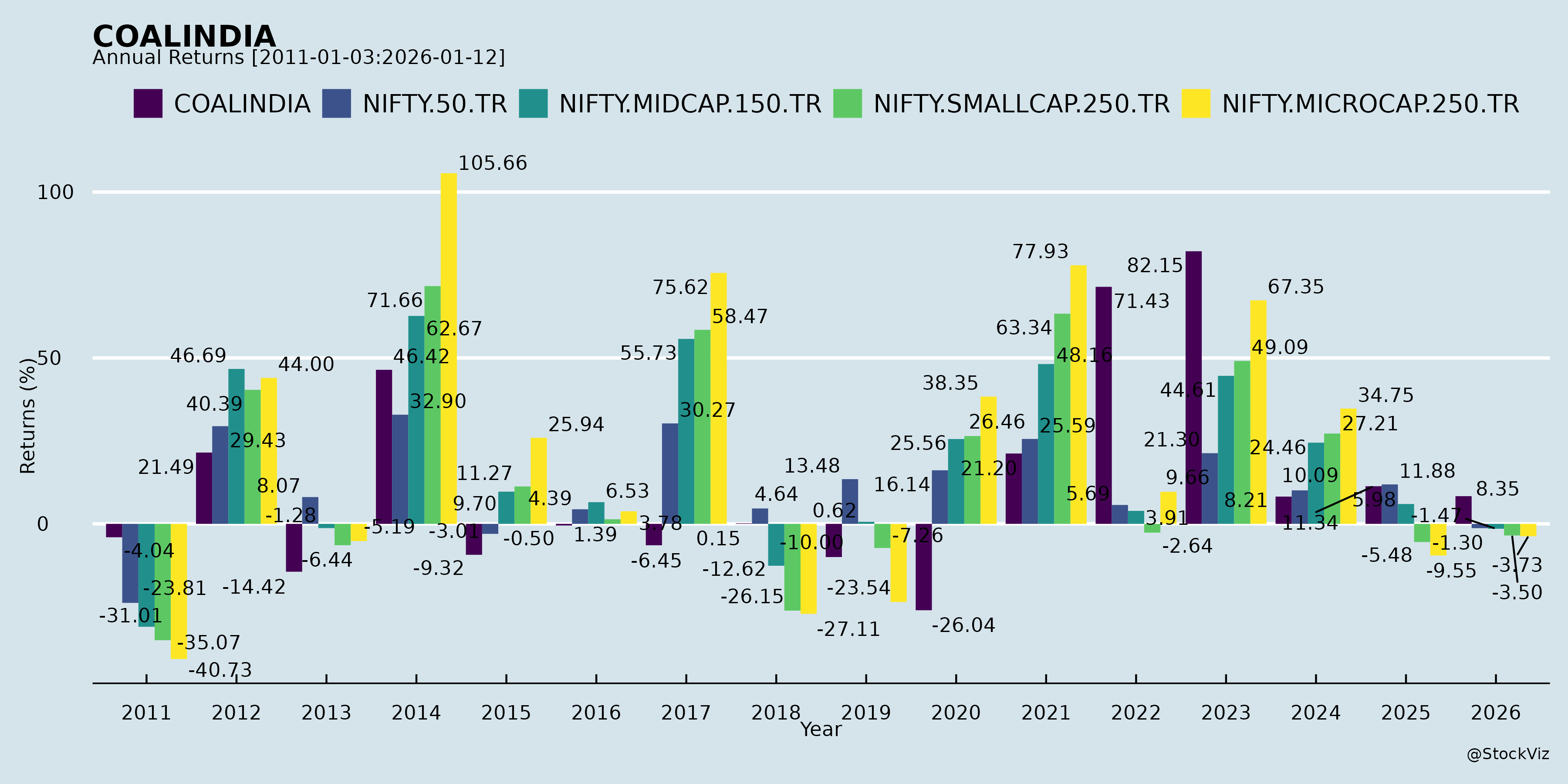

Annual Returns

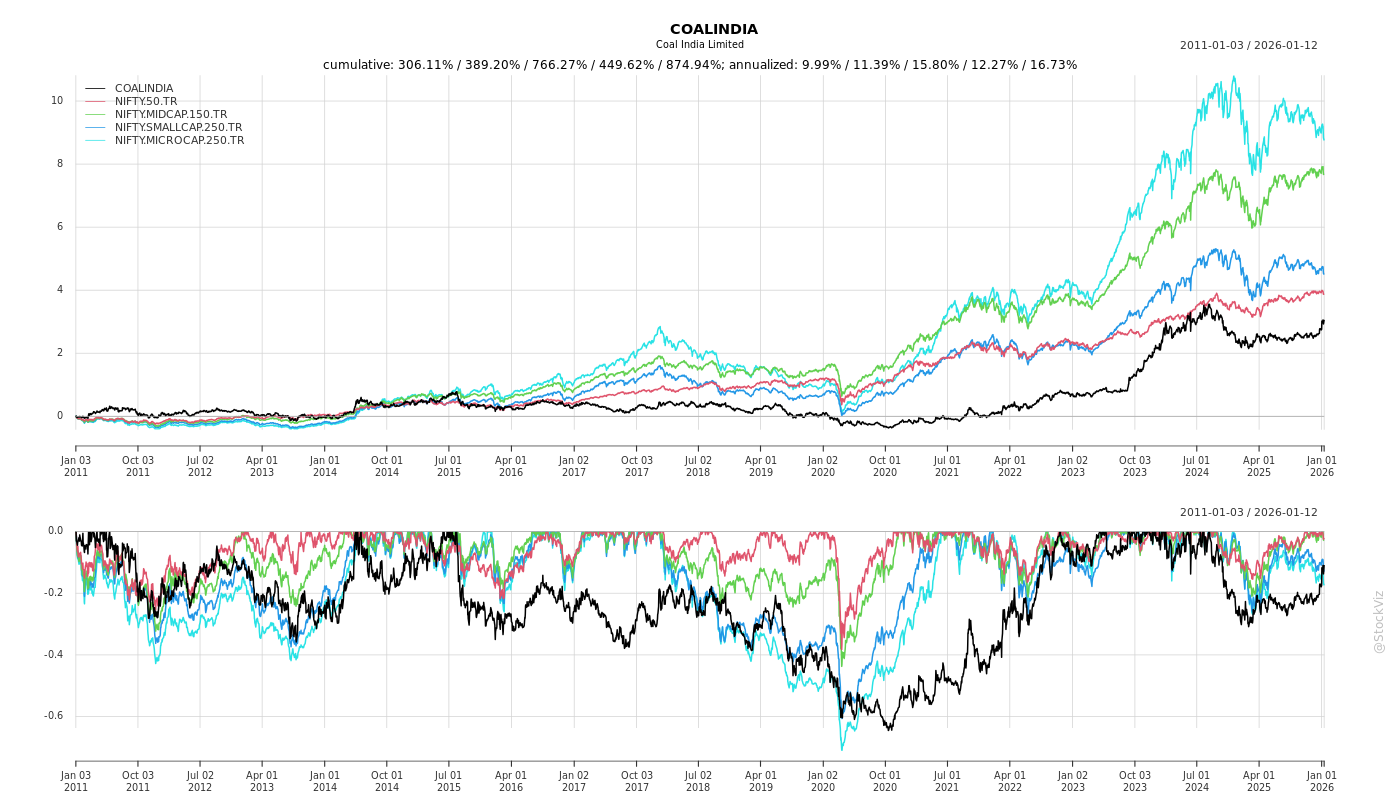

Cumulative Returns and Drawdowns

Fundamentals

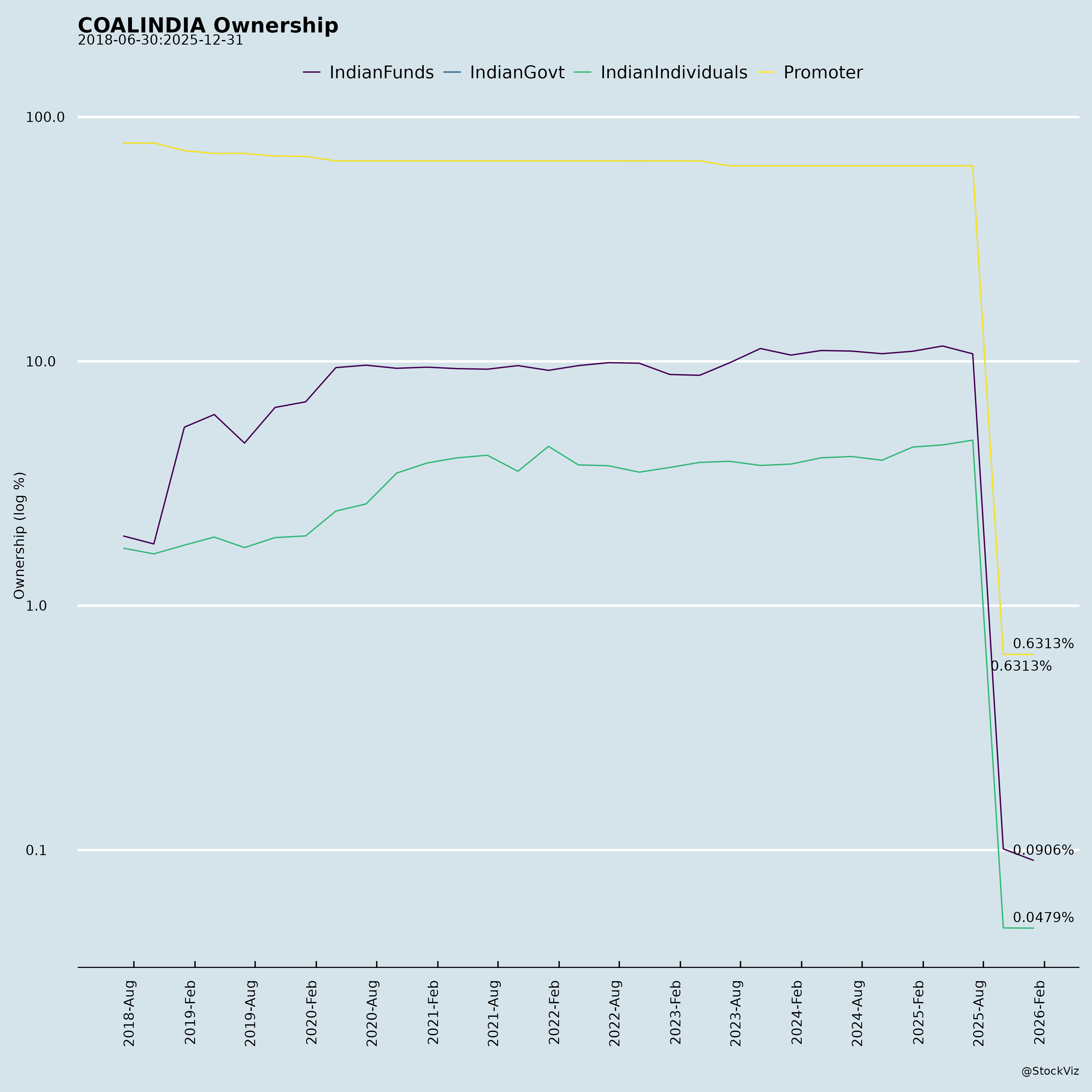

Ownership

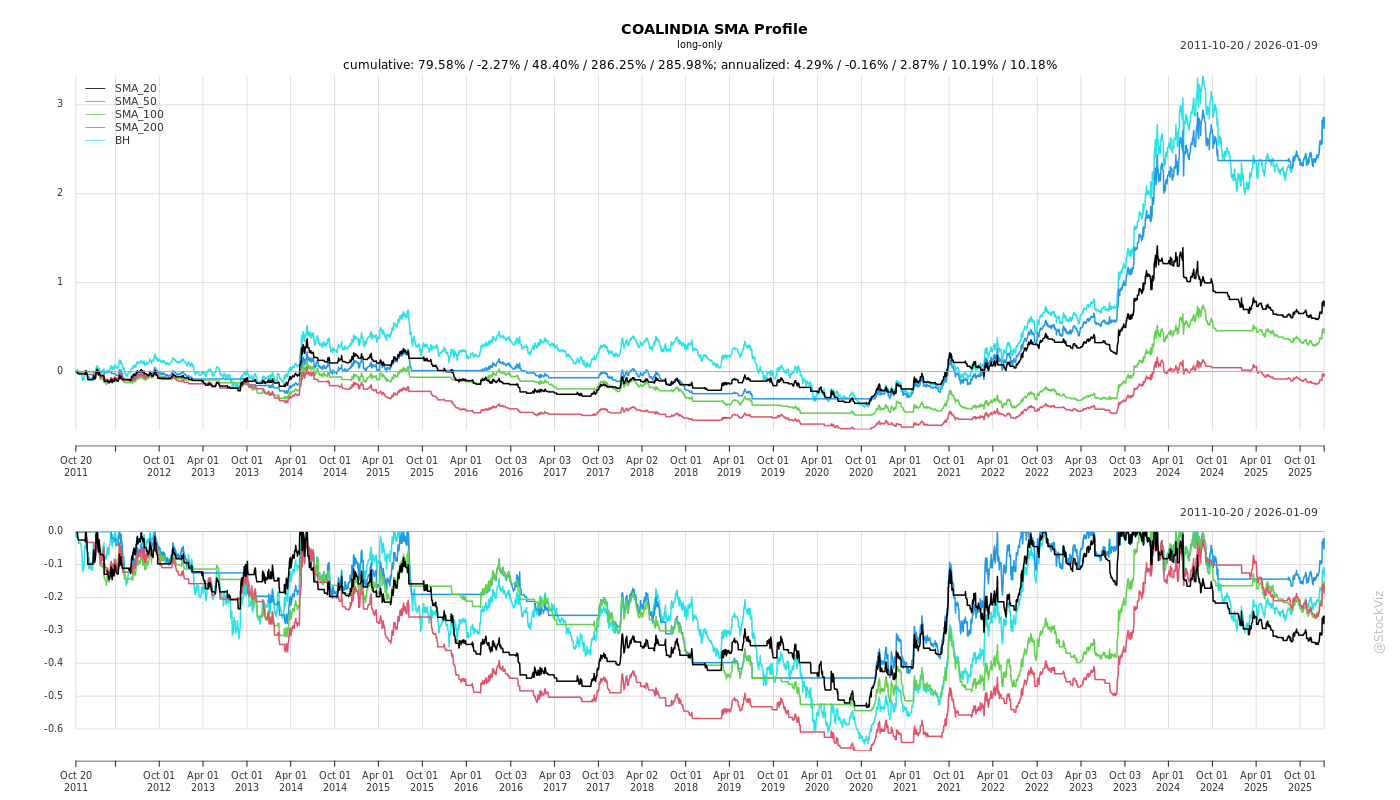

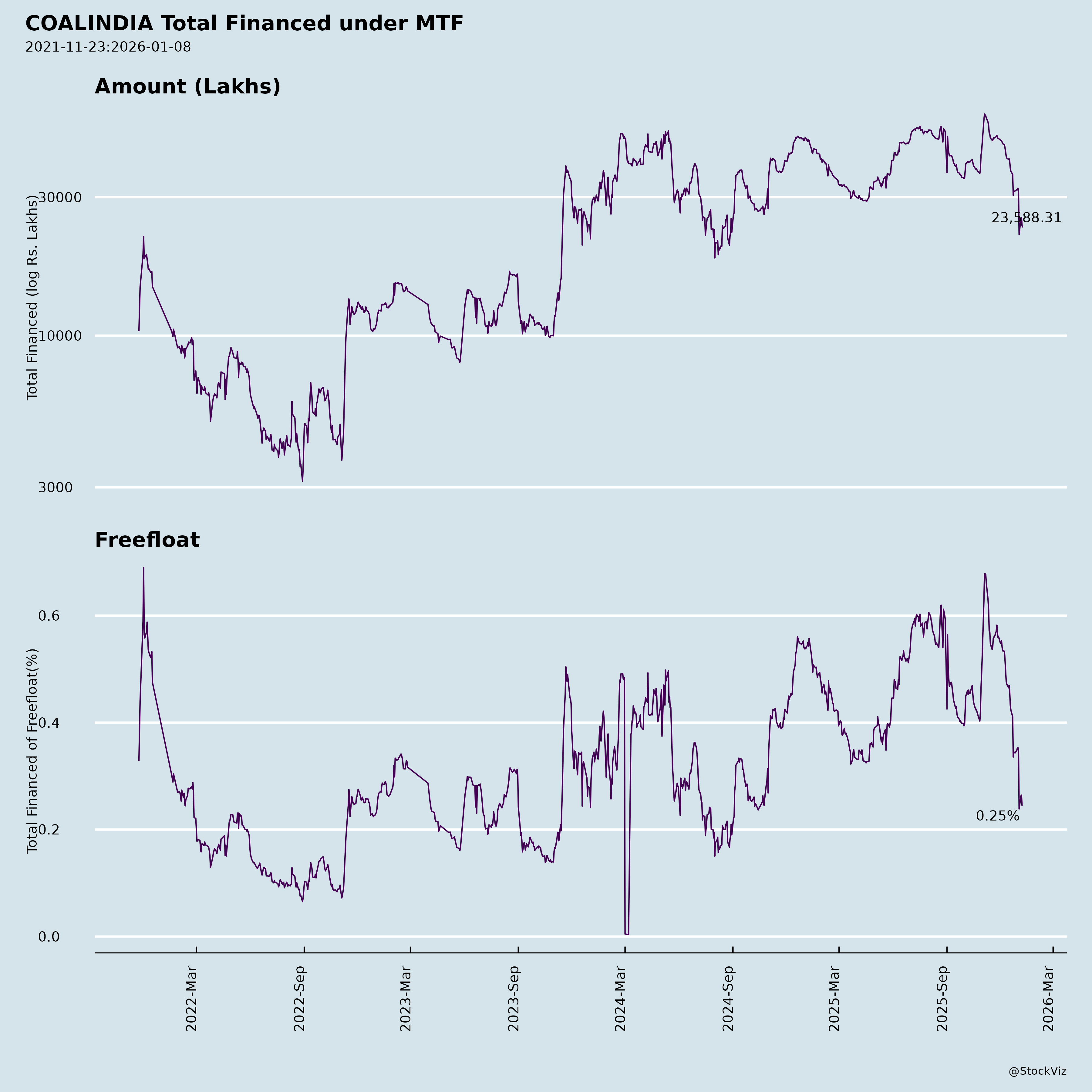

Margined

AI Summary

asof: 2025-12-03

Coal India Limited (COALINDIA) Analysis

Based on provided disclosures (Q2/H1 FY26 results, production/offtake data, JV announcement, investor meet, and auditor reports as of Oct-Dec 2025). All figures consolidated unless specified.

Tailwinds (Positive Catalysts)

- Robust Dividend Policy: 2nd interim dividend of ₹10.25/share (102.5%) declared (post 1st interim ₹5.50/share), signaling strong cash generation. H1 FY26 profit supports sustained payouts, appealing to income-focused investors (yield ~8-10% annualized).

- GST Relief: Rate hike on coal to 18% (effective Sep 2025) resolves inverted duty structure, enabling utilization of ₹18,133 Cr accumulated ITC (up from ₹17,006 Cr). Standalone ITC at ₹98 Cr.

- Strong Balance Sheet: Total assets ₹2.66 lakh Cr (+2% YoY), equity ₹1.06 lakh Cr, cash equivalents ₹9,433 Cr. Net debt low; operating cash flow ₹8,845 Cr (H1).

- Subsidiary Resilience: SECL (+18.6% Nov prod., +3.5% H1), NCL (+1.1% H1 prod.), MCL stable. Nov’25 group production +1.2% YoY.

- Strategic Initiatives: Brownfield JV with DVC for 1,600 MW (2x800 MW) ultra-supercritical thermal plant at Chandrapura (Jharkhand). 50:50 equity (₹21,000 Cr capex), coal from CCL, COD by FY32. Explores further thermal/RE projects; leverages existing infra for low variable costs.

Headwinds (Challenges)

- Volume Declines: H1 FY26 production 453.5 MT (-3.7% YoY), offtake 478.9 MT (-2% YoY). Nov’25 marginal (+1.2% prod., -0.3% offtake). Weak subs: BCCL (-16.3% H1 prod.), WCL (-11.7%), ECL (-1.7%), CCL (-14.1%).

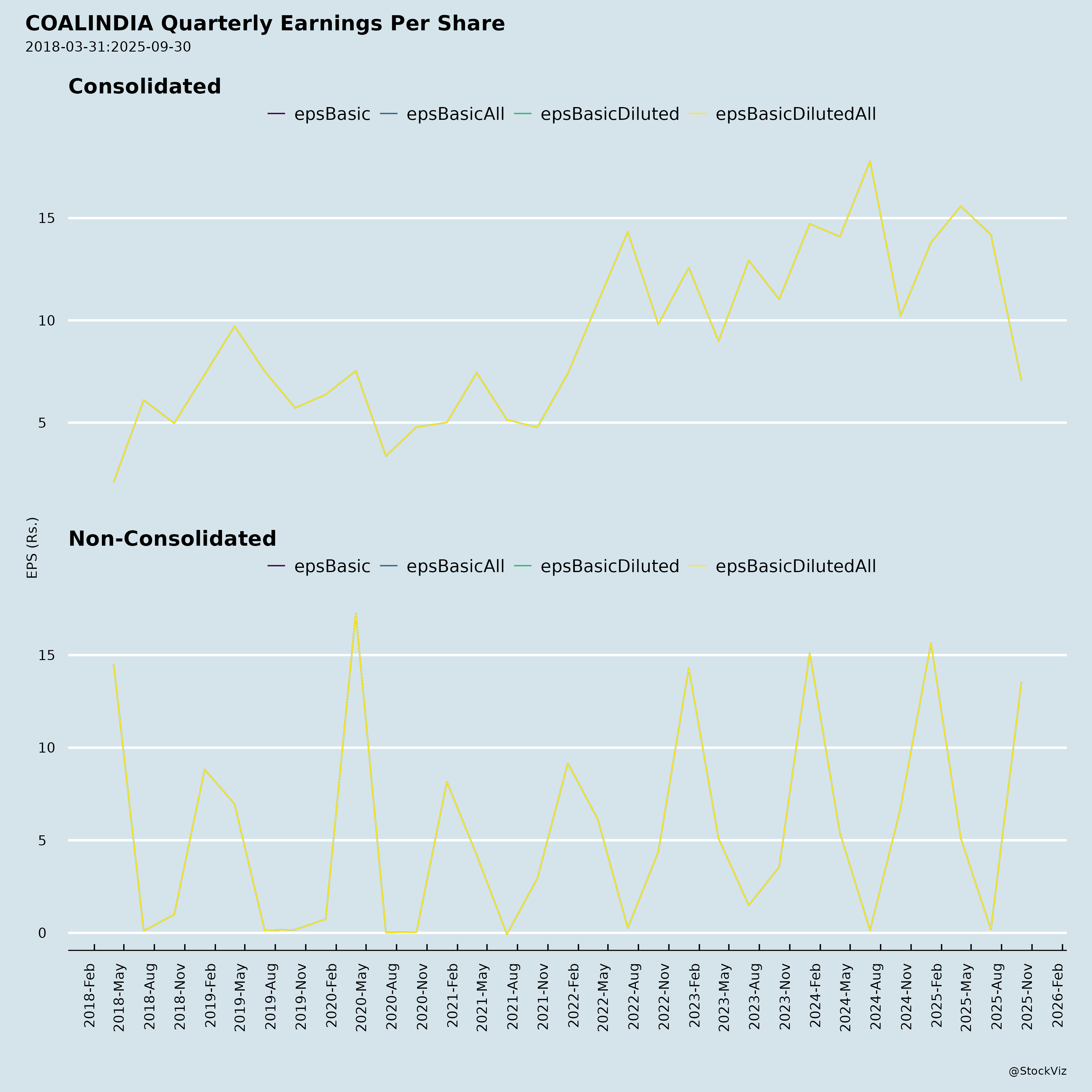

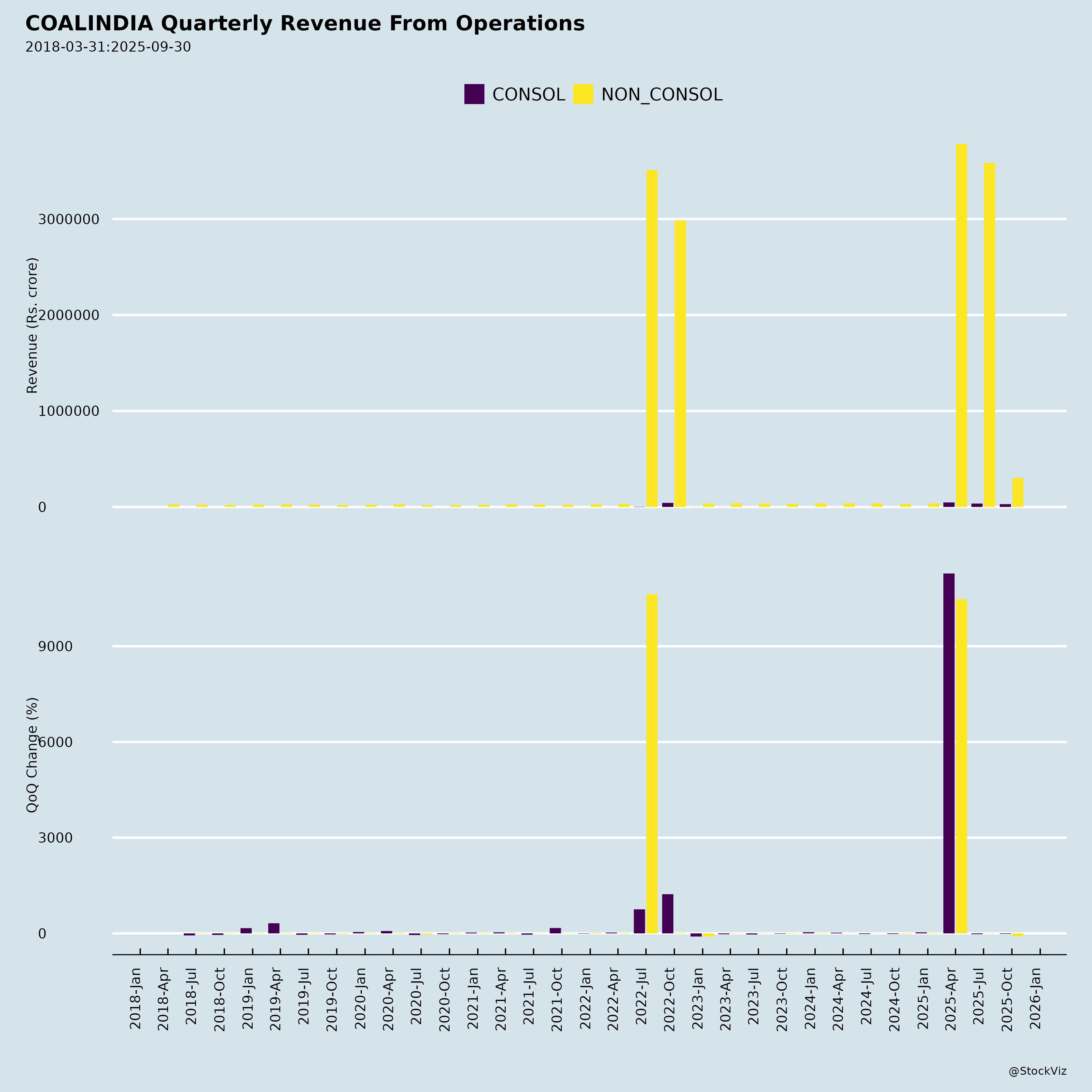

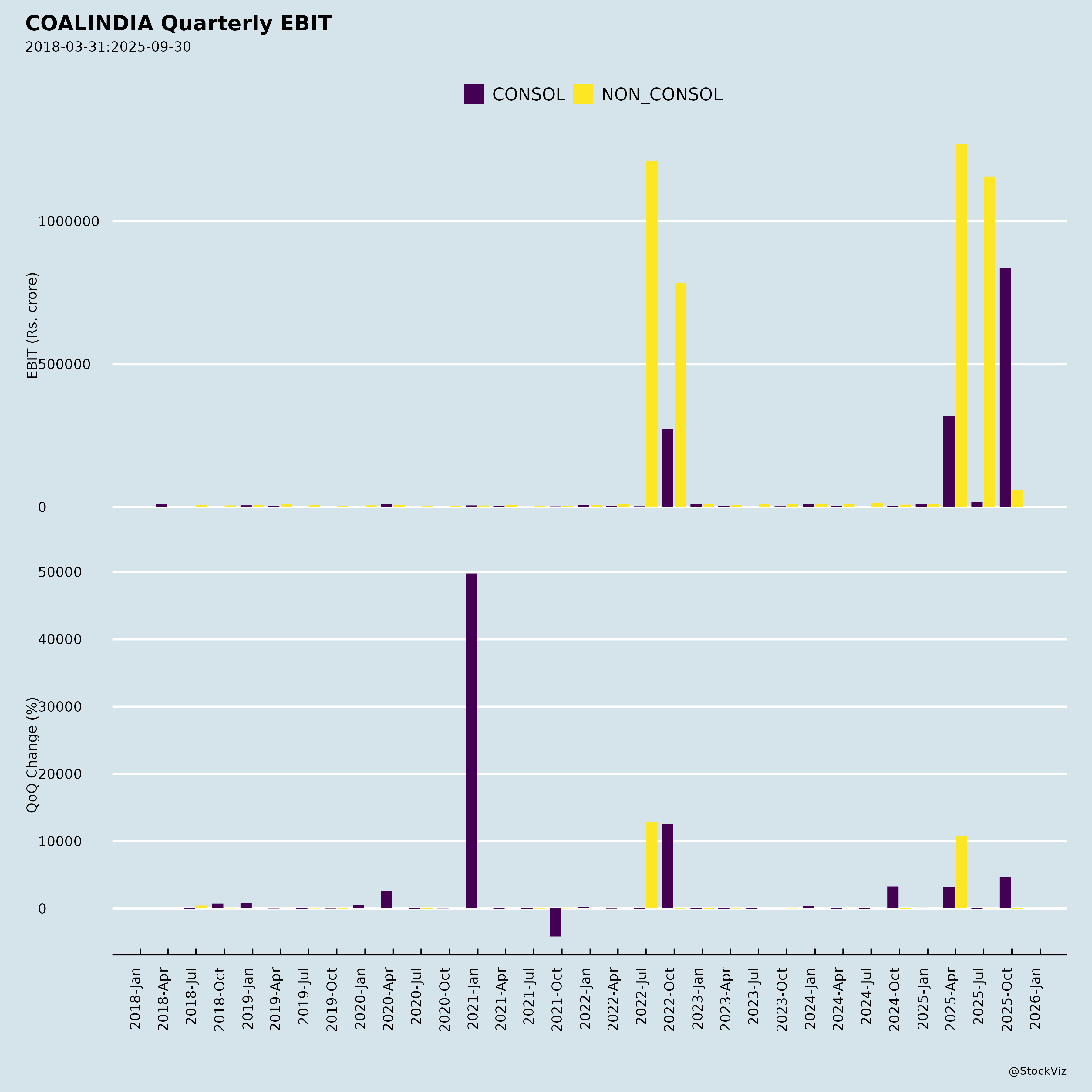

- Revenue & Profit Pressure: H1 revenue from ops ₹66,029 Cr (-4% YoY), PBT ₹17,824 Cr (-20% YoY), PAT ₹12,997 Cr (-25% YoY), EPS ₹21.25 (-24% YoY). Q2 sales ₹26,909 Cr (-1% YoY). Higher costs: employee (₹21,679 Cr, flat but high base), depreciation (₹4,972 Cr, +29% YoY), contractual (₹14,020 Cr).

- Margin Squeeze: Stripping adjustment (-₹2,266 Cr H1 credit, but ongoing provisions ₹57,831 Cr). Elevated other expenses and inventory buildup (₹11,532 Cr).

- Standalone Volatility: Relies on subsidiary dividends (₹8,263 Cr in Q2 other income); core ops revenue low (₹651 Cr H1).

Growth Prospects

- Power Sector Demand: JV taps baseload power needs (national/regional); competitive costs from coalfield proximity. Potential pipeline: more thermal/RE with DVC.

- Volume Recovery Potential: H1 dip vs. strong FY25 (target 1B+ MT); SECL/MCL/NCL could drive FY26 target (~1B MT). Investor meet (14 Nov’25) may signal outlook.

- Diversification: RE/solar JVs (e.g., CIL Solar PV closed, but Rajasthan Akshay Urja new); gasification/railway subs.

- Capex Momentum: H1 capex ₹6,042 Cr; CWIP ₹17,238 Cr (+9%). FY26 guidance implicit via steady dividends.

- Outlook: FY26 PAT could stabilize at ₹30,000-35,000 Cr (if volumes rebound 5-10%); JV adds long-term revenue (post-FY32).

Key Risks

| Risk Category | Details | Potential Impact |

|---|---|---|

| Operational | Sub declines (BCCL/WCL/ECL); monsoon/infra delays. | Volume miss; EBITDA margin <40%. |

| Financial | ITC utilization delay; stripping provisions (₹58k Cr legacy). | Cash flow hit if GST refunds stall. |

| Governance/Regulatory | <50% indep. directors (CIL); no women directors (SECL/MCL) → SEBI penalties. Auditor flags error corrections (e.g., SECL DTA reversal ₹227 Cr). | Fines, reputational damage. |

| Macro/Policy | RE shift, coal auction competition, royalty hikes, import pressure. Supreme Court land levy overhang. | Demand erosion; pricing power loss. |

| Execution | JV delays (COD FY32); forex/JV profit share (e.g., HURL ₹210 Cr H1). | Capex overrun; ROE dilution. |

| Market | China/Indonesia coal imports; power sector slowdown. | Offtake <90%; stock multiple compression (P/E ~8-10x). |

Summary

Neutral-Positive Outlook: CIL faces near-term headwinds from H1 volume/profit declines (-4%/-25% YoY) amid sub-specific issues, but tailwinds from dividends, GST fix, and DVC JV (1,600 MW growth vector) provide support. Balance sheet strength (low debt, high cash) mitigates risks; FY26 recovery hinges on Q3/Q4 volumes. Valuation: Trades at ~8x FY26E EPS (~₹55-60); attractive yield but monitor production (Dec’25 data key). Recommendation: Hold/Buy on dips for dividend play; risks tilted operational/regulatory. Investor meet (HSBC) could catalyze updates.

Copyright © 2023 SAS Data Analytics Pvt. Ltd. All rights reserved.