CCL

Equity Metrics

January 13, 2026

CCL Products (India) Limited

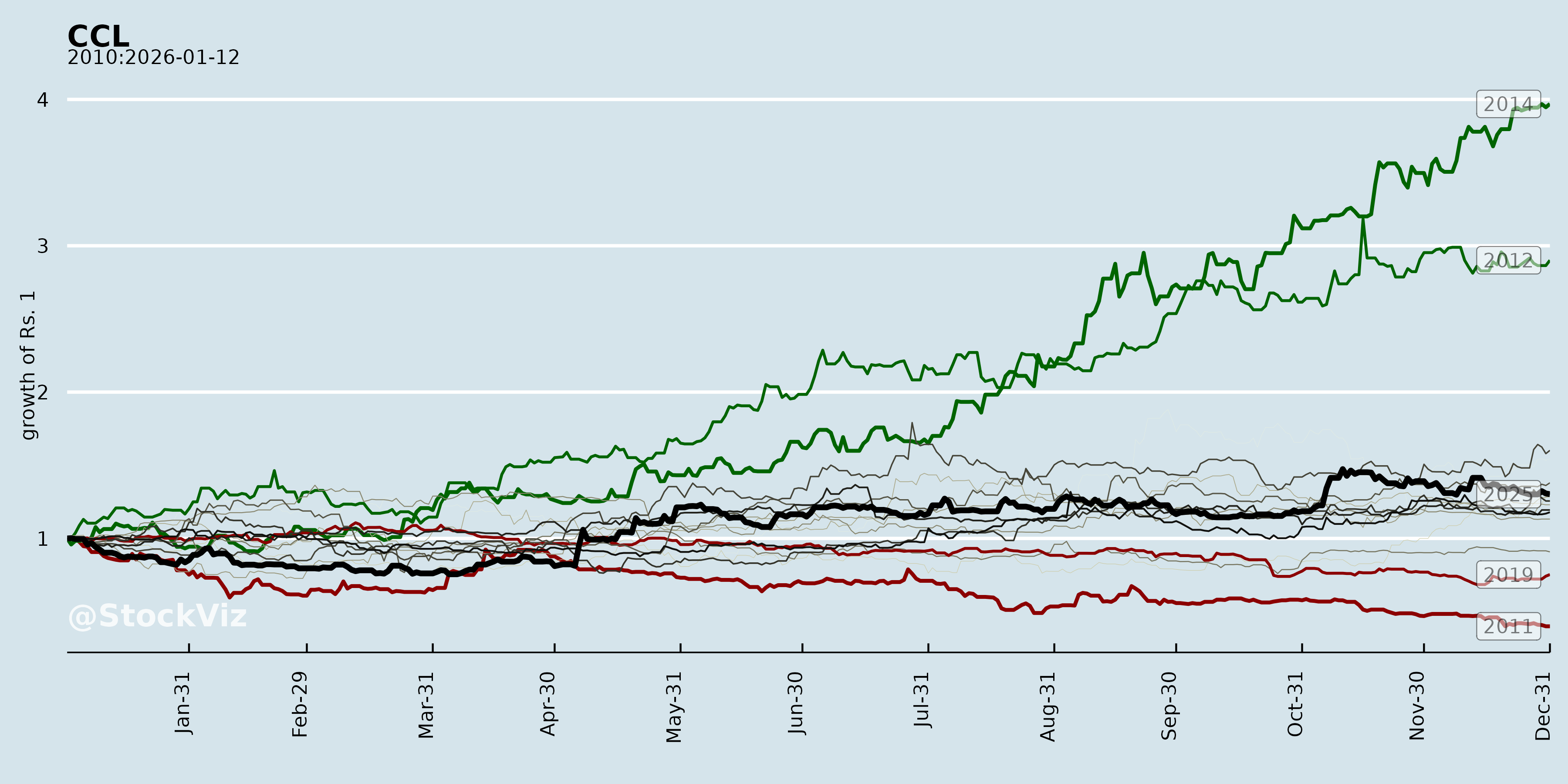

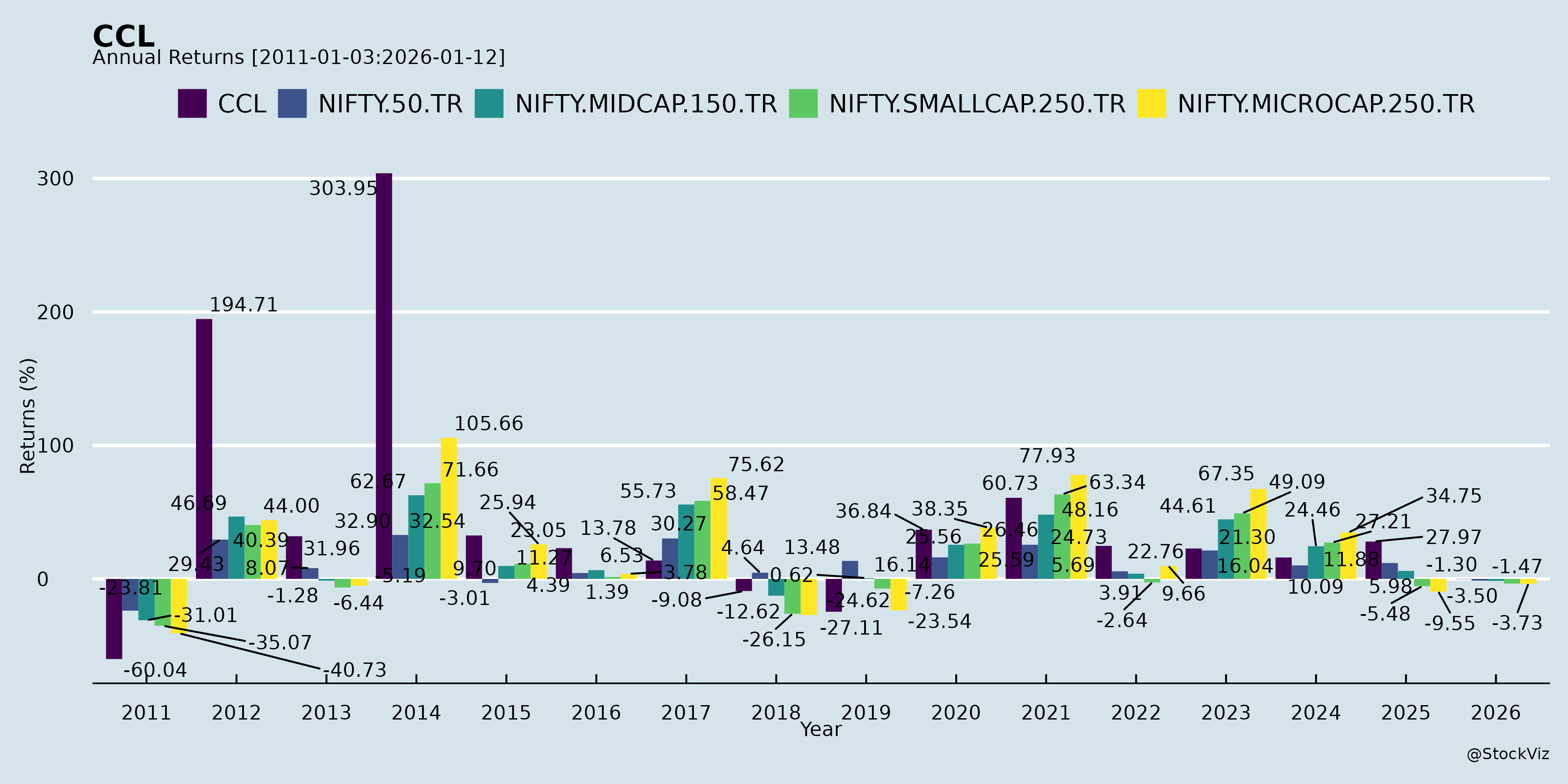

Annual Returns

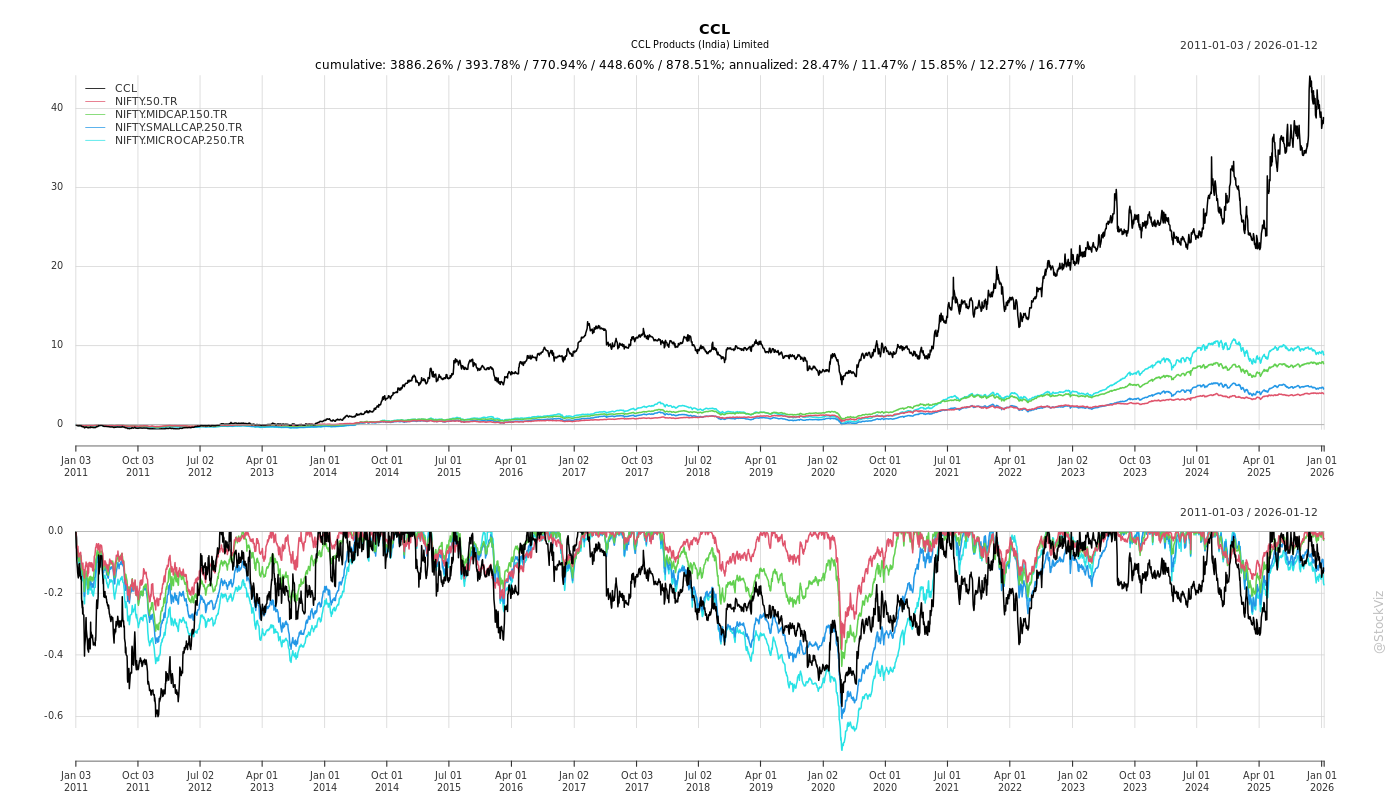

Cumulative Returns and Drawdowns

Fundamentals

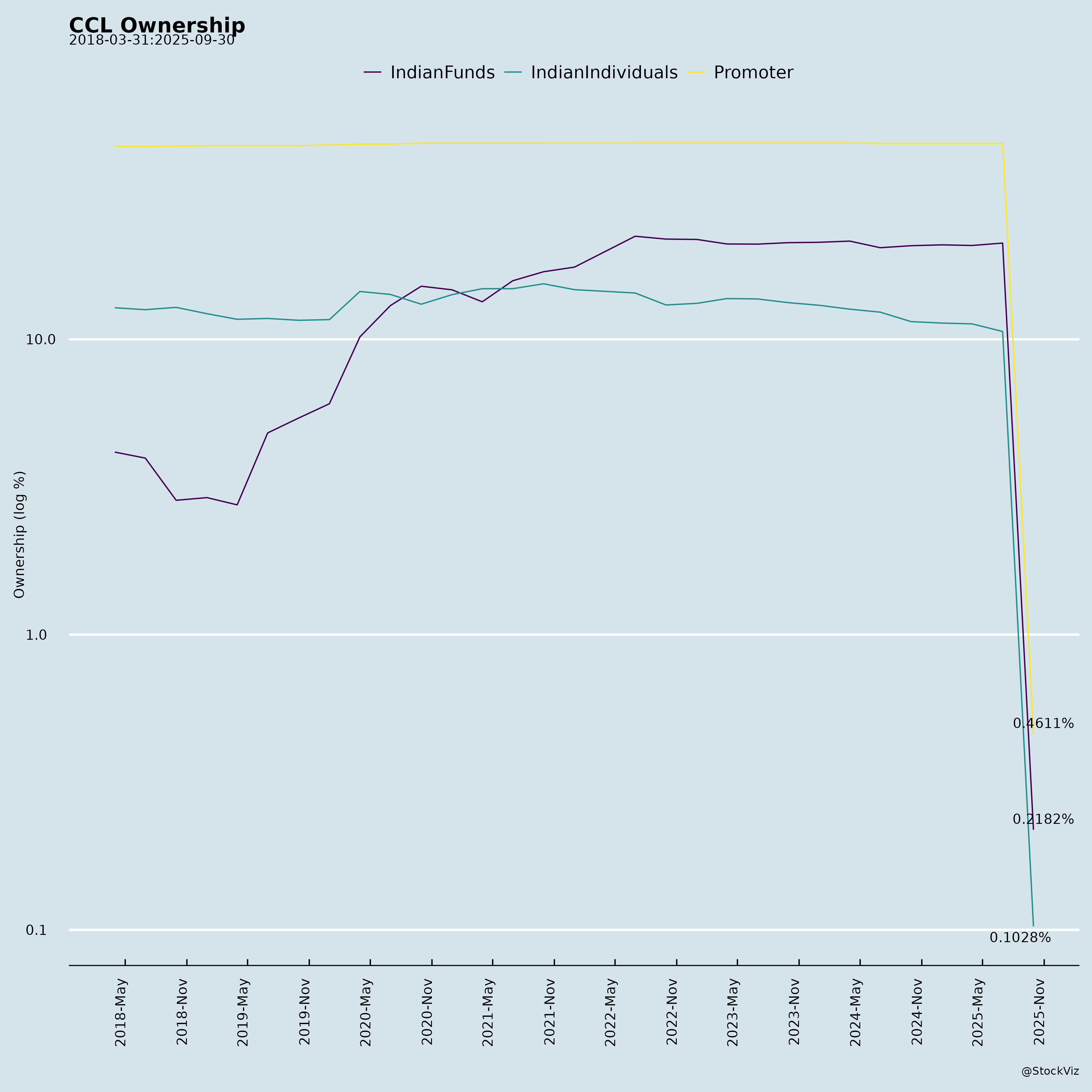

Ownership

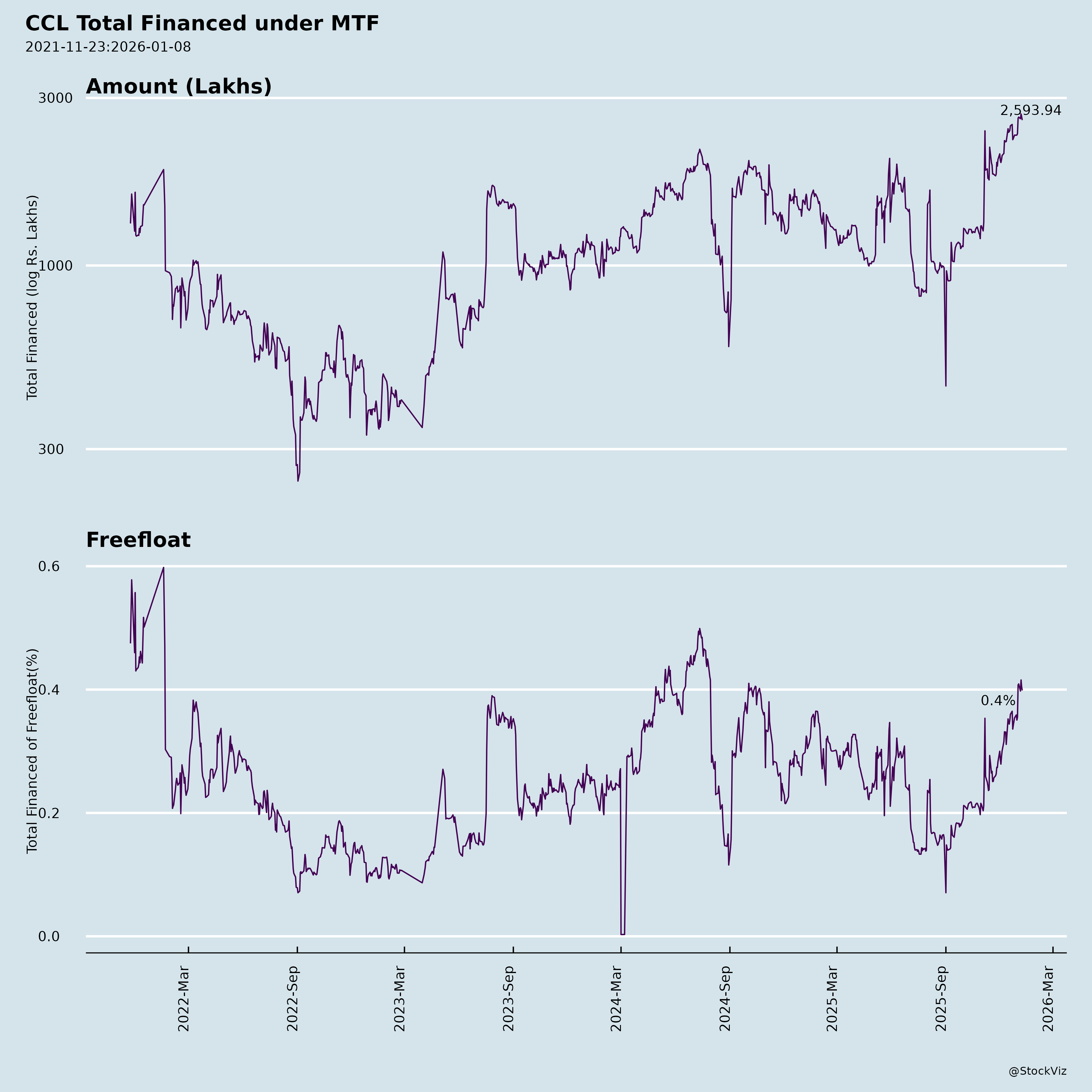

Margined

AI Summary

asof: 2025-12-03

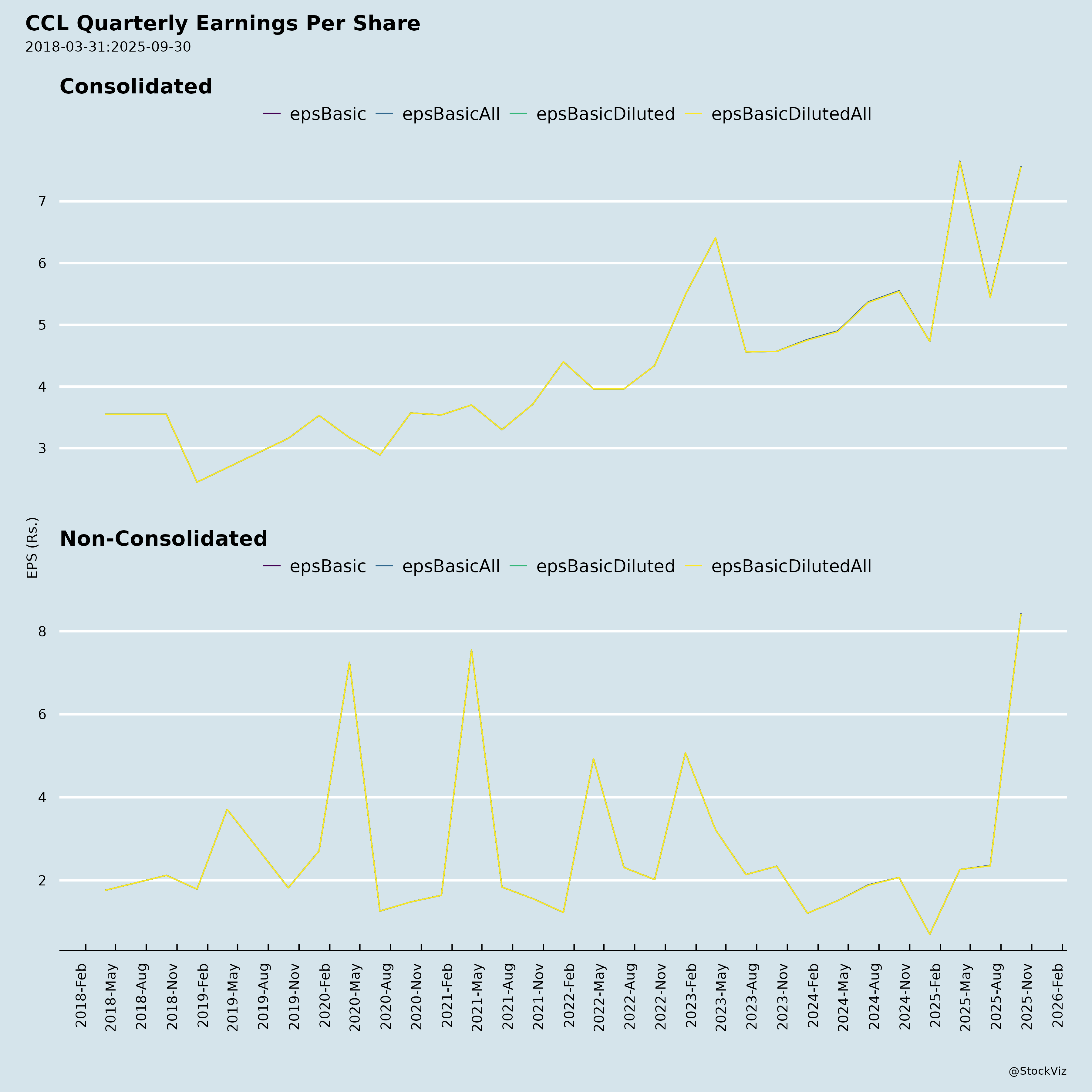

CCL Products (India) Limited (CCL) - Q2 FY26 Analysis

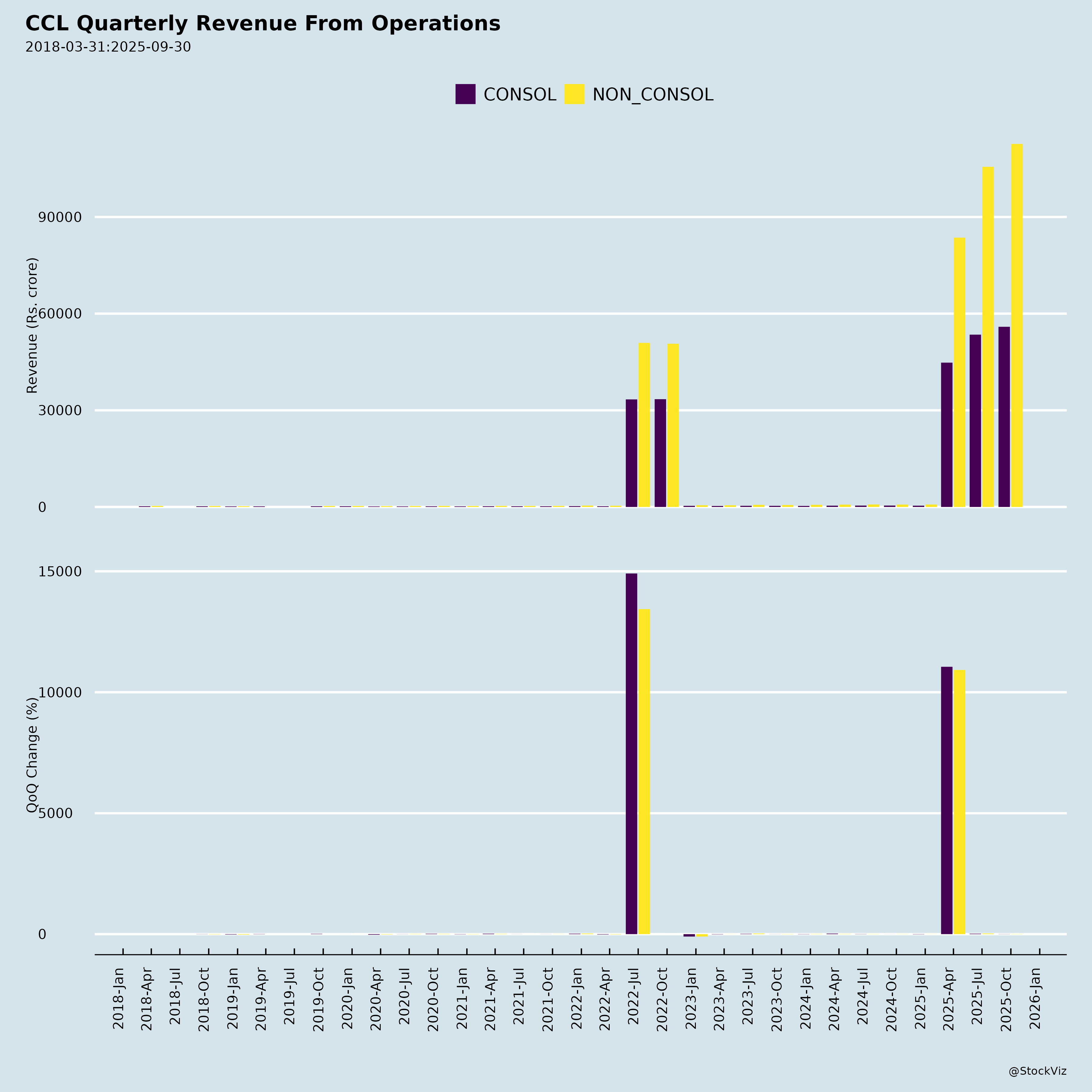

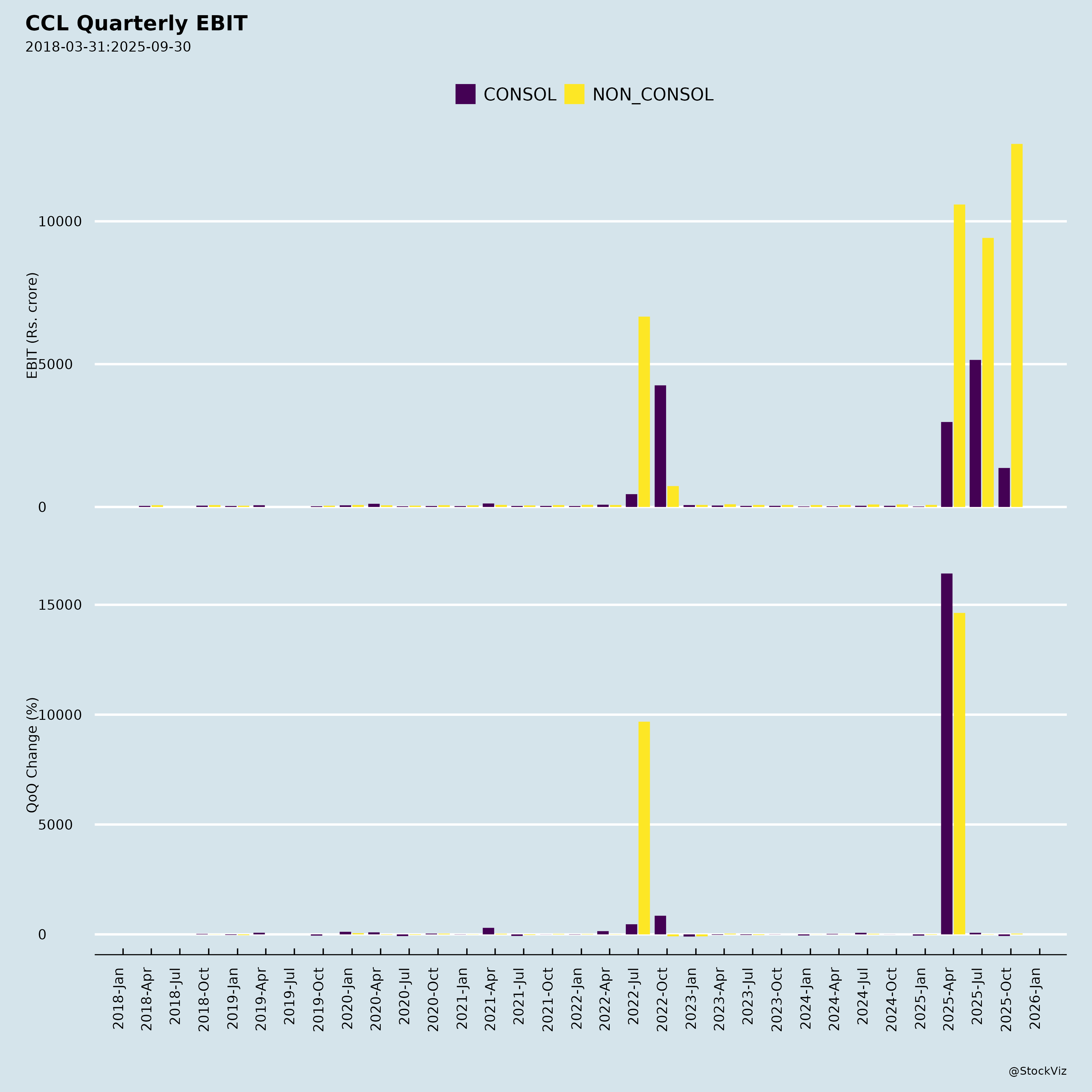

CCL, a leading instant coffee manufacturer with operations in India and Vietnam, reported robust Q2/H1 FY26 results amid volatile coffee prices. Consolidated revenue grew 52.7% YoY to ₹1,128 Cr (Q2) and 44.5% to ₹2,186 Cr (H1), driven by ~20% volume growth (blended H1 ~15%) and higher realizations. EBITDA margins held firm at ~17-18%, with EBITDA/kg improving to ~₹130/kg (up ₹10-12 QoQ). Net profit rose 36.4% YoY (Q2). Domestic branded sales hit ₹110 Cr (Q2)/₹210 Cr (H1), up 40-50% with market share gains. Debt reduction is on track (net debt ~₹1,250 Cr currently; guidance ₹1,200 Cr by FY26-end). Management reaffirmed 10-20% volume growth and 15-20% EBITDA growth guidance, with a pivot to FMCG ambitions.

Tailwinds (Positive Drivers)

- Strong Volume-Led Growth: 20%+ Q2 volumes (B2B ~20%, B2C 25-30%), backed by demand robustness. H1 blended ~15%, on track for guidance.

- Domestic Branded Momentum: ₹310 Cr H1 domestic sales (68% branded); 40-50% growth, double-digit share in e-com/modern trade/quick commerce (pan-India). #2 in AP/Telangana; penetration via small packs/sachets in South, variety/flavors in North/West/Northeast. Distribution at 1.3-1.4L outlets (aim: double in 3 years).

- Export Resilience: Vietnam facilities diverted US business amid high India tariffs; competitive in Europe/US. No major Brazil diversion impact.

- Margin Expansion: EBITDA/kg up due to freeze-dried mix, small packs, domestic profitability (beyond breakeven), operational efficiencies (yields, inventory/utilization), and working capital gains (receivables down via early payments/discounts).

- Strategic Moves: Renewables investment (26% stake in Mukkonda Renewables for 10 MW hybrid captive power; ₹12 Cr outlay) for 50-60% green energy, cost savings (2-3 yr payback). FMCG pivot (iced tea, snacks test-launched; self-funded via B2C accruals).

- Balance Sheet Strength: Cash from ops up sharply; dividend payout sustained. Capex cycle peaked; depreciation/interest at highs but stabilizing.

Headwinds (Challenges)

- Coffee Price Volatility: Green coffee prices softened post-Brazil but rebounded; conflicting Vietnam crop reports (flooding risks). Fluctuations (~$100/2 days) delaying long-term contracts, keeping buyers tentative.

- US Tariff Pressure: High duties on Indian exports persist; reliant on Vietnam diversion (no disruption yet, but limits flexibility).

- Capacity Ramp Lag: Blended utilization 65-70% (old capacity 100%, new 15-20%). New FD/SD capacities (~half of total 77K MT) need 3-4 years to optimize.

- B2C Margins: EBITDA ~5-6% (reinvesting in marketing/distribution); below company average, though incremental volumes now profitable.

- Seasonal Procurement: H2 harvesting to pressure working capital/debt (guidance intact at ₹1,200 Cr net debt by Mar’26).

Growth Prospects

- Core Coffee (80-85% Revenue): 15-20% EBITDA growth FY26 (upper end likely); volumes 10-20%. Domestic to ₹420-430 Cr (profitable). Exports stable via cost-plus model (short/long-term contracts).

- FMCG Transition: Build multi-category portfolio (coffee + adjacencies like tea/snacks) on 1.5L+ outlets. B2C self-funds expansion; aim FMCG player in 3-5 years.

- Efficiency Leverage: EBITDA/kg to rise further (optimal utilization, renewables, yields). H1 cash flows support debt paydown/capex.

- Medium-Term (FY27-28): 20%+ topline CAGR feasible if prices stabilize/crop improves; capacity headroom for 20% volumes. UK brand (Continental) growing 30-40%.

- Catalysts: Vietnam crop clarity (Dec’25); tariff relief hopes; distribution scaling.

| Metric | H1 FY26 | YoY Growth | Guidance FY26 |

|---|---|---|---|

| Revenue | ₹2,186 Cr | +44.5% | Volume-driven (prices volatile) |

| EBITDA | ₹360 Cr | +33.7% | 15-20% |

| Volumes | ~15% | - | 10-20% |

| Domestic Branded | ₹210 Cr | 40-50% | ₹420-430 Cr |

| Net Debt | ~₹1,250 Cr | Down from peak | ₹1,200 Cr (Mar’26) |

Key Risks

- Commodity Risk (High): 60-70% costs tied to green coffee; Vietnam supply disruptions could spike prices, hit margins/volumes (cost-plus mitigates but delays contracts).

- Trade/Geopolitical Risk (Medium): US tariffs persist; Brazil competition in Europe. Currency volatility (noted in cash flows).

- Execution Risk (Medium): FMCG pivot/new categories failure; distribution scaling costs. Intense branded competition (#1/#2 players growing 20-25%).

- Financial Risk (Low-Medium): Debt at ₹1,580 Cr gross (~0.7x FY25 EBITDA); procurement seasonality. Tax rate ~17% (geo-mix dependent).

- Operational Risk (Low): Low new capacity utilization; reliance on Vietnam (one unreviewed sub ~20% revenue).

- Market Risk: Demand softening if prices stay elevated (in-home low single-digits; out-of-home stronger but category-dependent).

Overall Outlook: Strong tailwinds from domestic share gains and efficiencies outweigh headwinds. CCL is de-risking via diversification (FMCG, Vietnam, renewables). Bias positive for FY26 (20%+ EBITDA growth likely), with 15-20% EPS CAGR medium-term. Monitor Vietnam crop (Dec’25) and tariffs. Recommendation: Accumulate on dips; target upside to ₹750-800 (20x FY27E EPS).

Copyright © 2023 SAS Data Analytics Pvt. Ltd. All rights reserved.