CAPTRUST

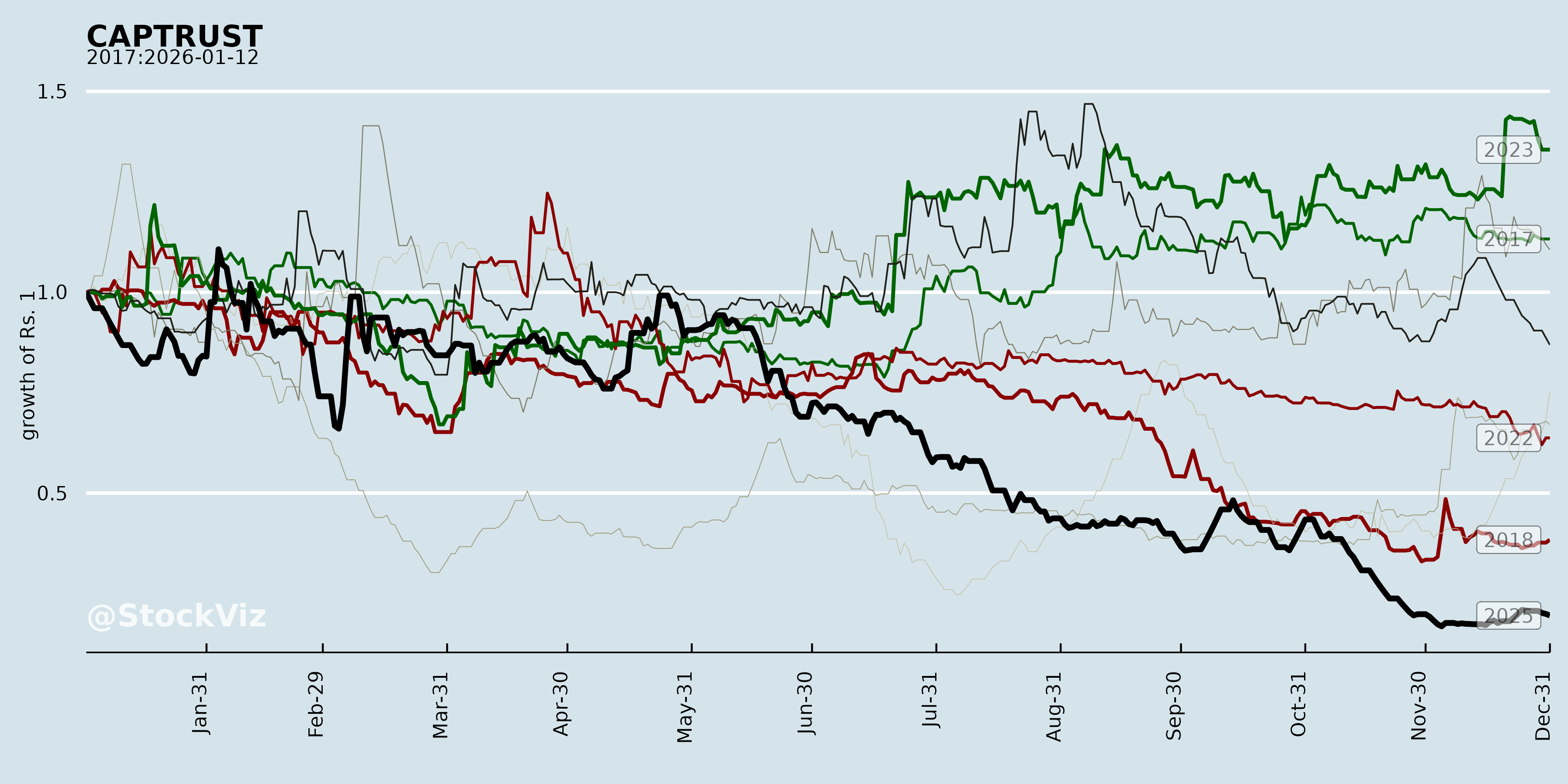

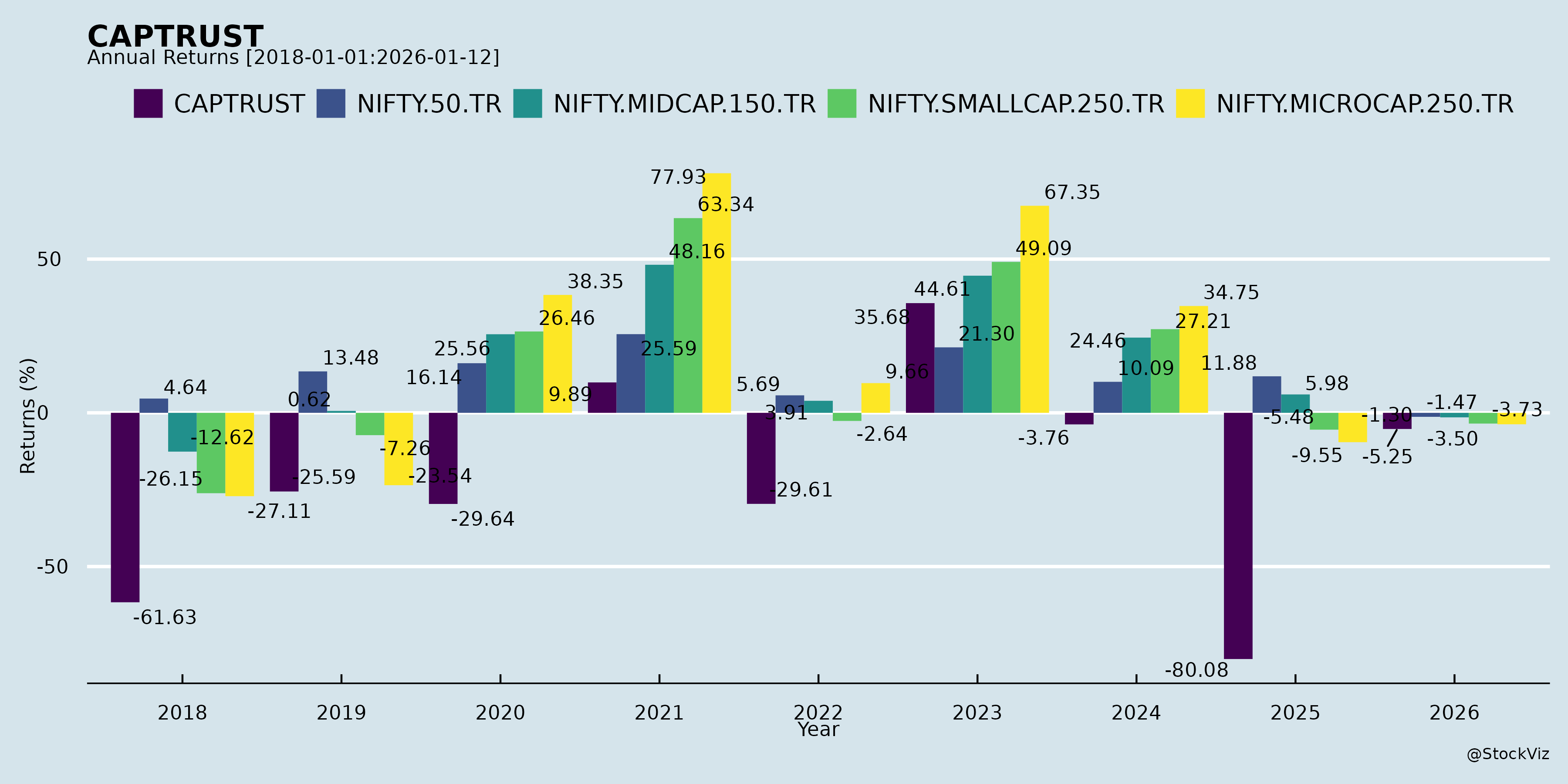

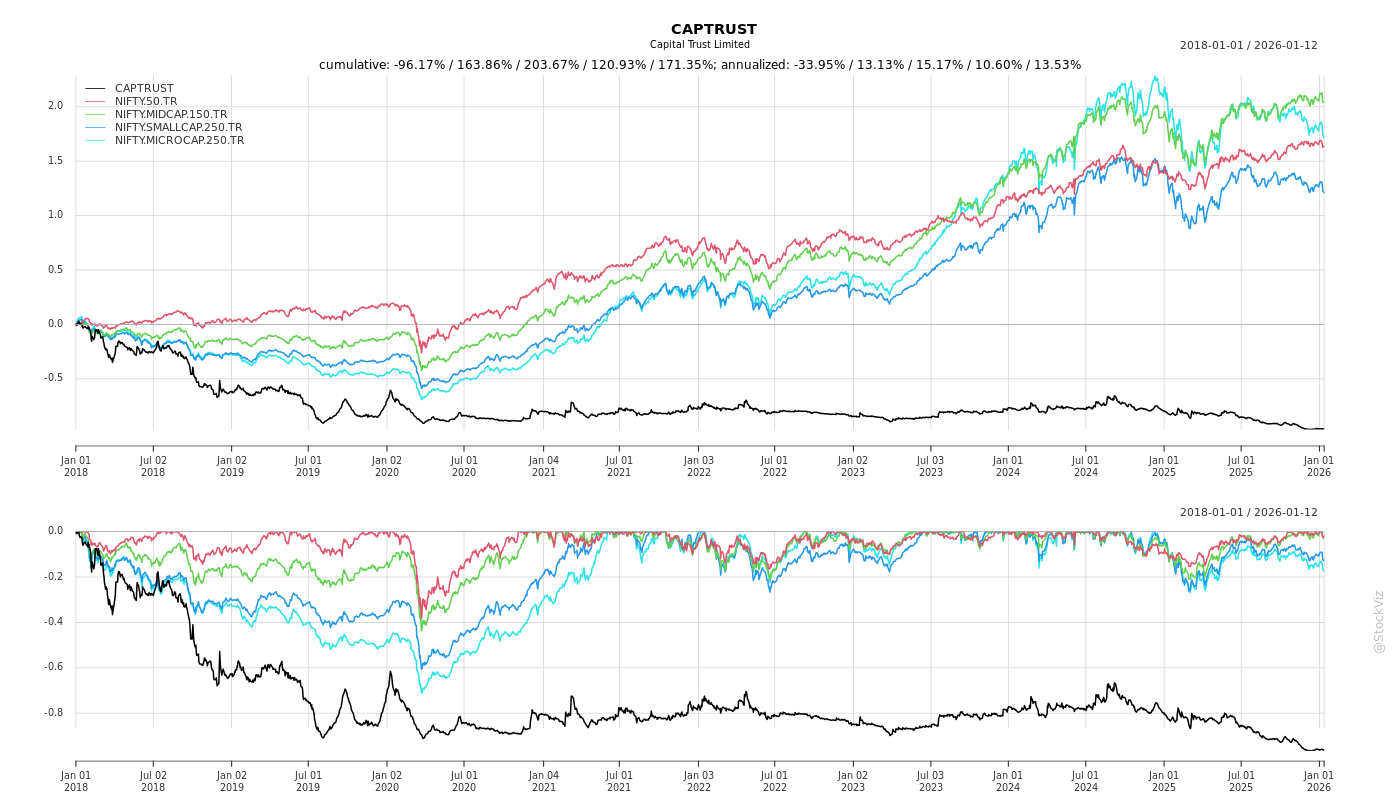

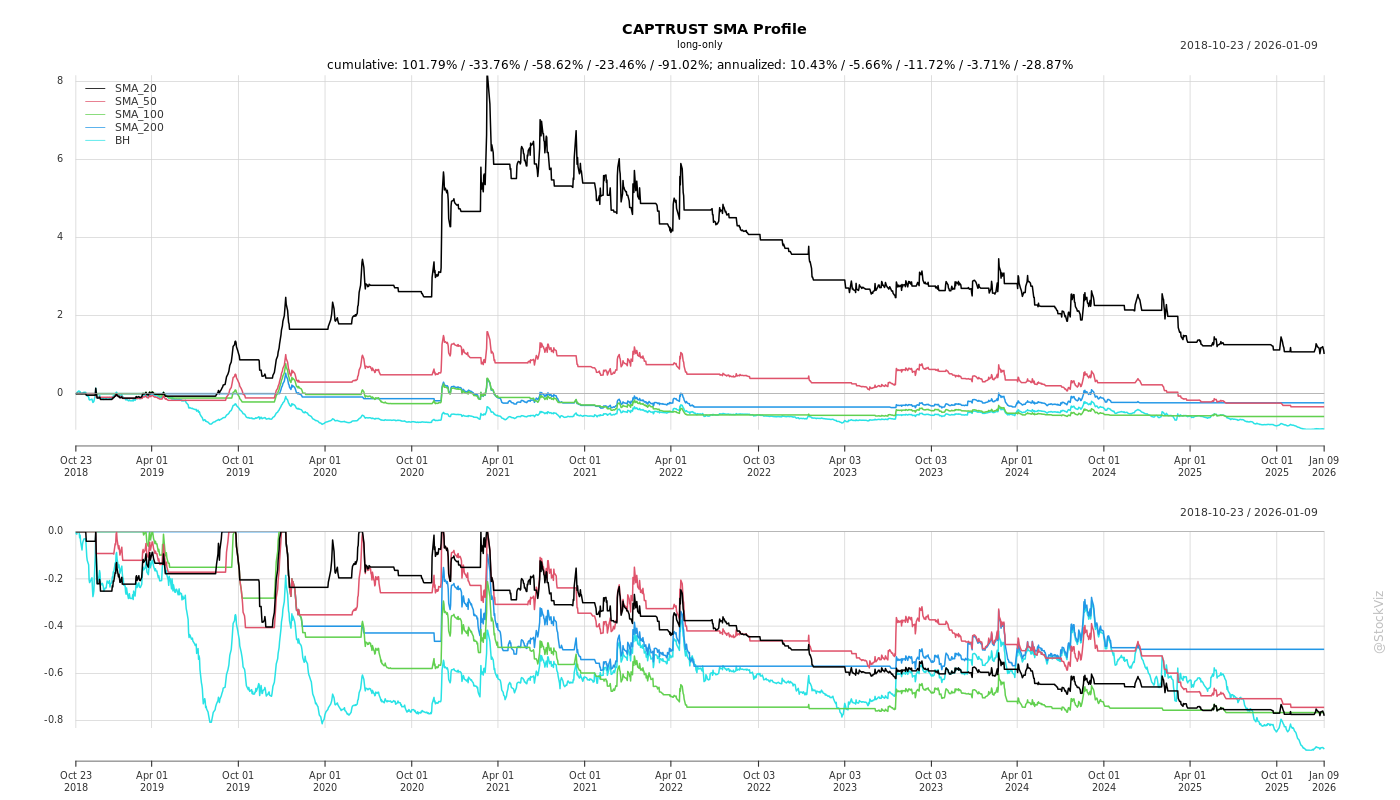

Equity Metrics

January 13, 2026

Capital Trust Limited

Non Banking Financial Company (NBFC)

Annual Returns

Cumulative Returns and Drawdowns

Fundamentals

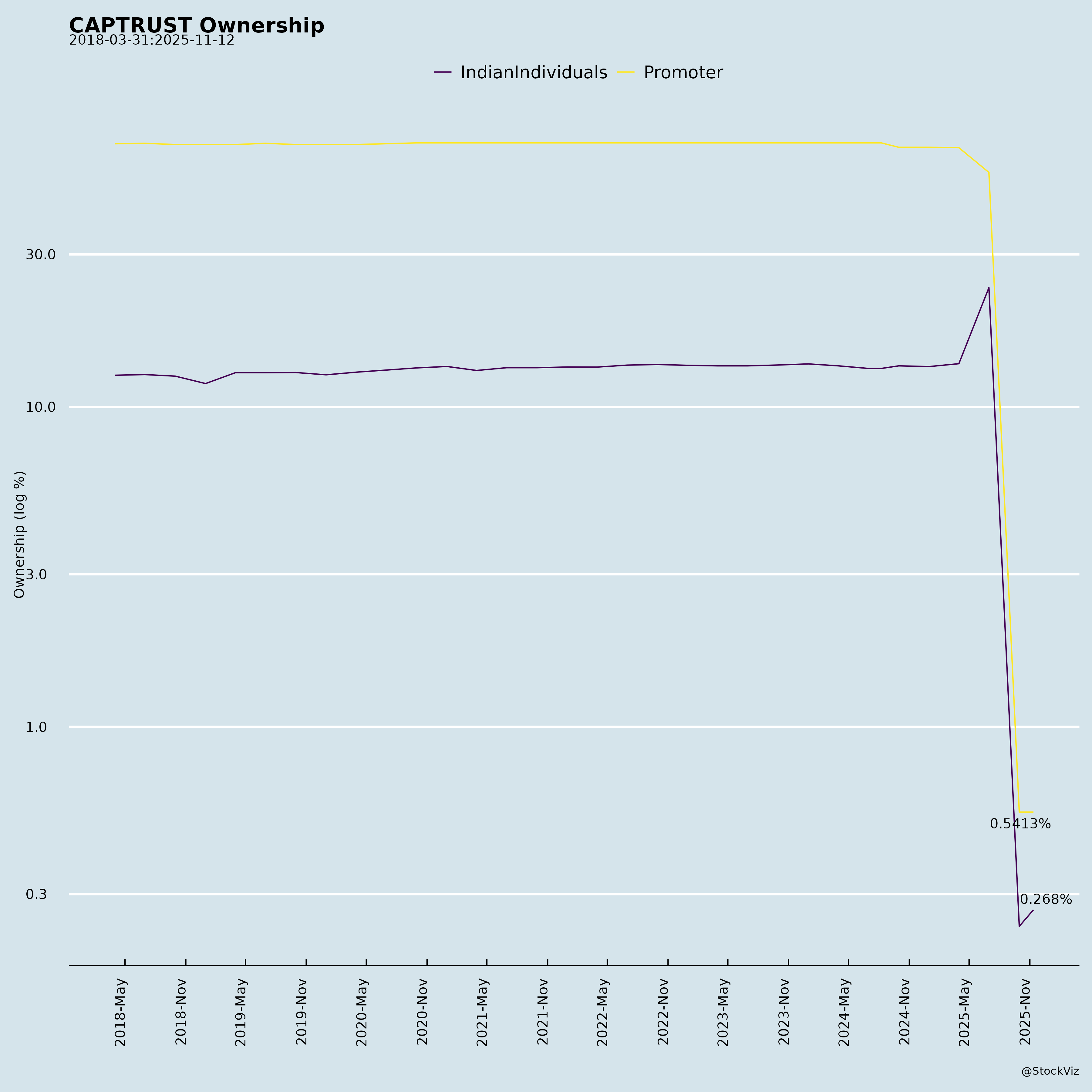

Ownership

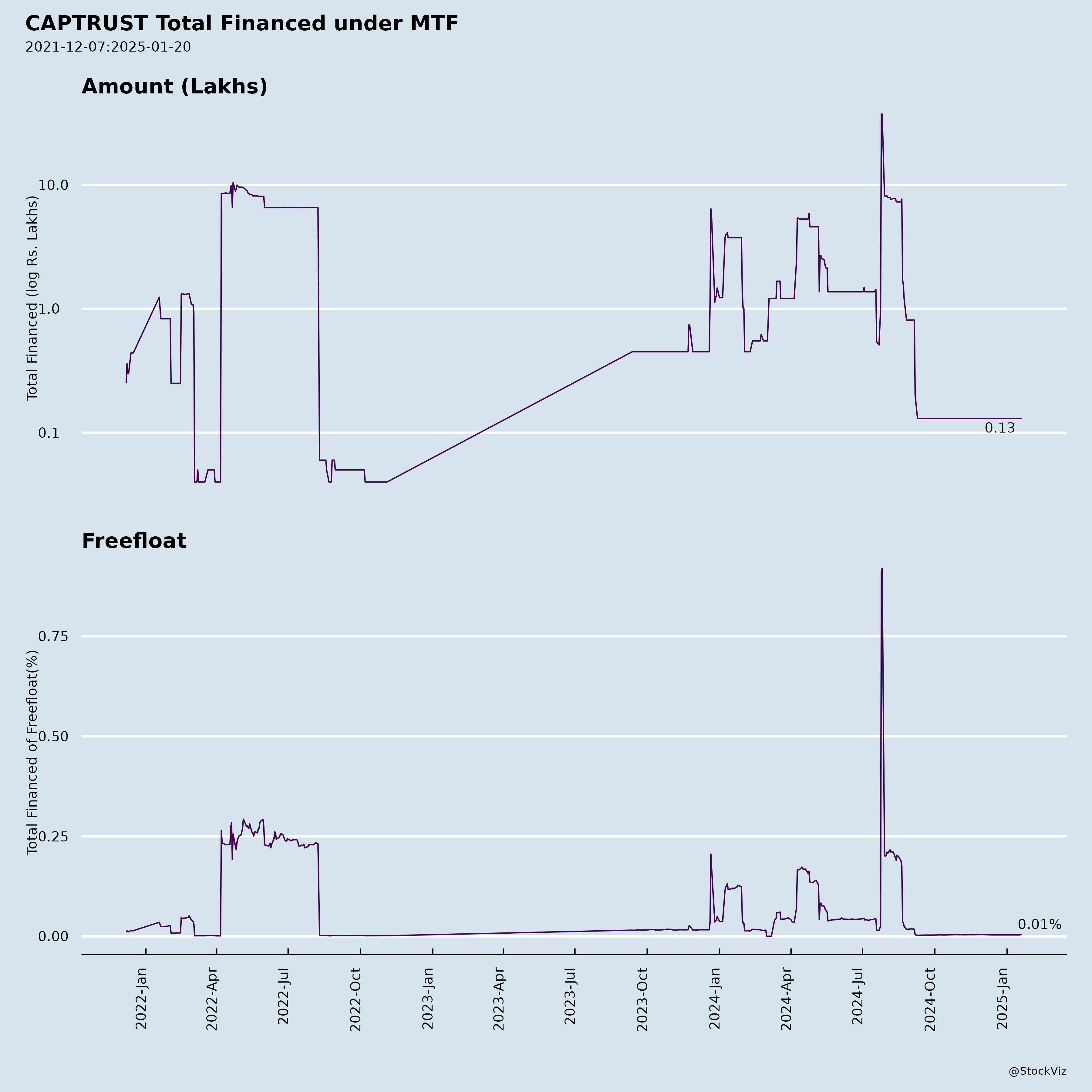

Margined

AI Summary

asof: 2025-11-27

Analysis of Capital Trust Limited (CAPTRUST): Headwinds, Tailwinds, Growth Prospects, and Key Risks

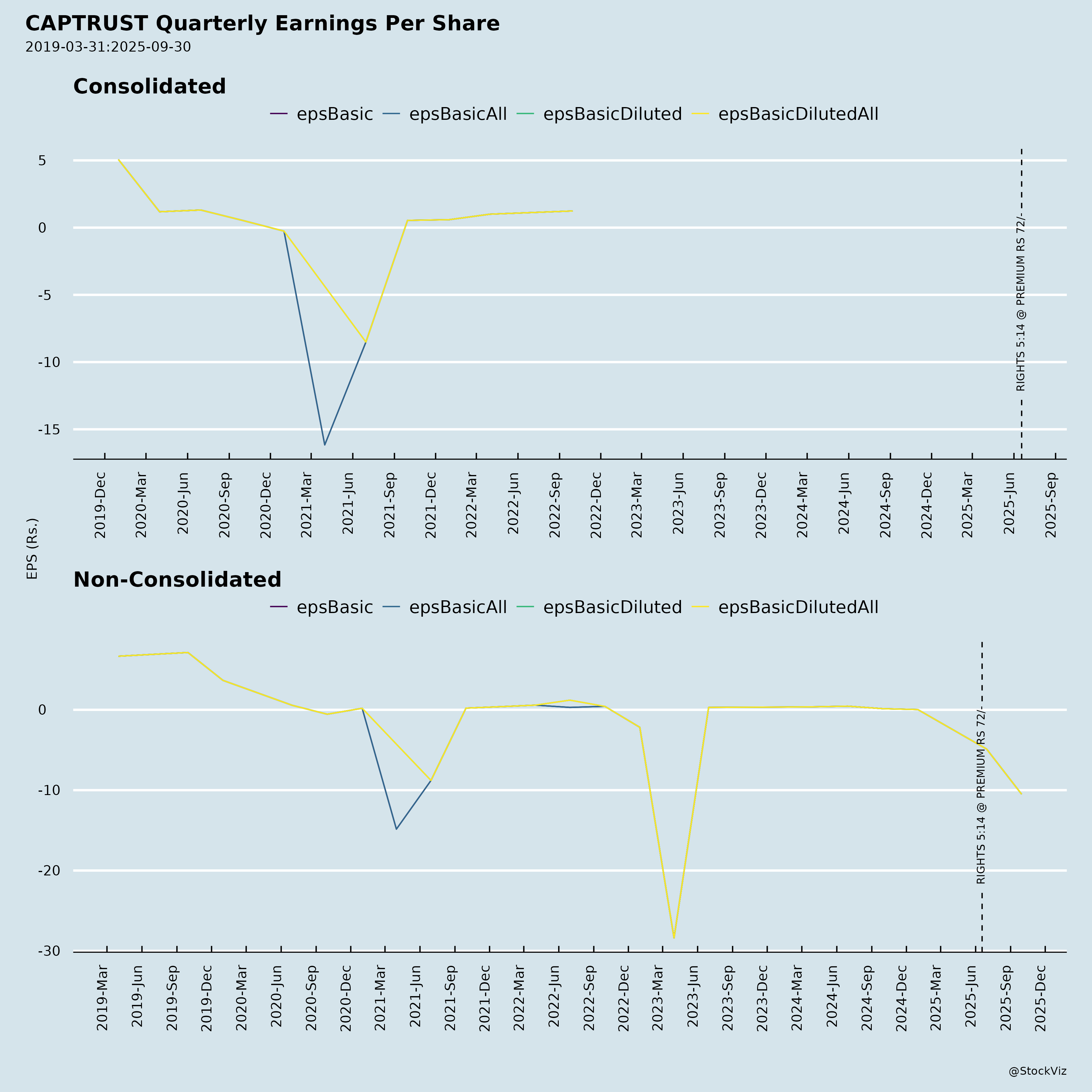

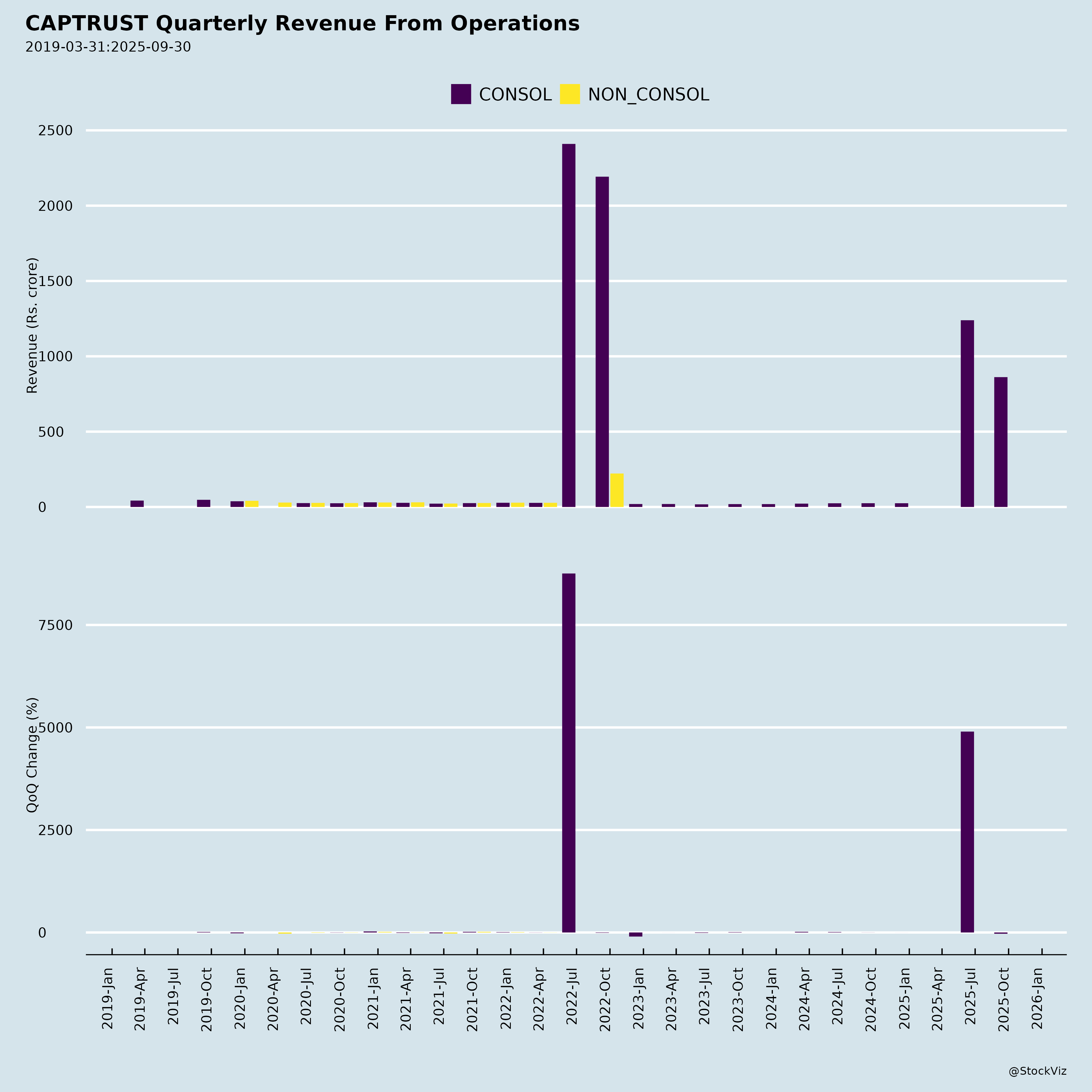

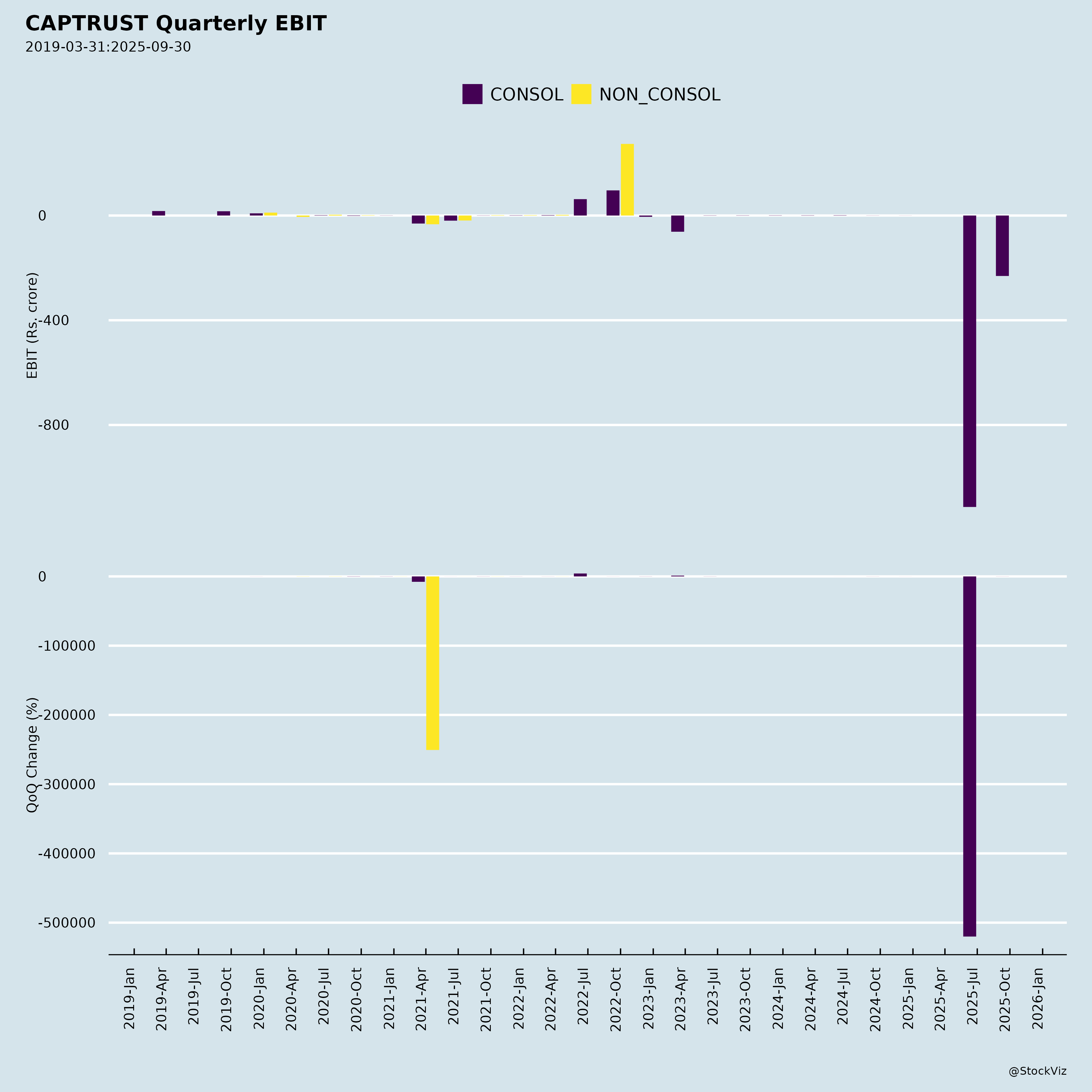

Capital Trust Limited (CTL), a 40-year-old listed NBFC (BSE: 511505, NSE: CAPTRUST), specializes in MSME/shopkeeper loans in rural/semi-urban India (250+ branches, Hindi belt focus). It has disbursed ₹4,500 Cr to 12L+ clients historically. Q2FY26 results (ended Sep 30, 2025) reflect a strategic pivot from high-risk unsecured MSME lending to secured gold loans and risk-free BC/co-lending partnerships (e.g., Suryoday SFB). AUM contracted to ₹124 Cr (-26% QoQ, -56% YoY) amid paused disbursements and ₹160 Cr impairments/write-offs on legacy unsecured book. Rights Issue (₹23.8 Cr, 1.33x oversubscribed) bolstered capital (CAR: 33%). Half-year PAT loss: ₹26 Cr (driven by one-time provisions), but post-cleanup, own-book Net NPA is ₹0 Cr.

Headwinds (Challenges Pressuring Performance)

- Legacy Unsecured Portfolio Stress: High credit costs (FY25/26: ~₹30 Cr total impact; Q2FY26 impairments ₹160 Cr) from rural MSME collections amid economic slowdown/tightening credit. Led to AUM shrinkage (on-book: ₹49 Cr, -33% QoQ) and losses (Q2 PBT: -₹23 Cr).

- Income Decline: Total income -65% YoY (₹88 Cr Q2) due to paused disbursements (Aug-Sep FY26) and lower fees/interest.

- Operational Scale-Down: Shift from own-book lending reduces velocity; reliance on off-book (₹75 Cr, -19% QoQ) exposes to partner dependency.

- Market/Regulatory Pressures: Unsecured MSME stigma rising; gold loans face RBI scrutiny (e.g., June 2025 directions on LTV, auctions).

Tailwinds (Positive Catalysts Supporting Recovery)

- Clean Balance Sheet Post-Restructuring: Front-loaded all unsecured losses (provisions ₹70 Cr > 90+ book ₹61 Cr); Net NPA ₹0 Cr; CAR 33% (+30% QoQ, incl. Rights Issue). Enables fresh start.

- Strategic Partnerships: BC model with Suryoday (47 branches, Phase 1; 11-13% risk-free yield); co-lending (5 partners). Off-book AUM stable.

- Rights Issue Success: ₹23.8 Cr infusion (Nov 2025) signals investor confidence; supports gold loan ramp-up.

- Proven Infrastructure: 250+ branches, tech stack (e-KYC, dashboards), audit discipline (17+ yrs experience); aligns with RBI gold norms (20-min disbursal/release).

- Macro Tailwinds: Gold loan formalization (organized ~37% of ₹20L Cr market); MSME shift from informal lenders (84% market).

Growth Prospects (High-Upside Opportunities)

- Gold Loans (Core Bet): Early traction (2 branches in UP/Delhi: ₹75L/month); cluster model near incumbents for credibility. Targets small-ticket (≤₹5L), high-yield, fast-churn; ₹20L Cr TAM with low penetration (5-6%). Potential: High RoA/velocity using existing network.

- Hybrid MSME Model: Continue via BC/co-lending (no credit risk); legacy disbursements ₹4,500 Cr validate demand. Shopkeeper loans (₹50K-5L, 28%+ ROI) via 250 branches.

- Scalability: 250-branch moat in underserved Hindi/rural areas; tech for efficiency. FY26 targets: Gold expansion, MSME partnerships; AUM rebound post-H2FY26.

- Financial Trajectory: Post-provision “clean slate”; expect profitability from H2FY26 (no further MSME stress). Blended model: Secured (low risk) + partnerships (steady yield).

Projected Upside: If gold scales to 50+ branches and MSME partnerships hit 200+, AUM could 2-3x in 2-3 yrs; RoA improve to 4-6% (vs. current uncertain).

Key Risks (Potential Downside Threats)

| Risk Category | Description | Mitigation |

|---|---|---|

| Execution | Gold loan ramp-up delays (hiring, infra); low initial uptake. | Proven branch mgmt.; cluster strategy; experienced hires (BMs 5+ yrs exp.). |

| Credit/Operational | Gold fraud/valuation errors; staff collusion; gold price volatility. | 8-layer security (HO-controlled vaults, CCTV); dual valuation; weekly audits. |

| Regulatory | RBI changes (LTV, auction norms); gold scrutiny (e.g., recent NBFC issues). | Pre-aligned with June 2025 directions; clean RBI history. |

| Funding/Liquidity | High borrowing cost (16.2%); partner dependency; equity dilution. | Rights Issue; 16+ funders; CAR buffer. |

| Market | Intense gold competition (top-4: 81% share); MSME slowdown persists. | Niche: Speed/service for small-ticket; rural focus. |

| Financial | Prolonged losses erode equity (Net Worth -23% QoQ to ₹60 Cr); forex/NPA creep. | Provisions exhausted; Net NPA 0%; monitored 30+ static pool (low 2-3% delinquency). |

Overall Summary: CTL is at an inflection point—high risk-reward pivot from stressed unsecured MSME (headwind resolved via provisions) to gold loans/BC (tailwinds for 2-3x growth). Short-term pain (losses, AUM dip) sets up long-term gains in low-risk, high-velocity segments. Bull Case: Gold scales rapidly; partnerships stabilize yields → Profitable FY27. Bear Case: Execution slips → Funding crunch. Attractive for patient investors (low valuation post-losses); monitor Q3FY26 gold AUM traction. Positive: Strong mgmt. intent, capital raise, clean slate.

Copyright © 2023 SAS Data Analytics Pvt. Ltd. All rights reserved.