BSE

Equity Metrics

January 13, 2026

BSE Limited

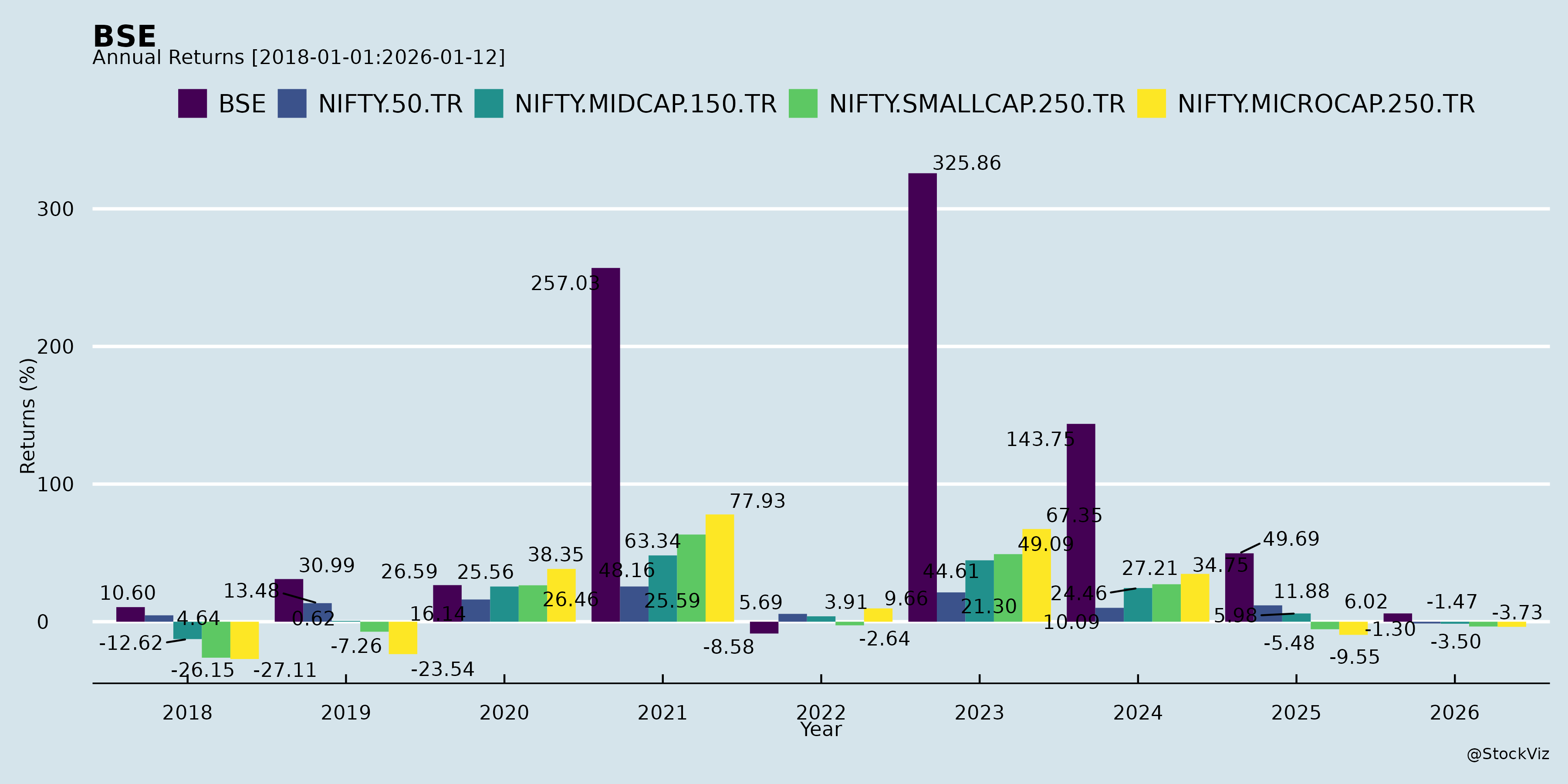

Annual Returns

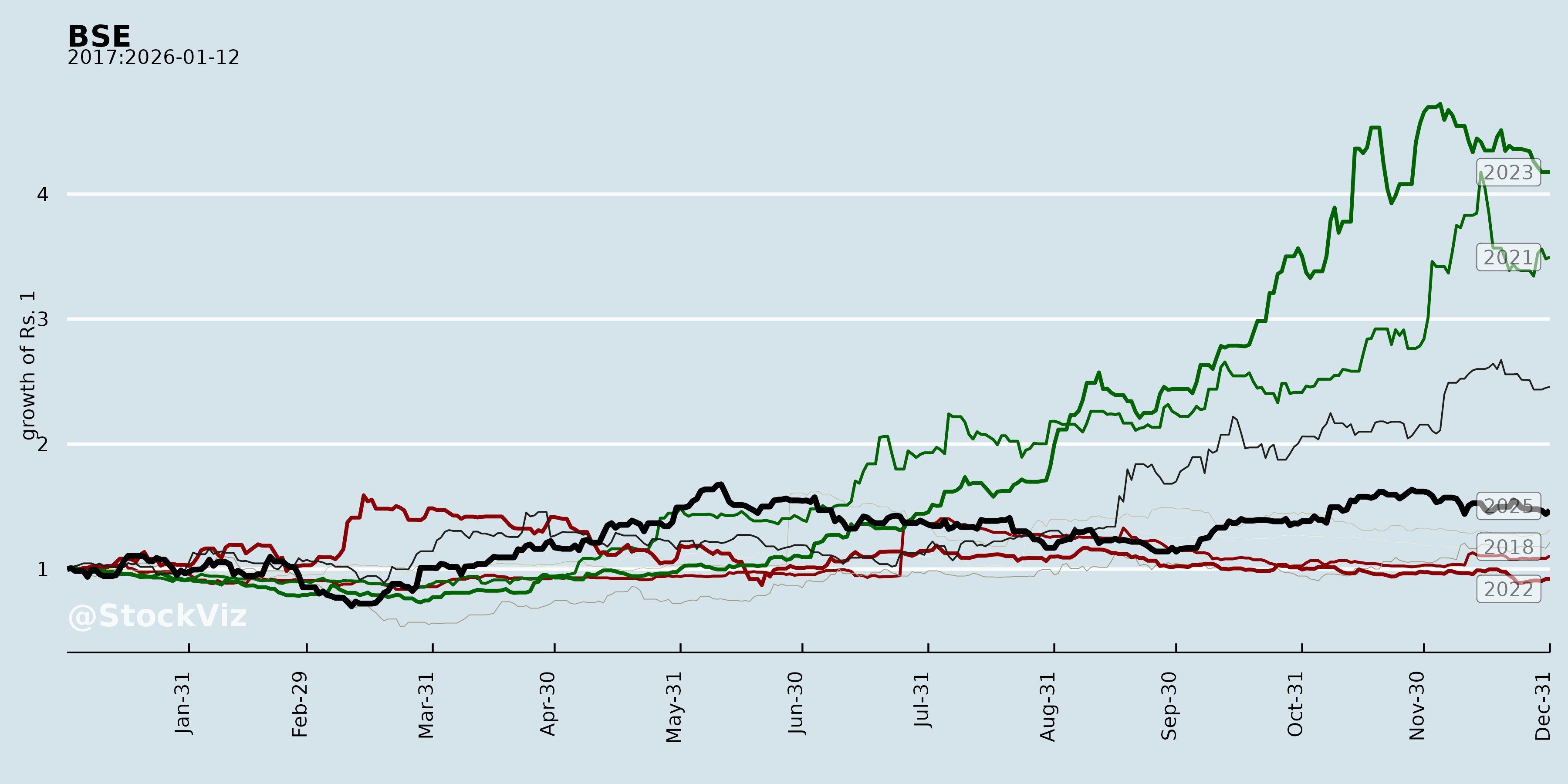

Cumulative Returns and Drawdowns

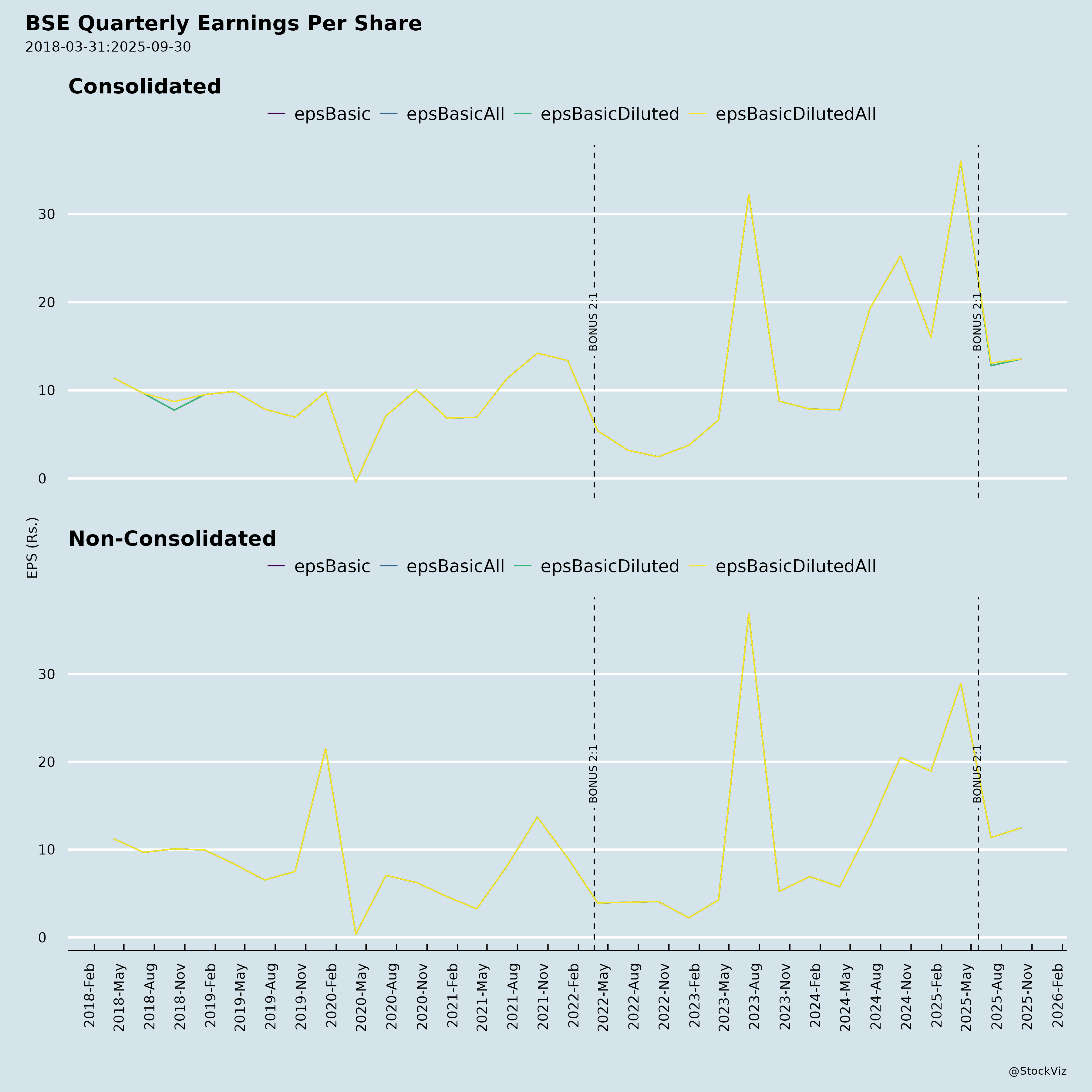

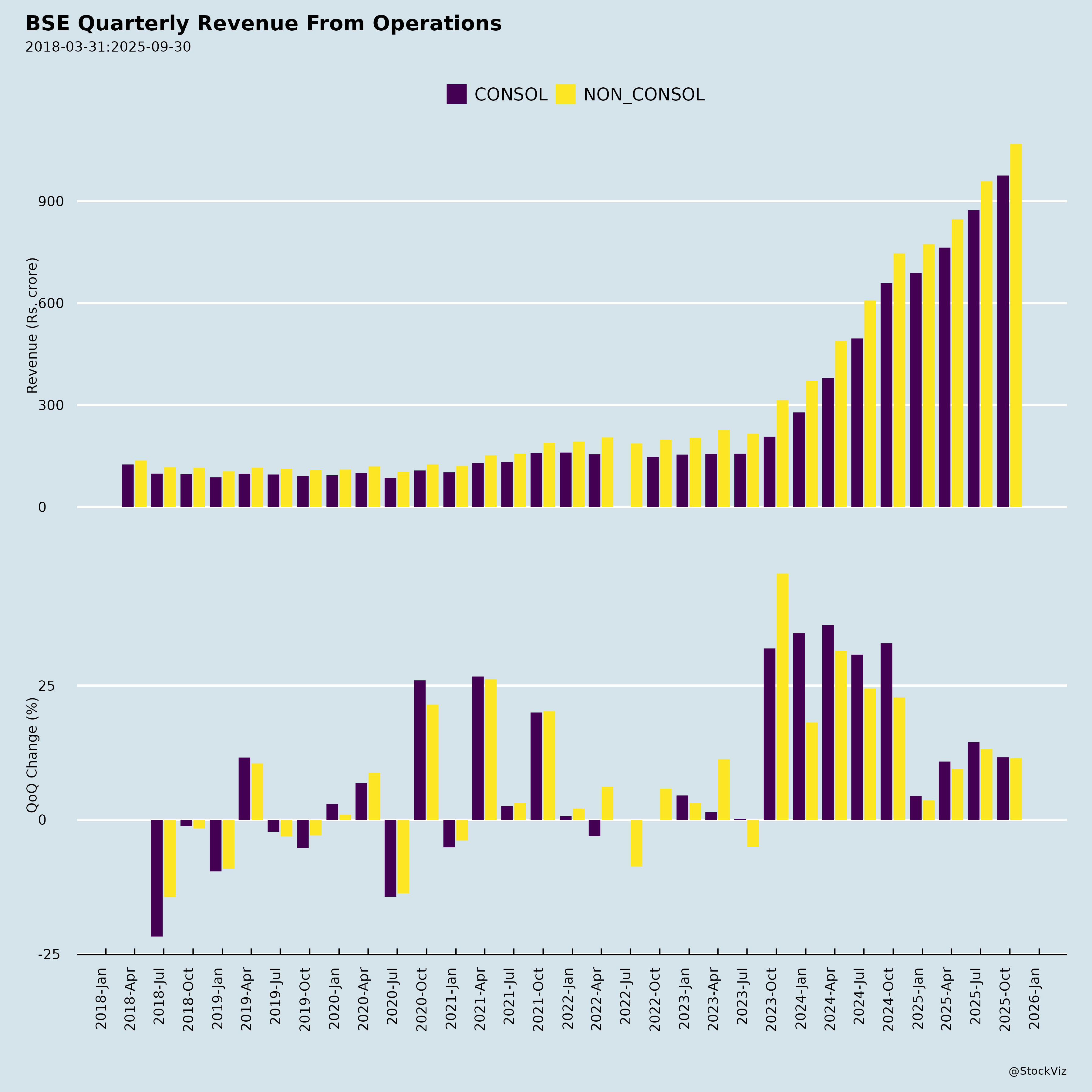

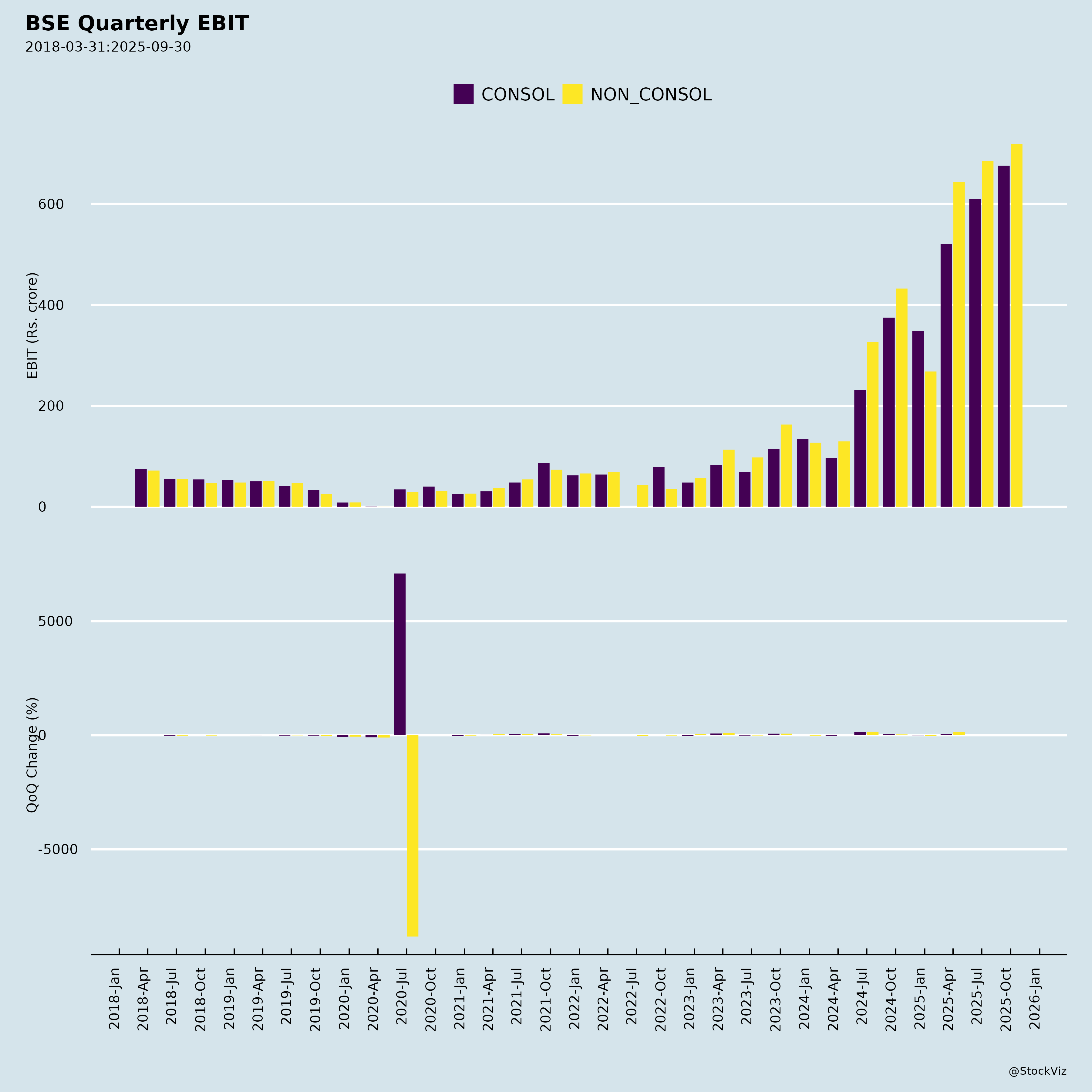

Fundamentals

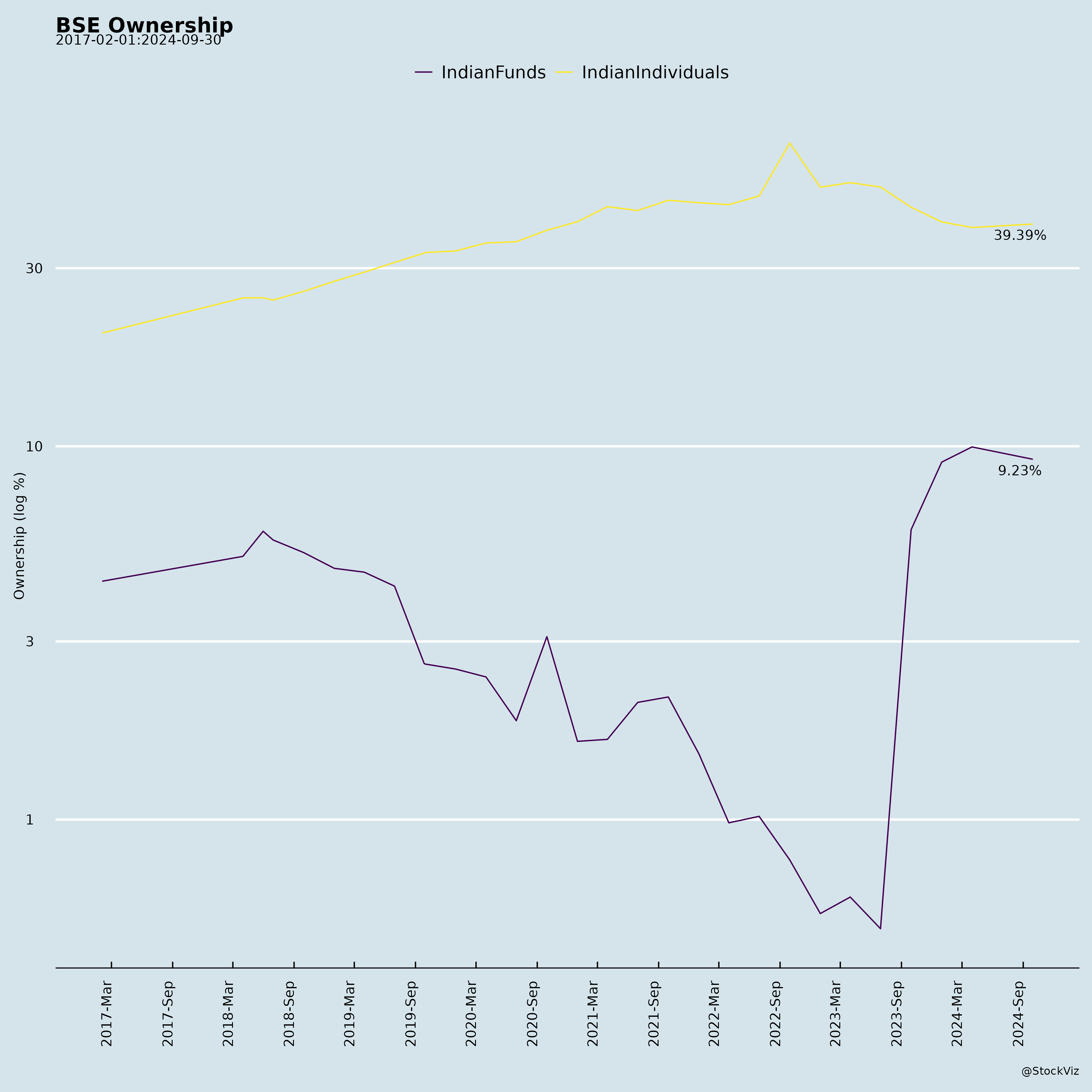

Ownership

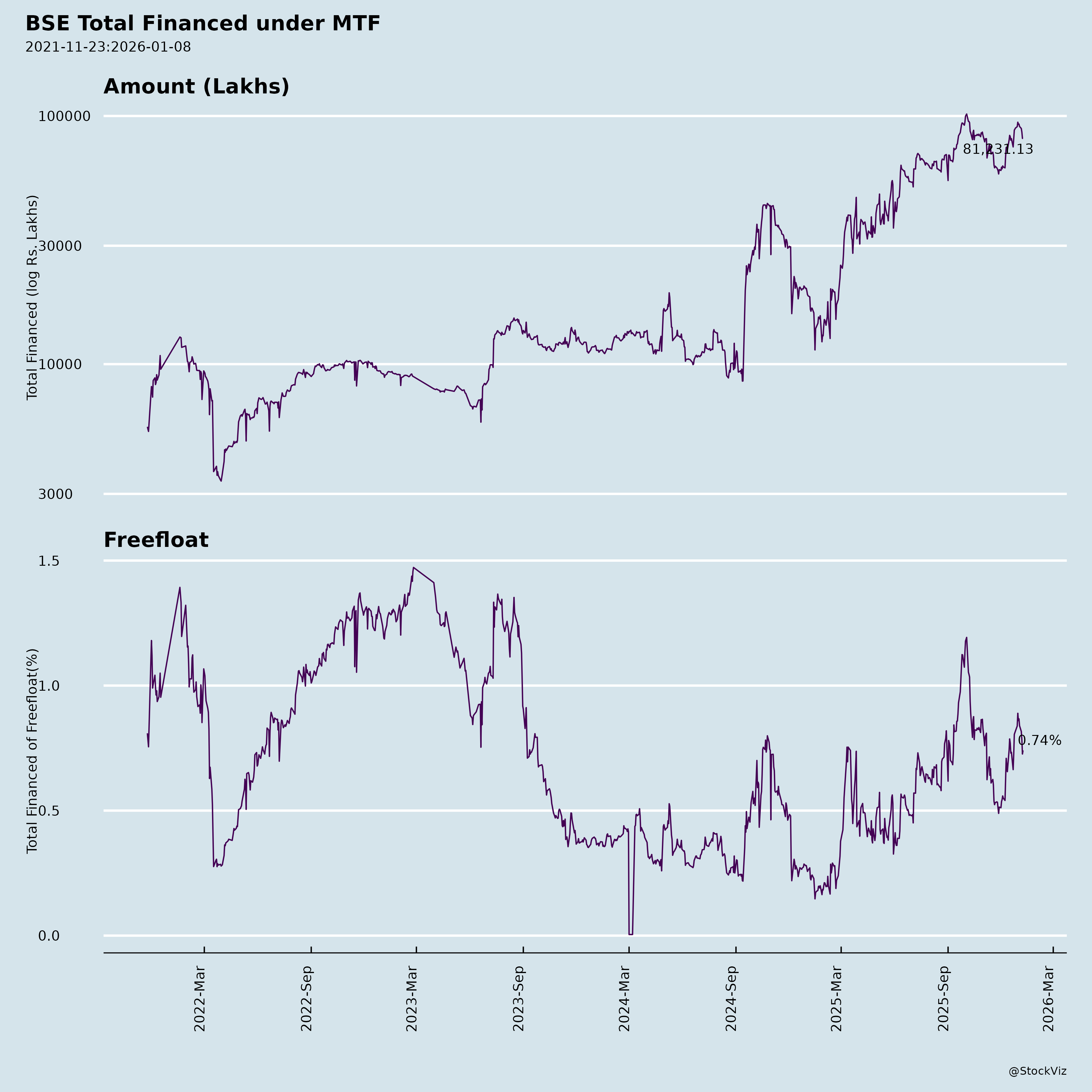

Margined

AI Summary

asof: 2025-12-03

BSE Limited (BSE) Analysis: Headwinds, Tailwinds, Growth Prospects, and Key Risks

BSE Limited, India’s oldest stock exchange, demonstrated robust H1 FY26 (Apr-Sept 2025) performance with consolidated revenue of ₹21,840 Mn (+48% YoY), net profit of ₹10,833 Mn (+79% YoY from continuing ops), and EPS of ₹26.36 (50% net margin). This was driven by surging transaction charges (₹15,315 Mn, +69% YoY) amid high equity cash ADTV (₹75,837 Cr) and derivatives growth. The company operates a diversified model (trading, clearing, MF distribution, indices, international ops via India INX), with 223 Mn+ registered investors and USD 5.27 Tn market cap of listed firms. A 2:1 bonus issue (effective Jun 2025) expanded share capital to ₹8,146 Mn. Upcoming Elara Capital conference (Dec 2, 2025, Singapore) signals investor engagement.

Tailwinds (Positive Factors)

- Market Boom & Volume Surge: Indian capital markets tailwinds (rising retail participation, household savings shift to financial assets) boosted equity cash (stable ADTV), derivatives (premium/members growth), and StAR MF platform (383.9 Mn orders, ₹5.32 Tn value; 256 Mn investors, 81,805 distributors across 721 cities).

- Diversified Revenue: Transaction charges (74% of revenue), services to corporates (listings up), and recurring streams (data fees, treasury) yield high margins (65% EBITDA ex-SGF). Subsidiaries like ICCL (upgraded risk mgmt), BSE Index Services (₹11.12 Lakh Cr AUM tracked, 80% revenue growth), and India INX (global access, SENSEX F&O from Feb 2025) add resilience.

- Operational Efficiency: Tech upgrades (6μs latency), T+1 settlement, new products (weekly expiries, commodity options), and ISO certifications enhance competitiveness. Bonus issue and high RoE support shareholder returns (dividend payout ~30-40%).

- Strong Balance Sheet: Net worth ₹52,108 Mn, cash reserves ample; low debt.

Headwinds (Challenges)

- High Regulatory & OpEx Burden: Regulatory contributions (₹2,630 Mn, 12% of revenue) and clearing expenses rose sharply; total opex up 6% YoY despite scale.

- Volume Volatility: Equity cash ADTV flat YoY; over-reliance on derivatives/markets (e.g., NSE dominance in cash/derivs).

- Capex Intensity: CWIP jumped to ₹21,385 Mn (from ₹4,073 Mn), signaling heavy tech/infra spend (e.g., risk systems, colocation).

- Subsidiary Drag: Divestment of BSE Institute (₹1,440 Mn gain as discontinued ops); proposed mergers (BSEINV/BASL into BTPL) add execution risks.

Growth Prospects

- Derivs & Products Expansion: Equity derivs relaunch (May 2023) gaining share; new expiries (Tue weekly for Sensex), IRF, commodities, spot markets. Target: Double-digit market share via 2 Cr+ equity/4 Cr+ derivs daily capacity.

- Platform Scale: StAR MF (48 funds, ₹15.21 Tn mobilized) and e-platforms (IPO book-building, bonds) poised for SIP/demat growth amid rising AUM.

- International & Indices: India INX (diversified products, 135+ global exchanges access); BISPL (180+ indices, RBI benchmark approval, 32 new launches).

- Efficiency Gains: ICCL upgrades, HPX power trading, EGR platform. FY26 guidance implicit: 20-30% revenue CAGR via 10-15% volume growth + pricing.

- Macro Tailwinds: Demat accounts >150 Mn, IPO boom, GIFT City push; 150-year milestone aids branding.

Key Risks

| Risk Category | Description | Mitigation |

|---|---|---|

| Market/Volume | Volatility/crash reduces ADTV (e.g., FY21 dip); NSE ~90% derivs share. | Diversification (non-volume revenue ~25%); new products. |

| Regulatory | SEBI changes (e.g., expiry norms, true-to-label); higher SGF contributions (₹106 Mn Q2). | Proactive compliance; PID board oversight. |

| Competition | NSE, MCX dominance; new entrants in IFSC. | Tech edge (speed, capacity); niche (SME, MF). |

| Operational | Cyber threats, system failures; high capex delays. | CISO, ISO 27001/22301; ERM upgrades. |

| Financial | Forex/interest rate swings; tax on gains (e.g., CDSL divestment). | Hedging; ₹86 Bn cash buffer. |

| Execution | Subsidiary mergers/divestments; bonus dilution impact. | Strong governance (new PIDs, MD&CEO experience). |

Overall Summary: BSE is riding strong tailwinds from India’s retail investing frenzy and derivs revival, posting hyper-growth (79% profit YoY) with fortress-like margins. Growth prospects are bright (20%+ CAGR potential via derivs/international), but headwinds like regulation and competition persist. Risks are manageable with diversification/tech focus; stock trades at premium valuations (MCap ₹8.5 Lakh Cr, P/E ~30x FY26E). Positive for long-term holders; monitor Q3 volumes and SEBI policy.

Copyright © 2023 SAS Data Analytics Pvt. Ltd. All rights reserved.