ANANDRATHI

Equity Metrics

January 13, 2026

Anand Rathi Wealth Limited

Financial Products Distributor

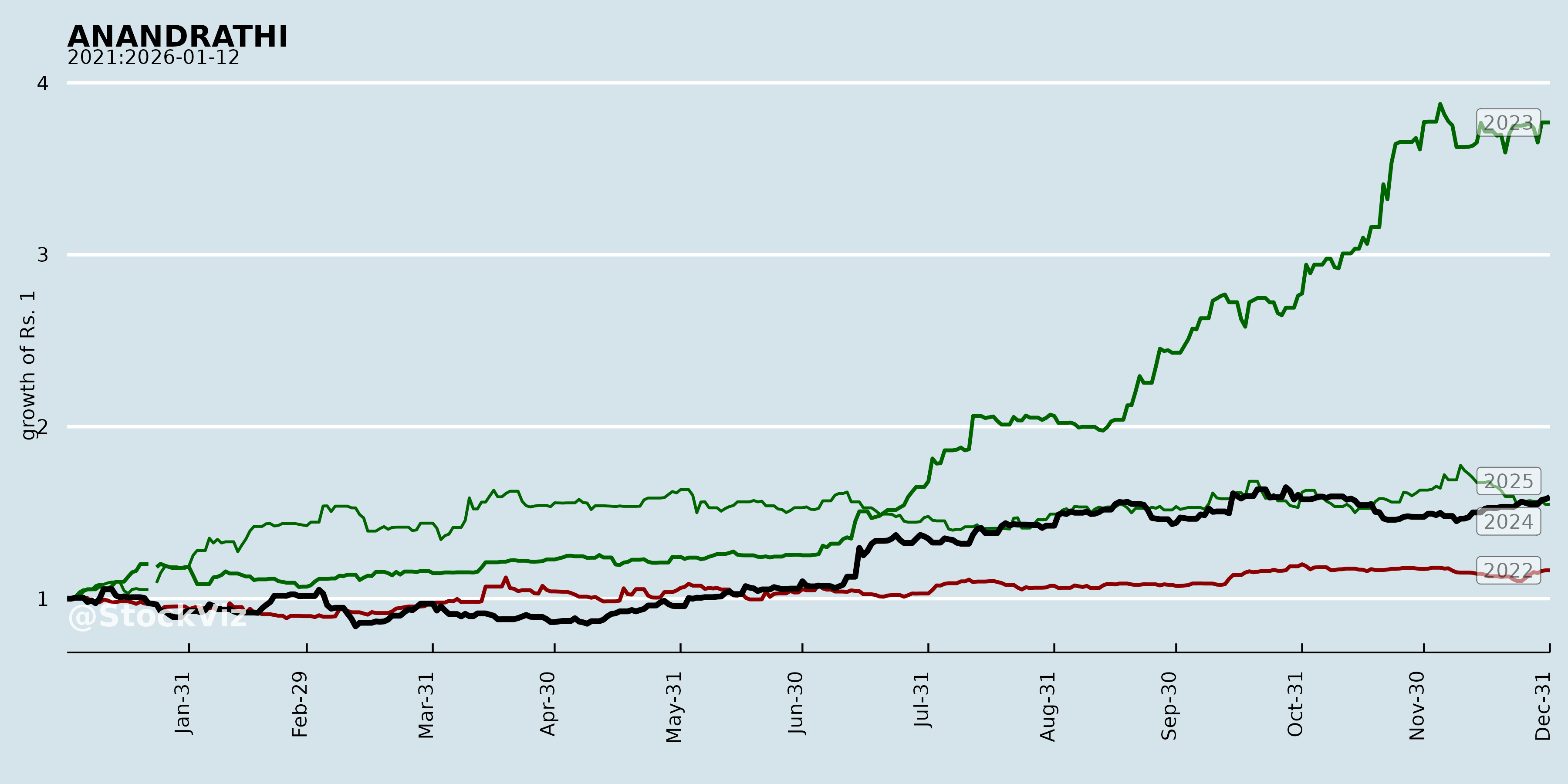

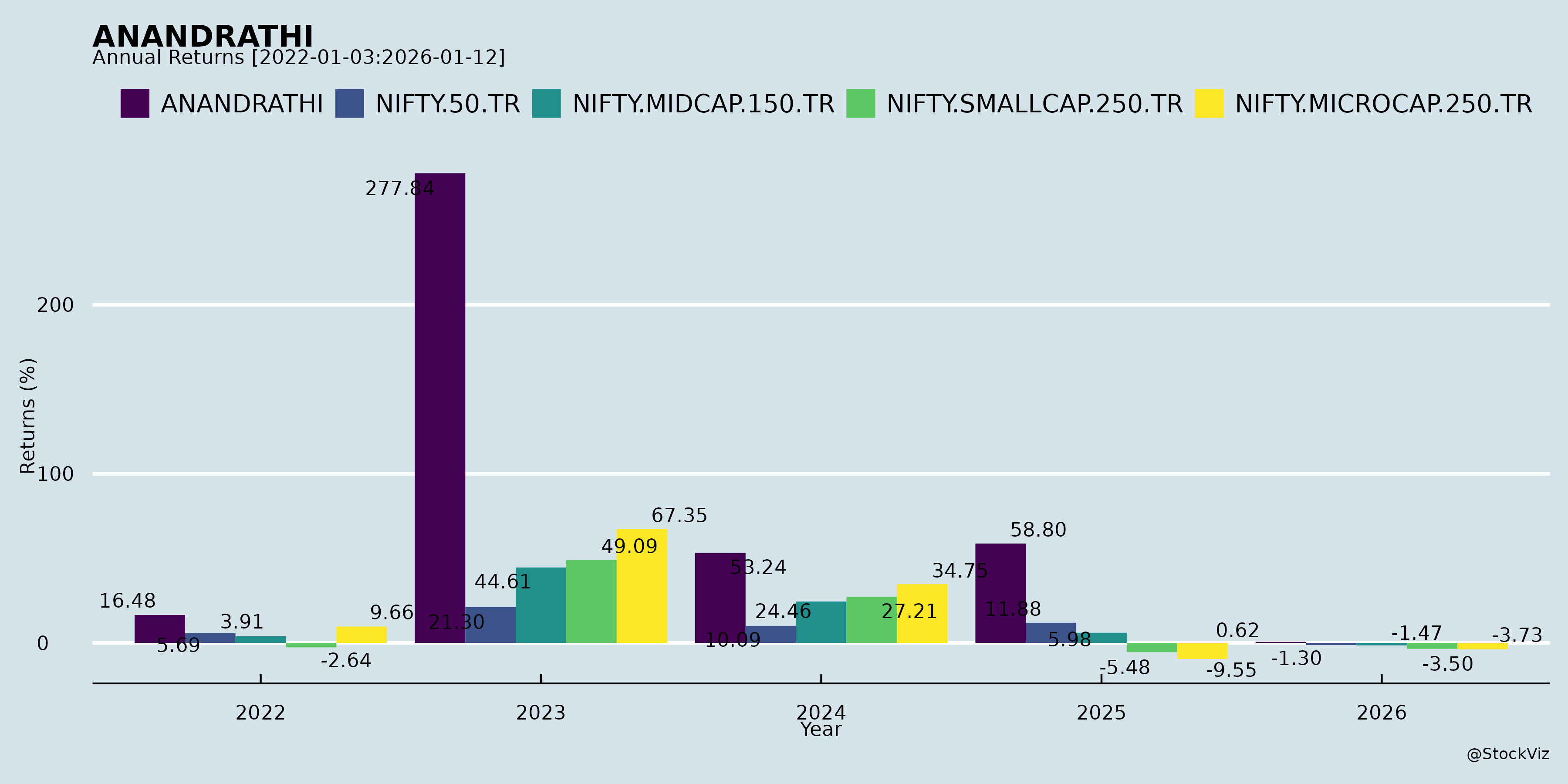

Annual Returns

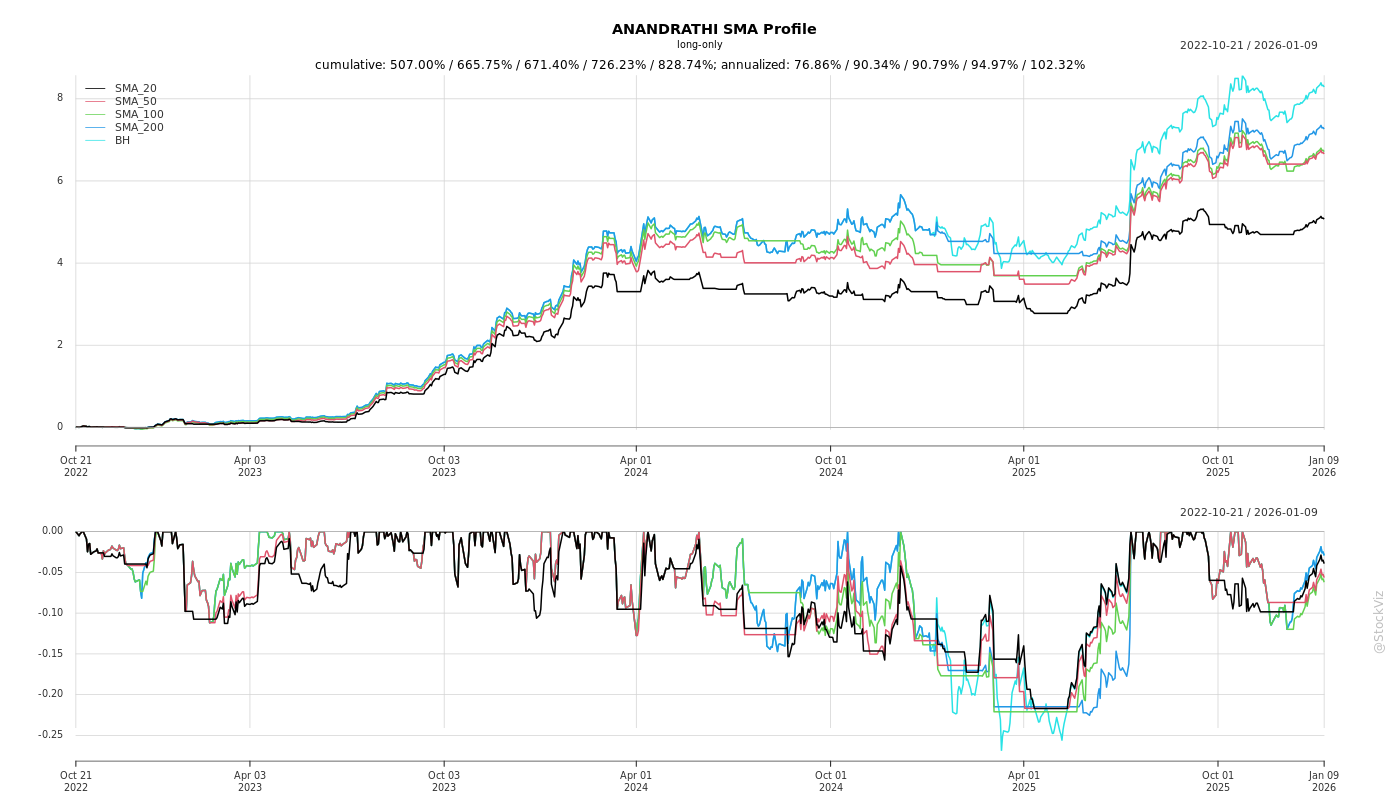

Cumulative Returns and Drawdowns

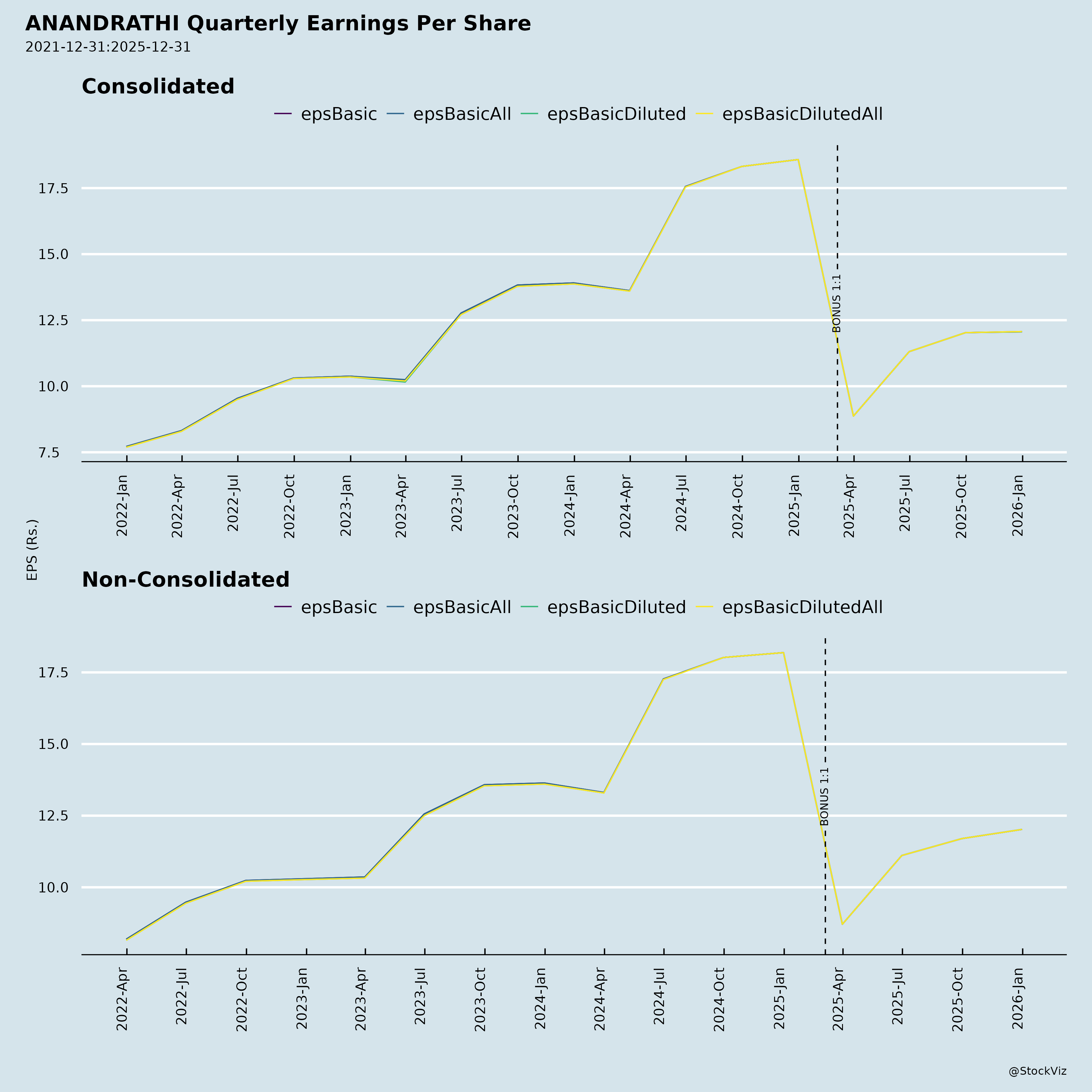

Fundamentals

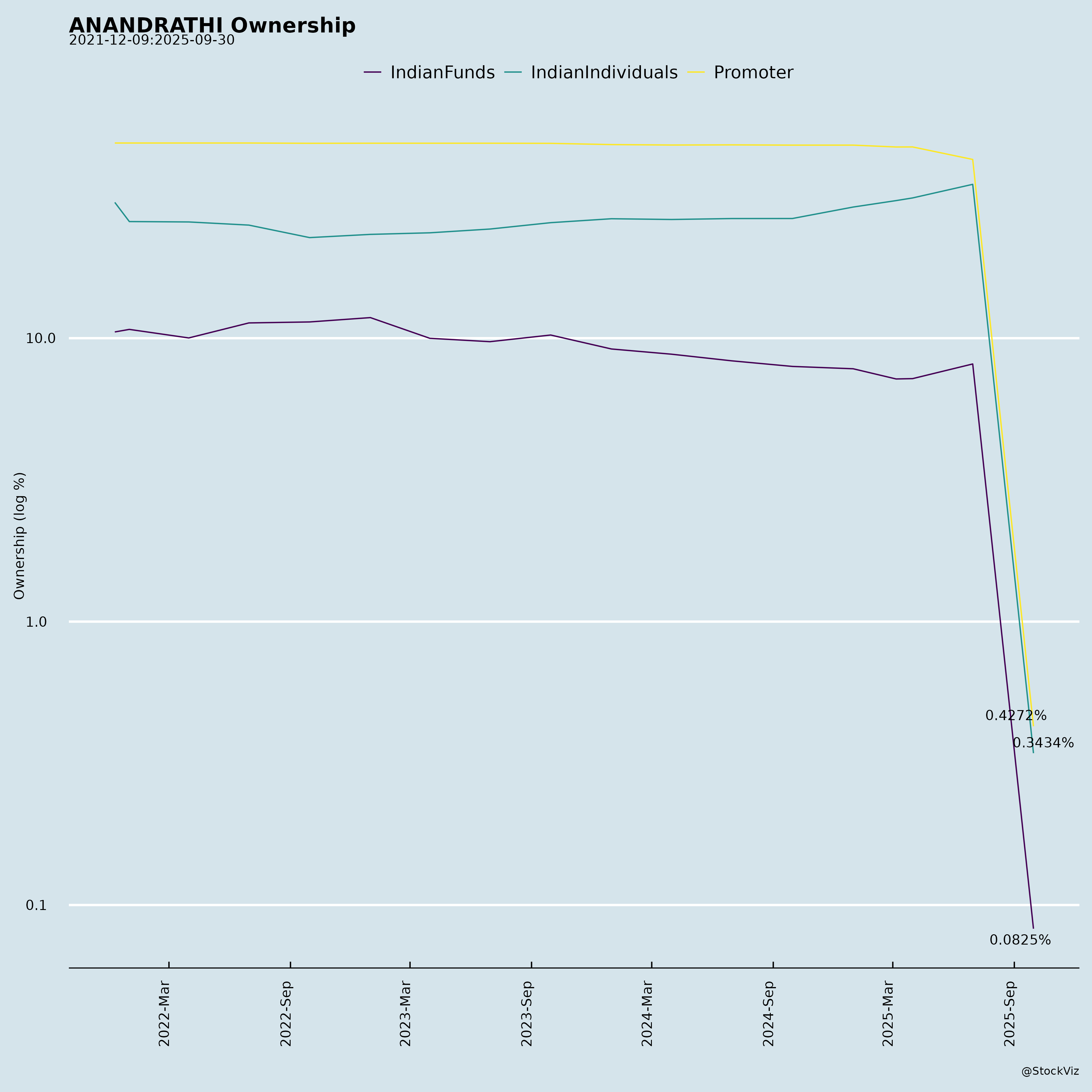

Ownership

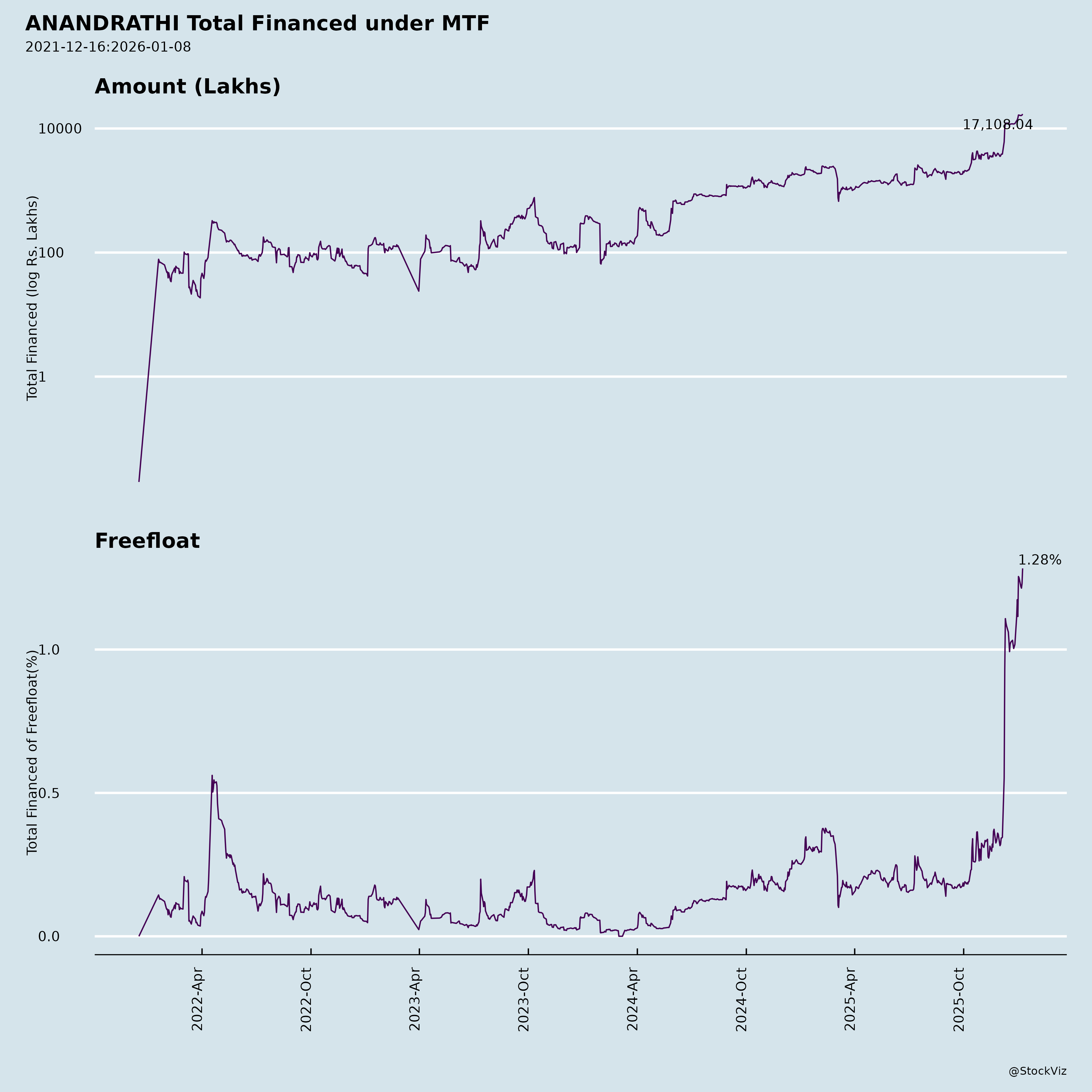

Margined

AI Summary

asof: 2025-12-03

Analysis of Anand Rathi Wealth Limited (ANANDRATHI)

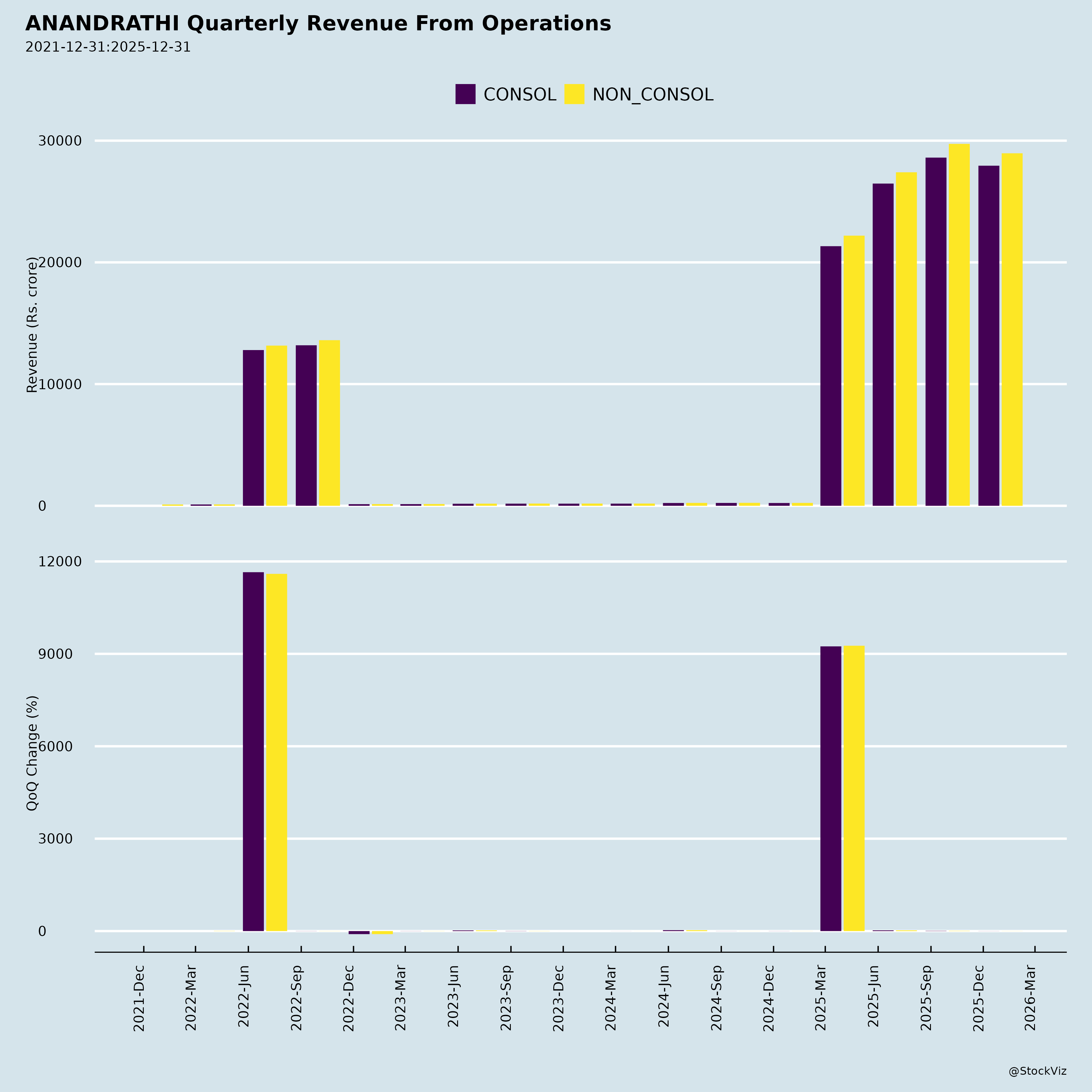

Anand Rathi Wealth Limited (ARWL), a leading Indian wealth management firm focused on HNI/UHNI clients, reported robust H1 FY26 results (ended Sep 2025): consolidated revenue up 19% YoY to ₹591 Cr, PAT up 29% YoY to ₹194 Cr (32.8% margin), and AUM up 22% YoY to ₹91,568 Cr. This marks market-agnostic growth amid Nifty declines (-3.6% in Q2 FY26). EPS rose 30% YoY to ₹23.3 (adjusted for 1:1 bonus). ROE stands at 45% (annualized). Equity MF inflows surged 101% YoY in Q2, with market share at 2.33% (up from 1.85% FY25). Client families +16% YoY to 12,781; RMs at 386. Already ~50% of FY26 guidance achieved (Revenue ₹1,175 Cr; PAT ₹375 Cr; AUM ₹1L Cr). Interim dividend ₹6/share declared.

Tailwinds (Positive Drivers)

- Resilient Financial Performance: Consistent 30%+ PAT growth (median 33.4% over 14 quarters, SD 4.2%) despite market downturns (e.g., Nifty -3.6% Q2 FY26). PAT margins expanded to 32.8% (H1 FY26), PBT margins 44%. High ROE (45%) supports dividends/buybacks (₹165 Cr buyback FY25; bonus issues).

- AUM & Inflows Momentum: 22% AUM growth to ₹91,568 Cr; net inflows +20% YoY to ₹6,827 Cr (H1). Equity MF inflows +30% YoY (₹4,045 Cr), market share rising (0.16% FY20 → 2.33% H1 FY26).

- Client Stickiness & Low Attrition: Client attrition 0.18% (AUM lost, H1 FY26); 82% AUM retention post RM exits. Vintage analysis shows >3-year clients = 64% AUM. Portfolio alpha 6.56% (beta 0.55 vs Nifty since 2014).

- Strategic Focus: Shift to rewarding HNI segment (₹50 Cr+ AUM clients now 52% share vs 28% in 2020). Product audits (MF, PMS, etc.) drive wallet share. Subsidiaries scaling: Digital Wealth AUM +21% YoY (₹2,211 Cr); OFA subscribers +10% to 6,790.

- Macro Support: India’s HNI growth (3M+ by FY27E); low MF penetration (7.5% financial assets vs global 32-58%); household savings shifting to MFs (15% share in FY25 vs 1.6% FY15).

Headwinds (Challenges)

- Market Volatility: Equity markets declined (Nifty -3.6% Q2 FY26, -8.4% Q3 FY25), impacting AUM MTM. 54% household assets still in low-yield deposits/cash.

- Cost Pressures: Employee expenses +10% YoY (H1, 41% of revenue); other expenses +21% YoY. Scaling RMs (386 vs 374) adds costs.

- RM Attrition: Regret attrition low (4 RMs in Q2 FY26, avg 7-yr tenure), but H1 FY26 at 6% for high-AUM RMs (>₹40 Cr).

- Subsidiary Divestment: In-principle approval to sell Freedom Wealth Solutions (non-material sub), potentially minor revenue hit (subs total ₹23 Cr H1 FY26, +28% YoY).

- Execution in New Segments: Digital/OFA growth nascent (2-3% of total AUM/revenue); competition from fintechs/banks.

Growth Prospects

- High Conviction Outlook: On track for FY26 guidance (50% achieved in H1). Historical CAGR: Revenue 23%, PAT 31%, AUM 27% (FY19-25). Sources: (1) Wallet share gains, (2) New clients/RMs/cities, (3) Organic returns, (4) New inflows.

- Market Opportunity: India’s financial assets to grow (household savings ₹35-36L Cr annually); equity/MF share rising (17.4% Jun’25). HNI population CAGR 16% (to 3L+ by FY27E). Target: AUM ₹1L Cr FY26.

- Differentiated Model: 65:35 Equity-SP strategy delivers 16% CAGR (vs Nifty 12%). Tech audits (MF/PMS/lost folios) automate onboarding. Expansion: 18 cities + Dubai; PW clients +16%, RMs focused on high-AUM buckets (e.g., >₹170 Cr bucket growing).

- New Businesses: Digital Wealth (mass affluent ₹10L-5Cr); OFA (MFD platform, assets ₹1,862 Cr). Potential to capture 4x MF penetration gap vs global.

- Shareholder Rewards: Consistent dividends (total ₹87/share FY25, adj.), buybacks, bonuses signal confidence.

Key Risks

| Risk Category | Description | Mitigation |

|---|---|---|

| Market/Equity Risk | AUM sensitive to MTM (55% Equity/Debt MF mix); Nifty volatility. | Low beta (0.55), diversified products (SP 28%, Others 20%); market-agnostic history. |

| Competition | Intense from banks (HDFC, ICICI), peers (ICICI Sec, 360 One), fintechs. | Niche HNI focus, alpha-generating strategy, low attrition. |

| Regulatory | SEBI LODR changes, MF distributor norms (AMFI-registered). | Compliant disclosures; no UPSI in investor meets. |

| Talent/Operational | RM attrition (key to AUM/client acquisition); scaling new biz. | Low regret attrition; 19K+ training hrs H1 FY26; “Great Place to Work” certified. |

| Execution | Hitting guidance amid costs; sub divestment. | 50% guidance met; strong inflows/ROE. |

| Macro | Slow HNI growth, savings shift to deposits. | Tailwinds from rising equity allocation (16% financial assets). |

Overall Summary

Bullish Outlook with Resilience: ARWL exemplifies a high-quality, scalable wealth manager with 30%+ PAT CAGR, 45% ROE, and sticky clients amid market headwinds. Tailwinds from India’s wealth boom (low penetration, HNI surge) and internal levers (inflows, tech) outweigh moderate headwinds (volatility, costs). Growth prospects strong (FY26 guidance achievable; long-term AUM multiples via digital/HNI focus). Risks are manageable via proven model (14-qtr consistency). Recommendation: Accumulate on dips; target upside to FY26 guidance implies 20-25% EPS growth. Valuation premium justified by ROE/margins vs peers. (Data as of Oct 2025 filings.)

Copyright © 2023 SAS Data Analytics Pvt. Ltd. All rights reserved.