ADANIENSOL

Equity Metrics

January 13, 2026

Adani Energy Solutions Limited

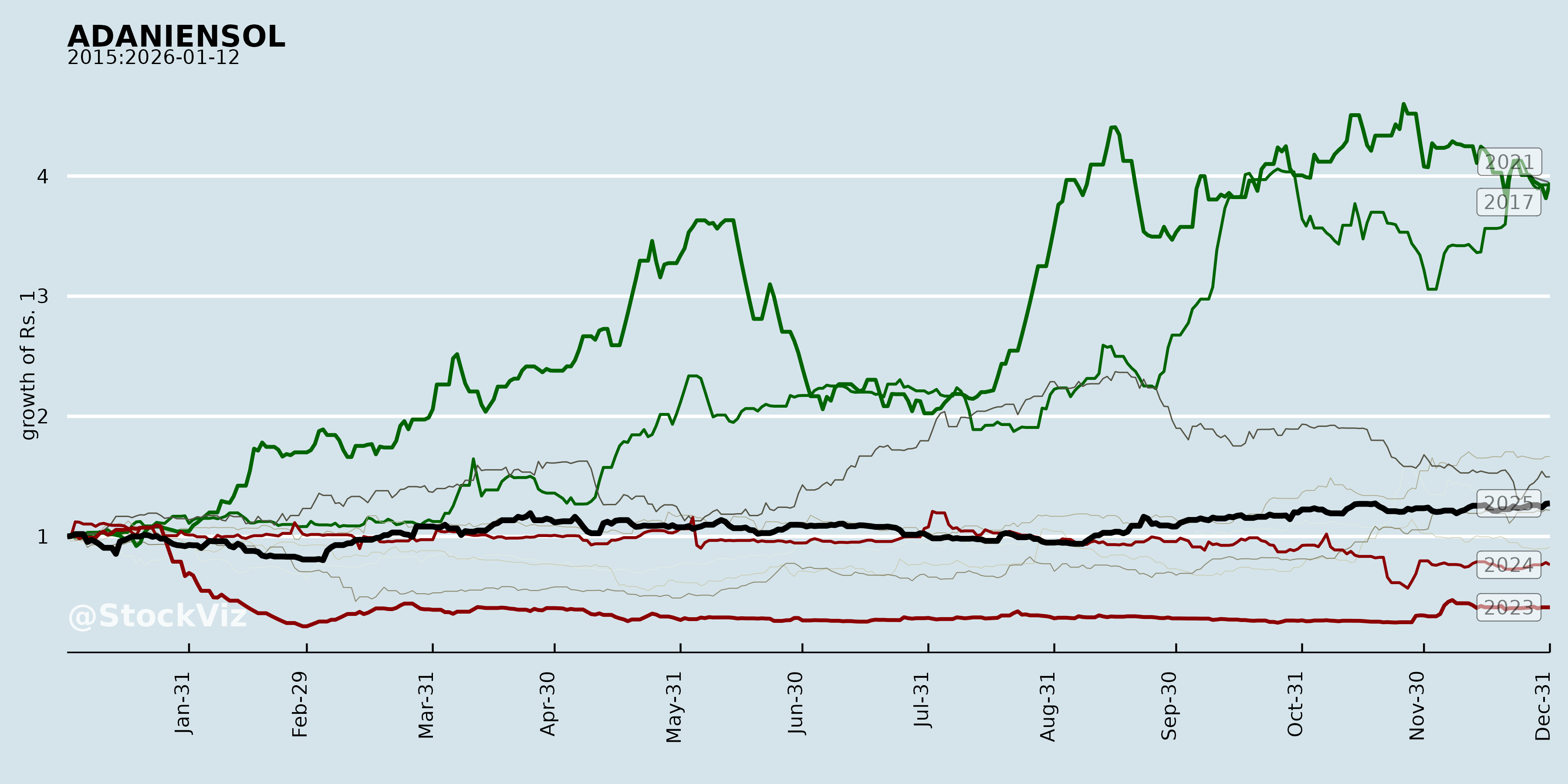

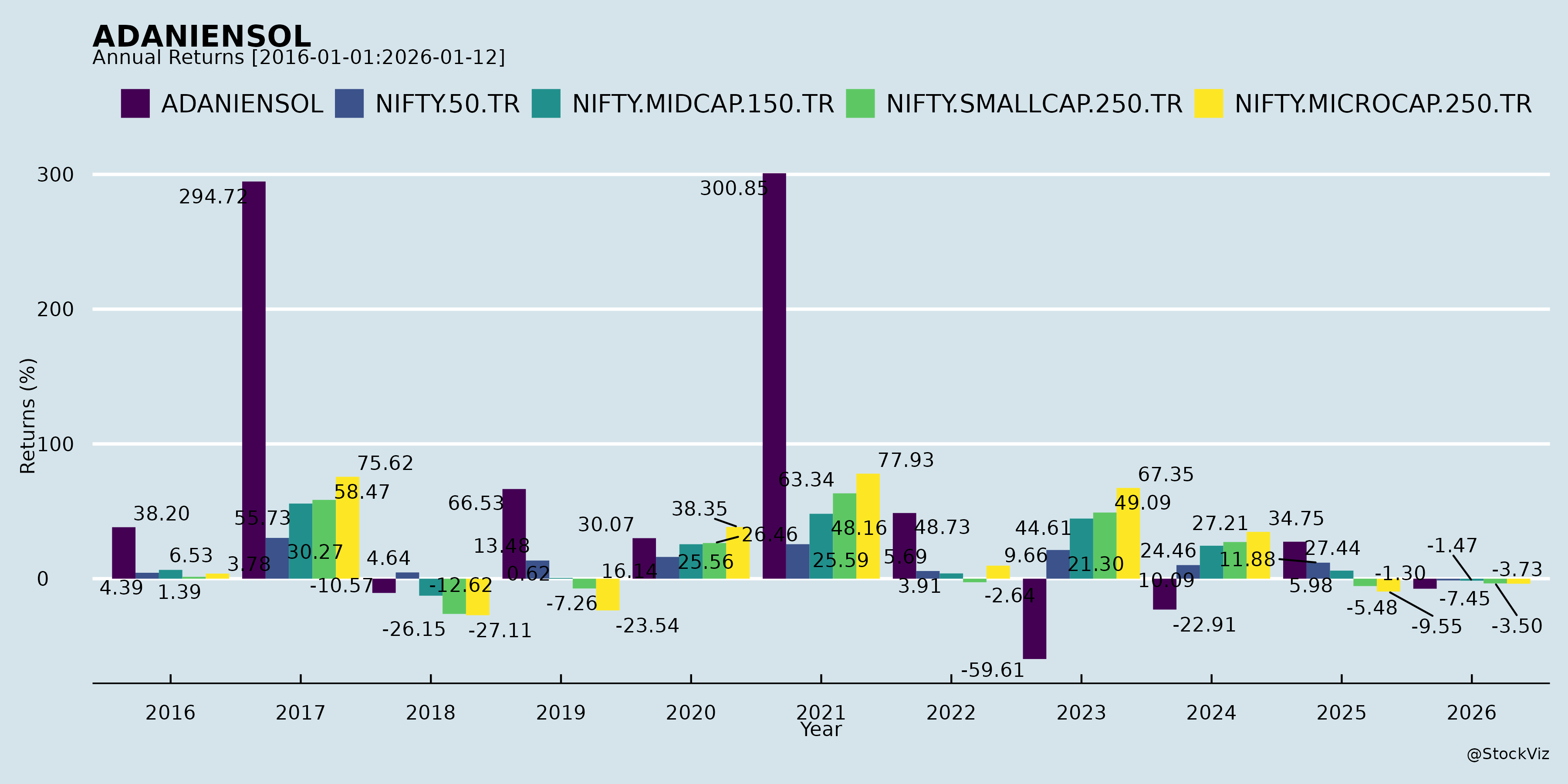

Annual Returns

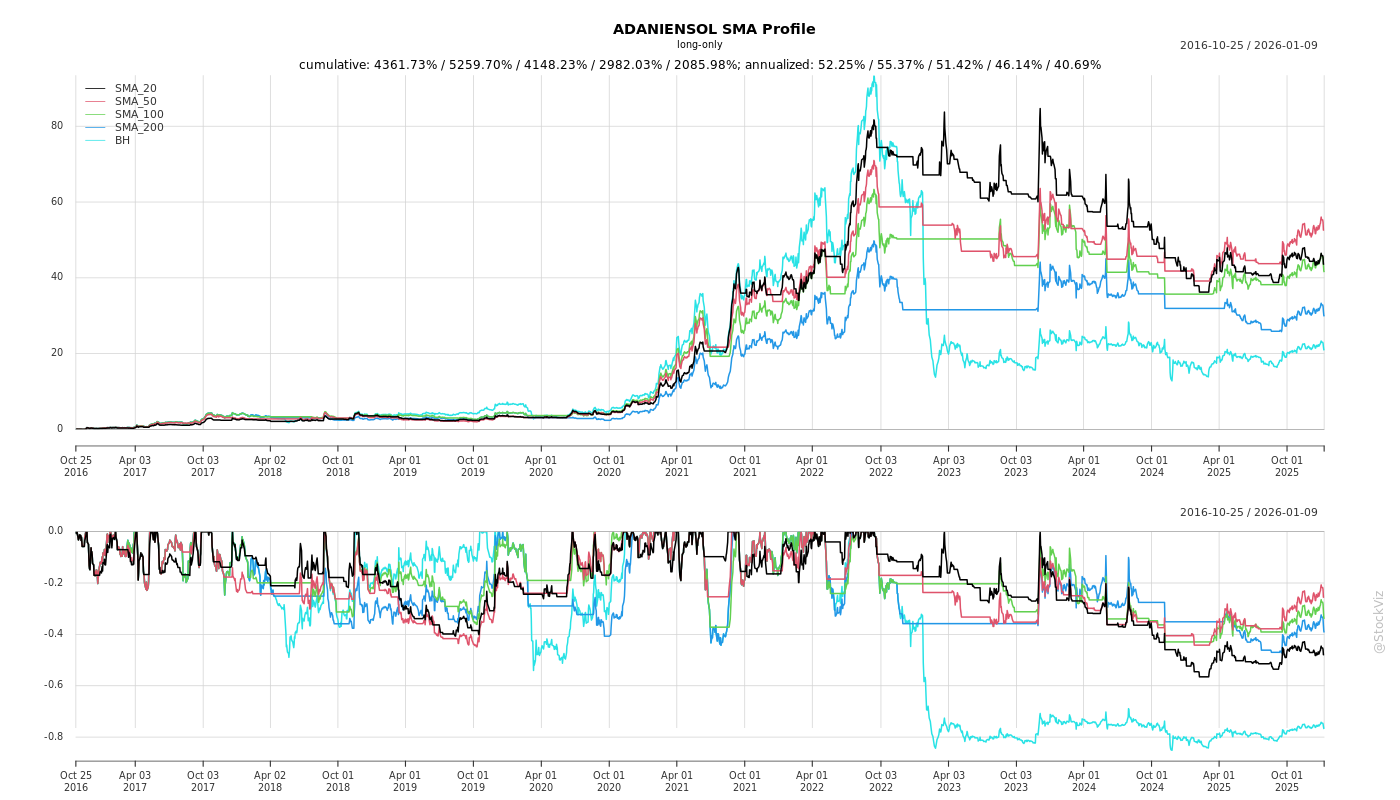

Cumulative Returns and Drawdowns

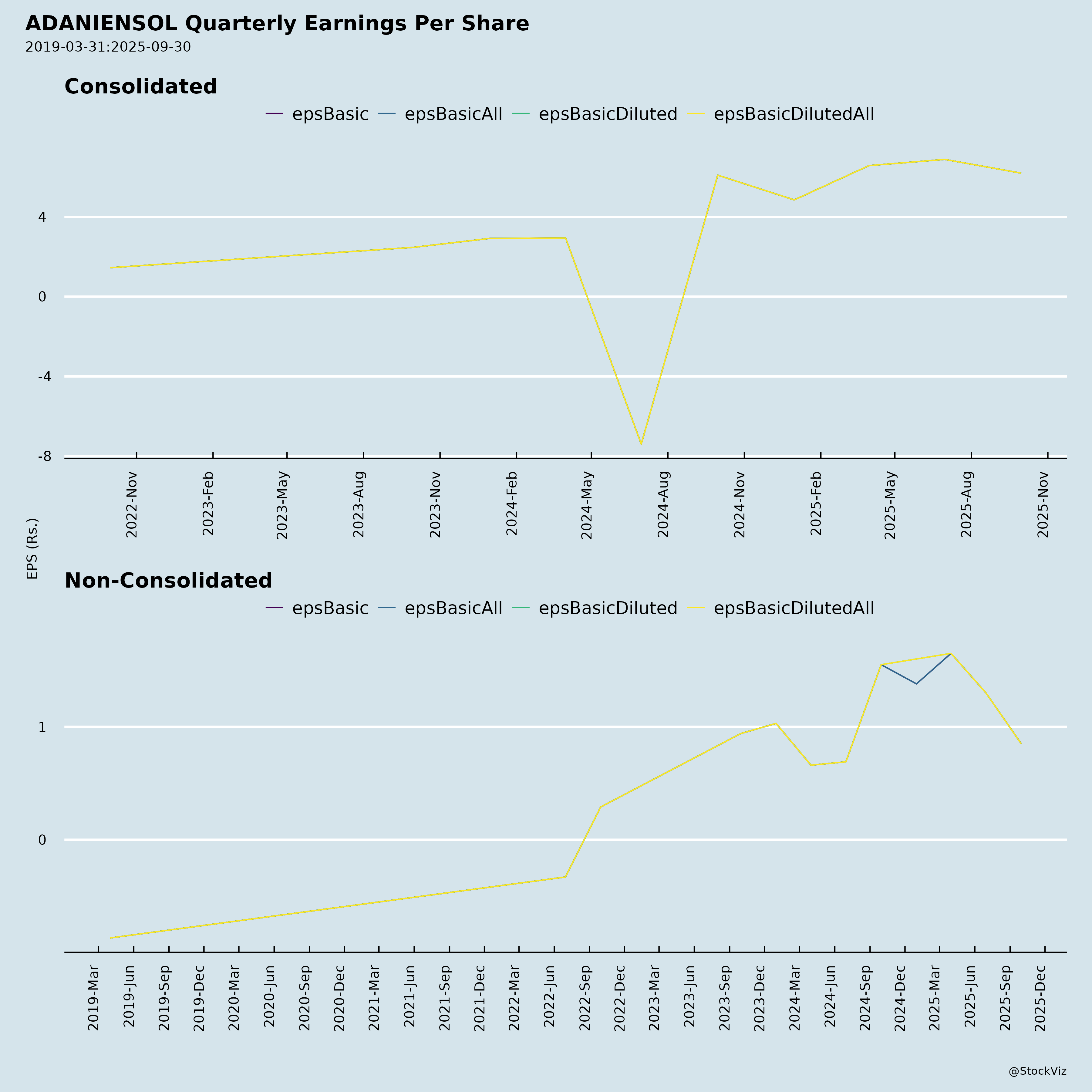

Fundamentals

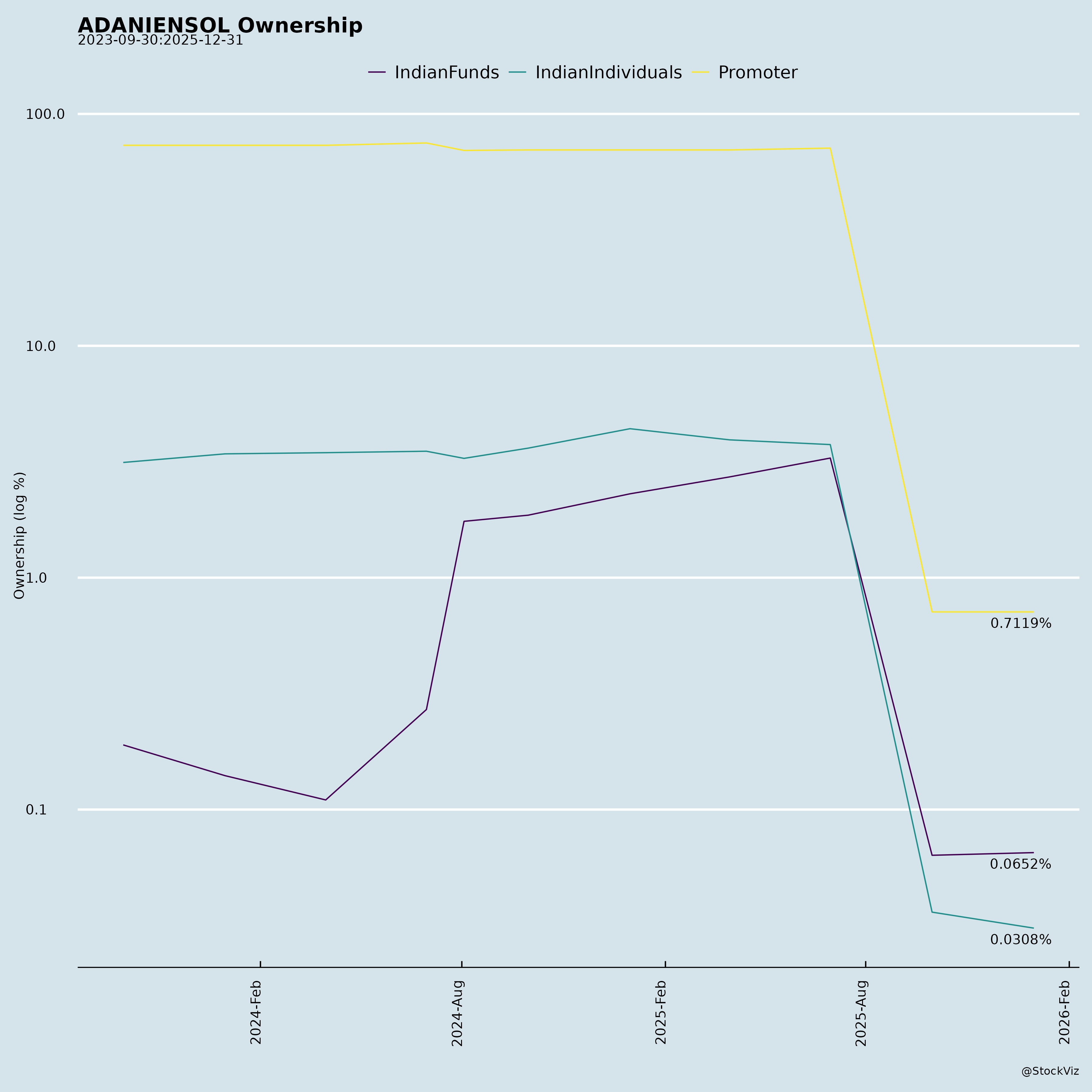

Ownership

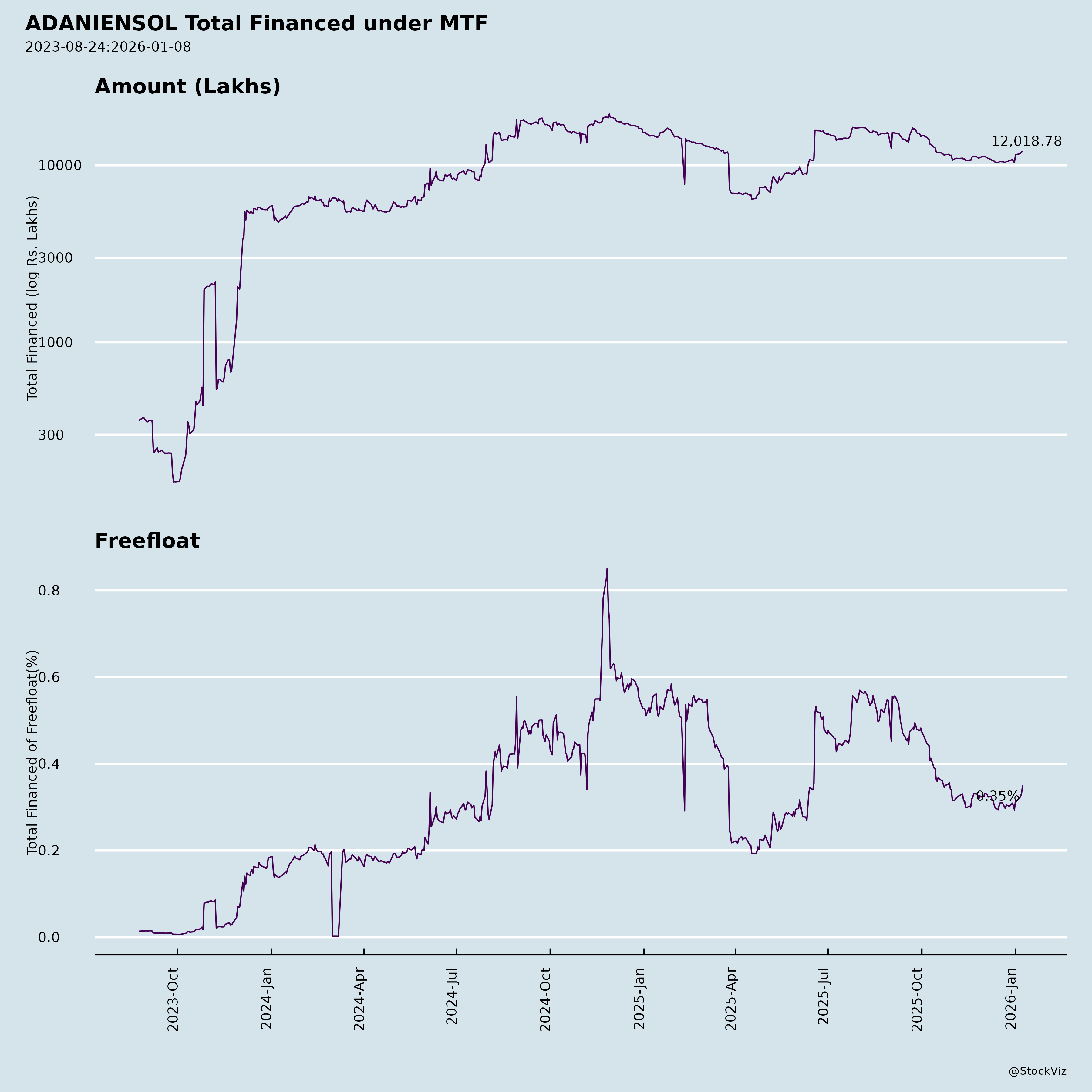

Margined

AI Summary

asof: 2025-12-03

Summary Analysis for Adani Energy Solutions Ltd (ADANIENSOL)

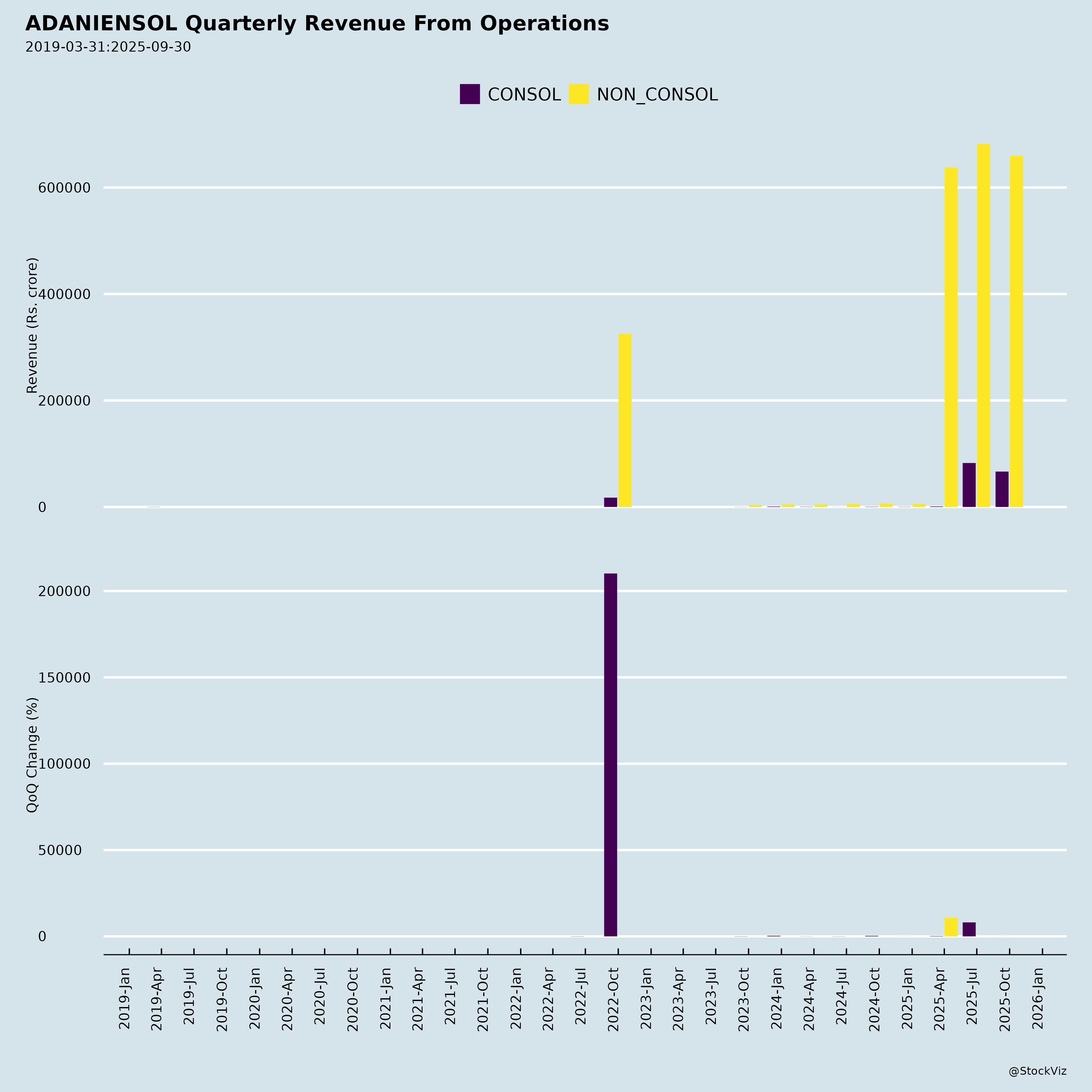

Adani Energy Solutions Ltd (AESL), India’s largest private power transmission company (26,705-27,905 ckm network post new LOI), operates across transmission, distribution (Mumbai/Mundra), smart metering (22.8M meters order book), trading, and cooling. H1 FY26 results show robust recovery: revenue ₹15,415 Cr (+33% YoY), PAT ₹1,098 Cr (vs loss), driven by transmission (₹4,560 Cr) and distribution (₹6,478 Cr). Network expansion to 27,905 ckm/97,236 MVA via RE evacuation project strengthens positioning. Below is a structured analysis of headwinds, tailwinds, growth prospects, and key risks.

Tailwinds (Positive Catalysts)

- Project Wins & Infrastructure Scale: LOI for 2,500 MW HVDC RE evacuation project (Khavda, Gujarat) adds strategic RE integration capacity, aligning with India’s 500 GW RE target by 2030.

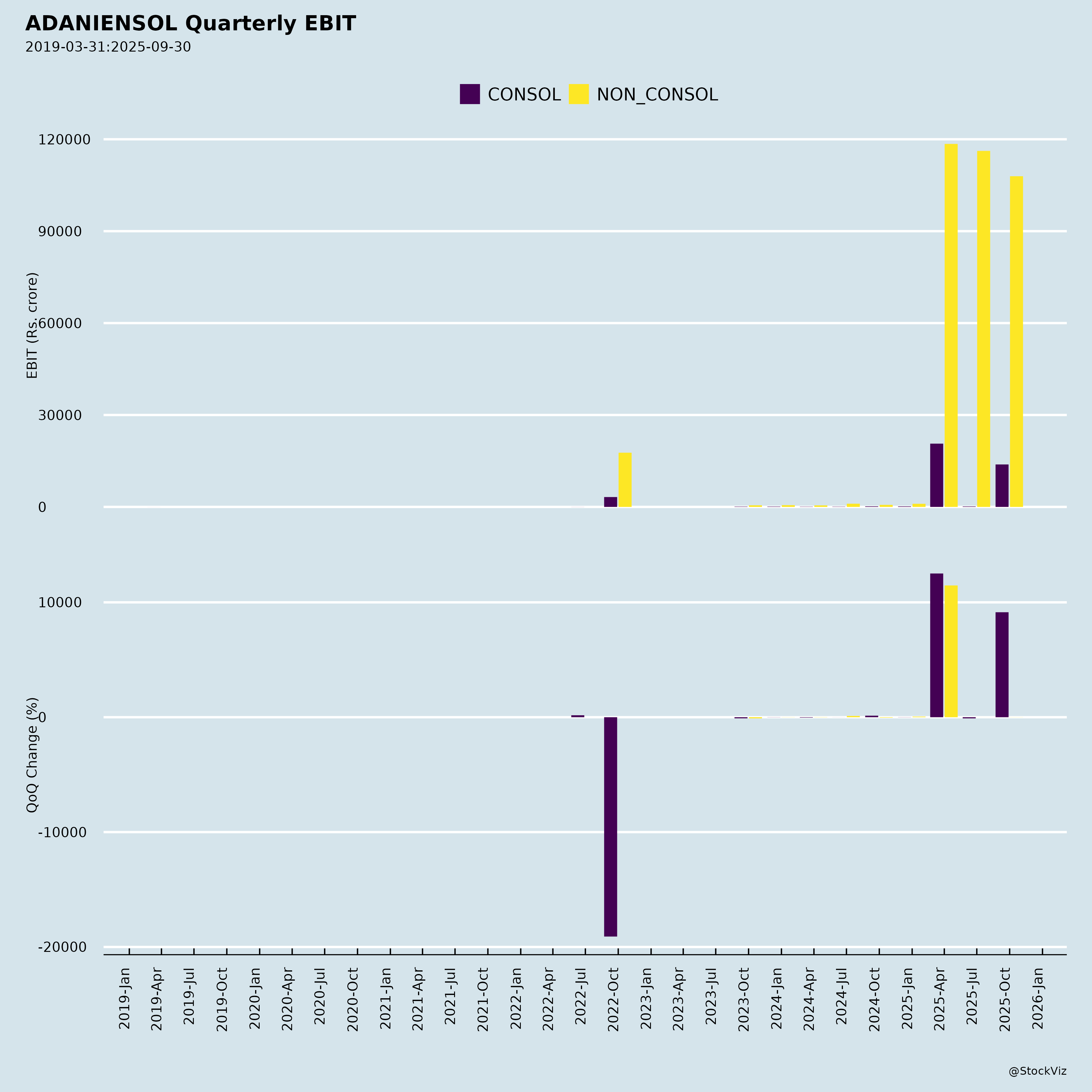

- Financial Momentum: H1 revenue growth (33% YoY), EBITDA margins ~28%, strong cash from ops (₹4,007 Cr). Transmission segment PBIT up 20% YoY; smart metering emerging as high-growth (₹294 Cr revenue).

- Diversified Revenue Streams: Distribution serves 12M+ consumers; trading via subsidiary Powerpulse (PTSL) scales with merchant power demand. Investor conference signals confidence.

- Sustainability Edge: Partnerships (e.g., RSWM for recycled PET) and RE focus enhance ESG appeal, aiding green financing.

- Regulatory Support: Tariff-based competitive bidding (TBCB) favors incumbents like AESL.

Headwinds (Challenges)

- High Leverage: Outstanding debt ₹43,376 Cr (D/E 1.86x, up from 1.78x YoY); finance costs ₹1,766 Cr (H1). Regulatory deferral drag (₹838 Cr negative H1).

- RPT Dependence: Incremental approvals sought for ₹4,500 Cr (APL) + ₹2,000 Cr (MEL) power trading via PTSL (total FY26 ~₹16,495 Cr); exposes to promoter-linked scrutiny.

- Past Losses: Exceptional items (e.g., ₹1,506 Cr Dahanu divestment) and regulatory gaps impacted prior PAT.

- Capex Intensity: CWIP ₹6,992 Cr signals heavy investments; H1 investing cash outflow ₹9,920 Cr.

- Segment Volatility: Trading margins thin (regulated by CERC); distribution exposed to consumer gaps.

Growth Prospects

- Transmission Leadership: Pipeline of RE evacuation projects (e.g., Phase-V BGW); target 30,000+ ckm by FY27.

- Smart Metering Boom: 22.8M meters; Q2 revenue ₹294 Cr (+ve CODM restatement); potential ₹5,000-7,000 Cr revenue over 5-7 years.

- Distribution Expansion: New licenses (e.g., Kalyan-Dombivli, Pune); green power retail push for 12M+ consumers.

- Trading Scale: PTSL’s CERC license enables merchant/bilateral trades; FY26 gross volumes could hit ₹16k+ Cr.

- Overall Outlook: 15-20% revenue CAGR FY26-28; RE focus positions for ₹50,000 Cr+ assets under management. ROE ~10-12% sustainable with deleveraging.

| Metric | H1 FY26 | H1 FY25 | FY25 |

|---|---|---|---|

| Revenue | ₹15,415 Cr | ₹11,562 Cr | ₹23,767 Cr |

| PAT | ₹1,098 Cr | (₹417 Cr) | ₹922 Cr |

| Debt | ₹43,376 Cr | ₹38,951 Cr | ₹40,206 Cr |

Key Risks

| Risk Category | Description | Mitigation |

|---|---|---|

| Regulatory | Tariff delays, deferral balances (₹2,274 Cr asset liability); CERC trading caps. RPT approvals (postal ballot). | Strong track record; arm’s-length pricing certified. |

| Financial/Leverage | Debt service coverage 1.93x; forex/interest rate volatility (OCI hedging gains ₹391 Cr H1). | Cash ops cover; contingency reserves. |

| Execution | Project delays (e.g., 6,992 Cr CWIP); capex funding amid high rates. | EPC expertise; 97 GW+ transformation capacity. |

| Legal/Reputational | US DOJ/SEC indictment of non-exec director (no company impact claimed); ESG scrutiny post-Dahanu sale. | Independent audits; no material financial hit. |

| Market | Power demand slowdown; competition from NTPC/JSW; RE intermittency. | Merchant flexibility; diversified portfolio. |

| Related Party | 50%+ revenue exposure to APL/MEL trades; promoter conflicts. | Audit Committee oversight; minority abstention. |

Overall Outlook: Bullish with caution. Tailwinds from RE infra and metering dominate; growth 15-20% CAGR feasible. Risks center on debt and RPTs—monitor Q3 results and ballot outcome (Dec 7, 2025). Target upside to ₹1,200-1,400/share (current ~₹1,000 assumed) on execution. Investors: Buy on dips for long-term RE play.

Copyright © 2023 SAS Data Analytics Pvt. Ltd. All rights reserved.