Tyres & Rubber Products

Industry Metrics

January 13, 2026

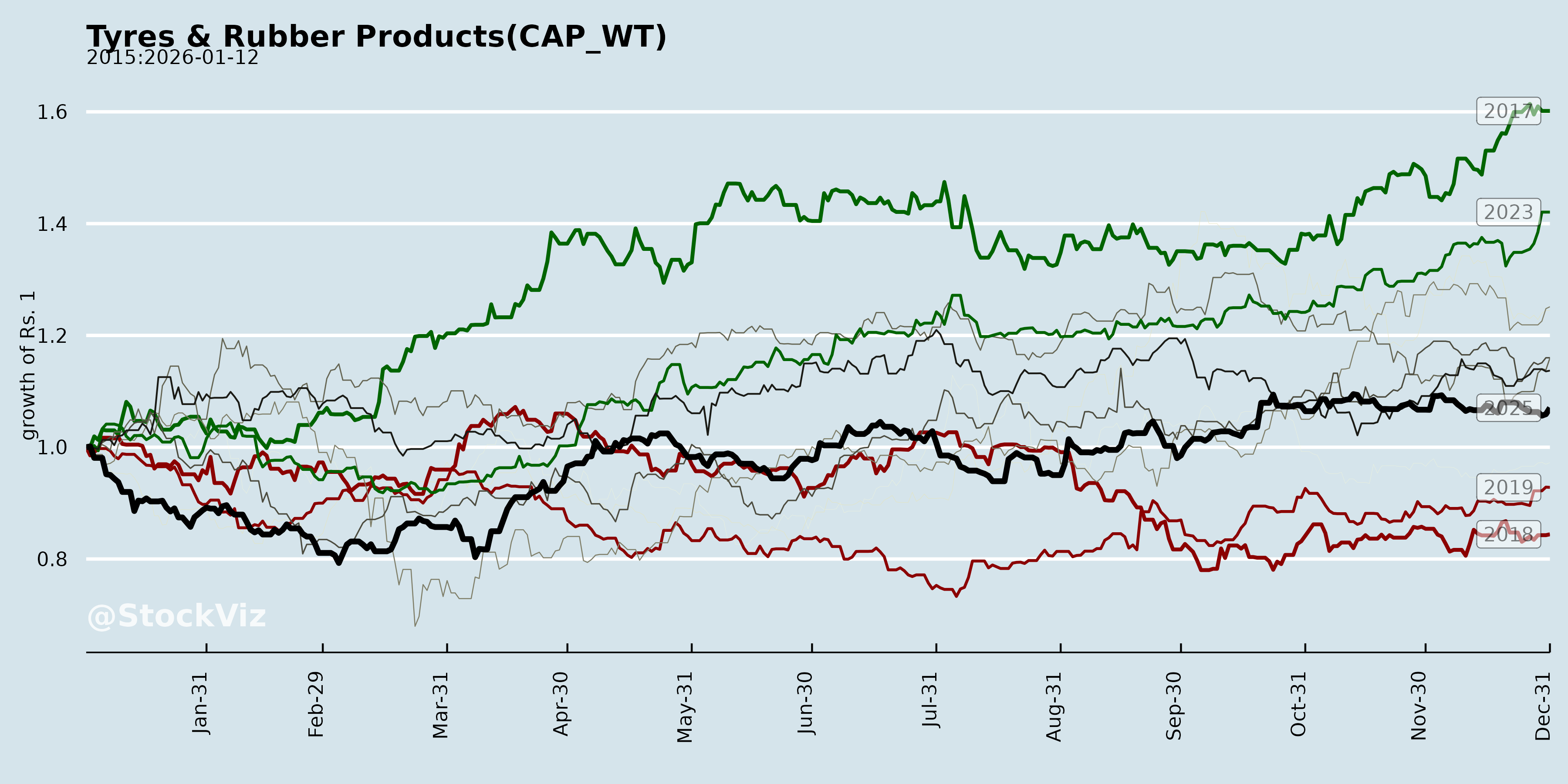

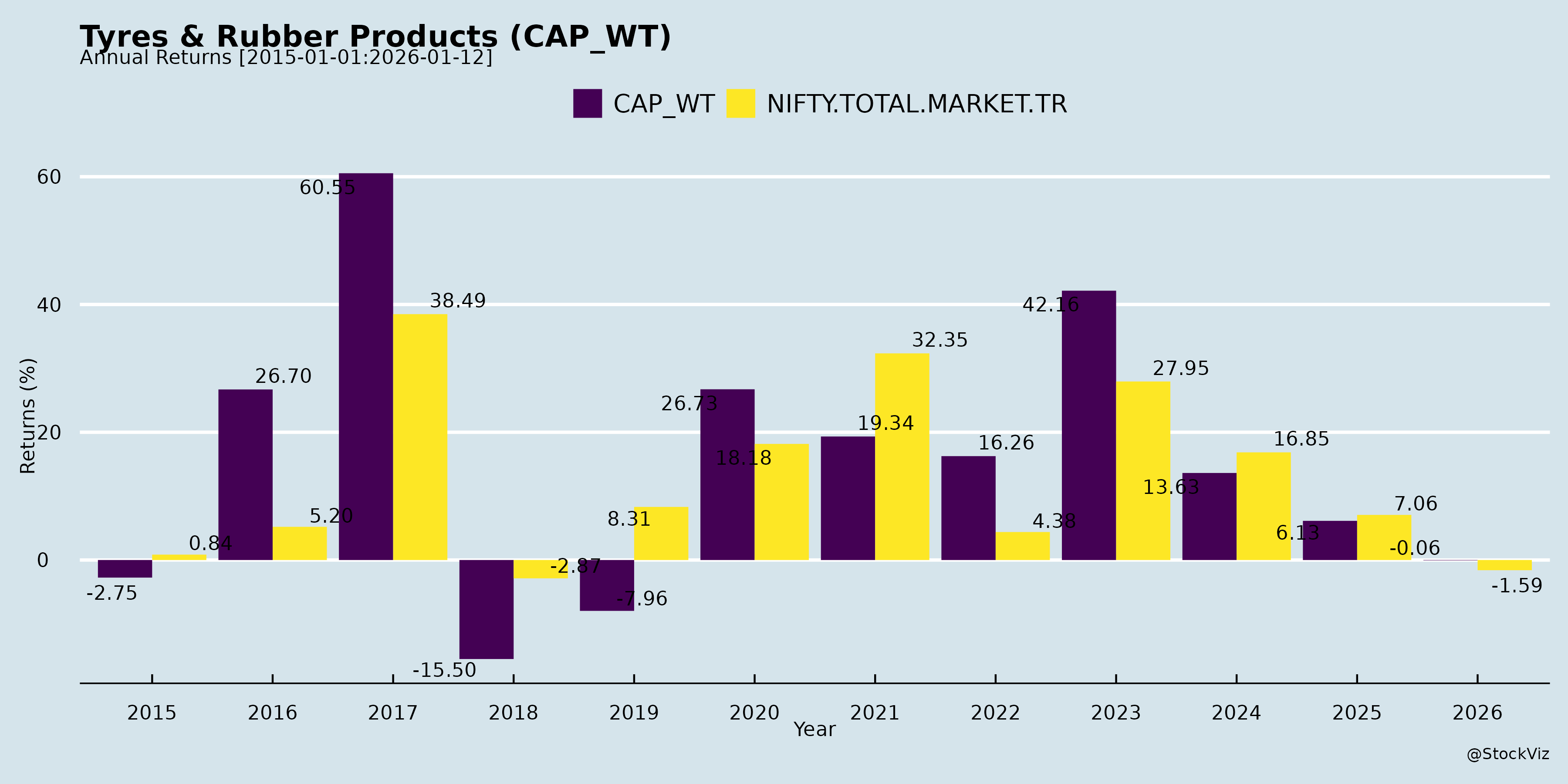

Annual Returns

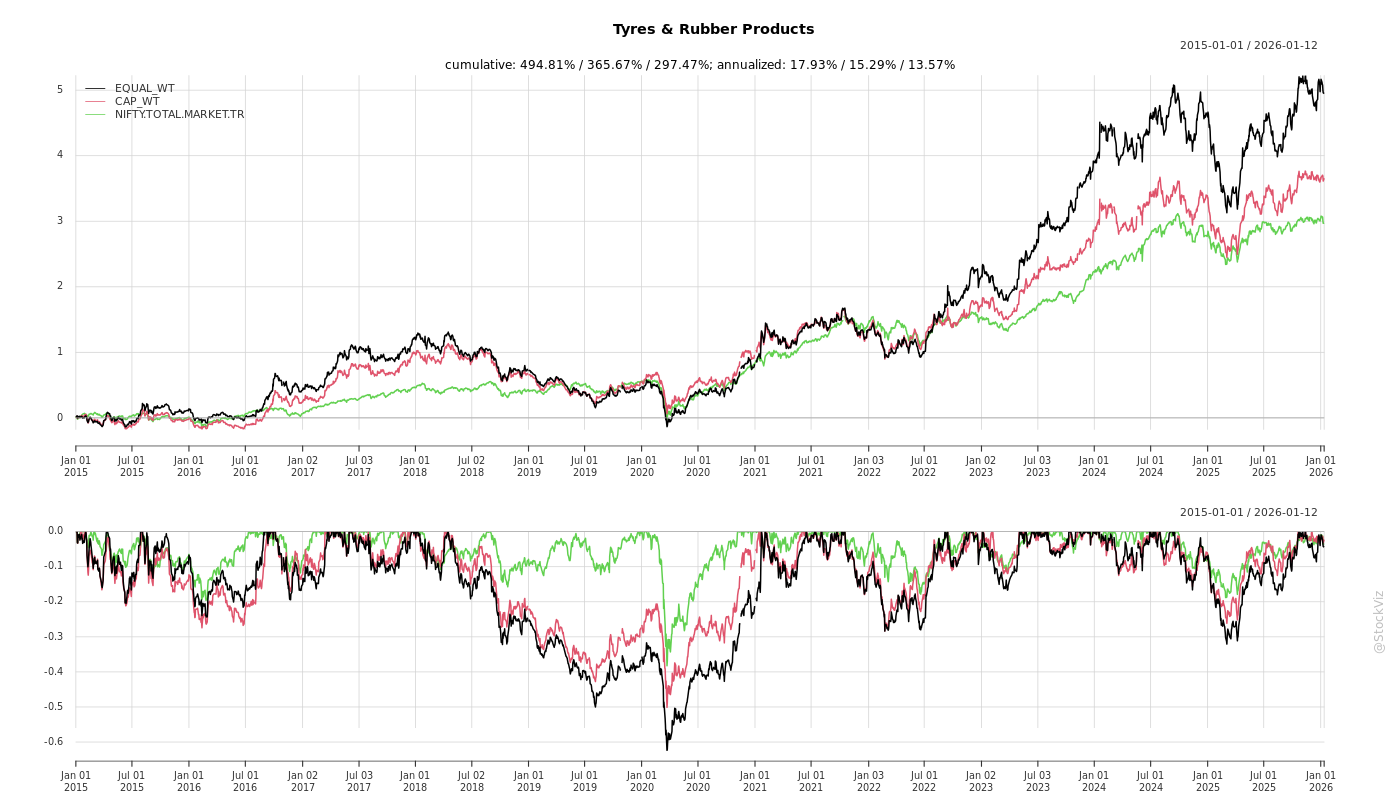

Cumulative Returns and Drawdowns

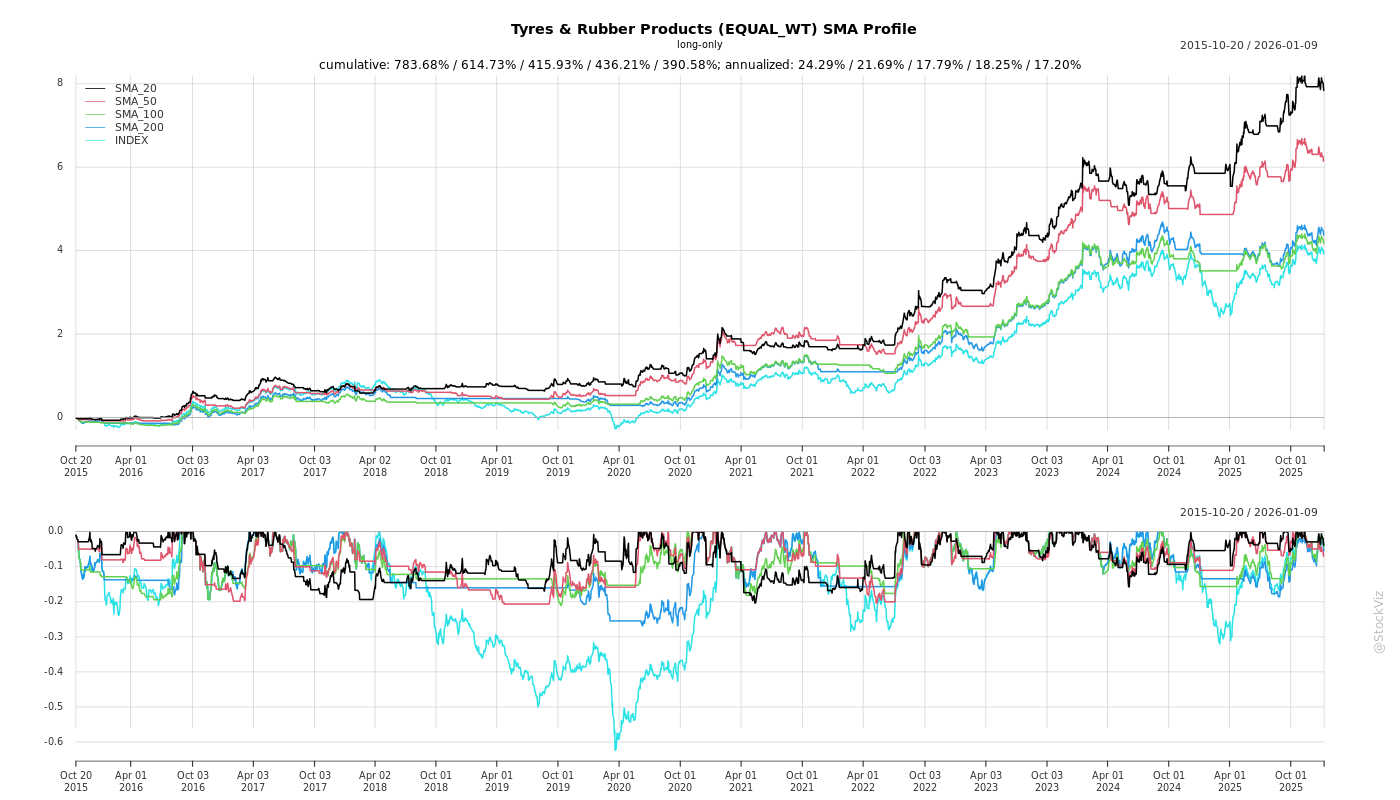

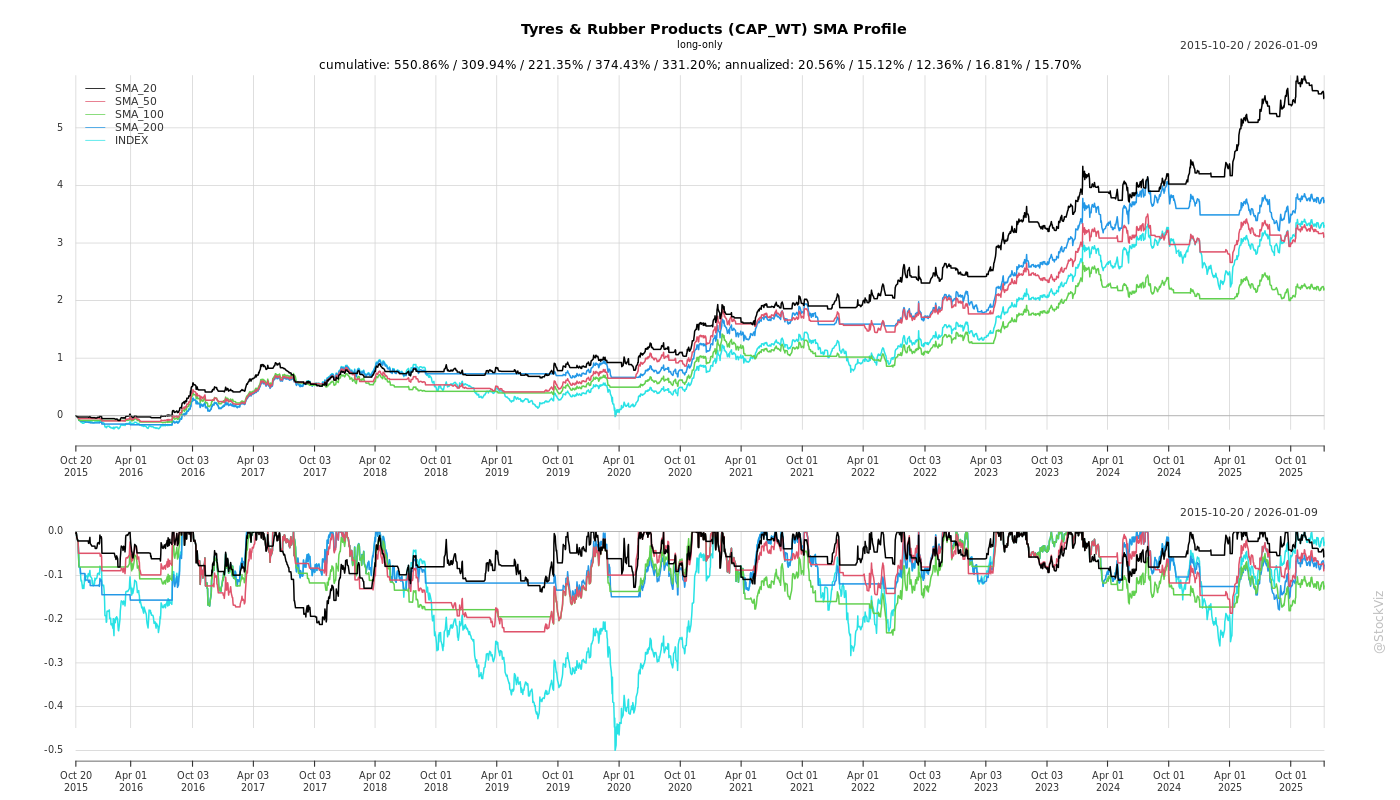

SMA Scenarios

Current Distance from SMA

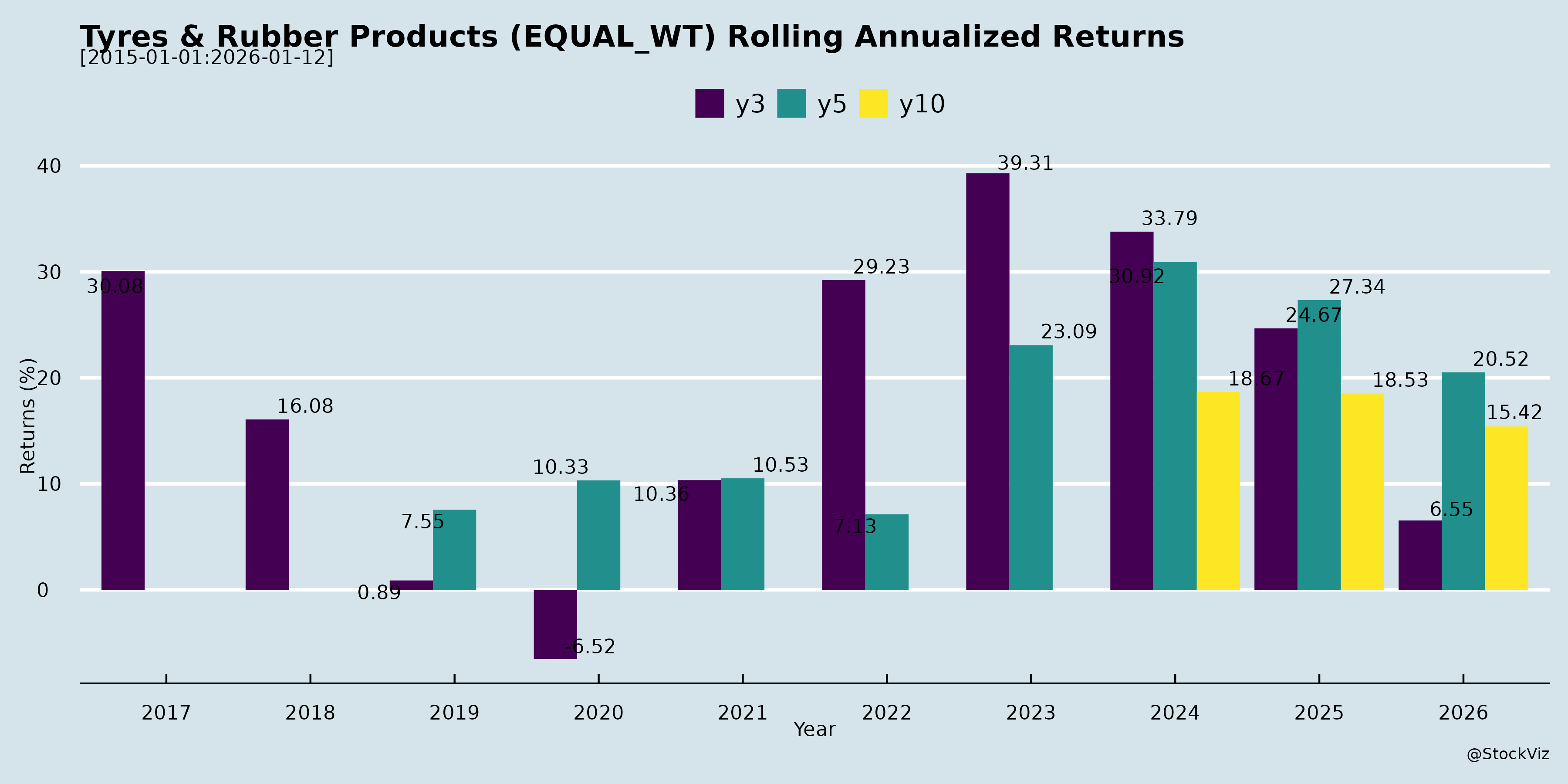

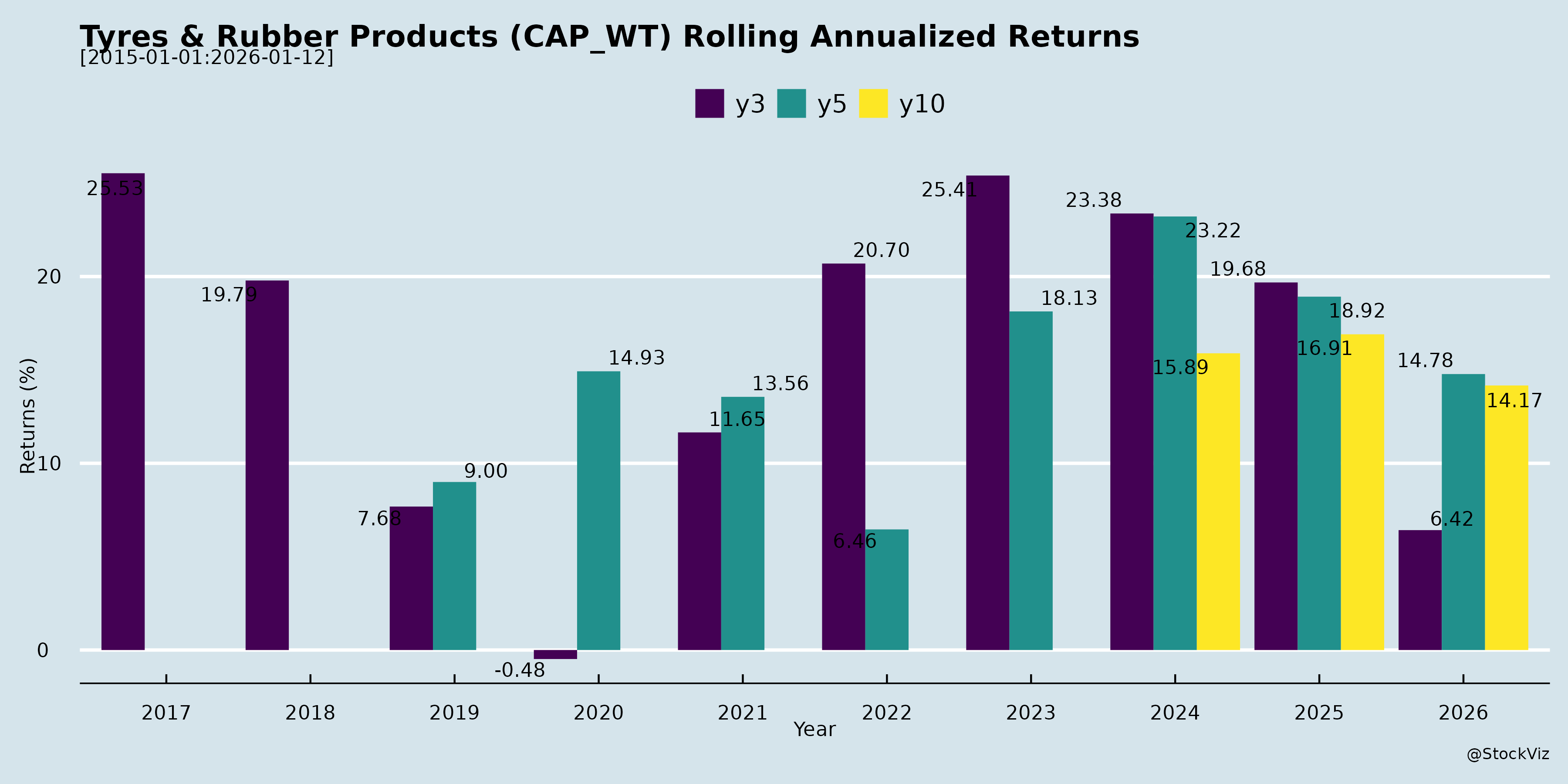

Rolling Returns

Market Cap

EBIT (% of Industry Total)

Revenue (% of Industry Total)

AI Summaries

Analyst

asof: 2025-11-30

Indian Tyres & Rubber Products Sector Analysis

Based on Q2/H1 FY26 Earnings Transcripts/Announcements from Balkrishna Industries (BKT), Apollo Tyres, JK Tyre, and others (CEAT/Tolins minor). Sector focuses on off-highway (OHT/agri/mining via BKT), passenger car radial (PCR), truck/bus radial (TBR), and bias tires, with India (~70-80% revenue for most) driving growth amid global headwinds.

Headwinds (Short-term Pressures)

- US Tariffs & Trade Tensions: BKT cites 50% duties (from 25%) slashing US sales (10% of FY25 volume); JK Tyre (3% exposure) diverts to Mexico/LATAM but notes uncertainty. Apollo/JK monitor USMCA revisions (2026). Peers report inventory depletion and wait-and-watch in US.

- Europe Weakness: BKT/Europe “challenges” (agri replacement low single-digit); Apollo sees “challenging” demand (low single-digit growth outlook), offset by restructuring (Enschede closure, EUR 55mn cost).

- Regulatory Costs: BKT highlights EUDR (EU Deforestation Reg) raw material inventory buildup (full impact Q4FY26 onward; ~10% natural rubber premium, offset by softening others). Higher freight (6-7% of sales).

- Demand Volatility: GST transition slowed Apollo replacement (Sep destocking); monsoon/infra delays; Muted PCR OEM (Apollo).

- Margin Mix Pressure: BKT: Lower US/high India sales mix hit EBITDA (21.5%); forex losses (INR 68cr).

Tailwinds (Positive Catalysts)

- GST Rationalization: Game-changer—tires 28%→18%, farm 18%→5%. BKT/Apollo/JK praise demand boost (8-9% auto uptick); Apollo: Highest revenue in 10Q; JK: 15% domestic volume growth. Festive/rural/infra rebound (Oct strong).

- Raw Material Soften: 3% QoQ drop (natural rubber ~INR185-210/kg, synthetics/carbon black/steel cord down); stable/range-bound Q3 outlook aids margins (BKT 22.7% H1; Apollo 14.9%; JK 13.3%).

- Domestic Strength: Volumes up (BKT H1 flat but India focus; Apollo mid-single replacement/OEM; JK TBR +22% YoY replacement). Agri/farm +12-78%; 2/3W +11-155%; CV recovery.

- Export Diversification: JK Tornel (Mexico) +26% QoQ (7.6% EBITDA); Apollo exports double-digit Q2 recovery. BKT: Rest-of-world/Australia/Asia mining push.

- Operational Wins: Awards (BKT Caterpillar 4th year); premiumization (Apollo Vredestein; BKT UX Royale on Hyundai); sustainability/ESG ratings.

Growth Prospects (Medium/Long-term Outlook)

- India Leadership: 50%+ sector revenue; GST/infra/rural/EV tailwinds → mid/high-single volume growth (Apollo H2; JK double-digit FY26). Market shares stable/gaining (Apollo TBR 29%, PCR 20%; JK TBR +22%, PCR +16%; BKT agri >20%).

- Capacity Ramp: High capex (BKT INR1,737cr H1, FY26 ~INR2,000-2,200cr; JK INR1,200cr FY26 for PCR/TBR; Apollo Hungary/AP expansions). Radial utilizations 88-90%+; new TBR/PCR pilots (BKT H2FY27).

- Export/Intl Expansion: Non-US focus (Mexico/LATAM/Africa/EU/Australia); BKT ROW; Apollo Europe premium (UHP 49%). Optimism on India-US trade deal easing tariffs.

- Strategic Shifts: Premium/radialization; carbon black (BKT 55% production); EV/OHT/mining. BKT: INR23,000cr by 2030; Apollo: Profitable growth/ROCE 15%.

- Overall: Double-digit revenue FY26 feasible (JK guidance); H2 acceleration on GST/demand.

Key Risks

| Risk Category | Details | Mitigation |

|---|---|---|

| Geopolitical/Trade | Prolonged US tariffs (50%+); EU headwinds/EUDR. | Diversification (India 25-30%→higher); trade deals. |

| Raw Materials | Volatility reversal (rubber/crude upturn); EUDR full cost (Q4FY26). | Hedging; index-linked PCR pricing (JK). |

| Competition | New entrants (OHT/PCR/TBR); pricing wars. | Premiumization/distribution/brand (Apollo cricket sponsor; JK/BKT OEM wins). |

| Execution | Capex delays (INR3,500cr+ sector-wide); ramp-up risks. | On-schedule (BKT/JK Q3 start); utilizations high. |

| Macro/Demand | Europe slowdown; monsoon/CV weakness; channel destocking. | Domestic focus; festive/infra buffer. |

| Financial | Debt (BKT net INR456cr; Apollo 0.8x); forex (EUR/MXN). | Strong FCF/margins; low leverage (JK 2.5x ND/EBITDA). |

Summary Verdict: Cautiously Optimistic. Headwinds (US/Europe ~20-30% exposure) cap near-term growth (volumes flat/decline for BKT), but GST/raw mat tailwinds drive India resilience (6-15% growth). Long-term prospects strong on capex/domestic/export pivot; risks skewed to trade/raw mats but mitigated by derisking. Sector EBITDA margins sustainable at 13-15%+ H2FY26.

Financial

asof: 2025-12-03

Analysis of Indian Tyres & Rubber Products Sector (Based on Q3/N9M FY25 Results)

The Indian tyre sector, represented by key players like MRF, Balkrishna Industries (BKT), Apollo Tyres, JK Tyre, and TVS Srichakra, showed mixed performance in Q3 FY25 (ended Dec 2024). Aggregate revenue grew ~5-15% YoY across most companies (e.g., MRF ~13% Consol, BKT ~13%, Apollo ~5%, JK flat, TVS ~12%), driven by replacement demand and exports. However, profitability was pressured with sequential PAT declines (QoQ down 30-70% in MRF, Apollo, JK) due to rising raw material costs (esp. natural rubber). EBITDA margins contracted (e.g., MRF 6% vs 11% YoY, JK 9% vs 15%). All companies declared interim dividends (MRF ₹3, BKT ₹4), signaling confidence. Below is a structured analysis of headwinds, tailwinds, growth prospects, and key risks.

Tailwinds (Positive Factors)

- Robust Revenue Growth: Volume-led expansion in replacement segment (JK: “healthy growth”); OEM recovery post-slowdown. Exports strong (BKT off-road focus, JK Mexico ops contributing ~14% revenue).

- Capacity & Product Premiumization: BKT’s 35k MTPA off-road project (Phase 1 by H1 FY26); JK’s 30Mth TBR milestone, smart tyres/TPMS. MRF/Apollo focus on radials/high-margin products.

- Fundraising Success: JK raised ₹740 Cr (Preferential + QIP) for capex/working capital; deployed per objects (no deviations).

- Dividend Payouts & Shareholder Returns: Consistent (MRF 30%, BKT 200%); reflects cash generation.

- Sustainability/ESG Momentum: JK “Best in Class” CareEdge rating; first tyre co with IFC Sustainability-Linked Loan; RE100 commitment.

- OCI Gains (TVS): ₹101 Cr fair value gain from demerger (TVS Auto Solutions).

Net Impact: Supported top-line resilience amid global slowdowns.

Headwinds (Challenges)

- Margin Squeeze: Raw material inflation (natural rubber up; MRF materials 67% of costs, up 24% YoY). Operating margins fell: MRF 6% (vs 11% YoY), JK 9% (vs 15%), Apollo 13.9% (vs 18%), BKT stable ~17% but freight up.

- Profitability Decline: Q3 PAT down QoQ (MRF -45%, Apollo -32%, JK -77%, TVS loss). N9M PAT growth muted (MRF flat, JK -35%, TVS down).

- Exceptional Costs: VRS (all cos), PF dues (TVS ₹6 Cr), EPR obligations (Apollo/TVS). Forex losses in OCI (Apollo -₹3,812 Cr Q3).

- High Input Costs: Employee/depreciation steady but other expenses up (freight, power).

- Demand Volatility: OEM weakness lingers; inventory corrections (MRF inv changes positive).

Net Impact: Eroded EBITDA/PAT; debt service ratios stable but strained (Apollo 1.6x, JK 1.45x).

Growth Prospects

| Driver | Details | Key Players |

|---|---|---|

| Domestic Demand | Replacement ~70% market; OEM rebound (PV/CV up post-festive). Rural/farm tyres strong. | All (JK/BKT emphasis) |

| Exports | Rupee parity aids; BKT/JK Mexico/Europe ops (BKT 50%+ exports). | BKT (off-road), JK (100+ countries) |

| Capex/Expansion | ₹1,000s Cr planned: BKT Bhuj plant; JK digital COE; MRF/Apollo greenfield. | BKT, JK, MRF |

| Premium/Tech Shift | Radials/smart tyres; sustainability (EPR compliance). | JK (motorsport), MRF (tubes/flaps) |

| **M&A/D |

General

asof: 2025-11-30

Analysis of Indian Tyres & Rubber Products Sector

Based on recent SEBI Regulation 30 disclosures from key players (MRF, Apollo Tyres, CEAT, JK Tyre, TVS Srichakra, Tolins Tyres), here’s a summary of headwinds, tailwinds, growth prospects, and key risks. These reflect sustainability pushes, order wins, divestments, and compliance pressures amid a sector focused on tyres, retreading, and rubber products.

Headwinds (Challenges)

- Regulatory Compliance Burden: TVS Srichakra’s disclosure highlights SEBI’s stringent KYC/PAN/Aadhaar mandates for physical shareholders (per June/July 2025 circulars), restricting dividend payouts and service requests without updates. This could delay investor services and increase administrative costs across the sector.

- Restructuring Pressures: JK Tyre’s sale of 40L shares (Rs. 130.64 Cr) in high-contribution subsidiary Cavendish Industries (27% of FY25 consolidated income, 22% net worth) to promoter/promoter group entities signals portfolio optimization but reduces direct control.

- High Investment Costs: MRF’s Rs. 99 Cr equity stake in a nascent renewables firm (Serentica, incorporated May 2025, zero turnover) adds upfront capex amid volatile raw material/energy prices.

Tailwinds (Positive Factors)

- ESG Momentum: Apollo (rating ‘76’), CEAT (‘67’ Good, unsolicited), and implied sector focus boost investor appeal and access to green financing. Aligns with SEBI’s Nov 2024 circular emphasizing ESG disclosures.

- Renewable Energy Shift: MRF’s captive solar/wind power deal (up to 26% stake) under Electricity Act reduces long-term energy costs and hedges fossil fuel volatility.

- Order Inflows: Tolins Tyres secures Rs. 40-50 Cr rate contract from Institute of Road Transport (Tamil Nadu STUs) for tread rubber/gums (6-month execution), signaling robust retreading demand.

Growth Prospects

- Sustainability-Driven Expansion: Renewables investments (e.g., MRF) and ESG ratings position the sector for cost savings (energy ~10-15% of costs), premium pricing, and exports to eco-conscious markets. Retreading segment (Tolins) taps replacement tyre growth (projected 8-10% CAGR).

- Domestic Demand Resilience: Govt/transport orders (Tolins) and captive power setups support volume growth amid rising vehicle parc (India’s ~350M vehicles).

- Strategic Flexibility: JK’s divestment unlocks Rs. 130 Cr liquidity for core tyre ops; sector could see 7-9% revenue growth in FY26 on auto recovery.

Key Risks

- Execution & Financial Strain: New ventures like Serentica (completion by Jul 2026) face delays in renewables commissioning; high capex (MRF Rs. 99 Cr) amid thin margins (~8-12%).

- Related Party Dependencies: JK’s arm’s-length promoter deals risk conflicts or valuation scrutiny; Cavendish remains subsidiary but stake dilution exposes to group dynamics.

- Compliance & Market Risks: KYC non-compliance could freeze dividends/transfers; unsolicited ESG ratings (CEAT) raise authenticity concerns. Broader risks include raw material inflation (rubber ~50% of costs) and auto slowdown.

Overall Outlook: Tailwinds from ESG/renewables outweigh headwinds, with strong retreading/domestic prospects. Sector resilient but needs agile compliance and execution. Monitor Q3 FY26 earnings for renewables impact.

Investor

asof: 2025-11-30

Indian Tyres & Rubber Products Sector Analysis (Based on Q2/H1 FY26 Earnings Transcripts)

The sector, dominated by off-highway (OHT), truck & bus radial (TBR), passenger car radial (PCR), and agri tires, shows resilience amid global headwinds, driven by strong domestic tailwinds from GST cuts and infra push. Key insights from Balkrishna Industries (BKT), Apollo Tyres, JK Tyre (strong performers), with minor notes from CEAT/Tolins.

Headwinds

- US Tariffs & Trade Uncertainty: Severe impact; BKT reports 50% duties (from 25%) hit ~10% of volumes, leading to 4% YoY volume degrowth (Q2: 70k MT). JK Tyre (~3% exposure) diverted to Mexico/LATAM/Africa but warns of prolonged risks. Apollo notes export recovery but global volatility.

- Europe Softness: BKT cites overall market challenges (no competitor traction, but cautious); Apollo sees weak demand (low single-digit growth expected), with restructuring costs at Enschede plant (EUR 17mn exceptional item).

- Regulatory Costs (EUDR): BKT building raw material inventory for Jan’26 compliance (margin hit in Q2/H1, ~21.5% EBITDA margin); full Q3 impact offset by softening commodities.

- Geopolitical/Macro Volatility: BKT/Apollo highlight uncertainty outside India; freight costs stable at 6-7% (BKT).

- Competitive Pressure: Apollo flags new entrants (e.g., OHT players into TBR/PCR), potential pricing wars; channel destocking pre-GST noted.

Tailwinds

- GST Rationalization: Game-changer; reduced to 18% (tyres)/5% (farm tyres). BKT/Apollo/JK passed 100% benefit, boosting end-user demand (8-9% auto uplift expected). Apollo: Highest revenue growth in 10 quarters (India +6% YoY); JK: 15% domestic volume growth.

- Raw Material Softening: 3% QoQ drop (natural rubber ~INR 185-210/kg, synthetics ~INR 175/kg per Apollo/BKT). Stable/range-bound in Q3 supports margins (BKT: 21.5%; Apollo India: 15.3%; JK: 13.3%).

- Domestic Demand Surge: Replacement/OEM growth; JK TBR replacement +22% YoY, farm +78% OEM; Apollo mid-single-digit volumes; post-monsoon infra/mining rebound. Festive/rural momentum strong (Oct volumes up).

- Export Diversification: JK Tornel (Mexico) +26% QoQ to INR 639cr (EBITDA 7.6%); benefits from INR/MXN depreciation (~7%). BKT eyes ROW (Australia/Asia mining).

- Operational Efficiencies: Premiumization (Apollo UHP mix 49%; JK higher rims); awards (BKT Caterpillar 4th year); brand investments (Apollo cricket sponsorship, BKT series).

Growth Prospects

- Short-Term (H2 FY26): Double-digit revenue growth sustained (JK guidance: 10% FY26; Apollo H2 acceleration). Volumes: Mid-high single-digit India replacement (TBR/PCR/farm); capex ramps (BKT INR 2k-2.2k cr FY26; JK INR 1.2k cr H2; Apollo Hungary/AP expansions).

- Medium-Term (2-3 Yrs): Domestic derisking (India ~25-30% mix up from 12%); TBR/PCR ramps (BKT slow start H2 FY27, target INR 5k cr by 2030 ~7-8% share); OHT/mining via new capacities/products. Apollo: Premium brands (Vredestein) scaling. JK: Radial util. >90%, merger synergies by Nov’25.

- Long-Term: BKT vision INR 23k cr by 2030; sector aided by EV adoption, exports (20%+ vehicle exports), sustainability (ESG ratings, EPDs). Carbon black diversification (BKT 55% production).

- Margins/Returns: 13-15% EBITDA sustainable (JK); ROCE uptick (Apollo targeting 15%).

Key Risks

| Risk Category | Details | Mitigation |

|---|---|---|

| Trade/Geo-Political | Prolonged US tariffs (50%+), USMCA revision (2026); EU headwinds. | Diversification (LATAM/Africa/Asia); India focus; trade deal optimism (BKT). |

| Cost/Commodity | EUDR full impact Q3+; RM volatility reversal. | Hedging; inventory buildup; softening offsets. |

| Demand/Competition | Europe weakness; new entrants eroding TBR/PCR shares; destocking. | Premiumization; distribution expansion; brand (cricket/sports). |

| Execution | Capex delays (INR 1.7k cr BKT H1); ramp-up risks. | On-schedule (PCR/TBR Q3/Q4); util. 80-90%. |

| Financial | Debt rise (BKT net debt INR 456cr; Apollo 0.8x); FX (EURINR tailwind). | Healthy leverage (JK 2.5x ND/EBITDA); FCF focus. |

| Regulatory | GST implementation hiccups; sustainability compliance. | Passed on benefits; ESG leadership. |

Overall Outlook: Positive with Cautious Optimism. Domestic strength (GST/infra) offsets global woes; expect 8-12% sector volume growth FY26 (India-led). Focus on premium/OHT derisks; monitor US/Europe for upgrades. BKT/Apollo/JK exemplify sector resilience (revenue +6-10% YoY, margins up 100-240bps QoQ).

Press Release

asof: 2025-11-30

Indian Tyres & Rubber Products Sector Analysis

Based on Q2 FY26 (ended Sep 2025) announcements from MRF, CEAT, JK Tyre, TVS Srichakra (Eurogrip), and Tolins Tyres.

The sector demonstrates resilient growth amid softening raw materials and OEM demand, with top players reporting 7-14% YoY revenue growth. Key themes include capacity expansion, international push, sustainability focus, and margin recovery, though seasonal/monsoon pressures persist. Overall, H1 FY26 signals a positive trajectory for FY26, driven by domestic OEM/replacement recovery and exports.

Tailwinds (Positive Drivers)

- Strong Revenue & Profit Momentum: MRF: Consolidated revenue +7% YoY to ₹7,487 Cr, PBT +11% to ₹699 Cr, PAT +12% to ₹526 Cr. CEAT: Consolidated revenue +14.2% YoY to ₹3,773 Cr (+6.9% QoQ), PAT +53% YoY to ₹186 Cr; Standalone +12.2% to ₹3,701 Cr. Attributed to volume growth (OEM double-digit), softening raw materials, and healthy realizations.

- Margin Expansion: CEAT EBITDA margin +240 bps YoY/+259 bps QoQ to 13.5% (standalone 13.7%); MRF benefits from raw material tailwinds. Gross margins improved 350-400 bps YoY across players.

- OEM & Export Strength: MRF notes double-digit OE growth despite monsoons; exports resilient amid tariffs. CEAT: OEM/festive inventory tailwinds; International business recovering.

- Capacity & Strategic Expansions: CEAT’s $225 Mn Camso OHT acquisition (completed Sep 2025) boosts off-highway; JK Tyre’s $100 Mn IFC sustainability-linked loan for PCR/TBR capacity (Banmore/Laksar plants). Tolins new Gujarat depot (Dec 2025) enhances Western India penetration.

- International & Channel Push: Eurogrip showcased at Mexico/Colombo motor shows; Tolins exports to 40+ countries (US breakthrough).

- Policy Support: GST reduction (MRF) positive for H2 replacement demand; sustainability financing (JK Tyre SLL first in sector).

- Dividend/ESG Signals: MRF interim dividend ₹3/share; CEAT/JK ESG awards/recognition.

Headwinds (Challenges)

- Seasonal/Weather Impacts: MRF: Monsoon subdued Q2 sales; temporary GST revision dip in replacement.

- Cost Pressures: CEAT: Employee costs +19.5% YoY (increments); Finance costs +31% YoY (debt for Camso). MRF: Higher provisions/tax.

- Debt Build-Up: CEAT net debt ₹2,944 Cr (D/E 0.64x, up from 0.40x QoQ due to acquisition/dividends).

- Export Headwinds: MRF flags tariff issues; global demand recovery uneven.

- Inventory/Working Capital: CEAT inventories up (negative NWC); capex heavy (~₹423 Cr/Q in CEAT).

Growth Prospects

- Volume-Led Expansion (Double-Digit H2 Outlook): CEAT expects double-digit H2 growth (OEM, exports, premiumisation via Camso). MRF: GST revision, softening RM augur well. Sector poised for 10-15% FY26 growth via OEM (PCV/2W/3W), replacement recovery.

- Premium/Sustainable Segments: PCR/TBR/off-highway focus (JK/CEAT); Eurogrip’s radial premiums (Protorq Extreme). Sustainability tyres (CEAT SecuraDrive CIRCL 90% sustainable materials).

- Geographic Diversification: Gujarat depot (Tolins), Latin America/South Asia (Eurogrip), Mexico/US exports. Capacity ramps to meet EV/OHT demand.

- Domestic Tailwinds: Festive/rural recovery, infrastructure push; RE100/ESG (JK Tyre first tyre firm).

- Projections: H1 FY26 revenue +12% (CEAT/MRF aggregate); full-year EBITDA margins 12-14%; capex sustains 15-20% CAGR.

Key Risks

| Risk Category | Details | Mitigation |

|---|---|---|

| Raw Material Volatility | Rubber/oil price swings (current softening may reverse). | Backward integration (Tolins near rubber sources); hedging. |

| Demand/Seasonal | Monsoon/GST disruptions; weak replacement (urban slowdown). | OEM diversification; H2 policy boosts. |

| Debt/Liquidity | Rising borrowings (CEAT D/E 0.64x; interest coverage 4.9x). | Strong FCF (CEAT op. cash ₹935 Cr H1); low payout ratios. |

| Geopolitical/Exports | Tariffs, global slowdown (US/EU). | Domestic focus (52% replacement in CEAT); new markets (Mexico/Sri Lanka). |

| Competition/Execution | Intense rivalry (Apollo, MRF); capex delays (CEAT ₹1,120 Cr H1 outflow). | Premium tech (198 patents CEAT); sustainability edge. |

| Regulatory/ESG | EPR compliance, emission norms; GST changes. | SBTi commitments (CEAT); SLL structures (JK). |

Summary Outlook: Bullish for FY26 with 12-15% revenue growth potential, margins at 12-13% EBITDA. Tailwinds from OEM/exports/RM relief outweigh headwinds; risks manageable via balance sheet strength (CEAT net worth +5% to ₹4,572 Cr) and strategic moves. Sector benefits from auto recovery, infra, and green financing—watch RM prices and H2 replacement for upside.

Copyright © 2023 SAS Data Analytics Pvt. Ltd. All rights reserved.