Other Electrical Equipment

Industry Metrics

January 13, 2026

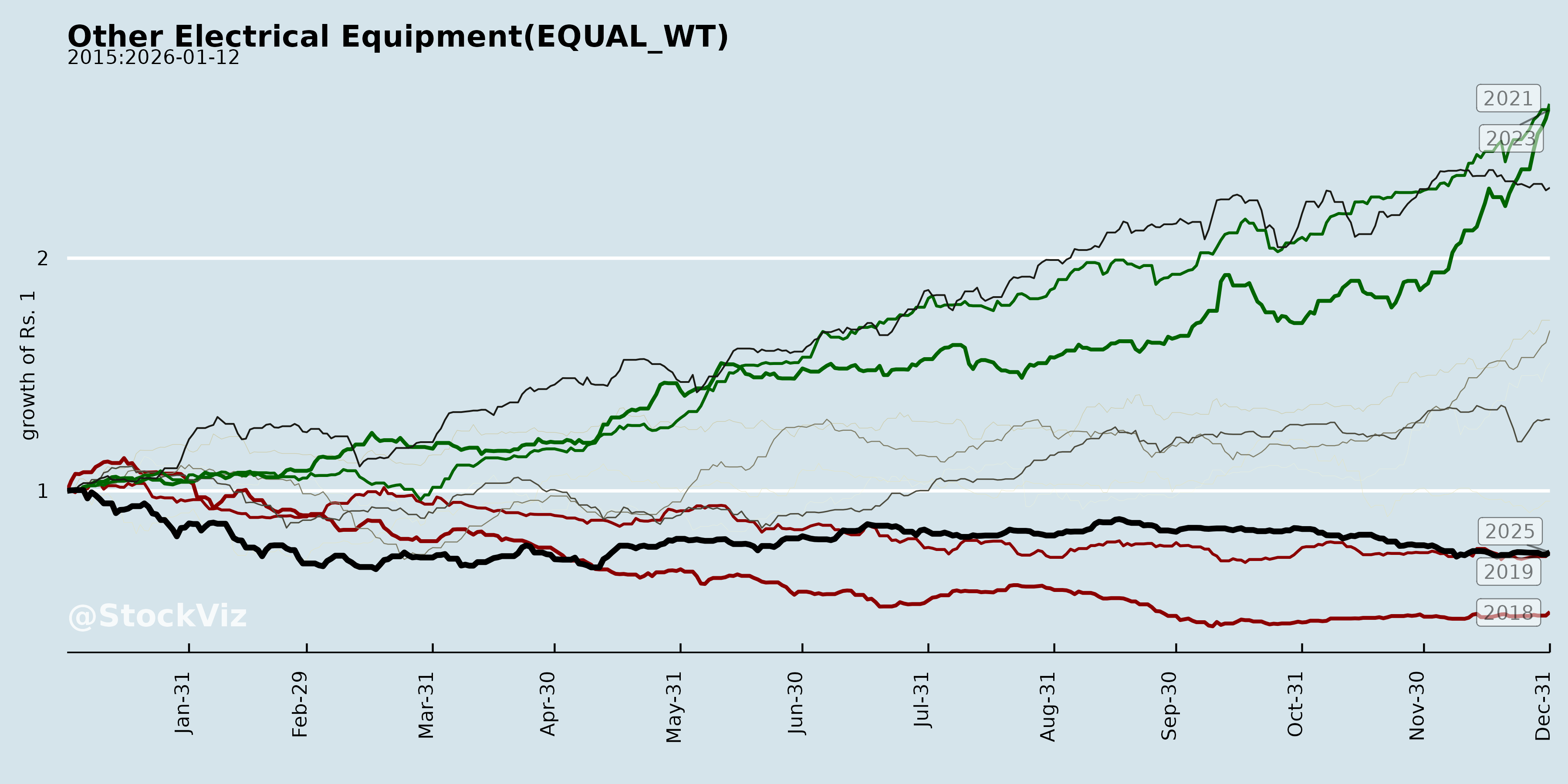

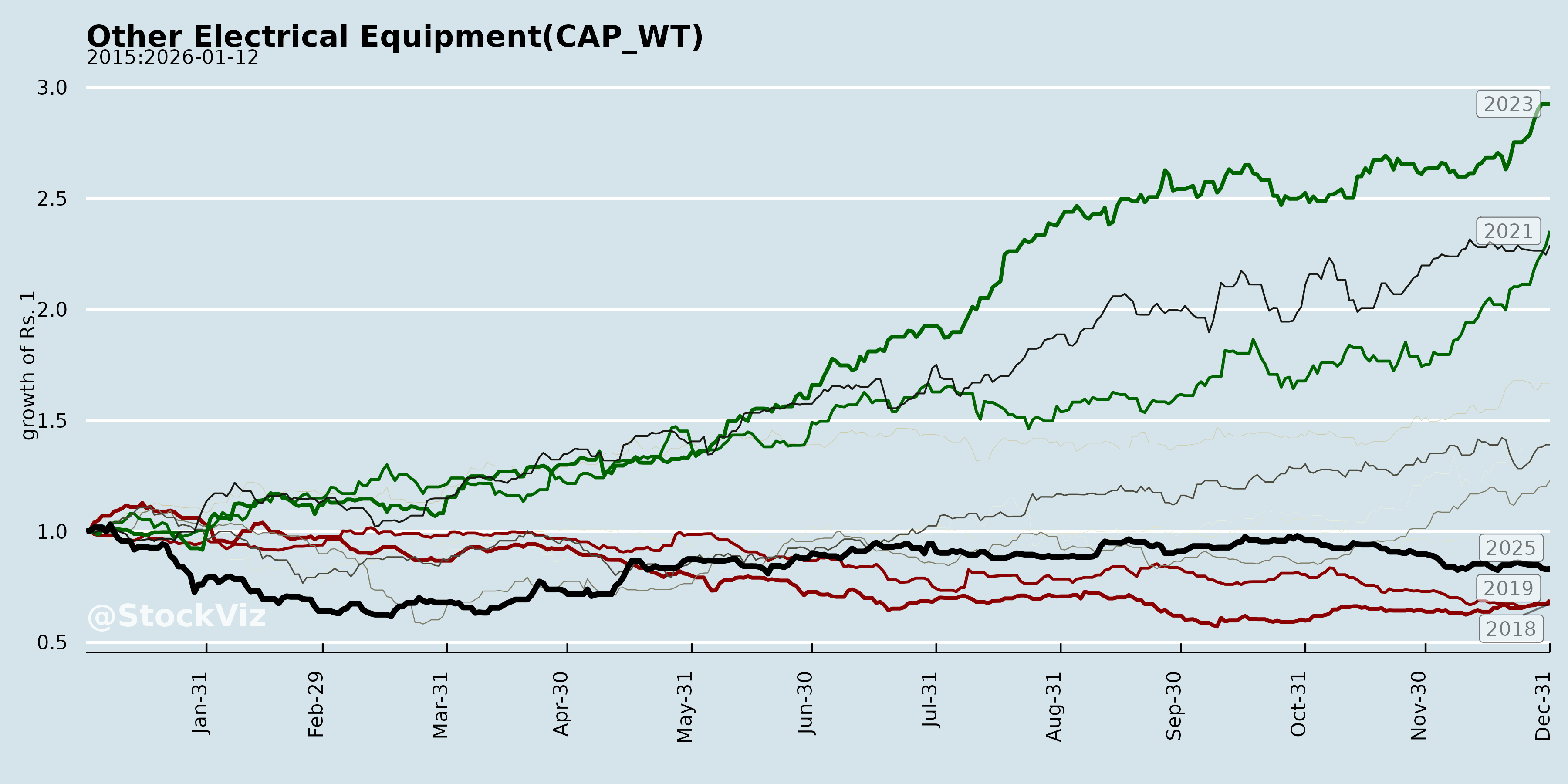

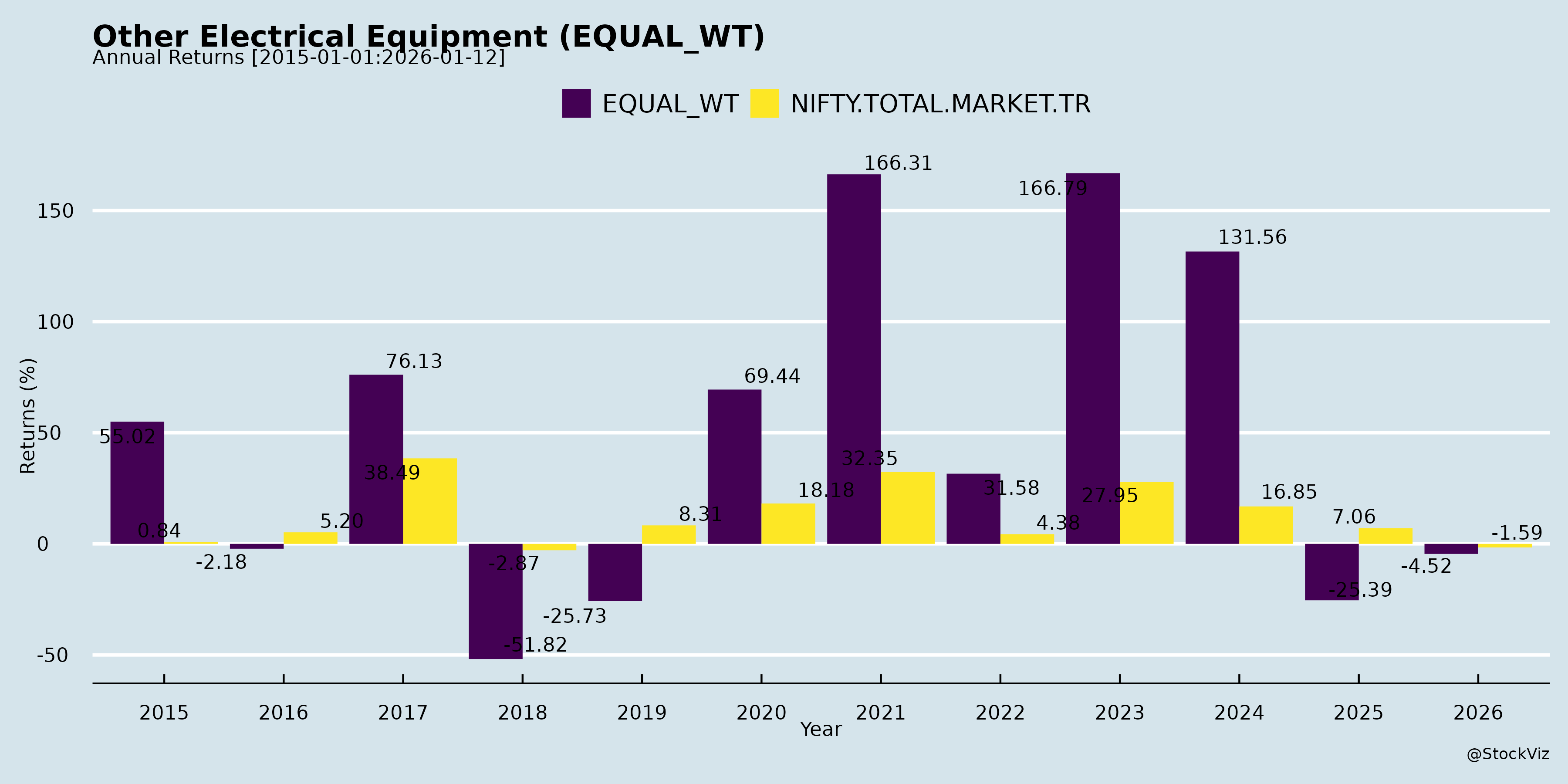

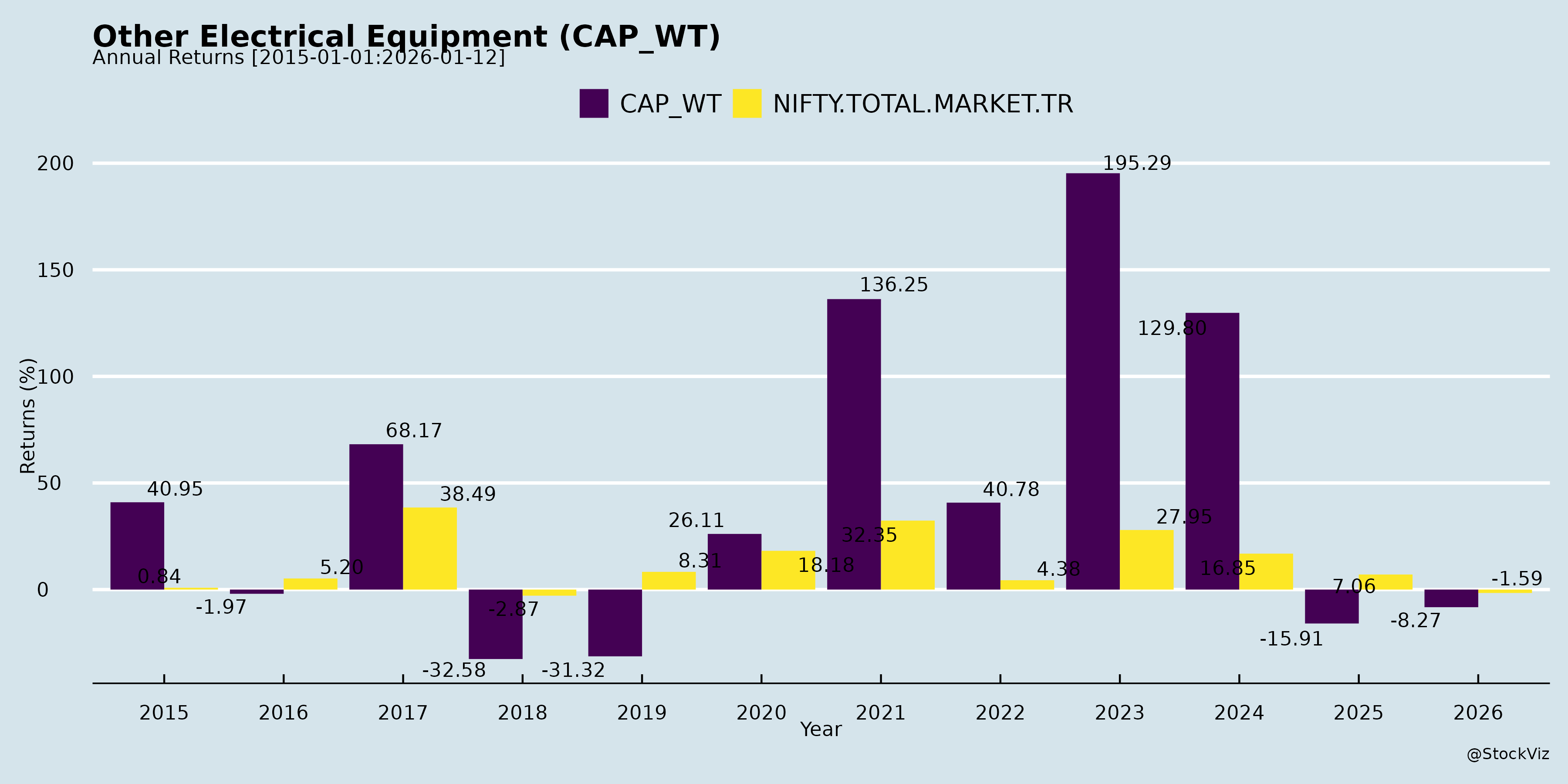

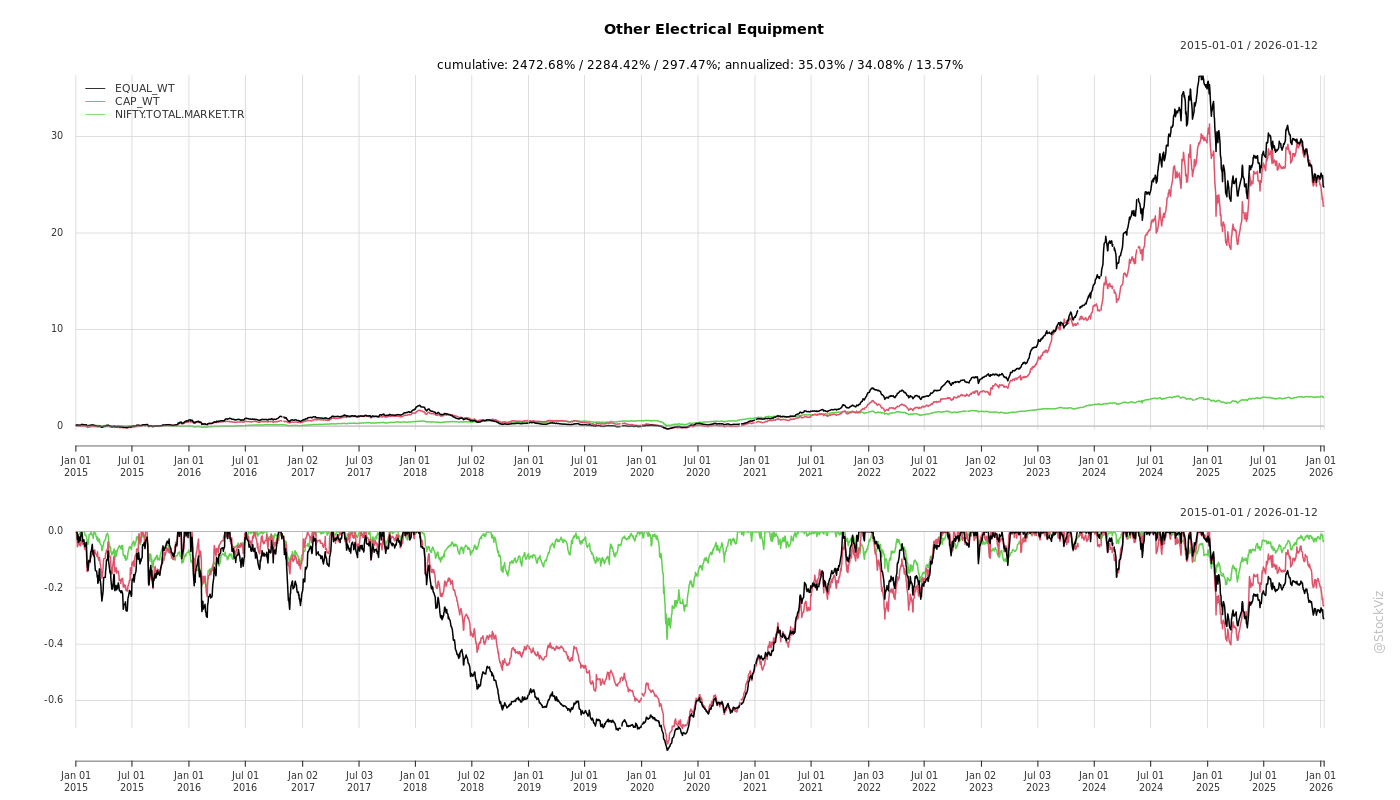

Annual Returns

Cumulative Returns and Drawdowns

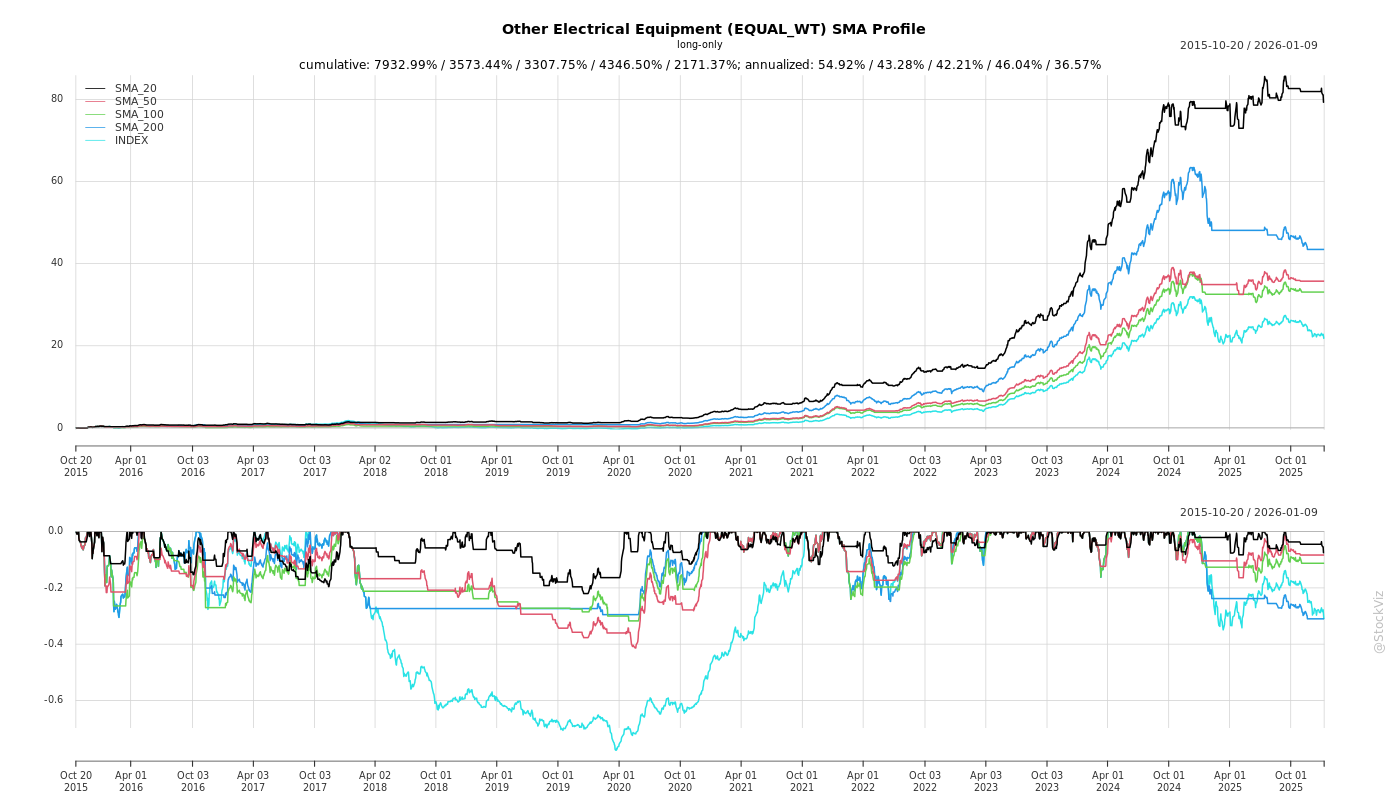

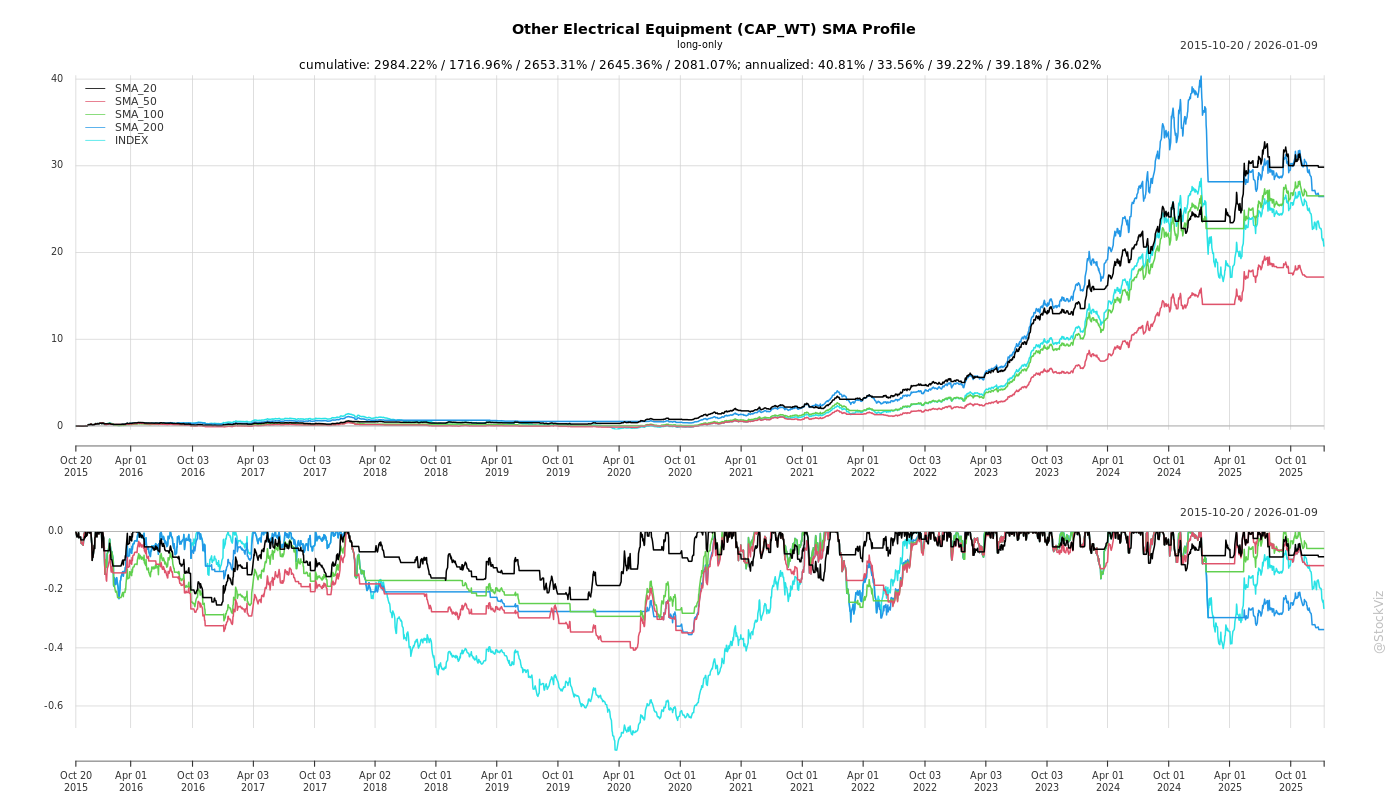

SMA Scenarios

Current Distance from SMA

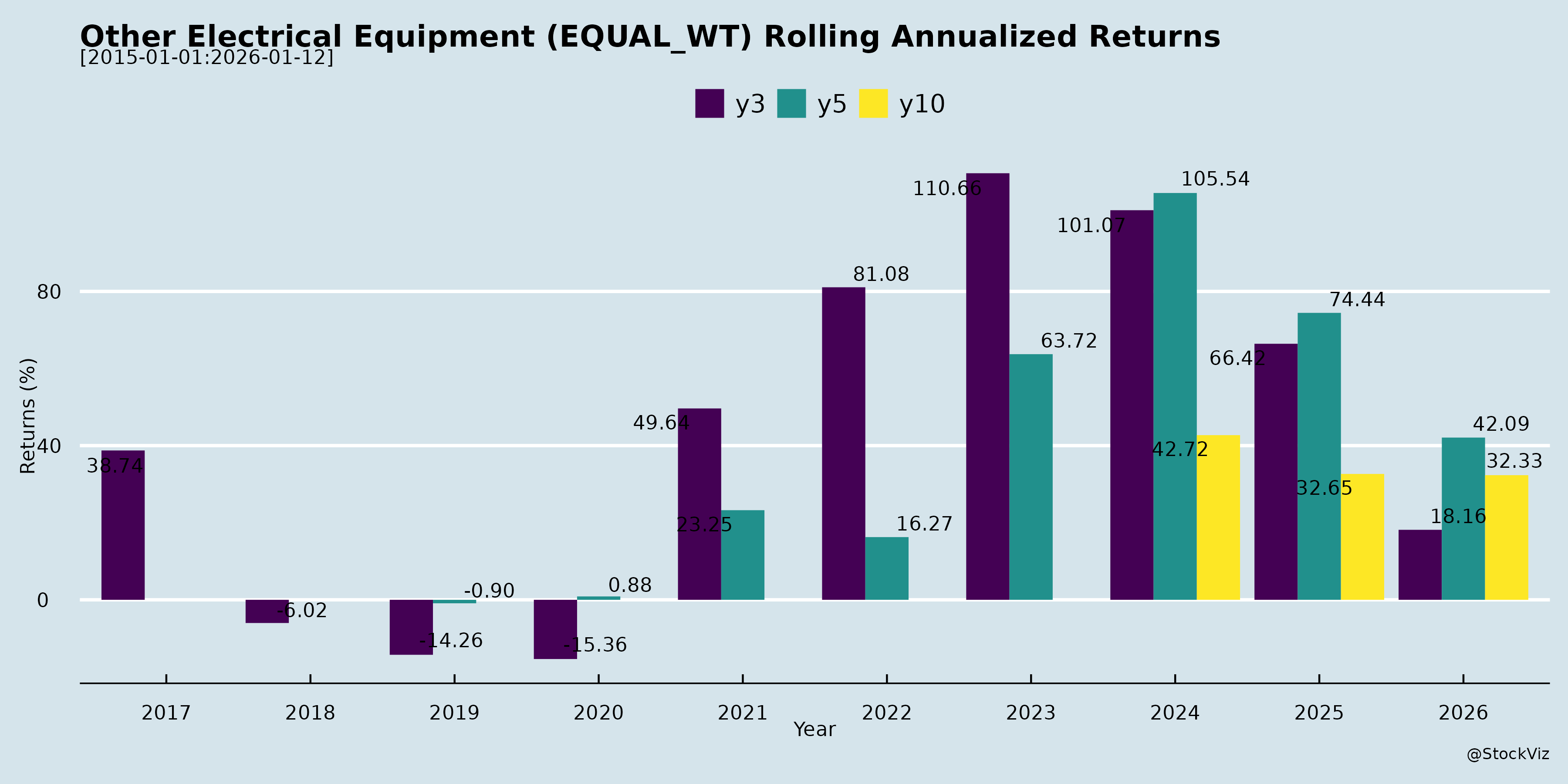

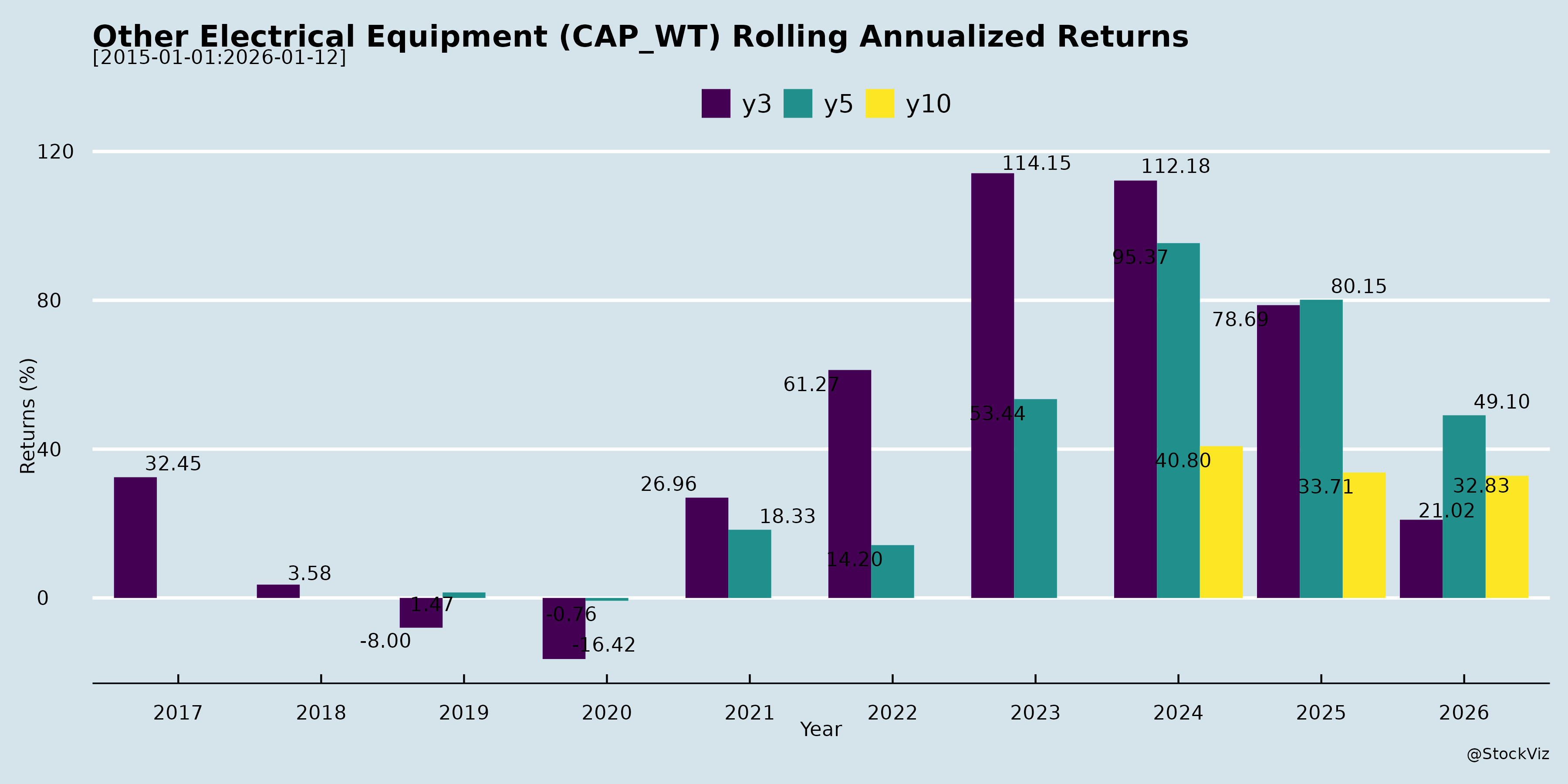

Rolling Returns

Market Cap

EBIT (% of Industry Total)

Revenue (% of Industry Total)

AI Summaries

Analyst

asof: 2025-12-03

Summary Analysis: Indian Other Electrical Equipment Sector

(Based on recent announcements, earnings transcripts, and investor interactions from key players like APAR Industries, Saatvik Green Energy, Waaree Energies, Premier Energies, Vikram Solar, etc. Sector includes conductors, cables, solar modules/cells, inverters, and related equipment. FY26 H1 shows robust growth amid renewables push, but short-term pressures from metals and tariffs.)

Tailwinds (Positive Drivers)

- Renewable Energy Boom: Record 25GW capacity addition in H1 FY26 (21.7GW solar), driven by govt targets (500GW non-fossil by 2030). Policies like PM Surya Ghar, PM-KUSUM, CPSU Scheme-II boost domestic demand for modules, conductors, cables.

- Infrastructure Push: Rs 6.4T transmission plan for 76GW hydro evacuation; substation capacity +74% YoY (44.6k MVA added). Reconductoring (HTLS conductors) gaining traction as cost-effective alternative to new lines (+150-200% throughput).

- Export Momentum: US revenues up 121-145% YoY for cables/conductors (data centers, wind/solar). Exports = 34-43% of revenues for APAR/Saatvik; new markets (Europe, LatAm, Canada).

- Premiumization & Integration: Premium products (45% mix in conductors) yield higher EBITDA/ton (Rs 39-41k vs guidance Rs 30k). Backward integration (cells/modules) enhances margins (3-4% EBITDA uplift); capex scaling capacities to 8-10GW+.

- Financial Strength: H1 revenue +25-133% YoY (APAR: Rs 10.8k Cr; Saatvik: Rs 1.7k Cr); EBITDA margins 9-18%; order books healthy (APAR: Rs 9k Cr; Saatvik: 4.7GW, 97% capacity booked).

- Demand Diversification: Data centers, EVs, green H2, wind (strong Q3-Q4 pick-up); B2C entry (inverters, pumps).

Headwinds (Challenges)

- Commodity Volatility: Al prices ~$2,900/t, Cu ~$11,200/t (all-time highs) → global/US order hold-ups (customers wait for correction); impacts solar cables, conductors.

- US Tariff Disruptions: Section 232 (50% on Al/Cu/Steel, uniform globally) + reciprocal duties (India: 54% non-metal) caused 2-month order freeze (Aug-Sep); Q3 revenue pressure (execution lag to Q4); partial absorption by customers.

- Execution Delays: Transmission lines -27% YoY (only 39% of target); monsoon/rains slowed Q2 dispatches (Saatvik); right-of-way issues, milestone billing norms.

- GST Cut Impact: Module GST 12%→5% (Sep 2025) deferred Q2 invoicing (18-day halt); logistics shortages amplified.

- Seasonality: Q2 slowest (monsoon, festivals); domestic power cable work halts.

Growth Prospects

- Medium-Term (FY26-28): 25-30%+ revenue CAGR feasible; renewables/data centers to drive 20%+ domestic growth. Exports to rebound Q4 FY26 (US IRA incentives deadline: Jul 2026-Dec 2027). Reconductoring, 1100kV UHV lines, hydro evacuation unlock Rs 7k+ Cr order potential (APAR).

- Capacity Ramp: Ongoing capex (APAR: Rs 1.3k Cr FY26; Saatvik: Odisha 4.8GW modules/4GW cells by Q4 FY26) supports 25%+ YoY growth. Premium/HTLS conductors, TOPCon/N-type cells, BESS/EPC diversification.

- EBITDA Outlook: Sustainable 10-18% (conductors Rs 30k/ton; cables 10-12%; modules ~16%). H2 FY26 rebound expected (80% of FY25 H2 revenues).

- Market Size: Solar pumps/inverters scaling (Saatvik: Rs 9 Cr H1 FY26 → Rs 50 Cr FY27); BESS/RTC projects emerging.

Key Risks

- High (Near-Term): Metal price spikes/forex volatility eroding orders/margins (hedged books mitigate but delay inflows). US trade deal delays → sustained tariff hit (30-50% non-metal exposure).

- Medium: Capex execution (Odisha timelines); overcapacity in Mono PERC → tech shift (TOPCon) favors integrated players.

- Low-Medium: Competition from new entrants (e.g., Reliance rumors); policy reversals (ALMM, PLI); weather/ROW delays.

- Mitigants: Strong balance sheets (D/E 0.44x), repeat marquee clients, 9-12 month visibility.

Overall Outlook: Sector poised for 20-25% FY26 growth (H2 acceleration post-Q3 dip). Fundamentals intact (renewables/grid capex), but Q3 softness from metals/tariffs. Integrated players with premium focus (e.g., APAR, Saatvik) best positioned. Monitor US trade talks, metal prices.

Financial

asof: 2025-12-03

Analysis of Indian Other Electrical Equipment Sector

The provided documents encompass Q3FY25 (ended Dec 31, 2024) financial results, limited review reports, and disclosures from 10+ listed companies in the “Other Electrical Equipment” sector (e.g., motors, transformers, cables, solar cells/modules, EMS, measuring instruments, EV infra). Key players include Diamond Power (cables), Websol (solar cells), Bharat Bijlee (transformers/motors), Ram Ratna (wires), Servotech (renewables/EV), Rishabh Instruments (meters), Salzer (installation products), Kirloskar Electric (generators/motors), and others like Avalon (EMS) and Premier Energies (solar).

Overall Sector Snapshot: - Revenue Growth: Strong QoQ/Y-o-Y upticks (e.g., Diamond Power +413% YoY; Websol +28,000% YoY; Servotech +316% YoY), driven by renewables/infra demand. 9M FY25 revenues robust across most (e.g., Ram Ratna ₹2,720 Cr). - Profitability: Turnarounds evident (Websol PAT ₹106 Cr vs prior loss; Salzer PAT ₹54 Cr). EBITDA margins 20-46% in leaders. - Market Context: Aligned with India’s renewable push (solar capacity targets), PLI schemes, and infra capex. Single-segment focus dominant.

Headwinds (Challenges)

- High Debt & Finance Costs: Elevated (e.g., Kirloskar ₹520L Q3; Salzer ₹105 Cr 9M; Ram Ratna ₹38 Cr Q3), straining margins amid rising rates.

- Audit Qualifications/Concerns: Persistent issues like Diamond Power’s PPE register unreconciled/depreciation (20% provisional rate); Kirloskar ECL provisions on subsidiaries (₹84 Cr); Rishabh forex losses.

- Compliance/Technical Glitches: XBRL errors (Premier, Salzer), delays in filings/clarifications.

- Margin Pressures: Raw material volatility (copper prices), forex translation losses (Rishabh OCI -₹103L Q3).

- Legacy Issues: Kirloskar net worth erosion (going concern reliance on asset sales); ED attachments (Diamond).

Tailwinds (Supportive Factors)

- Renewable Energy Boom: Solar/EV tailwinds strong—Websol (₹402 Cr 9M rev, Phase II/III expansions); Servotech (EV infra); Premier/Salzer (EV charges/solar).

- Order Book Strength: Fully booked FY25 capacities (Websol); export/diversified orders (Ram Ratna ₹116 Cr to US/UK/Africa; Bharat Bijlee steady).

- Capacity Expansions: Websol (1.2 GW cells); Diamond (post-NCLT revival); Rishabh acquisitions (Microsys).

- Policy Support: Make in India, PLI for solar/EV; falling interest rates aiding capex.

- Turnaround Momentum: Profit flips (Diamond PAT ₹627L Q3; Websol EBITDA 46%).

Growth Prospects

- High: Renewables/infra demand (solar cells/modules, EV chargers, cables/transformers). Exports rising (20-30% rev mix). Capex cycles (Websol Phase III greenfield; Servotech subsidiaries).

- Projections: 15-25% sector CAGR FY25-27 (renewables 50%+ of growth); order backlogs ensure visibility (e.g., Websol FY26 booked).

- Opportunities: PLI/ALMM compliance boosts domestic mfg; EMS/power equip tie-ups (Avalon); asset monetization (Kirloskar Hubballi land ₹96 Cr potential).

Key Risks

| Risk Category | Details | Impacted Cos. | Mitigation |

|---|---|---|---|

| Operational/Execution | PPE reconciliation delays; capex overruns (Diamond, Kirloskar). | Diamond, Kirloskar | Independent agencies; NCLT protections. |

| Financial | Debt (2-3x EBITDA); ECL on dues (subsidiaries ₹110 Cr). | Kirloskar, Salzer | Asset sales; bank tie-ups. |

| Regulatory/Legal | ED/tax probes (Diamond ED attachment; Kirloskar resale tax ₹52 Cr SLP). | Diamond, Kirloskar | Court petitions; IBC S.32 protections. |

| Market | Copper price volatility; forex (imports/exports). | Ram Ratna, Rishabh | Hedging; diversification. |

| Going Concern | Net worth erosion; overdue creditors. | Kirloskar | Restructuring; monetization. |

Summary

The sector exhibits strong tailwinds from renewables/infra capex, with revenue/PAT surges (avg. 20-50% YoY) and robust orders signaling 15-25% FY26 growth. Leaders like Websol/Ram Ratna/Bharat Bijlee are scaling via expansions/exports. However, headwinds from debt, audit qualifiers, and legacy issues (e.g., Kirloskar erosion) temper optimism. Growth prospects hinge on policy continuity (solar/EV PLI), but key risks include execution delays, legal overhangs, and commodity volatility. Overall, bullish medium-term (renewables-led), but monitor debt deleveraging and audit resolutions for sustained momentum. Investors favor pure-plays (solar/cables) over legacy-heavy firms.

General

asof: 2025-12-03

Analysis of Indian Other Electrical Equipment Sector

The “Other Electrical Equipment” sector in India encompasses solar modules/inverters, power cables/conductors, transmission infrastructure, EV-related equipment, and ancillary power solutions. Insights are derived from recent announcements (Nov 2025) by key players like Waaree Energies, Premier Energies, APAR Industries, Vikram Solar, DICABS, Saatvik Green Energy, Ravindra Energy, Ram Ratna Wires, Genus Power, and others. The sector benefits from India’s renewable push (e.g., solar capacity targets, PLI schemes) but faces execution and regulatory hurdles.

Tailwinds (Supportive Factors)

- Renewable Energy Boom: Strong government schemes (e.g., MSKVY Phases 1-3 by MSEDCL) driving solar EPC and generation. Ravindra Energy commissioned 187 MW (100 MW AC under MSKVY Phase 1) with 182 MW under development. Vikram Solar expanded to 9.5 GW modules (+6 GW underway). Premier Energies commissioned 1.4 GW TOPCon modules.

- Capacity Expansions & Order Books: DICABS reported ₹301 Cr Q1 FY26 revenue, ₹2,555 Cr order book (AL-59 conductors dominant), and expansions in EHV cables/conductors (up to 64,800 CKM cables, 100,000 MTPA rods). Ram Ratna Wires completed merger, boosting capital to ₹27 Cr.

- Product Diversification: New launches like Saatvik’s UDAY on-grid inverters (1.1-50 kW), APAR’s dark fiber monetization (PPP with KPTCL for 6,100 km OPGW), Vikram’s energy storage arm (CEO appointment), and DICABS ReNEW range for solar/EV.

- EV & Infrastructure Momentum: Ravindra’s EIM sold 91 e-tractors (185 order book), launched swap stations (JNPA Port, NH-44); LOI from major cement firm for 45 e-tractors.

- Financial Resilience: Strong revenues (Ravindra standalone PAT ₹56 Cr H1 FY26; DICABS 10% QoQ growth); approvals (NABL, ISO) and client wins (Adani, JSW, NTPC).

Headwinds (Challenges)

- Regulatory Scrutiny: Waaree Energies faced IT investigation (resolved); Servotech fined ₹1.32L by NSE for delayed Reg 17(1A) compliance on 75+ age ID appointment.

- Execution Delays: Projects under construction (Ravindra 45 MW, DICABS mills/phases) with SCODs in FY26-27; Genus ESOP trust formation amid compliance focus.

- Profitability Pressures: Ravindra EIM reported H1 loss (₹1.7 Cr PAT); high debt (consolidated ₹389 Cr vs. ₹192 Cr prior year).

- Market/Operational: Dependence on tenders (Ravindra L1 in HESCOM bid); commodity volatility (aluminum rods for conductors).

Growth Prospects

- Solar & RE Ecosystem: 500 GW RE target by 2030; backward integration (cells, modules, inverters, storage). Vikram/Premier/DICABS expansions position for 15-20% CAGR; EPC/third-party (Ravindra 6 MW).

- Transmission Infra: EHV cables/HTLS conductors demand (DICABS AL-59 shortfall: 1M MT demand vs. 500K MT supply); APAR’s OPGW PPP for recurring revenue.

- EV Transition: Battery swapping for heavy vehicles (Ravindra’s 50K MT/month cement LOI); aligns with FAME/PLI.

- Exports & Premiumization: Tier-1 status (Vikram), global demand; DICABS Vision 2030 targets top-3 market share.

- Projections: Sector revenue potential ₹50,000+ Cr by FY30 (cables/conductors ~₹5,000 Cr max capacity value); 15-20% CAGR driven by grid upgrades, RE evacuation.

Key Risks

| Risk Category | Description | Mitigation/Examples |

|---|---|---|

| Regulatory/Compliance | Tax raids (Waaree), SEBI fines (Servotech), tender dependencies. | Resolutions filed; proactive filings (e.g., Genus ESOP trust). |

| Execution | Delays in commissioning (Ravindra MSKVY Phase 2/3, DICABS mills). | Phased rollouts; strong order pipelines. |

| Financial | Rising debt (Ravindra ₹389 Cr); losses in new segments (EIM). | Networth growth (₹394-408 Cr); EPC margins. |

| Market/Competition | Import reliance (AL-59), tender competition; commodity prices. | Backward integration (DICABS rods); PLI benefits. |

| Geopolitical/External | Supply chain (solar cells), policy shifts. | Domestic focus; diversified clients (Adani, Powergrid). |

Overall Outlook: Bullish with 15-25% sector growth FY26-30, fueled by RE/transmission capex (₹2-3L Cr). Tailwinds dominate, but monitor debt and regulatory risks. Leaders like DICABS/Ravindra show robust pipelines; focus on execution key to unlocking value.

Investor

asof: 2025-12-03

Summary Analysis: Indian Other Electrical Equipment Sector

(Based on announcements from key players like APAR Industries, Saatvik Green Energy, Waaree Energies, Premier Energies, Vikram Solar, Websol Energy, etc., covering Q2/H1 FY26 earnings, analyst meets, capacity updates, and investor interactions. Sector includes solar modules/cells/inverters, conductors, cables, transmission equipment, and renewables EPC.)

Tailwinds (Positive Drivers)

- Robust Renewables Momentum: Record 25 GW capacity addition in H1 FY26 (21.7 GW solar), driven by govt. schemes (PM Surya Ghar, PM-KUSUM, CPSU-II). Steady solar/wind demand boosts modules, cables, conductors.

- Domestic Infrastructure Push: Substation capacity up 74% YoY (44.6k MVA); hydro/transmission plans (208 projects, Rs. 6.4 Tn investment); reconductoring/HTLS demand for grid upgrades/data centers.

- Export Resilience: US revenues surged (e.g., APAR conductors +145%, cables +128% in H1); exports 22-43% of revenues. Diversification to Europe/LatAm/Canada.

- Premium Mix & Margins: APAR EBITDA/ton at Rs. 39.6k (conductors), 10-12% (cables); Saatvik 18% EBITDA margins. High-efficiency tech (N-TOPCon) aids pricing.

- Order Visibility: Healthy books (APAR: Rs. 7.2k Cr conductors + Rs. 1.8k Cr cables; Saatvik: 4.68 GW). Repeat orders from IPPs/EPCs.

- Policy Support: ALMM, PLI incentives; GST cut (12%→5% modules) lowers project costs, boosting volumes long-term.

Headwinds (Challenges)

- Metal Price Spikes: Al at $2,900/ton (+ve pressure), Cu at $11,200-12,000/ton; customers delaying orders, impacting Q3 inflows (global/US/domestic).

- US Tariff Uncertainty: Section 232 (50% on Al/Cu/steel); reciprocal duties (India 54% vs. ME/UK 10%). Q2 order halt (Aug-Sep); lower margins passed partially to customers.

- Execution Delays: Monsoon/rains (Saatvik sales deferral); RoW issues; transmission lines down 27% YoY (2.4k ckm). Milestone billing slows domestic offtake.

- Seasonal/Monsoon Impact: Q2 slowdown (e.g., Saatvik revenue -16% QoQ; APAR cables domestic flat).

- Overhead Pressures: Forex, IPO costs, working capital (APAR/Saatvik noted Rs. 22 Cr hit).

Growth Prospects

- Capacity Ramp-Up: Saatvik (8.8 GW modules + 4.8 GW cells by FY27); APAR (conductors/cables expansions); Waaree/Vikram plant visits signal solar scaling. Capex Rs. 1-1.3k Cr FY26 (e.g., APAR Rs. 800 Cr cables → Rs. 10k Cr revenue potential).

- Sectoral Tailwinds: Renewables to 500 GW by 2030 (CAGR 5-6% energy demand); data centers/wind corridors/reconductoring (cheaper/faster than new lines, +150-200% throughput).

- Backward Integration: Cells/inverters/BESS entry (Saatvik Uday inverters, BESS pilots); premium conductors (45% mix).

- Revenue Guidance: APAR H1 revenue +25% (Rs. 10.8k Cr); Saatvik +133% (Rs. 1.7k Cr). FY26 growth 25-80% implied; EBITDA sustainable 16-18%.

- US Incentives: IRA deadlines (construction by Jul’26, ops by Dec’27) to spur Q4 orders despite tariffs.

- H2 Pickup: Post-monsoon execution; Q3 pressure but Q4 rebound (APAR/Saatvik consensus).

| Metric | H1 FY26 Highlights (Select Cos.) |

|---|---|

| Revenue Growth | APAR +25%; Saatvik +133% |

| EBITDA Margins | APAR 9.2%; Saatvik 18% |

| Exports Mix | APAR 35%; Cables/Conductors 22-42% |

| Order Book | Strong (e.g., Saatvik 97% capacity booked) |

Key Risks

- Commodity/Tariff Volatility: Metal prices/US duties (fluid; no trade deal yet) → Q3 topline/margin pressure (APAR expects US billing dip).

- Execution/Capex Delays: Odisha/expansions (Saatvik Q4 target); RoW/transmission shortfalls (39% of plan).

- Competition/Overcapacity: Solar module/cell additions; new entrants (e.g., rumors Jio); shift to N-TOPCon obsolesces PERC.

- Demand Deferral: GST/metal waits; US incentives non-extension under new admin.

- Geopolitical/External: Forex, supply chain (ME delays in oils); bankability for new capacities.

- Margin Compression: Hedged metals but non-metal duties; overheads (20-50 bps risk).

Overall Outlook: Sector fundamentals strong (renewables/grid demand), with H1 FY26 validating growth (20-100%+ YoY). Short-term Q3 hiccups (metals/tariffs) but H2/FY27 rebound via capex/orders. Bullish medium-term (2-3 yrs) on policy/backward integration; monitor US tariffs/metals closely. Active investor engagement signals confidence.

Meeting

asof: 2025-12-03

Summary Analysis: Indian Other Electrical Equipment Sector (Solar-Focused EMS, Modules, EPC)

The sector, exemplified by companies like Waaree Energies, Saatvik Green Energy, Waaree RTL, Genus Power, Vikram Solar, Emmvee, Avalon Technologies, etc., demonstrates robust H1 FY26 performance amid India’s solar push. Aggregate revenue growth ~2-3x YoY for leaders (e.g., Waaree ~₹8k Cr H1 revenue; Saatvik ~₹17k Cr), driven by EPC/module demand. PAT margins 15-25% reflect operational leverage. Key insights below:

Tailwinds (Positive Drivers)

- Explosive Demand & Policy Support: Strong order books (e.g., Genus ₹28.8k Cr; Waaree RTL EPC/power sales up 75% YoY). PLI schemes, 500 GW RE target, SPV pumps boost EPC/module volumes.

- Capacity Ramp-Up: IPO proceeds (Waaree ₹3.6k Cr; Saatvik ₹7k Cr fresh issue) funding GW-scale expansions (e.g., Waaree 6GW Odisha→Gujarat shift; Saatvik 4.5GW Odisha).

- Export Resilience: US/Europe demand; tax credits (e.g., Waaree Solar Americas 45X credits ₹162 Cr).

- Financial Strength: High cash flows (Waaree RTL ₹8.4k Cr ops cash); dividends (Waaree ₹2/share); ESOP/QIP approvals for talent/capital.

- Diversification: EPC (Waaree RTL 75% rev), metering (Genus), EMS (Avalon up 25% YoY).

Headwinds (Challenges)

- Working Capital Strain: Inventory surges (Waaree standalone +₹3.7k Cr; Genus -₹59k Cr ops cash drag); receivables up (Waaree RTL +₹11k Cr).

- Rising Costs: Finance costs 2-5% rev (debt for capex); employee expenses up 50-100% YoY amid expansion.

- Margin Pressure: Raw material volatility (polysilicon implied); forex losses (Saatvik ₹78 Cr).

- Execution Delays: Capex budgets approved (Waaree RTL 75 MWp plants); but Odisha→Gujarat shifts add uncertainty.

Growth Prospects

- Multi-Year Boom: 20-30% CAGR FY26-28; RE capex ₹10L Cr+ via PLI/500GW. Leaders targeting 10-20GW modules (Waaree, Saatvik).

- Vertical Integration: Ingot-wafer-module-EPC (Waaree, Saatvik); US presence for IRA credits.

- Exports/EPC: 50%+ rev potential; AMISP/metering (Genus ₹26k Cr JV orders).

- Fundraises: QIPs (DICABS ₹1k Cr); ESOPs for retention.

- Projections: H2 FY26 rev +50-100% YoY; EBITDA margins 20-25% on scale.

Key Risks

- Trade/Geopolitical: US CBP probes (Waaree exports since 2021; no adjustments yet, but duties possible).

- Execution/Capex: Delays in GW plants (e.g., Saatvik Odisha); ₹5-10k Cr unutilized IPO funds.

- Debt/Liquidity: Borrowings up (Saatvik ₹5k+ Cr current); high capex needs.

- Competition/Imports: China dumping; margin erosion if PLI incentives lapse.

- Regulatory: ED searches (Genus); demergers (Genus SID); forex volatility.

- Macro: Interest rates, raw mat inflation; monsoon/RE tenders delays.

Overall Outlook: Bullish (Buy/Hold) on scale leaders (Waaree, Saatvik); monitor US risks, capex execution. Sector P/E ~40x FY26E; 20-40% upside on 500GW trajectory.

Press Release

asof: 2025-12-03

Summary Analysis: Indian Other Electrical Equipment Sector

(Based on Q1/Q2 FY26 financials/press releases from key players: Waaree Energies, Premier Energies, APAR Industries, Emmvee Photovoltaic Power, Waaree Renewable Tech, Genus Power, Vikram Solar, Diamond Power Infra, Avalon Technologies, Saatvik Green Energy, Websol Energy, Ram Ratna Wires. Sector focus: Solar PV (modules/cells/EPC), cables/conductors/oils, smart metering, EMS.)

The sector exhibits robust momentum driven by India’s renewable energy transition (256 GW RE capacity as of Sep’25, solar at 127 GW), grid modernization, and policy tailwinds. Aggregate revenue growth across sampled firms: ~50-200% YoY in H1 FY26, with EBITDA/PAT margins expanding (e.g., 9-25%). Order books signal multi-year visibility (e.g., Waaree 25 GW/₹49k Cr; Genus ₹28.8k Cr; Saatvik 4.68 GW).

Tailwinds (Key Positive Drivers)

- Policy & Demand Surge: Strong govt push (PLI, DCR, Make in India, RDSS smart metering). Solar EPC/mfg booming toward 500 GW RE target by 2030. E.g., Waaree/Saatvik/Emmvee report 30-193% YoY revenue growth from module/EPC execution.

- Capacity Expansion & Tech Upgrades: Aggressive capex (e.g., Waaree +4.8 GW cells; Vikram Solar 9.5 GW modules; Saatvik Odisha 8.8 GW integrated; Premier G12R TOPCon). Automation/NABL labs (Diamond Power) boost efficiency/quality.

- Order Book Strength & Exports: Robust pipelines (Waaree 27+ GW bidding; APAR ₹7k Cr conductors). US exports up 100-145% YoY (APAR, Waaree Solar Americas).

- Margin Expansion: EBITDA margins 9-25% (up 200-800 bps YoY) via scale, premium products (TOPCon/HJT), cost focus. E.g., Genus 21% EBITDA; Emmvee PAT 7x YoY.

- Diversification: Inverters/BESS (Waaree), smart metering (Genus), EMS semis/rail (Avalon), copper tubes (Ram Ratna).

Headwinds (Key Challenges)

- US Tariff Uncertainty: Fluid policies impacting exports (APAR notes “tactical decisions” needed; 30-40% export mix).

- High Capex & Debt: Debt/Equity improving (Saatvik 0.44x) but expansions strain (e.g., Waaree ₹2.8k Cr capex). Working capital pressure in EPC/metering.

- Commodity Volatility: Copper prices implicit headwind for wires/cables (APAR/Ram Ratna); inventory changes noted.

- Competition & Imports: Chinese dumping risk; domestic intensity in solar (capacity > demand short-term).

- Execution Delays: Large projects (EPC/mfg ramps) vulnerable to supply chain/logistics.

Growth Prospects (High Potential)

- Solar Dominance: 100+ GW pipelines; backward integration (Websol-Linton MoU for ingots/wafers). H1 FY26 trends: 100-190% YoY growth sustainable into FY26 (Waaree EBITDA guidance ₹75-76k Cr).

- Metering/Grid: Genus-like players to benefit from 25 Cr+ smart meters; APAR conductors/oils tied to RE/grid augmentation.

- Exports & Value-Add: US/EU demand; premium tech (TOPCon/G12R) yields higher margins. EMS (Avalon +49% H1) expands to semis/rail.

- Projections: Sector revenue CAGR 25-40% FY26-28; EBITDA margins 12-20% via scale. Total addressable market: ₹5-10 lakh Cr (RE + grid + metering).

Key Risks (Moderate-High; Monitor Closely)

| Risk Category | Description | Mitigation from Firms |

|---|---|---|

| Policy/Geopolitical | Tariff hikes (US), subsidy cuts, PLI delays. | Diversification (domestic 60-80% mix); Odisha/Gujarat shifts (Waaree). |

| Execution/Operational | Project delays, capex overruns (Odisha Phase I). | Strong order books; automation (Vikram/Diamond). |

| Financial | Debt rise (0.4-1.4x D/E), forex/commodity volatility. | IPO proceeds (Emmvee ₹2.9k Cr debt repayment); cost controls. |

| Market/Competition | China imports, oversupply in modules. | DCR compliance; tech edge (TOPCon). |

| Macro | Slowdown in RE tenders, monsoon impacts. | Multi-year visibility; EPC annuity (WaareeRTL 3.48 GW). |

Overall Outlook: Bullish (Buy/Hold). Tailwinds >> headwinds; growth prospects intact amid RE boom. Near-term volatility from tariffs/capex, but 20-30% EPS CAGR feasible. Investors: Favor integrated players (Waaree/APAR) with order book/debt discipline. Sector PE likely 30-50x FY26E on 25%+ growth.

Data as of Oct-Dec 2025 filings; forward-looking based on guidance.

Copyright © 2023 SAS Data Analytics Pvt. Ltd. All rights reserved.