Industrial Products

Industry Metrics

January 13, 2026

Annual Returns

Cumulative Returns and Drawdowns

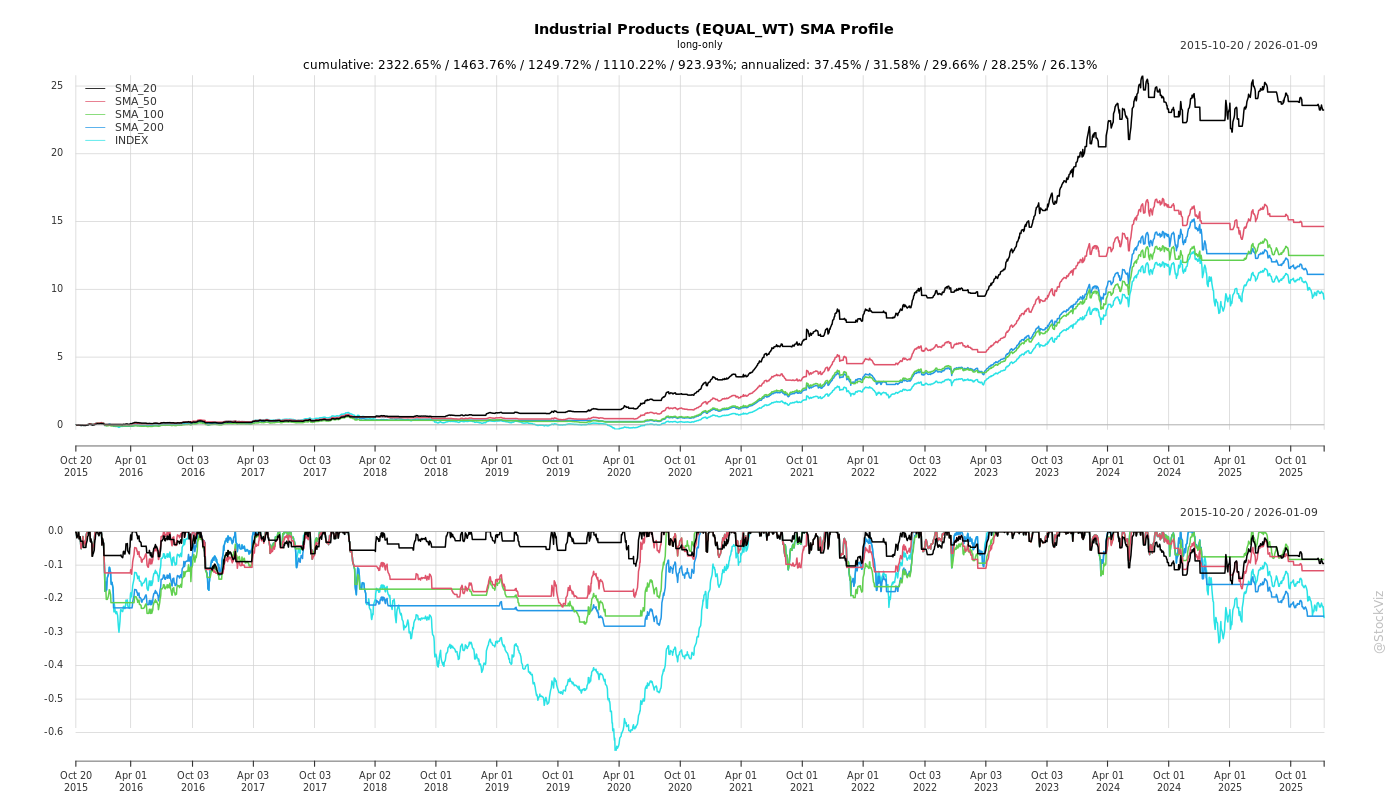

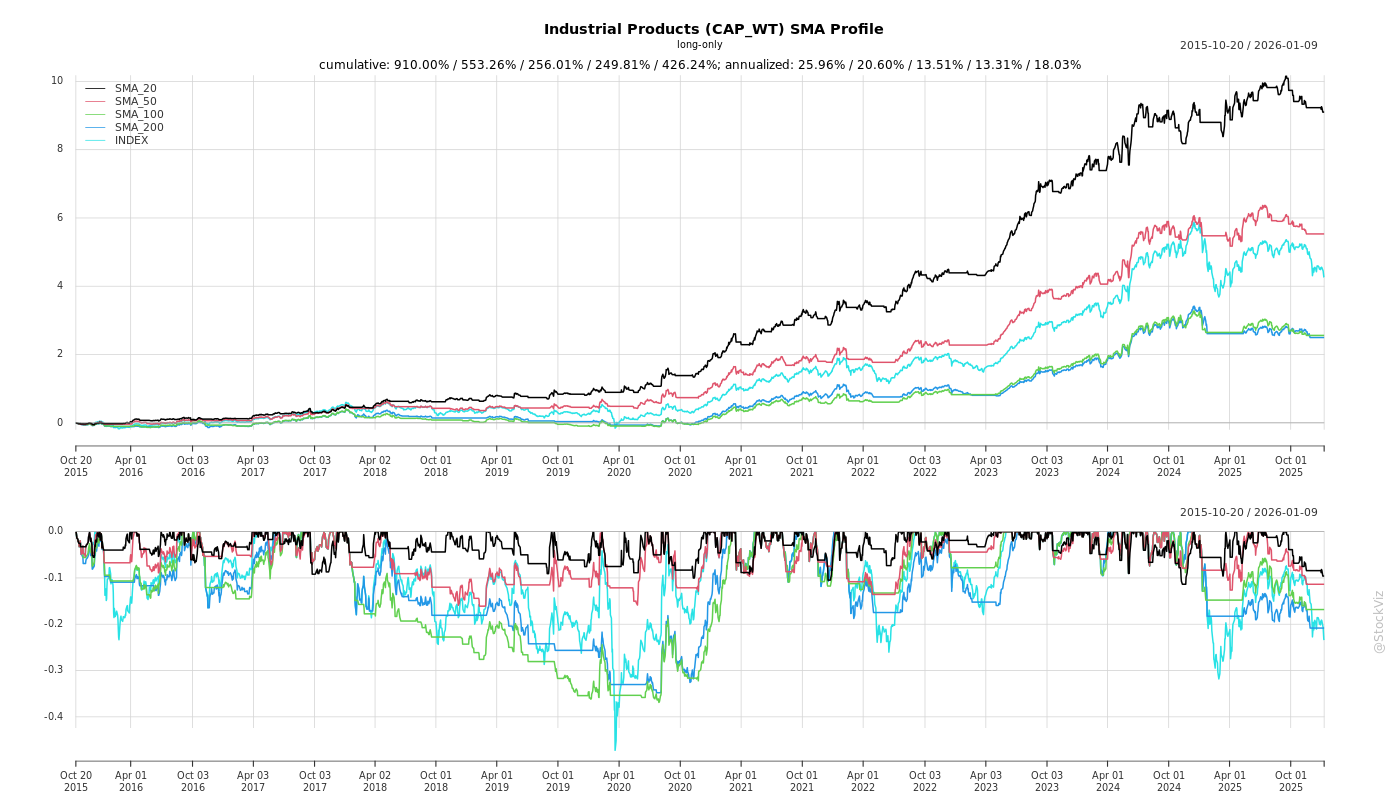

SMA Scenarios

Current Distance from SMA

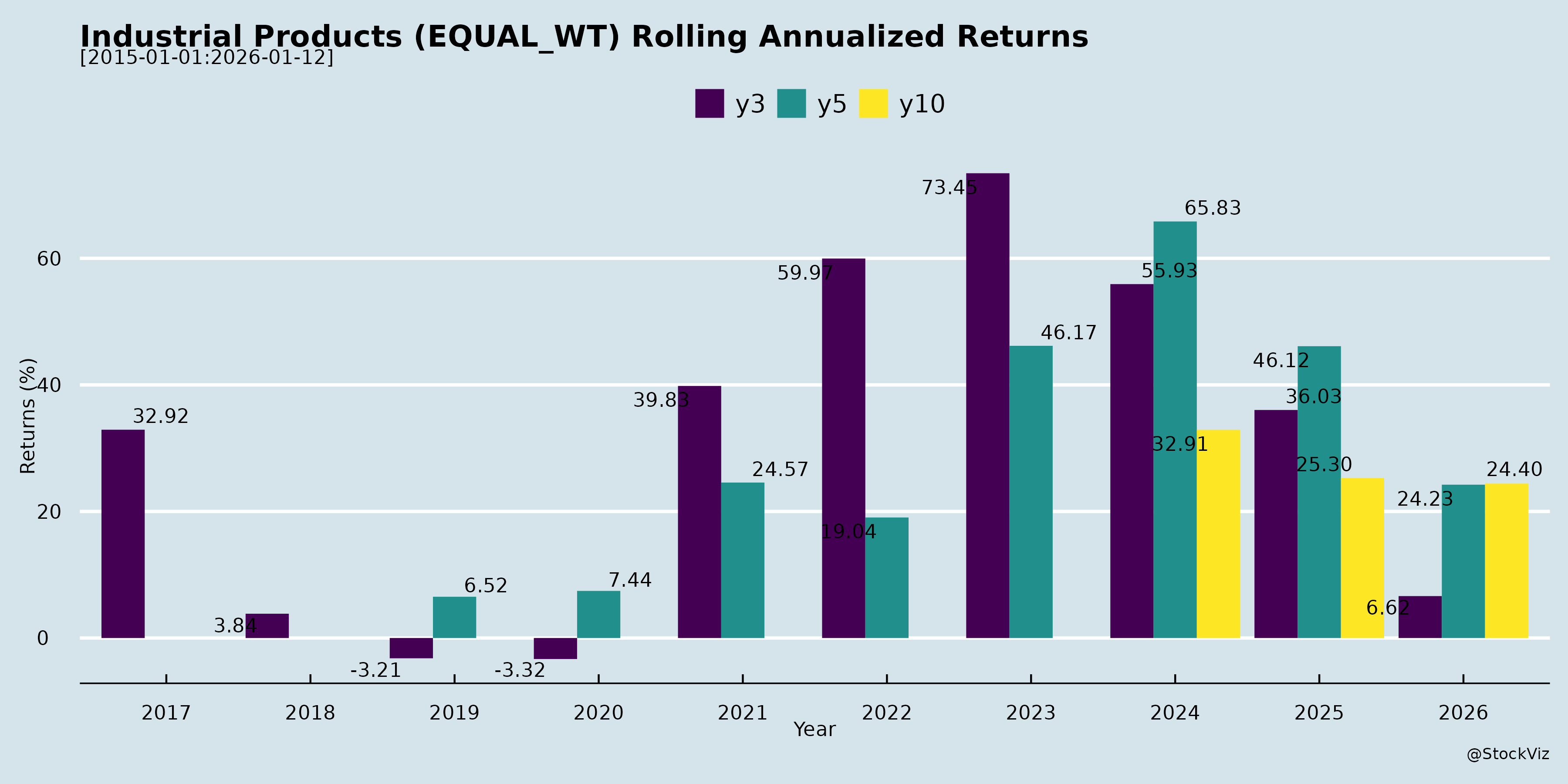

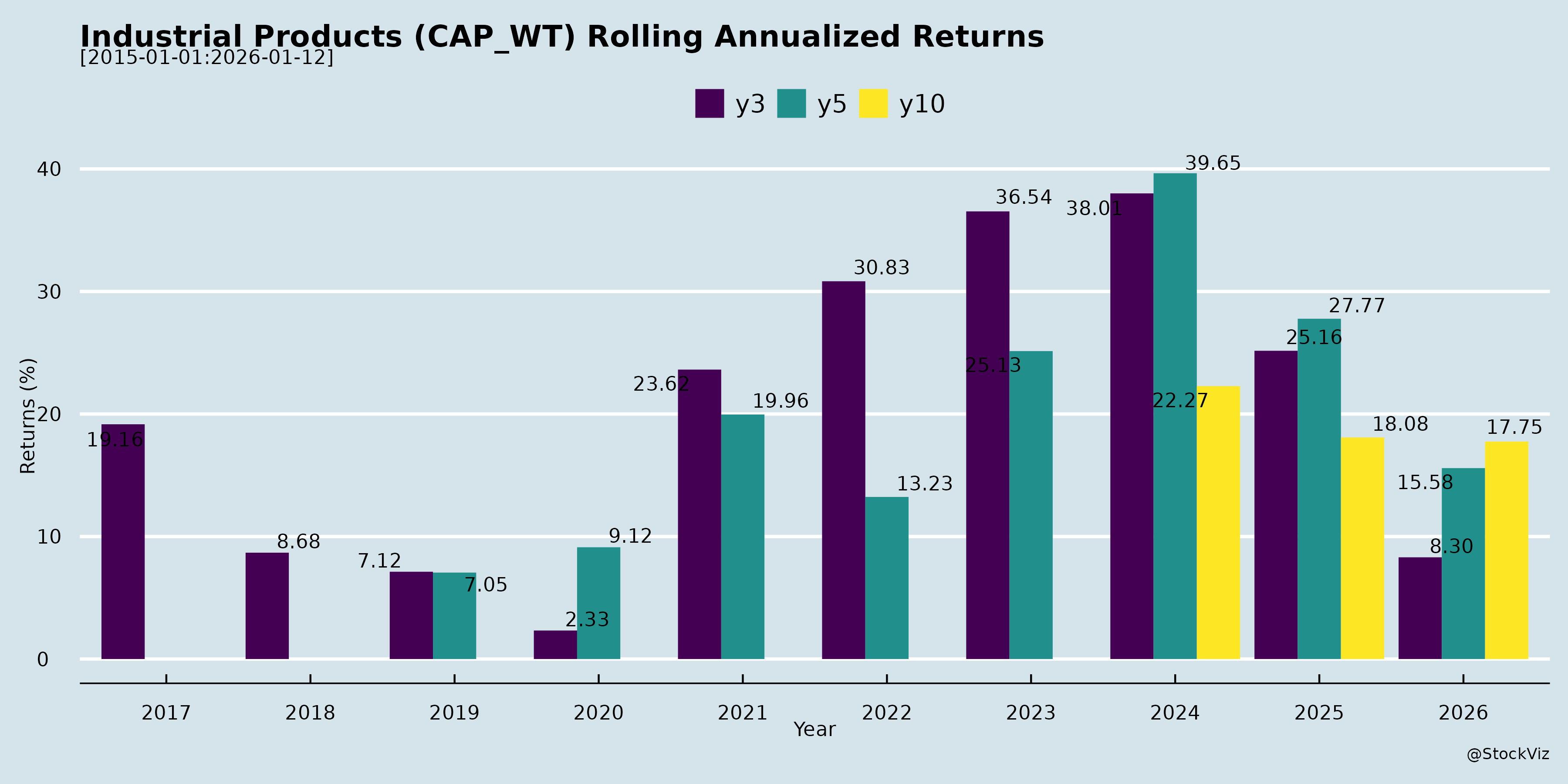

Rolling Returns

Market Cap

EBIT (% of Industry Total)

Revenue (% of Industry Total)

AI Summaries

Analyst

asof: 2025-12-03

Summary Analysis: Indian Industrial Products Sector

The provided documents primarily cover filings and earnings transcripts from listed Indian industrial/manufacturing companies (e.g., EMS like Syrma SGS/Kaynes; engineering like Praj/GMM Pfaudler/Anup; rail/rolling stock like Texmaco; machine tools/CNC like LMW/Jyoti; others like Tega/Centum). These reflect a sector focused on electronics manufacturing services (EMS), heavy engineering, rail infrastructure, mixing/process equipment, and niche areas like bioenergy/defense. Overall, the sector shows resilience amid cyclical pressures, driven by government capex and diversification, but faces global headwinds.

Tailwinds (Positive Drivers)

- Strong Government Support & Capex: Rail capex at record INR 1.42T (H1 FY26, Texmaco); PLI schemes (Syrma PCB approval); defense indigenization (Syrma Elcome acquisition); nuclear/green H2 (GMM heavy engineering); EBP20 ethanol (achieved, Praj).

- Robust Order Books & Visibility: Syrma (INR 5,800 Cr, 35% auto/industrial); Texmaco (INR 6,367 Cr); GMM (INR 2,146 Cr post-SEMCO); Texmaco/LMW machine tools at 70% utilization.

- Diversification & Synergies: Acquisitions/JVs (Syrma: Elcome/KSolare/Elemaster; Texmaco: Jindal/RVNL; GMM: SEMCO/Poland); entry into high-margin areas (defense, solar inverters, mining agitators, peptides/Semaglutide).

- Export Momentum: Syrma exports +40% YoY (INR 270 Cr/Q2); Texmaco #1 rolling stock exporter; global mixing (GMM SEMCO in Brazil).

- Margin Expansion: Syrma EBITDA 10.1% (up 500bps); GMM 13.5%; operational leverage (LMW machine tools).

Headwinds (Challenges)

- Global Trade/Geopolitical Pressures: US tariffs hitting exports (Texmaco foundry dip; Syrma US 5-6% revenue); Europe slowdown in chem/pharma (GMM/LMW); China overcapacity (GMM).

- Cyclical Demand Weakness: Ethanol greenfield slowdown post-EBP20 (Praj); textile CapEx weak (LMW 40-45% utilization); delayed decisions (Syrma IT/industrial).

- Operational/Financial Strains: Working capital rise (Syrma 73 days; GMM inventory); receivables delays (Syrma); execution extensions/funding issues (Praj); wheelset shortages (Texmaco).

- Pricing/Competition: Past undercutting in glass-lined (GMM stabilizing); high employee costs (GMM).

Growth Prospects

- Short-Term (FY26): 20-35% revenue growth (Syrma 30%; Texmaco 35-40% wagons); rail electrification (2x25kV, Texmaco); EMS ramp-up (Syrma $100M new customers); heavy eng. (GMM nuclear/fertilizer/green H2, INR 260 Cr FY25 base).

- Medium-Term (2-3 Yrs): EMS/PCB (Syrma Dec’26 trial); defense (Syrma Elcome INR200-350 Cr); mixing/tech (GMM SEMCO/MixPro, peptides/Semaglutide); exports/private wagons (Texmaco 15-16K wagons/yr); bioenergy/SAF/CBG (Praj).

- Long-Term (5+ Yrs): Market leadership in diversified verticals (defense/mining/semicon via Edlon; flow chem/biotech); EBITDA teens+ (Syrma >9.5%; Texmaco mid-teens); global footprint (GMM mixing umbrella).

- Overall CAGR Potential: 15-20% topline (diversified plays offsetting core cyclicality); India-led (GMM/Praj), exports 25-35% mix.

Key Risks

- External/Macro: US tariffs/escalation (5-10% revenue exposure, Syrma/Texmaco); Europe/China slowdown prolonging (GMM chem/pharma); forex volatility (GMM unrealized losses).

- Execution/Operational: Order delays/funding (Praj/Syrma); capex absorption (Syrma PCB INR1,500 Cr); working capital spikes (net debt INR600 Cr Texmaco).

- Sector-Specific: Cyclical CapEx (textile/ethanol); competition/pricing wars (glass-lined/EMS); tech adoption lags (flow chem, Praj ZLD).

- Financial: Debt/leverage (GMM <1x target; Texmaco peak TBD); goodwill/PPA adjustments (GMM INR200 Cr rise).

- Mitigants: Strong backlogs, JVs, diversification (non-core >50% growth drivers).

Overall Outlook: Sector poised for 15-25% CAGR over 3 yrs on policy tailwinds/diversification, but H2 FY26 growth contingent on tariff resolution/export revival. Resilient amid headwinds (e.g., Syrma/GMM beats), with EMS/rail/heavy eng. as stars. Monitor US policy/global CapEx for upside risks.

General

asof: 2025-12-03

Analysis of Indian Industrial Products Sector

The provided documents represent announcements from key players in the Indian Industrial Products sector, including electronics manufacturing (Kaynes, Aditya Infotech/CP PLUS), precision engineering/CNC (Jyoti CNC), aerospace/hydraulics/metallurgy (Dynamatic, Syrma SGS), rail/engineering (Texmaco, Lloyds Engineering), bioenergy/engineering (Praj Industries), mining equipment (Tega), textiles (LMW), and heavy engineering (GMM Pfaudler, Anup Engineering). These filings highlight QIPs, financial results (Q2/H1 FY26), expansions, partnerships, order books, and strategic moves amid a capex-heavy environment. The sector benefits from government push (Make in India, PLI, rail infra) but faces global headwinds.

Tailwinds (Positive Drivers)

- Robust Domestic Demand & Policy Support: High railway capex (₹2.52 lakh Cr in FY26 budget, highest ever; Texmaco’s ₹6,367 Cr order book), ethanol blending targets (E20+; Praj’s bioenergy growth), defense spending (₹6.8 lakh Cr FY26), and infra/green energy (LMW MoU with Tamil Nadu). Bioenergy/CBG mandates (5% blending by 2029) and PLI schemes boost electronics/renewables (Aditya Infotech’s 37.5% YoY revenue).

- Strong Financial Momentum: Revenue growth (Aditya 27-37% YoY; Dynamatic Aerospace 23.7%; Praj 11% 3-yr CAGR), healthy margins (Lloyds 18.5%; Kaynes QIP ₹16 Bn), net debt-free status (Praj), and ROCE >20% (Praj 23%). Order inflows strong (Praj ₹8.1 Bn in Q2 FY26; Texmaco rebound post-wheelset issues).

- Export & Global Expansion: 100+ countries (Praj), US/Brazil grain ethanol (Praj), rail castings (Texmaco 550+ wagons exported), France facility (Jyoti CNC). Partnerships (Texmaco with RVNL, Wabtec; Praj-Axens for SAF).

- Capex & Tech Upgrades: New facilities (Praj Mangalore SEZ, Lloyds drone tie-ups), AI/automation (Aditya, Dynamatic FAI), and JVs (Texmaco-Nymwag).

Headwinds (Challenges)

- Supply Chain Disruptions: Wheelset shortages (Texmaco Q1 dip), raw material volatility (Dynamatic forex impact).

- External Pressures: US tariffs on exports (Texmaco foundry halt), European slowdowns (Dynamatic Metallurgy: German auto weakness, high energy costs), geopolitical uncertainties.

- Margin Pressures: EBITDA dips (Dynamatic 11.0% vs. 11.5%; Texmaco 9.7% vs. 11.0% H1 YoY) due to restructuring (Dynamatic UK), exceptional items (₹69 Cr), and forex (EUR/GBP/USD gains but volatile).

- Execution Delays: Amalgamations (Texmaco West Rail), cessations (Anup-Graham agreement ended, no material impact).

Growth Prospects

- High Visibility Pipeline: Order books (Texmaco ₹6,367 Cr; Praj ₹44 Bn+ backlog), rail procurement (1-1.3 lakh wagons/3-4 yrs), ethanol/CBG (Praj’s RenGas™), SAF/marine biofuels (Praj-Gevo/Axens). Electronics: Surveillance (Aditya 25-30% FY26 guidance), EMS QIPs (Kaynes ₹16 Bn).

- Sector Tailwinds: Rail freight share to 45% by 2030 (vs. 27%), DFC (₹1.5 lakh Cr), green hydrogen/electrification (Texmaco infra). Bioeconomy (Praj #1 hottest company), defense drones (Lloyds-FlyFocus).

- Capex Expansion: New plants (Praj Mangalore 1.4 Mn sq ft; Lloyds/Bhilai acquisitions), capacity ramps (Aditya Kadapa 2 Mn units/month). 3-5x export growth (Texmaco castings).

- FY26 Outlook: 20-30% growth in select segments (electronics, rail); sustained EBITDA 10-18% (Lloyds, Aditya).

Key Risks

- Geopolitical/Trade: Tariffs (US on steel; Texmaco exports), Europe slowdowns (Dynamatic), forex volatility (Dynamatic: ₹144 Cr Q2 impact).

- Execution/Supply Risks: Wheelset/raw material shortages, project delays (large infra orders), labor issues (Dynamatic UK restructuring).

- Cyclicality: Auto/mining slowdowns (Dynamatic, Tega), commodity prices (steel/energy).

- Financial: Debt (Dynamatic Net Debt/EBITDA 2.7x), capex funding (QIPs/ESOPs), exceptional items.

- Competition/Regulatory: Intense rivalry (rail tenders), policy shifts (ethanol blending delays), ESG compliance.

- Macro: Inflation, slowing capex if GDP dips below 7%.

Summary: The sector is buoyed by infra/bioenergy/rail tailwinds (CAGR 10-20% prospects), strong order books, and policy support, with leaders like Praj/Texmaco/Lloyds executing expansions. Headwinds from exports/Europe persist but are mitigated by domestic focus. Risks are manageable with diversified portfolios; growth hinges on execution amid ₹2.5+ lakh Cr rail capex and green mandates. Overall positive outlook for FY26+.

Investor

asof: 2025-12-03

Analysis of Indian Industrial Products Sector

Based on Q2/H1 FY26 Earnings Transcripts, Announcements, and Investor Meets (e.g., EMS like Syrma/Kaynes, Engineering like GMM Pfaudler/Anup/Texmaco/Lloyds, Machinery like LMW/Jyoti CNC, Bioenergy like Praj, Rail/Mining like Texmaco/Tega, Electronics like Centum).

The sector exhibits resilience amid global uncertainties, driven by domestic policy tailwinds (PLI, rail CapEx, green energy) and diversification into high-margin areas (defense, renewables, nuclear). EMS and engineering lead growth, while textiles/machinery face cyclical slowdowns. Overall H1 revenue growth ~7-37% YoY across peers, with EBITDA margins expanding (e.g., Syrma 10.1%, GMM 13.5%).

Headwinds

- Export/Trade Disruptions: US tariffs/election uncertainty delaying orders (Syrma: 5-6% US revenue; Texmaco/LMW foundry hit; GMM notes China weakness). Wheelset shortages (Texmaco) and forex volatility (GMM unrealized losses).

- Cyclical Demand Weakness: Textile CapEx bottomed out (LMW: flat TMD sales, 40-45% utilization); ethanol EBP20 target met slowing greenfield (Praj); chemical/pharma investments deferred in Europe/US (GMM).

- Operational Pressures: Working capital strain (Syrma: 73 days, inventory up INR100cr; Praj: collections/funding delays); pricing competition (LMW); under-absorption in new facilities (Praj GenX: INR8.5-9cr/month fixed costs).

- Macro Slowdown: GenX/energy transition projects stalled (Praj); industrial slowdown Q-o-Q (Syrma).

Tailwinds

- Policy Support: PLI/ECMS approvals (Syrma PCB groundbreaking Dec’25); rail CapEx record INR1.42tn H1 (Texmaco: 2x25kV electrification); nuclear/fertilizer/green H2 push (GMM/Anup).

- Diversification Success: Acquisitions/JVs accretive (Syrma: Elcome/Navicom 25% EBITDA, KSolare solar; Texmaco: RVNL/HORMANN; GMM: SEMCO INR162cr, Poland JV); new verticals (Praj: SAF demo operational, CBG Napier grass; GMM: acid recovery, peptides).

- Domestic Revival: Agrochem/pharma rebound (GMM: 31% India growth); auto/industrial/IT ramp-up (Syrma: 37% YoY revenue); strong inquiries (LMW ITMA exhibition; Jyoti/Aditya plant meets).

- Order Visibility: Robust backlogs (Syrma INR5,800cr; Texmaco INR6,367cr; GMM INR2,146cr); services/upgrades offsetting capex slowdown (Praj brownfield focus).

Growth Prospects

- Short-Term (FY26): 20-35% organic revenue (Syrma: 30% guided; GMM India strong); H2 acceleration via execution (Texmaco: 15-16k wagons capacity; Praj: low-carbon US ethanol commissioning). EMS/rail lead (Kaynes/Jyoti/Texmaco group meets signal demand).

- Medium-Term (2-3 Yrs): Diversified mix (Syrma: PCB Dec’26 trial, defense INR300-350cr; Praj: SAF/isobutanol diesel blending; GMM: mixing synergies, nuclear EPC approvals; Texmaco: passenger mobility/track renewal). Exports/private wagons up (Texmaco leasing JV; LMW China/LMW Global up 2x).

- Long-Term (5 Yrs): High-teens CAGR potential (GMM: semiconductors/nuclear; Praj BioVerse: 2G ethanol exports/CBG; Texmaco: global rolling stock). PLI/green mandates (solar inverters, EV content) key drivers.

| Segment | H1 FY26 Growth | Key Drivers |

|---|---|---|

| EMS (Syrma/Kaynes) | 37% YoY | Auto/IT/industrial; JVs |

| Engineering (GMM/Anup/Texmaco) | 10-15% | Nuclear/rail infra; acquisitions |

| Bioenergy (Praj) | Flat (H1) | Brownfield/SAF/CBG ramp |

| Machinery (LMW/Jyoti) | 5-11% | Machine tools/foundry; diversification |

Key Risks

- Geopolitical/Trade: Prolonged US tariffs/Biosecure Act delays (impacts 20-40% exports); forex swings (GMM/Praj).

- Execution/CapEx: Project delays/funding (Praj: extended cycles); working capital peaks (Syrma/Praj targeting <65 days).

- Demand Volatility: Cyclical slowdowns (textiles/ethanol); competition in glass-lined/mixing (GMM).

- Financial: Debt rise post-acquisitions (GMM leverage <1x guided; Texmaco peak INR600cr net debt); pension liabilities (GMM INR312cr).

- Regulatory: Blending mandate changes (Praj); PLI delays.

Overall Summary: Bullish with Cautious Optimism. Tailwinds from policy/diversification outweigh headwinds; sector poised for 15-25% CAGR (FY26-28) via EMS/engineering/green tech. Risks mitigated by strong backlogs (avg. 8-18 months) and domestic focus (~65% orders). Monitor US trade and customer CapEx for H2 inflection. Peers guide superior growth (Syrma >30%, Texmaco mid-teens EBITDA).

Press Release

asof: 2025-12-03

Analysis of Indian Industrial Products Sector

Based on the provided documents (press releases and financials from 12 companies across electronics manufacturing (Kaynes, Syrma SGS, Aditya Infotech/CP Plus), machining/CNC tools (Jyoti CNC, LMW, Pitti Engineering), engineering/equipment (Anup Engg, GMM Pfaudler, Praj), rail/infra (Texmaco), aerospace/defense (Dynamatic), and mining/specialized (Tega)), the sector shows robust momentum driven by domestic capex, indigenization, and global expansions. Most firms reported double-digit YoY growth in Q2/H1 FY26 revenue/EBITDA (e.g., Kaynes +58% revenue, Anup +20%, Pitti +13%), strong orderbooks (e.g., Kaynes ₹81bn, Texmaco ₹6.4bn, GMM ₹2.1bn), and capacity/JV announcements. However, pockets of softness exist (e.g., Praj revenue -2-8% YoY).

Tailwinds (Positive Drivers)

- Govt Policies & Capex Boom: Make in India/Atmanirbhar Bharat fueling electronics (PLI schemes, semicon localization via L&T-CP Plus JV for 9M IP cameras), rail (₹1.42tn H1 FY26 Indian Railways spend on electrification/multi-tracking/safety; Texmaco benefits), defense (Dynamatic-L&T-BEL for AMCA 5th Gen fighter), and infra (Syrma SGS PCB plant in AP).

- Capacity Expansions & JVs: New facilities (Jyoti CNC doubles France capacity for aerospace; Syrma JV with Korea’s Shinhyup; Anup Phase-2 Kheda; Pitti machined hours at 87-90%). Global footprints (LMW at EMO Hannover; GMM Poland/Brazil acquisition).

- Strong Demand & Order Inflows: EMS/electronics surge (Kaynes 58% YoY revenue, 81bn orderbook); rail wagons (Texmaco 2,334 units delivered); machined components (Pitti stator frames +117% YoY); bioenergy (Praj 1000+ global refs).

- Margin Resilience: Healthy EBITDA margins (Anup/GMM/Pitti ~22%/13-16%; Kaynes 16.3%) amid diversification (Kaynes IPM/AR-VR/Space; Praj SAF/CBG).

- Exports & Diversification: 35-45% export orderbooks; new sectors like mining (Tega-Molycop $1.45bn acquisition), biofuels (Praj global ethanol share ~10%).

Headwinds (Challenges)

- Execution & Supply Issues: Project delays/funding/site readiness (Praj 1G ethanol); supply constraints (Texmaco wheelsets); underabsorption (Praj GenX fixed costs).

- Global/Macro Pressures: Sluggish chemical markets/overcapacity/geopolitics (GMM); US tariffs hitting exports (Texmaco foundry volumes down); policy waits (Praj ethanol EBP20+ directives).

- YoY Declines in Pockets: Revenue/PAT softness (Praj consol -2% H1 revenue, -82% PAT due to tax/execution; Texmaco export impact).

- Working Capital Strain: Rising short-term debt (Anup for WC); higher expenses (Praj other costs up on execution).

Growth Prospects

- High Visibility: Orderbooks provide 1-2yr revenue surety (e.g., Kaynes H2+; Texmaco rail infra pipeline); H1 FY26 growth 10-58% across most firms projects FY26 acceleration.

- Emerging Themes: Semicon/electronics self-reliance (CP Plus 9M cameras; Kaynes semicon sub); defense/aero indigenization (Dynamatic AMCA; Jyoti aero demand); green energy (Praj SAF/CBG/Napier grass; Texmaco 2x25kV traction).

- Capex Ramp: New plants/JVs to unlock ₹150-200cr/annum each (Anup Kheda; Syrma 1000 jobs); Tega post-Molycop: 26 global plants, mineral boom.

- Exports/Global: Europe/US/Asia traction (LMW 80+ models; GMM Brazil mining/water); medium-term CAGR 10-20% implied (Praj 3yr 11% revenue).

- Margins/ROCE: Sustained 13-22% EBITDA, ROCE 23-27% (Anup/Praj); efficiency gains from integration (Texmaco post-amalgamation).

Key Risks

| Risk Category | Details | Impacted Firms |

|---|---|---|

| Execution/Policy | Project delays, policy changes (ethanol funding; rail NOCs). | Praj, Texmaco |

| Geopolitical/Trade | Tariffs (US), overcapacity, FX volatility. | Texmaco, GMM, Jyoti |

| Supply Chain | Wheelsets/raw materials; global disruptions. | Texmaco, Pitti |

| Financial | High WC debt, tax rates (Praj ETR 35-37%), capex funding. | Anup, Praj |

| Demand/Cyclical | Chemical/mining slowdown; competition. | GMM, Tega |

| M&A Integration | Acquisition risks (Tega Molycop; GMM SEMCO). | Tega, GMM |

Overall Summary: Bullish outlook with strong tailwinds from govt infra/defense/electronics push outweighing headwinds (mostly execution/global). Sector growth prospects pegged at 15-25% FY26 revenue CAGR for leaders, backed by ₹2-80bn orderbooks and expansions. Key watch: Policy execution (rail/ethanol), global trade stability. Investment Thesis: Favor diversified players (Kaynes, Texmaco, Anup) with rail/electronics/defense exposure; monitor Praj for bioenergy recovery. Sector ROCE/margins resilient at 20%+/15-22%, positioning India as manufacturing hub.

Copyright © 2023 SAS Data Analytics Pvt. Ltd. All rights reserved.