Consumer Electronics

Industry Metrics

January 13, 2026

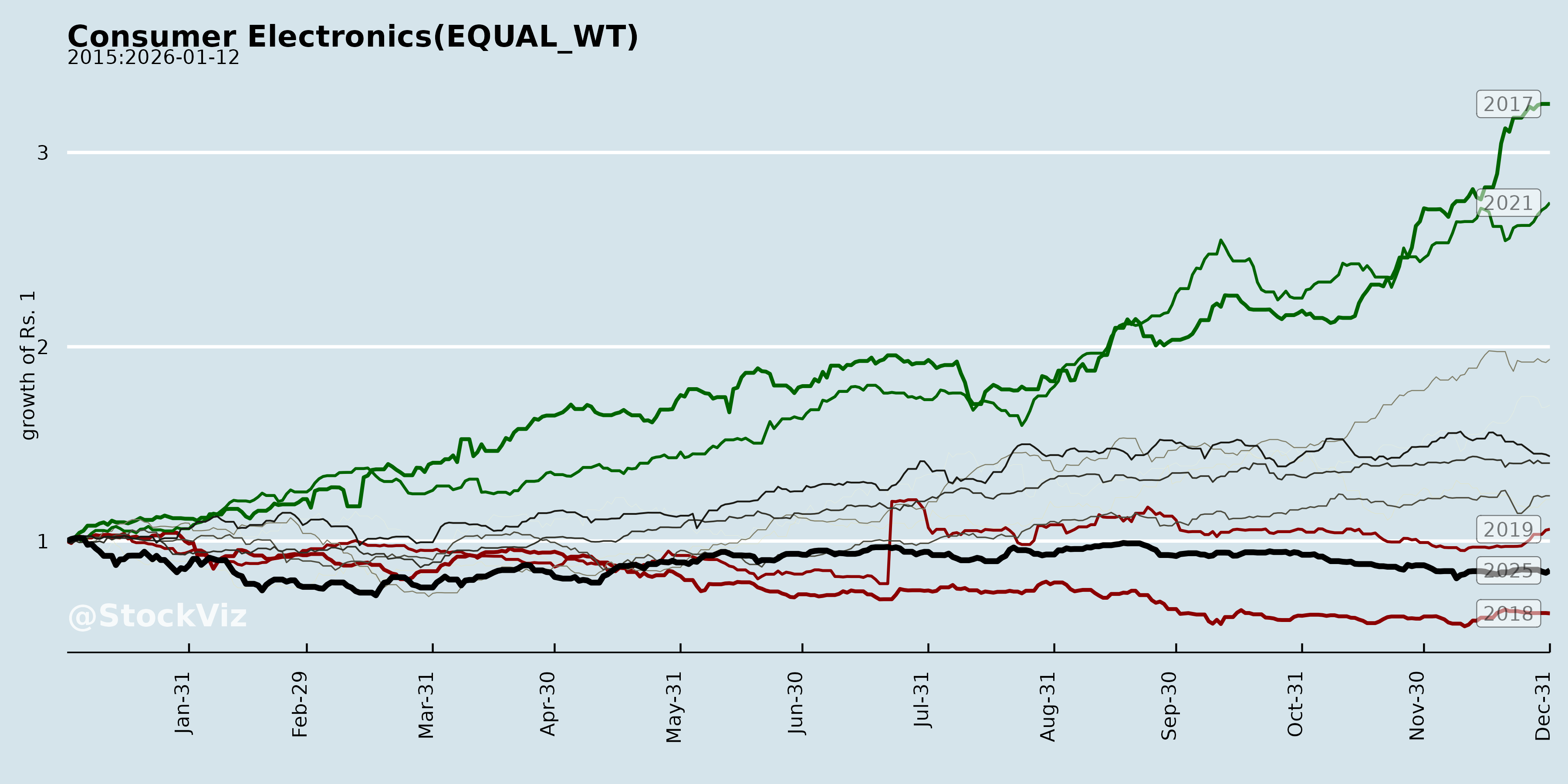

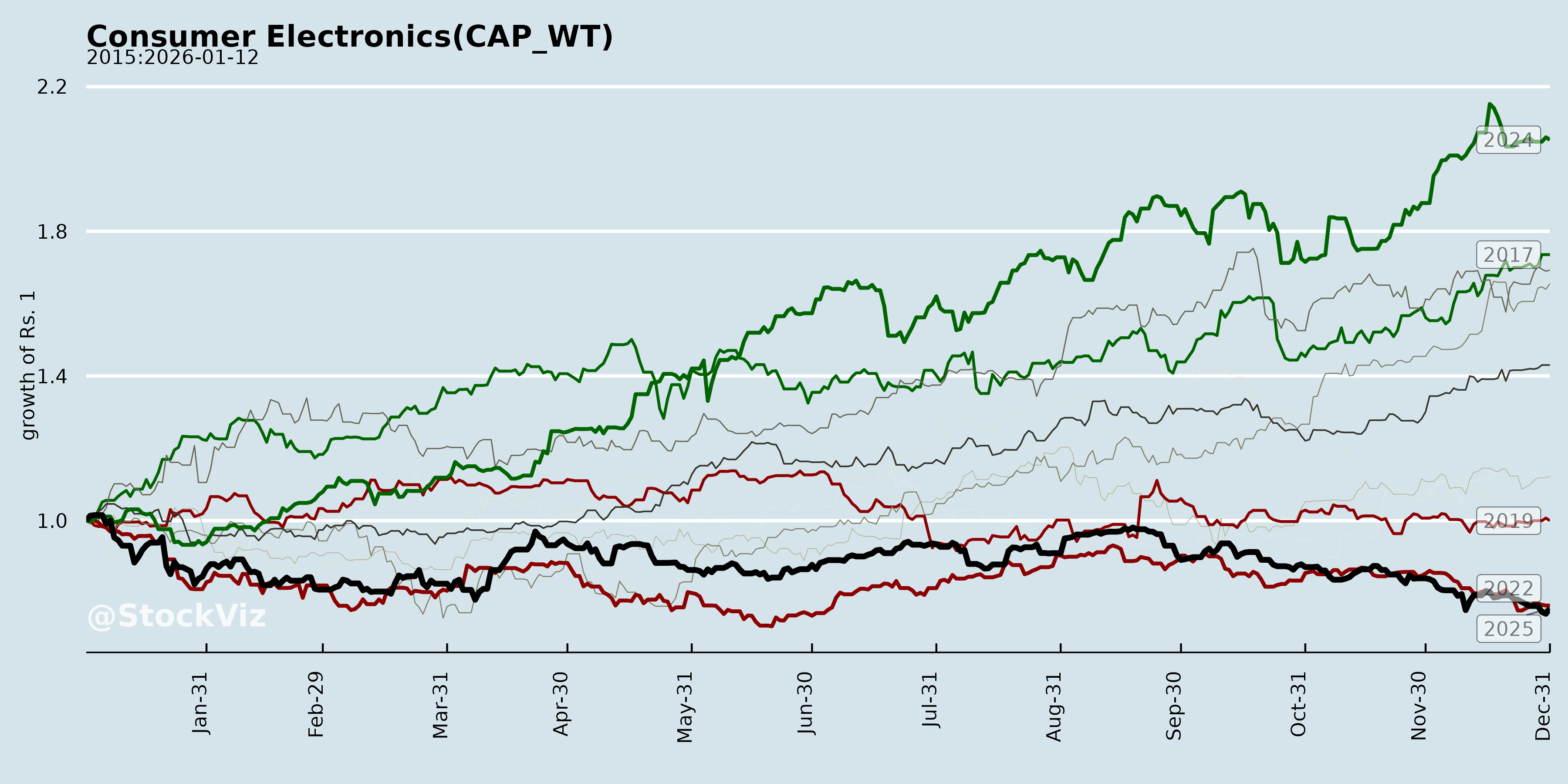

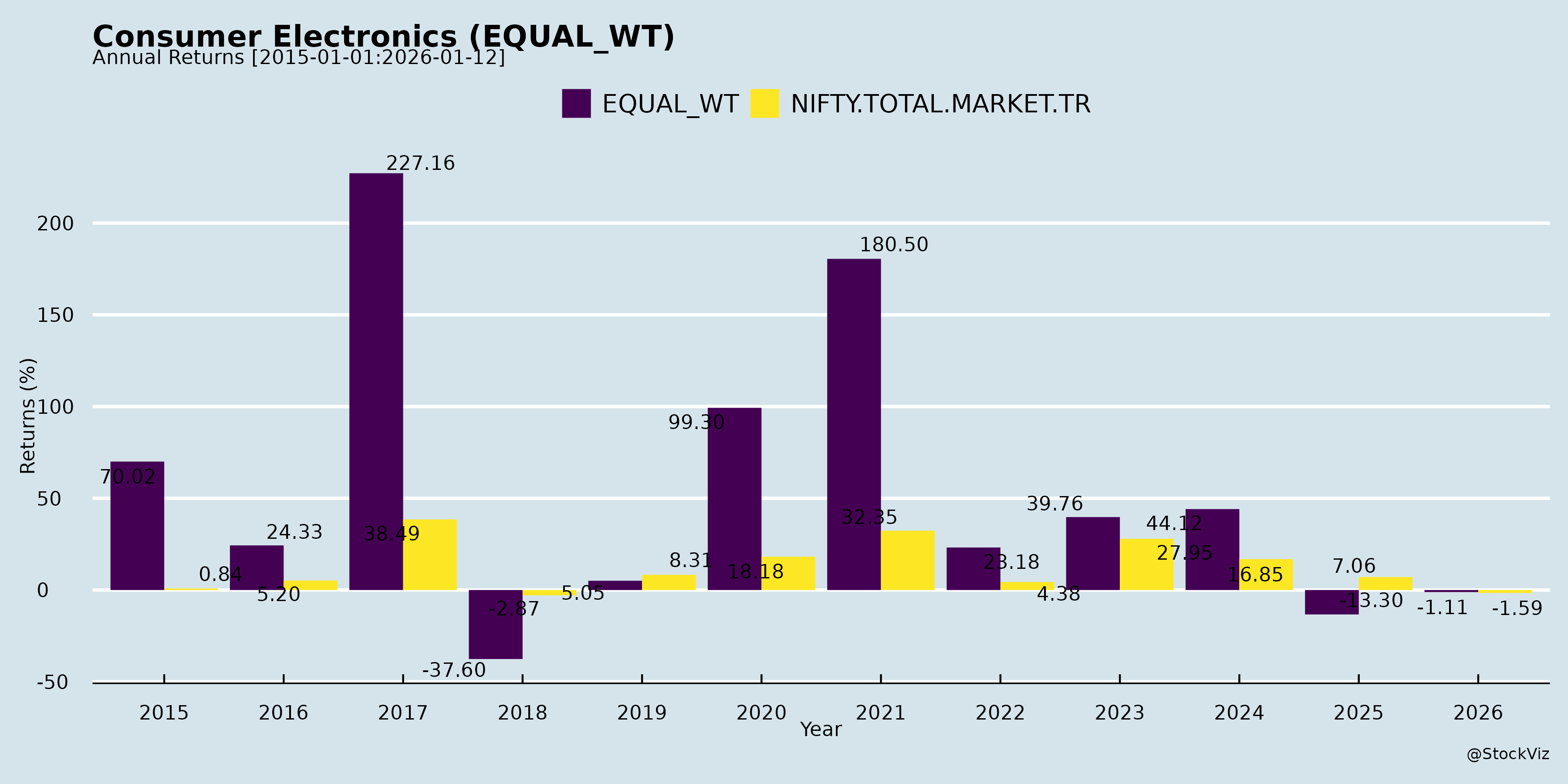

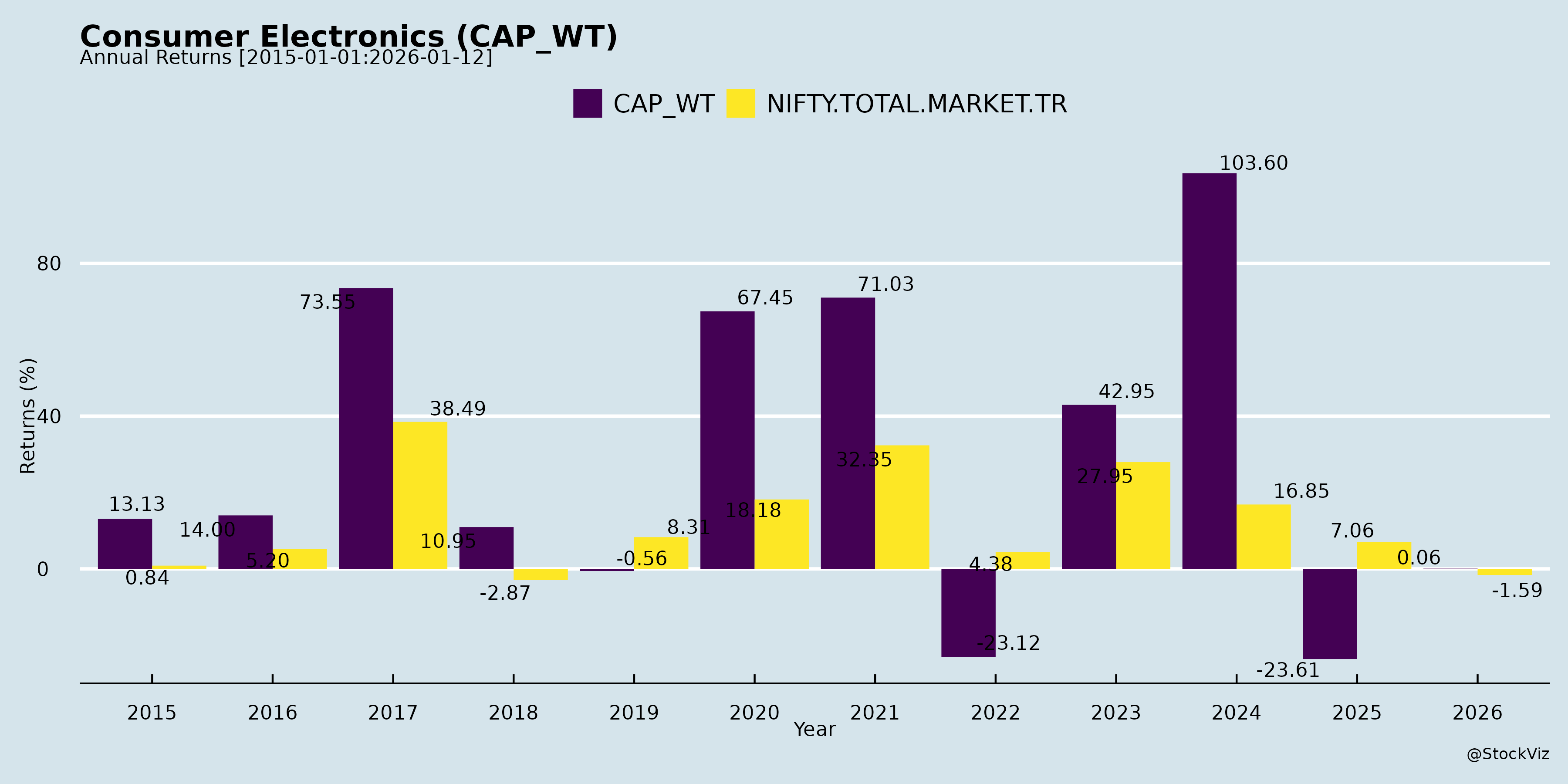

Annual Returns

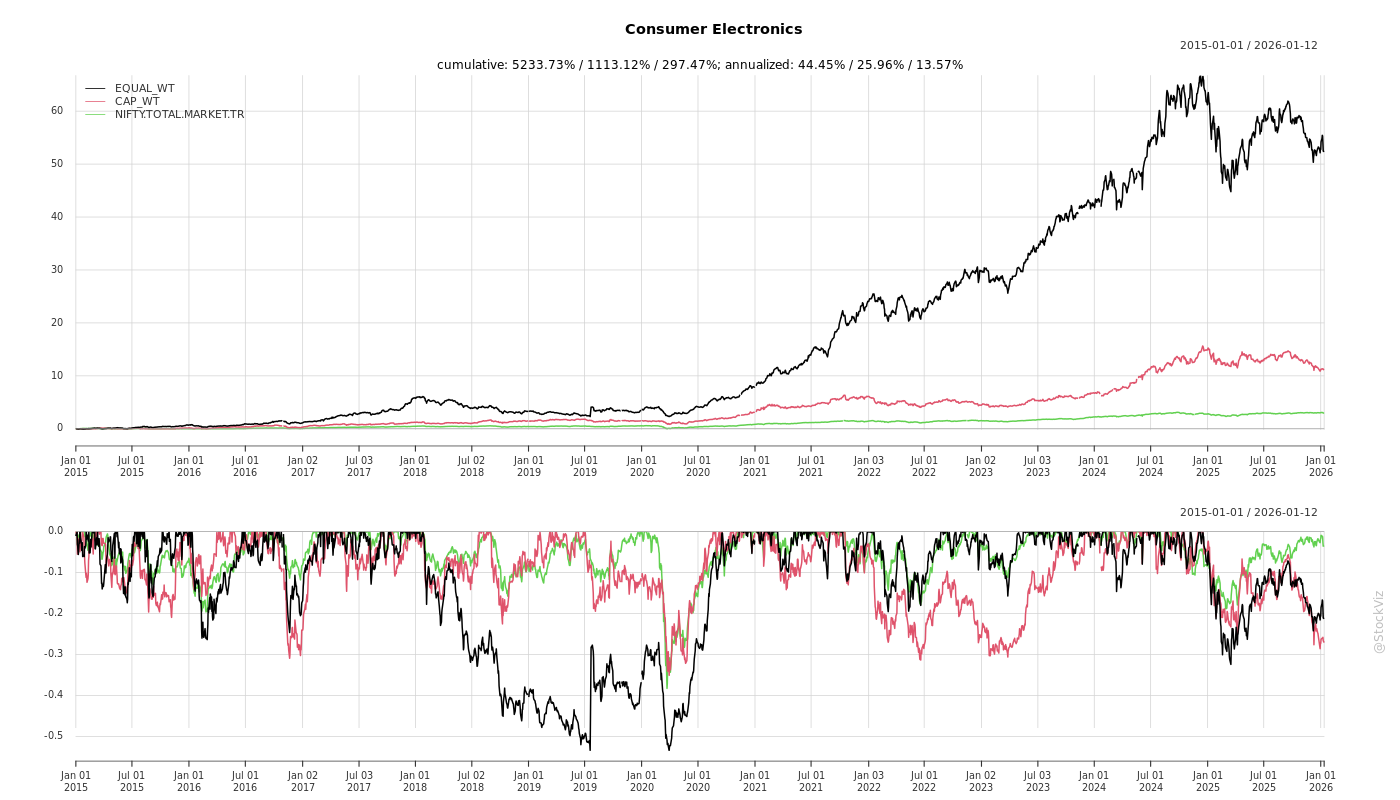

Cumulative Returns and Drawdowns

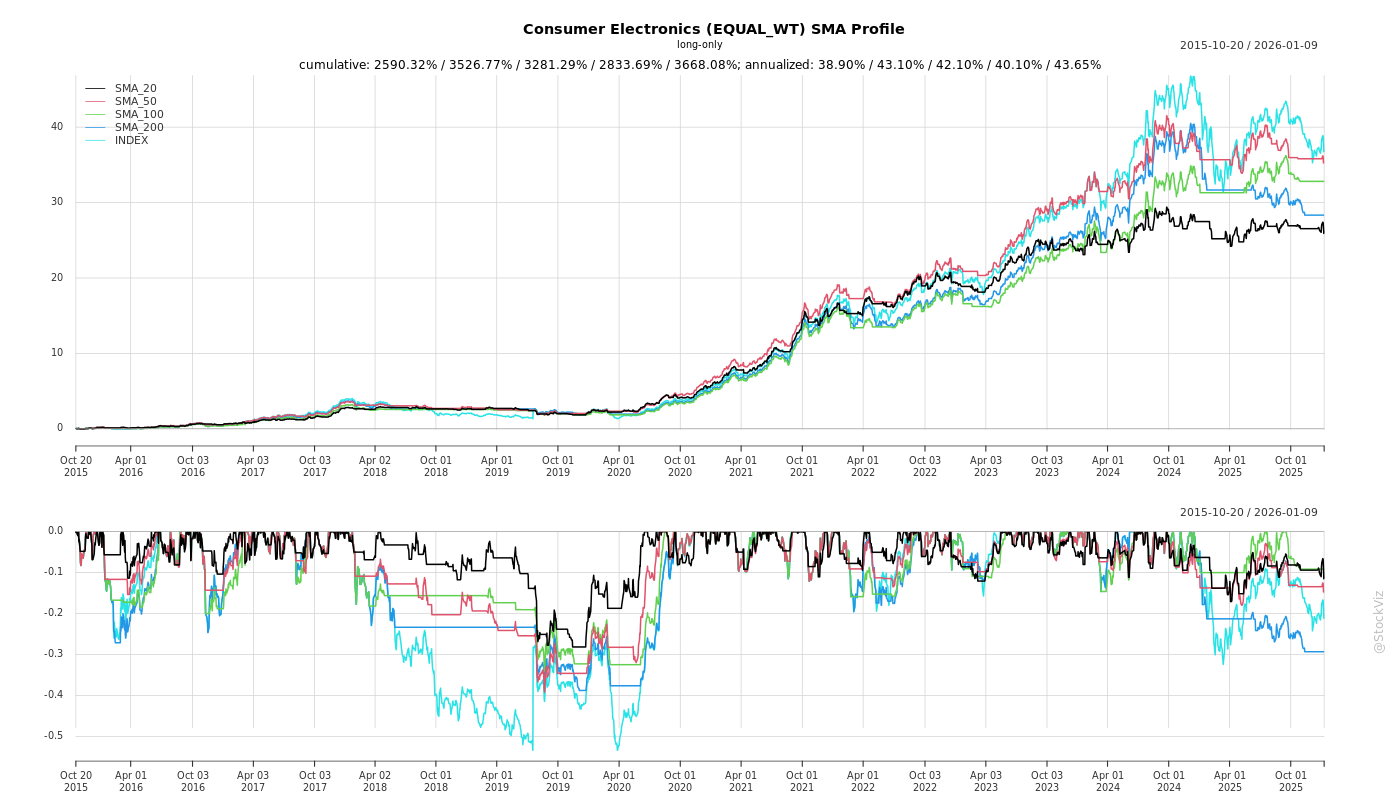

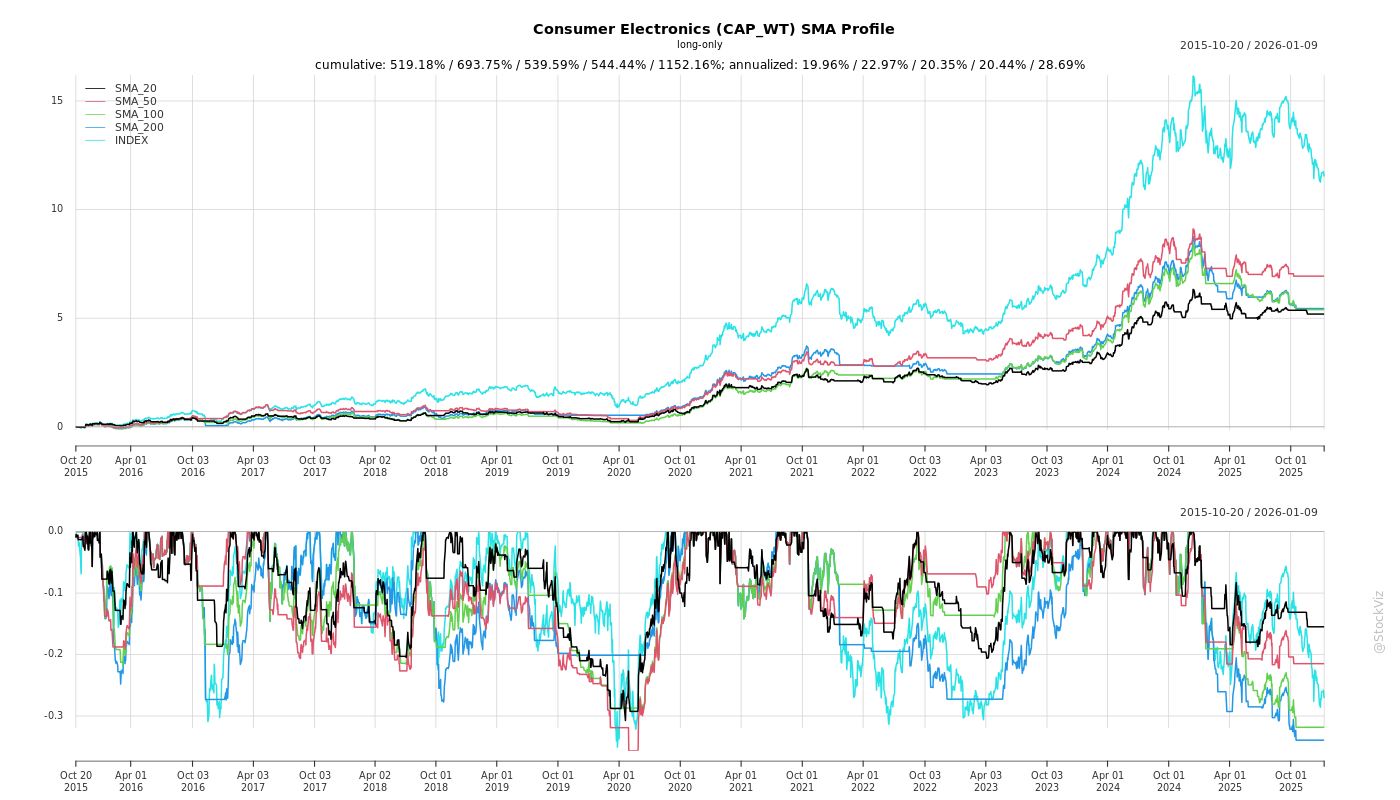

SMA Scenarios

Current Distance from SMA

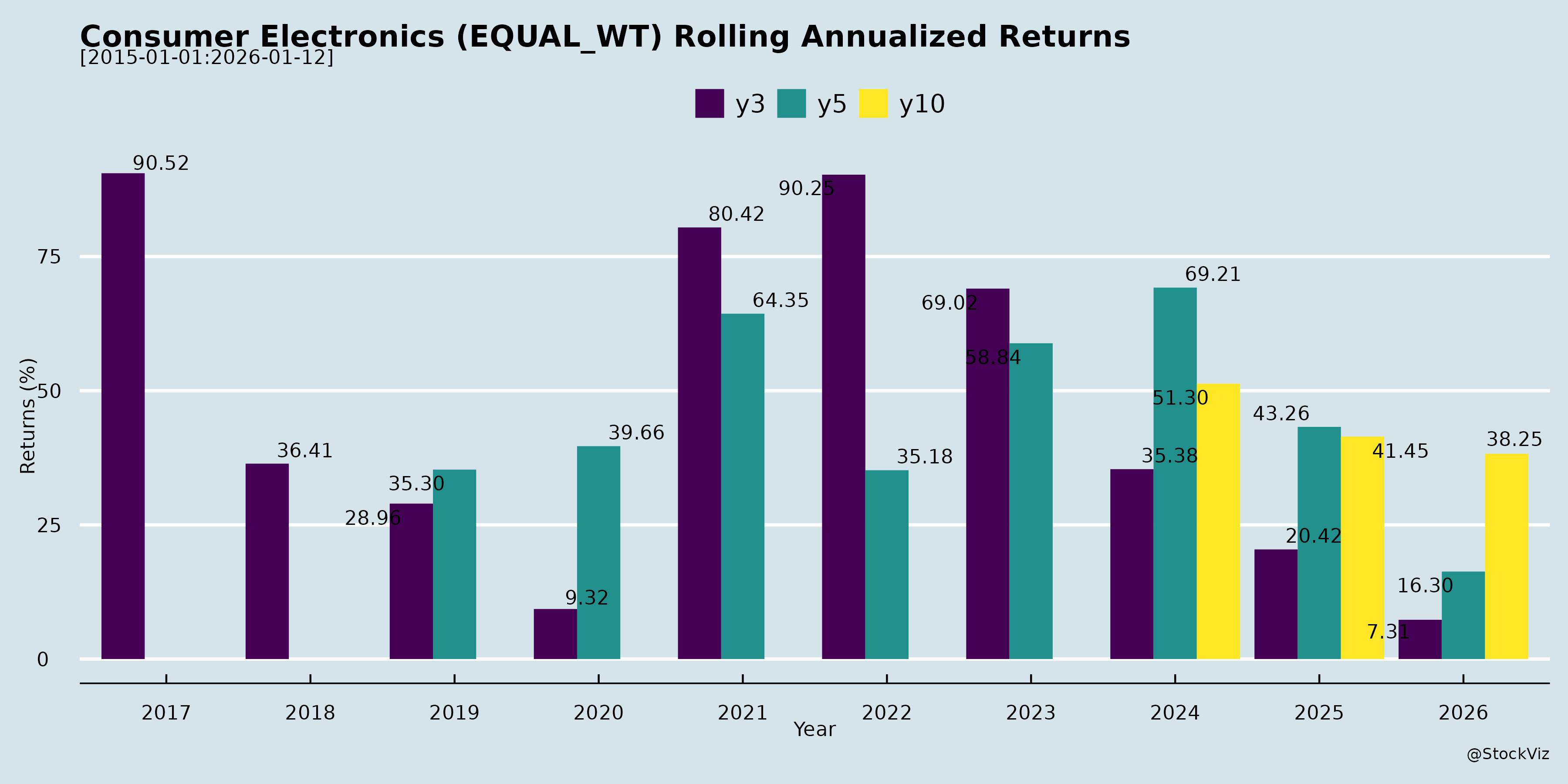

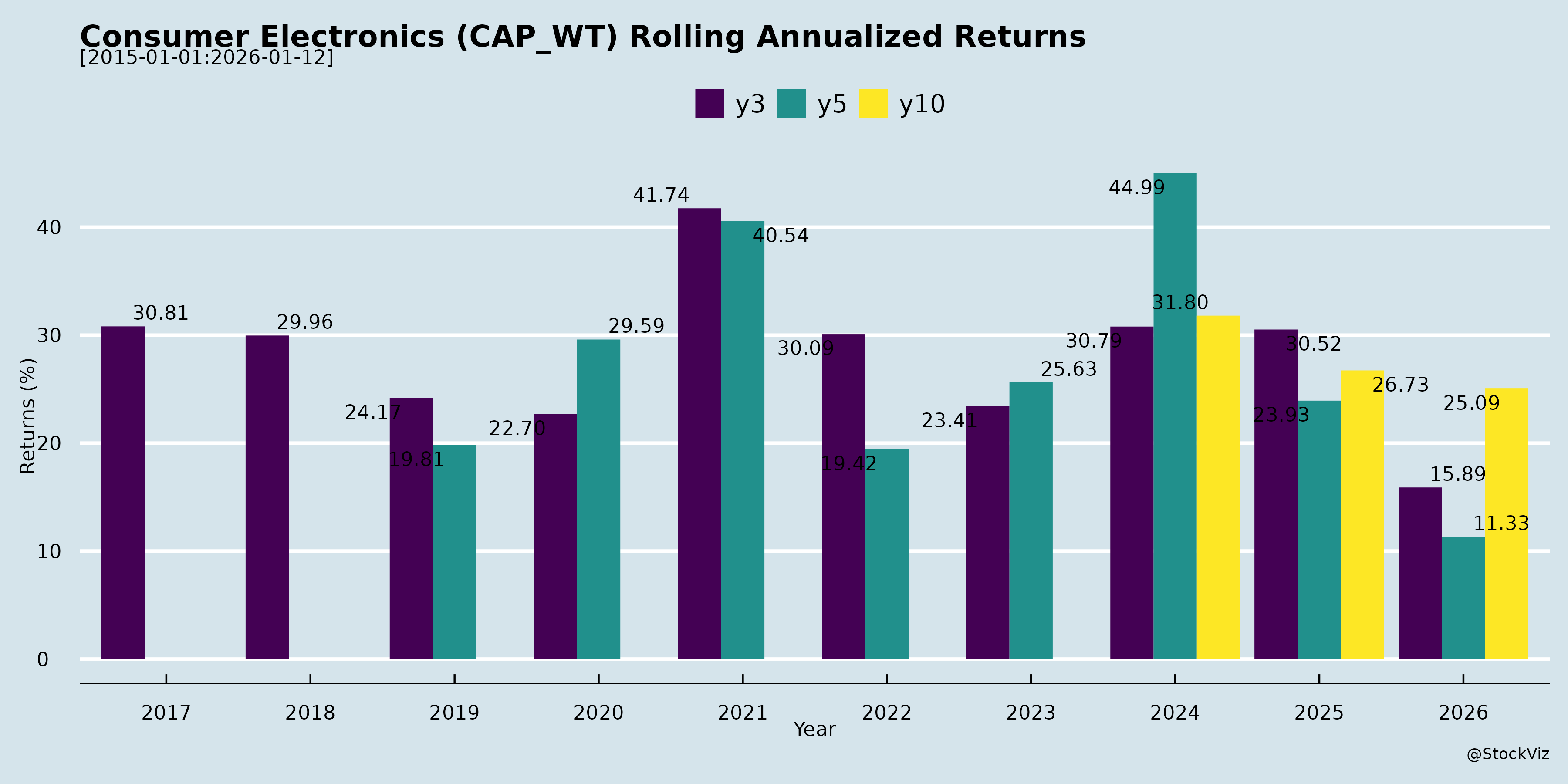

Rolling Returns

Market Cap

EBIT (% of Industry Total)

Revenue (% of Industry Total)

AI Summaries

Analyst

asof: 2025-12-03

Summary Analysis: Indian Consumer Electronics Sector (Based on Provided Documents)

The documents highlight activities of key players like Havells India, Dixon Technologies, PG Electroplast, IKIO Technologies, and Focus Lighting—primarily ODM/OEM manufacturers in lighting, wearables, hearables, displays, and related electronics. IKIO’s Q2/H1 FY26 earnings transcript provides the most granular insights (revenue: ₹284cr H1, +13% YoY; other businesses +54% YoY to ₹197cr), supplemented by investor/analyst meet schedules indicating strong institutional interest. Analysis focuses on sector headwinds, tailwinds, growth prospects, and risks.

Tailwinds (Positive Drivers)

- Product Diversification & New Verticals: Strong momentum in wearables/hearables (13-14% of Q2 revenue for IKIO; top Indian brands, NDAs in place), display/in-store lighting (Middle East/Dubai hub profitable in Year 1), Honeywell orders (fire alarms, sensors, PA systems), and upcoming automotive lighting (sampling complete, Dec’25 start). Shift to high-volume audio (soundbars, TWS) amid plateauing smartwatch demand.

- Geographic Expansion: Exports up 127% YoY/30% QoQ to ₹37cr (23% of H1 revenue); Middle East/ASEAN (Philippines, Vietnam, Indonesia) offsetting US issues. US subsidiary (Royallux) stable.

- Capacity Ramp-Up & Investments: IKIO’s 5L sq ft greenfield (Phase 1 operational at 15-20% utilization, Phase 2 nearing completion); 78% IPO proceeds deployed (debt repaid). Backward integration for margins/quality.

- Investor Engagement: Dense schedules (e.g., Dixon: 20+ US/UK investors Dec’25; Havells/PG: Nov’25 conferences) signal confidence. No UPSI shared, but physical/virtual meets underscore demand visibility.

- Sector Enablers: Make-in-India alignment (electronics heritage from DVD/audio); client trust via infrastructure visits.

Headwinds (Challenges)

- Margin Pressures: EBITDA at 11.2% (Q2; down from historical 20-23% due to front-loaded expenses, new vertical onboarding, low initial volumes/high raw material costs). Gross margins stable at 35-36% but expected to improve gradually. Employee costs elevated for R&D/BD teams.

- Demand Softness: Smartwatch plateau/decline in India; reliance on seasonal display lighting. New ODM clients routed via subsidiaries for comparability.

- Export Disruptions: US tariffs shrinking India-US direct exports (mitigated by subsidiaries/stock builds); monitoring trade developments.

- Operational Scaling: Low capacity utilization (15-20%); new verticals (e.g., hearables) start small, with multi-stage validation (R&D, certifications, market trials).

Growth Prospects

- Near-Term (FY26): IKIO guides ~15% topline growth (on track); H1 other businesses +54%, Q2 +71% YoY. Expect QoQ momentum from new clients/products (e.g., automotive Q4 FY26), EBITDA to 16-18% in “few quarters.”

- Medium-Term (2-3 Years): 40-60% of growth from new verticals (hearables/wearables, Middle East, ODM diversification beyond Philips). Capacity to support 4.5-5.5x asset turns; pipeline of 30-40 products under development. Multi-brand ODM (lighting/audio) with 1,500+ SKUs potential via indigenization.

- Sector Outlook: PLI-driven exports/geos (Middle East/ASEAN/US recovery); 30-50%+ growth in non-lighting segments. Investor meets (e.g., UBS, CLSA, JP Morgan) suggest 15-25% CAGR feasible with execution.

Key Risks

- Execution/Scale Risks: New verticals maturing (1-2yr ramp; e.g., hearables lower margins initially). Capacity underutilization if client wins delay.

- Trade/Geopolitical: US tariffs persist/escalate; dependency on Middle East seasonality.

- Market/Competition: Demand volatility (e.g., wearables); client shifts (incumbents preferred); intense ODM rivalry (Dixon/Havells peers).

- Financial: Elevated expenses persist if volumes lag; no buyback plans (despite cash PAT +94% QoQ to ₹18cr).

- External: Meet cancellations (e.g., Focus) signal exigencies; broader CE slowdown (smartwatches).

Overall: Bullish on diversification/export tailwinds, with 15-20% FY26 growth likely. Margins recover with scale, but trade risks cap upside. Sector poised for China+1 benefits, monitor Q3 updates.

Financial

asof: 2025-12-02

Analysis of Indian Consumer Electronics Sector (Based on Q3 FY25 Financial Filings)

The provided filings cover key players in consumer electronics (e.g., lighting, cables, switchgears, EMS, appliances) like Havells India, PG Electroplast, IKIO Lighting, MIRC Electronics (Onida), Focus Lighting, Veto Switchgears, Sonam Ltd., Khaitan (India), and others. Period: Mostly Q3/Nine Months FY25 (ended Dec 2024) or Q1 FY26 (June 2025). Sector shows mixed performance: Leaders like Havells and PG Electroplast drive growth via scale-up and diversification, while smaller players face revenue pressure. Overall revenue growth ~10-20% YoY in top firms, but profitability volatile due to segment losses and costs. Below is a structured summary of headwinds, tailwinds, growth prospects, and key risks.

Tailwinds (Positive Factors)

- Robust Demand in Core Segments: Cables (Havells: Rs 1,688 Cr Q3, up 7% YoY), Switchgears, and Lighting strong. Veto Switchgears reported steady Q1 FY26 revenue (Rs 4,324 Cr standalone). Focus Lighting stable at Rs 4,151 Cr Q3 revenue.

- EMS and Export Boom: PG Electroplast’s explosive FY25 growth (standalone revenue Rs 148,676 Cr, profit Rs 8,471 Cr) signals outsourcing tailwind (likely AirPods/electronics manufacturing). IKIO/Focus highlight international subsidiaries contributing.

- Capex and Fundraises: QIPs (PG: Rs 1,500 Cr utilized for capex/working capital), insurance settlements (Havells: Rs 17 Cr gain), and dividends (Havells Rs 4/share) indicate financial strength.

- Margin Recovery: Havells Cables/EBITDA up; Veto PAT steady at Rs 372 Cr Q1 FY26. Sonam steady EPS (Rs 0.53 Q3).

- Policy Support: E-waste compliance (MIRC provisioned Rs 543 Cr), PLI schemes implied in manufacturing expansions.

Headwinds (Challenges)

- Revenue Declines in Niche Players: IKIO standalone revenue crashed 32% YoY to Rs 401 Cr Q3; MIRC down 43% to Rs 1,668 Cr with Q3 loss (Rs 527 Cr).

- Loss-Making Segments: Havells Lloyd Consumer loss Rs 31 Cr Q3 (improving from Rs 66 Cr YoY); MIRC persistent losses (9M FY25: Rs 346 Cr).

- Cost Pressures: Raw materials (Havells: Rs 2,973 Cr Q3), inventory fluctuations (PG: changes Rs 639 Cr), high finance costs (Sonam Rs 58 Cr Q3, Khaitan Rs 43 Cr Q1).

- Demand Volatility: Consumer durables slowdown; Khaitan sugar mill suspension (auditor qualification).

- Working Capital Strain: High trade receivables/payables (Khaitan note: subject to reconciliation).

Growth Prospects

- High Double-Digit Revenue CAGR: PG Electroplast (148% YoY FY25), Havells 11% 9M revenue growth. Veto/Focus project 15-20% via exports/capex.

- Diversification: Havells Cables/Lighting up 20%+ YoY; EMS (PG) poised for Apple/Samsung expansion. Lighting (IKIO/Focus) premiumization tailwind.

- Capex Cycle: Rs 75k+ Cr QIPs/FDs (PG), new facilities (Havells Neemrana fire recovery). Q1 FY26 Veto signals recovery.

- Export/International: Subsidiaries (Havells intl., Focus PTE/FZE) contribute 10-20% revenue; forex gains (Focus Rs 1.94 Cr Q3).

- Projections: Sector FY26 revenue +15-20% (PLI-driven); PAT margins 8-12% for leaders. Smaller players (Sonam) steady at Rs 2.5k Cr quarterly.

Key Risks

| Risk Category | Details | Impacted Companies | Mitigation |

|---|---|---|---|

| Operational | Segment losses (Lloyd, Sugar mills); e-waste compliance (MIRC Rs 223 Cr exceptional). | Havells, MIRC, Khaitan | Improving (Lloyd EBITDA positive); EPR provisioning. |

| Financial | High debtors/creditors (reconciliation pending); inventory volatility (Havells -Rs 488 Cr Q3 change). | Khaitan, All | Cash positives (PG Rs 4,718 Cr ops cash); QIPs. |

| Regulatory/Audit | Auditor qualifications (Khaitan sugar impairment); EPR rates dispute (MIRC Rs 1,780 Cr shortfall). | Khaitan, MIRC | Industry representations; asset realizations. |

| Market | Commodity inflation (metals/raw mats 60-70% costs); demand slowdown (IKIO -32% rev). | All | Hedging/diversification (Havells cables). |

| Execution | Capex delays (PG QIP utilization Rs 759 Cr of Rs 1,478 Cr); forex (subsidiaries). | PG, Focus | Monitoring agencies (CRISIL). |

| Liquidity | Finance costs up (Sonam 25% YoY); negative working capital shifts. | Sonam, Khaitan | Debt reduction (Havells Rs 9 Cr Q3). |

Overall Sector Outlook: Positive with Caution. Tailwinds from EMS/manufacturing push outweigh headwinds; growth pegged at 15%+ FY26 led by PG/Havells. Risks mitigated by strong balance sheets (low debt), but monitor consumer spending and raw mat volatility. Smaller firms (MIRC/IKIO) vulnerable to consolidation. Investors: Favor diversified leaders.

Data aggregated from filings; FY25 trends extrapolated.

General

asof: 2025-11-29

Analysis of Indian Consumer Electronics Sector

Based on the provided regulatory filings (SEBI LODR Regulation 30 disclosures from companies like BPL, Dixon, Focus Lighting, Havells, IKIO, Khaitan, MIRC/Onida, PG Electroplast, Universus Photo Imagings, and Veto Switchgears), the sector shows a mixed outlook. These announcements highlight operational continuity, legal resolutions, fundraising efforts, but also liquidity pressures, sales shortfalls, and disputes. Below is a structured summary of headwinds, tailwinds, growth prospects, and key risks. Insights are generalized from these samples, representing mid/small-cap players in electronics, lighting, switchgears, and imaging.

Headwinds (Challenges/Drag Factors)

- Liquidity and Debt Pressures: Promoter group entities of BPL pledged shares worth securing INR 96 Cr loan from Claypond Capital, signaling cash flow strains amid high borrowing costs. This could erode investor confidence if invoked.

- Sales and Export Shortfalls: IKIO reported only ~USD 1 Mn cumulative sales vs. USD 8 Mn MOU target with a US partner, due to slow ramp-up, US tariffs, and market conditions—highlighting export vulnerabilities in a high-interest, protectionist global environment.

- Legal Overhangs: Universus faces an ongoing NCLAT appeal on oppression/mismanagement claims (post-NCLT dismissal), adding uncertainty. Historical disputes (e.g., Havells’ resolved trademark battle) indicate persistent IP/litigation risks.

- Macro Pressures: US tariffs and subdued domestic demand (implied in IKIO’s update) amid slowing consumer spending and inflation.

Tailwinds (Supportive Factors)

- Legal Resolutions and Clarity: Havells settled a long-standing trademark dispute (since 1971) with HPL Group for INR 129.6 Cr, affirming brand rights and removing multi-year litigation (Delhi HC/Supreme Court)—boosting focus on core operations.

- ESG and Governance Momentum: Dixon received an independent ‘BB’ MSCI ESG rating, enhancing appeal to global investors amid rising sustainability mandates.

- Operational Stability: Focus Lighting approved Q2/H1 FY26 results, senior management hire (Rahul Thakkar, 35+ yrs exp.), and RPT policy updates—signaling steady execution. Routine filings (e.g., Veto’s AGM e-voting, MIRC’s EGM approval) reflect compliance maturity.

Growth Prospects

- Fundraising and Capital Infusion: MIRC (Onida) passed EGM for preferential equity issue (99.99% approval), enabling fresh capital for revival/expansion. PG Electroplast allotted 6.13L ESOP shares (expanding paid-up capital to INR 28.5 Cr), incentivizing talent. Khaitan converted INR 3 Cr loan into 13.79% stake in subsidiary Eskay—strengthening group ecosystem.

- Talent and Operational Scaling: Focus’s factory head appointment targets manufacturing efficiency, key for sector growth amid PLI schemes and rising domestic demand (electronics ~15-20% CAGR projected).

- Export/Partnership Potential: Despite shortfalls, IKIO’s USD 1 Mn US sales and ongoing MOU indicate foothold in high-margin markets. Havells’ settlement frees resources for innovation in consumer electricals.

- Overall Sector Tail: PLI incentives, China+1 shift, and festive demand could drive 12-15% revenue growth; these filings suggest mid-caps gearing up via equity raises.

Key Risks

| Risk Category | Description | Examples from Filings | Potential Impact |

|---|---|---|---|

| Promoter/Liquidity Risk | High pledging/debt; invocation could trigger control changes. | BPL’s promoter pledge (96 Cr loan). | Share price volatility, M&A threats. |

| Execution/Revenue Risk | Demand slowdown, tariffs delaying ramps. | IKIO’s 87% MOU shortfall. | Margin compression (EBITDA <10%). |

| Legal/Regulatory Risk | Prolonged disputes eroding value. | Universus NCLAT appeal; Havells (resolved). | Costs (e.g., Havells’ 130 Cr payout), distractions. |

| Governance Risk | Related-party deals, fundraises needing scrutiny. | Focus RPT policy tweak; MIRC preferential issue. | Shareholder activism, penalties. |

| Macro Risk | Inflation, rates, geopolitics. | US tariffs (IKIO); broader sector capex delays. | 5-10% growth downgrade if prolonged. |

Overall Summary: Moderately positive with tailwinds from resolutions and fundraising outweighing headwinds like debt/exports (net neutral FY26 outlook). Growth hinges on execution (PLI-driven EMS boom), but risks from liquidity/legal issues warrant caution for investors. Sector PE ~25-30x; monitor Q3 results for festive traction. Positive for EMS leaders (Dixon/PG); watch debt-heavy names (BPL).

Investor

asof: 2025-12-03

Indian Consumer Electronics Sector Analysis

Based on recent announcements and IKIO Technologies’ Q2/H1 FY26 earnings transcript (key input), alongside investor/analyst meet schedules from Havells, Dixon, PG Electroplast, and Focus Lighting. These reflect sector trends in EMS/ODM (electronics manufacturing services), lighting, wearables/hearables, and exports as of Nov-Dec 2025.

Tailwinds

- Product Diversification & New Categories: Strong traction in wearables/hearables (TWS earphones, smartwatches, soundbars, Bluetooth speakers), contributing ~13-14% to revenue; up 71% YoY in “other businesses” (Rs. 115cr Q2). Entry into automotive lighting, display/in-store lighting, fire alarms/sensors/PA systems for clients like Honeywell.

- Client Expansion: Onboarding top Indian brands (NDA-protected), new ODM lighting clients, and institutional interest (e.g., Dixon’s meets with Invesco, JP Morgan, Goldman Sachs).

- Export Momentum: Middle East (Dubai hub) up significantly (127% YoY exports, 23% of H1 revenue); ASEAN approvals (Philippines, Vietnam); US subsidiary (Royallux) resilient despite tariffs.

- Capacity & Infrastructure: Greenfield expansions (e.g., IKIO’s 5L sq ft facility, Block 1 operational at 15-20% utilization); backward integration for margins/quality; 78% IPO proceeds deployed.

- Sector Engagement: Active analyst/investor meets (Havells, Dixon, PG Electroplast) signal confidence; no UPSI shared, focusing group/one-on-one interactions.

Headwinds

- US Tariff Disruptions: Exports from India to US shrunken; reliance shifting to Middle East mitigated but temporary.

- Margin Pressures: EBITDA at 11.2% (Q2, down from historical 20-23%); gross margins 35-36% impacted by new verticals’ low initial volumes/high raw material costs, front-loaded expenses (R&D, hiring).

- Demand Softness: Smartwatch demand plateauing in India (shifting to audio/hearables); seasonality in display lighting.

- Event Cancellations: Minor (e.g., Focus Lighting meet cancelled), indicating scheduling exigencies.

Growth Prospects

- Near-Term (FY26): IKIO guides ~15% topline growth (H1 at Rs. 284cr, +13% YoY); Q2 revenue +31% YoY/+37% QoQ. Other businesses up 54% H1 YoY; exports +30% QoQ.

- Medium-Term (2-3 Years): Capacity ramp-up (e.g., IKIO Block 2 nearing completion); new verticals (50-60% of growth) to mature, targeting 16-18% EBITDA; historical asset turns 4.5-5.5x support higher revenue.

- Long-Term: Multi-brand portfolio (40+ products/SKUs in hearables/wearables); geographic expansion (Middle East, ASEAN, potential others); ROCE focus in high-volume categories; “Indianizing” products for value-add (90-95% localization like lighting).

- Overall Sector: EMS demand from brands; Make-in-India tailwind; potential buyback discussions (IKIO).

Key Risks

- Execution in New Verticals: Delays in client onboarding, certifications, volume ramp-up (e.g., hearables/wearables <1 year old); pipeline-dependent (30-40 products under dev).

- Margin Volatility: Employee costs, buying inefficiencies in early stages; normalization expected but unproven.

- Geopolitical/Trade: US tariff persistence; over-reliance on Middle East exports.

- Competition & Demand: Incumbent suppliers in wearables; market shifts (e.g., smartwatches to audio).

- Operational: Low capacity utilization; exigencies in meets/investor schedules; no long-term guidance beyond FY26.

Summary: Bullish on diversification/export growth offsetting US headwinds; 15%+ FY26 growth viable, with 3-5yr upside from capacity/clients. Risks tied to scaling new biz amid margins/tariffs—watch Q3 execution. Sector resilient via EMS/ODM pivot.

Press Release

asof: 2025-11-29

Analysis of Indian Consumer Electronics Sector (Focus: Durables like Lighting, ACs, Refrigerators, Washing Machines)

Using the provided documents from Focus Lighting & Fixtures (lighting solutions), Havells India (Lloyd refrigerators), and PG Electroplast (EMS for ACs, washing machines, etc.), here’s a structured analysis of headwinds, tailwinds, growth prospects, and key risks. These reflect Q2/H1 FY26 performance (ended Sep 2025) amid seasonal and macro factors.

Headwinds (Challenges Impacting Near-Term Performance)

- Subdued Demand in Key Segments: Room AC sales moderated due to early monsoons and delayed buying post-GST cut announcement (PGEL Q2 revenues -2.4% YoY; coolers -19.7% YoY). Summer products faced headwinds, contributing to H1 revenue moderation.

- Margin Compression: EBITDA margins declined sharply (FOCUS: 10.4% vs. 17% YoY; PGEL Q2: down 26%; H1 down ~6%). Driven by higher costs, pricing pressures, and mix shift toward lower-margin segments.

- Profitability Pressure: Net profits fell significantly (FOCUS H1: 3.7% margin vs. 9%; PGEL Q2: ₹2.4 Cr vs. ₹19.5 Cr; H1 down 34%). Reflects operational leverage loss amid uneven demand.

- Seasonal/Weather Dependency: AC and cooling products vulnerable to monsoons, delaying peak summer sales.

Tailwinds (Supportive Factors Driving Resilience)

- Government Initiatives: Make in India, Digital India, Smart Cities boosting infrastructure/retail lighting and energy-efficient products (FOCUS highlights constructive environment).

- Consumer Shift to Premium/Smart Products: Demand for stylish, feature-rich appliances (e.g., Lloyd Kolors Refrigerator with inverter tech, auto-defrost, Bactshield; pastel designs appealing to urban/tier-2/3 homes). E-commerce expansion (Flipkart launch) enhances accessibility.

- Category Growth: Washing machines +47% YoY (PGEL); low AC penetration in India; rising sustainability focus (LED, eco-lighting via FOCUS R&D).

- GST Reduction: Expected to improve affordability and penetration for durables like ACs/refrigerators (PGEL).

- Order Inflows & Client Wins: FOCUS secured ₹5.23 Cr orders (residential/commercial); PGEL’s product business +9% YoY.

Growth Prospects (Medium-to-Long Term Opportunities)

- Robust Guidance: PGEL eyes FY26 consolidated revenues ₹5,700-5,800 Cr (+17-19% YoY), group ₹6,550-6,650 Cr (+21-23%); products (ACs/WMs) +17-21%. Net profit ₹300-310 Cr (+3-7%).

- Capacity Expansion: PGEL capex ₹700-750 Cr for AC/WM/refrigerator facilities (Rajasthan, Noida, South/West India). FOCUS expanding portfolio (TRIX range, patented facade lighting).

- EMS & Diversification: PGEL’s JV (Goodworth) +57% revenue growth to ₹850 Cr; electronics +29%. FOCUS segments (retail/home/infra) at ₹90 Cr H1 consolidated.

- Digital & Export Push: Flipkart tie-up for Lloyd expands reach; FOCUS presence in Singapore/UAE; overall shift to online/smart lighting/appliances.

- Low Penetration + Premiumization: ACs/WMs/refrigerators have structural headroom; R&D focus on human-centric, IoT-enabled products.

| Key Metrics (H1 FY26 vs. H1 FY25) | FOCUS (Standalone) | PGEL (Consolidated) |

|---|---|---|

| Revenue Growth | +14% (₹86 Cr) | +8% (₹2,159 Cr) |

| EBITDA Margin | -650 bps (10%) | -560 bps (8.5%) |

| Net Profit Growth | -54% | -34% |

Key Risks

- Demand Volatility: Weather/economic slowdowns could prolong AC/refrigerator weakness; subdued H1 traction signals broader consumer caution.

- Margin & Cost Pressures: Raw material inflation, forex volatility (imports for tech/components), competition eroding pricing power.

- Execution Risks: Heavy capex (PGEL ₹700+ Cr) amid moderated growth; delays in new facilities/projects.

- Macro/Regulatory: Govt policy shifts (e.g., GST changes), political/economic developments (all docs note forward-looking risks).

- Competition & Tech Disruption: Intensifying rivalry in EMS/durables; need for continuous innovation (e.g., LED/smart tech obsolescence).

Summary

The Indian consumer electronics durables sector faces near-term headwinds from seasonal AC weakness and margin squeezes (H1 growth muted at 8-14%, profits down 30-50%), but strong tailwinds from govt schemes, premiumization, e-commerce, and GST cuts support recovery. Growth prospects are promising (17-23% FY26 revenue upside per PGEL), fueled by low penetration, capex-led expansion, and EMS scale. Risks center on demand volatility and execution, but resilient order books/ESOPs signal confidence. Overall outlook: Cautiously optimistic for FY26, with structural positives outweighing cyclical pressures. Sector ROCE/RoE remains solid (PGEL ~20%/13% TTM).

Copyright © 2023 SAS Data Analytics Pvt. Ltd. All rights reserved.