Business Process Outsourcing (BPO)/ Knowledge Process Outsourcing (KPO)

Industry Metrics

January 13, 2026

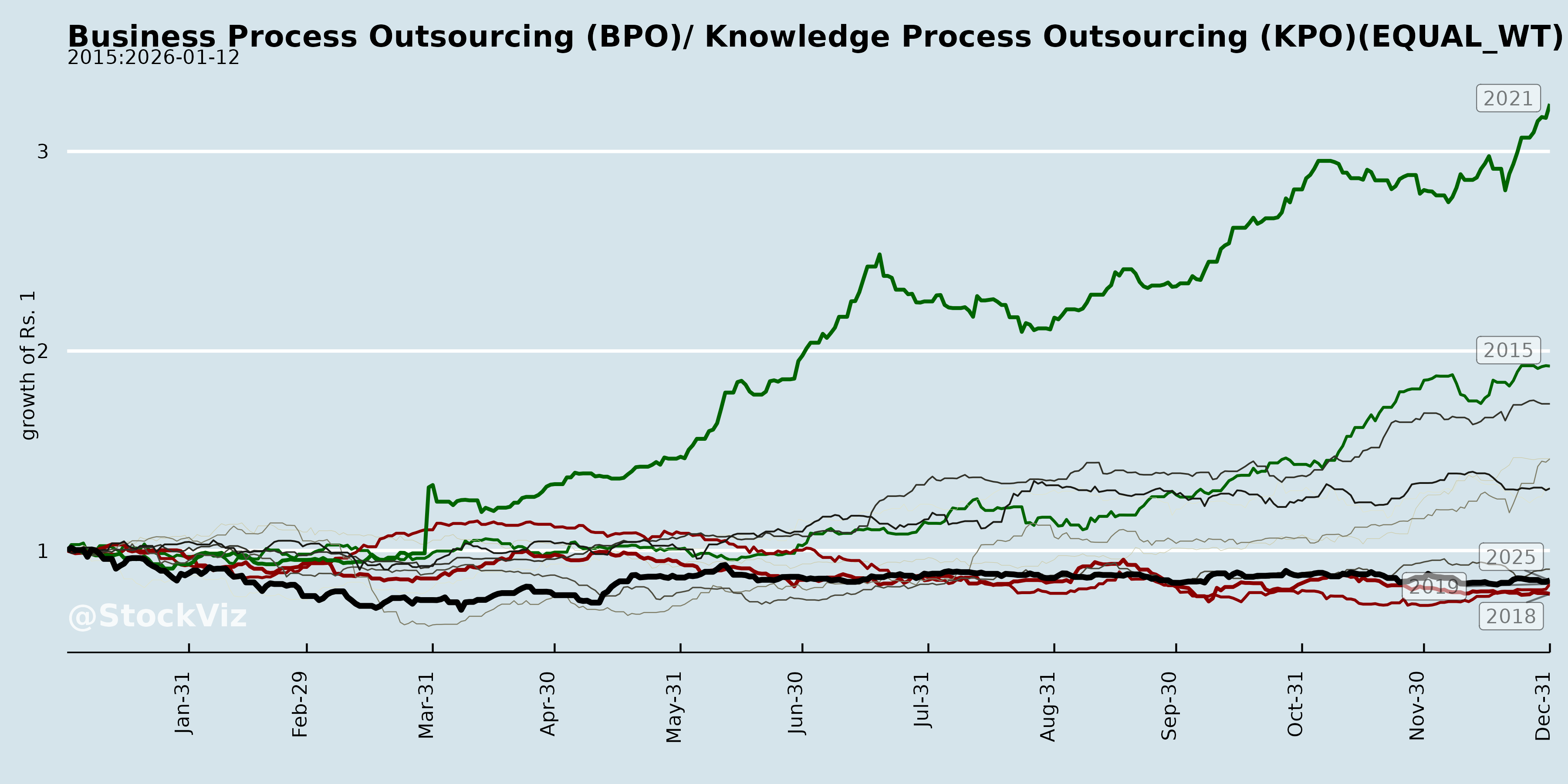

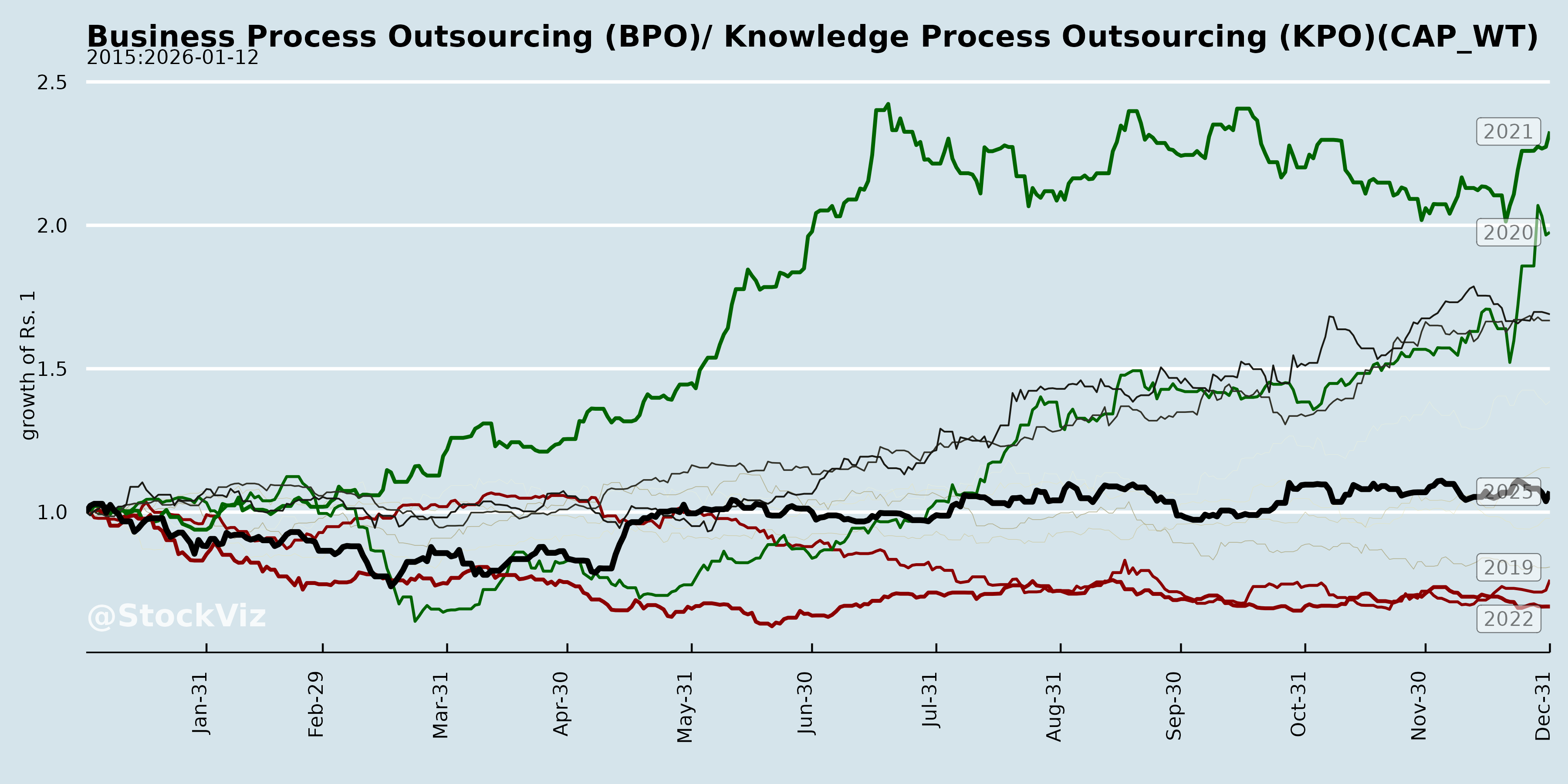

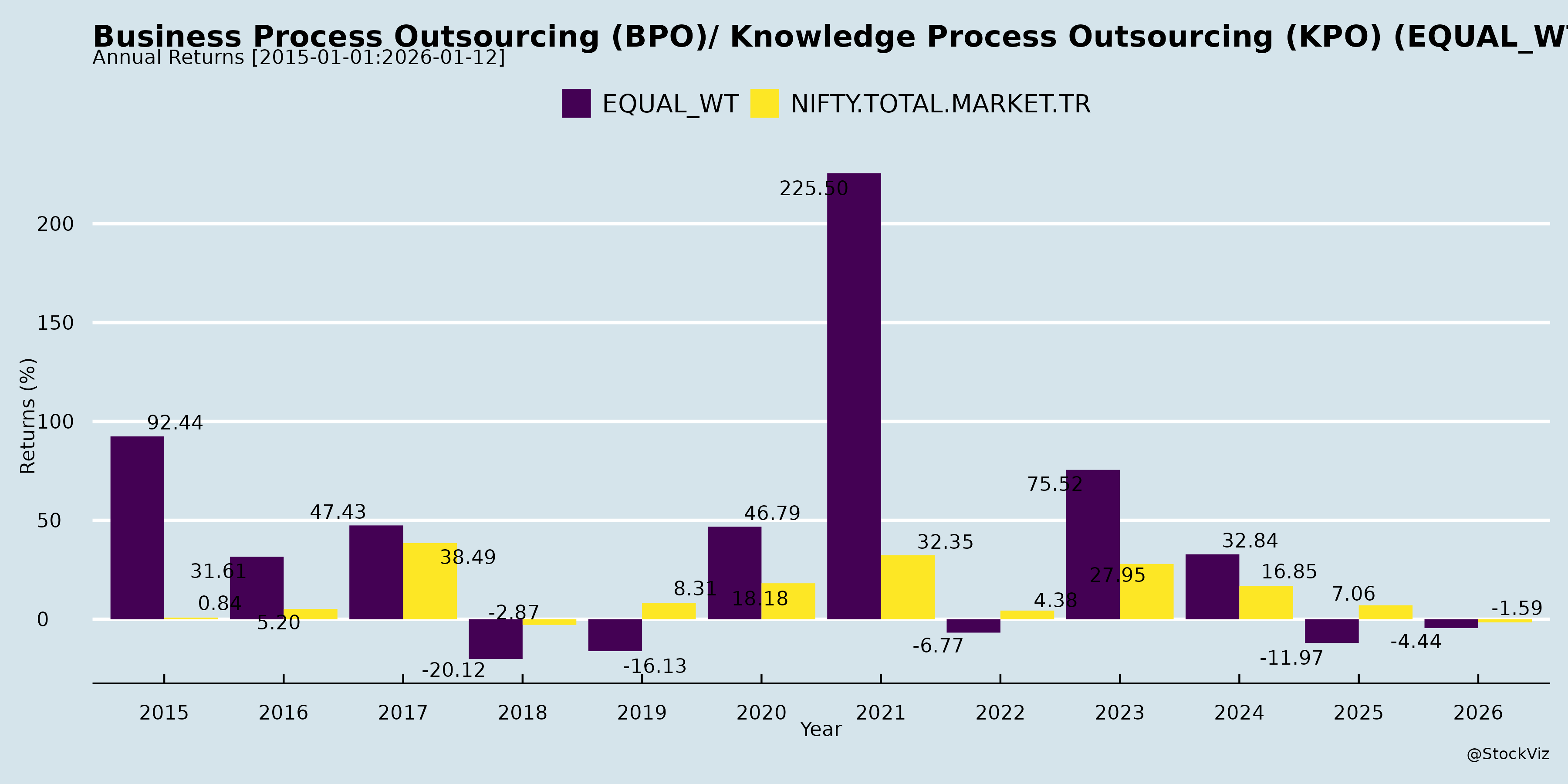

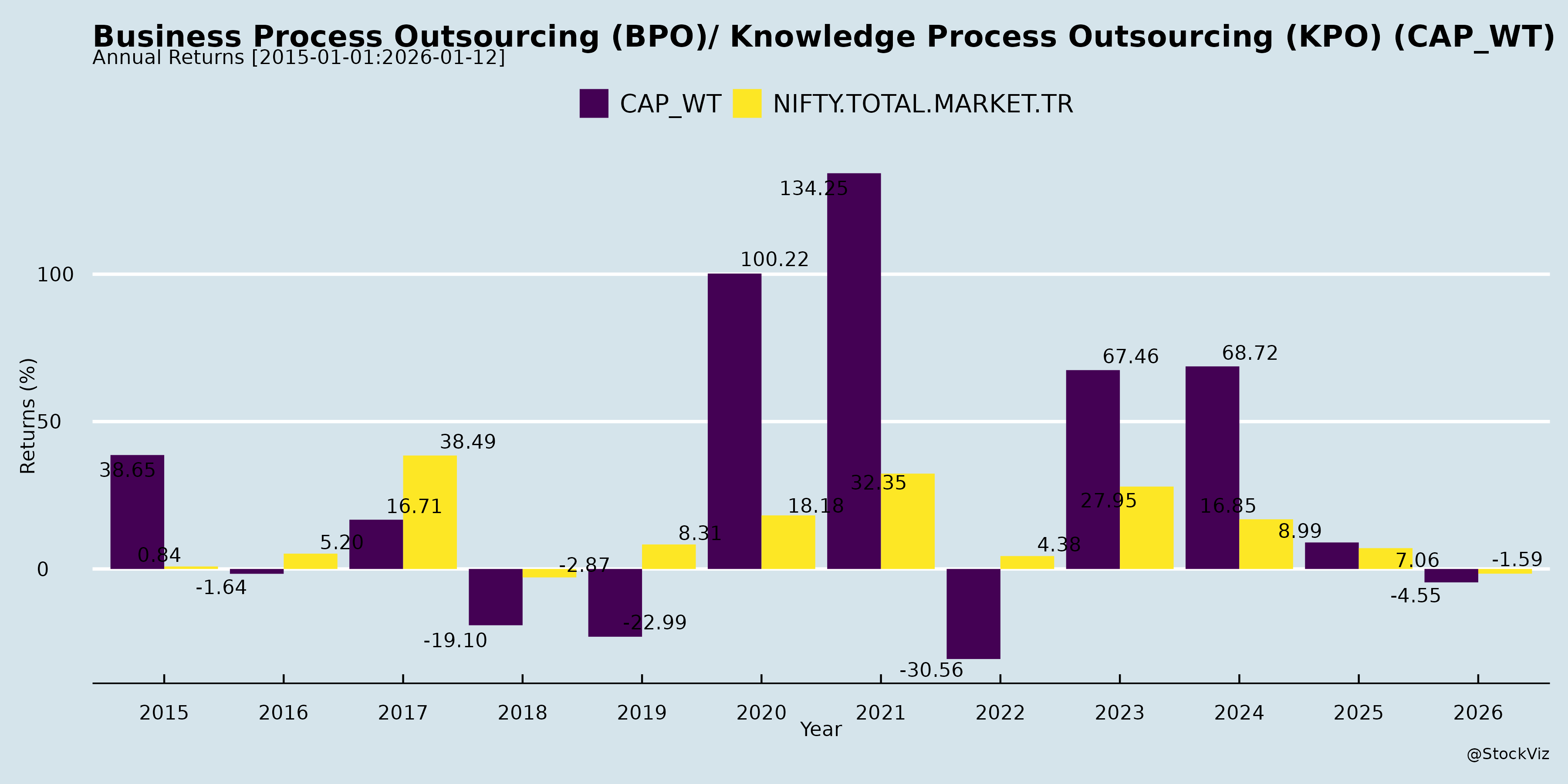

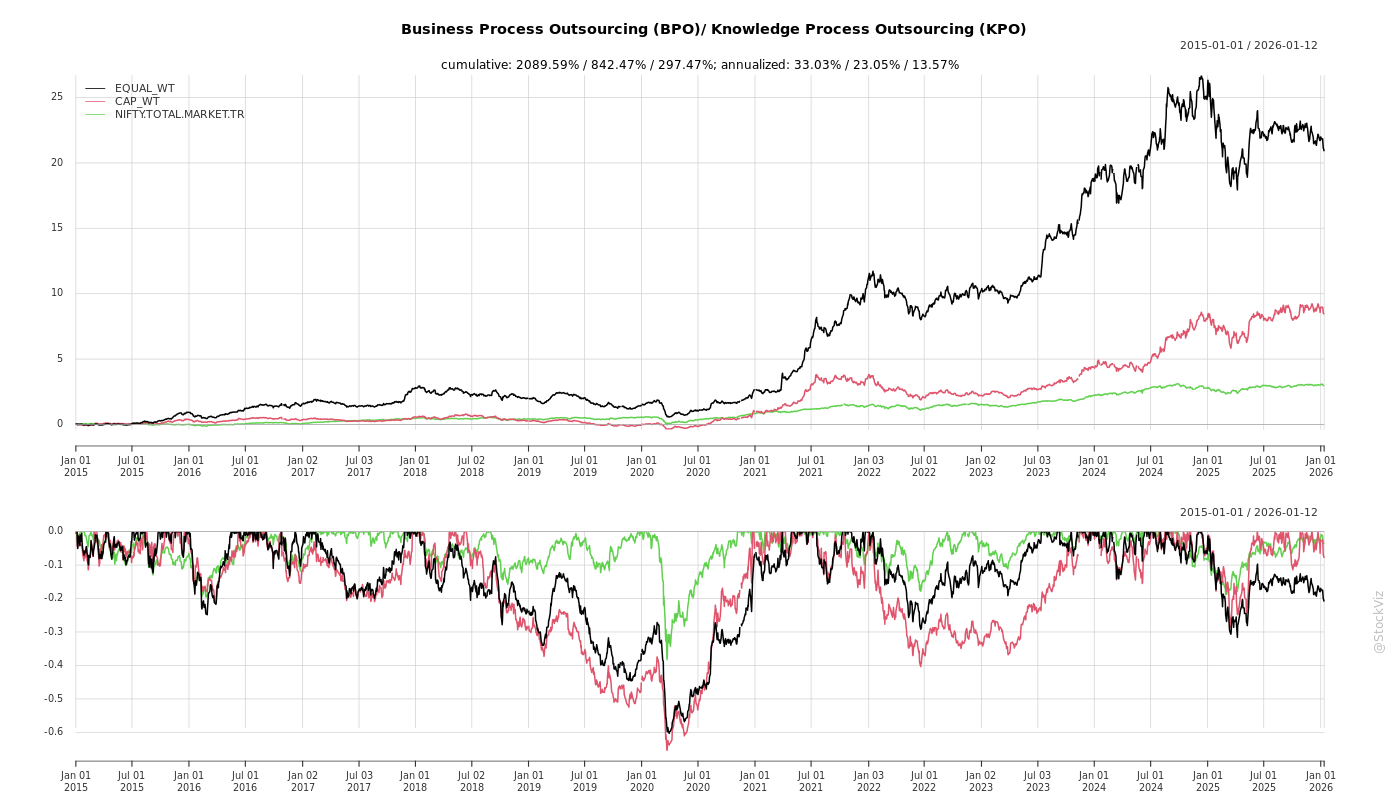

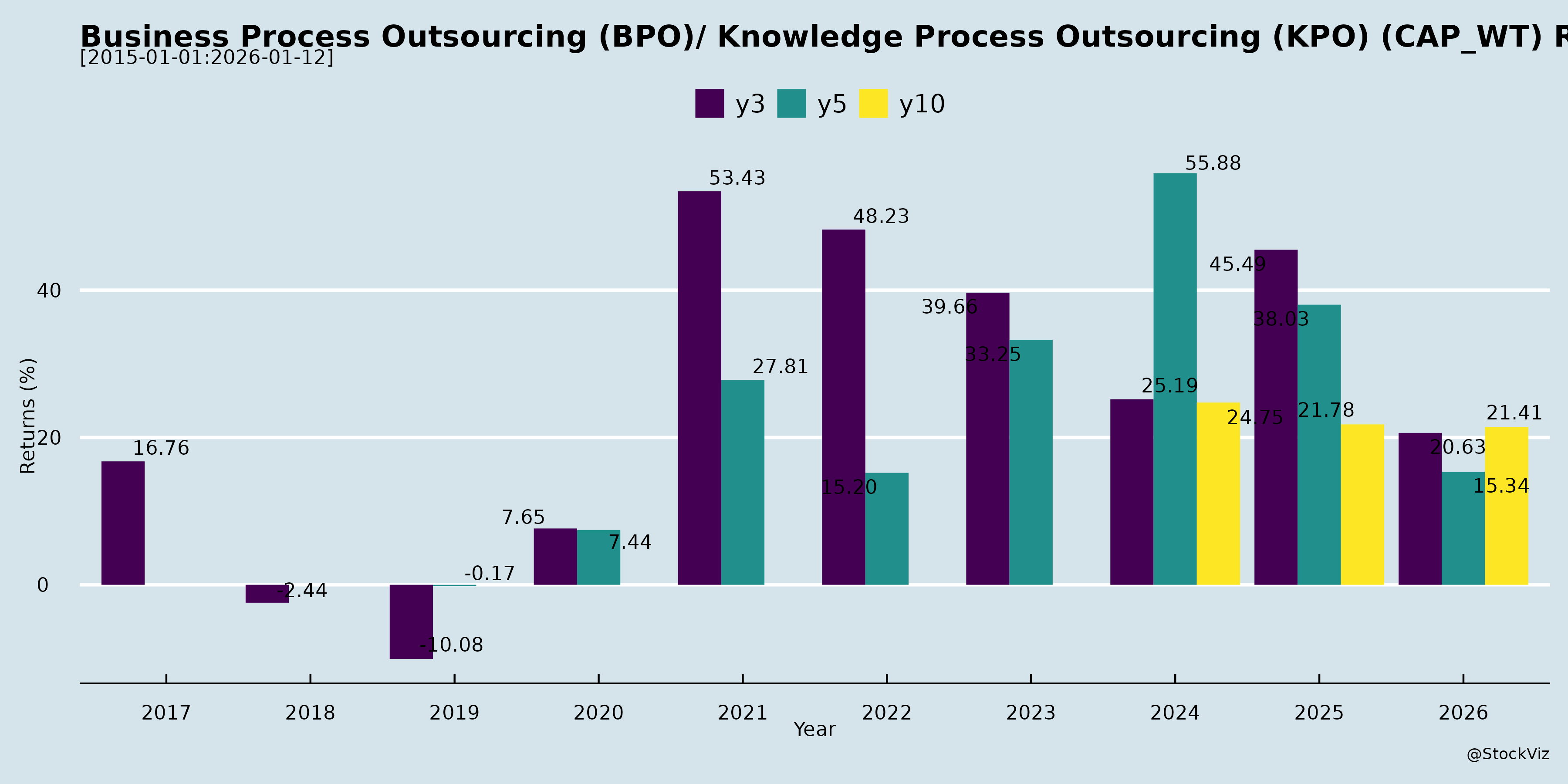

Annual Returns

Cumulative Returns and Drawdowns

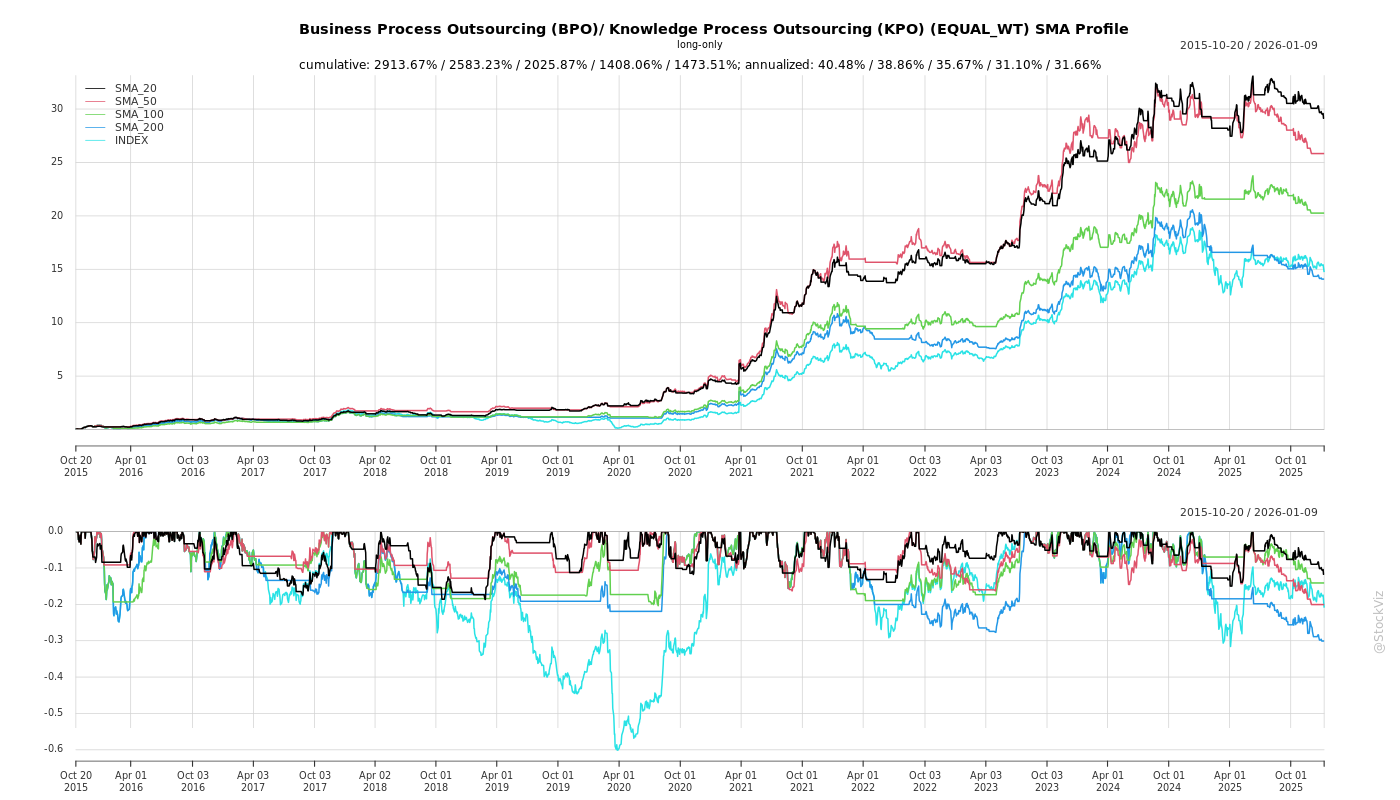

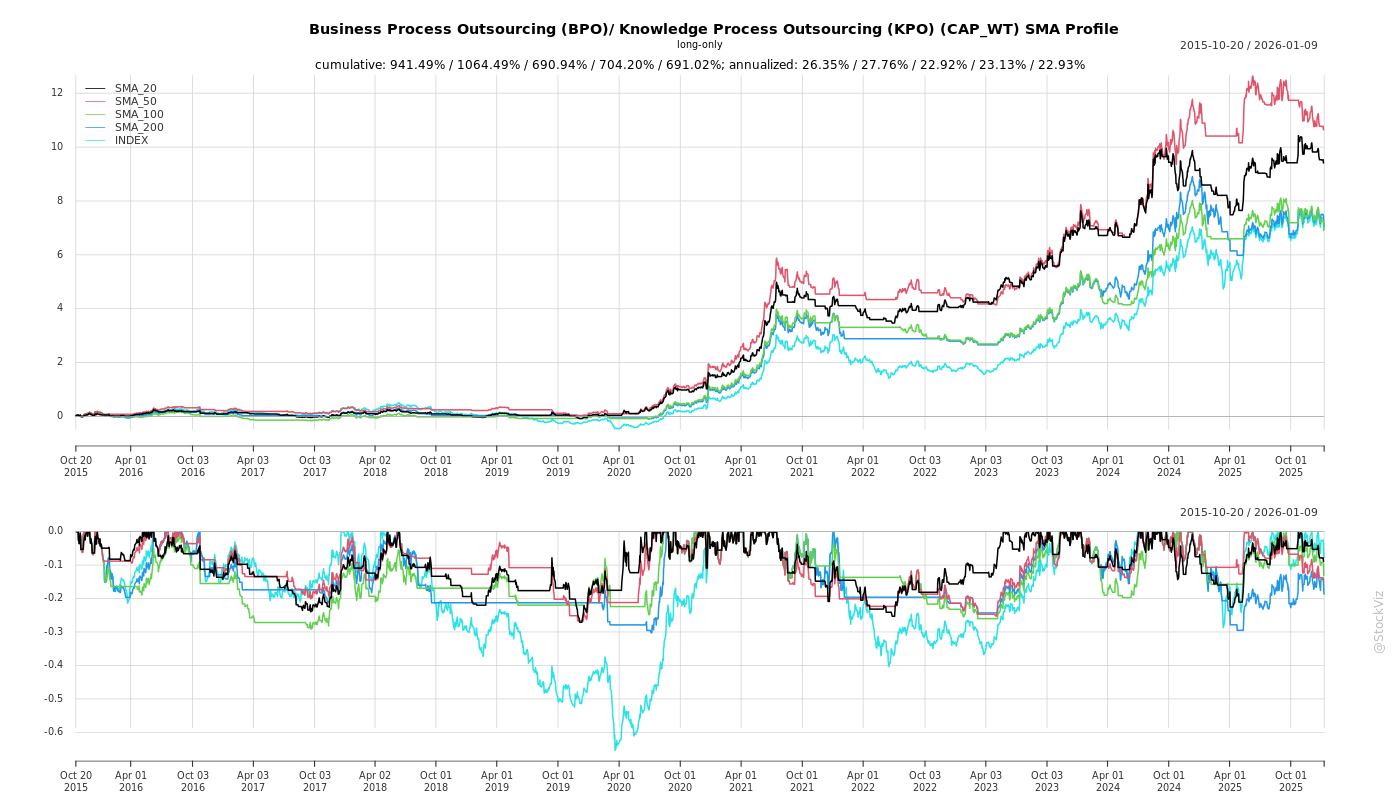

SMA Scenarios

Current Distance from SMA

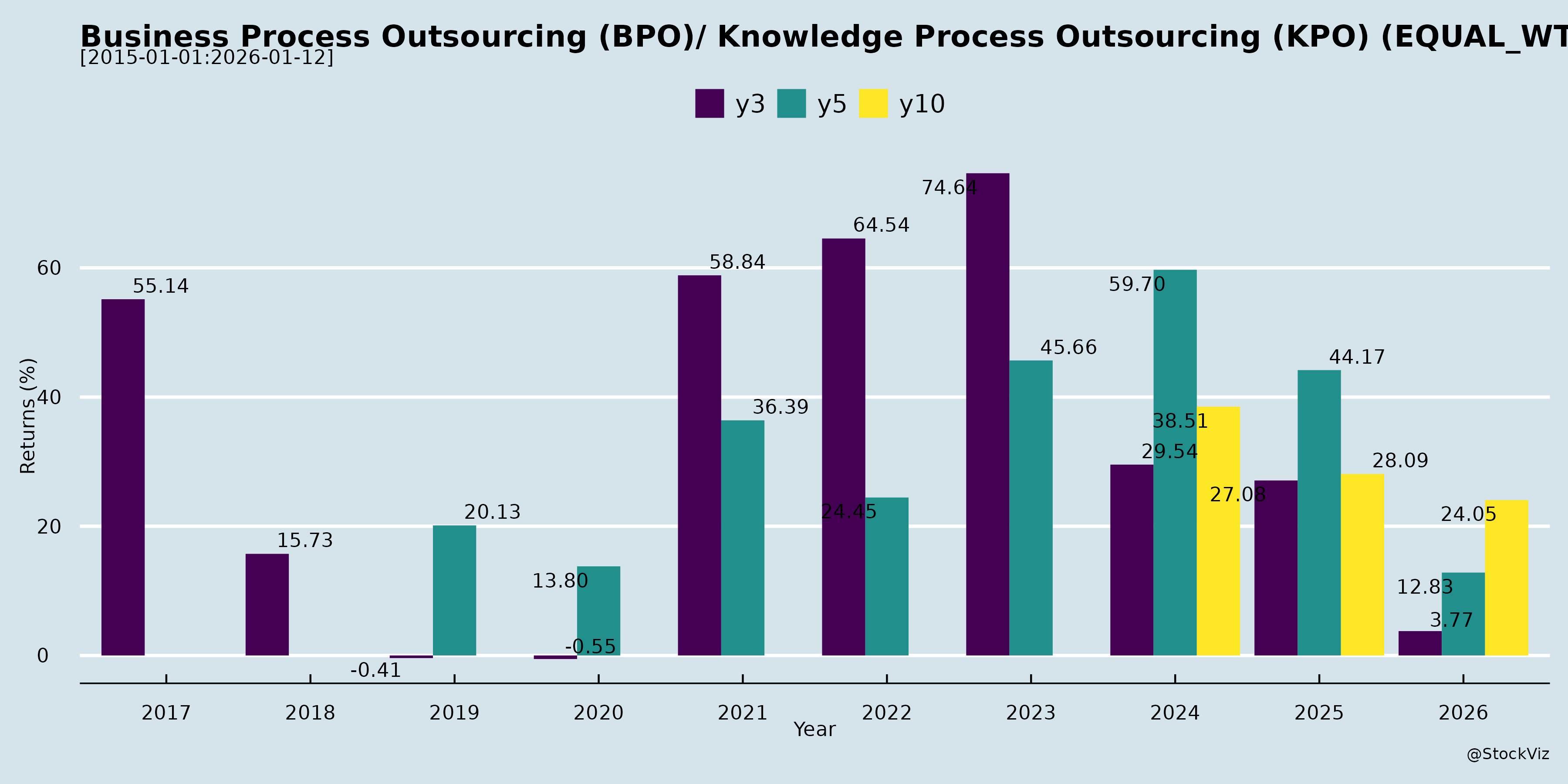

Rolling Returns

Market Cap

EBIT (% of Industry Total)

Revenue (% of Industry Total)

AI Summaries

Analyst

asof: 2025-11-29

Indian BPO/KPO Sector Analysis (Based on Q2/H1 FY26 Earnings Transcripts & Filings)

The analysis draws from transcripts/filings of Firstsource Solutions (strong growth leader), HGS (transformation-focused amid losses), Alldigi Tech (steady performer), and limited updates from eClerx and One Point One (investor meetings, no financials). Sector shows resilience with AI-driven innovation, but uneven performance amid macros. Overall: Moderate growth (10-15% CC YoY), margin pressure easing via tech, but Europe drags.

Tailwinds (Positive Drivers)

| Factor | Evidence/Details | Impact |

|---|---|---|

| AI/Tech Adoption | - Firstsource: UnBPO™ playbook, investments in AppliedAI/Lyzr; AI in mortgages/healthcare; data-as-a-service for top tech firms. - HGS: AgentX (20 clients, 30% margin uplift); solutions like Cloud FinOps, AM Lens (60% false positives cut). - Alldigi: AI in BPM/healthcare; SP4/Smart HR platforms; RCM billing ramp. - Sector: Agentic AI, automation reducing cycle times (e.g., HGS: agent proficiency 10-12wks → 2-3wks). |

High-margin digital services (62% of HGS pipeline); revenue/FTE decoupling from linear headcount growth. |

| Deal Momentum & Pipeline | - Firstsource: 4 large deals (>$5M ACV), 10 new logos (4 strategic), $1B+ pipeline (first time); 22 large deals past 6qtrs. - Alldigi: H1 ACV ₹40Cr (BPM ₹22Cr, Tech ₹18Cr); 16.2L employee records (+10% YoY). - HGS: 35 new contracts H1; multi-tower deals in BFSI/Healthcare. |

Broad-based (non-top-5 clients >50% ACV); strategic logos hitting $5M run-rate fast. |

| Vertical/Geography Diversification | - Healthcare/BFSI traction: Firstsource (payers, collections); Alldigi (RCM Philippines); HGS (healthcare intake). - New markets: Firstsource (Dubai, South Africa, Australia-Monash AI tie-up); Alldigi (Intl 64% mix). - Client dilution: Firstsource top-5/10 share down 6-9% in 8qtrs. |

NA/Europe recovery via nearshore/offshore; non-UK Europe gradual. |

| Operational Efficiencies | - Attrition down (Firstsource 28% T12M, -12ppt in 8qtrs); right-shoring (80% offshore hires). - Margins: Firstsource 11.5% EBIT (+70bps YoY, 4qtr expansion); Alldigi T&D 40%; HGS EBITDA 13% (mid-20s in 5yrs). |

Wage hikes offset; OCF strong (Firstsource 82% EBITDA H1; Alldigi 93% Q2). |

Headwinds (Challenges)

| Factor | Evidence/Details | Impact |

|---|---|---|

| Macro/Geopolitical | - Firstsource: Uncertainties persist despite 6qtr YoY growth; Europe soft (UK muted growth, regs/labor costs → offshore shift). - HGS: Media headwinds (OTT/free TV); stagnant topline (Q2 +0.4% YoY). |

NA healthy (16% YoY Firstsource), but Europe gradual recovery; decision cycles longer. |

| Margin Pressures | - Investments: Sales/leadership hires (Alldigi dip Q1→Q2); wage hikes (Firstsource 90% covered). - HGS: Losses narrowing (PAT -₹27Cr Q2 vs -₹46Cr Q1) but persistent (-₹73Cr H1). |

EBITDA expansion (50-75bps/yr Firstsource/Alldigi) but forex/depreciation offsets PBT (Alldigi dep +50% YoY). |

| Demand Volatility | - Mortgage sluggish (Firstsource: high rates, 88% mortgages <5%); Diverse portfolio flat (UK utilities/retail). - HGS: BPM/digital mix ~55/45; DSO 61 days (imp). |

Project transitions cause QoQ volatility (Firstsource CMT -1%). |

| Execution Delays | - Staggered ramps (Firstsource Healthcare BPaaS Q3+; FCA approvals for collections/Pastdue). | Growth non-linear; H1 organic ~8-10% ex-acquisitions (Firstsource). |

Growth Prospects

- Guidance: Firstsource 13-15% CC FY26 (ex-Pastdue); Alldigi mid-high teens; HGS moderate FY26, accelerate FY27 (digital-led).

- FY26 Outlook: 12-15% sector CC growth; H2 acceleration (Firstsource: ramps, headcount +1.5K highest 6qtrs).

- Medium-Term (3-5yrs):

- $1B+ revenue scale (Firstsource T12M done); high-teens CAGR (Alldigi).

- Digital/UnBPO shift: Non-linear pricing (Firstsource); outcome-based (HGS).

- M&A: Firstsource (Pastdue, AppliedAI); Alldigi exploring geo/vertical adds.

- Verticals: Healthcare (2.5x pipeline Firstsource), BFSI, Tech/Media.

- Recognitions: Everest Star Performer (Alldigi MCP/CXM); HFS Leader (Firstsource mortgages).

- Upside: AI moat (domain+tech); share gains (Firstsource +0.5% vs peers); MSME/enterprise HR (Alldigi).

Key Risks

| Risk | Details | Mitigation |

|---|---|---|

| Macro/Execution | Geopolitics, rate cuts delay (mortgages); ramp delays/FCA approvals. | Pipeline depth; nearshore (South Africa). |

| Currency/Financial | Forex volatility (HGS gains aid losses); dep/capex rise (Alldigi ₹14.8Cr Q2). | Hedging (Firstsource GBP/USD); strong cash (Firstsource ₹2.9B; Alldigi ₹137Cr). |

| Competition | IT peers’ BPO push; pure-plays vs integrated (Firstsource: pure BPO > IT+BPO per Everest). | Domain depth (Firstsource 39 $5M+ accounts); AI differentiation. |

| Client/Concentration | Top-5 reliance (diluting but HGS top-1 7.6%); DSO creep (Firstsource 69d). | 80-90% growth from existing (HGS); new logos. |

| Talent/Regulatory | Attrition (imp but monitored); tax scrutiny (Alldigi refunds pending); regs (UK FCA). | Upskilling (HGS DigiRise); diversity (Alldigi 48% women). |

| M&A Integration | Pastdue/AppliedAI delays; impairments (Firstsource Ascensos). | Proactive (Firstsource 13/19 strategic logos hit $5M). |

Summary: Sector resilient (10-15% growth, margins 11-13% stabilizing), powered by AI/digital tailwinds and deal pipes, but headwinds from Europe/macros cap upside. Leaders like Firstsource/Alldigi eye high-teens; laggards like HGS need execution. Net Positive: Tech arbitrage > labor; watch H2 ramps/M&A closes for re-rating. Risks tilted macro/execution (medium).

Financial

asof: 2025-12-02

Analysis of Indian BPO/KPO Sector: Headwinds, Tailwinds, Growth Prospects, and Key Risks

The provided documents contain Q3 FY25 (ended Dec 31, 2024) and 9M FY25 unaudited financial results from five listed Indian BPO/KPO players: eClerx Services (data analytics/process outsourcing), RPSG Ventures (process outsourcing as a key segment), One Point One Solutions (IT-enabled services), Alldigi Tech (formerly Allsec; CXM/EXM focus), and We Win (call center services). These represent a mix of mid-to-large players with international operations (US, UK, Philippines, etc.). Overall, the sector shows resilient revenue growth (10-40% YoY in most cases) driven by global demand, but faces margin pressures from costs. Consolidated revenues aggregate ~₹32,000 Cr for Q3 across these firms, with healthy PAT in leaders (eClerx, Alldigi).

Below is a structured summary:

Tailwinds (Positive Drivers)

- Robust Revenue Momentum: | Company | Q3 Revenue (₹ Cr) | YoY Growth | 9M Revenue (₹ Cr) | YoY Growth | |———|——————-|————|——————-|————| | eClerx (Cons.) | 8,538 | +13% | 24,676 | +14% | | RPSG Ventures (Cons.) | 2,385 | +29% | 7,067 | +19% | | One Point One (Cons.) | 6,568 | +57% (post-acq.) | 18,931 | +61% | | Alldigi Tech (Cons.) | 13,946 | +16% | 40,021 | +18% | | We Win (Stand.) | 192.7 | +15% | 582 | +27% |

- Key: CXM/EXM (Alldigi: CXM ₹10,488 Cr Q3), data analytics (eClerx), and services outsourcing drive growth. Geographic diversification (India 70-80%, exports 20-30%).

- Profitability in Leaders: eClerx PAT +18% YoY (₹1,372 Cr Q3); Alldigi PAT ₹1,992 Cr (+77% YoY); One Point One PAT ₹843 Cr (+41%). EBITDA margins 20-25% in top firms.

- Strategic Moves: Acquisitions (One Point One: ITCube; RPSG: multiple subs), international subs (eClerx: 20+ entities), dividends (Alldigi: ₹40/share FY25).

- Macro Support: Cost arbitrage, digital transformation demand (AI/analytics), post-COVID outsourcing rebound.

Headwinds (Challenges)

- Cost Pressures: | Expense Category | % of Revenue (Avg. Q3) | Key Notes | |——————|————————-|———–| | Employee Costs | 55-65% | eClerx: ₹5,233 Cr; RPSG: ₹1,369 Cr (up 20% YoY). Wage inflation, attrition risks. | Finance Costs | 1-3% | Rising (RPSG: ₹190 Cr Q3, up 26% YoY) due to debt for expansions. | Depreciation | 5-8% | High capex on IT infra (eClerx: ₹358 Cr Q3).

- Margin Compression: EBITDA margins dipped in RPSG (negative pre-exceptional), We Win (breakeven). OCI volatility (forex losses: Alldigi -₹63 lakhs Q3).

- Segment Weakness: RPSG EXM/Sports losses; Alldigi divested LLC division (gain ₹1,769 lakhs 9M).

- Uneven Performance: We Win Q3 loss (₹28 lakhs); RPSG owner-attributable loss ₹60 Cr Q3.

Growth Prospects

- High Potential (20-30% CAGR Projected):

- Demand Drivers: Global BPO market ~$300 Bn (India 55% share); KPO growth in analytics/AI (eClerx single segment: data mgmt/analytics).

- Expansion: International subs revenue (eClerx: ₹609 Cr Q3 from 4 subs); RPSG: 50+ subs/JVs; Alldigi CXM (70% revenue).

- Organic/Inorganic: Acquisitions (One Point One), buybacks (eClerx: ₹3,850 Cr completed), new markets (eClerx Peru, RPSG acquisitions).

- 9M Trends: Aggregate revenue +25% YoY; PAT leaders >20% growth. FY25 guidance implicit: sustained double-digit growth.

- Sector Tailwinds: US/UK offshoring, GenAI adoption, nearshore/hybrid models.

Key Risks

| Risk Category | Description | Evidence from Filings |

|---|---|---|

| Operational/Talent | High employee costs (60%+ revenue); attrition in skilled roles. | Universal; RPSG demand order (₹39 Cr GST). |

| Forex/Volatility | OCI forex swings (Alldigi: -₹40 lakhs Q3); export-heavy. | eClerx/Alldigi OCI losses; translation reserves. |

| Regulatory/Compliance | Tax/GST disputes, insider trading codes. | RPSG GST demand; all have PIT policies. |

| Client/Concentration | Dependency on key clients/geos (US 40-50%). | Implicit in geo segments (India dominant). |

| Execution | Integration risks post-M&A; capex heavy (depn up 15-20%). | One Point One ITCube integration; RPSG 50+ subs. |

| Macro | Recession, rupee appreciation eroding arbitrage. | Slow Q3 in some (We Win loss). |

| Financial | Debt rise (finance costs +20%); exceptional items volatility. | Alldigi divestment gains; RPSG losses. |

Overall Summary: The Indian BPO/KPO sector is bullish with strong tailwinds from outsourcing demand and expansions (revenue +15-60% YoY), led by eClerx/Alldigi. Tailwinds outweigh headwinds for scale players, but smaller ones (We Win) face breakeven risks. Growth prospects: 20%+ FY25, fueled by digital services. Key Monitor: Cost control (employee/finance) and forex. Sector resilient, but talent/geopolitical risks loom. Investors should favor diversified leaders with intl. footprint.

General

asof: 2025-11-30

Summary Analysis of Indian BPO/KPO Sector (Based on Provided Documents)

The documents highlight positive momentum in the Indian BPO/KPO sector, driven by AI-led transformation (e.g., Firstsource’s UnBPO™, One Point One’s AI Voice acquisition), strong Q2FY26 financials (Alldigi Tech), recognitions, and strategic expansions. Companies like Firstsource, Alldigi, and One Point One show robust growth, while others (eClerx, HGS) focus on compliance/AGMs. Below is a structured analysis:

Tailwinds (Supportive Factors)

- AI & Digital Transformation: Shift from labor-cost to tech-arbitrage (Firstsource CEO chat). AI tools like real-time translation, claims agents (30% cost cuts), propensity models (60% win-back jump), and True VA Voice AI (One Point One acquisition) enhance CX, collections, healthcare, and utilities.

- Strong Financial Momentum: Alldigi Tech reports Q2 revenue +12.2% YoY (₹147 Cr), H1 +11.7% (₹291 Cr), EBITDA +17%, PAT +45% YoY; Tech&Digital (HRO) +16% YoY, BPM +11%.

- Industry Recognitions & Partnerships: Firstsource: HFS ‘Market Leader’, Everest ‘Star Performer’/Major Contender, ESG award. Events like COBA, Investor Day signal demand.

- Talent & Expansion: Alldigi adds ~4.3L employee records (+10% YoY); Firstsource adds 4 industry veterans to Advisory Board (banking, healthcare, tech); new Dubai subsidiary and Singapore AI stake.

- ACV & Client Wins: Alldigi H1 ACV ₹18-22 Cr (2x YoY), 15+ new logos; Healthcare mining drives BPM growth.

Headwinds (Challenges)

- Margin Pressures: Alldigi EBITDA margin dips 100bps YoY to 24.4% due to sales/leadership investments; BPM margins ~12-13%.

- Cash Flow/DSO Fluctuations: Alldigi cash dips post-dividend (₹136 Cr); DSO at 77 days (+1 YoY but improved QoQ); collections strong but variable.

- Operational Scaling: Higher employee costs (+10% YoY at Alldigi); depreciation up 42% YoY on capex/tech upgrades.

- Macro Dependencies: Reliance on client sectors (healthcare, finance, utilities); BPM international growth (+16% YoY) vulnerable to global slowdowns.

Growth Prospects

- High Potential in AI-First Models: UnBPO™ quarterly insights, outcome-based deals; AI-driven efficiencies position sector for 10-15%+ revenue CAGR (Alldigi’s 14-22% segment growth).

- Geographic & Vertical Expansion: Middle East (Firstsource), Singapore (One Point One 64-100% stake in ITNITY for USD 3.6M); BPM international +16% YoY; Healthcare/utilities/collections success stories.

- M&A & Ecosystem Building: RPSG’s 40% stake in FSP Design; Alldigi’s multi-lingual hubs (India/Philippines/US); 600+ Fortune 500 clients.

- Projections: Alldigi-like trends suggest sector revenue growth ~12% YoY, with Tech&Digital leading; ACV doubling supports pipeline.

| Metric | Q2FY26 Growth (Alldigi Proxy) | H1FY26 Growth |

|---|---|---|

| Revenue | +12.2% YoY | +11.7% YoY |

| EBITDA | +16.9% YoY | +17.1% YoY |

| PAT | +45.5% YoY | +26.3% YoY (adj. for one-offs) |

Key Risks

- Execution & Integration: AI adoption (e.g., UnBPO™, True VA) risks delays; M&A integration (ITNITY, FSP Design) could strain finances.

- Competition & Attrition: Offshore shift to tech-arbitrage intensifies rivalry; FTE growth (Alldigi BPM +14% YoY) amid talent wars.

- Financial Volatility: Dividend payouts (Alldigi ₹46 Cr), forex gains/losses, DSO spikes; PAT volatility from taxes/one-offs.

- Regulatory/Geopolitical: No approvals needed for acquisitions but ESG/compliance scrutiny (eClerx/HGS AGMs); global events impacting client spend.

- Economic Sensitivity: Client concentration in cyclical verticals (finance, healthcare); withholding tax/divestment impacts (Alldigi PAT -26% YoY raw).

Overall Outlook: Strong tailwinds from AI/digitalization outweigh headwinds, with 10-15% sector growth likely in FY26. Focus on UnBPO™/AI outcomes and expansions positions leaders like Firstsource/Alldigi for outperformance, but monitor margins and execution risks.

Investor

asof: 2025-11-29

Indian BPO/KPO Sector Analysis (Based on Q2/H1 FY26 Earnings Transcripts & Filings)

The analysis draws from key players: Firstsource Solutions (strong growth leader), HGS (struggling with flat revenue/losses), Alldigi Tech (steady mid-teens growth), One Point One Solutions (high growth via AI/tech), and eClerx (limited data, investor outreach). Sector shows resilience amid macro challenges, with AI/tech as a key differentiator. Overall: Mid-teens revenue growth sustainable, margins expanding 50-150bps YoY via efficiency/AI.

Summary Table

| Aspect | Key Highlights | Outlook (FY26/FY27) |

|---|---|---|

| Headwinds | Macro/geopolitical uncertainty; Europe/UK softness; wage hikes; media losses (HGS). | Persistent but moderating; Europe recovery gradual. |

| Tailwinds | AI adoption (agentic AI, UnBPO); deal wins ($1B+ pipelines); broad-based verticals (Healthcare/BFSI). | Accelerating; tech arbitrage replacing labor arbitrage. |

| Growth Prospects | 13-20% YoY revenue (high-teens CAGR); international mix ↑ (64-76%); new markets/acquisitions. | H2 FY26 acceleration; doubling employee records in 4-5 yrs (Alldigi). |

| Key Risks | Client concentration; regulatory delays; competition from IT peers; forex/inflation. | Medium; mitigated by diversification/AI moats. |

Headwinds (Challenges Slowing Momentum)

- Macro/Geopolitical Pressures: Firstsource notes “continued macroeconomic and geopolitical uncertainties”; Europe (UK-focused) soft due to muted growth, high labor costs, regulatory changes (e.g., FCA approvals delaying deals). HGS reports stagnant top-line (0.4% YoY Q2 growth), losses narrowing but persistent (PAT -₹27Cr Q2).

- Vertical/Geography-Specific Weakness: US mortgage sluggish (high rates ~6.25%, low refi incentive); Diverse portfolio flat QoQ (UK utilities/retail demand). HGS digital media faces OTT/free TV headwinds, EBITDA losses narrowing but volatile (-₹37.6Cr Q2).

- Cost Pressures: Annual wage hikes (90%+ employees at Firstsource); depreciation ↑ (Alldigi +50% YoY); segment margins dip temporarily (Alldigi BPM flat YoY).

- Execution Delays: Staggered ramps in large deals (e.g., Healthcare BPaaS starting Q3); HGS notes smaller digital engagements scaling slowly.

Tailwinds (Positive Drivers)

- Robust Financials & Deal Momentum: Firstsource: 20.1% YoY revenue (₹2,310Cr Q2), 11.5% EBIT (4th straight expansion); $1B pipeline (1st time), 4 large deals ($5M+ ACV). Alldigi: 12% YoY (₹147Cr Q2), 17% EBITDA growth; H1 ACV ₹40Cr. One Point: 54% YoY revenue FY25 (₹270Cr).

- AI/Tech Transformation: Shift to “UnBPO™” (Firstsource), agentic AI (Lyzr/AppliedAI investments), RPA/GenAI (One Point/Alldigi). Efficiency gains: Alldigi employee records/FTE ↑5% YoY; HGS AgentX ↑30% gross margins, time-to-proficiency ↓70%.

- Vertical Diversification: Healthcare (6-10% growth, payer focus); BFSI (11-16% YoY); Tech/Media (15% YoY at Firstsource). International mix ↑ (Firstsource NA 16% YoY; Alldigi 76% BPM).

- Operational Excellence: Attrition ↓ (Firstsource 28%, -12pts/8qtrs); high cash conversion (Alldigi 93% OCF/EBITDA); analyst accolades (Everest Star Performer for Alldigi MCP/CXM).

- Client Broadening: Top-5/10 share ↓ (Firstsource -6%/9% in 8qtrs); 39 $5M+ accounts (↑ from 26).

Growth Prospects (High-Teens Trajectory)

- Revenue Guidance: Firstsource 13-15% CC FY26 (H2 acceleration); Alldigi mid-high teens (high-teens CAGR, double employee records in 4-5yrs); One Point AI-led expansion (agentic/deep tech platforms). Sector peers eye 15-20% via non-linear deals.

- AI-Led Expansion: “Services-as-software” (higher rev/employee); new offerings (HGS Cloud FinOps/AM Lens; Firstsource data-as-a-service for hyperscalers). Multi-tower deals ↑ (HGS 62% pipeline digital).

- Geographies & Verticals: NA healthy (16% YoY); Australia/ME/Canada ramps; Healthcare pipeline 2.5x YoY (Firstsource). Acquisitions (Firstsource Pastdue/AppliedAI; One Point deep tech).

- Margin Upside: 50-75bps expansion (Firstsource/Alldigi); HGS targets mid-20s EBITDA in 5yrs. H1 FY26: Firstsource 11.4% EBIT; Alldigi T&D 40%.

- Market Share Gains: Firstsource +0.5% vs. 15 peers (8qtrs); pure-plays outperforming IT-BPO hybrids (Everest).

Key Risks (Potential Vulnerabilities)

- Macro/Execution: Prolonged US refi weakness, Europe delays (decision cycles longer); staggered ramps (Firstsource Healthcare Q3 start).

- Competition & Concentration: IT peers entering BPO (HGS notes); top-client dilution ongoing but slow (Firstsource 50% large deals non-top-5).

- Operational/Financial: Attrition rebound; forex volatility (Firstsource hedge book); tax/depreciation (Alldigi scrutiny/capex ↑); HGS losses if media headwinds persist.

- Regulatory/External: Deal approvals (FCA for collections/Pastdue); wage/regulatory costs (UK). Over-reliance on AI hype without delivery.

- M&A Integration: Past impairments (Firstsource Ascensos); HGS awaiting approvals.

Overall Summary

Indian BPO/KPO remains resilient and growth-oriented (10-20% YoY across leaders), buoyed by AI tailwinds (agentic automation, 30%+ efficiency gains) offsetting macro headwinds (Europe softness, costs). Pure-plays like Firstsource/Alldigi lead with mid-teens growth/margin expansion; HGS lags but narrowing losses via AI/digital pivot. Prospects strong (high-teens CAGR to FY27+ via verticals/geos/AI), but risks tilted macro/execution (mitigated by diversification, $1B+ pipelines). Investors should watch H2 ramps, AI monetization, and Europe recovery for sustained top-decile performance. Sector TTM run-rate ~$10-15B for listed peers, poised for $15-20B by FY27.

Meeting

asof: 2025-12-02

Analysis of Indian BPO/KPO Sector: Headwinds, Tailwinds, Growth Prospects, and Key Risks

The provided documents encompass Q1/Q2 FY26 financial results, board outcomes, and announcements from key players like Firstsource Solutions (FSL, RPSG Ventures subsidiary), eClerx, Hinduja Global Solutions (HGS), Alldigi Tech, One Point One Solutions, and We Win Limited. These reflect a resilient sector with YoY revenue growth (e.g., FSL +23.8%, HGS +0.4% QoQ), AI-driven innovation, and deal momentum, amid challenges like high attrition and forex volatility. Overall, the sector shows mid-teens growth potential (FSL guidance: 13-15% CC FY26), fueled by digital transformation.

Tailwinds (Positive Drivers)

- Robust Demand & Deal Pipeline: FSL secured 4 large deals + 17 new logos (highest in 3 years); HGS added 19 digital CX + 10 HRO logos. Verticals like Healthcare (FSL: 8 new clients), BFSI, and CMT lead growth.

- AI/Tech Adoption: Emphasis on GenAI, Agentic AI (FSL relAI™, HGS AMLens/SOC-as-a-Service), boosting efficiency (FSL EBIT +26.8% YoY). Awards validate leadership (e.g., FSL Top BPS, HGS ISG Leader).

- Financial Strength: Strong cash flows (FSL FCF/PAT 196%; eClerx net cash +₹2.4bn ops); revenue uptick (FSL ₹22.2bn Q1, HGS ₹1.2bn Q2). Healthy EBITDA margins (FSL 11.3%, eClerx ~20%).

- Talent & Ops Efficiency: Attrition decline (FSL 28.9%, -13ppt YoY); offshore hiring (80%). Geographic expansion (HGS Manila center; One Point UAE subsidiary).

- Capital Returns: eClerx buyback (₹3bn @ ₹4,500/share); ESOP approvals (We Win, Alldigi).

Headwinds (Challenges)

- Cost Pressures: Employee expenses dominant (FSL 59% of revenue; HGS ~51%). Rising finance costs (FSL +37% YoY).

- Forex & OCI Volatility: Negative OCI (FSL -₹1.2bn Q1; HGS forex losses). Macro uncertainty noted.

- High Attrition: Still elevated (~29% FSL), impacting scalability.

- Margin Squeeze: EBITDA margins stable but pressured (eClerx ~20%, FSL 11.3%). Exceptional items/deals pending (FSL PDC acquisition).

- Regulatory Scrutiny: GAAR/tax disputes (HGS ₹282cr exposure); buybacks/postal ballots signal governance focus.

Growth Prospects

- High-Teens Revenue Trajectory: FSL ups FY26 CC guidance to 13-15%; HGS targets mid-20s EBITDA via AI transformation. eClerx H1 revenue +19% YoY.

- AI/Digital Shift: Non-linear growth via multi-tower deals, AI suites (FSL UnBPO™; HGS Agent X). Healthcare/BFSI tailwinds; new logos signal ramp-up.

- M&A & Expansion: Acquisitions (FSL PDC GBP22mn; RPSG Manchester); subsidiaries (One Point UAE). Capacity adds (HGS 1,500 seats).

- Sector Tailwinds: Offshore/nearshore leverage (FSL 80% hires); vertical diversification (Retail/CPG per Everest). Employee base ~34k (FSL) +18k (HGS).

- Capital Efficiency: Buybacks/ESOPs enhance ROE; strong FCF funds growth.

Projected FY26 Outlook: 12-15% sector growth (revenue ~₹1.5-2tn), margins 10-12% EBITDA, driven by AI deals (20-30% of pipeline).

Key Risks

| Risk Category | Description | Mitigants |

|---|---|---|

| Execution/Operational | High attrition (25-30%); ramp-up delays in new deals. | AI automation; offshore focus; ESOPs for retention. |

| Macro/Economic | Client spend cuts in volatility; US/UK slowdown. | Diversification (Healthcare 33% FSL revenue); multi-year deals. |

| Forex/Financial | Rupee volatility; rising debt costs (FSL finance +37%). | Hedging; FCF strength (FSL +135% QoQ). |

| Regulatory/Tax | GAAR disputes (HGS ₹282cr); SEBI compliance (buybacks/ESOP). | Legal challenges; policy adherence. |

| Competition/Talent | Intense rivalry (eClerx, HGS peers); wage inflation. | AI differentiation; awards/leadership positioning. |

| Cyber/Geopolitical | Data breaches; global ops risks (30+ centers). | Not explicitly addressed; implied in awards. |

Overall Sector Rating: Positive (Buy/Hold). Tailwinds from AI/digital outweigh headwinds; monitor US macro and attrition. Growth hinges on deal conversion (FSL/HGS pipelines strong).

Press Release

asof: 2025-11-29

Analysis of Indian BPO/KPO Sector: Headwinds, Tailwinds, Growth Prospects, and Key Risks

The provided documents from key Indian BPO/KPO players—Firstsource (FSL), eClerx (ECLERX), Hinduja Global Solutions (HGS), One Point One Solutions (ONEPOINT), and Alldigi Tech (ALLDIGI)—reveal a resilient sector amid digital transformation. Q1/Q2 FY26 results show aggregate YoY revenue growth of ~12-20% (eClerx: 20.2%, Alldigi: 12%, FSL/HGS qualitative strength), driven by AI-led CX, BPM, payroll/HR tech, and global demand. EBITDA margins remain robust (eClerx: 28.8%, Alldigi: 24.4%, ONEPOINT: 27.6%). However, challenges like forex, attrition, and regulations persist. Below is a structured summary.

Tailwinds (Positive Drivers)

- Robust Demand & Revenue Momentum: Strong YoY growth (eClerx OPG revenue +17% USD; Alldigi +12%; HGS total income +1.3%; ONEPOINT +19.9%). Client wins (HGS: 29 new logos; FSL: healthcare/telecom deals) in high-value verticals (BFSI 41-44%, healthcare, retail).

- AI/Digital Recognition & Innovation: Multiple “Leader”/“Major Contender” awards (FSL: ISG Leader in Digital Ops; Alldigi/HGS: Everest PEAK Matrix; HGS: CII AI Awards). AI-first platforms (FSL UnBPO™, Agentic AI Studio; HGS Agent X; eClerx A&A focus) enable modular CX, RPA/ML optimization.

- Geographic & Capacity Expansion: New centers (HGS Manila 1,500 seats; FSL NA/UK/ANZ); global footprint (eClerx NA 80%; FSL 10 countries). Acquisitions (FSL: Ascensos/Quintessence; ONEPOINT: ITCube).

- Margin Expansion & Capital Returns: EBITDA up 15-28% YoY (eClerx +28%; Alldigi +17%); high cash flows (eClerx net profit +29%; proposed INR 300 Cr buyback). Utilization steady (eClerx 75%; HGS 73%).

- Sector Tailwinds: Shift to outcome-based delivery, agentic AI, and non-linear CX (FSL/HGS emphasis).

Headwinds (Challenges)

- QoQ Volatility: Mixed results (eClerx +9.5% revenue QoQ but HGS standalone losses; Alldigi BPM margins flat/down QoQ; FSL/HGS forex gains/losses).

- High Attrition & Headcount Pressure: eClerx offshore attrition 20.3% (up QoQ); HGS total headcount 18k (stable but FTE dips in Alldigi BPM -0.7% YoY).

- Forex & Cost Pressures: Currency impacts (eClerx revaluation +186 Cr gain; HGS forex noted); rising employee costs (eClerx 52.5% of revenue).

- Domestic Slowdown: Alldigi domestic BPM -1.4% YoY; eClerx emerging verticals variable.

- Macro Headwinds: Client concentration (eClerx top-10: 63%; geo NA-heavy 75-80%), potential US/EU slowdowns.

Growth Prospects

- High Double-Digit Trajectory: Sector poised for 12-20% CAGR (mirroring filings); eClerx 4-yr revenue CAGR 16.6%; Alldigi payslips +10% YoY. AI/CX demand (FSL “Rising Star” in Intelligent CX; HGS digital ops wins).

- Vertical/Geographic Expansion: BFSI/Healthcare/Retail growth (FSL domain expertise; eClerx BFSI 41%; HGS healthcare devices/AML). APAC/US/EMEA focus; payroll boom (Alldigi 47.6L records/Q2).

- Tech-Led Differentiation: Modular AI (FSL UnBPO; HGS Speed to Lead/AMLens); BPaaS rise (eClerx 18%). M&A/partnerships for scale.

- Aspirational Targets: HGS eyes mid-20s EBITDA margins in 5 yrs; eClerx constant currency +16% YoY.

- Overall Outlook: $10-15B Indian BPO export market by FY27 (inferred from growth); tailwinds from GenAI, nearshoring (Philippines/NA expansion).

Key Risks

| Risk Category | Details | Mitigation (from Filings) |

|---|---|---|

| Forex/Volatility | USD/INR/EUR/GBP swings (eClerx hedge $249M; HGS forex losses). | 100% forwards hedging (eClerx). |

| Regulatory/Tax | GAAR disputes (HGS: Rs 282 Cr exposure; writ filed). | Legal advice, no adjustments booked. |

| Talent/Operational | Attrition 17-28% (eClerx/HGS); DSO 76-86 days. | Upskilling (FSL human-centric); utilization focus. |

| Competition/Concentration | Top clients 60%+ revenue; “Contender” vs. “Leader” status. | Diversification (eClerx 44 clients $500k-$1M); awards. |

| Execution/Geopolitical | Global ops (40+ countries/subsidiaries in HGS); economic slowdowns. | Location-agnostic delivery (FSL); cash buffers (eClerx Rs 10B). |

| Cyber/Tech | AI reliance risks; legacy BPO modernization. | Partner ecosystems (FSL); RPA investments. |

Summary: Indian BPO/KPO is in a strong growth phase (tailwinds > headwinds), fueled by AI/digital CX adoption and global outsourcing revival. Prospects are bright (15%+ CAGR potential) for innovators like FSL/eClerx, but risks from forex/tax/attrition warrant vigilance. Sector resilience evident in 20%+ YoY metrics despite macro noise; focus on AI outcomes key to sustaining momentum.

Copyright © 2023 SAS Data Analytics Pvt. Ltd. All rights reserved.