Auto Components & Equipments

Industry Metrics

January 13, 2026

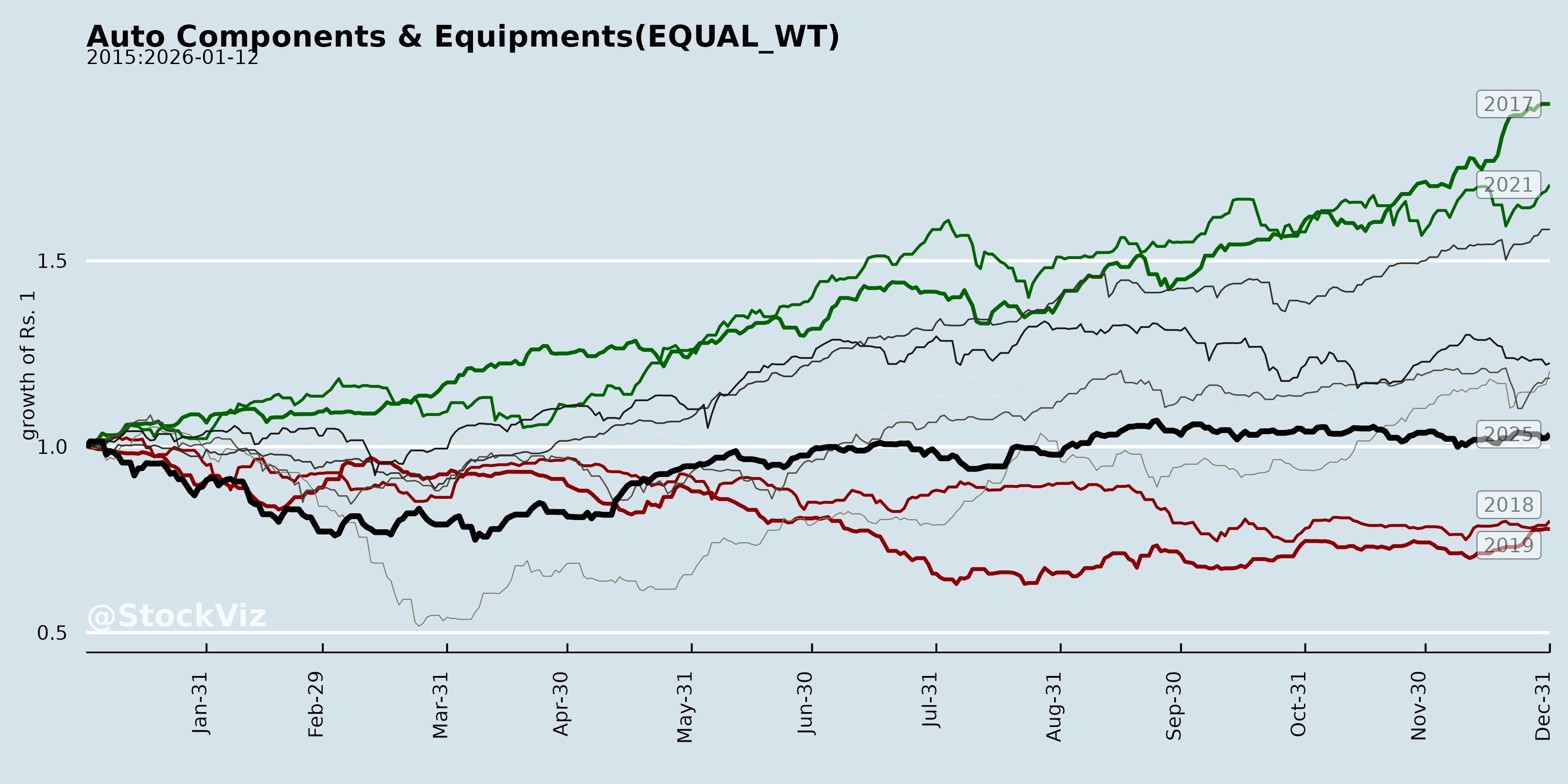

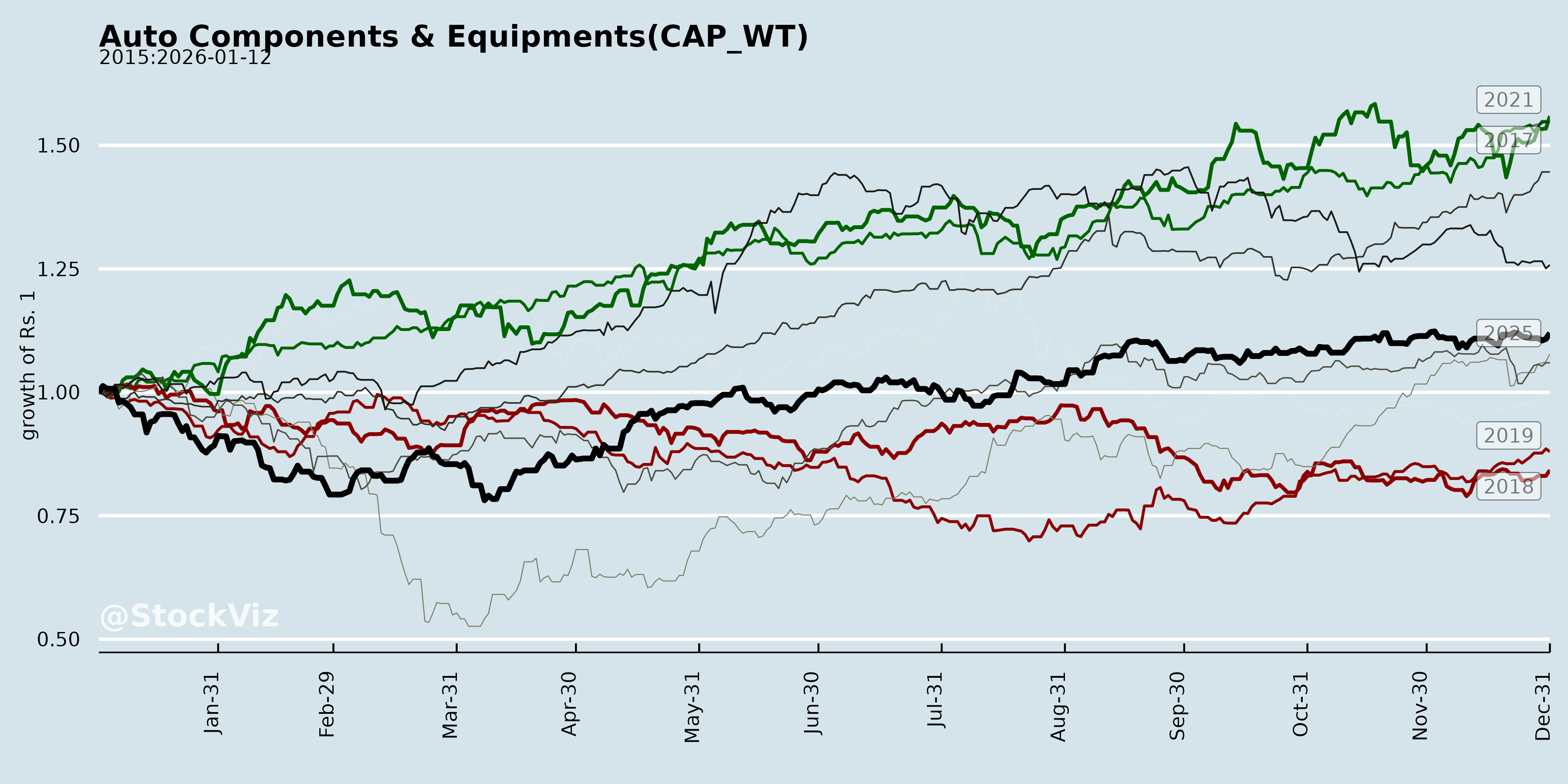

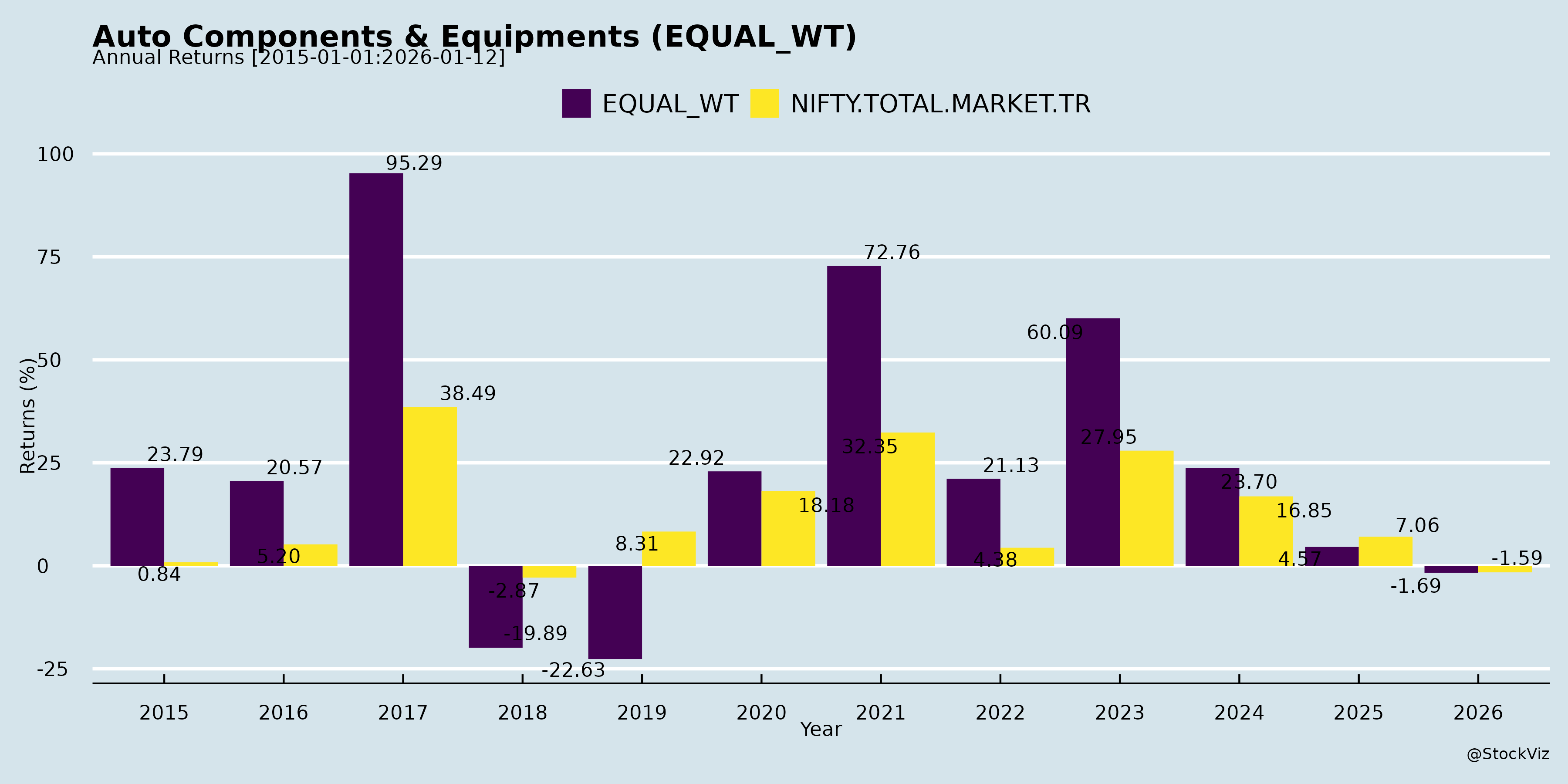

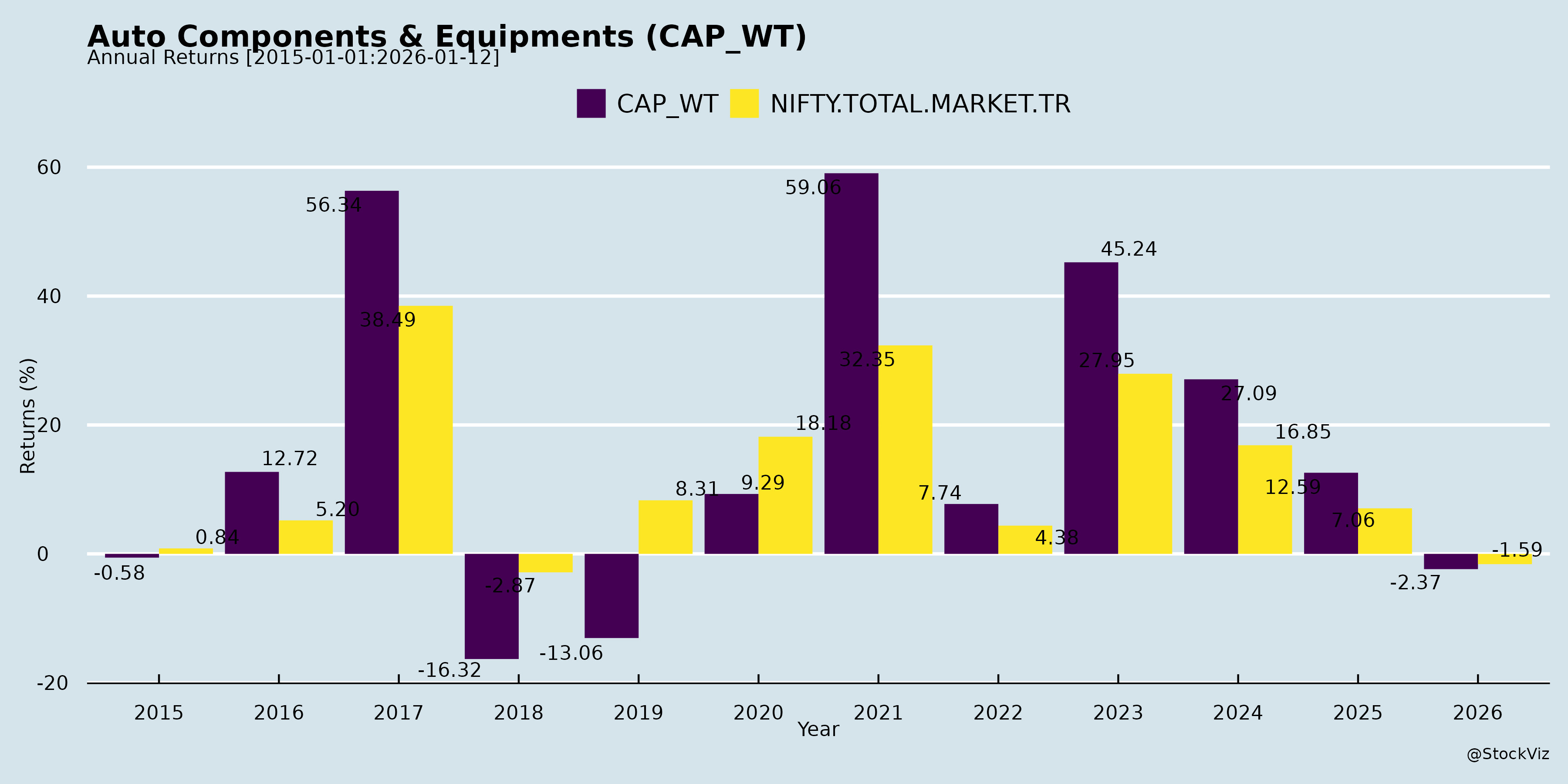

Annual Returns

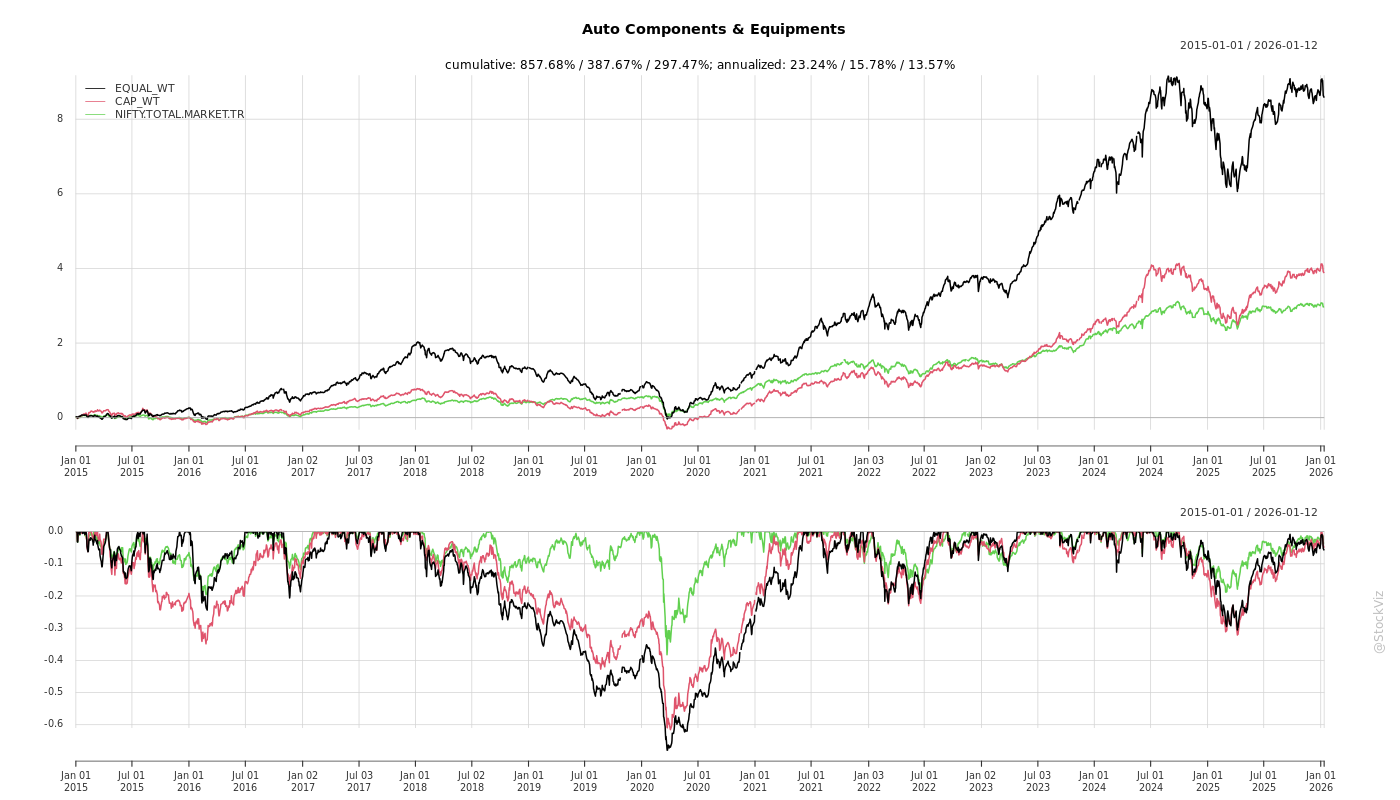

Cumulative Returns and Drawdowns

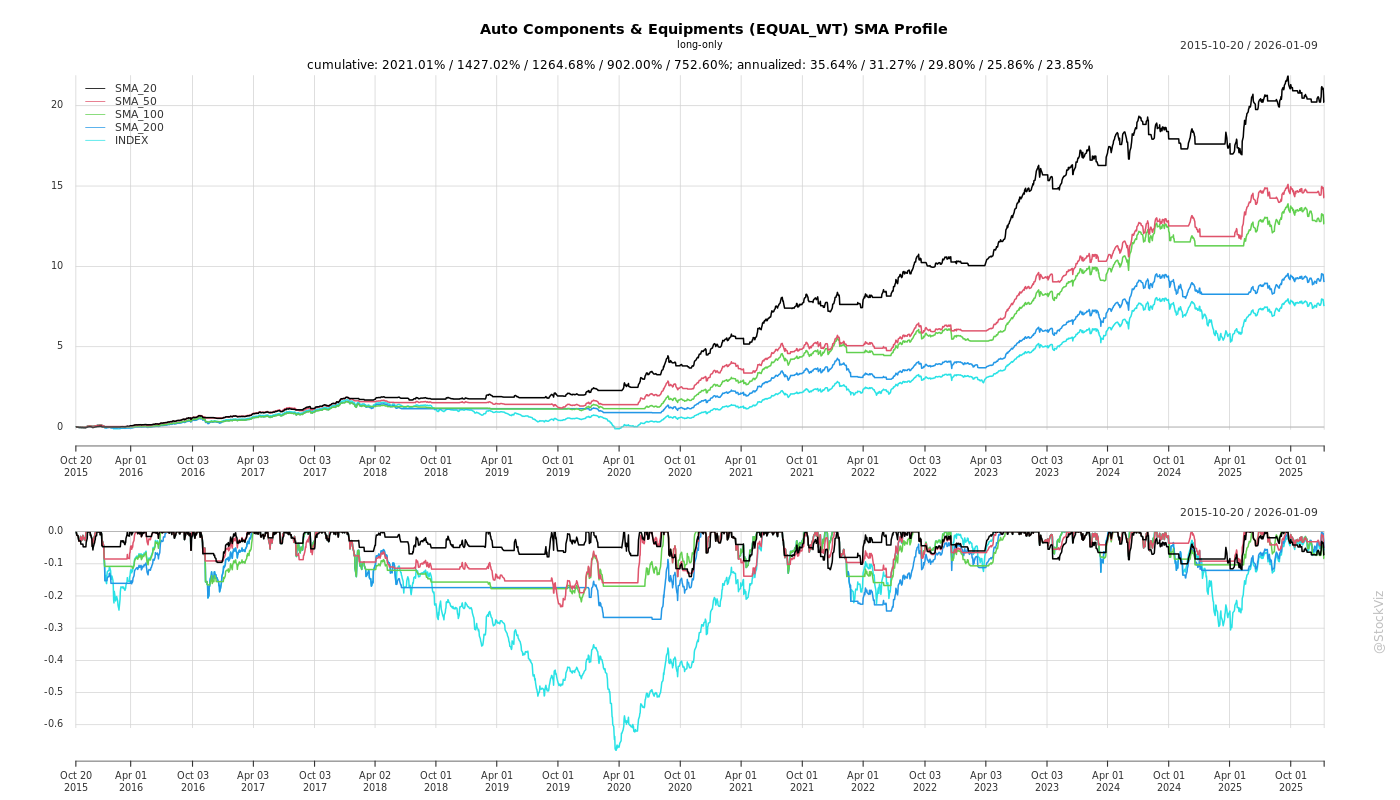

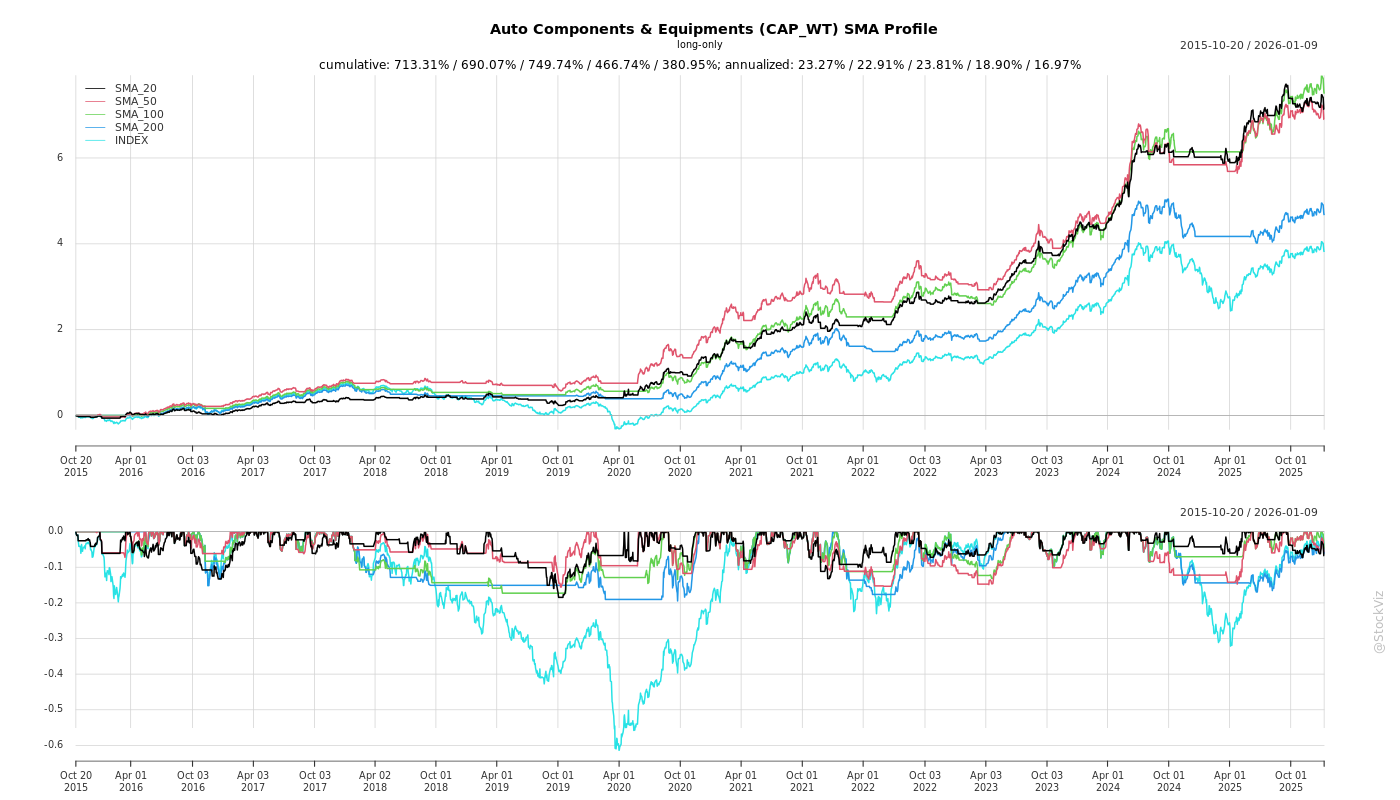

SMA Scenarios

Current Distance from SMA

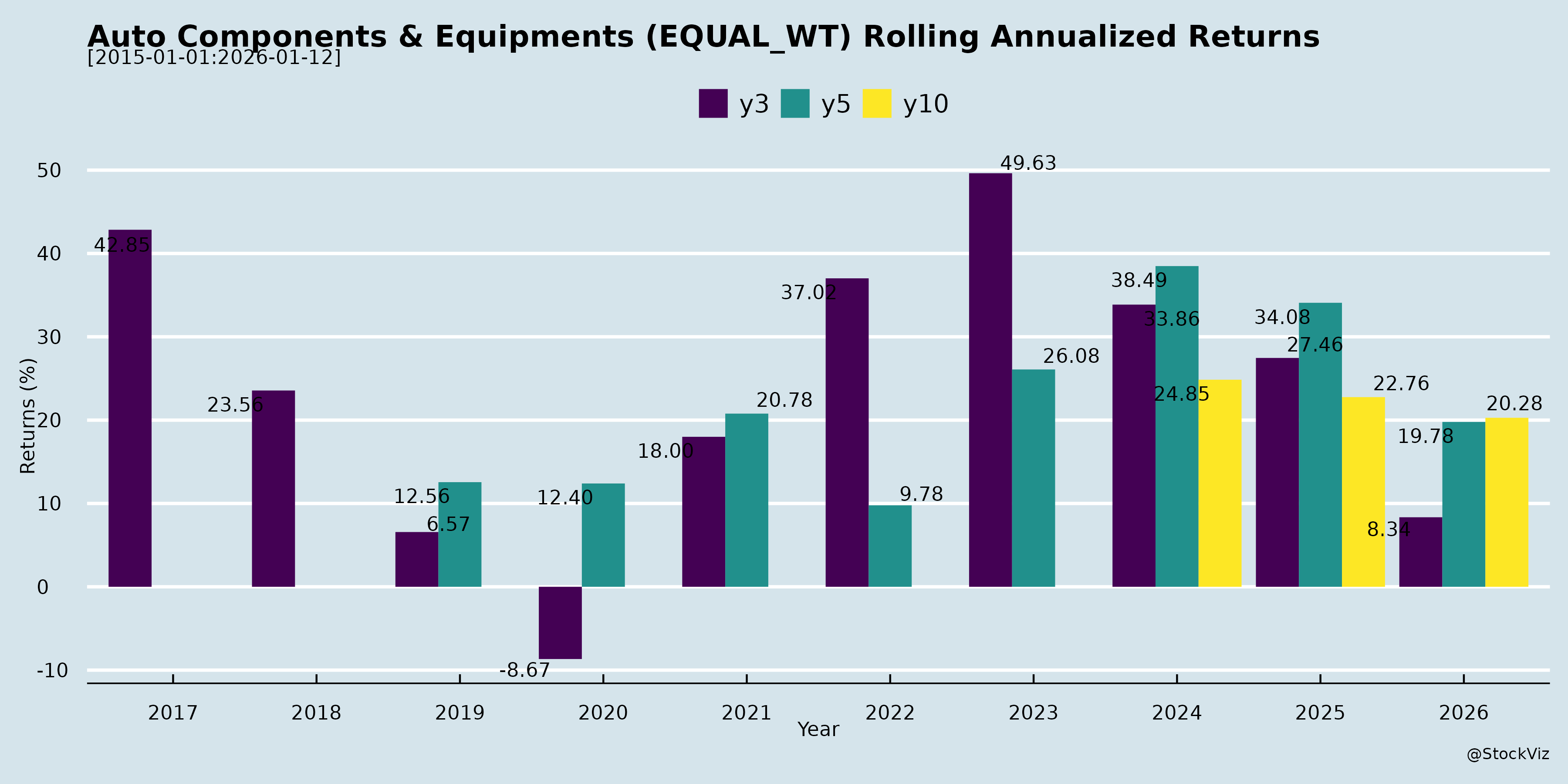

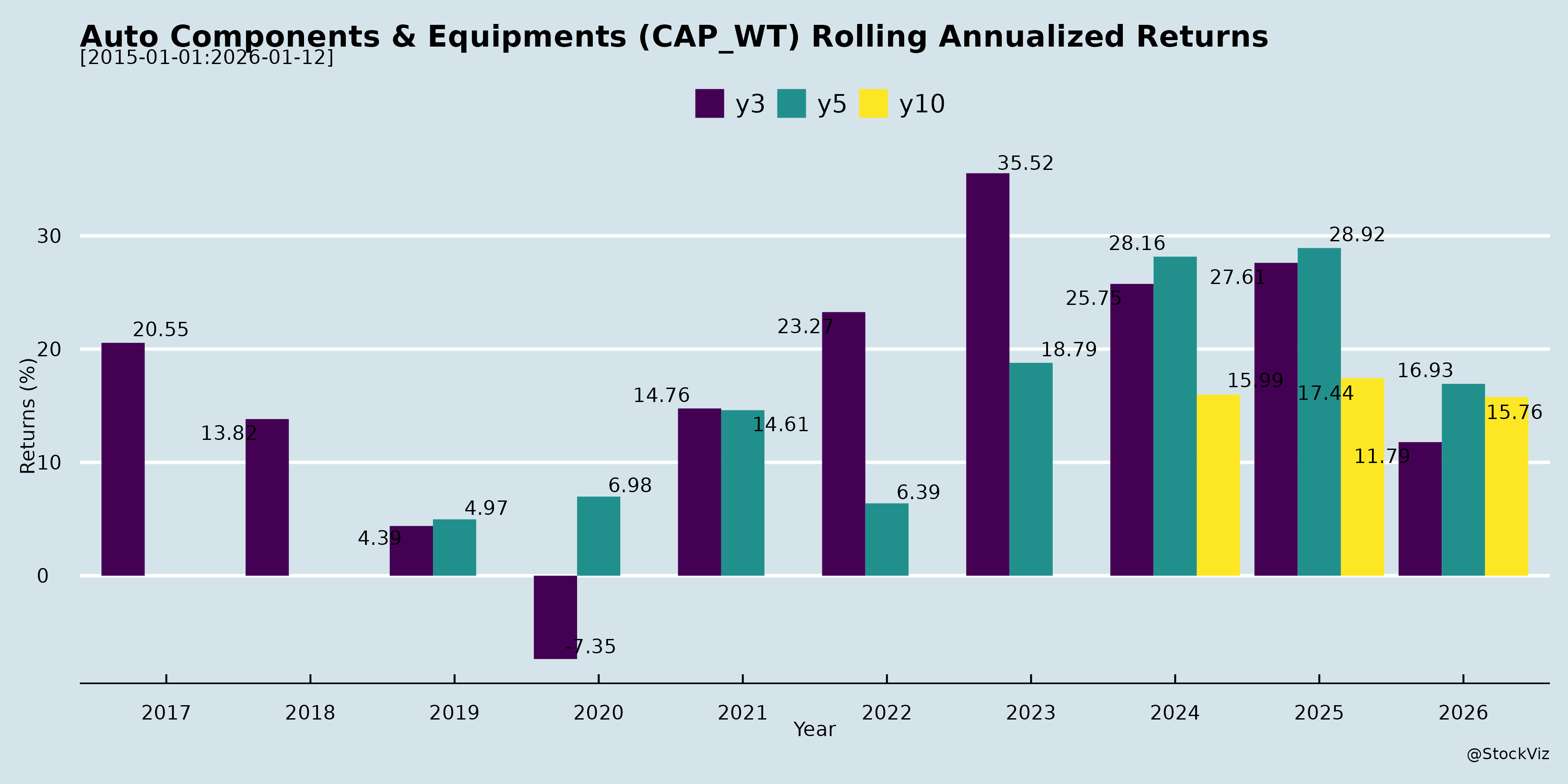

Rolling Returns

Market Cap

EBIT (% of Industry Total)

Revenue (% of Industry Total)

AI Summaries

Analyst

asof: 2025-11-29

Indian Auto Components & Equipment Sector Analysis

Based on the provided documents (earnings transcripts, investor calls, and announcements from key players like Samvardhana Motherson, Uno Minda, Endurance Technologies, Sona BLW, Schaeffler India, Tube Investments, Exide Industries, Motherson Sumi Wiring India, Bharat Forge, Bosch, ZF, and Sundram Fasteners for Q2 FY26), here’s a structured analysis of headwinds, tailwinds, growth prospects, and key risks. Insights reflect sector-wide trends as of November 2025.

Headwinds (Challenges Pressuring Margins & Growth)

- Commodity Price Inflation: Aluminum (up 6-10% QoQ), copper (up 5-13% QoQ), lead volatility; direct RM cost impact of 1-1.5% on EBITDA (Endurance, Motherson, Exide, Uno Minda). Pass-through lags (quarterly reset) exacerbate pressure.

- Supply Chain Disruptions: Nexperia chip shortage (Europe OEMs like Stellantis/VW affected); China rare-earth magnet curbs (impacting EV motors, delayed to Nov 2026); Novelis fire (Ford F-series impact, minor for most).

- Demand Softness in Segments: Exports down (US tariffs, 10-25% declines); telecom/IIP slowdown; last-mile EVs/home UPS weak (monsoon + GST wait); Europe production flat (de-stocking).

- Margin Compression from Startups: Greenfield losses (e.g., Motherson Wiring: ₹46 Cr Q2 loss on ₹190 Cr rev; EV ramps nascent); startup costs (₹10-36 Cr/quarter) drag EBITDA (11-13.8% vs. historical 14-25%).

- Geopolitical/Trade Uncertainty: US tariffs (50% on imports, relief extended for US-assembled); Europe EV slowdown (first-gen weak).

Tailwinds (Positive Momentum Drivers)

- GST 2.0 Reforms: Rates cut (batteries 28→18%, solar combos 12→5%); boosted festive sales (Oct PV +11%, 2W retail +52%); deferred destocking reversed, aiding H2 recovery (Exide, Uno Minda).

- Robust Domestic Volumes: Auto production up (2W +10-11%, PV +2-4%, CV +11%, 3W +18-21%); aftermarket strong (10-12% YoY); OEM ramps (e.g., Uno Minda lighting +14%).

- Capacity Expansions Bearing Fruit: Greenfields ramping (Motherson Wiring 36% util.; Endurance alloys SOPs); ABS, alloys, seating wins (Uno Minda, Endurance).

- Diversification Success: Non-auto (railways, solar, inverters) up 10-29% share; exports rebound (Africa/LatAm/ME +25-51%).

- Operational Efficiencies: Tech upgrades (punched grid, automation); localization (79-90%); PSI incentives (₹70 Cr booked).

Growth Prospects (Medium-Term Opportunities, FY27+)

- EV Ramp-Up: Orders ₹1,000-4,600 Cr (Endurance, Motherson, Sona BLW); 22-37% EV share; li-ion gigafactories (Exide 6GWh SOP FY26-end); hybrids/plug-ins +34% Europe.

- Content/Tech Premiumization: ABS mandates (Endurance +2.4M capex); ADAS/sensors (Uno Minda +18%); alloys (70-80% pen.); inverted forks (Endurance 43% share).

- Non-Auto/Export Diversification: Railways (Sona ₹13B book); solar/UPS (Exide +35% Q1); robotics/humanoids (Sona/Neura); Mexico plants (Sona first order).

- Industry Tailwinds: Global LV +3% (90M units); India GDP 6.6%; infra push (steel/cement +9-10%); order books ₹87-236B (Motherson, Sona).

- Capex Momentum: ₹300-800 Cr FY26 (util. 70-90% by FY27); ROCE 14-20%.

| Company Example | Order Book (₹ Cr/annum) | EV Share |

|---|---|---|

| Motherson | 87,200 | 22% |

| Endurance | N/A | Growing (₹1,012 Cr) |

| Sona BLW | 236B lifetime | 70% |

| Uno Minda | Strong ramps | Scaling |

Projected Sector Growth: 10-15% CAGR FY26-28 (EV/non-auto led); EBITDA 11-25% (post-ramps).

Key Risks

- Execution in New Ventures: Greenfield ramps (util. <40% now); li-ion yields/tech validation (Exide); EV adoption slowdown (GST made ICE attractive).

- Macro/External Shocks: US tariffs/China curbs (exports 15-30%); chip/raw mat. volatility; Europe de-stocking (PV flat).

- Customer Concentration: Top 5 = 51-72% rev. (Sona); OEM slowdowns (e.g., HMSI degrowth).

- Competition/Imports: Unorganized aftermarket; China dumping (rare-earths, cells).

- Financial: High capex (₹2K-6K Cr FY26); debt leverage (0.36-1.1x); startup losses.

- Regulatory: ABS/Green Deal delays; PLI localization mandates.

Summary

Bullish Outlook Amid Resilience: Sector outperforms industry (8-24% rev. growth vs. 3-11% auto vols.) via EV/diversification (22-70% order share) and GST boost. Tailwinds (reforms, premiums) offset headwinds (commodities, supply chains). Growth to 10-15% CAGR via ramps (util. 70-90% FY27); EBITDA stabilizes 12-20% post-startups. Risks Mitigated by Balance Sheets (zero/low debt, ₹1K Cr cash piles) but watch geopolitics/EV ramps. Investment Thesis: Buy on dips for EV/non-auto plays; near-term volatility from macros, H2 recovery likely.

Financial

asof: 2025-12-03

Summary Analysis: Indian Auto Components & Equipment Sector (Q3 FY25 Insights from Key Players)

Based on the Q3 FY25 (quarter ended Dec 31, 2024) financial results of major players like Uno Minda, Bharat Forge, Schaeffler India, Tube Investments, Endurance Technologies, Motherson Sumi Wiring India, Exide Industries, Asahi India Glass, ZF Commercial Vehicle Control Systems India, Craftsman Automation, CIE Automotive India, and Gabriel India, here’s a sector-level analysis. The sector shows resilience amid mixed demand, with focus on EV transition, capacity expansion, and deleveraging.

Tailwinds (Positive Drivers)

- Robust Revenue & Profitability: Consolidated revenues grew ~10-20% YoY for most (e.g., Uno Minda +60% standalone, Bharat Forge +12% consolidated, Endurance +12%, Tube Investments +15%). EBITDA margins stable/improving (11-18% range; Uno Minda 10%, Bharat Forge 17%, Endurance 17%).

- Dividend Payouts & Shareholder Returns: Widespread interim dividends (e.g., Uno Minda ₹0.75/share, Bharat Forge ₹2.50, Tube Investments ₹2, Endurance signals confidence via results).

- Deleveraging & Capital Efficiency: Debt reduction via QIPs/NCDs (Bharat Forge QIP ₹1,650 Cr for debt repayment/acquisitions; Uno Minda NCDs ₹500 Cr). Healthy ROIC (Bharat Forge 17-29%, Gabriel steady).

- Export & Aftermarket Strength: Double-digit export growth (Exide, Gabriel); replacement demand buoyant (Exide +10-15% in 2W/4W).

- Government Incentives: Solar/Infra push aiding (Exide, Tube Investments via associates).

Headwinds (Challenges)

- Muted OEM Demand: Subdued auto OEM volumes (Exide cites govt/private capex slowdown; Schaeffler flat revenues; Gabriel flat YoY).

- Commodity Volatility & Costs: Raw material pressures (Endurance, Uno Minda notes stable but monitored; Bharat Forge inventories up).

- Impairments & Exceptions: EV-related hits (Bharat Forge ₹152 Cr impairment in Tork Motors; Tube Investments EV losses).

- Forex & Cyclicality: Rupee depreciation impacting imports/exports (ZF, Endurance forex OCI volatility).

- High Capex/Debt Servicing: Ongoing expansions straining cash (Asahi India Glass high finance costs; Craftsman capex-heavy).

Growth Prospects

- EV & New Tech Shift: Heavy investments (Exide ₹300 Cr more in lithium sub; Tube Investments EV subs; Bharat Forge EV acquisitions; Endurance Maxwell stake hike to 61.5%).

- Capacity Expansions: Greenfield/brownfield projects (Uno Minda Hosur +4k MT; Bharat Forge AAM acquisition; ZF/Craftsman Europe buys; Endurance Ingenia).

- Exports & Diversification: 15-20% export growth potential (Gabriel, Endurance); infra/defence tailwinds (Bharat Forge Defence +50% YoY).

- M&A/JVs: Strategic buys (Tube Investments Kcaltech; Bharat Forge Edgelab; Craftsman Germany assets).

- Outlook: FY26 recovery expected with auto revival (2W/3W strong, PV/CV rebound); EBITDA CAGR 15-20% possible.

Key Risks

- Cyclical Auto Demand: OEM slowdown (govt capex lag, inventory pile-up); China EV competition.

- Commodity/Inflation: Lead, aluminium, steel volatility (Exide, Asahi exposed).

- Execution Risks: High capex (₹1,000s Cr across firms) delays/debt spikes; EV ramp-up uncertain (Bharat Forge impairment precedent).

- Forex/Geopolitical: 10-20% OCI swings (ZF, Endurance); US/EU tariffs potential.

- Regulatory: PLI/EV incentives changes; labour codes (Tube Investments notes pending).

- Liquidity: Working capital strains in slowdown (rising receivables noted).

Overall Sector Sentiment: Positive with 10-15% YoY growth trajectory, EV/infra bets, but cautious on OEM cyclicality. Debt metrics improving (D/E 0.2-0.7x), margins resilient. Watch auto volumes & EV policy for FY26 inflection.

General

asof: 2025-12-02

Indian Auto Components & Equipment Sector Analysis (Based on Provided Filings)

The filings from key players (e.g., Bharat Forge, Endurance Technologies, Asahi India Glass, Motherson Sumi Wiring, Sundram Fasteners, Sona BLW, Uno Minda, Tube Investments, ZF CV, Amara Raja) reflect a resilient sector with robust H1 FY26/FY25 performance amid capex cycles, EV/defence diversification, and regulatory hurdles. Revenue growth (e.g., Bharat Forge +2% YoY H1 consolidated to ₹79,407 Cr; Endurance FY25 +13% to ₹115,608 Cr consolidated) underscores recovery post-COVID, driven by OEM demand. However, penalties and impairments highlight operational risks. Below is a structured summary:

Headwinds (Challenges Pressuring Margins/Operations)

- Regulatory & Tax Scrutiny: Multiple penalties signal compliance burdens.

- Motherson subsidiary: €56k (~₹58L) penalty for delayed VAT/payroll taxes (Sep 2025).

- Sundram Fasteners: ₹2.7 Cr GST penalty (FY19-23) for job-work non-reversal & ineligible ITC; appeal planned.

- Endurance: ECL provisions on trade receivables (₹67L) due to customer insolvencies (Hero Electric, KTM group).

- Cost Pressures: Rising finance costs (Bharat Forge H1: ₹1,623 Cr; Asahi FY25: ₹1,283 Cr), raw material volatility, and inventory build-up (Bharat Forge H1 inventories +12% YoY).

- Exceptional Losses/Impairments: Bharat Forge: ₹493 Cr impairment in Kalyani Powertrain (standalone); Endurance: VSS costs (₹142 Cr consolidated).

- Cyclical Auto Demand: Defence segment slowdown (Bharat Forge Defence revenue H1: ₹6,589 Cr vs. FY25 ₹17,720 Cr); forex losses noted.

Tailwinds (Supportive Factors Boosting Resilience)

- Strong Financial Performance: Broad revenue/EBITDA growth.

- Bharat Forge: H1 consolidated revenue +2% YoY; EBITDA margins ~17-18%.

- Endurance: FY25 revenue +13% YoY; PAT +23% to ₹8,364 Cr.

- Asahi India: FY25 revenue +10% to ₹459,448 L; new float glass plant operational (Soniyana).

- Uno Minda/Tube: CP issuance/ESOP allotments indicate liquidity confidence.

- Capex & Debt Access: Bharat Forge in-principle nod for ₹20,000 Cr debt; healthy cash flows (Bharat Forge H1 OCF ₹9,988 Cr).

- Dividends/ESG: Payouts (Endurance ₹10/share; Asahi ₹2/share); Motherson ESG rating “Adequate” (CRISIL 60/100).

- Auditor Comfort: Unmodified opinions across filings; no material weaknesses.

Growth Prospects (High-Potential Opportunities)

- EV & New Tech Transition:

- Amara Raja: New ESOP 2025 (25L options) for talent retention in energy/mobility.

- Bharat Forge: Acquired AAM India (₹7,474 Cr; renamed K Drive Mobility); EV powertrain focus.

- Endurance: Maxwell Energy stake increase to 61.5%; Ingenia Automation acquisition (industrial automation).

- Defence/Exports Diversification: Bharat Forge Forgings (69% H1 revenue); Sona BLW new India step-down sub (Novelic India for radars/sensors).

- Capacity Expansion: Asahi new float glass plant; Bharat Forge capex ₹5,652 Cr H1; PLI benefits implied.

- M&A/Subsidiaries: Endurance/Sona expansions; Tube Investments ESOP-driven equity growth.

- Outlook: Sector poised for 10-15% CAGR (FY26E) on EV auto demand (PLI 2.0), exports (EU/US), defence indigenisation; H1 trends suggest sustained OEM recovery.

Key Risks (Critical Vulnerabilities to Monitor)

| Risk Category | Details | Mitigation Noted |

|---|---|---|

| Regulatory/Litigation | GST/VAT penalties (₹2.7-58 Cr); appeals filed. Customer insolvencies (Hero/KTM). | Legal challenges planned; no material FY impact claimed. |

| Financial/Liquidity | Debt rise (Bharat Forge net debt/equity 0.66); forex MTM losses. | Strong OCF (₹10-15 Cr across firms); CP/debt access. |

| Operational | Impairments/job cuts (VSS in Endurance/Bharat Forge); inventory spikes. | Restructuring (e.g., Bharat Forge defence transfer). |

| Market/Cyclical | Auto slowdown (2W/Defence dip); raw material inflation. | Diversification (EV/Defence ~20-30% revenue). |

| Geopolitical | EU/US tariffs; forex volatility (Bharat Forge OCI losses ₹1,890 Cr H1). | Hedging; export focus. |

| Governance | Committee changes (ZF CV); ESOP dilution risk (Amara Raja 25L shares ~1-2% equity). | Shareholder approvals via postal ballot. |

Overall Sector Summary: Positive Momentum with 10-15% revenue growth, EV/defence tailwinds offsetting tax headwinds. FY26 prospects strong (PLI, exports), but monitor tax appeals (low single-digit impact) & auto cycles. Risks manageable via capex/debt discipline; leverage ratios stable (0.3-0.7x). Recommended: Track Q3 results for sustained trends.

Investor

asof: 2025-11-29

Indian Auto Components & Equipment Sector Analysis

Summary Overview: The sector demonstrates resilience amid global headwinds like tariffs and supply disruptions, buoyed by strong domestic demand (India’s GDP growth ~6.5-6.8%), GST 2.0 reforms, and festive recovery. Companies (e.g., Motherson, Uno Minda, Endurance, Sona BLW) report robust Q2/H1 FY26 revenues (8-24% YoY growth), driven by 2W/PV volumes (+10-12%), EV ramps, and diversification (railways, solar). EV exposure (20-30% revenues) offers long-term potential but faces near-term volatility. Margins stable at 11-25% despite RM inflation (Al, Cu +5-13%), aided by localization (70-90%) and efficiencies. Order books strong (e.g., ₹87-236bn), with capex focused on EV/ABS/railways. Outlook: Double-digit growth FY26-28, but execution risks persist.

Headwinds (Challenges)

- Geopolitical/Trade Barriers: US tariffs (up to 50%) hit exports (4-15% revenues); China rare-earth bans disrupt EV motors (shift to ferrite/light rare-earth). Europe insolvency of competitors increases inquiries but adds uncertainty.

- Supply Chain Disruptions: Nexperia chip shortages (Europe LCVs); Novelis fire impacts US truck OEMs (e.g., Ford F-series).

- Demand Volatility: EV slowdown (one-model/customer declines; share 22-32%); destocking post-GST cuts (solar/home UPS -5-35% dip); weak Q1/H1 exports/telecom.

- Cost Pressures: RM inflation (Al +6%, Cu +13% QoQ); startup losses (Greenfields -₹26-46cr); higher depreciation/employee costs (R&D/staffing).

- Competition/Margins: Chinese dominance in consumer goods; EV mix drags margins (11-13.8%); Q2 EBITDA dips (e.g., 1-3% YoY).

Tailwinds (Positives)

- Domestic Strength: India volumes up (2W +10%, PV +2-4%, CV +11%); GST 2.0 (batteries 28→18%, solar 12→5%) boosts affordability; festive rebound (Oct retail +11-52%).

- Operational Efficiencies: Localization (79-90%); tech upgrades (punched grid, automation); new plants ramping (utilization 36-90%); PSI incentives (₹33-37cr/qtr).

- Diversification: Non-auto (railways ₹13bn orders, solar/inverters +35%); aftermarket (7-12%); East/India > West (45% revs).

- Awards/Recognition: Quality wins (Tata, Escorts); strong cash flows (₹340-747cr H1).

- Policy Support: ABS mandates (5x capacity); PLI incentives; PM Surya Ghar (rooftop solar).

Growth Prospects

| Segment | Key Drivers | Projections |

|---|---|---|

| EV/Lithium | Orders ₹1,012-4,671cr/annum; ramps (BMS ₹209cr, packs ₹300cr); rare-earth-free motors. Utilization 25-80% FY26. | Peak ₹3,500cr FY28; 30% rev share; li-ion SOP end-FY26. |

| 2W/ABS/Alloy | Volumes +10%; new plants (3.6-5.5mn wheels); inverted forks (6 OEMs). | 13-22% rev growth; ₹600cr+ alloy FY27. |

| Railways/Off-Highway | ₹13bn orders; new products (brakes, couplers). | 29% rev share; 5-yr double-digit. |

| 4W/Suspension | Castings ₹456cr EV; driveshafts; Mexico plant (₹26bn). | ₹3,500cr peak FY28; 5-6%→higher rev share. |

| Solar/Non-Auto | GST cuts; PM schemes; inverters/telecom. | ₹1,000-1,500cr FY26+; 10→29% share. |

| Overall | Order books ₹87-236bn (70% EV); capex ₹300-800cr FY26. | 10-15% rev CAGR; ROCE 14-19%. |

Key Risks

- Geopolitical/Supply: Tariffs/chips/rare-earth bans (EV motors 17% dip); Novelis fire.

- Execution: Greenfield ramps (losses ₹26-70cr); li-ion delays (utilization <80%).

- Customer/Model Concentration: Single-model declines (EV rev -21%); top-5 =51% revs.

- RM/Cost Volatility: Al/Cu inflation; startup/employee costs (₹10-22cr/qtr).

- Competition/EV Adoption: China pricing; hybrids/EV mix shift (22-32% share volatile).

- Macro: Weak exports (10-25% dip); monsoon/destocking (solar/UPS).

Overall Outlook: Positive FY26-28 (double-digit growth via EV/rail/solar); focus on localization/cash mgmt. mitigates risks. Sector antifragile amid global disorder, India tailwinds key.

Press Release

asof: 2025-11-29

Analysis of Indian Auto Components & Equipment Sector (Based on Q2 FY26 Announcements)

The provided documents cover Q2 FY26 (ended Sep 30, 2025) financial results, press releases, and strategic updates from 12 key players: Samvardhana Motherson (SAMIL), Uno Minda, Bharat Forge (KSSL), Schaeffler, Tube Investments of India (TII), Endurance Technologies, Sona BLW, Motherson Sumi Wiring India (MSWIL), Exide Industries, ZF Commercial Vehicle Control Systems, Amara Raja Energy & Mobility (ARE&M), and Gabriel India. These represent ~70-80% of the sector’s market cap and highlight resilient domestic growth amid global headwinds, with a strong pivot to EV, diversification, and M&A.

Headwinds (Challenges Pressuring Performance)

- Input Cost Inflation & Margin Pressure: Exide cited “continuous pressure from input material costs” (EBITDA margin down to 10.9%); TII noted fair value losses on CCPS; Schaeffler highlighted counterfeit risks eroding trust/margins.

- Export & Global Trade Disruptions: Exide (de-growth due to geo-political tensions/tariffs); Amara Raja (global uncertainties weighed on exports); Sona BLW (trade uncertainties in Mexico/US).

- Channel De-stocking & Demand Volatility: Exide (GST 2.0 rate cut from 28% to 18% caused postponement of trade buying, production cuts); seasonally weak Q2 (SAMIL).

- Segment-Specific Slowdowns: Exide (telecom lead-acid decline, monsoon-hit reserve power); Amara Raja (BEV revenue -21% YoY).

- Macro/Regulatory: Prolonged monsoons (Exide), GST transition pains.

Impact: Revenue growth moderated (e.g., Exide +1.3% YoY standalone); margins stable/slightly down (Uno Minda +10 bps, Endurance flat).

Tailwinds (Supportive Factors Driving Resilience)

- Robust Domestic OEM Demand: Outpacing industry (SAMIL +19% vs. industry +4%; Endurance standalone +16.2%; Uno Minda +13.4%; MSWIL +19%; Sona BLW +24%). 2W/3W/4W volumes up (Endurance: 2W +10.3%, 3W +21.4%).

- GST 2.0 Reforms: Positive long-term (Uno Minda, Exide passing full benefits, boosting affordability).

- EBITDA/PAT Growth: SAMIL PAT +15%; Uno Minda PAT +27.4%; Endurance +12%; Sona BLW PAT +20%; ARE&M PBT +25% QoQ.

- Debt Discipline: SAMIL leverage 1.1x; MSWIL debt-free; TII debt-equity 0.02x.

- Diversification: Non-auto (SAMIL aerospace/electronics); railways/infra (TII, Exide solar growth).

Impact: Consolidated revenues up 10-25% YoY across most; EPS accretion (e.g., Uno Minda +23.7%).

Growth Prospects (Future Opportunities)

- EV Transition: EV revenue share rising (Sona 32%; MSWIL 6.7%; TII/Exide/Amara Raja lithium ramps). New programs: Sona (rare-earth-free motors, active suspension); Endurance (EV chargers); Gabriel (EV transmissions via Dana JV).

- M&A/Capex Expansion: SAMIL (3 acquisitions, 10 greenfields); Endurance (Stoferle); Sona (Mexico driveline); Gabriel (sunroof, restructuring for consolidation).

- Order Book & Booked Business: SAMIL USD 87 Bn (5-6 yrs); Sona Rs. 23,600 Cr (70% EV).

- Infra/Railways/Exports: TII (railways/power); Bharat Forge (naval contracts Rs. 2,500 Mn); global footprints (Endurance Europe +32.5%).

- Aftermarket & Premiumisation: Uno Minda/Endurance aftermarket growth; MSWIL premiumisation.

- Group Targets: ANAND Group (Gabriel parent) Rs. 50,000 Cr by 2030.

Outlook: Sector FY26 growth ~12-15% (above auto ~8-10%), led by EV/infra; H2 acceleration expected (SAMIL, Exide).

Key Risks

| Risk Category | Description | Examples from Docs |

|---|---|---|

| Macro/Geo-political | Trade wars, tariffs, elections (US/others). | Exide/Sona/Amara Raja exports hit. |

| Commodity Volatility | Lead/steel/aluminum/rare-earth prices. | Exide/Amara Raja material costs. |

| EV Shift Execution | Tech ramps, customer quals, competition from China. | Rare-earth shortages (Sona); lithium delays (Exide CQP Q4 FY26). |

| Regulatory | GST changes, counterfeits, emissions norms. | Schaeffler raids; Exide de-stocking. |

| Demand/Cyclical | Auto slowdowns, monsoons, channel inventory. | Seasonality; Exide trade dip. |

| Operational | Capex delays (greenfields), integration risks (M&A). | SAMIL 10 greenfields FY27; Gabriel scheme approvals (10-12 months). |

| Currency/Debt | Rupee volatility; leverage spikes. | TII forex hedges; stable leverage overall. |

Mitigants: Diversification (EV/non-auto), strong balance sheets, OEM ties.

Overall Summary

| Parameter | Status | Key Metrics (Avg. Q2 FY26 YoY) |

|---|---|---|

| Headwinds | Moderate (exports/costs) | Revenue impact: -5-10% in weak segments |

| Tailwinds | Strong (domestic OEM) | Revenue +15%; PAT +15-25% |

| Growth Prospects | High (EV/M&A) | Order book +20-30%; FY26 rev. +12-15% |

| Risks | Medium (macro/EV execution) | Volatility in exports/EV ramps |

Verdict: Sector remains resilient & growth-oriented (double-digit topline across 80% cos), transitioning to EV/diversified play. Domestic tailwinds > headwinds; H2 rebound likely on GST benefits/infra spend. Investors: Focus on EV-exposed (Sona/TII/Exide) vs. traditional (Uno/Endurance). Long-term: 15-20% CAGR to 2030 on auto/EV boom.

Copyright © 2023 SAS Data Analytics Pvt. Ltd. All rights reserved.